Brookfield Reinsurance (NYSE, TSX: BNRE, BNRE.A), soon to be

renamed ‘Brookfield Wealth Solutions,’ today announced financial

results for the quarter ended June 30, 2024.

Sachin Shah, CEO, stated, “We delivered strong

operating results during the second quarter. With the closing of

American Equity Life our asset base has doubled, our annuity sales

are growing and we are well positioned for our next stage of

growth.”

|

UnauditedAs of and for the periods ended June 30(US$ millions,

except per share amounts) |

Three Months Ended |

|

Six Months Ended |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total assets |

$ |

130,533 |

|

$ |

47,994 |

|

$ |

130,533 |

|

$ |

47,994 |

| Adjusted equity1 |

|

11,384 |

|

|

5,047 |

|

|

11,384 |

|

|

5,047 |

| Distributable operating

earnings1 |

|

298 |

|

|

160 |

|

|

577 |

|

|

305 |

| Net income |

|

269 |

|

|

360 |

|

|

606 |

|

|

267 |

|

Net income per each class A and A-1 share |

$ |

0.08 |

|

$ |

0.07 |

|

$ |

0.16 |

|

$ |

0.14 |

- See Non-GAAP and

Performance Measures on page 7 and a reconciliation from net income

and reconciliation from equity on page 6.

Highlights

- Completed the acquisition

of American Equity Investment Life Holding Company (“AEL”) on May

2, 2024, and have since redeployed more than $3 billion of assets

into Brookfield strategies

- Across our full portfolio,

originated approximately $5 billion in proprietary investment

strategies during the quarter at returns in excess of

8.5%

- Generated $3 billion of

retail annuity sales, including approximately $1.3 billion of sales

at AEL during our two months of ownership

- Closed 25 pension risk

transfer transactions, representing over $450 million in premiums

in the quarter

Operating Update

We recognized $298 million and $577 million

of distributable operating earnings (“DOE”) for the three and six

months ended June 30, 2024, compared to $160 million and $305

million in the prior year periods. The increase in earnings for the

current period reflect contributions from our recent acquisitions,

notably two months of ownership of AEL and a full period of Argo

Group, which closed in late 2023. Additionally, our results reflect

strong annuity sales and other premium growth from underwriting

actions taken over the last twelve months. Lastly, we have

benefitted from higher spread earnings on our existing business,

driven by higher net investment income resulting from the progress

made repositioning assets into higher yielding investment

strategies.

We recorded net income of $269 million and $606

million for the three and six months ended June 30, 2024,

compared to net income of $360 million and $267 million in the

prior year periods. Net income in the current period is the result

of strong operating performance and contributions from our DOE

partially offset by transaction related costs associated with the

acquisition of AEL. Additionally, the prior year period included

unrealized mark to market gains on our investments and insurance

reserves.

Today, we are in a strong liquidity position

across the portfolio, with over $25 billion of cash and short-term

liquid investments across our investment portfolios, and another

$22 billion of long-term liquid investments. These liquid assets

will facilitate the ongoing rotation of our investment portfolio

into higher yielding investment strategies, while also continuing

to ensure we have sufficient liquidity coverage for our liabilities

in the case of any stress events across the broader market.

Update on Capital Structure and Name

Change

At a meeting on July 22, 2024, our company’s

shareholders approved bye-law amendments designed to simplify and

enhance our capital structure, including a re-designation of our

class A-1 exchangeable non-voting shares into class A shares of our

company and related changes to the terms of the class A shares that

will result in no shareholder having the power to vote more than

9.9% of the class A shares, regardless of economic ownership. The

third amended and restated bye-laws will become effective on August

9, 2024, with the re-designation occurring on August 29, 2024.

Holders of our company’s class A-1 shares do not need to take any

action with respect to the re-designation. Once the re-designation

is implemented, all previously held class A-1 shares will

automatically be re-designated as class A shares and your holdings

will be updated accordingly.

