UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20546

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month

of August, 2024

Commission

File Number: 333-221916

Corporación América Airports S.A.

(Name of Registrant)

128, Boulevard de la Pétrusse

L-2330 Luxembourg

Tel: +35226258274

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: August 21, 2024

| |

Corporación América Airports S.A. |

| |

|

| |

By: |

/s/ Andres Zenarruza |

| |

Name: |

Andres Zenarruza |

| |

Title: |

Head of Legal & Compliance |

| |

|

| |

By: |

/s/ Jorge Arruda |

| |

Name: |

Jorge Arruda |

| |

Title: |

Chief Financial Officer |

Exhibit Index

Exhibit 99.1

CORPORACION AMERICA AIRPORTS REPORTS SECOND

QUARTER 2024 RESULTS

Consolidated Revenues, ex-IFRIC12 up 0.2% YoY,

despite 5% traffic decline Ex-Natal

Diversified portfolio mitigated soft performance

in Argentina

Strong cash position with Net Debt to LTM Adjusted

EBITDA improving to 1.1x

Luxembourg,

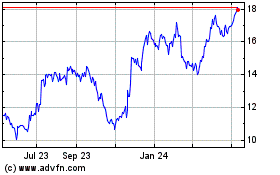

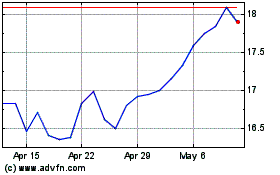

August 21, 2024— Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”)

one of the leading private airport operators in the world, reported today its unaudited, consolidated results for the three and six-month

period ended June 30, 2024. Financial results are expressed in millions of U.S. dollars and are prepared in accordance with International

Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (“IASB”).

Commencing 3Q18, the Company began reporting

results of its Argentinean subsidiaries applying Hyperinflation Accounting, in accordance with IFRS rule IAS 29 (“IAS 29”),

as detailed in Section “Hyperinflation Accounting in Argentina” on page 22.

Second Quarter 2024 Highlights

| § | Consolidated

Revenues ex-IFRIC12 of $366.1 million, increased 0.2% year-over-year (YoY), as the 2.9% decrease

in Commercial Revenues was offset by a 3.2% increase in Aeronautical Revenues. Excluding

rule IAS 29, consolidated revenues ex-IFRIC12 decreased 1.7% YoY to $363.3 million. |

| § | 7.8%

decrease in passenger traffic to 18.2 million. Excluding Natal, passenger traffic decreased

5.4% YoY. |

| § | 4.7%

increase in cargo volume to 95.1 thousand tons. |

| § | 9.5%

decrease in aircraft movements, or 7.8%, excluding Natal. |

| § | Operating

Income of $92.9 million, down from $110.4 million in 2Q23. |

| § | Adjusted

EBITDA ex-IFRIC12 decreased 8.8% to $136.2 million, from $149.3 million in the year-ago

period. Excluding rule IAS 29, Adjusted EBITDA ex-IFRIC12 decreased 10.3% to $134.6

million. |

| § | Adjusted

EBITDA margin ex-IFRIC12 contracted to 37.2% from 40.9% in 2Q23, or to 37.0% from 40.6% when

excluding rule IAS 29. |

| § | Strong

cash position with Cash & Cash equivalents totaling $439.4 million as of June 2024. |

| § | Net

debt to LTM Adjusted EBITDA improved to 1.1x as of June 30, 2024, from 1.4x as of December 31,

2023. |

CEO Message

Commenting on the results for the quarter Mr. Martín

Eurnekian, CEO of Corporación América Airports, noted: “Despite a mild decline in overall passenger traffic, our

revenues remained resilient, thanks to our geographic diversification. This is reflected in our revenue per passenger ex-IFRIC12, which

increased by 9% year-over-year, outpacing revenue growth and underpinning our ability to adapt to challenging market dynamics.

EBITDA ex-IFRIC12, declined by 9% year-over-year,

primarily due to the impact of Argentina's macroeconomic dynamics on our domestic traffic, duty-free revenues, and operational expenses.

Nonetheless, international traffic in Argentina performed well and we have also delivered strong performances in Italy and Uruguay, underscoring

the strength of our operations in those regions.

We closed the quarter with a solid balance

sheet and a favorable debt maturity profile. Our net leverage ratio reached another record low of 1.1x as of June 30, 2024, demonstrating

our commitment to maintaining a disciplined capital structure.

On the strategic front, we remain engaged

in negotiating a new $400 million Capex plan with the Armenian government and awaiting approval for the new master plan for Florence

airport. Additionally, we remain active in assessing new expansion projects across various geographies, aligning with our strategic roadmap

to pursue growth opportunities.

Looking ahead, we expect the positive dynamics

in Uruguay and Italy to continue throughout the year. Moreover, recent open skies bilateral agreements concluded by Argentina with multiple

countries open the opportunity for airlines to offer new routes and destinations to travel from/to Argentina, contributing to improved

flexibility and dynamism in the country’s aeronautical activity.

In

sum, our healthy balance sheet provides the financial flexibility to support our global growth initiatives while we navigate near-term

challenges in Argentina and Brazil. We have the foundation in place and are confident about the long-term growth potential of our Company.”

Operating & Financial Highlights

(In millions of U.S. dollars, unless otherwise

noted)

| | |

2Q24

as

reported | | |

2Q23

as

reported | | |

%

Var as

reported | | |

IAS

29

2Q24 | | |

2Q24

ex

IAS 29 | | |

2Q23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| Passenger Traffic

(Million Passengers) | |

| 18.2 | | |

| 19.7 | | |

| -7.8 | % | |

| | | |

| 18.2 | | |

| 19.7 | | |

| -7.8 | % |

| Revenue | |

| 416.2 | | |

| 422.7 | | |

| -1.5 | % | |

| 4.1 | | |

| 412.1 | | |

| 428.6 | | |

| -3.8 | % |

| Aeronautical Revenues | |

| 193.7 | | |

| 187.7 | | |

| 3.2 | % | |

| 0.4 | | |

| 193.2 | | |

| 190.1 | | |

| 1.6 | % |

| Non-Aeronautical Revenues | |

| 222.6 | | |

| 235.0 | | |

| -5.3 | % | |

| 3.7 | | |

| 218.9 | | |

| 238.5 | | |

| -8.2 | % |

| Revenue excluding construction

service | |

| 366.1 | | |

| 365.5 | | |

| 0.2 | % | |

| 2.8 | | |

| 363.3 | | |

| 369.6 | | |

| -1.7 | % |

| Operating Income / (Loss) | |

| 92.9 | | |

| 110.4 | | |

| -15.9 | % | |

| -21.0 | | |

| 113.9 | | |

| 130.5 | | |

| -12.7 | % |

| Operating Margin | |

| 22.3 | % | |

| 26.1 | % | |

| -382 | | |

| 0.0 | % | |

| 27.6 | % | |

| 30.5 | % | |

| -282 | |

| Net (Loss) / Income Attributable

to Owners of the Parent | |

| 50.2 | | |

| 69.8 | | |

| -28.0 | % | |

| -7.6 | | |

| 57.8 | | |

| 46.6 | | |

| 24.0 | % |

| EPS (US$) | |

| 0.31 | | |

| 0.43 | | |

| -28.1 | % | |

| -0.05 | | |

| 0.36 | | |

| 0.29 | | |

| 23.9 | % |

| Adjusted EBITDA | |

| 136.4 | | |

| 150.9 | | |

| -9.6 | % | |

| 1.6 | | |

| 134.8 | | |

| 151.6 | | |

| -11.1 | % |

| Adjusted EBITDA Margin | |

| 32.8 | % | |

| 35.7 | % | |

| -294 | | |

| - | | |

| 32.7 | % | |

| 35.4 | % | |

| -267 | |

| Adjusted EBITDA Margin excluding

Construction Service | |

| 37.2 | % | |

| 40.9 | % | |

| -367 | | |

| - | | |

| 37.0 | % | |

| 40.6 | % | |

| -356 | |

| Net Debt to LTM Adjusted

EBITDA | |

| 1.1 | x | |

| 1.8 | x | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net

Debt to LTM Adjusted EBITDA excl. impairment on intangible assets (1) | |

| 1.3 | x | |

| 1.8 | x | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

Note: Figures in historical dollars (excluding

IAS29) are included for comparison purposes.

| 1) | LTM Adjusted

EBITDA excluding impairments of intangible assets. |

Operating & Financial Highlights

(In millions of U.S. dollars, unless otherwise

noted)

