- 4Q24 diluted GAAP EPS of $0.77, diluted non-GAAP(1) EPS of

$0.92, on revenue of $746.3 million

- 4Q24 net income of $71.1 million, adjusted EBITDA(1) of $130.3

million

- 2024 diluted GAAP EPS of $3.07, diluted non-GAAP(1) EPS of

$3.33, on revenue of $2.7 billion

- 2024 net income of $282.3 million, adjusted EBITDA(1) of $498.7

million

- 2024 operating cash flow of $408.4 million, free cash flow(1)

of $254.8 million

- Closed acquisition of A.O.T on January 3, 2025; Announced

agreement to acquire Kinectrics, Inc. on January 7, 2025

- Initiates 2025 guidance for non-GAAP EPS of $3.40-$3.55,

adjusted EBITDA(1) of $550 million-$570 million

BWX Technologies, Inc. (NYSE: BWXT) ("BWXT", "we", "us" or the

"Company") reported fourth quarter and full year 2024 results. A

reconciliation of non-GAAP results is detailed in Exhibit 1.

“We closed out the year with better-than-expected fourth quarter

financial results and are poised for another strong year in 2025,”

said Rex D. Geveden, president and chief executive officer.

“Throughout 2024 we captured significant new awards, including a

record level of bookings in Commercial Operations driven by

critical equipment for North America’s first small modular reactor

project and power plant refurbishments, as well as robust bookings

in Government Operations for naval propulsion components, special

materials and multiple long-term technical services contracts.”

“Demand in our national security, clean energy, and medical

end-markets continues to build, and we are investing both

organically and inorganically to enhance our portfolio of

high-quality nuclear solutions,” continued Geveden. “I am grateful

for our entire workforce and their steadfast commitment to our

critical missions.”

“BWXT is benefitting from our strategic growth efforts and our

focus on driving performance and shareholder value. We are driving

operational excellence throughout the organization – from the shop

floor and supply chain optimization to working capital management

to tax planning to digital transformation, and those efforts

contributed to the strong financial performance we delivered in

2024,” said Geveden. “That momentum continues into 2025, and we are

therefore initiating strong 2025 guidance calling for $3.40-$3.55

of non-GAAP EPS, $550-$570 million of adjusted EBITDA and $265-$285

million of free cash flow.”

Financial Results Summary

Three Months Ended December

31,

Year Ended December

31,

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

(Unaudited)

(In millions, except per share

amounts)

Revenue

Government Operations

$

595.0

$

601.6

$

(6.6

)

(1

)%

$

2,183.0

$

2,031.3

$

151.7

7

%

Commercial Operations

$

152.3

$

124.1

$

28.2

23

%

$

524.0

$

466.3

$

57.6

12

%

Consolidated

$

746.3

$

725.5

$

20.8

3

%

$

2,703.7

$

2,496.3

$

207.3

8

%

Operating Income

Government Operations

$

98.1

$

116.3

$

(18.2

)

(16

)%

$

377.9

$

374.7

$

3.2

1

%

Commercial Operations

$

14.9

$

15.9

$

(1.1

)

(7

)%

$

46.8

$

37.5

$

9.3

25

%

Unallocated Corporate (Expense)

$

(20.7

)

$

(9.0

)

$

(11.7

)

NM

$

(44.1

)

$

(29.2

)

$

(14.9

)

NM

Consolidated

$

92.3

$

123.2

$

(30.9

)

(25

)%

$

380.6

$

383.1

$

(2.5

)

(1

)%

Non-GAAP Operating Income

Government Operations

$

100.6

$

117.2

$

(16.6

)

(14

)%

$

380.9

$

376.1

$

4.8

1

%

Commercial Operations

$

19.1

$

16.9

$

2.3

14

%

$

55.9

$

42.2

$

13.7

32

%

Unallocated Corporate (Expense)

$

(11.9

)

$

(6.8

)

$

(5.1

)

NM

$

(24.0

)

$

(25.0

)

$

1.0

NM

Consolidated

$

107.9

$

127.3

$

(19.4

)

(15

)%

$

412.8

$

393.3

$

19.5

5

%

EPS (Diluted)

GAAP

$

0.77

$

0.72

$

0.05

7

%

$

3.07

$

2.68

$

0.39

15

%

Non-GAAP(1)

$

0.92

$

1.01

$

(0.09

)

(9

)%

$

3.33

$

3.02

$

0.31

10

%

Net Income

GAAP

$

71.1

$

66.3

$

4.8

7

%

$

282.3

$

246.3

$

36.0

15

%

Non-GAAP(1)

$

84.8

$

93.3

$

(8.5

)

(9

)%

$

306.6

$

278.4

$

28.3

10

%

Adjusted EBITDA(1)

Government Operations

$

116.7

$

131.3

$

(14.6

)