Shareholders also approved a resolution

authorizing the change of our name from “Brookfield Reinsurance” to

“Brookfield Wealth Solutions”. We expect that the name change will

be effected on or about Friday, September 6, 2024 and that our

class A will begin trading on the New York Stock Exchange and

Toronto Stock Exchange under the symbol “BNT” at market open as of

such date.

Regular Distribution Declaration

The Board declared a quarterly distribution of

$0.08 per class A shares, class A-1 shares and class B shares,

payable on September 27, 2024 to shareholders of record as at the

close of business on September 12, 2024. This distribution is

identical in amount per share and has the same payment date as the

quarterly distribution announced today by Brookfield Corporation on

the Brookfield Class A Shares. The re-designation will have no

impact on the payment of the quarterly distribution, and investors

who currently hold class A-1 shares do not need to take any action

in order to receive the quarterly distribution.

Brookfield Corporation Operating

Results

An investment in Class A shares of our company

is intended to be, as nearly as practicable, functionally and

economically, equivalent to an investment in the Brookfield Class A

Shares. A summary of Brookfield Corporation’s second quarter

operating results is provided below:

|

UnauditedAs of and for the periods ended June 30(US$ millions,

except per share amounts) |

Three Months Ended |

|

Last Twelve Months Ended |

|

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income attributable to Brookfield shareholders1 |

$ |

43 |

|

|

$ |

81 |

|

$ |

1,074 |

|

$ |

308 |

| Net income (loss) of

consolidated business2 |

|

(285 |

) |

|

|

1,512 |

|

|

3,403 |

|

|

2,696 |

| Distributable earnings before

realizations1,3,4 |

|

1,113 |

|

|

|

1,013 |

|

|

4,379 |

|

|

4,078 |

|

– Per Brookfield share1,3,4 |

|

0.71 |

|

|

|

0.64 |

|

|

2.77 |

|

|

2.56 |

| Distributable earnings1,3 |

|

2,127 |

|

|

|

1,187 |

|

|

5,805 |

|

|

5,205 |

|

– Per Brookfield share1,3 |

|

1.35 |

|

|

|

0.75 |

|

|

3.67 |

|

|

3.26 |

-

Excludes amounts attributable to non-controlling interests.

-

Consolidated basis – includes amounts attributable to

non-controlling interests.

-

See Reconciliation of Net Income to Distributable Earnings on page

5 and Non-IFRS and Performance Measures section on page 8 of

Brookfield Corporation’s press release dated August 8, 2024.

-

Distributable earnings before realizations, including per share

amounts, for the twelve months ended June 30, 2023 were adjusted

for the special distribution of 25% of Brookfield’s asset

management business on December 9, 2022. Prior to the adjustment,

distributable earnings before realizations were $4.3 billion

for the twelve months ended June 30, 2023.

Brookfield Corporation net income above is

presented under IFRS. Given the economic equivalence, we expect

that the market price of the Class A Shares of our company will be

impacted significantly by the market price of the Brookfield Class

A Shares and the business performance of Brookfield as a whole. In

addition to carefully considering the disclosure made in this news

release in its entirety, shareholders are strongly encouraged to

carefully review Brookfield’s letter to shareholders, supplemental

information and its other continuous disclosure filings. Investors,

analysts and other interested parties can access Brookfield

Corporation’s disclosure on its website under the Reports &

Filings section at bn.brookfield.com.