| | |

6M24

as

reported | | |

6M23

as

reported | | |

%

Var as

reported | | |

IAS

29

6M24 | | |

6M24

ex

IAS 29 | | |

6M23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| Passenger Traffic

(Million Passengers) | |

| 37.2 | | |

| 38.2 | | |

| -2.7 | % | |

| | | |

| 37.2 | | |

| 38.2 | | |

| -2.7 | % |

| Revenue | |

| 880.4 | | |

| 809.4 | | |

| 8.8 | % | |

| 55.8 | | |

| 824.6 | | |

| 815.2 | | |

| 1.1 | % |

| Aeronautical Revenues | |

| 431.8 | | |

| 375.6 | | |

| 15.0 | % | |

| 29.7 | | |

| 402.0 | | |

| 377.5 | | |

| 6.5 | % |

| Non-Aeronautical Revenues | |

| 448.7 | | |

| 433.8 | | |

| 3.4 | % | |

| 26.1 | | |

| 422.6 | | |

| 437.7 | | |

| -3.5 | % |

| Revenue excluding construction

service | |

| 784.9 | | |

| 718.0 | | |

| 9.3 | % | |

| 50.3 | | |

| 734.6 | | |

| 720.6 | | |

| 1.9 | % |

| Operating Income / (Loss) | |

| 227.7 | | |

| 213.8 | | |

| 6.5 | % | |

| -18.6 | | |

| 246.4 | | |

| 250.1 | | |

| -1.5 | % |

| Operating Margin | |

| 25.9 | % | |

| 26.4 | % | |

| -55 | | |

| - | | |

| 29.9 | % | |

| 30.7 | % | |

| -80 | |

| Net (Loss) / Income Attributable

to Owners of the Parent | |

| 219.9 | | |

| 102.1 | | |

| 115.4 | % | |

| 76.8 | | |

| 143.1 | | |

| 53.0 | | |

| 169.9 | % |

| EPS (US$) | |

| 1.37 | | |

| 0.63 | | |

| 115.3 | % | |

| 0.48 | | |

| 0.89 | | |

| 0.33 | | |

| 169.8 | % |

| Adjusted EBITDA | |

| 313.0 | | |

| 293.4 | | |

| 6.7 | % | |

| 25.7 | | |

| 287.3 | | |

| 292.8 | | |

| -1.9 | % |

| Adjusted EBITDA Margin | |

| 35.5 | % | |

| 36.2 | % | |

| -70 | | |

| - | | |

| 34.8 | % | |

| 35.9 | % | |

| -109 | |

| Adjusted EBITDA Margin excluding

Construction Service | |

| 39.7 | % | |

| 40.6 | % | |

| -83 | | |

| - | | |

| 39.0 | % | |

| 40.4 | % | |

| -138 | |

| Net Debt to LTM Adjusted

EBITDA | |

| 1.1 | x | |

| 1.8 | x | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net

Debt to LTM Adjusted EBITDA excl. impairment on intangible assets (1) | |

| 1.3 | x | |

| 1.8 | x | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

Note: Figures in historical dollars (excluding

IAS29) are included for comparison purposes.

| 1) | LTM Adjusted

EBITDA excluding impairments of intangible assets. |

2Q24 Operating Performance

Passenger Traffic

Total passenger traffic declined by 7.8% year-over-year

(YoY) to 18.2 million passengers, or 5.4% when adjusted for the discontinuation of the Natal airport, effective February 19, 2024,

as part of a friendly termination process agreed upon with the Brazilian government. Domestic passenger traffic decreased by 18.4% YoY,

or 14.8% when excluding Natal, primarily due to weaker performances in Argentina and, to a lesser extent, Brazil and Ecuador. However,

international traffic increased by 8.0%, mainly driven by strong performances in Italy, Argentina, and Uruguay.

Passenger traffic in Argentina declined

by 11.6% YoY, primarily due to weaker performance in domestic traffic, partially offset by international travel growth. Domestic traffic

declined 19.0% YoY, reflecting a difficult comparison as travel demand last year benefited from incentives provided by the 'Previaje'

government program aimed at boosting domestic tourism, which did not take place this year. Moreover, traffic this quarter was impacted

by the temporary suspension of several routes operated by Aerolíneas Argentinas (AA) and some flight cancellations by both AA

and Flybondi, together with the prevailing recession in the country. By contrast, international passenger traffic continued to benefit

from the gradual resumption of routes and frequencies, increasing by 9.3% YoY in the second quarter. During the quarter, Avianca inaugurated

a new route from Ezeiza to Medellin, and ITA Airways increased the frequency of its route from Ezeiza to Rome.

In Italy, passenger traffic increased

by 14.3% YoY to 2.6 million passengers. International traffic, which accounted for over 80% of total traffic, increased by 16.6% YoY,

supported by strong performances at both Pisa and Florence airports. Domestic passenger traffic increased by 5.6% YoY, driven by a 23.8%

increase at Florence airport, partially offset by a slight decline of 0.4% at Pisa airport.

In Brazil, total passenger traffic decreased

by 14.9% YoY, or by 3.4% YoY, when adjusting for the discontinuation of Natal Airport. Domestic traffic, which accounted for almost 60%

of total traffic, was down 22.0% YoY, or 5.4% when excluding Natal, while transit passengers were down 1.1% YoY. Traffic in Brazil remained

heavily impacted by financial and aircraft constraints in some local airlines, causing a lack of supply. As a reminder, following the

friendly termination process concluded in February 2024, effective February 19, 2024 CAAP no longer operates Natal Airport.

Therefore, statistics for Natal are available up to February 18, 2024.

In Uruguay, where activity is mainly international,

passenger traffic increased by 11.2% YoY to 0.5 million, despite a difficult comparison due to the Easter holiday falling in April last

year. During the quarter, traffic was boosted by new routes and increased frequencies. JetSMART Airlines inaugurated a new route between

Montevideo and Buenos Aires with two daily frequencies starting on May 29, while SKY Airline increased the frequency of its Montevideo

to Lima route in May.

Passenger traffic in Armenia decreased

by 2.9% YoY to 1.3 million passengers against a strong performance in 2023, which benefited from the introduction of new airlines and

a higher number of flight frequencies.

In Ecuador, total passenger traffic decreased

by 5.5% YoY to 1.2 million passengers, as higher international traffic was more than offset by a weak performance in domestic travel.

International passenger traffic increased by 3.9% YoY, while domestic traffic decreased by 13.4% YoY, mainly driven by the exit of local

airline Equair in October 2023 and national insecurity issues.

Cargo Volume

Cargo volume increased by 4.7% YoY in the second

quarter of 2024, with significant contributions from Argentina, Ecuador, and Armenia. Together, these countries accounted for more than

70% of the total volume, with YoY increases of 5.9%, 22.2%, and 6.1%, respectively.

Aircraft Movements

Total aircraft movements decreased by 9.5% YoY

in the second quarter of 2024, with declines in all countries except Italy, where aircraft movements increased by 8.9% YoY. Argentina,

Brazil, and Italy together accounted for more than 80% of total aircraft movements during the quarter.

Tables with detailed passenger traffic, cargo

volume and aircraft movement information for each airport can be found on page 35 of this report.

Operational Statistics: Passenger Traffic,

Cargo Volume and Aircraft Movements

| | |

2Q24 | | |

2Q23 | | |

%

Var. ('24

vs '23) | |

| Domestic

Passengers (in thousands) | |

| 9,107 | | |

| 11,155 | | |

| -18.4 | % |

| International

Passengers (in thousands) | |

| 7,485 | | |

| 6,928 | | |

| 8.0 | % |

| Transit

Passengers (in thousands) | |

| 1,600 | | |

| 1,645 | | |

| -2.7 | % |

| Total

Passengers (in thousands) | |

| 18,193 | | |

| 19,728 | | |

| -7.8 | % |

| Cargo

Volume (in thousands of tons) | |

| 95.1 | | |

| 90.8 | | |

| 4.7 | % |

| Total

Aircraft Movements (in thousands) | |

| 194.5 | | |

| 214.9 | | |

| -9.5 | % |

| Passenger

Traffic Breakdown | |

Cargo

Volume | | |

Aircraft

Movements | |

| Country | |

2Q24 | | |

2Q23 | | |

%

Var. | | |

2Q24 | | |

2Q23 | | |

%

Var. | | |

2Q24 | | |

2Q23 | | |

%

Var. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(thousands) | | |

(tons) | | |

| |

| Argentina | |

| 9,070 | | |

| 10,262 | | |

| -11.6 | % | |

| 49,863 | | |

| 47,065 | | |

| 5.9 | % | |

| 100,608 | | |

| 112,786 | | |

| -10.8 | % |

| Italy | |

| 2,646 | | |

| 2,314 | | |

| 14.3 | % | |

| 3,244 | | |

| 3,374 | | |

| -3.8 | % | |

| 24,527 | | |

| 22,522 | | |

| 8.9 | % |

| Brazil | |

| 3,508 | | |

| 4,122 | | |

| -14.9 | % | |

| 15,491 | | |

| 15,487 | | |

| 0.0 | % | |

| 34,250 | | |

| 40,944 | | |

| -16.3 | % |

| Uruguay | |

| 481 | | |

| 433 | | |

| 11.2 | % | |

| 8,321 | | |

| 8,969 | | |

| -7.2 | % | |

| 6,847 | | |

| 7,376 | | |

| -7.2 | % |

| Ecuador

(1) | |

| 1,174 | | |

| 1,243 | | |

| -5.5 | % | |

| 9,800 | | |

| 8,019 | | |

| 22.2 | % | |

| 18,417 | | |

| 20,025 | | |

| -8.0 | % |

| Armenia | |

| 1,314 | | |

| 1,353 | | |

| -2.9 | % | |

| 8,344 | | |

| 7,863 | | |

| 6.1 | % | |

| 9,871 | | |

| 11,231 | | |

| -12.1 | % |

| TOTAL | |

| 18,193 | | |

| 19,728 | | |

| -7.8 | % | |

| 95,062 | | |

| 90,776 | | |

| 4.7 | % | |

| 194,520 | | |

| 214,884 | | |

| -9.5 | % |

| 1) | CAAP

owns 99.9% of ECOGAL, which operates and maintains the Galapagos Airport, but due to the

terms of the concession agreement, ECOGAL’s results are accounted for by the equity

method. However, 100% of ECOGAL’s passenger traffic and aircraft movements are included

in this table. |

Review of Consolidated Results

Results for ECOGAL, which operates the Galapagos

Airport in Ecuador, are accounted for under the equity method.

Revenues

Consolidated Revenues decreased by 1.5% YoY to

$416.2 million in 2Q24. Excluding Construction Services and the impact of IAS 29, revenues decreased by 1.7% YoY to $363.3 million.

This was mainly driven by higher aeronautical and commercial revenues in Uruguay and Italy, which were more than offset by lower commercial

revenues in Argentina, particularly Duty Free and Cargo revenues.

The following table shows revenue performance by country. More detail

on the performance of CAAP´s countries of operations can be found on page 11.