(11

)%

$

441.9

$

429.4

$

12.4

3

%

Commercial Operations

$

23.7

$

21.3

$

2.4

11

%

$

73.6

$

60.0

$

13.6

23

%

Corporate

$

(10.1

)

$

(5.0

)

$

(5.1

)

NM

$

(16.9

)

$

(17.5

)

$

0.7

NM

Consolidated

$

130.3

$

147.6

$

(17.3

)

(12

)%

$

498.7

$

471.9

$

26.8

6

%

Cash Flows

Operating Cash Flow(2)

$

276.9

$

221.8

$

55.1

25

%

$

408.4

$

363.7

$

44.7

12

%

Capital Expenditures(2)

$

52.5

$

50.8

$

1.7

3

%

$

153.6

$

151.3

$

2.4

2

%

Free Cash Flow(1)

$

224.4

$

171.0

$

53.4

31

%

$

254.8

$

212.4

$

42.4

20

%

Share Repurchases(2)

$

—

$

—

$

—

NM

$

20.0

$

—

$

20.0

NM

Dividends Paid(2)

$

22.0

$

21.1

$

0.9

4

%

$

88.3

$

85.0

$

3.4

4

%

NM = Not Meaningful

(1) A reconciliation of non-GAAP results

are detailed in Exhibit 1. Additional information can be found in

the materials on the BWXT investor relations website at

www.bwxt.com/investors.

(2) Items named in the Financial Results

Summary differ from names in BWXT Financial Statement. Operating

Cash Flow = Net Cash Provided by Operating Activities; Capital

Expenditures = Purchases of Property, Plant and Equipment; Share

Repurchases = Repurchases of Common Stock; Dividends Paid =

Dividends Paid to Common Shareholders

Revenues

Fourth quarter consolidated revenue increased as slightly lower

Government Operations revenue was offset by higher Commercial

Operations revenue. Government Operations revenue decreased

slightly as higher naval nuclear component production and

microreactors were offset by lower long-lead material procurement

and favorable contract adjustments in the fourth quarter of 2023,

that did not occur this year. The Commercial Operations increase

was driven by higher revenue associated with commercial nuclear

components, fuel and fuel handling, as well as higher medical

sales, which was partially offset by lower field services

revenue.

Full year consolidated revenue increased, driven by growth in

both operating segments. The Government Operations increase was

driven by higher naval nuclear component production, microreactors

volume and higher special materials revenue. The Commercial

Operations increase was driven by higher revenue associated with

nuclear components, fuel and fuel handling, and medical sales,

partially offset by lower field services activity.

Operating Income and Adjusted EBITDA(1)

Fourth quarter GAAP operating income decreased due to lower

operating income in both segments and higher corporate expense, as

well as increased costs associated with restructuring and

transformation, acquisitions, and losses on asset disposals. Fourth

quarter non-GAAP(1) operating income decreased as lower Government

Operations operating income and higher corporate expense were

partially offset by higher Commercial Operations operating income.

The Government Operations decline was mainly due to a favorable

contract adjustment in the fourth quarter of 2023, that did not

occur this year, as well as business mix, which was partially

offset by higher volumes of naval nuclear components, and the

higher microreactors volumes noted above. The Commercial Operations

increase was due to higher revenue as noted above, partially offset

by mix within commercial power. Corporate expense increased, mainly

due to timing of certain corporate costs, and higher stock

compensation expense.

Full year GAAP and non-GAAP(1) operating income increased in

both segments. The Government Operations increase was due to the

higher revenue noted above as well as higher technical services

income. The Commercial Operations increase was due to the revenue

increases noted above, as well as better profitability in medical,

and mix within commercial power. Corporate expense was flat

compared to 2023.

Fourth quarter and full year total adjusted EBITDA(1) changes

are in-line with the reasons noted above.

EPS

Fourth quarter 2024 GAAP EPS increased as lower operating income

was offset by lower interest expense, slightly higher pension

income, a lower effective tax rate, and a lower mark-to-market loss

on the pension compared to fourth quarter 2023. Fourth quarter 2024

non-GAAP(1) EPS decreased as lower operating income, was partially

offset by lower interest expense, slightly higher pension income,

and a lower effective tax rate, excluding mark-to-market pension

losses, restructuring costs, and other one-time items.

Full year 2024 GAAP EPS increased due to higher operating and

pension income, lower interest expense and effective tax rate, and

a lower mark-to-market loss on the pension compared to 2023. Full

year 2024 non-GAAP EPS(1) increased driven by the items noted

above, excluding market-to-market pension losses, restructuring and

acquisition-related costs, and other one-time items.

Cash Flows

Fourth quarter and full year 2024 operating cash flow increased

due to higher net income and improved working capital management.

Capital expenditures increased modestly, mainly due to growth

investment in the expansion of our Cambridge, Ontario commercial

nuclear power equipment manufacturing plant.