CONSOLIDATED BALANCE SHEETS

| |

|

|

|

|

|

|

| Unaudited |

|

|

June 30 |

|

|

December 31 |

|

(US$ millions) |

|

|

|

2024 |

|

|

|

2023 |

|

Assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

$ |

14,335 |

|

|

$ |

4,308 |

| Investments |

|

|

|

85,117 |

|

|

|

39,838 |

| Reinsurance recoverables and

deposit assets |

|

|

|

10,275 |

|

|

|

3,388 |

| Reinsurance funds

withheld |

|

|

|

1,573 |

|

|

|

7,248 |

| Accrued investment income |

|

|

|

781 |

|

|

|

280 |

| |

|

|

|

112,081 |

|

|

|

55,062 |

| |

|

|

|

|

|

|

| Premiums due and other

receivables |

|

|

|

725 |

|

|

|

711 |

| Deferred policy acquisition

costs |

|

|

|

10,539 |

|

|

|

2,468 |

| Deferred tax asset |

|

|

|

700 |

|

|

|

432 |

| Other assets |

|

|

|

5,222 |

|

|

|

1,781 |

|

Separate account assets |

|

|

|

1,266 |

|

|

|

1,189 |

|

Total assets |

|

|

|

130,533 |

|

|

|

61,643 |

|

|

|

|

|

|

|

|

| Liabilities and

equity |

|

|

|

|

|

|

| Policy and contract

claims |

|

|

|

7,397 |

|

|

|

7,288 |

| Future policy benefits |

|

|

|

10,920 |

|

|

|

9,813 |

| Policyholders’ account

balances |

|

|

|

80,489 |

|

|

|

24,939 |

| Deposit liabilities |

|

|

|

1,546 |

|

|

|

1,577 |

| Market risk benefits |

|

|

|

3,276 |

|

|

|

89 |

| Unearned premium reserve |

|

|

|

2,037 |

|

|

|

2,056 |

| |

|

|

|

105,665 |

|

|

|

45,762 |

| |

|

|

|

|

|

|

| Other policyholder funds |

|

|

|

343 |

|

|

|

335 |

| Due to related parties |

|

|

|

734 |

|

|

|

564 |

| Notes payable |

|

|

|

657 |

|

|

|

174 |

| Corporate borrowings |

|

|

|

1,615 |

|

|

|

1,706 |

| Subsidiary borrowings |

|

|

|

2,846 |

|

|

|

1,863 |

| Funds withheld for reinsurance

liabilities |

|

|

|

3,526 |

|

|

|

83 |

| Other liabilities |

|

|

|

2,115 |

|

|

|

1,118 |

| Separate account

liabilities |

|

|

|

1,266 |

|

|

|

1,189 |

| |

|

|

|

|

|

|

| Junior preferred shares |

|

|

|

2,751 |

|

|

|

2,694 |

| Non-controlling interest |

848 |

|

|

|

146 |

|

| Class A, class A-1 and class

B |

1,591 |

|

|

|

1,591 |

|

| Class

C |

6,576 |

|

|

9,015 |

|

4,418 |

|

6,155 |

|

Total liabilities and equity |

|

|

$ |

130,533 |

|

|

$ |

61,643 |

CONSOLIDATED STATEMENTS OF

OPERATIONS

|

UnauditedFor the periods ended June 30US$ millions |

Three Months Ended |

|

Six Months Ended |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net premiums and other policy revenue |

