Fourth Quarter 2024 Highlights

- Earnings per diluted share (EPS) from continuing operations of

$1.20, up 58%, and adjusted EPS from continuing operations of

$1.26, also up 58%.

- Sales of $544 million, up 12% driven by 8% core sales

growth.

- Core order growth up 8% and core backlog growth up 9%, driven

primarily by ongoing strength at Aerospace & Electronics.

- Declaring first quarter 2025 regular dividend of $0.23 per

share, and raising the annual dividend by 12% to $0.92 per

share.

2025 Outlook

- Initiating our full year 2025 adjusted EPS outlook with a range

of $5.30-$5.60 reflecting 12% growth at the midpoint compared to

2024 adjusted EPS.

Crane Company ("Crane," NYSE: CR) today announced its financial

results for the fourth quarter of 2024 and initiated its adjusted

full-year 2025 EPS outlook. Following the completion of the

Engineered Materials divestiture effective on January 1, 2025,

results for the fourth quarter of 2024 and all prior periods have

been recast with the Engineered Materials segment presented as

discontinued operations.

Max Mitchell, Crane's Chairman, President and Chief Executive

Officer, stated: "Crane Company had an exceptional year with both

segments executing at a high level. As a result, we delivered 8%

core sales growth with 28% adjusted EPS growth in 2024. Further, we

continued to strengthen and focus our portfolio with the

acquisitions of Vian, CryoWorks and Technifab, as well as with the

divestiture of our Engineered Materials segment."

Mr. Mitchell concluded: "As we look to 2025, I remain excited

about the momentum we continue to build at Crane and the

performance we continue to drive within the businesses. Demand

trends remain strong within Aerospace & Electronics and we

continue to outperform in Process Flow Technologies even as

industrial demand signals remain mixed giving us confidence as we

start 2025. In setting our initial view for the year, the macro

backdrop remains largely unchanged, and consistent with our

customary convention, our initial 2025 adjusted EPS guidance of

$5.30-$5.60 reflects what we have confidence in delivering, and

reflects solid 12% adjusted EPS growth at the midpoint."

Fourth Quarter 2024 Results

Fourth quarter 2024 GAAP EPS from continuing operations of $1.20

compared to $0.76 in the fourth quarter of 2023. Fourth quarter

2024 adjusted EPS from continuing operations of $1.26 compared to

$0.80 in the fourth quarter of 2023.

Fourth quarter sales increased 12%, with 8% core sales growth, a

4% contribution from acquisitions, and a slight contribution from

favorable foreign exchange. Operating profit of $86 million

increased 38% compared to last year, and adjusted operating profit

of $96 million increased 38% compared to last year, in both cases

primarily reflecting the impact from higher volumes, productivity,

and net price.

Summary of Fourth Quarter 2024 Results

Fourth Quarter

Change

(unaudited, dollars in millions)

2024

2023

$

%

Net sales

$544

$484

$

60

12%

Core sales

37

8%

Acquisitions

22

4%

Foreign exchange

1

0%

Operating profit

$86

$62

$

24

38%

Adjusted operating profit*

$96

$70

$

26

38%

Operating profit margin

15.8%

12.9%

290bps

Adjusted operating profit margin*

17.7%

14.5%

320bps

*Please see the attached Non-GAAP

Financial Measures tables

Full Year 2024 Results

Full year 2024 GAAP EPS from continuing operations of $4.60

compared to $3.06 in 2023. Full year 2024 adjusted EPS from

continuing operations of $4.88 compared to $3.80 in 2023.

Sales in 2024 increased 14%, with 8% core sales growth, a 6%

contribution from acquisitions, and a slight contribution from

favorable foreign exchange. Operating profit of $356 million

increased 42% compared to last year, and adjusted operating profit

of $383 million increased 29% compared to last year, in both cases

primarily reflecting the impact from higher volumes, net price and

productivity.

Cash Flow, Financing Activities and Other Financial

Metrics

During the fourth quarter of 2024, cash provided by operating

activities from continuing operations was $202 million, capital

expenditures were $14 million, and free cash flow (cash provided by

operating activities less capital spending) was $188 million.

Adjusted free cash flow was $193 million. For the full year, cash

provided by operating activities was $258 million, capital

expenditures were $37 million, and free cash flow was $221 million.

Adjusted free cash flow from continuing operations was $234 million

for the full year 2024. (Please see the attached non-GAAP Financial

Measures tables.)

As of December 31, 2024, the Company's cash balance was $307

million with total debt of $247 million. Subsequent to the end of

the fourth quarter, on January 2, 2025, the Company received net

proceeds of $208 million related to the divestiture of Engineered

Materials.