Revenues by Segment (in US$ million)

| Country | |

2Q24

as

reported | | |

2Q23

as

reported | | |

%

Var as

reported | | |

IAS

29 | | |

2Q24

ex

IAS 29 | | |

2Q23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| Argentina | |

| 224.8 | | |

| 240.3 | | |

| -6.5 | % | |

| 4.1 | | |

| 220.7 | | |

| 246.2 | | |

| -10.4 | % |

| Italy | |

| 35.3 | | |

| 33.9 | | |

| 4.0 | % | |

| - | | |

| 35.3 | | |

| 33.9 | | |

| 4.0 | % |

| Brazil | |

| 26.8 | | |

| 27.3 | | |

| -1.5 | % | |

| - | | |

| 26.8 | | |

| 27.3 | | |

| -1.5 | % |

| Uruguay | |

| 42.8 | | |

| 36.1 | | |

| 18.6 | % | |

| - | | |

| 42.8 | | |

| 36.1 | | |

| 18.6 | % |

| Armenia | |

| 59.3 | | |

| 59.1 | | |

| 0.4 | % | |

| - | | |

| 59.3 | | |

| 59.1 | | |

| 0.4 | % |

| Ecuador

(1) | |

| 27.1 | | |

| 25.9 | | |

| 4.7 | % | |

| - | | |

| 27.1 | | |

| 25.9 | | |

| 4.7 | % |

| Unallocated | |

| 0.2 | | |

| 0.2 | | |

| -12.3 | % | |

| - | | |

| 0.2 | | |

| 0.2 | | |

| -12.3 | % |

| Total

consolidated revenue (2) | |

| 416.2 | | |

| 422.7 | | |

| -1.5 | % | |

| 4.1 | | |

| 412.1 | | |

| 428.6 | | |

| -3.8 | % |

1 Only includes Guayaquil Airport.

2 Excluding Construction

Service revenue, ‘As reported’ revenues decreased 4.1% YoY in Argentina (or 7.4% excluding IAS29), 2.3% in Brazil and 2.3%

in Armenia; and increased 15.0% in Italy, 17.3% in Uruguay and 4.5% in Ecuador.

Revenue Breakdown (in US$ million)

| | |

2Q24

as

reported | | |

2Q23

as

reported | | |

%

Var as

reported | | |

IAS

29 | | |

2Q24

ex

IAS 29 | | |

2Q23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| Aeronautical

Revenue | |

| 193.7 | | |

| 187.7 | | |

| 3.2 | % | |

| 0.4 | | |

| 193.2 | | |

| 190.1 | | |

| 1.6 | % |

| Non-aeronautical Revenue | |

| 222.6 | | |

| 235.0 | | |

| -5.3 | % | |

| 3.7 | | |

| 218.9 | | |

| 238.5 | | |

| -8.2 | % |

| Commercial revenue | |

| 171.4 | | |

| 176.5 | | |

| -2.9 | % | |

| 2.3 | | |

| 169.1 | | |

| 178.1 | | |

| -5.1 | % |

| Construction

service revenue (1) | |

| 50.1 | | |

| 57.2 | | |

| -12.4 | % | |

| 1.3 | | |

| 48.8 | | |

| 59.0 | | |

| -17.3 | % |

| Other revenue | |

| 1.0 | | |

| 1.3 | | |

| -25.6 | % | |

| 0.0 | | |

| 1.0 | | |

| 1.3 | | |

| -25.6 | % |

| Total

Consolidated Revenue | |

| 416.2 | | |

| 422.7 | | |

| -1.5 | % | |

| 4.1 | | |

| 412.1 | | |

| 428.6 | | |

| -3.8 | % |

| Total

Revenue excluding Construction Service revenue (2) | |

| 366.1 | | |

| 365.5 | | |

| 0.2 | % | |

| 2.8 | | |

| 363.3 | | |

| 369.6 | | |

| -1.7 | % |

1 Construction Service

revenue equals the construction or upgrade costs plus a reasonable margin.

2 Excludes Construction

Service revenue.

Aeronautical

Revenues accounted for 46.5% of total revenues, increasing by 3.2% YoY to $193.7 million, or 1.6% YoY to $193.2 million

when excluding the effects of IAS 29. This increase was mainly driven by higher passenger use fees and aircraft fees in Uruguay and

Italy, where aeronautical revenues rose by 20.8% and 15.5% respectively, following increased YoY passenger traffic. In Argentina,

aeronautical revenues increased by 1.2%, or declined by 1.6% excluding IAS 29, and rose by 5.0% in Ecuador due to higher tariffs.

Conversely, aeronautical revenues in Brazil and Armenia decreased by 14.8% and 1.7% YoY, respectively, in line with declines in

passenger traffic.

Non-Aeronautical

Revenues accounted for 53.5% of total revenues and decreased by 5.3% YoY to $222.6 million, or by 8.2% YoY to $218.9 million

when excluding the impact of IAS 29. Commercial revenues decreased by 2.9%, or $5.0 million, as lower Warehouse use fees (Cargo)

and Duty-free revenues in Argentina more than offset improvements in VIP lounges, Advertising, and Rental of space. Construction service

revenue decreased by 12.4%, or $7.1 million, mainly due to lower capital expenditures in Argentina.

Operating Costs and Expenses

In 2Q24, Total Costs and Expenses, excluding

Construction Service Costs, increased 5.8% YoY to $280.9 million, or 3.0% to $257.1 when excluding IAS 29. This increase was mainly

driven by higher Maintenance expenses, primarily in Argentina, combined with higher Amortization and depreciation, and SG&A expenses.

Cost

of Services increased 2.2% YoY to $286.1 million, or decreased 1.6% to $261.3 million when excluding the impact of rule IAS29,

mainly as a result of the following increases:

| § | 24.0%,

or $7.9 million, in Maintenance expenses, |

| § | 7.1%,

or $2.8 million, in Amortization and depreciation, and |

| § | 6.6%,

or $1.1 million, in Services and fees. |

This was partially offset by a decline in Construction

service costs reflecting lower Capex, combined with reduced Cost of fuel, mainly in Armenia.

Excluding Construction service costs, Cost of

services increased 5.3% YoY to $236.2 million, or 2.2% to $212.7 million excluding IAS 29, mainly reflecting the aforementioned increases

in Maintenance expenses, A&D and Services and fees.

Selling,

General and Administrative Expenses (“SG&A”) increased 9.0% YoY, to $43.8 million in 2Q24, mainly as

a result of higher Services and fees and Advertising expenses. Excluding the impact of rule IAS 29, SG&A expenses increased

7.2% to $43.4 million.

Other

Expenses remained flat YoY at $1.0 million in 2Q24.

Costs and Expenses (in US$ million)

| | |

2Q24

as

reported | | |

2Q23

as

reported | | |

%

Var as

reported | | |

IAS

29 | | |

2Q24

ex

IAS 29 | | |

2Q23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| Cost of Services | |

| 286.1 | | |

| 280.0 | | |

| 2.2 | % | |

| 24.8 | | |

| 261.3 | | |

| 265.5 | | |

| -1.6 | % |

| Salaries and social security

contributions | |

| 57.4 | | |

| 56.1 | | |

| 2.4 | % | |

| 0.0 | | |

| 57.5 | | |

| 57.5 | | |

| 0.0 | % |

| Concession fees | |

| 47.3 | | |

| 47.3 | | |

| 0.0 | % | |

| 0.2 | | |

| 47.2 | | |

| 48.1 | | |

| -1.9 | % |

| Construction service cost | |

| 49.9 | | |

| 55.6 | | |

| -10.3 | % | |

| 1.3 | | |

| 48.6 | | |

| 57.4 | | |

| -15.4 | % |

| Maintenance expenses | |

| 40.7 | | |

| 32.8 | | |

| 24.0 | % | |

| 0.8 | | |

| 39.9 | | |

| 33.3 | | |

| 19.8 | % |

| Amortization and depreciation | |

| 41.8 | | |

| 39.0 | | |

| 7.1 | % | |

| 22.4 | | |

| 19.4 | | |

| 19.8 | | |

| -1.9 | % |

| Other | |

| 48.9 | | |

| 49.0 | | |

| -0.4 | % | |

| 0.1 | | |

| 48.8 | | |

| 49.5 | | |

| -1.5 | % |

| Cost of Services Excluding

Construction Service cost | |

| 236.2 | | |

| 224.3 | | |

| 5.3 | % | |

| 23.4 | | |

| 212.7 | | |

| 208.2 | | |

| 2.2 | % |

| Selling, general and administrative

expenses | |

| 43.8 | | |

| 40.2 | | |

| 9.0 | % | |

| 0.4 | | |

| 43.4 | | |

| 40.5 | | |

| 7.2 | % |

| Other

expenses | |

| 1.0 | | |

| 1.0 | | |

| 0.7 | % | |

| 0.0 | | |

| 1.0 | | |

| 1.0 | | |

| -1.3 | % |

| Total

Costs and Expenses | |

| 330.8 | | |

| 321.1 | | |

| 3.0 | % | |

| 25.2 | | |

| 305.7 | | |

| 307.0 | | |

| -0.4 | % |

| Total

Costs and Expenses Excluding Construction Service cost | |

| 280.9 | | |

| 265.5 | | |

| 5.8 | % | |

| 23.8 | | |

| 257.1 | | |

| 249.7 | | |

| 3.0 | % |

Adjusted EBITDA and Adjusted EBITDA excluding Construction Service

During 2Q24, CAAP reported an Adjusted

EBITDA of $136.4 million and an Adjusted EBITDA ex-IFRIC12 of $136.2 million, declining from $149.3 million in the year-ago period.