Dividend

BWXT paid $22.0 million, or $0.24 per common share, to

shareholders in the fourth quarter 2024 and paid $88.3 million to

shareholders for the full year 2024. On February 20, 2025, the BWXT

Board of Directors declared a quarterly cash dividend of $0.25 per

common share payable on March 28, 2025, to shareholders of record

on March 11, 2025.

2025 Guidance

BWXT announced its expectations for fiscal year 2025 financial

results, providing the following guidance:

(In millions, except per share

amounts)

Year Ended

Year Ending

December 31, 2024

December 31, 2025

Results

Guidance(2)

Revenue

$2,704

~$3,000

Adjusted EBITDA(1)

$499

$550 - $570

Non-GAAP(1) Earnings Per Share

$3.33

$3.40 - $3.55

Free Cash Flow(1)

$255

$265 - $285

(2) BWXT has not included a reconciliation

of provided non-GAAP guidance to comparable GAAP measures due to

the difficulty of estimating any mark-to-market adjustments for

pension and post-retirement benefits, which are determined at the

end of the year.

Additional information can be found in the 2024 fourth quarter

earnings call presentation on the BWXT investor relations website

at investors.bwxt.com. The Company does not provide GAAP guidance

because it is unable to reliably forecast most of the items that

are excluded from GAAP to calculate non-GAAP results. These items

could cause GAAP results to differ materially from non-GAAP

results.

Conference Call to Discuss Fourth

Quarter 2024 Results

Date:

Monday, February 24, 2025, at 5:00 p.m.

EST

Live Webcast:

BWXT Investor Relations website at

investors.bwxt.com

Full Earnings Release Available on BWXT Website

A full version of this earnings release is available on our

Investor Relations website at

http://investors.bwxt.com/4Q2024-release.

BWXT may use its website (www.bwxt.com) as a channel of

distribution of material Company information. Financial and other

important information regarding BWXT is routinely accessible

through and posted on our website. In addition, you may elect to

automatically receive e-mail alerts and other information about

BWXT by enrolling through the “Email Alerts” section of our website

at http://investors.bwxt.com.

Non-GAAP Measures

BWXT uses and makes reference to adjusted EBITDA, Non-GAAP EPS,

free cash flow and free cash flow conversion, which are not

recognized measures under GAAP. BWXT is providing these non-GAAP

measures to supplement the results provided in accordance with GAAP

and it should not be considered superior to, or as a substitute

for, the comparable GAAP measures. BWXT believes the non-GAAP

measures provide meaningful insight and transparency into the

Company’s operational performance and provides these measures to

investors to help facilitate comparisons of operating results with

prior periods and to assist them in understanding BWXT's ongoing

operations. Definitions for the non-GAAP measures are provided

below and reconciliations are detailed in Exhibit 1, except that

reconciliations of forward-looking GAAP measures are not provided

because the company is unable to reliably forecast most of the

items that are excluded from GAAP to calculate non-GAAP results.

Other companies may define these measures differently or may

utilize different non-GAAP measures, thus impacting

comparability.

Non-GAAP Earnings Per Share (EPS) is calculated using GAAP EPS

less the non-operational tax effected per share impact of pension

& OPEB mark-to-market gains or losses and other one-time items,

such as restructuring, transformation, and acquisition-related

costs.

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization (EBITDA) is calculated using non-GAAP net income, plus

provision for income taxes, less other – net, less interest income,

plus interest expense, plus depreciation and amortization.

Adjusted pre-tax income is non-GAAP income before provision for

income taxes.

Free Cash Flow (FCF) is calculated using net income to derive

net cash provided by (used in) operating activities less purchases

of property, plant and equipment.

Free Cash Flow conversion is free cash flow divided by net

income.

Non-GAAP Adjustments

Our GAAP financial results detailed in Exhibit 1 have been

adjusted for the following items:

Restructuring and Transformation Costs: Restructuring and

transformation related costs include restructuring charges as well

as costs associated with our efforts to optimize underlying

business processes through investments in information technology,

process improvements and the implementation of strategic actions

and initiatives which we deem to be incremental and non-recurring

in nature.

Acquisition-related Costs: Acquisition-related costs relate to

third-party professional service costs and one-time incremental

costs associated with efforts to integrate the acquired business

with our legacy operations.

