Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

August 24 2022 - 9:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2022

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

A strategic

partnership between Bradesco and banco BV to form an independent

wealth management

Banco Bradesco

S.A. (“Bradesco”) would like to inform its shareholders and the market in general that it has signed a strategic partnership

with Banco Votorantim S.A. (“banco BV”) to form an independent wealth management, which will have its own brand, to be defined.

In the transaction,

Bradesco, through one of its indirect subsidiary, will acquire 51% of the capital of BV DTVM (“Company”), which concentrates

the management of third-party funds and private banking operations of banco BV. The Company has BRL 41 billion in assets under management

and R$22 billion under custody in private banking.

The Company

will have autonomy in the management of resources, with a highly specialized team, focused on and aligned with achieving the best results

for clients, in addition to relying on the reputation and solid experience of its shareholders.

Operating

in the Brazilian market since 1999, the Company is the 9th largest real estate fund manager, in June/2022 ranking by ANBIMA,

the Brazilian Association of Financial and Capital Market Entities. In private banking, it offers customized financial and asset solutions

for high-income clients and ranks 9th among

the largest in the country.

Bradesco

Organization has a broad and solid local asset management platform with over BRL 544 billion under management and private banking with

over BRL 380 billion under management, being the 3rd and 2nd largest player in each segment, respectively.

The conclusion

of the transaction is subject to compliance with legal and regulatory conditions.

Cidade de

Deus, Osasco, SP, August 24, 2022

Leandro

de Miranda Araujo

Executive

Officer and

Investor

Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 24, 2022

|

BANCO BRADESCO S.A. |

|

|

By: |

|

/S/Leandro de Miranda Araujo

|

| |

|

Leandro de Miranda Araujo

Executive Managing Officer and

Investor Relations Officer. |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

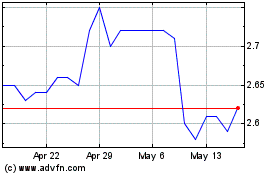

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Jan 2025 to Feb 2025

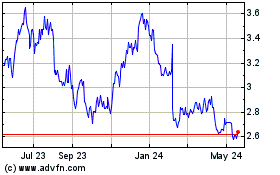

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Feb 2024 to Feb 2025