- Delivered Net Sales of $263.8 million

- Generated gross margin expansion of 285 basis points to

36.1%

- Net Loss of $1.2 million compared to Net Loss of $2.7

million last year

- Updated 2024 Net Sales and Adjusted EBITDA(1)

Outlook

Torrid Holdings Inc. (“Torrid” or the “Company”) (NYSE: CURV), a

direct-to-consumer apparel, intimates, and accessories brand in

North America for women sizes 10 to 30, today announced its

financial results for the quarter ended November 2, 2024.

Lisa Harper, Chief Executive Officer of Torrid, stated, “Our

third quarter results were below our expectations as our fall

assortments did not offer enough newness and novelty. We also saw

the environment change meaningfully from the end of September and

into October. Despite the weaker top line sales, we delivered a

positive full-price comp, 285 basis points of gross profit

expansion, and modest Adjusted EBITDA(1) growth. We ended the

quarter with clean inventory levels, down 19% to last year, and $44

million in cash.”

Ms. Harper continued, “While we are encouraged by our customers’

response to the newness in our assortments, given the volatility we

have seen in our business, and recognizing that there is still

considerable amount of the quarter ahead of us, we are taking a

prudent approach to our fourth quarter outlook. As we move into

fiscal 2025, we are confident that we have put in place the

necessary changes and strategies to position us for growth.”

Financial Highlights for the Third Quarter of Fiscal

2024

- Net sales decreased 4.2% to $263.8 million compared to $275.4

million for the third quarter of last year. Comparable sales(2)

decreased 6.5% in the third quarter of this year compared to the

third quarter of last year.

- Gross profit margin was 36.1% compared to 33.2% in the third

quarter of last year. The 285-bps improvement was primarily driven

by reduced product costs and an increase in sales of regular-priced

products.

- Net loss of $1.2 million, or ($0.01) per share, compared to net

loss of $2.7 million, or ($0.03) per share in the third quarter of

last year.

- Adjusted EBITDA(1) was $19.6 million, or 7.4% of net sales,

compared to $19.4 million, or 7.0% of net sales, in the third

quarter of last year.

- In the third quarter, we opened two Torrid stores and closed

four Torrid stores. The total store count at quarter end was 655

stores.

Third Quarter of Fiscal 2024 Financial and Operating

Metrics

November 2, 2024

October 28, 2023

Number of stores (as of end of period)

655

643

Three Months Ended

(in thousands, except

percentages)

November 2, 2024

October 28, 2023

Comparable sales(A)

(7

)%

(8

)%

Net loss

$

(1,194

)

$

(2,748

)

Adjusted EBITDA(B)

$

19,584

$

19,379

(A)

Comparable sales(2) for the

three-month period ended November 2, 2024 compares sales for the

13-week period ended November 2, 2024, with sales for the 13-week

period ended November 4, 2023.

(B)

Please refer to “Non-GAAP

Reconciliation” below for a reconciliation of net loss to Adjusted

EBITDA(1).

Balance Sheet and Cash

Flow

Cash and cash equivalents at the end of the third quarter

of 2024 totaled $44.0 million. Total liquidity at the end of the

quarter, including available borrowing capacity under our revolving

credit agreement, was $151.8 million.

Cash flow from operations for the nine-month period ended

November 2, 2024, was $65.4 million, compared to $33.7 million for

the nine-month period ended October 28, 2023.

Outlook

For the fourth quarter of fiscal 2024 the Company

expects:

- Net sales between $255.0 million and $270.0 million.

- Adjusted EBITDA(1) between $9.0 million and $15.0 million.

For the full year 2024, which has 52 weeks compared to 53

weeks in full year 2023, the Company expects:

- Net sales between $1.083 billion and $1.098 billion.

- Adjusted EBITDA(1) between $101.0 million and $107.0

million.

- Capital expenditures between $20 million and $25 million

reflecting infrastructure and technology investments as well as new

stores for the year.

- As part of our previously announced store fleet optimization

program, we intend to open 12 to 16 new Torrid stores while closing

30 to 40 stores to move towards balancing outdoor centers and

enclosed mall locations.

The above outlook is based on several assumptions, including,

but not limited to, the macroeconomic challenges in the industry in

fiscal 2024 as well as higher labor costs. The above outlook does

not take into consideration the Consumer Financial Protection

Bureau ruling which mandates, among other things, decreases in

credit card late fees, and could alter the profitability of our

agreements with our private label credit card financing company.

