Federal Reserve Board Approves Capital One Plan To Buy ING Bank

February 14 2012 - 5:12PM

Dow Jones News

The U.S. Federal Reserve Board, after delaying a decision twice

in a week, unanimously approved Capital One Financial Corp.'s (COF)

plan to buy ING Groep NV's (ING, INGA.AE) U.S. online-banking

business, sending a signal that banks can expand even in this new

era of heightened scrutiny.

"The Board has concluded that consummation of the proposal can

reasonably be expected to produce public benefits that would

outweigh any likely adverse effects," said the Fed in an order

released late Tuesday.

It added that it expects Capital One to ensure that its

"risk-management framework and methodologies, including its

compliance functions, are commensurate with its new size and

complexity."

Capital One, the nation's seventh-largest bank by assets

according to data from SNL Financial, announced in June its plan to

buy ING Direct USA, an Internet bank known for its orange lion logo

and high-interest savings accounts. Immediately, consumer groups

assailed the proposal as one that would create a risky megabank

that could jeopardize the U.S. economy. Community banks urged Fed

officials to block the deal as well as any other bank deals that

could make the financial system riskier.

The Fed was slated to vote on the proposal on Feb. 8, but

postponed the meeting. This week, the Fed met but delayed a

decision, all this adding suspense about the deal's fate. "Last

week's delay ... and today's non-decision are unsettling," Keefe

Bruyette & Woods analyst Brian Gardner said Monday.

But eight months later, after Capital One steadily defended the

deal and promised to add thousands of jobs and invest billions of

dollars in low-income communities, the transaction has become the

biggest bank deal to win approval from the Federal Reserve since

the 2010 Dodd-Frank financial overhaul law was passed.

The $9 billion acquisition bolsters Capital One's transformation

from a credit-card lender into a large, full-service national

bank.

"I think the ING deal is going to prove to be one of the

strategically most transformational things that's ever happened to

this company," Capital One Chief Executive Richard Fairbank said at

a financial conference last week. Fairbank said it would only take

"a few days" after Fed approval to close the deal.

The bank is also aiming to complete a separate $2.6 billion plan

to buy the U.S. credit-card business of HSBC Holdings PLC (HBC,

HSBA.LN, 0005.HK) in the second quarter.

-By Maya Jackson Randall, Dow Jones Newswires; 202-862-6687, maya.jackson-randall@dowjones.com

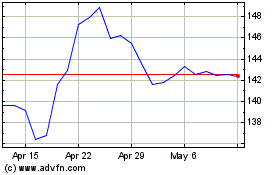

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

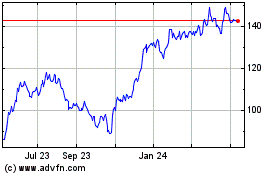

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024