Rich Maue, Crane's Executive Vice President and Chief Financial

Officer, added: "As we enter 2025, our balance sheet along with

solid expected cash flow, position us well to invest in our organic

growth initiatives and pursue strategic acquisitions to drive

long-term value creation."

Fourth Quarter 2024 Segment Results

All comparisons detailed in this section refer to operating

results for the fourth quarter 2024 versus the fourth quarter

2023.

Aerospace & Electronics

Fourth Quarter

Change

(unaudited, dollars in millions)

2024

2023

$

%

Net sales

$

237

$

213

$

24

11

%

Core sales

14

7

%

Acquisitions

10

4

%

Operating profit

$

53

$

43

$

10

24

%

Adjusted operating profit*

$

55

$

43

$

12

28

%

Operating profit margin

22.4

%

20.2

%

220bps

Adjusted operating profit margin*

23.1

%

20.2

%

290bps

*Please see the attached Non-GAAP

Financial Measures tables

Sales of $237 million increased 11% compared to the prior year,

driven by 7% core sales growth and a 4% benefit from the previously

announced Vian acquisition. Operating profit margin of 22.4%

increased 220 basis points from last year, primarily reflecting the

impact of productivity, higher volumes, a more favorable mix, and

higher price net of inflation. Adjusted operating profit margin of

23.1% increased 290 basis points from last year. Aerospace &

Electronics' order backlog was $864 million as of December 31, 2024

compared to $701 million as of December 31, 2023.

Process Flow Technologies

Fourth Quarter

Change

(unaudited, dollars in millions)

2024

2023

$

%

Net sales

$

307

$

272

$

36

13

%

Core sales

23

9

%

Acquisitions

12

4

%

Foreign exchange

1

0

%

Operating profit

$

58

$

43

$

15

34

%

Adjusted operating profit*

$

62

$

46

$

16

36

%

Operating profit margin

19.0

%

16.0

%

300bps

Adjusted operating profit margin*

20.3

%

17.0

%

330bps

*Please see the attached Non-GAAP

Financial Measures tables

Sales of $307 million increased 13% compared to the prior year,

driven by 9% core sales growth and a 4% benefit from the previously

announced CryoWorks and Technifab acquisitions. Operating profit

margin expanded 300 basis points to 19.0% primarily due to net

price, productivity, and higher volumes, partially offset by

unfavorable mix. Adjusted operating profit margin expanded 330

basis points from last year to 20.3%. Process Flow Technologies

order backlog was $376 million as of December 31, 2024 compared to

$379 million as of December 31, 2023.

Initiating 2025 Guidance

We are initiating our full-year adjusted EPS outlook with a

range of $5.30 to $5.60, up 12% at the mid-point over 2024.

Key assumptions for our guidance include:

- Total sales growth of approximately 5%, driven by core sales

growth of approximately 4% to 6% and an acquisition benefit of

approximately 1-2%, partially offset by a 1% headwind from foreign

exchange.

- Adjusted segment operating margin of 22.5%+ (up from

21.9%).

- Corporate cost of $80 million.

- Net non-operating expense of $10 million.

- Adjusted tax rate of 23.5%.

- Diluted shares of ~59 million.

Additional details of our outlook and guidance are included in

the presentation that accompanies this earnings release available

on our website at www.craneco.com in the "investors" section.

Declaring First Quarter Dividend

Crane's Board of Directors has declared a 12% increase in the

Company's quarterly dividend to $0.23 per share from $0.205 per

share. The regular quarterly dividend of $0.23 per share for the

first quarter of 2025 is payable on March 12, 2025 to shareholders

of record as of February 28, 2025.

Additional Information

References to changes in “core sales” or "core growth" in this

report include the change in sales excluding the impact of foreign

currency translation and acquisitions and divestitures from closing

up to the first anniversary of such acquisitions or

divestitures.

Following the completion of the Engineered Materials divestiture

effective on January 1, 2025, results for the fourth quarter of

2024 and all prior periods have been recast with the Engineered

Materials segment presented as discontinued operations.

Conference Call

Crane has scheduled a conference call to discuss the fourth

quarter financial results on Tuesday, January 28, 2025 at 10:00

A.M. (Eastern). All interested parties may listen to a live webcast

of the call at www.craneco.com. An archived webcast will also be

available to replay this conference call directly from the

Company’s website under Investors, Events & Presentations.

Slides that accompany the conference call will be available on the

Company’s website.