See “Forward-Looking Statements” for additional information.

Conference Call Details

A conference call to discuss the Company’s third quarter 2024

results is scheduled for December 3, 2024, at 4:30 p.m. ET. Those

who wish to participate in the call may do so by dialing (877)

407-9208 or (201) 493-6784 for international callers. The

conference call will also be webcast live at

https://investors.torrid.com. For those unable to participate, a

replay of the conference call will be available approximately three

hours after the conclusion of the call until December 10, 2024.

Notes

(1)

Adjusted EBITDA is a non-GAAP financial

measure. See “Non-GAAP Financial Measures” and “Non-GAAP

Reconciliation” for additional information on non-GAAP financial

measures and the accompanying table for a reconciliation to the

most comparable GAAP measure. The Company does not provide

reconciliations of the forward-looking non-GAAP measures of

Adjusted EBITDA to the most directly comparable forward-looking

GAAP measure because the timing and amount of excluded items are

unreasonably difficult to fully and accurately estimate. For the

same reasons, the Company is unable to address the probable

significance of the unavailable information, which could be

material to future results.

(2)

Comparable sales for any given period are

defined as the sales of our e-Commerce operations and stores that

we have included in our comparable sales base during that period.

We include a store in our comparable sales base after it has been

open for 15 full fiscal months. If a store is closed during a

fiscal year, it is only included in the computation of comparable

sales for the full fiscal months in which it was open. Comparable

sales for the third quarter of fiscal year 2024 compares sales for

the 13-week period ended November 2, 2024, with sales for the

13-week period ended November 4, 2023. Partial fiscal months are

excluded from the computation of comparable sales. We apply current

year foreign currency exchange rates to both current year and prior

year comparable sales to remove the impact of foreign currency

fluctuation and achieve a consistent basis for comparison.

Comparable sales allow us to evaluate how our unified commerce

business is performing exclusive of the effects of non-comparable

sales and new store openings.

About Torrid

TORRID is a direct-to-consumer brand in North America dedicated

to offering a diverse assortment of stylish apparel, intimates, and

accessories skillfully designed for curvy women. Specializing in

sizes 10 to 30, TORRID’s primary focus is on providing fashionable,

comfortable, and affordable options that meet the unique needs of

its customers. TORRID’s extensive collection features high quality

merchandise, including tops, bottoms, denim, dresses, intimates,

activewear, footwear, and accessories. Revenues are generated

primarily through its e-Commerce platform www.torrid.com and its

stores in the United States of America, Puerto Rico and Canada.

Non-GAAP Financial Measures

In addition to results determined in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”), management utilizes certain non-GAAP performance

measures, such as Adjusted EBITDA, for purposes of evaluating

ongoing operations and for internal planning and forecasting

purposes. We believe that these non-GAAP operating measures, when

reviewed collectively with our GAAP financial information, provide

useful supplemental information to investors in assessing our

operating performance.

Adjusted EBITDA is a supplemental measure of our operating

performance that is neither required by, nor presented in

accordance with, GAAP and our calculations thereof may not be

comparable to similarly titled measures reported by other

companies. Adjusted EBITDA represents GAAP net income (loss) plus

interest expense less interest income, net of other expense

(income), plus provision for income taxes, depreciation and

amortization (“EBITDA”), and share-based compensation, non-cash

deductions and charges, and other expenses

We believe Adjusted EBITDA facilitates operating performance

comparisons from period to period by isolating the effects of

certain items that vary from period to period without any

correlation to ongoing operating performance. We also use Adjusted

EBITDA as one of the primary methods for planning and forecasting

the overall expected performance of our business and for evaluating

on a quarterly and annual basis, actual results against such

expectations.

Further, we recognize Adjusted EBITDA as a commonly used measure

in determining business value and, as such, use it internally to

report and analyze our results and as a benchmark to determine

certain non-equity incentive payments made to executives.

Adjusted EBITDA has limitations as an analytical tool. This

measure is not a measurement of our financial performance under

GAAP and should not be considered in isolation or as an alternative

to or substitute for net income (loss), income (loss) from

operations, earnings (loss) per share or any other performance

measures determined in accordance with GAAP or as an alternative to

cash flows from operating activities as a measure of our liquidity.

