0000025232false00000252322024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 8, 2024

Cousins Properties Incorporated

(Exact name of registrant as specified in its charter)

Georgia 001-11312 58-0869052

(State or other jurisdiction of incorporation) (Commission File Number) (IRS Employer Identification Number)

3344 Peachtree Road NE, Suite 1800, Atlanta, Georgia 30326-4802

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (404) 407-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $1 par value per share | | CUZ | | New York Stock Exchange | ("NYSE") |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the securities Act of 1933 (§230.405 of this chapter) or Rule 12b-12 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

In connection with the Company and its operating partnership, Cousins Properties LP, filing a new registration statement on Form S-3 (Registration No. 333-279209), on May 8, 2024, Cousins Properties Incorporated (the “Company”) and Cousins Properties LP, entered into a second amendment (the “Amendment”) to the Equity Distribution Agreement, dated August 3, 2021 (as amended, the “Equity Distribution Agreement”), with Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, as managers (collectively, the “Managers”), Morgan Stanley & Co. LLC, Bank of America, N.A., JPMorgan Chase Bank, National Association, The Toronto-Dominion Bank, Truist Bank and Wells Fargo Bank, National Association, as forward purchasers (collectively, the “Forward Purchasers”), and Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, as forward sellers (collectively, the “Forward Sellers”), pursuant to which the Company may issue and sell, from time to time, through the Managers, as the Company’s agents, or to the Managers for resale, shares of the Company’s common stock, par value $1.00 per share, representing the unsold amount available under the Company’s at-the-market offering program, prior to such Amendment.

The Amendment provides that shares of common stock to be sold pursuant to the Equity Distribution Agreement will be issued pursuant to a prospectus dated May 8, 2024, and a prospectus supplement filed with the Securities and Exchange Commission on May 8, 2024, in connection with one or more offerings of shares from the Company’s new effective shelf registration statement on Form S-3 (Registration No. 333-279209). Sales of shares of the Company’s common stock through the Managers, if any, will be made in amounts and at times to be determined by the Company from time to time, but the Company has no obligation to sell any of the shares in the offering and may suspend sales in connection with the offering at any time. Actual sales will depend on a variety of factors to be determined by the Company from time to time, including (among others) market conditions, the trading price of the Company’s common shares and determinations by the Company of the appropriate sources of funding for the Company. Any sales of shares of the Company’s common stock through the Managers will be made by means of ordinary brokers’ transactions on the New York Stock Exchange or otherwise at market prices prevailing at the time of sale, in block transactions, or as otherwise agreed upon by us and the Managers.

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

The Equity Distribution Agreement is filed as Exhibits 1.1, 1.2 and 1.3 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description of the Equity Distribution Agreement and the transactions contemplated thereby is qualified in its entirety by reference to Exhibits 1.1, 1.2 and 1.3.

Exhibits 5.1 and 23.1 to this Current Report on Form 8-K are filed herewith in connection with the Company’s effective registration statement on Form S-3 (Registration No. 333-279209) and are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(a)Exhibits

| | | | | | | | |

Exhibit

Number | | Exhibit Description |

| 1.1 | | Equity Distribution Agreement, dated August 3, 2021, among Cousins Properties Incorporated, Cousin Properties LP and Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, as managers, Morgan Stanley & Co. LLC, Bank of America, N.A., JPMorgan Chase Bank, National Association, The Toronto-Dominion Bank, Truist Bank and Wells Fargo Bank, National Association, as forward purchasers, and Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC, as forward sellers (incorporated by reference from Exhibit 1.1 to the Company’s Form 8-K filed on August 3, 2021) |

| 1.2 | | |

| 1.3 | | |

| 5.1 | | |

| 23.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 8, 2024

| | | | | |

COUSINS PROPERTIES INCORPORATED |

| |

| By: | /s/ Pamela F. Roper |

| Pamela F. Roper |

Executive Vice President, General Counsel, and Corporate Secretary |

SECOND AMENDMENT TO EQUITY DISTRIBUTION AGREEMENT

May 8, 2024

Morgan Stanley & Co. LLC

1585 Broadway

New York, New York 10036

BofA Securities, Inc.