About Crane Company

Crane Company has delivered innovation and technology-led

solutions for customers since its founding in 1855. Today, Crane is

a leading manufacturer of highly engineered components for

challenging, mission-critical applications focused on the

aerospace, defense, space and process industry end markets. The

Company has two strategic growth platforms: Aerospace &

Electronics and Process Flow Technologies. Crane has approximately

7,500 employees in the Americas, Europe, the Middle East, Asia and

Australia. Crane Company is traded on the New York Stock Exchange

(NYSE: CR). For more information, visit www.craneco.com.

Forward-Looking Statements Disclaimer

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements include all statements that are not historical

statements of fact and those regarding our intent, belief, or

expectations, including, but not limited to: benefits and synergies

of the separation transaction; strategic and competitive advantages

of Crane; future financing plans and opportunities; and business

strategies, prospects and projected operating and financial

results. We caution investors not to place undue reliance on any

such forward-looking statements.

These statements are based on management’s current expectations

and beliefs and are subject to a number of risks and uncertainties

that could lead to actual results differing materially from those

projected, forecasted or expected. Although we believe that the

assumptions underlying the forward-looking statements are

reasonable, we can give no assurance that our expectations will be

attained.

Risks and uncertainties that could cause actual results to

differ materially from our expectations include, but are not

limited to: changes in global economic conditions (including

inflationary pressures) and geopolitical risks, including

macroeconomic fluctuations that may harm our businesses, results of

operations, and cash flows; information systems and technology

networks failures and breaches in data security, theft of

personally identifiable and other information, non-compliance with

our contractual or other legal obligations regarding such

information; our ability to source components and raw materials

from suppliers, including disruptions and delays in our supply

chain; demand for our products, which is variable and subject to

factors beyond our control; governmental regulations and failure to

comply with those regulations; fluctuations in the prices of our

components and raw materials; loss of personnel or being able to

hire and retain additional personnel needed to sustain and grow our

business as planned; risks from environmental liabilities, costs,

litigation and violations that could adversely affect our financial

condition, results of operations, cash flows and reputation; risks

associated with conducting a substantial portion of our business

outside the U.S.; being unable to identify or complete

acquisitions, or to successfully integrate the businesses we

acquire, or complete dispositions; adverse impacts from intangible

asset impairment charges; potential product liability or warranty

claims; being unable to successfully develop and introduce new

products, which would limit our ability to grow and maintain our

competitive position and adversely affect our financial condition,

results of operations and cash flow; significant competition in our

markets; additional tax expenses or exposures that could affect our

financial condition, results of operations and cash flows;

inadequate or ineffective internal controls; specific risks

relating to our reportable segments, including Aerospace &

Electronics and Process Flow Technologies; the ability and

willingness of Crane Company and Crane NXT, Co. to meet and/or

perform their obligations under any contractual arrangements that

were entered into among the parties in connection with the

separation transaction and any of their obligations to indemnify,

defend and hold the other party harmless from and against various

claims, litigation and liabilities; and the ability to achieve some

or all the benefits that we expect to achieve from the separation

transaction.

Readers should carefully review Crane’s financial statements and

the notes thereto, as well as the section entitled “Risk Factors”

in Item 1A of Crane’s Annual Report on Form 10-K for the year ended

December 31, 2023 and the other documents Crane files from time to

time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Crane assumes no (and disclaims any)

obligation to revise or update any forward-looking statements.

We make no representations or warranties as to the accuracy of

any projections, statements or information contained in this press

release. It is understood and agreed that any such projections,

targets, statements and information are not to be viewed as facts

and are subject to significant business, financial, economic,

operating, competitive and other risks, uncertainties and

contingencies many of which are beyond our control, that no

assurance can be given that any particular financial projections

ranges, or targets will be realized, that actual results may differ

from projected results and that such differences may be material.

While all financial projections, estimates and targets are

necessarily speculative, we believe that the preparation of

prospective financial information involves increasingly higher

levels of uncertainty the further out the projection, estimate or

target extends from the date of preparation. The assumptions and

estimates underlying the projected, expected or target results are

inherently uncertain and are subject to a wide variety of

significant business, economic and competitive risks and

uncertainties that could cause actual results to differ materially

from those contained in the financial projections, estimates and

targets. The inclusion of financial projections, estimates and

targets in this press release should not be regarded as an

indication that we or our representatives, considered or consider

the financial projections, estimates and targets to be a reliable

prediction of future events.