Strong contributions from Italy and Uruguay helped partially offset Argentina’s year-over-year underperformance, mainly

impacted by a decrease in Domestic passenger traffic, lower Duty-free revenues, and an inflation rate above currency devaluation,

which exerted pressure on EBITDA levels. Excluding the impact of IFRS rule IAS 29, Adjusted EBITDA ex-IFRIC12 decreased 10.3%

YoY to $134.6 million. Adjusted EBITDA margin, ex-IFRIC12, contracted 3.7 percentage points to 37.2% from 40.9% in 2Q23, or 3.6

percentage points to 37.0% from 40.6%, when also excluding IAS 29, as margin expansion in Italy, Uruguay, Armenia and Brazil, was

more than offset by lower margin in Argentina and Ecuador.

Adjusted EBITDA by Segment (in US$ million)

| | |

2Q24

as

reported | | |

2Q23

as

reported | | |

%

Var as

reported | | |

IAS

29 | | |

2Q24

ex

IAS 29 | | |

2Q23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| Argentina | |

| 69.0 | | |

| 88.9 | | |

| -22.4 | % | |

| 1.6 | | |

| 67.4 | | |

| 89.6 | | |

| -24.8 | % |

| Italy | |

| 13.3 | | |

| 10.4 | | |

| 27.0 | % | |

| - | | |

| 13.3 | | |

| 10.4 | | |

| 27.0 | % |

| Brazil | |

| 11.4 | | |

| 11.6 | | |

| -2.4 | % | |

| - | | |

| 11.4 | | |

| 11.6 | | |

| -2.4 | % |

| Uruguay | |

| 12.2 | | |

| 9.5 | | |

| 27.8 | % | |

| - | | |

| 12.2 | | |

| 9.5 | | |

| 27.8 | % |

| Armenia | |

| 24.5 | | |

| 24.5 | | |

| 0.2 | % | |

| - | | |

| 24.5 | | |

| 24.5 | | |

| 0.2 | % |

| Ecuador | |

| 8.2 | | |

| 8.1 | | |

| 1.0 | % | |

| - | | |

| 8.2 | | |

| 8.1 | | |

| 1.0 | % |

| Unallocated | |

| -2.1 | | |

| -2.0 | | |

| 2.0 | % | |

| - | | |

| -2.1 | | |

| -2.0 | | |

| 2.0 | % |

| Total

segment EBITDA | |

| 136.4 | | |

| 150.9 | | |

| -9.6 | % | |

| 1.6 | | |

| 134.8 | | |

| 151.6 | | |

| -11.1 | % |

Adjusted EBITDA Reconciliation to Income from

Continuing Operations (in US$ million)

| | |

2Q24

as

reported | | |

2Q23

as

reported | | |

%

Var as

reported | | |

IAS

29 | | |

2Q24

ex

IAS 29 | | |

2Q23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| Income from

Continuing Operations | |

| 54.5 | | |

| 80.8 | | |

| -32.6 | % | |

| -7.6 | | |

| 62.1 | | |

| 57.7 | | |

| 7.6 | % |

| Financial Income | |

| -17.6 | | |

| -18.1 | | |

| -2.8 | % | |

| 7.0 | | |

| -24.5 | | |

| -38.3 | | |

| -35.9 | % |

| Financial Loss | |

| 8.7 | | |

| 38.4 | | |

| -77.3 | % | |

| -79.5 | | |

| 88.2 | | |

| 197.3 | | |

| -55.3 | % |

| Inflation adjustment | |

| 1.6 | | |

| 10.8 | | |

| -85.5 | % | |

| 2.8 | | |

| -1.2 | | |

| 0.0 | | |

| 8428.9 | % |

| Income Tax Expense | |

| 45.6 | | |

| -1.6 | | |

| -2881.4 | % | |

| 56.3 | | |

| -10.7 | | |

| -86.2 | | |

| -87.6 | % |

| Amortization and Depreciation | |

| 43.6 | | |

| 40.6 | | |

| 7.4 | % | |

| 22.6 | | |

| 20.9 | | |

| 21.2 | | |

| -1.2 | % |

| Adjusted EBITDA | |

| 136.4 | | |

| 150.9 | | |

| -9.6 | % | |

| 1.6 | | |

| 134.8 | | |

| 151.6 | | |

| -11.1 | % |

| Adjusted EBITDA Margin | |

| 32.8 | % | |

| 35.7 | % | |

| -294 | | |

| - | | |

| 32.7 | % | |

| 35.4 | % | |

| -267 | |

| Adjusted EBITDA excluding

Construction Service | |

| 136.2 | | |

| 149.3 | | |

| -8.8 | % | |

| 1.6 | | |

| 134.6 | | |

| 150.0 | | |

| -10.3 | % |

| Adjusted EBITDA Margin excluding

Construction Service | |

| 37.2 | % | |

| 40.9 | % | |

| -367 | | |

| - | | |

| 37.0 | % | |

| 40.6 | % | |

| -356 | |

Financial Income and Loss

CAAP reported a Net financial Income of

$7.3 million in 2Q24 compared to a loss of $31.2 million in 2Q23. This improvement was mainly driven by higher year-over-year foreign

exchange transaction gains in Argentina, due to the impact of lower devaluation than inflation on the net liability monetary position,

combined with a positive variance in inflation adjustment. This was partially offset by slightly higher net interest expenses. Had IAS

29 not been applied, CAAP would have reported a net financial loss of $62.5 million in 2Q24, compared to a loss of $158.9 million in

the year-ago period.

| | |

2Q24

as

reported | | |

2Q23

as

reported | | |

%

Var as

reported | | |

IAS

29 | | |

2Q24

ex

IAS 29 | | |

2Q23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| Financial Income | |

| 17.6 | | |

| 18.1 | | |

| -2.8 | % | |

| -7.0 | | |

| 24.5 | | |

| 38.3 | | |

| -35.9 | % |

| Interest income | |

| 12.8 | | |

| 14.8 | | |

| -13.6 | % | |

| 0.0 | | |

| 12.8 | | |

| 15.1 | | |

| -15.8 | % |

| Foreign exchange income | |

| 0.2 | | |

| 0.3 | | |

| -34.2 | % | |

| -7.0 | | |

| 7.2 | | |

| 20.2 | | |

| -64.4 | % |

| Other | |

| 4.6 | | |

| 3.0 | | |

| 53.4 | % | |

| 0.0 | | |

| 4.6 | | |

| 3.0 | | |

| 53.4 | % |

| Inflation adjustment | |

| -1.6 | | |

| -10.8 | | |

| -85.5 | % | |

| -2.8 | | |

| 1.2 | | |

| 0.0 | | |

| 8,428.9 | % |

| Inflation adjustment | |

| -1.6 | | |

| -10.8 | | |

| -85.5 | % | |

| -2.8 | | |

| 1.2 | | |

| 0.0 | | |

| 8,428.9 | % |

| Financial Loss | |

| -8.7 | | |

| -38.4 | | |

| -77.3 | % | |

| 79.5 | | |

| -88.2 | | |

| -197.3 | | |

| -55.3 | % |

| Interest Expenses | |

| -25.4 | | |

| -27.2 | | |

| -6.6 | % | |

| -0.1 | | |

| -25.3 | | |

| -27.0 | | |

| -6.1 | % |

| Foreign exchange transaction

expenses | |

| 40.8 | | |

| 13.0 | | |

| 214.4 | % | |

| 79.6 | | |

| -38.9 | | |

| -146.2 | | |

| -73.4 | % |

| Changes in liability for concessions | |

| -21.2 | | |

| -22.2 | | |

| -4.2 | % | |

| - | | |

| -21.2 | | |

| -22.2 | | |

| -4.2 | % |

| Other expenses | |

| -2.8 | | |

| -2.1 | | |

| 38.7 | % | |

| 0 | | |

| -2.8 | | |

| -2.0 | | |

| 44.6 | % |

| Financial Loss, Net | |

| 7.3 | | |

| -31.2 | | |

| -123.4 | % | |

| 69.8 | | |

| -62.5 | | |

| -158.9 | | |

| -60.7 | % |

See “Use of Non-IFRS Financial Measures”

on page 22.

Income Tax Expense

During 2Q24, the Company reported an income tax

expense of $45.6 million versus a benefit of $1.6 million in 2Q23. Excluding the impact of IAS 29, CAAP reported an income tax benefit

of $10.7 million in 2Q24, compared to a tax benefit of $86.2 million in the year-ago quarter.

Net Income and Net Income Attributable to Owners of the Parent

During 2Q24, CAAP reported Net Income of

$54.5 million, compared to $80.8 million in 2Q23. This decrease was primarily driven by lower operating income and higher income

tax expenses, partially offset by the aforementioned year-over-year increase in foreign exchange net gains and, to a lesser extent, a

positive variation in inflation adjustment results.

In 2Q24, the Company reported Net Income Attributed

to Owners of the Parent of $50.2 million and earnings per common share of $0.31, compared with Net Income Attributable to Owners

of the Parent of $69.8 million in 2Q23, equivalent to earnings per common share of $0.43.

Consolidated Financial Position

As of June 30, 2024, cash and cash equivalents

amounted to $439.4 million, a decrease of 6.5% from the $469.8 million reported as of March 31, 2024, and an increase of 18.8% from

the $369.8 million reported as of December 31, 2023. Total liquidity as of June 30, 2024, which includes cash and cash equivalents

as well as other current financial assets, totaled $548.5 million, compared to $545.1 million as of March 31, 2024, and $457.9 million

as of December 31, 2023.

Total Debt at the close of 2Q24 decreased 8.3%,

or $110.9 million, to $1,222.4 million, from $1,333.2 million as of December 31, 2023, mainly due to debt reductions in Argentina,

Brazil and Italy. A total of $883.4 million, or 72.3% of total debt is denominated in U.S. dollars, while $180.9 million, or 14.8%

is denominated in Brazilian Reals, and $158.1 million, or 12.9%, is in Euros.

