HSBC Seeks Buyer for Canadian Unit - Analyst Blog

September 07 2011 - 8:00AM

Zacks

On Tuesday, HSBC Holdings Plc (HBC) confirmed

that the company is in talks with the potential acquirers regarding

the sale of its Canadian retail brokerage business, which employs

120 advisors.

Late last month, Reuters had reported about the

possible sale of HSBC’s Canadian retail brokerage business, which

manages about C$16 billion ($16.3 billion) in investors' money.

However, at that time the company had refused to acknowledge the

same.

Among the foreign banks, HSBC has the largest presence in

Canada. So, the sale of its retail brokerage business would be

significant with respect to foreign companies’ confidence in the

Canadian market. However, the possible sale would not include the

company’s online brokerage and trust services in Canada, the

company asserted.

As the Canadian market is highly consolidated, the chance to

expand through merger and acquisitions is limited for the banks.

So, the HSBC unit should be lucrative to all the financially-sound

Canadian banks.

Although, the company declined to reveal the names of the

potential buyers, the business has drawn interest from National

Bank Financial, a unit of National Bank of Canada

(NA). National Bank is one of largest six banks in Canada without

any notable foreign exposure. Given National’s location and

expansion capacity, it seems to be most suitable buyer for the HSBC

unit.

The proposed sale of the Canadian unit is in sync with HSBC’s

long-term strategy to reduce costs up to $3.5 billion through

worldwide restructuring by 2013 and cut back retail banking.

Earlier in August, Capital One Financial

Corporation (COF) had announced a definitive agreement to

buy HSBC’s U.S. credit card business for $32.7 billion. The deal

will help HSBC reap an estimated post-tax gain of $2.4 billion.

The divestiture of the Canadian retail brokerage business should

bring long-term benefits for both HSBC and the acquirer. While

after selling the unit, HSBC will be able to concentrate on its

emerging market strategy, the acquirer would be able to expand in

the highly-consolidated Canadian market.

HSBC retains a Zacks #4 Rank, which translates into a short-term

‘Sell’ rating.

CAPITAL ONE FIN (COF): Free Stock Analysis Report

HSBC HOLDINGS (HBC): Free Stock Analysis Report

Zacks Investment Research

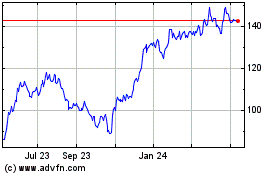

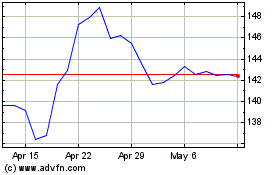

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024