Our presentation of Adjusted EBITDA should not be construed as an

inference that our future results will be unaffected by unusual or

non-recurring items.

Forward-Looking Statements

Certain statements made in this earnings release are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”) and

Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and are subject to the safe harbor created thereby

under the Private Securities Litigation Reform Act of 1995. All

statements other than statements of historical or current fact

included in this earnings release are forward-looking statements.

Forward-looking statements reflect our current expectations and

projections relating to our financial condition, results of

operations, plans, objectives, future performance and business. You

can identify forward-looking statements by the fact that they do

not relate strictly to historical or current facts. These

statements may include words such as “anticipate,” “estimate,”

“expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,”

“should,” “can have,” “likely” and other words and terms of similar

meaning (including their negative counterparts or other various or

comparable terminology).

For example, all statements we make relating to our estimated

and projected costs, expenditures, cash flows, growth rates and

financial results, our plans and objectives for future operations,

growth or initiatives, strategies or the expected outcome or impact

of pending or threatened litigation are forward-looking statements.

All forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially

from those that we expected, including:

• the adverse impact of rulemaking changes implemented by the

Consumer Financial Protection Bureau on our income streams,

profitability and results of operations;

• changes in consumer spending and general economic

conditions;

• the negative impact on interest expense as a result of steep

interest rates;

• inflationary pressures with respect to labor and raw materials

and global supply chain constraints that could increase our

expenses;

• our ability to identify and respond to new and changing

product trends, customer preferences and other related factors;

• our dependence on a strong brand image;

• increased competition from other brands and retailers;

• our reliance on third parties to drive traffic to our

website;

• the success of the shopping centers in which our stores are

located;

• our ability to adapt to consumer shopping preferences and

develop and maintain a relevant and reliable omni-channel

experience for our customers;

• our dependence upon independent third parties for the

manufacture of all of our merchandise;

• availability constraints and price volatility in the raw

materials used to manufacture our products;

• interruptions of the flow of our merchandise from

international manufacturers causing disruptions in our supply

chain;

• our sourcing a significant amount of our products from

China;

• shortages of inventory, delayed shipments to our e-Commerce

customers and harm to our reputation due to difficulties or

shut-down of our distribution facility;

• our reliance upon independent third-party transportation

providers for substantially all of our product shipments;

• our growth strategy;

• our failure to attract and retain employees that reflect our

brand image, embody our culture and possess the appropriate skill

set;

• damage to our reputation arising from our use of social media,

email and text messages;

• our reliance on third-parties for the provision of certain

services, including real estate management;

• our dependence upon key members of our executive management

team;

• our reliance on information systems;

• system security risk issues that could disrupt our internal

operations or information technology services;

• unauthorized disclosure of sensitive or confidential

information, whether through a breach of our computer system,

third-party computer systems we rely on, or otherwise;

• our failure to comply with federal and state laws and

regulations and industry standards relating to privacy, data

protection, advertising and consumer protection;

• payment-related risks that could increase our operating costs

or subject us to potential liability;

• claims made against us resulting in litigation;

• changes in laws and regulations applicable to our

business;

• regulatory actions or recalls arising from issues with product

safety;

• our inability to protect our trademarks or other intellectual

property rights;

• our substantial indebtedness and lease obligations;

• restrictions imposed by our indebtedness on our current and

future operations;

• changes in tax laws or regulations or in our operations that

may impact our effective tax rate;

• the possibility that we may recognize impairments of

long-lived assets;

• our failure to maintain adequate internal control over

financial reporting; and

• the threat of war, terrorism or other catastrophes, including

natural disasters, that could negatively impact our business.

The outcome of the events described in any of our

forward-looking statements are also subject to risks, uncertainties

and other factors described in the sections entitled "Risk Factors"

and "Management's Discussion and Analysis of Financial Condition

and Results of Operations" in our Annual Report on Form 10-K filed

with the Securities and Exchange Commission ("SEC") on April 2,

2024 and in our other filings with the SEC and public

communications. You should evaluate all forward-looking statements

made in this earnings release in the context of these risks and

uncertainties.