One Bryant Park

New York, New York 10036

J.P. Morgan Securities LLC

383 Madison Avenue

New York, New York 10179

TD Securities (USA) LLC

1 Vanderbilt Avenue

New York, New York 10017

Truist Securities, Inc.

3333 Peachtree Road NE, 11th Floor

Atlanta, Georgia 30326

Wells Fargo Securities, LLC

500 West 33rd Street, 14th Floor

New York, New York 10001

As Managers

Morgan Stanley & Co. LLC

1585 Broadway

New York, New York 10036

Bank of America, N.A.

c/o BofA Securities, Inc.

One Bryant Park

New York, New York 10036

JPMorgan Chase Bank, National Association

383 Madison Avenue, 6th Floor

New York, New York 10179

The Toronto-Dominion Bank

c/o TD Securities (USA) LLC

1 Vanderbilt Avenue

New York, New York 10017

Truist Bank

3333 Peachtree Road NE, 11th Floor

Atlanta, Georgia 30326

Wells Fargo Bank, National Association

500 West 33rd Street, 14th Floor

New York, New York 10001

As Forward Purchasers

Morgan Stanley & Co. LLC

1585 Broadway

New York, New York 10036

BofA Securities, Inc.

One Bryant Park

New York, New York 10036

J.P. Morgan Securities LLC

383 Madison Avenue

New York, New York 10179

TD Securities (USA) LLC

1 Vanderbilt Avenue

New York, New York 10017

Truist Securities, Inc.

3333 Peachtree Road NE, 11th Floor

Atlanta, Georgia 30326

Wells Fargo Securities, LLC

500 West 33rd Street, 14th Floor

New York, New York 10001

As Forward Sellers

Ladies and Gentlemen:

Reference is hereby made to the Equity Distribution Agreement, dated August 3, 2021 (the "Original EDA"), as amended by the Amendment to Equity Distribution Agreement, dated February 17, 2023 (the "First Amendment" and, together with the Original EDA, the “Distribution Agreement”), among Cousins Properties Incorporated, a Georgia corporation (the “Company”), Cousin Properties LP, a Delaware limited partnership (the “Operating Partnership”), and Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC (collectively, the “Managers”), Morgan Stanley & Co. LLC, Bank of America, N.A, JPMorgan Chase Bank, National Association, The Toronto-Dominion Bank, Truist Bank and Wells Fargo

Bank, National Association (collectively, the “Forward Purchasers”) and Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC (collectively, the “Forward Sellers”), which shall be amended as set forth in this Second Amendment to Equity Distribution Agreement (this “Second Amendment” and, the Distribution Agreement as amended by this Second Amendment, this “Agreement”). Capitalized terms used herein and not defined have the respective meanings set forth in the Distribution Agreement.

The Distribution Agreement contemplates the offering and sale of Shares pursuant to the Company’s automatic shelf registration statement on Form S-3 (File No. 333-269859). The Company has filed with the Commission (i) an automatic shelf registration statement on Form S-3 (File No. 333-279209) relating to, among other things, the Company’s Common Stock (which new registration statement became effective upon the filing thereof with the Commission on the date hereof) and (ii) a prospectus supplement dated May 8, 2024, relating to the Shares and an accompanying prospectus dated May 8, 2024.

The parties hereto hereby agree that, from and after the date hereof, the second paragraph of the introduction of the Distribution Agreement shall be replaced in its entirety with the following:

The Company has filed with the Securities and Exchange Commission (the “Commission”) a registration statement (File No. 333-279209), including a prospectus, on Form S-3, relating to the securities (the “Shelf Securities”), including the Shares, to be offered from time to time by the Company. The registration statement as of its most recent effective date, including the information (if any) deemed to be part of the registration statement at the time of effectiveness pursuant to Rule 430A or Rule 430B under the Securities Act of 1933, as amended (the “Securities Act”), is hereinafter referred to as the “Registration Statement”, and the related prospectus covering the Shelf Securities and filed as part of the Registration Statement, together with any amendments or supplements thereto (other than a prospectus supplement relating solely to the offering of Shelf Securities other than the Shares) as of the most recent effective date of the Registration Statement, is hereinafter referred to as the “Basic Prospectus”. “Prospectus Supplement” means the final prospectus supplement, relating to the Shares, filed by the Company with the Commission pursuant to Rule 424(b) under the Securities Act on or before the second business day after the date hereof, in the form furnished by the Company to the Managers, the Forward Purchasers and the Forward Sellers in connection with the offering of the Shares. Except where the context otherwise requires, “Prospectus” means the Basic Prospectus, as supplemented by the Prospectus Supplement and the most recent Interim Prospectus Supplement (as defined in Section 6(b) below), if any. For purposes of this Agreement, “free writing prospectus” has the meaning set forth in Rule 405 under the Securities Act. “Permitted Free Writing Prospectuses” means the documents listed on Schedule I hereto or otherwise approved in writing by the Managers, the Forward Purchasers and the Forward Sellers in accordance with Section 6(a), and “broadly available road show” means a “bona fide electronic road show” as defined in Rule 433(h)(5) under the Securities Act that has been made available without restriction to any person. As used herein, the terms “Registration Statement”, “Basic Prospectus”, “Prospectus Supplement”, “Interim Prospectus Supplement” and “Prospectus” shall include the documents, if any, incorporated by reference therein as of the date hereof. The

terms “supplement”, “amendment” and “amend” as used herein with respect to the Registration Statement, the Basic Prospectus, the Prospectus Supplement, any Interim Prospectus Supplement or the Prospectus shall include all documents subsequently filed by the Company with the Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are deemed to be incorporated by reference therein (the “Incorporated Documents”).

The parties hereto hereby further agree that (i) notwithstanding the foregoing, each reference to a "Registration Statement," "Prospectus," "Prospectus Supplement," "Interim Prospectus Supplement," "General Disclosure Package" or "Permitted Free Writing Prospectus" in Section 8 of the Distribution Agreement shall be deemed to include each such Registration Statement, Prospectus, Prospectus Supplement, Interim Prospectus Supplement, General Disclosure Package and Permitted Free Writing Prospectus utilized by the Transaction Entities in connection with the issuance of Shares pursuant to the Original EDA, the Distribution Agreement and this Agreement and (ii) the Distribution Agreement, as amended hereby, shall otherwise remain in full force and effect.

This Agreement may be executed by any one or more of the parties hereto in any number of counterparts, each of which shall be deemed to be an original, but all such respective counterparts shall together constitute one and the same instrument. Delivery of an executed signature page of this Agreement by facsimile or any other rapid transmission device designed to produce a written record of the communication transmitted shall be as effective as delivery of a manually executed counterpart thereof. The words “execution,” “executed,” “signed,” signature” and words of like import in this Agreement or in any other certificate, agreement or document related to this Agreement shall include images of manually executed signatures transmitted by facsimile, email or other electronic format (including, without limitation, “pdf,” “tif” or “jpg”) and other electronic signatures (including, without limitation, DocuSign and AdobeSign). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code.

THIS AGREEMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE RELATING TO OR ARISING OUT OF THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO ITS CHOICE OF LAW PROVISIONS.

[signature pages follow]

If the foregoing is in accordance with your understanding of our agreement, please sign and return to the Company and the Operating Partnership a counterpart hereof, whereupon this Agreement, along with all counterparts, will become a binding agreement between the Company, the Operating Partnership, the Managers, the Forward Purchasers and the Forward Sellers in accordance with its terms.

| | | | | |

| Very truly yours, |

| |

| COUSINS PROPERTIES INCORPORATED |

| |

| By: | /s/ Gregg D. Adzema |

| Name: | Gregg D. Adzema |

| Title: | Executive Vice President |

| and Chief Financial Officer |

| |

| COUSINS PROPERTIES LP |

| |

| By: | /s/ Gregg D. Adzema |

| Name: | Gregg D. Adzema |

| Title: | Executive Vice President |

| and Chief Financial Officer |

[Signature Page to Second Amendment to Equity Distribution Agreement]

Accepted as of the date first written above.

| | | | | |

| MORGAN STANLEY & CO. LLC |

| As Manager, Forward Seller and Forward Purchaser |

| |

| By: | /s/ Russ Lindberg |

| Name: | Russ Lindberg |

| Title: | Managing Director |

[Signature Page to Second Amendment to Equity Distribution Agreement]

Accepted as of the date first written above.