$ |

1,716 |

|

|

$ |

1,202 |

|

|

$ |

3,359 |

|

|

$ |

2,099 |

|

| Net investment income,

including funds withheld |

|

1,162 |

|

|

|

517 |

|

|

|

1,832 |

|

|

|

975 |

|

| Net

investment gains (losses), including funds withheld |

|

24 |

|

|

|

255 |

|

|

|

196 |

|

|

|

75 |

|

|

Total revenues |

|

2,902 |

|

|

|

1,974 |

|

|

|

5,387 |

|

|

|

3,149 |

|

| |

|

|

|

|

|

|

|

| Benefits and claims paid on

insurance contracts |

|

(1,515 |

) |

|

|

(1,133 |

) |

|

|

(2,929 |

) |

|

|

(1,875 |

) |

| Interest sensitive contract

benefits |

|

(422 |

) |

|

|

(156 |

) |

|

|

(607 |

) |

|

|

(243 |

) |

| Amortization of deferred

policy acquisition costs |

|

(276 |

) |

|

|

(185 |

) |

|

|

(501 |

) |

|

|

(332 |

) |

| Changes in fair value of

insurance-related derivatives and embedded derivatives |

|

13 |

|

|

|

30 |

|

|

|

57 |

|

|

|

(39 |

) |

| Changes in fair value of

market risk benefits |

|

(168 |

) |

|

|

14 |

|

|

|

(199 |

) |

|

|

8 |

|

| Other reinsurance

expenses |

|

(7 |

) |

|

|

30 |

|

|

|

(14 |

) |

|

|

36 |

|

| Operating expenses |

|

(461 |

) |

|

|

(141 |

) |

|

|

(694 |

) |

|

|

(315 |

) |

|

Interest expense |

|

(95 |

) |

|

|

(60 |

) |

|

|

(167 |

) |

|

|

(120 |

) |

|

Total benefits and expenses |

|

(2,931 |

) |

|

|

(1,601 |

) |

|

|

(5,054 |

) |

|

|

(2,880 |

) |

|

Net income before income taxes |

|

(29 |

) |

|

|

373 |

|

|

|

333 |

|

|

|

269 |

|

| Income

tax recovery (expense) |

|

298 |

|

|

|

(13 |

) |

|

|

273 |

|

|

|

(2 |

) |

|

Net income for the period |

$ |

269 |

|

|

$ |

360 |

|

|

$ |

606 |

|

|

$ |

267 |

|

|

|

|

|

|

|

|

|

|

| Attributable

to: |

|

|

|

|

|

|

|

| Class A, class A-1 and class B

shareholders1 |

$ |

3 |

|

|

$ |

1 |

|

|

$ |

6 |

|

|

$ |

2 |

|

| Class C shareholder |

|

261 |

|

|

|

362 |

|

|

|

593 |

|

|

|

263 |

|

|

Non-controlling interest |

|

5 |

|

|

|

(3 |

) |

|

|

7 |

|

|

|

2 |

|

|

|

$ |

269 |

|

|

$ |

360 |

|

|

$ |

606 |

|

|

$ |

267 |

|

- Class A and A-1

shares receive distributions at the same amount per share as the

cash dividends paid on each Brookfield Class A Share.

SUMMARIZED FINANCIAL

RESULTS

RECONCILIATION OF NET INCOME TO

DISTRIBUTABLE OPERATING EARNINGS

|

UnauditedFor the periods ended June 30US$ millions |

Three Months Ended |

|

Six Months Ended |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income |

$ |

269 |

|

|

$ |

360 |

|

|

$ |

606 |

|

|

$ |

267 |

|

| Unrealized net investment

gains, including funds withheld |

|

(24 |

) |

|

|

(255 |

) |

|

|

(196 |

) |

|

|

(75 |

) |

|

Mark-to-market on insurance contracts and other net assets |

|

225 |

|

|

|

34 |

|

|

|

290 |

|

|

|

96 |

|

|

|

|

470 |

|

|

|

139 |

|

|

|

700 |

|

|

|

288 |

|

| Deferred income tax (recovery)

expense |

|

(343 |

) |

|

|

11 |

|

|

|

(328 |

) |

|

|

(2 |

) |

| Transaction costs |

|

137 |

|

|

|

5 |

|

|

|

149 |

|

|

|

9 |

|

|

Depreciation |

|

34 |

|

|

|

5 |

|

|

|

56 |

|

|

|

10 |

|

|

Distributable operating

earnings1 |

$ |

298 |

|

|

$ |

160 |

|

|

$ |

577 |

|

|

$ |

305 |

|

RECONCILIATION OF EQUITY TO ADJUSTED

EQUITY

|

UnauditedAs of June 30US$ millions |

|

2024 |

|

|

|

2023 |

|

Equity |

$ |

9,015 |

|

|

$ |

1,911 |

| Add: |

|

|

|

|

Accumulated other comprehensive (income) loss |

|

(382 |

) |

|

|

501 |

|

Junior preferred shares |

|

2,751 |

|

|

|

2,635 |

|

Adjusted equity1 |

$ |

11,384 |

|

|

$ |

5,047 |

- Non-GAAP measure -

see Non-GAAP and Performance Measures on page 7.