(Financial Tables Follow)

Source: Crane Company

CRANE COMPANY Condensed

Statements of Operations Data

(unaudited, in millions, except

per share data)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Net

sales:

Aerospace & Electronics

$

236.8

$

212.8

$

932.7

$

789.3

Process Flow Technologies

307.3

271.5

1,198.5

1,072.8

Total net sales

$

544.1

$

484.3

$

2,131.2

$

1,862.1

Operating

profit:

Aerospace & Electronics

$

53.1

$

42.9

$

209.0

$

159.0

Process Flow Technologies

58.4

43.4

240.3

208.5

Corporate

(25.3

)

(23.9

)

(93.5

)

(117.1

)

Total operating profit

$

86.2

$

62.4

$

355.8

$

250.4

Interest income

$

1.5

$

1.9

$

5.5

5.1

Interest expense

(5.3

)

(6.0

)

(27.2

)

(22.7

)

Miscellaneous income, net

3.5

1.4

4.4

0.3

Income from continuing operations before

income taxes

85.9

59.7

338.5

233.1

Provision for income taxes

15.6

16.1

70.3

57.2

Net income from continuing operations

attributable to common shareholders

70.3

43.6

268.2

175.9

Income from discontinued operations, net

of tax

10.7

5.8

26.5

80.0

Net income attributable to common

shareholders

$

81.0

$

49.4

$

294.7

$

255.9

Earnings per diluted share from continuing

operations

$

1.20

$

0.76

$

4.60

$

3.06

Earnings per diluted share from

discontinued operations

0.18

0.10

0.45

1.39

Earnings per diluted share

$

1.38

$

0.86

$

5.05

$

4.45

Average diluted shares outstanding

58.4

57.6

58.3

57.5

Average basic shares outstanding

57.3

56.9

57.2

56.7

Supplemental

data:

Cost of sales

$

321.6

$

300.4

$

1,263.4

$

1,111.1

Selling, general & administrative

136.3

121.5

512.0

500.6

Transaction related expenses (a)

7.4

6.3

23.7

42.8

Repositioning related charges, net (a)

2.8

1.4

3.5

3.8

Depreciation and amortization (a)

13.5

10.0

51.0

35.4

Stock-based compensation expense (a)

7.2

4.2

25.6

25.8

(a) Amounts included within Cost of sales

and/or Selling, general & administrative costs.

CRANE COMPANY Condensed

Balance Sheets

(unaudited, in millions)

December 31,

2024

December 31,

2023

Assets

Current assets

Cash and cash equivalents

$

306.7

$

329.6

Accounts receivable, net

339.1

297.7

Inventories, net

380.4

343.9

Other current assets

135.8

100.3

Current assets held for sale

217.9

19.3

Total current assets

1,379.9

1,090.8

Property, plant and equipment, net

261.3

244.5

Other assets

315.9

240.8

Goodwill

661.6

576.4

Long-term assets held for sale

—

198.9

Total assets

$

2,618.7

$

2,351.4

Liabilities and Equity

Current liabilities

Accounts payable

$

188.2

$

156.9

Accrued liabilities

279.9

260.5

Income taxes

7.9

14.3

Current liabilities held for sale

44.1

35.4

Total current liabilities

520.1

467.1

Long-term debt

247.0

248.5

Long-term deferred tax liability

34.8

36.1

Other liabilities

175.8

220.2

Long-term liabilities held for sale

—

19.2

Total liabilities

977.7

991.1

Total equity

1,641.0

1,360.3

Total liabilities and equity

$

2,618.7

$

2,351.4

CRANE COMPANY Condensed

Statements of Cash Flows

(unaudited, in millions)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Operating activities:

Net income attributable to common

shareholders

$

81.0

$

49.4

$

294.7

$

255.9

Less: Income from discontinued operations,

net of tax

10.7

5.8

26.5

80.0

Net income from continuing operations

attributable to common shareholders

70.3

43.6

268.2

175.9

Depreciation and amortization

13.5

10.0

51.0

35.4

Stock-based compensation expense

7.2

4.2

25.6

25.8

Defined benefit plans and postretirement

cost

1.0

1.9

3.5

8.9

Deferred income taxes

(8.5

)

(19.4

)

(11.6

)

(18.8

)

Cash provided by (used for) operating

working capital

125.2

100.6

(51.8

)

(51.3

)

Defined benefit plans and postretirement

contributions

(0.6

)

(2.2

)

(17.1

)

(18.3

)

Environmental payments, net of

reimbursements

(0.7

)

(0.9

)

(4.2

)

(3.9

)

Other

(5.4

)

4.1

(5.8

)

8.4

Total provided by operating activities

from continuing operations

202.0

141.9

257.8

162.1

Investing activities:

Payment for acquisitions - net of cash

acquired and working capital adjustments

(38.8

)

(90.5

)

(200.5

)

(90.5

)

Capital expenditures

(13.8

)

(11.6

)

(36.6

)

(39.0

)

Proceeds from insurance recoveries for

damaged property, plant and equipment

1.0

—

1.0

—

Other investing activities

0.5

0.1

6.1

0.7

Total used for investing activities from

continuing operations

(51.1

)

(102.0

)

(230.0

)

(128.8

)

Financing activities:

Dividends paid

(11.8

)

(10.3

)

(46.9

)

(57.3

)

Net proceeds (payments) related to

employee stock plans

2.6

6.1

(0.9

)

21.8

Debt issuance costs

—

(1.5

)

—

(9.0

)

Proceeds from debt

—

—

190.0

300.0

Proceeds from term facility of

discontinued operations

—

—

—

350.0

Repayments of debt

(85.0

)

(1.8

)

(191.9

)

(450.6

)

Distribution of Crane NXT, Co.