Forward-Looking Statements

BWXT cautions that this release contains forward-looking

statements, including, without limitation, statements relating to

backlog, to the extent they may be viewed as an indicator of future

revenues; our plans and expectations for each of our reportable

segments, including growth opportunities and the expectations,

timing and revenue of our strategic initiatives, such as medical

radioisotopes, SMR components and recent acquisitions; disruptions

to our supply chain and/or operations, changes in government

regulations and other factors; and our expectations and guidance

for 2025 and beyond. These forward-looking statements are based on

management’s current expectations and involve a number of risks and

uncertainties, including, among other things, our ability to

execute contracts in backlog; federal budget uncertainty, the risk

of future budget cuts, the impact of continuing resolution funding

mechanisms and the debt ceiling, the potential for government

shutdowns and changing funding and acquisition priorities; the

demand for and competitiveness of nuclear products and services;

capital priorities of power generating utilities and other

customers; the timing of technology development, regulatory

approvals and automation of production; the receipt and/or timing

of government approvals; the potential recurrence of subsequent

waves or strains of COVID-19 or similar diseases; labor market

challenges, including employee retention and recruitment; adverse

changes in the industries in which we operate; and delays, changes

or termination of contracts in backlog. If one or more of these

risks or other risks materialize, actual results may vary

materially from those expressed. For a more complete discussion of

these and other risk factors, see BWXT’s filings with the

Securities and Exchange Commission, including our annual report on

Form 10-K for the year ended December 31, 2024. BWXT cautions not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this release, and undertakes no

obligation to update or revise any forward-looking statement,

except to the extent required by applicable law.

About BWXT

At BWX Technologies, Inc. (NYSE: BWXT), we are People Strong,

Innovation Driven. Headquartered in Lynchburg, Virginia, BWXT is a

Defense News Top 100 manufacturing and engineering innovator that

provides safe and effective nuclear solutions for global security,

clean energy, environmental restoration, nuclear medicine and space

exploration. With more than 8,700 employees, BWXT has 15 major

operating sites in the U.S., Canada and the U.K. In addition, BWXT

joint ventures provide management and operations at a dozen U.S.

Department of Energy and NASA facilities. For more information,

visit www.bwxt.com. Follow us on LinkedIn, X, Facebook and

Instagram.

EXHIBIT

1

BWX TECHNOLOGIES, INC.

RECONCILIATION OF NON-GAAP

OPERATING INCOME AND EARNINGS PER SHARE(1)(2)(3)

(In millions, except per share

amounts)

Three Months Ended December

31, 2024

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring &

Transformation Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Operating Income

$

92.3

$

—

$

7.8

$

4.2

$

3.6

$

107.9

Interest Income (Expense), net

(8.8

)

—

—

—

—

(8.8

)

Other - net

(5.4

)

10.9

—

$

—

$

—

$

5.5

Income before Provision for Income

Taxes

78.1

10.9

7.8

$

4.2

$

3.6

104.6

Provision for Income Taxes

(7.0

)

(2.4

)

(8.5

)

(0.9

)

(0.9

)

(19.8

)

Net Income

71.1

8.4

(0.7

)

$

3.3

$

2.7

84.8

Net Income Attributable to Noncontrolling

Interest

(0.1

)

—

—

—

—

(0.1

)

Net Income Attributable to BWXT

$

71.0

$

8.4

$

(0.7

)

$

3.3

$

2.7

$

84.7

Diluted Shares Outstanding

91.9

91.9

Diluted Earnings per Common Share

$

0.77

$

0.09

$

(0.01

)

$

0.04

$

0.03

$

0.92

Effective Tax Rate

9.0

%

18.9

%

Government Operations Operating Income

$

98.1

$

—

$

0.7

$

0.2

$

1.7

$

100.6

Commercial Operations Operating Income

$

14.9

$

—

$

2.7

$

1.6

$

—

$

19.1

Unallocated Corporate Operating Income

$

(20.7

)

$

—

$

4.5

$

2.4

$

1.9

$

(11.9

)

Three Months Ended December

31, 2023

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Operating Income

$

123.2

$

—

$

4.0

$

—

$

—

$

127.3

Interest Income (Expense), net

(11.1

)

—

—

—

—

$

(11.1

)

Other - net

(26.5

)

30.8

$

—

$

—

$

—

$

4.3

Income before Provision for Income

Taxes

85.6

30.8

4.0

—

—

120.5

Provision for Income Taxes

(19.3

)

(7.1

)

(0.7

)

(0.0

)

—

(27.2

)

Net Income

66.3

23.7

3.3

—

—

93.3

Net Income Attributable to Noncontrolling

Interest

(0.4

)

—

Net Income Attributable to BWXT

$

65.9

$

23.7

$

3.3

$

—

$

—

$

92.9

Diluted Shares Outstanding

92.0

92.0

Diluted Earnings per Common Share

$

0.72

$

0.26

$

0.04

$

0.00

$

—

$

1.01

Effective Tax Rate

22.6

%

22.5

%

Government Operations Operating Income

$

116.3

$

—

$

1.0

$

—

$

—

$

117.2

Commercial Operations Operating Income

$

15.9

$

—

$

0.9

$

—

$

—

$

16.9

Unallocated Corporate Operating Income

$

(9.0

)

$

—

$

2.2

$

0.0

$

—

$

(6.8

)

EXHIBIT 1

(continued)

BWX TECHNOLOGIES, INC.