The Net Debt to LTM Adjusted EBITDA ratio improved

to 1.1x as of June 30, 2024, down from 1.4x as of December 2023, reflecting Adjusted EBITDA growth driven by strong revenue

performance, as well as reduced net debt levels. Excluding impairment of intangible assets, the Net Debt to LTM Adjusted EBITDA ratio

stood at 1.3x. As of June 30, 2024, all of CAAP’s subsidiaries were in compliance with their covenants.

Consolidated Debt Indicators (in US$ million)

| | |

As of Jun 30, 2024 | | |

As of Dec 31, 2023 | |

| Leverage | |

| | | |

| | |

| Total Debt / LTM Adjusted EBITDA (Times)1,3 | |

| 1.78 | x | |

| 1.97 | x |

| Total Net Debt / LTM Adjusted EBITDA (Times) 2,3, 4 | |

| 1.14 | x | |

| 1.42 | x |

| Total Net Debt / LTM Adjusted EBITDA (Times) 2,3,5 | |

| 1.34 | x | |

| 1.68 | x |

| Total Debt | |

| 1,222.4 | | |

| 1,333.2 | |

| Short-Term Debt | |

| 150.6 | | |

| 199.7 | |

| Long-Term Debt | |

| 1,071.8 | | |

| 1,133.5 | |

| Cash & Cash Equivalents | |

| 439.4 | | |

| 369.8 | |

| Total Net Debt3 | |

| 783.0 | | |

| 963.4 | |

1

The Total Debt to EBITDA Ratio is calculated as CAAP’s interest-bearing liabilities divided by its EBITDA.

2 The Total Net Debt to EBITDA Ratio is calculated

as CAAP’s interest-bearing liabilities minus Cash & Cash Equivalents, divided by its EBITDA.

3 The Total Net Debt is calculated as Total Debt

minus Cash & Cash Equivalents.

4 LTM Adjusted EBITDA as of June 30, 2024

was $686.5 million.

5 LTM Adjusted EBITDA excluding impairment of

intangible assets as of June 30, 2024 was $583.6 million.

Total Debt by Segment (in US$ million)

| | |

As of Jun 30, 2024 | | |

As of Dec 31, 2023 | |

| Argentina | |

| 610.4 | | |

| 646.1 | |

| Italy (1) | |

| 158.1 | | |

| 179.2 | |

| Brazil (2) | |

| 180.9 | | |

| 213.9 | |

| Uruguay (3) | |

| 264.9 | | |

| 269.8 | |

| Armenia | |

| - | | |

| 13.2 | |

| Ecuador | |

| 8.1 | | |

| 11.0 | |

| Total | |

| 1,222.4 | | |

| 1,333.2 | |

1

Of which approximately $94.0 million remain at Toscana Aeroporti level.

2

At Inframérica Concessionaria do Aeroporto de Brasilia level.

3

Of which approximately $247.4 million remain at ACI Airport Sudamérica SAU.

Maturity of borrowings:

| | |

1 year or less | | |

1 – 2 years | | |

2 – 5 years | | |

Over 5 years | | |

Total | |

| Debt service (1) | |

| 240.9 | | |

| 188.9 | | |

| 557.0 | | |

| 702.5 | | |

| 1,689.4 | |

1 The

amounts disclosed in the table are undiscounted cash flows of principal and estimated interest. Variable interest rate cash flows

have been estimated using variable interest rates applicable at the end of the reporting period.

Maturity

of borrowings – Breakdown by segment (in USD) as of June 30,

2024:

| Segment | |

| |

Currency | |

1 year or less | | |

1 – 2 years | | |

2 – 5 years | | |

Over 5 years | | |

Total | |

| Argentina | |

Principal | |

USD | |

| 63.6 | | |

| 78.4 | | |

| 247.8 | | |

| 229.5 | | |

| 619.3 | |

| | |

Interest | |

USD | |

| 42.3 | | |

| 38.4 | | |

| 85.5 | | |

| 22.3 | | |

| 188.5 | |

| Italy | |

Principal | |

EUR | |

| 64.2 | | |

| - | | |

| 8.5 | | |

| 87.2 | | |

| 159.9 | |

| | |

Interest | |

EUR | |

| 7.9 | | |

| 6.3 | | |

| 18.4 | | |

| 5.5 | | |

| 38.2 | |

| Brazil | |

Principal | |

R$ | |

| 11.3 | | |

| 12.7 | | |

| 47.8 | | |

| 108.5 | | |

| 180.2 | |

| | |

Interest | |

R$ | |

| 16.9 | | |

| 15.7 | | |

| 38.8 | | |

| 25.8 | | |

| 97.3 | |

| Uruguay | |

Principal | |

USD | |

| 10.6 | | |

| 16.9 | | |

| 64.6 | | |

| 182.7 | | |

| 274.9 | |

| | |

Interest | |

USD | |

| 18.4 | | |

| 17.7 | | |

| 45.6 | | |

| 40.9 | | |

| 122.5 | |

| Ecuador | |

Principal | |

USD | |

| 5.2 | | |

| 2.7 | | |

| - | | |

| - | | |

| 7.9 | |

| | |

Interest | |

USD | |

| 0.5 | | |

| 0.1 | | |

| - | | |

| - | | |

| 0.7 | |

| Total | |

| |

| |

| 240.9 | | |

| 188.9 | | |

| 557.0 | | |

| 702.5 | | |

| 1,689.4 | |

Cash & Cash Equivalent by Segment (in US$ million)

| | |

As of Jun 30, 2024 | | |

As of Dec 31, 2023 | |

| Argentina | |

| 114.1 | | |

| 91.2 | |

| Italy (1) | |

| 23.0 | | |

| 34.8 | |

| Brazil (2) | |

| 70.5 | | |

| 65.8 | |

| Uruguay | |

| 38.2 | | |

| 35.9 | |

| Armenia | |

| 29.1 | | |

| 39.0 | |

| Ecuador | |

| 5.7 | | |

| 16.1 | |

| Intermediate holding Companies | |

| 158.8 | | |

| 86.9 | |

| Total | |

| 439.4 | | |

| 369.8 | |

1

Of which approximately $20.8 million remain at Toscana Aeroporti level.

2 Of which approximately $66.7 million remain

at Inframérica Concessionaria do Aeroporto de Brasilia level.

CAPEX

During 2Q24, CAAP made capital expenditures of

$57.0 million, a 9.1% YoY decrease from $62.7 million in 2Q23. Excluding IAS 29, capital expenditures amounted to $56.9 million in the

quarter, with Argentina and Uruguay accounting for 73% and 15%, respectively. The latter included investments related to the airports

incorporated through the extension of the Puerta del Sur concession agreement in November 2021.

Review of Segment Results

Argentina

Starting

in 3Q18, reported numbers are presented applying Hyperinflation accounting for the Company’s Argentinean subsidiaries, in accordance

with IAS 29, as explained above. The following table presents the impact from Hyperinflation accounting under the column ‘IAS 29’,

while the columns indicated with “ex IAS 29” present results calculated without the impact from Hyperinflation accounting.

The impact of IAS 29 is presented only for Aeropuertos Argentina (AA), the Company’s largest subsidiary in Argentina, which

accounted for over 95% of passenger traffic, revenues and Adjusted EBITDA of the Argentina segment in 2Q24.

| | |

2Q24

as

reported | | |

2Q23

as

reported | | |

%

Var as

reported | | |

IAS

29 | | |

2Q24

ex

IAS 29 | | |

2Q23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| OPERATING STATISTICS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Domestic

Passengers (in millions) (1) | |

| 5.9 | | |

| 7.3 | | |

| -19.0 | % | |

| | | |

| 5.9 | | |

| 7.3 | | |

| -19.0 | % |

| International

Passengers (in millions) (1) | |

| 2.8 | | |

| 2.6 | | |

| 9.3 | % | |

| | | |

| 2.8 | | |

| 2.6 | | |

| 9.3 | % |

| Transit

Passengers (in millions) (1) | |

| 0.3 | | |

| 0.3 | | |

| -11.1 | % | |

| | | |

| 0.3 | | |

| 0.3 | | |

| -11.1 | % |

| Total

Passengers (in millions) (1) | |

| 9.1 | | |

| 10.3 | | |

| -11.6 | % | |

| | | |

| 9.1 | | |

| 10.3 | | |

| -11.6 | % |

| Cargo

Volume (in thousands of tons) | |

| 49.9 | | |

| 47.1 | | |

| 5.9 | % | |

| | | |

| 49.9 | | |

| 47.1 | | |

| 5.9 | % |

| Total

Aircraft Movements (in thousands) | |

| 100.6 | | |

| 112.8 | | |

| -10.8 | % | |

| | | |

| 100.6 | | |

| 112.8 | | |

| -10.8 | % |

| FINANCIAL HIGHLIGHTS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Aeronautical Revenue | |