| | | | | |

| BOFA SECURITIES, INC. |

| As Manager and Forward Seller |

| |

| By: | /s/ Chris Djoganopoulos |

| Name: | Chris Djoganopoulos |

| Title: | Managing Director |

| |

| BANK OF AMERICA, N.A. |

| As Forward Purchaser |

| |

| By: | /s/ Rohan Handa |

| Name: | Rohan Handa |

| Title: | Managing Director |

[Signature Page to Second Amendment to Equity Distribution Agreement]

Accepted as of the date first written above.

| | | | | |

| J.P. MORGAN SECURITIES LLC |

| As Manager and Forward Seller |

| |

| By: | /s/ Brett Chalmers |

| Name: | Brett Chalmers |

| Title: | Executive Director |

| |

| JP MORGAN CHASE BANK, NATIONAL ASSOCIATION |

| As Forward Purchaser |

| |

| By: | /s/ Brett Chalmers |

| Name: | Brett Chalmers |

| Title: | Executive Director |

[Signature Page to Second Amendment to Equity Distribution Agreement]

Accepted as of the date first written above.

| | | | | |

| TD SECURITIES (USA) LLC |

| As Manager and Forward Seller |

| |

| By: | /s/ Bradford Limpert |

| Name: | Bradford Limpert |

| Title: | Managing Director |

| |

| THE TORONTO-DOMINION BANK |

| As Forward Purchaser |

| |

| By: | /s/ Vanessa Simonetti |

| Name: | Vanessa Simonetti |

| Title: | Managing Director |

[Signature Page to Second Amendment to Equity Distribution Agreement]

Accepted as of the date first written above.

| | | | | |

| TRUIST SECURITIES, INC. |

| As Manager and Forward Seller |

| |

| By: | /s/ Michael Collins |

| Name: | Michael Collins |

| Title: | Managing Director |

| |

| TRUIST BANK |

| As Forward Purchaser |

| |

| By: | /s/ Michael Collins |

| Name: | Michael Collins |

| Title: | Managing Director |

[Signature Page to Second Amendment to Equity Distribution Agreement]

Accepted as of the date first written above.

| | | | | |

| WELLS FARGO SECURITIES, LLC |

| As Manager and Forward Seller |

| |

| By: | /s/ Elizabeth Alvarez |

| Name: | Elizabeth Alvarez |

| Title: | Managing Director |

| |

| WELLS FARGO BANK, NATIONAL ASSOCIATION |

| As Forward Purchaser |

| |

| By: | /s/ Elizabeth Alvarez |

| Name: | Elizabeth Alvarez |

| Title: | Managing Director |

[Signature Page to Second Amendment to Equity Distribution Agreement]

| | | | | | | | |

| | King & Spalding LLP

1180 Peachtree Street N.E. Ste. 1600

Atlanta, GA 30309-3521

Tel: +1 404 572 4600

Fax: +1 404 572 5100

www.kslaw.com |

May 8, 2024

Ladies and Gentlemen,

We have acted as counsel to Cousins Properties Incorporated, a Georgia corporation (the “Company”), in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”), of the offer and sale of shares of the Company’s common stock, par value $1.00 per share, having an aggregate gross sales price of up to $394,949,683 (the “Shares”), to be offered and sold by the Company from time to time pursuant to the Equity Distribution Agreement, dated May 8, 2024 (as amended through the date hereof, the “Equity Distribution Agreement”), among the Company, Cousins Properties LP, a Delaware limited partnership, and Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC (each, in its capacity as sales agent in connection with the offering and sale of Shares, a “Manager” and collectively, the “Managers”), Morgan Stanley & Co. LLC, Bank of America, N.A., JPMorgan Chase Bank, National Association, The Toronto-Dominion Bank, Truist Bank and Wells Fargo Bank, National Association (each, in its capacity as purchaser under any Forward Contract (as defined in the Equity Distribution Agreement), a “Forward Purchaser” and collectively, the “Forward Purchasers”) and Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, TD Securities (USA) LLC, Truist Securities, Inc. and Wells Fargo Securities, LLC (each, as agent for its affiliated Forward Purchaser in connection with the offering and sale of any Forward Hedge Shares (as defined in the Equity Distribution Agreement), a “Forward Seller” and collectively, the “Forward Sellers”).