RECONCILIATION OF NON-GAAP

OPERATING INCOME AND EARNINGS PER SHARE(1)(2)(3)

(In millions, except per share

amounts)

Year Ended December 31,

2024

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring &

Transformation Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Operating Income

$

380.6

$

—

$

21.2

$

7.4

$

3.6

$

412.8

Interest Income (Expense), net

(36.9

)

—

—

—

—

$

(36.9

)

Other - net

5.0

10.9

—

$

—

$

—

15.9

Income before Provision for Income

Taxes

348.7

10.9

21.2

7.4

3.6

391.8

Provision for Income Taxes

(66.4

)

(2.4

)

(13.8

)

(1.7

)

(0.9

)

(85.1

)

Net Income

282.3

8.4

7.4

5.8

2.7

306.6

Net Income Attributable to Noncontrolling

Interest

(0.4

)

—

—

—

—

(0.4

)

Net Income Attributable to BWXT

$

281.9

$

8.4

$

7.4

$

5.8

$

2.7

$

306.3

Diluted Shares Outstanding

91.9

91.9

Diluted Earnings per Common Share

$

3.07

$

0.09

$

0.08

$

0.06

$

0.03

$

3.33

Effective Tax Rate

19.0

%

21.7

%

Government Operations Operating Income

$

377.9

$

—

$

1.1

$

0.2

$

1.7

$

380.9

Commercial Operations Operating Income

$

46.8

$

—

$

6.7

$

2.4

$

—

$

55.9

Unallocated Corporate Operating Income

$

(44.1

)

$

—

$

13.4

$

4.8

$

1.9

$

(24.0

)

Year Ended December 31,

2023

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Operating Income

$

383.1

$

—

$

9.6

$

0.7

$

—

$

393.3

Interest Income (Expense), net

(44.6

)

—

—

—

—

$

(44.6

)

Other - net

(17.0

)

30.8

—

$

—

—

13.8

Income before Provision for Income

Taxes

321.4

30.8

9.6

0.7

—

362.4

Provision for Income Taxes

(75.1

)

(7.1

)

(1.7

)

(0.2

)

—

(84.1

)

Net Income

246.3

23.7

7.8

0.5

—

278.4

Net Income Attributable to Noncontrolling

Interest

(0.5

)

—

—

—

—

(0.5

)

Net Income Attributable to BWXT

$

245.8

$

23.7

$

7.8

$

0.5

$

—

$

277.9

Diluted Shares Outstanding

91.9

91.9

Diluted Earnings per Common Share

$

2.68

$

0.26

$

0.09

$

0.01

$

—

$

3.02

Effective Tax Rate

23.4

%

23.2

%

Government Operations Operating Income

$

374.7

$

—

$

1.1

$

0.3

$

—

$

376.1

Commercial Operations Operating Income

$

37.5

$

—

$

4.6

$

0.1

$

—

$

42.2

Unallocated Corporate Operating Income

$

(29.2

)

$

—

$

3.9

$

0.3

$

—

$

(25.0

)

(1)

Tables may not foot due to

rounding.

(2)

BWXT is providing non-GAAP

information regarding certain of its historical results and

guidance on future earnings per share to supplement the results

provided in accordance with GAAP and it should not be considered

superior to, or as a substitute for, the comparable GAAP measures.

BWXT believes the non-GAAP measures provide meaningful insight and

transparency into the Company’s operational performance and

provides these measures to investors to help facilitate comparisons

of operating results with prior periods and to assist them in

understanding BWXT's ongoing operations.

(3)

BWXT has not included a

reconciliation of provided non-GAAP guidance to the comparable GAAP

measures due to the difficulty of estimating any mark-to-market

adjustments for pension and post-retirement benefits, which are

determined at the end of the year.

EXHIBIT 1

(continued)

RECONCILIATION OF CONSOLIDATED

ADJUSTED EBITDA(1)(2)(3)

(In millions)

Three Months Ended December

31, 2024

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring &

Transformation Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Net Income

$

71.1

$

8.4

$

(0.7

)

$

3.3

2.7

$

84.8

Provision for Income Taxes

7.0

2.4

8.5

0.9

0.9

19.8

Other – net

5.4

(10.9

)

—

—

(5.5

)

Interest Expense

9.3

—

—

—

9.3

Interest Income

(0.5

)

—

—

—

(0.5

)

Depreciation & Amortization

22.4

—

—

—

22.4

Adjusted EBITDA

$

114.7

$

—

$

7.8

$

4.2

3.6

$

130.3

Three Months Ended December

31, 2023

GAAP

Pension & OPEB MTM

(Gain) / Loss

Restructuring Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Net Income

$

66.3

$

23.7

$

3.3

$

—

$

—

$

93.3

Provision for Income Taxes

19.3

7.1

0.7

0.0

0.0

27.2

Other – net

26.5

(30.8

)

—

—

—

(4.3

)