| 103.6 | | |

| 102.4 | | |

| 1.2 | % | |

| 0.4 | | |

| 103.1 | | |

| 104.8 | | |

| -1.6 | % |

| Non-aeronautical revenue | |

| 121.2 | | |

| 137.9 | | |

| -12.1 | % | |

| 3.7 | | |

| 117.5 | | |

| 141.3 | | |

| -16.8 | % |

| Commercial revenue | |

| 84.1 | | |

| 93.2 | | |

| -9.8 | % | |

| 2.3 | | |

| 81.8 | | |

| 94.9 | | |

| -13.8 | % |

| Construction

service revenue | |

| 37.1 | | |

| 44.7 | | |

| -17.0 | % | |

| 1.3 | | |

| 35.7 | | |

| 46.4 | | |

| -23.0 | % |

| Total

Revenue | |

| 224.8 | | |

| 240.3 | | |

| -6.5 | % | |

| 4.1 | | |

| 220.7 | | |

| 246.2 | | |

| -10.4 | % |

| Total

Revenue Excluding IFRIC12(2) | |

| 187.7 | | |

| 195.6 | | |

| -4.1 | % | |

| 2.8 | | |

| 184.9 | | |

| 199.8 | | |

| -7.4 | % |

| Cost of Services | |

| 164.5 | | |

| 158.9 | | |

| 3.5 | % | |

| 24.8 | | |

| 139.7 | | |

| 144.5 | | |

| -3.3 | % |

| Selling, general and administrative

expenses | |

| 20.6 | | |

| 20.2 | | |

| 2.4 | % | |

| 0.4 | | |

| 20.3 | | |

| 20.5 | | |

| -1.2 | % |

| Other expenses | |

| 0.6 | | |

| 0.5 | | |

| 18.4 | % | |

| 0.0 | | |

| 0.6 | | |

| 0.5 | | |

| 13.9 | % |

| Total

Costs and Expenses | |

| 185.7 | | |

| 179.6 | | |

| 3.4 | % | |

| 25.2 | | |

| 160.6 | | |

| 165.5 | | |

| -3.0 | % |

| Total

Costs and Expenses Excluding IFRIC12(3) | |

| 148.7 | | |

| 135.0 | | |

| 10.2 | % | |

| 23.8 | | |

| 124.9 | | |

| 119.2 | | |

| 4.8 | % |

| Adjusted Segment EBITDA | |

| 69.0 | | |

| 88.9 | | |

| -22.4 | % | |

| 1.6 | | |

| 67.4 | | |

| 89.6 | | |

| -24.8 | % |

| Adjusted Segment EBITDA Mg | |

| 30.7 | % | |

| 37.0 | % | |

| -631 | | |

| - | | |

| 30.5 | % | |

| 36.4 | % | |

| -586 | |

| Adjusted

EBITDA Margin excluding IFRIC 12(4) | |

| 36.7 | % | |

| 45.4 | % | |

| -870 | | |

| - | | |

| 36.4 | % | |

| 44.8 | % | |

| -842 | |

| Capex | |

| 41.8 | | |

| 45.5 | | |

| -8.3 | % | |

| 0.1 | | |

| 41.6 | | |

| 47.3 | | |

| -11.9 | % |

| 1) | See

Note 1 in Table "Operating & Financial Highlights”. |

| 2) | Excludes

Construction Service revenue. |

| 3) | Excludes

Construction Service cost. |

| 4) | Excludes

the effect of IFRIC 12 with respect to the construction or improvements to assets under the

concession, and is calculated by dividing EBITDA by total revenues less Construction Service

revenue. |

| | |

6M24

as

reported | | |

6M23

as

reported | | |

%

Var as

reported | | |

IAS

29 | | |

6M24

ex

IAS 29 | | |

6M23

ex

IAS 29 | | |

%

Var ex

IAS 29 | |

| OPERATING STATISTICS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Domestic

Passengers (in millions) (1) | |

| 12.9 | | |

| 14.3 | | |

| -9.6 | % | |

| | | |

| 12.9 | | |

| 14.3 | | |

| -9.6 | % |

| International

Passengers (in millions) (1) | |

| 6.3 | | |

| 5.6 | | |

| 12.7 | % | |

| | | |

| 6.3 | | |

| 5.6 | | |

| 12.7 | % |

| Transit

Passengers (in millions) (1) | |

| 0.7 | | |

| 0.7 | | |

| 2.6 | % | |

| | | |

| 0.7 | | |

| 0.7 | | |

| 2.6 | % |

| Total

Passengers (in millions) (1) | |

| 19.9 | | |

| 20.5 | | |

| -3.2 | % | |

| | | |

| 19.9 | | |

| 20.5 | | |

| -3.2 | % |

| Cargo

Volume (in thousands of tons) | |

| 94.1 | | |

| 90.7 | | |

| 3.8 | % | |

| | | |

| 94.1 | | |

| 90.7 | | |

| 3.8 | % |

| Total

Aircraft Movements (in thousands) | |

| 214.6 | | |

| 223.1 | | |

| -3.8 | % | |

| | | |

| 214.6 | | |

| 223.1 | | |

| -3.8 | % |

| FINANCIAL HIGHLIGHTS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Aeronautical Revenue | |

| 255.6 | | |

| 216.8 | | |

| 17.9 | % | |

| 29.7 | | |

| 225.9 | | |

| 218.7 | | |

| 3.3 | % |

| Non-aeronautical revenue | |

| 255.4 | | |

| 251.7 | | |

| 1.5 | % | |

| 26.1 | | |

| 229.3 | | |

| 255.6 | | |

| -10.3 | % |

| Commercial

revenue | |

| 180.7 | | |

| 177.7 | | |

| 1.7 | % | |

| 20.5 | | |

| 160.2 | | |

| 178.3 | | |

| -10.2 | % |

| Construction

service revenue | |

| 74.6 | | |

| 74.0 | | |

| 0.9 | % | |

| 5.5 | | |

| 69.1 | | |

| 77.2 | | |

| -10.5 | % |

| Total

Revenue | |

| 511.0 | | |

| 468.5 | | |

| 9.1 | % | |

| 55.8 | | |

| 455.1 | | |

| 474.3 | | |

| -4.0 | % |

| Total

Revenue Excluding IFRIC12(2) | |

| 436.3 | | |

| 394.5 | | |

| 10.6 | % | |

| 50.3 | | |

| 386.0 | | |

| 397.1 | | |

| -2.8 | % |

| Cost of Services | |

| 337.8 | | |

| 302.1 | | |

| 11.8 | % | |

| 70.4 | | |

| 267.4 | | |

| 271.5 | | |

| -1.5 | % |

| Selling,

general and administrative expenses | |

| 45.0 | | |

| 39.8 | | |

| 13.2 | % | |

| 4.8 | | |

| 40.2 | | |

| 40.0 | | |

| 0.6 | % |

| Other

expenses | |

| 2.7 | | |

| 1.0 | | |

| 171.5 | % | |

| 0.5 | | |

| 2.2 | | |

| 1.0 | | |

| 116.7 | % |

| Total

Costs and Expenses | |

| 385.6 | | |

| 342.8 | | |

| 12.5 | % | |

| 75.7 | | |

| 309.9 | | |

| 312.5 | | |

| -0.8 | % |

| Total

Costs and Expenses Excluding IFRIC12(3) | |

| 311.1 | | |

| 268.9 | | |

| 15.7 | % | |

| 70.2 | | |

| 240.9 | | |

| 235.4 | | |

| 2.4 | % |

| Adjusted Segment EBITDA | |

| 185.4 | | |

| 180.5 | | |

| 2.7 | % | |

| 25.7 | | |

| 159.7 | | |

| 180.0 | | |

| -11.3 | % |

| Adjusted Segment EBITDA Mg | |

| 36.3 | % | |

| 38.5 | % | |

| -225 | | |

| - | | |

| 35.1 | % | |

| 37.9 | % | |

| -286 | |

| Adjusted

EBITDA Margin excluding IFRIC 12(4) | |

| 42.5 | % | |

| 45.7 | % | |

| -328 | | |

| - | | |

| 41.3 | % | |

| 45.3 | % | |

| -397 | |

| Capex | |

| 74.7 | | |

| 74.4 | | |

| 0.4 | % | |

| 0.0 | | |

| 74.7 | | |

| 72.3 | | |

| 3.3 | % |

| 5) | See

Note 1 in Table "Operating & Financial Highlights”. |

| 6) | Excludes

Construction Service revenue. |

| 7) | Excludes

Construction Service cost. |

| 8) | Excludes

the effect of IFRIC 12 with respect to the construction or improvements to assets under the

concession, and is calculated by dividing EBITDA by total revenues less Construction Service

revenue. |

Passenger

Traffic declined by 11.6% YoY, primarily due to weaker performance in domestic traffic, partially offset by international

travel growth. Domestic traffic declined 19.0% YoY, reflecting a difficult comparison as travel demand last year benefited from incentives

provided by the 'Previaje' government program aimed at boosting domestic tourism, which did not take place this year. Moreover, traffic

this quarter was impacted by the temporary suspension of several routes operated by Aerolíneas Argentinas (AA) and some flight

cancellations by both AA and Flybondi, together with the prevailing recession in the country. By contrast, international passenger traffic

continued to benefit from the gradual resumption of routes and frequencies, increasing by 9.3% YoY in the second quarter. During the

quarter, Avianca inaugurated a new route from Ezeiza to Medellin, and ITA Airways increased the frequency of its route from Ezeiza to

Rome.

Revenues

decreased by 6.5% YoY to $224.8 million in 2Q24 on an ‘as reported’ basis, primarily due to a 9.8% decline in

Commercial revenues, partially offset by a 1.2% increase in Aeronautical revenues. Construction service revenue decreased by 17.0% YoY,

reflecting lower Capex during the reported quarter. Excluding the impact of IAS 29, revenues declined by 10.4% to $220.7 million, or

by 7.4% to $184.9 million when also excluding IFRIC 12.

| · | Aeronautical

Revenues ex-IAS29 decreased by 1.6% YoY, in line with lower activity in domestic passenger

traffic, coupled with a YoY reduction in domestic passenger fees measured in U.S. dollars. |

| | |

| · | Commercial

Revenues ex-IAS29 decreased 13.8% YoY, mainly driven by a decrease of 39.4%, or $6.5

million in Duty Free revenues as a result of the devaluation of the Argentina Peso in late

December, combined with lower Cargo and Parking revenues. This was partially offset by higher

VIP lounges, Rental of space, Catering and Advertising-related revenues. |

Total

Costs and Expenses increased by 3.4% YoY to $185.7 million in 2Q24 on an ‘as reported’ basis. Excluding Construction

service and the impact of IAS 29, Total costs and expenses increased by 4.8% YoY, mainly due to higher Cost of service, partially offset

by a slight decrease in SG&A expenses.

| · | Cost

of Services ex-IAS29 and excluding Construction Service Costs increased 6.0% YoY, or

$5.9 million, driven mainly by the following: |

| · | 25.4%,

or $6.1 million, increase in Maintenance expenses, |

| · | 55.3%,

or $2.4 million, increase in Services and fees, and |

| · | 1.3%,

or $0.4 million, increase in Salaries and social security contributions, mainly as a result

of inflation rates above currency depreciation. |

The above was partially offset by decreases

of 7.6%, or $2.2 million, in Concession Fees, due to lower revenues, and 27.8%, or $1.0 million, D&A expenses.

| · | SG&A

ex-IAS29 decreased by 1.2% YoY, or $0.2 million, to $20.3 million, mainly due

to lower Taxes. |

Adjusted

Segment EBITDA decreased 22.4% YoY to $69.0 million in 2Q24 on an ‘As reported basis’. When excluding the impact

of IAS 29, Adjusted Segment EBITDA declined by 24.8% YoY to $67.4 million, with Adjusted EBITDA margin EX-IFRIC12 of 36.4% in the quarter,

compared to 44.8% in 2Q23.