In our capacity as such counsel, we have reviewed (i) the Registration Statement on Form S-3ASR, dated May 8, 2024 (Registration No. 333-279209), in the form it became effective (the “Registration Statement”), including the prospectus included therein (the “Base Prospectus”), (ii) the prospectus supplement, dated May 8, 2024, filed with the Commission pursuant to Rule 424(b) promulgated under the Securities Act (together with the Base Prospectus, the “Prospectus”), the (iii) the Equity Distribution Agreement, (iv) the Master Forward Confirmations, each dated as of August 3, 2021 (each a “Master Forward Confirmation” and, together with the Equity Distribution Agreement, the “Transaction Documents”), (v) the Company’s Restated and Amended Articles of Incorporation, as amended (the “Articles of Incorporation”), (vi) the Company’s Bylaws, as amended (the “Bylaws”), and (vii) the resolutions adopted by the Board of Directors of the Company on July 27, 2021 (the “Resolutions”) relating to the transactions contemplated by the Transaction Documents.

In connection with this opinion, we have examined and relied upon the accuracy of original, certified, conformed or photographic copies of such records, agreements, certificates and other documents as we have deemed necessary or appropriate to enable us to render the opinions set forth below. In all such examinations, we have assumed the genuineness of signatures on all documents submitted to us as original documents and the conformity to such original documents of all documents submitted to us as certified, conformed or photographic copies and, as to certificates of public officials, we have assumed the same to have been properly given and to be accurate. As to matters of fact material to this opinion, we have relied, without independent verification, upon certificates, statements and representations of representatives of the Company and public officials.

We have also assumed that the Shares will not be issued or transferred in violation of the restrictions on transfer and ownership of shares of beneficial interest of the Company set forth in Article 11 of the Company’s Articles of Incorporation; that upon the issuance of any of the Shares, the total number of shares of common stock of the Company issued and outstanding will not exceed the total number of shares that the Company is then authorized to issue under its Articles of Incorporation; and that the number of Shares, and the offering price of each Share, to be sold from time to time pursuant to the Equity Distribution Agreement will be authorized and approved by the Board of Directors of the Company or the Executive Committee thereof in accordance with Georgia law, the Articles of Incorporation, the Bylaws and the Resolutions (with such determinations referred to hereinafter as the “Proceedings”) prior to the issuance thereof.

Based on the foregoing, and subject to the assumptions, qualifications and limitations set forth herein, we are of the opinion that the Shares, when issued and delivered by the Company to the Managers, Forward Purchasers and Forward Sellers, as applicable, in the manner provided in the Resolutions and the Proceedings and in accordance with the terms of the Equity Distribution Agreement and any applicable supplemental confirmation under a Master Forward Confirmation and against payment of the consideration therefor as contemplated by the Equity Distribution Agreement, any applicable supplemental confirmation under a Master Forward Confirmation and the Proceedings, will be validly issued and fully paid and non-assessable.

This opinion is limited in all respects to the federal laws of the United States of America and the laws of the State of Georgia and no opinion is expressed with respect to the laws of any other jurisdiction or any effect that such laws may have on the opinions expressed herein. This opinion is limited to the matters stated herein, and no opinion is implied or may be inferred beyond the matters expressly stated herein.

This opinion is given as of the date hereof, and we assume no obligation to advise you after the date hereof of facts or circumstances that come to our attention or changes in law that occur which could affect the opinions contained herein. This opinion is being rendered for the benefit of the Company in connection with the matters addressed herein.

We consent to the filing of this opinion as an exhibit to the Current Report on Form 8-K filed on May 8, 2024 to be incorporated by reference into the Registration Statement and to the reference to us under the caption “Legal matters” in the prospectus supplement, dated May 8, 2024. In giving such consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

Very truly yours,

/s/ King & Spalding LLP

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

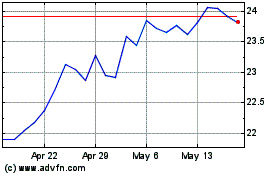

Cousins Properties (NYSE:CUZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

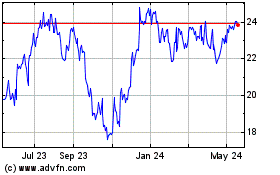

Cousins Properties (NYSE:CUZ)

Historical Stock Chart

From Feb 2024 to Feb 2025