—

—

—

(578.1

)

Total used for financing activities from

continuing and discontinued operations

(94.2

)

(7.5

)

(49.7

)

(423.2

)

Discontinued operations:

Total provided by operating activities

7.0

17.8

15.0

66.1

Total used for investing activities

(0.5

)

(1.4

)

(3.2

)

(7.8

)

Increase in cash and cash equivalents from

discontinued operations

6.5

16.4

11.8

58.3

Effect of exchange rate on cash and cash

equivalents

(13.2

)

7.0

(11.3

)

3.6

Increase (decrease) in cash and cash

equivalents

50.0

55.8

(21.4

)

(328.0

)

Cash and cash equivalents at beginning of

period (a)

258.2

273.8

329.6

657.6

Cash and cash equivalents at end of

period

$

308.2

$

329.6

$

308.2

$

329.6

Less: Cash and cash equivalents of

discontinued operations

1.5

—

1.5

—

Cash and cash equivalents of continuing

operations at end of period

$

306.7

$

329.6

$

306.7

$

329.6

(a) 2023 Includes cash and cash

equivalents of discontinued operations.

CRANE COMPANY Order

Backlog

(unaudited, in millions)

December 31,

September 30,

June 30,

March 31,

December 31,

2024

2024

2024

2024

2023

Aerospace & Electronics (a)

$

863.8

$

833.3

$

814.9

$

791.8

$

700.9

Process Flow Technologies(b) (c)

376.4

392.0

399.9

393.3

379.0

Total backlog

$

1,240.2

$

1,225.3

$

1,214.8

$

1,185.1

$

1,079.9

(a) Includes $52.3 million, $59.1 million,

$62.3 million and $53.5 million of backlog as of December 31, 2024,

September 30, 2024, June 30, 2024 and March 31, 2024, respectively,

pertaining to the Vian acquisition.

(b) Includes $11.2 million, $12.8 million,

$11.6 million of backlog as of December 31, 2024, September 30,2024

and June 30, 2024, respectively, pertaining to the CryoWorks

acquisition.

(c) Includes $10.4 million of backlog as

of December 31, 2024, pertaining to the Technifab acquisition.

CRANE COMPANY Non-GAAP

Financial Measures

(unaudited, in millions, except

per share data)

Three Months Ended December

31,

2024

2023

% Change

$

Per Share

$

Per Share

(on $)

Net sales (GAAP)

$

544.1

$

484.3

12.3

%

Adjusted Operating Profit and Adjusted

Operating Profit Margin

Operating profit (GAAP)

$

86.2

$

62.4

38.1

%

Operating profit margin (GAAP)

15.8

%

12.9

%

Special items impacting operating

profit:

Transaction related expenses(a)(b)

7.4

6.3

Repositioning related charges, net

2.8

1.4

Adjusted operating profit (Non-GAAP)

$

96.4

$

70.1

37.5

%

Adjusted operating profit margin

(Non-GAAP)

17.7

%

14.5

%

Adjusted Net Income and Adjusted Net

Income per Share

Net income from continuing operations

attributable to common shareholders (GAAP)

$

70.3

$

1.20

$

43.6

$

0.76

61.2

%

Transaction related expenses(a)(b)

2.9

0.05

3.1

0.05

Repositioning related charges, net

2.8

0.05

1.4

0.02

Impact of pension non-service costs

—

—

1.5

0.03

Tax effect of the Non-GAAP adjustments

(2.3

)

(0.04

)

(3.6

)

(0.06

)

Adjusted net income (Non-GAAP)

$

73.7

$

1.26

$

46.0

$

0.80

60.2

%

Adjusted EBITDA and Adjusted EBITDA

Margin

Net income from continuing operations

attributable to common shareholders (GAAP)

$

70.3

$

43.6

61.2

%

Net income margin (GAAP)

12.9

%

9.0

%

Adjustments to net income:

Interest expense, net

3.8

4.1

Income tax expense

15.6

16.1

Depreciation

8.7

8.0

Amortization

4.8

2.0

Miscellaneous income, net

(3.5

)

(1.4

)

Repositioning related charges, net

2.8

1.4

Transaction related expenses(a)(b)

5.4

6.0

Adjusted EBITDA (Non-GAAP)

$

107.9

$

79.8

35.2

%

Adjusted EBITDA Margin (Non-GAAP)

19.8

%

16.5

%

(a) 2024 transaction-related expenses are

primarily associated with the Technifab acquisition and the

divestiture of the Engineered Materials business.