We caution you that the important factors referenced above may

not include all of the factors that are important to you. In

addition, we cannot assure you that we will realize the results or

developments we expect or anticipate or, even if substantially

realized, that they will result in the outcomes or affect us or our

operations in the way we expect. The forward-looking statements

included in this earnings release are made only as of the date

hereof. We undertake no obligation to publicly update or revise any

forward-looking statement as a result of new information, future

events or otherwise except to the extent required by law. Our

forward-looking statements do not reflect the potential impact of

any future acquisitions, mergers, dispositions, joint ventures or

investments.

Investors and others should note that we may announce material

information to our investors using our investor relations website

(https://investors.torrid.com), SEC filings, press releases, public

conference calls and webcasts. We use these channels, as well as

social media, to communicate with our investors and the public

about our company, our business and other issues. It is possible

that the information that we post on social media could be deemed

to be material information. We therefore encourage investors to

visit these websites from time to time. The information contained

on such websites and social media posts is not incorporated by

reference into this filing. Further, our references to website URLs

in this filing are intended to be inactive textual references

only.

TORRID HOLDINGS INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

(UNAUDITED)

(In thousands, except per

share data)

Three Months Ended

November 2, 2024

October 28, 2023

Net sales

$

263,766

$

275,408

Cost of goods sold

168,609

183,906

Gross profit

95,157

91,502

Selling, general and administrative

expenses

74,899

71,881

Marketing expenses

13,056

12,739

Income from operations

7,202

6,882

Interest expense

8,784

9,757

Other income, net of other expense

(362

)

267

Loss before benefit from income taxes

(1,220

)

(3,142

)

Benefit from income taxes

(26

)

(394

)

Net loss

$

(1,194

)

$

(2,748

)

Comprehensive loss:

Net loss

$

(1,194

)

$

(2,748

)

Other comprehensive loss:

Foreign currency translation

adjustment

(86

)

(271

)

Total other comprehensive loss

(86

)

(271

)

Comprehensive loss

$

(1,280

)

$

(3,019

)

Net loss per share:

Basic

$

(0.01

)

$

(0.03

)

Diluted

$

(0.01

)

$

(0.03

)

Weighted average number of

shares:

Basic

104,698

104,081

Diluted

104,698

104,081

TORRID HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)(In thousands,

except share and per share data)

November 2, 2024

February 3, 2024

Assets

Current assets:

Cash and cash equivalents

$

43,953

$

11,735

Restricted cash

399

399

Inventory

138,261

142,199

Prepaid expenses and other current

assets

33,343

22,229

Prepaid income taxes

6,617

2,561

Total current assets

222,573

179,123

Property and equipment, net

85,569

103,516

Operating lease right-of-use assets

149,732

162,444

Deposits and other noncurrent assets

18,027

14,783

Deferred tax assets

8,681

8,681

Intangible asset

8,400

8,400

Total assets

$

492,982

$

476,947

Liabilities and stockholders'

deficit

Current liabilities:

Accounts payable

$

77,478

$

46,183

Accrued and other current liabilities

116,650

107,750

Operating lease liabilities

36,312

42,760

Borrowings under credit facility

—

7,270

Current portion of term loan

16,144

16,144

Due to related parties

4,330

9,329

Income taxes payable

62

2,671

Total current liabilities

250,976

232,107

Noncurrent operating lease liabilities

145,126

155,825

Term loan

276,445

288,553

Deferred compensation

3,735

5,474

Other noncurrent liabilities

5,986

6,705

Total liabilities

682,268

688,664

Commitments and contingencies

Stockholders' deficit

Preferred shares: $0.01 par value;

5,000,000 shares authorized; zero shares issued and outstanding at

November 2, 2024 and February 3, 2024

—

—

Common shares: $0.01 par value;

1,000,000,000 shares authorized; 104,732,148 shares issued and

outstanding at November 2, 2024; 104,204,554 shares issued and

outstanding at February 3, 2024

1,049

1,043

Additional paid-in capital

138,532

135,140

Accumulated deficit

(328,281

)

(347,587

)

Accumulated other comprehensive loss

(586

)

(313

)

Total stockholders' deficit

(189,286

)

(211,717

)

Total liabilities and stockholders'

deficit

$

492,982

$

476,947

TORRID HOLDINGS INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

(In thousands)

Nine Months Ended

November 2,

2024

Nine Months Ended

October 28, 2023

OPERATING ACTIVITIES

Net income

$

19,306

$

15,689

Adjustments to reconcile net income to net

cash provided by operating activities:

Write down of inventory

1,519

3,767

Operating right-of-use assets

amortization

30,429

30,494

Depreciation and other amortization

27,842

28,242

Share-based compensation

4,531

5,981

Other

(957

)

(1,351

)

Changes in operating assets and

liabilities:

Inventory

2,052

4,969

Prepaid expenses and other current

assets

(11,114

)

(4,578

)

Prepaid income taxes

(4,056

)

(2,564

)

Deposits and other noncurrent assets

(3,375

)

(6,433

)

Accounts payable

31,876

2,969

Accrued and other current liabilities

10,775

(5,954

)

Operating lease liabilities

(33,527

)

(31,565

)

Other noncurrent liabilities

(588

)

(468

)

Deferred compensation

(1,739

)

507

Due to related parties

(4,999

)

(5,975

)

Income taxes payable

(2,609

)

—

Net cash provided by operating

activities

65,366

33,730

INVESTING ACTIVITIES

Purchases of property and equipment

(12,617

)

(15,228

)

Net cash used in investing activities

(12,617

)

(15,228

)

FINANCING ACTIVITIES

Proceeds from revolving credit

facility

62,780

455,110

Principal payments on revolving credit

facility

(70,050

)

(458,390

)

Principal payments on term loan

(13,125

)

(13,125

)

Proceeds from issuances under share-based

compensation plans

704

320

Withholding tax payments related to

vesting of restricted stock units and awards

(675

)

(249

)

Net cash used in financing activities

(20,366

)

(16,334

)

Effect of foreign currency exchange rate

changes on cash, cash equivalents and restricted cash

(165

)

(141

)

Increase in cash, cash equivalents and

restricted cash

32,218

2,027

Cash, cash equivalents and restricted cash

at beginning of period

12,134

13,935

Cash, cash equivalents and restricted cash

at end of period

$

44,352

$

15,962

SUPPLEMENTAL INFORMATION

Cash paid during the period for interest

related to the revolving credit facility and term loan

$

27,080

$

24,852

Cash paid during the period for income

taxes

$

14,200

$

10,976

SUPPLEMENTAL DISCLOSURE OF NON-CASH

INVESTING AND FINANCING ACTIVITIES

Property and equipment purchases included

in accounts payable and accrued liabilities

$

1,450

$

3,360

Non-GAAP Reconciliation

The following table provides a reconciliation of Net loss to

Adjusted EBITDA for the periods presented (dollars in

thousands):

Three Months Ended

November 2, 2024

October 28, 2023

Net loss

$

(1,194

)

$

(2,748

)

Interest expense

8,784

9,757

Other income, net of other expense

(362

)

267

Benefit from income taxes

(26

)

(394

)

Depreciation and amortization(A)

8,523

8,785

Share-based compensation(B)

685

1,585

Non-cash deductions and charges(C)

112

409

Other expenses(D)

3,062

1,718

Adjusted EBITDA

$

19,584

$

19,379

(A)

Depreciation and amortization

excludes amortization of debt issuance costs and original issue

discount that are reflected in interest expense.

(B)

During the three months ended

November 2, 2024 and October 28, 2023, share-based compensation

includes $(0.3) million and $0.1 million, respectively, for awards

that will be settled in cash as they are accounted for as

share-based compensation in accordance with ASC 718,

Compensation—Stock Compensation, similar to awards settled in

shares.

(C)

Non-cash deductions and charges

includes non-cash losses on property and equipment disposals and

the net impact of non-cash rent expense.

(D)

Other expenses include certain

transaction and litigation fees (including certain settlement

costs) and severance costs for certain key management

positions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203834068/en/

Investors Lyn Walther IR@torrid.com Media Joele

Frank, Wilkinson Brimmer Katcher Michael Freitag / Arielle

Rothstein / Lyle Weston Media@torrid.com

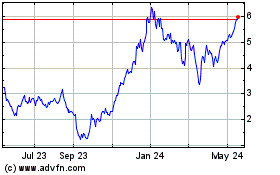

Torrid (NYSE:CURV)

Historical Stock Chart

From Feb 2025 to Mar 2025

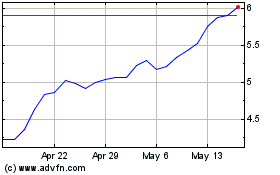

Torrid (NYSE:CURV)

Historical Stock Chart

From Mar 2024 to Mar 2025