Additional Information

Brookfield Reinsurance was established on

December 10, 2020 by Brookfield and on June 28, 2021 Brookfield

completed the spin-off of the company, which was effected by way of

a special dividend, to holders of Brookfield's Class A and B

Shares. The statements contained herein are based primarily on

information that has been extracted from our financial statements

for the quarter ended June 30, 2024, which have been prepared

using generally accepted accounting principles in the United States

of America (“US GAAP” or “GAAP”).

Brookfield Reinsurance’s Board of Directors have

reviewed and approved this document, including the summarized

unaudited consolidated financial statements prior to its

release.

Information on our distributions can be found on

our website under Stock & Distributions/Distribution

History.

Brookfield Reinsurance Ltd.

(NYSE, TSX: BNRE, BNRE.A) is a leading wealth solutions provider,

focused on securing the financial futures of individuals and

institutions through a range of wealth protection and retirement

services, and tailored capital solutions. Each class A exchangeable

limited voting share and each class A-1 exchangeable non-voting

share of Brookfield Reinsurance are exchangeable on a one-for-one

basis with a class A limited voting share of Brookfield Corporation

(NYSE, TSX: BN). For more information, please visit our website at

bnre.brookfield.com or contact:

|

Communications & Media:Kerrie McHugh Tel:

(212) 618-3469Email: kerrie.mchugh@brookfield.com |

|

Investor Relations: Rachel SchneiderTel: (416)

369-3358 Email: rachel.schneider@brookfield.com |

Non-GAAP and Performance

Measures

This news release and accompanying financial

statements are based on US GAAP, unless otherwise noted.

We make reference to Distributable operating

earnings. We define distributable operating earnings as net income

excluding the impact of depreciation and amortization, deferred

income taxes, and breakage and transaction costs, as well as

certain investment and insurance reserve gains and losses,

including gains and losses related to asset and liability matching

strategies, non-operating adjustments related to changes in cash

flow assumptions for future policy benefits, and change in market

risk benefits, and is inclusive of returns on equity invested in

certain variable interest entities and our share of adjusted

earnings from our investments in certain associates. Distributable

operating earnings is a measure of operating performance. We use

distributable operating earnings to assess our operating results.

We also make reference to Adjusted equity. Adjusted equity

represents the total economic equity of our Company through its

Class A, A-1, B and C shares, excluding Accumulated other

comprehensive income, and the Junior preferred shares issued by our

Company. We use adjusted equity to assess our return on our

equity.

We provide additional information on key terms

and non-GAAP measures in our filings available at

bnre.brookfield.com.

Notice to Readers

Brookfield Reinsurance is not making any offer

or invitation of any kind by communication of this news release and

under no circumstance is it to be construed as a prospectus or an

advertisement.

This news release contains “forward-looking

information” within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of

Canadian provincial securities laws and “forward-looking

statements” within the meaning of the U.S. Securities Act of 1933,

the U.S. Securities Exchange Act of 1934, and “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or

conditions, include statements which reflect management’s

expectations regarding the operations, business, financial

condition, expected financial results, performance, prospects,

opportunities, priorities, targets, goals, ongoing objectives,

strategies and outlook of Brookfield Reinsurance, Brookfield

Corporation and their respective subsidiaries, as well as the

outlook for North American and international economies for the

current fiscal year and subsequent periods. Particularly,

statements regarding the AEL transaction, and benefits thereof,

future capital markets initiatives, including statements relating

to the redeployment of capital into higher yielding investments and

Brookfield Reinsurance’s balance sheet initiatives constitute

forward-looking statements. In some cases, forward-looking

statements can be identified by the use of forward-looking

terminology such as “expects,” “anticipates,” “plans,” “believes,”

“estimates,” “seeks,” “intends,” “targets,” “projects,” “forecasts”

or negative versions thereof and other similar expressions, or

future or conditional verbs such as “may,” “will,” “should,”