(b) 2023 transaction-related expenses are

primarily associated with the separation and the Baum

acquisition.

Totals may not sum due to rounding

CRANE COMPANY

Non-GAAP Financial

Measures

(in millions, except per share

data)

Twelve Months Ended December

31,

2024

2023

% Change

$

Per Share

$

Per Share

(on $)

Net sales (GAAP)

$

2,131.2

$

1,862.1

14.5

%

Adjusted Operating Profit and Adjusted

Operating Profit Margin

Operating profit (GAAP)

$

355.8

$

250.4

42.1

%

Operating profit margin (GAAP)

16.7

%

13.4

%

Special items impacting operating

profit:

Transaction related expenses(a)(b)

23.7

42.8

Repositioning related charges, net

3.5

3.8

Adjusted operating profit (Non-GAAP)

$

383.0

$

297.0

29.0

%

Adjusted operating profit margin

(Non-GAAP)

18.0

%

15.9

%

Adjusted Net Income and Adjusted Net

Income per Share

Net income from continuing operations

attributable to common shareholders (GAAP)

$

268.2

$

4.60

$

175.9

$

3.06

52.5

%

Transaction related expenses(a)(b)

18.7

0.32

39.6

0.69

Repositioning related charges, net

3.5

0.06

3.8

0.06

Impact of pension non-service costs

—

—

4.0

0.07

Interest expense

—

—

5.9

0.10

Tax effect of the Non-GAAP adjustments

(6.0

)

(0.10

)

(10.6

)

(0.18

)

Adjusted net income (Non-GAAP)

$

284.4

$

4.88

$

218.6

$

3.80

30.1

%

Adjusted EBITDA and Adjusted EBITDA

Margin

Net income from continuing operations

attributable to common shareholders (GAAP)

$

268.2

$

175.9

52.5

%

Net income margin (GAAP)

12.6

%

9.4

%

Adjustments to net income:

Interest expense, net

21.7

17.6

Income tax expense

70.3

57.2

Depreciation

33.4

29.3

Amortization

17.6

6.1

Miscellaneous income, net

(4.4

)

(0.3

)

Repositioning related charges, net

3.5

3.8

Transaction related expenses(a)(b)

16.4

42.5

Adjusted EBITDA (Non-GAAP)

$

426.7

$

332.1

28.5

%

Adjusted EBITDA Margin (Non-GAAP)

20.0

%

17.8

%

(a) 2024 transaction-related expenses are

primarily associated with the Vian, CryoWorks, and Technifab

acquisitions and the divestiture of the Engineered Materials

business.

(b) 2023 transaction-related expenses are

primarily associated with the separation and the Baum

acquisition.

Totals may not sum due to rounding

CRANE COMPANY Non-GAAP

Financial Measures by Segment

(unaudited, in millions)

Three Months Ended December 31,

2024

Aerospace &

Electronics

Process Flow

Technologies

Corporate

Total Company

Net sales

$

236.8

$

307.3

$

—

$

544.1

Operating profit (GAAP)

$

53.1

$

58.4

$

(25.3

)

$

86.2

Operating profit margin (GAAP)

22.4

%

19.0

%

15.8

%

Special items impacting operating

profit:

Transaction related expenses(a)

1.3

1.8

4.3

7.4

Repositioning related charges, net

0.3

2.3

0.2

2.8

Adjusted operating profit (Non-GAAP)

$

54.7

$

62.5

$

(20.8

)

$

96.4

Adjusted operating profit margin

(Non-GAAP)

23.1

%

20.3

%

17.7

%

Three Months Ended December 31,

2023

Net sales

$

212.8

$

271.5

$

—

$

484.3

Operating profit (GAAP)

$

42.9

$

43.4

$

(23.9

)

$

62.4

Operating profit margin (GAAP)

20.2

%

16.0

%

12.9

%

Special items impacting operating

profit:

Transaction related expenses(b)

—

1.3

5.0

$

6.3

Repositioning related charges, net

—

1.4

—

$

1.4

Adjusted operating profit (Non-GAAP)

$

42.9

$

46.1

$

(18.9

)

$

70.1

Adjusted operating profit margin

(Non-GAAP)

20.2

%

17.0

%

14.5

%

(a) 2024 transaction-related expenses are

primarily associated with the Technifab acquisition and the

divestiture of the Engineered Materials business.