Interest Expense

11.8

—

0.0

—

—

11.8

Interest Income

(0.7

)

—

—

—

—

(0.7

)

Depreciation & Amortization

20.4

—

—

—

—

20.4

Adjusted EBITDA

$

143.6

$

—

$

4.0

$

—

$

—

$

147.6

Year Ended December 31,

2024

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring &

Transformation Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Net Income

$

282.3

$

8.4

$

7.4

$

5.8

2.7

$

306.6

Provision for Income Taxes

66.4

2.4

13.8

1.7

0.9

85.1

Other – net

(5.0

)

(10.9

)

—

—

(15.9

)

Interest Expense

39.5

—

—

—

39.5

Interest Income

(2.6

)

—

—

—

(2.6

)

Depreciation & Amortization

85.9

—

—

—

85.9

Adjusted EBITDA

$

466.5

$

—

$

21.2

$

7.4

3.6

$

498.7

Year Ended December 31,

2023

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring Costs

Acquisition- related

Costs

Loss on Asset

Disposal

Non-GAAP

Net Income

$

246.3

$

23.7

$

7.8

$

0.5

$

—

$

278.4

Provision for Income Taxes

75.1

7.1

1.7

0.2

0.0

84.1

Other – net

17.0

(30.8

)

—

—

—

(13.8

)

Interest Expense

47.0

—

0.0

—

—

47.0

Interest Income

(2.4

)

—

—

—

—

(2.4

)

Depreciation & Amortization

78.6

—

—

—

—

78.6

Adjusted EBITDA

$

461.6

$

—

$

9.6

$

0.7

$

—

$

471.9

EXHIBIT 1

(continued)

RECONCILIATION OF REPORTING

SEGMENT ADJUSTED EBITDA(1)(2)(3)

(In millions)

Three Months Ended December

31, 2024

Operating Income

(GAAP)

Non-GAAP

Adjustments(4)

Depreciation &

Amortization

Adjusted EBITDA

Government Operations

$

98.1

$

2.6

$

16.1

$

116.7

Commercial Operations

$

14.9

$

4.3

$

4.6

$

23.7

Three Months Ended December

31, 2023

Operating Income

(GAAP)

Non-GAAP

Adjustments(4)

Depreciation &

Amortization

Adjusted EBITDA

Government Operations

$

116.3

$

1.0

$

14.0

$

131.3

Commercial Operations

$

15.9

$

0.9

$

4.5

$

21.3

Year Ended December 31,

2024

Operating Income

(GAAP)

Non-GAAP

Adjustments(4)

Depreciation &

Amortization

Adjusted EBITDA

Government Operations

$

377.9

$

3.0

$

61.0

$

441.9

Commercial Operations

$

46.8

$

9.1

$

17.7

$

73.6

Year Ended December 31,

2023

Operating Income

(GAAP)

Non-GAAP

Adjustments(4)

Depreciation &

Amortization

Adjusted EBITDA

Government Operations

$

374.7

$

1.4

$

53.4

$

429.4

Commercial Operations

$

37.5

$

4.7

$

17.7

$

60.0

RECONCILIATION OF CONSOLIDATED FREE

CASH FLOW(1)(2)(3)

(In millions)

Three Months Ended December

31,

2024

2023

Net Cash Provided By Operating

Activities

$

276.9

$

221.8

Purchases of Property, Plant and

Equipment

(52.5

)

(50.8

)

Free Cash Flow

$

224.4

$

171.0

Year Ended December

31,

2024

2023

Net Cash Provided By Operating

Activities

$

408.4

$

363.7

Purchases of Property, Plant and

Equipment

(153.6

)

(151.3

)

Free Cash Flow

$

254.8

$

212.4

(1)

Tables may not foot due to

rounding.

(2)

BWXT is providing non-GAAP

information regarding certain of its historical results and

guidance on future earnings per share to supplement the results

provided in accordance with GAAP and it should not be considered

superior to, or as a substitute for, the comparable GAAP measures.

BWXT believes the non-GAAP measures provide meaningful insight and

transparency into the Company’s operational performance and

provides these measures to investors to help facilitate comparisons

of operating results with prior periods and to assist them in

understanding BWXT's ongoing operations.

(3)

For Non-GAAP adjustment details,

see reconciliation of non-GAAP operating income and earnings per

share.