During

2Q24, CAAP made Capital Expenditures ex-IAS29 of $41.6 million, compared to $47.3 million in 2Q23. These expenditures were

primarily allocated to the new departure terminal building at Río Hondo Airport and construction works at Aeroparque Airport,

along with other projects at airports in the interior of the country.

Italy

| | |

2Q24 | | |

2Q23 | | |

% Var. | | |

6M24 | | |

6M23 | | |

% Var. | |

| OPERATING STATISTICS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Domestic Passengers (in millions) | |

| 0.5 | | |

| 0.5 | | |

| 5.6 | % | |

| 0.8 | | |

| 0.8 | | |

| 5.0 | % |

| International Passengers (in millions) | |

| 2.1 | | |

| 1.8 | | |

| 16.6 | % | |

| 3.3 | | |

| 2.8 | | |

| 16.9 | % |

| Transit Passengers (in millions) | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | |

| Total Passengers (in millions) | |

| 2.6 | | |

| 2.3 | | |

| 14.3 | % | |

| 4.1 | | |

| 3.6 | | |

| 14.2 | % |

| Cargo Volume (in thousands of tons) | |

| 3.2 | | |

| 3.4 | | |

| -3.8 | % | |

| 6.4 | | |

| 6.7 | | |

| -5.6 | % |

| Total Aircraft Movements (in thousands) | |

| 24.5 | | |

| 22.5 | | |

| 8.9 | % | |

| 38.2 | | |

| 35.0 | | |

| 9.1 | % |

| FINANCIAL HIGHLIGHTS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Aeronautical Revenue | |

| 20.4 | | |

| 17.6 | | |

| 15.5 | % | |

| 32.2 | | |

| 27.8 | | |

| 16.0 | % |

| Non-aeronautical revenue | |

| 14.9 | | |

| 16.3 | | |

| -8.5 | % | |

| 25.7 | | |

| 27.0 | | |

| -5.0 | % |

| Commercial revenue | |

| 12.6 | | |

| 10.6 | | |

| 19.2 | % | |

| 21.0 | | |

| 17.6 | | |

| 19.1 | % |

| Construction service revenue | |

| 1.3 | | |

| 4.4 | | |

| -70.6 | % | |

| 2.5 | | |

| 5.4 | | |

| -53.9 | % |

| Other revenue | |

| 1.0 | | |

| 1.3 | | |

| -25.5 | % | |

| 2.2 | | |

| 4.0 | | |

| -44.8 | % |

| Total Revenue | |

| 35.3 | | |

| 33.9 | | |

| 4.0 | % | |

| 57.9 | | |

| 54.8 | | |

| 5.6 | % |

| Total Revenue Excluding IFRIC12(1) | |

| 34.0 | | |

| 29.6 | | |

| 15.0 | % | |

| 55.4 | | |

| 49.4 | | |

| 12.1 | % |

| Cost of Services | |

| 22.2 | | |

| 23.4 | | |

| -5.2 | % | |

| 41.0 | | |

| 41.9 | | |

| -2.2 | % |

| Selling, general and administrative expenses | |

| 2.9 | | |

| 3.0 | | |

| -3.6 | % | |

| 5.8 | | |

| 6.5 | | |

| -10.5 | % |

| Total Costs and Expenses | |

| 25.1 | | |

| 26.4 | | |

| -5.0 | % | |

| 46.7 | | |

| 48.4 | | |

| -3.4 | % |

| Total Costs and Expenses Excluding IFRIC12(2) | |

| 23.9 | | |

| 23.6 | | |

| 1.3 | % | |

| 45.0 | | |

| 44.9 | | |

| 0.2 | % |

| Adjusted Segment EBITDA | |

| 13.3 | | |

| 10.4 | | |

| 27.0 | % | |

| 17.0 | | |

| 12.2 | | |

| 39.3 | % |

| Adjusted Segment EBITDA Mg | |

| 37.6 | % | |

| 30.8 | % | |

| 680 | | |

| 29.3 | % | |

| 22.2 | % | |

| 709 | |

| Adjusted EBITDA Margin excluding IFRIC 12(3) | |

| 38.7 | % | |

| 30.2 | % | |

| 854 | | |

| 29.2 | % | |

| 20.8 | % | |

| 848 | |

| Capex | |

| 2.1 | | |

| 4.6 | | |

| -54.1 | % | |

| 3.5 | | |

| 6.0 | | |

| -40.5 | % |

1 Excludes Construction Service revenue.

2 Excludes Construction Service cost.

3 Excludes the effect of IFRIC 12 with respect

to the construction or improvements to assets under the concession, and is calculated by dividing EBITDA by total revenues less Construction

Service revenue.

Passenger

Traffic in Italy increased by 14.3% YoY to 2.6 million passengers. International traffic, which accounted for over 80% of

total traffic, increased by 16.6% YoY, supported by strong performances at both Pisa and Florence airports. Domestic passenger traffic

increased by 5.6% YoY, driven by a 23.8% increase at Florence airport, partially offset by a slight decline of 0.4% at Pisa airport.

Revenues

increased 4.0% YoY to $35.3 million in 2Q24, driven by both Aeronautical and Commercial revenue growth reflecting the

year-over-year increase in passenger traffic.

| · | Aeronautical

Revenues increased 15.5% YoY, or $2.7 million, as a result of higher Passenger use fees

and, to a lesser extent, higher Aircraft fees as a result of increased YoY traffic activity. |

| · | Commercial

Revenues, increased 19.2% YoY, or $2.0 million, mainly driven by passenger-related

services such as Parking facilities, F&B services and VIP lounges, following the strong

year-over-year traffic recovery. |

Total

Costs and Expenses decreased 5.0% YoY, or $1.3 million, mainly driven by a decline in Construction Service costs due to lower

Capex. Excluding Construction Services, Total Cost and Expenses increased 1.3% YoY to $23.9 million.

| · | Cost

of Services excluding Construction service increased 2.1% YoY, or $0.4 million, primarily

driven by higher Maintenance expenses and Concession fees, partially offset by lower Salaries

and social security contributions. |

| | |

| · | SG&A

declined 3.6% YoY, or $0.1 million, to $2.9 million. |

Adjusted

Segment EBITDA increased 27.0% YoY to $13.3 million from $10.4 million in 2Q23, with Adjusted EBITDA margin Ex-IFRIC12 expanding

8.5 percentage points to 38.7%, on the back of traffic increase and strong revenue growth.

During 2Q24, CAAP made Capital Expenditures

of $2.1 million, compared to $4.6 million in 2Q23.

Brazil

| | |

2Q24 | | |

2Q23 | | |

% Var. | | |

6M24 | | |

6M23 | | |

% Var. | |

| OPERATING STATISTICS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Domestic Passengers (in millions) | |

| 2.1 | | |

| 2.7 | | |

| -22.0 | % | |

| 4.4 | | |

| 5.3 | | |

| -16.5 | % |

| International Passengers (in millions) | |

| 0.1 | | |

| 0.2 | | |

| -8.4 | % | |

| 0.3 | | |

| 0.3 | | |

| 13.0 | % |

| Transit Passengers (in millions) | |

| 1.3 | | |

| 1.3 | | |

| -1.1 | % | |

| 2.7 | | |

| 2.8 | | |

| -4.4 | % |

| Total Passengers (in millions) (1) | |

| 3.5 | | |

| 4.1 | | |

| -14.9 | % | |

| 7.4 | | |

| 8.4 | | |

| -11.5 | % |

| Cargo Volume (in thousands of tons) | |

| 15.5 | | |

| 15.5 | | |

| 0.0 | % | |

| 30.9 | | |

| 31.5 | | |

| -2.0 | % |

| Total Aircraft Movements (in thousands) | |

| 34.3 | | |

| 40.9 | | |

| -16.3 | % | |

| 69.9 | | |

| 79.7 | | |

| -12.3 | % |

| FINANCIAL HIGHLIGHTS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Aeronautical Revenue | |