(b) 2023 transaction-related expenses are

primarily associated with the separation and the Baum

acquisition.

Totals may not sum due to rounding

CRANE COMPANY

Non-GAAP Financial Measures by

Segment

(in millions)

Twelve Months Ended December 31,

2024

Aerospace &

Electronics

Process Flow

Technologies

Corporate

Total Company

Net sales

$

932.7

$

1,198.5

$

—

$

2,131.2

Operating profit (GAAP)

$

209.0

$

240.3

$

(93.5

)

$

355.8

Operating profit margin (GAAP)

22.4

%

20.1

%

16.7

%

Special items impacting operating

profit:

Transaction related expenses(a)

7.3

6.6

9.8

23.7

Repositioning related charges , net

0.3

3.0

0.2

3.5

Adjusted operating profit (Non-GAAP)

$

216.6

$

249.9

$

(83.5

)

$

383.0

Adjusted operating profit margin

(Non-GAAP)

23.2

%

20.9

%

18.0

%

Twelve Months Ended December 31,

2023

Net sales

$

789.3

$

1,072.8

$

—

$

1,862.1

Operating profit (GAAP)

$

159.0

$

208.5

$

(117.1

)

$

250.4

Operating profit margin (GAAP)

20.1

%

19.4

%

13.4

%

Special items impacting operating

profit:

Transaction related expenses(b)

—

1.3

41.5

42.8

Repositioning related charges, net

—

3.8

—

3.8

Adjusted operating profit (Non-GAAP)

$

159.0

$

213.6

$

(75.6

)

$

297.0

Adjusted operating profit margin

(Non-GAAP)

20.1

%

19.9

%

15.9

%

(a) 2024 transaction-related expenses are

primarily associated with the Vian, CryoWorks, and Technifab

acquisitions and the divestiture of the Engineered Materials

business.

(b) 2023 transaction-related expenses are

primarily associated with the separation and the Baum

acquisition.

Totals may not sum due to rounding

CRANE COMPANY Adjusted Free

Cash Flow

(unaudited, in millions, except

per share data)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

Cash Flow Items

2024

2023

2024

2023

Cash provided by operating activities from

continuing operations

$

202.0

$

141.9

$

257.8

$

162.1

Less: Capital expenditures

(13.8

)

(11.6

)

(36.6

)

(39.0

)

Free cash flow

$

188.2

$

130.3

$

221.2

$

123.1

Adjustments:

Transaction-related expenses

3.9

5.0

11.4

41.5

Proceeds from insurance recoveries for

damaged property, plant and equipment

1.0

—

1.0

—

Adjusted free cash flow from continuing

operations

$

193.1

$

135.3

$

233.6

$

164.6

Free cash flow from Engineered

Materials

6.5

16.4

11.8

27.8

Adjusted free cash flow

$

199.6

$

151.7

$

245.4

$

192.4

Crane Company reports its financial results in accordance with

U.S. generally accepted accounting principles (“GAAP”). This press

release includes certain non-GAAP financial measures, including

adjusted operating profit, adjusted operating profit margin,

adjusted net income, adjusted EPS, adjusted EBITDA, Free Cash Flow

and Adjusted Free Cash Flow, that are not prepared in accordance

with GAAP. These non-GAAP measures are an addition, and not a

substitute for or superior to, measures of financial performance

prepared in accordance with GAAP and should not be considered as an

alternative to operating income, net income or any other

performance measures derived in accordance with GAAP. We believe

that these non-GAAP measures of financial results (including on a

forward-looking or projected basis) provide useful supplemental

information to investors about Crane Company. Our management uses

certain forward looking non-GAAP measures to evaluate projected

financial and operating results. However, there are a number of

limitations related to the use of these non-GAAP measures and their

nearest GAAP equivalents. For example, other companies may

calculate non-GAAP measures differently or may use other measures

to calculate their financial performance, and therefore our

non-GAAP measures may not be directly comparable to similarly

titled measures of other companies.

Reconciliations of certain forward-looking and projected

non-GAAP measures for Crane Company, including Adjusted EPS, and

Adjusted segment margin to the closest corresponding GAAP measure

are not available without unreasonable efforts due to the high

variability, complexity and low visibility with respect to the

charges excluded from these non-GAAP measures, which could have a

potentially significant impact on our future GAAP results. For

Crane Company, these forward looking and projected non-GAAP

measures are calculated as follows:

- "Adjusted operating margin" is calculated as adjusted operating

profit divided by sales. Adjusted operating profit is calculated as

operating profit before Special Items which include transaction

related expenses such as professional fees, and incremental costs

related to the separation; and repositioning related charges. We

believe that non-GAAP financial measures that exclude these items

provide investors with an alternative metric that can assist in

predicting future earnings and profitability that are complementary

to GAAP metrics.