BWX TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(Unaudited)

(In thousands, except share

and per share amounts)

Revenues

$

746,267

$

725,515

$

2,703,654

$

2,496,309

Costs and Expenses:

Cost of operations

571,894

536,966

2,048,447

1,875,716

Research and development costs

2,636

1,658

7,478

7,613

Losses on asset disposals and impairments,

net

4,394

1,049

4,390

1,034

Selling, general and administrative

expenses

90,693

74,594

318,663

279,694

Total Costs and Expenses

669,617

614,267

2,378,978

2,164,057

Equity in Income of Investees

15,612

11,945

55,931

50,807

Operating Income

92,262

123,193

380,607

383,059

Other Income (Expense):

Interest income

505

736

2,554

2,359

Interest expense

(9,285

)

(11,836

)

(39,475

)

(47,036

)

Other – net

(5,392

)

(26,472

)

5,034

(16,982

)

Total Other Income (Expense)

(14,172

)

(37,572

)

(31,887

)

(61,659

)

Income before Provision for Income

Taxes

78,090

85,621

348,720

321,400

Provision for Income Taxes

7,012

19,310

66,422

75,079

Net Income

$

71,078

$

66,311

$

282,298

$

246,321

Net Income Attributable to Noncontrolling

Interest

(60

)

(424

)

(357

)

(472

)

Net Income Attributable to BWX

Technologies, Inc.

$

71,018

$

65,887

$

281,941

$

245,849

Earnings per Common Share:

Basic:

Net Income Attributable to BWX

Technologies, Inc.

$

0.78

$

0.72

$

3.08

$

2.68

Diluted:

Net Income Attributable to BWX

Technologies, Inc.

$

0.77

$

0.72

$

3.07

$

2.68

Shares used in the computation of earnings

per share:

Basic

91,596,519

91,686,671

91,572,674

91,619,156

Diluted

91,889,756

91,997,796

91,859,732

91,874,537

BWX TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

Year Ended December

31,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

(In thousands)

Net Income

$

282,298

$

246,321

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

85,862

78,566

Income of investees, net of dividends

(10,598

)

11,130

Losses on asset disposals and impairments

- net

4,390

1,034

Provision for deferred taxes

19,845

(5,128

)

Recognition of (gains) losses for pension

and postretirement plans

14,147

34,087

Stock-based compensation expense

21,680

15,896

Other, net

(83

)

(1,530

)

Changes in assets and liabilities, net of

effects from acquisitions:

Accounts receivable

(47,571

)

462

Accounts payable

34,532

(9,025

)

Retainages

21,514

(6,615

)

Contracts in progress and advance billings

on contracts

(7,155

)

28,868

Income taxes

1,650

(4,786

)

Accrued and other current liabilities

865

(9,754

)

Pension liabilities, accrued

postretirement benefit obligations and employee benefits

881

(6,964

)

Other, net

(13,829

)

(8,861

)

NET CASH PROVIDED BY OPERATING

ACTIVITIES

408,428

363,701

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property, plant and

equipment

(153,647

)

(151,286

)

Acquisition of businesses

—

—

Purchases of securities

—

(2,343

)

Sales and maturities of securities

—

5,996

Investments, net of return of capital, in

equity method investees

(197

)

—

Other, net

(717

)

(8,009

)

NET CASH USED IN INVESTING ACTIVITIES

(154,561

)

(155,642

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings of long-term debt

456,000

353,100

Repayments of long-term debt

(612,250

)

(434,350

)

Payment of debt issuance costs

—

—

Repurchases of common stock

(20,000

)

—

Dividends paid to common shareholders

(88,349

)

(84,974

)

Cash paid for shares withheld to satisfy

employee taxes

(7,570

)

(7,592

)

Settlements of forward contracts, net

19,591

3,689

Other, net

(207

)

756

NET CASH (USED IN) PROVIDED BY FINANCING

ACTIVITIES

(252,785

)

(169,371

)

EFFECTS OF EXCHANGE RATE CHANGES ON

CASH

(2,126

)

1,937

TOTAL (DECREASE) INCREASE IN CASH AND CASH

EQUIVALENTS AND RESTRICTED CASH AND CASH EQUIVALENTS

(1,044

)

40,625

CASH AND CASH EQUIVALENTS AND RESTRICTED

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD

81,615

40,990

CASH AND CASH EQUIVALENTS AND RESTRICTED

CASH AND CASH EQUIVALENTS AT END OF PERIOD

$

80,571

$

81,615

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION:

Cash paid during the period for:

Interest

$

72,426

$

63,216

Income taxes (net of refunds)

$

45,508

$

84,478

SCHEDULE OF NON-CASH INVESTING

ACTIVITY:

Accrued capital expenditures included in

accounts payable

$

17,537

$

7,105

BWX TECHNOLOGIES, INC.

CONSOLIDATED BALANCE

SHEETS

ASSETS

December 31,

2024

2023

(In thousands)

Current Assets:

Cash and cash equivalents

$

74,109

$

75,766

Restricted cash and cash equivalents

2,785

2,858

Investments

—

—

Accounts receivable – trade, net

99,112

70,180

Accounts receivable – other

53,199

16,339

Retainages

33,667

55,181

Contracts in progress

577,745

533,155

Other current assets

89,380

64,322

Total Current Assets

929,997

817,801

Property, Plant and Equipment, Net

1,278,161

1,228,520

Investments

10,609

9,496

Goodwill

287,362

297,020

Deferred Income Taxes

6,569

16,332

Investments in Unconsolidated

Affiliates

99,403

88,608

Intangible Assets

165,325

185,510

Other Assets

92,498

103,778

TOTAL

$

2,869,924

$

2,747,065

BWX TECHNOLOGIES, INC.