“would” and “could.” In particular, the forward-looking statements

contained in this news release include statements referring to the

future state of the economy or the securities market and expected

future deployment of capital and financial earnings. Although we

believe that our anticipated future results, performance or

achievements expressed or implied by the forward-looking statements

and information are based upon reasonable assumptions and

expectations, the reader should not place undue reliance on

forward-looking statements and information because they involve

known and unknown risks, uncertainties and other factors, many of

which are beyond our control, which may cause the actual results,

performance or achievements of Brookfield Reinsurance or Brookfield

Corporation to differ materially from anticipated future results,

performance or achievement expressed or implied by such

forward-looking statements and information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: (i)

investment returns that are lower than target; (ii) the impact or

unanticipated impact of general economic, political and market

factors in the countries in which we do business including as a

result of COVID-19 and the related global economic shutdown; (iii)

the behavior of financial markets, including fluctuations in

interest and foreign exchange rates; (iv) global equity and capital

markets and the availability of equity and debt financing and

refinancing within these markets; (v) strategic actions including

dispositions; the ability to complete and effectively integrate

acquisitions into existing operations and the ability to attain

expected benefits; (vi) changes in accounting policies and methods

used to report financial condition (including uncertainties

associated with critical accounting assumptions and estimates);

(vii) the ability to appropriately manage human capital; (viii) the

effect of applying future accounting changes; (ix) business

competition; (x) operational and reputational risks; (xi)

technological change; (xii) changes in government regulation and

legislation within the countries in which we operate; (xiii)

governmental investigations; (xiv) litigation; (xv) changes in tax

laws; (xvi) ability to collect amounts owed; (xvii) catastrophic

events, such as earthquakes, hurricanes and epidemics/pandemics;

(xviii) the possible impact of international conflicts and other

developments including terrorist acts and cyberterrorism; (xix) the

introduction, withdrawal, success and timing of business

initiatives and strategies; (xx) the failure of effective

disclosure controls and procedures and internal controls over

financial reporting and other risks; (xxi) health, safety and

environmental risks; (xxii) the maintenance of adequate insurance

coverage; (xxiii) the existence of information barriers between

certain businesses within our asset management operations; (xxiv)

risks specific to our business segments including our real estate,

renewable power, infrastructure, private equity, and other

alternatives, including credits; and (xxv) factors detailed from

time to time in our documents filed with the securities regulators

in Canada and the United States.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive and other

factors could also adversely affect its results. Readers are urged

to consider the foregoing risks, as well as other uncertainties,

factors and assumptions carefully in evaluating the forward-looking

information and are cautioned not to place undue reliance on such

forward-looking information. Except as required by law, Brookfield

Reinsurance undertakes no obligation to publicly update or revise

any forward-looking statements or information, whether written or

oral, that may be as a result of new information, future events or

otherwise.

Past performance is not indicative nor a

guarantee of future results. There can be no assurance that

comparable results will be achieved in the future, that future

investments will be similar to the historic investments discussed

herein (because of economic conditions, the availability of

investment opportunities or otherwise), that targeted returns,

diversification or asset allocations will be met or that an

investment strategy or investment objectives will be achieved.

Certain of the information contained herein is

based on or derived from information provided by independent

third-party sources. While Brookfield Reinsurance believes that

such information is accurate as of the date it was produced and

that the sources from which such information has been obtained are

reliable, Brookfield Reinsurance does not make any representation

or warranty, express or implied, with respect to the accuracy,

reasonableness or completeness of any of the information or the

assumptions on which such information is based, contained herein,

including but not limited to, information obtained from third

parties.

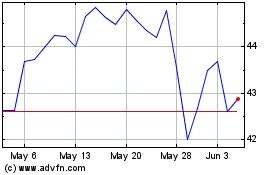

Brookfield (NYSE:BN)

Historical Stock Chart

From Nov 2024 to Dec 2024

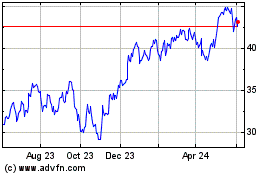

Brookfield (NYSE:BN)

Historical Stock Chart

From Dec 2023 to Dec 2024