- "Adjusted EPS" is calculated as adjusted net income divided by

diluted shares. Adjusted net income is calculated as net income

adjusted for Special Items which include transaction related

expenses such as professional fees, and incremental costs related

to the separation; repositioning related charges; and, the impact

of pension non-service costs. We believe that non-GAAP financial

measures adjusted for these items provide investors with an

alternative metric that can assist in predicting future earnings

and profitability that are complementary to GAAP metrics.

We believe that each of the following non-GAAP measures provides

useful information to investors regarding the Company’s financial

conditions and operations:

- "Adjusted Operating Profit" and "Adjusted Operating Profit

Margin" add back to Operating Profit items which are outside of our

core performance, some of which may or may not be non-recurring,

and which we believe may complicate the interpretation of the

Company’s underlying earnings and operational performance. These

items include income and expense such as: transaction related

expenses and repositioning related (gains) charges. These items are

not incurred in all periods, the size of these items is difficult

to predict, and none of these items are indicative of the

operations of the underlying businesses. We believe that non-GAAP

financial measures that exclude these items provide investors with

an alternative metric that can assist in predicting future earnings

and profitability that are complementary to GAAP metrics.

- "Adjusted Net Income" and "Adjusted EPS" exclude items which

are outside of our core performance, some of which may or may not

be non-recurring, and which we believe may complicate the

presentation of the Company’s underlying earnings and operational

performance. These measures include income and expense items that

impacted Operating Profit such as: transaction related expenses and

repositioning related (gains) charges. Additionally, these non-GAAP

financial measures exclude income and expense items that impacted

Net Income and Earnings per Diluted Share such as the impact of

pension non-service costs. These items are not incurred in all

periods, the size of these items is difficult to predict, and none

of these items are indicative of the operations of the underlying

businesses. We believe that non-GAAP financial measures that

exclude these items provide investors with an alternative metric

that can assist in predicting future earnings and profitability

that are complementary to GAAP metrics.

- "Adjusted EBITDA" adds back to net income: net interest

expense, income tax expense, depreciation and amortization,

miscellaneous (income) expense, net, and Special Items including

transaction related expenses. "Adjusted EBITDA Margin" is

calculated as adjusted EBITDA divided by net sales. We believe that

adjusted EBITDA and adjusted EBITDA margin provide investors with

an alternative metric that may be a meaningful indicator of our

performance and provides useful information to investors regarding

our financial conditions and results of operations that is

complementary to GAAP metrics.

- “Free Cash Flow” and “Adjusted Free Cash Flow” provide

supplemental information to assist management and investors in

analyzing the Company’s ability to generate liquidity from its

operating activities. The measure of free cash flow does not take

into consideration certain other non-discretionary cash

requirements such as, for example, mandatory principal payments on

the Company’s long-term debt. Free Cash Flow is calculated as cash

provided by operating activities less capital spending. Adjusted

Free Cash Flow is calculated as Free Cash Flow adjusted for certain

cash items which we believe may complicate the interpretation of

the Company’s underlying free cash flow performance such as certain

transaction related cash flow items related to acquisitions, the

separation transaction, and insurance proceeds related to damaged

property, plant and equipment caused by natural disasters and

including Free Cash Flow from Engineered Materials. These items are

not incurred in all periods, the size of these items is difficult

to predict, and none of these items are indicative of the

operations of the underlying businesses. We believe that non-GAAP

financial measures that exclude these items provide investors with

an alternative metric that can assist in predicting future cash

flows that are complementary to GAAP metrics.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127136917/en/

Jason D. Feldman Senior Vice President, Investor Relations,

Treasury & Tax Allison Poliniak-Cusic Vice President, Investor

Relations IR@craneco.com www.craneco.com

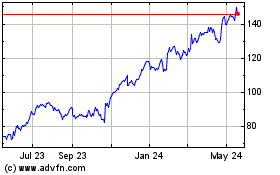

Crane (NYSE:CR)

Historical Stock Chart

From Dec 2024 to Jan 2025

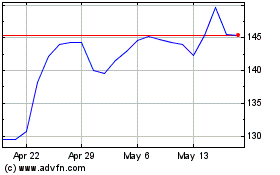

Crane (NYSE:CR)

Historical Stock Chart

From Jan 2024 to Jan 2025