CONSOLIDATED BALANCE

SHEETS

LIABILITIES AND STOCKHOLDERS’

EQUITY

December 31,

2024

2023

(In thousands, except

share and per share amounts)

Current Liabilities:

Current maturities of long-term debt

$

12,500

$

6,250

Accounts payable

158,077

126,651

Accrued employee benefits

77,234

64,544

Accrued liabilities – other

65,100

70,210

Advance billings on contracts

161,290

107,391

Total Current Liabilities

474,201

375,046

Long-Term Debt

1,042,970

1,203,422

Accumulated Postretirement Benefit

Obligation

16,515

18,466

Environmental Liabilities

94,225

90,575

Pension Liability

82,602

82,786

Other Liabilities

79,007

43,469

Commitments and Contingencies

Stockholders' Equity:

Common stock, par value $0.01 per share,

authorized 325,000,000 shares; issued 128,320,295 and 128,065,521

shares at December 31, 2024 and 2023, respectively

1,283

1,281

Preferred stock, par value $0.01 per

share, authorized 75,000,000 shares; no shares issued

—

—

Capital in excess of par value

228,889

206,478

Retained earnings

2,287,151

2,093,917

Treasury stock at cost, 36,869,498 and

36,537,695 shares at December 31, 2024 and 2023, respectively

(1,388,432

)

(1,360,862

)

Accumulated other comprehensive income

(loss)

(48,211

)

(7,463

)

Stockholders' Equity – BWX Technologies,

Inc.

1,080,680

933,351

Noncontrolling interest

(276

)

(50

)

Total Stockholders' Equity

1,080,404

933,301

TOTAL

$

2,869,924

$

2,747,065

BWX TECHNOLOGIES, INC.

BUSINESS SEGMENT

INFORMATION

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(Unaudited)

(In thousands)

REVENUES:

Government Operations

$

595,000

$

601,629

$

2,183,040

$

2,031,337

Commercial Operations

152,331

124,141

523,972

466,344

Eliminations

(1,065

)

(255

)

(3,358

)

(1,372

)

TOTAL

$

746,266

$

725,515

$

2,703,654

$

2,496,309

SEGMENT

INCOME:

Government Operations

$

98,059

$

116,282

$

377,875

$

374,682

Commercial Operations

14,868

15,919

46,816

37,532

SUBTOTAL

$

112,927

$

132,201

$

424,691

$

412,214

Unallocated Corporate

(20,666

)

(9,008

)

(44,084

)

(29,155

)

TOTAL

$

92,261

$

123,193

$

380,607

$

383,059

DEPRECIATION AND

AMORTIZATION:

Government Operations

$

16,079

$

14,035

$

61,027

$

53,388

Commercial Operations

4,554

4,467

17,708

17,745

Corporate

1,800

1,859

7,127

7,433

TOTAL

$

22,433

$

20,361

$

85,862

$

78,566

CAPITAL

EXPENDITURES:

Government Operations

$

28,050

$

33,584

$

81,063

$

91,699

Commercial Operations

19,620

12,769

62,773

53,358

Corporate

4,850

4,435

9,811

6,229

TOTAL

$

52,520

$

50,788

$

153,647

$

151,286

BACKLOG:

Government Operations

$

3,912,580

$

3,216,673

$

3,912,580

$

3,216,673

Commercial Operations

929,880

780,974

929,880

780,974

TOTAL

$

4,842,460

$

3,997,647

$

4,842,460

$

3,997,647

BOOKINGS:

Government Operations

$

1,762,228

$

559,412

$

2,878,808

$

1,731,618

Commercial Operations

446,438

182,906

670,288

618,029

TOTAL

$

2,208,666

$

742,318

$

3,549,096

$

2,349,647

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224459539/en/

Investor Contact: Chase Jacobson Vice President, Investor

Relations 980-365-4300 Investors@bwxt.com Media Contact:

John Dobken Senior Manager, Media & Public Relations

202-428-6913 jcdobken@bwxt.com

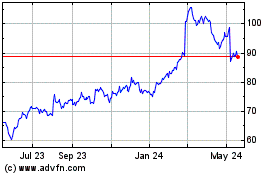

BWX Technologies (NYSE:BWXT)

Historical Stock Chart

From Jan 2025 to Feb 2025

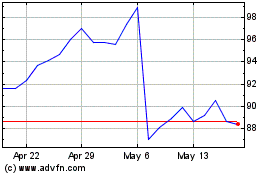

BWX Technologies (NYSE:BWXT)

Historical Stock Chart

From Feb 2024 to Feb 2025