| 9.5 | | |

| 11.2 | | |

| -14.8 | % | |

| 20.3 | | |

| 21.6 | | |

| -6.1 | % |

| Non-aeronautical revenue | |

| 17.3 | | |

| 16.1 | | |

| 7.6 | % | |

| 35.4 | | |

| 30.3 | | |

| 16.7 | % |

| Commercial revenue | |

| 17.1 | | |

| 16.1 | | |

| 6.4 | % | |

| 34.9 | | |

| 30.3 | | |

| 15.0 | % |

| Construction service revenue | |

| 0.2 | | |

| 0.0 | | |

| - | | |

| 0.5 | | |

| 0.0 | | |

| - | |

| Total Revenue | |

| 26.8 | | |

| 27.3 | | |

| -1.5 | % | |

| 55.7 | | |

| 51.9 | | |

| 7.2 | % |

| Total Revenue Excluding IFRIC122 | |

| 26.6 | | |

| 27.3 | | |

| -2.3 | % | |

| 55.1 | | |

| 51.9 | | |

| 6.2 | % |

| Cost of Services | |

| 17.4 | | |

| 19.3 | | |

| -9.7 | % | |

| 37.5 | | |

| 37.1 | | |

| 0.9 | % |

| Selling, general and administrative expenses | |

| 3.4 | | |

| 3.0 | | |

| 14.5 | % | |

| 5.0 | | |

| 4.8 | | |

| 3.6 | % |

| Other expenses | |

| 0.0 | | |

| 0.0 | | |

| 6180.0 | % | |

| 0.4 | | |

| 0.0 | | |

| 2468.8 | % |

| Total Costs and Expenses | |

| 20.8 | | |

| 22.3 | | |

| -6.4 | % | |

| 42.9 | | |

| 42.0 | | |

| 2.3 | % |

| Total Costs and Expenses Excluding IFRIC123 | |

| 20.6 | | |

| 22.3 | | |

| -7.3 | % | |

| 42.4 | | |

| 42.0 | | |

| 1.0 | % |

| Adjusted Segment EBITDA | |

| 11.4 | | |

| 11.6 | | |

| -2.4 | % | |

| 21.2 | | |

| 19.5 | | |

| 8.7 | % |

| Adjusted Segment EBITDA Mg | |

| 42.4 | % | |

| 42.4 | % | |

| 0 | | |

| 38.1 | % | |

| 37.6 | % | |

| 53 | |

| Adjusted EBITDA Margin excluding IFRIC124 | |

| 42.7 | % | |

| 42.4 | % | |

| 32 | | |

| 38.5 | % | |

| 37.6 | % | |

| 88 | |

| Capex | |

| 0.5 | | |

| 0.5 | | |

| 9.8 | % | |

| 1.1 | | |

| 0.8 | | |

| 49.8 | % |

| 1) | Following

the friendly termination process concluded in February 2024, CAAP no longer operates

Natal airport. Statistics for Natal are available up to February 18, 2024. |

| 2) | Excludes

Construction Service revenue. |

| 3) | Excludes

Construction Service cost. |

| 4) | Excludes

the effect of IFRIC 12 with respect to the construction or improvements to assets under the

concession, and is calculated by dividing EBITDA by total revenues less Construction Service

revenue. |

Passenger

Traffic decreased by 14.9% YoY, or by 3.4% YoY, when adjusting for the discontinuation of Natal Airport. Domestic traffic,

which accounted for almost 60% of total traffic, was down 22.0% YoY, or 5.4% when excluding Natal, while transit passengers were down

1.1% YoY. Traffic in Brazil remained heavily impacted by financial and aircraft constraints in some local airlines, causing a lack of

supply. As a reminder, following the friendly termination process concluded in February 2024, effective February 19, 2024 CAAP

no longer operates Natal Airport. Therefore, statistics for Natal are available up to February 18, 2024.

Revenues

decreased by 1.5% YoY, or $0.4 million, to $26.8 million in 2Q24, as growth in Commercial revenues was more than offset by

a decline in Aeronautical revenues due to lower traffic.

| · | Aeronautical

Revenues decreased 14.8% YoY, or $1.7 million, driven by both lower Passenger use

fees and Aircraft fees reflecting lower passenger traffic. |

| | |

| · | Commercial

Revenues increased 6.4% YoY, or $1.0 million, despite lower passenger traffic. The

increase in commercial revenue was primarily driven by a continued solid performance of VIP

lounges and, to a lesser extent, Cargo revenues and Rental of space. Commercial revenues

also included a one-time benefit of $1.7 million from the conclusion of a litigation process

with several telecommunication companies. |

Total

Costs and Expenses in 2Q24 decreased 6.4% YoY, or $1.4 million, mainly driven by lower Cost of Services, partially offset

by slightly higher SG&A expenses.

| · | Cost

of Services decreased 9.7% YoY, or $1.9 million, mainly driven by declines in Salaries

and social security contributions, Services and fees Concession fees and Maintenance expenses. |

| | |

| · | SG&A

increased 14.5% YoY, or $0.4 million, to $3.4 million in 2Q24. |

Adjusted

Segment EBITDA decreased 2.4% YoY, or $0.3 million, to $11.4 million, while Adjusted EBITDA margin Ex-IFRIC12 expanded 0.3

percentage points to 42.7%, despite the decline in passenger traffic. Adjusted EBITDA was supported by Commercial revenues and the aforementioned

$1.7 million one-time benefit related to the telecommunication companies.

During 2Q24, CAAP made Capital Expenditures

of $0.5 million, in line with 2Q23.

Uruguay

| | |

2Q24 | | |

2Q23 | | |

% Var. | | |

6M24 | | |

6M23 | | |

% Var. | |

| OPERATING STATISTICS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Domestic Passengers (in millions) | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | |

| International Passengers (in millions) | |

| 0.5 | | |

| 0.4 | | |

| 10.2 | % | |

| 1.1 | | |

| 0.9 | | |

| 18.7 | % |

| Transit Passengers (in millions) | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | | |

| n.m. | |

| Total Passengers (in millions) | |

| 0.5 | | |

| 0.4 | | |

| 11.2 | % | |

| 1.1 | | |

| 0.9 | | |

| 20.5 | % |

| Cargo Volume (in thousands of tons) | |

| 8.3 | | |

| 9.0 | | |

| -7.2 | % | |

| 15.2 | | |

| 16.0 | | |

| -4.6 | % |

| Total Aircraft Movements (in thousands) | |

| 6.8 | | |

| 7.4 | | |

| -7.2 | % | |

| 16.6 | | |

| 16.6 | | |

| 0.1 | % |

| FINANCIAL HIGHLIGHTS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Aeronautical Revenue | |

| 18.1 | | |

| 15.0 | | |

| 20.8 | % | |

| 43.3 | | |

| 33.1 | | |

| 30.9 | % |

| Non-aeronautical revenue | |

| 24.7 | | |

| 21.1 | | |

| 16.9 | % | |

| 50.1 | | |

| 41.0 | | |

| 22.3 | % |

| Commercial revenue | |

| 15.7 | | |

| 13.9 | | |

| 13.5 | % | |

| 35.1 | | |

| 30.6 | | |

| 14.8 | % |

| Construction service revenue | |

| 8.9 | | |

| 7.2 | | |

| 23.7 | % | |

| 14.9 | | |

| 10.3 | | |

| 44.3 | % |

| Total Revenue | |

| 42.8 | | |

| 36.1 | | |

| 18.6 | % | |

| 93.4 | | |

| 74.1 | | |

| 26.1 | % |

| Total Revenue Excluding IFRIC12(1) | |

| 33.8 | | |

| 28.9 | | |

| 17.3 | % | |

| 78.5 | | |

| 63.7 | | |

| 23.2 | % |

| Cost of Services | |

| 27.1 | | |

| 24.6 | | |

| 10.2 | % | |

| 52.4 | | |

| 43.4 | | |

| 20.6 | % |

| Selling, general and administrative expenses | |

| 5.1 | | |

| 3.3 | | |

| 54.4 | % | |

| 10.4 | | |

| 8.0 | | |

| 29.6 | % |

| Other expenses | |

| 0.1 | | |

| 0.1 | | |

| -32.7 | % | |

| 0.2 | | |

| 0.2 | | |

| 20.2 | % |

| Total Costs and Expenses | |

| 32.3 | | |

| 28.0 | | |

| 15.2 | % | |

| 63.0 | | |

| 51.6 | | |

| 22.0 | % |

| Total Costs and Expenses Excluding IFRIC12(2) | |

| 23.3 | | |

| 20.8 | | |

| 12.2 | % | |

| 48.1 | | |

| 41.3 | | |

| 16.4 | % |

| Adjusted Segment EBITDA | |

| 12.2 | | |

| 9.5 | | |

| 27.8 | % | |

| 34.1 | | |

| 25.6 | | |

| 33.2 | % |

| Adjusted Segment EBITDA Mg | |

| 28.5 | % | |

| 26.4 | % | |

| 206 | | |

| 36.5 | % | |

| 34.6 | % | |

| 193 | |

| Adjusted EBITDA Margin excluding IFRIC 12 (3) | |

| 36.0 | % | |

| 33.0 | % | |

| 297 | | |

| 43.5 | % | |

| 40.2 | % | |

| 327 | |

| Capex | |

| 8.3 | | |

| 8.0 | | |

| 4.7 | % | |

| 14.3 | | |

| 15.3 | | |

| -6.6 | % |

1) Excludes Construction Service revenue.

2) Excludes Construction Service cost.

3) Excludes the effect of IFRIC 12 with respect

to the construction or improvements to assets under the concession, and is calculated by dividing EBITDA by total revenues less Construction

Service revenue.

In Uruguay, where activity is mainly international,

passenger traffic increased by 11.2% YoY to 0.5 million, despite a difficult comparison due to the Easter holiday falling in April last

year. During the quarter, traffic was boosted by new routes and increased frequencies. JetSMART Airlines inaugurated a new route between

Montevideo and Buenos Aires with two daily frequencies starting on May 29, while SKY Airline increased the frequency of its Montevideo

to Lima route in May.

Revenues

increased 18.6% YoY to $42.8 million in 2Q24 on an ‘As reported’ basis, or 17.3% to $33.8 million, when excluding

Construction service revenue, driven by both higher Aeronautical and Commercial revenues.

| · | Aeronautical

Revenues increased 20.8% YoY, or $3.1 million, to $18.1 million, driven by tariff

adjustments and the 11.2% YoY increase in passenger traffic. |

| | |