- Reported earnings of $3.2 billion; adjusted earnings of $3.6

billion

- Returned record $27 billion cash to shareholders in 2024

- Increased 2024 worldwide and U.S. production by 7 and 19

percent to record levels

- Delivered key project start-ups and milestones in the U.S. and

Kazakhstan

- Announced a 5 percent increase in quarterly dividend to $1.71

per share

Chevron Corporation (NYSE: CVX) reported earnings of $3.2

billion ($1.84 per share - diluted) for fourth quarter 2024,

compared with $2.3 billion ($1.22 per share - diluted) in fourth

quarter 2023. Included in the quarter were severance charges of

$715 million and impairment charges of $400 million. Foreign

currency effects increased earnings by $722 million. Adjusted

earnings of $3.6 billion ($2.06 per share - diluted) in fourth

quarter 2024 compared to adjusted earnings of $6.5 billion ($3.45

per share - diluted) in fourth quarter 2023. See Attachment 4 for a

reconciliation of adjusted earnings.

Earnings & Cash Flow Summary

Unit

4Q 2024

3Q 2024

4Q 2023

2024

2023

Total Earnings / (Loss)

$ MM

$

3,239

$

4,487

$

2,259

$

17,661

$

21,369

Upstream

$ MM

$

4,304

$

4,589

$

1,586

$

18,602

$

17,438

Downstream

$ MM

$

(248

)

$

595

$

1,147

$

1,727

$

6,137

All Other

$ MM

$

(817

)

$

(697

)

$

(474

)

$

(2,668

)

$

(2,206

)

Earnings Per Share - Diluted

$/Share

$

1.84

$

2.48

$

1.22

$

9.72

$

11.36

Adjusted Earnings (1)

$ MM

$

3,632

$

4,531

$

6,453

$

18,256

$

24,693

Adjusted Earnings Per Share - Diluted

(1)

$/Share

$

2.06

$

2.51

$

3.45

$

10.05

$

13.13

Cash Flow From Operations (CFFO)

$ B

$

8.7

$

9.7

$

12.4

$

31.5

$

35.6

CFFO Excluding Working Capital (1)

$ B

$

5.3

$

8.3

$

11.4

$

30.3

$

38.8

(1) See non-GAAP reconciliation in

attachments

“In 2024, we delivered record production, returned record cash

to shareholders and started up key growth projects,” said Mike

Wirth, Chevron’s chairman and chief executive officer. Worldwide

and U.S. net oil-equivalent production increased 7 and 19 percent,

respectively, from last year.

The company started up several key projects in the Gulf of

America, including the industry-first, high-pressure Anchor

project. In Kazakhstan, Tengizchevroil completed the Wellhead

Pressure Management Project and recently started up the Future

Growth Project. Chevron also repurchased over $15 billion of its

shares in 2024, extending its track record of repurchasing shares

in 17 out of the last 21 years.

“We strengthened our portfolio and committed to reduce costs and

maintain capital discipline, positioning us for significant free

cash flow growth,” Wirth concluded.

The company recently closed asset sales in Canada, the Republic

of Congo and Alaska, progressed the acquisition of Hess

Corporation, and announced a target of $2-3 billion of structural

cost reductions by the end of 2026.

Financial and Business Highlights

Unit

4Q 2024

3Q 2024

4Q 2023

2024

2023

Return on Capital Employed (ROCE)

%

7.6

%

10.1

%

5.1

%

10.1

%

11.9

%

Capital Expenditures (Capex)

$ B

$

4.3

$

4.1

$

4.4

$

16.4

$

15.8

Affiliate Capex

$ B

$

0.6

$

0.6

$

0.9

$

2.4

$

3.5

Free Cash Flow (1)

$ B

$

4.4

$

5.6

$

8.1

$

15.0

$

19.8

Free Cash Flow ex. working capital (1)

$ B

$

1.0

$

4.2

$

7.1

$

13.8

$

23.0

Debt Ratio (end of period)

%

13.9

%

14.2

%

11.5

%

13.9

%

11.5

%

Net Debt Ratio (1) (end of period)

%

10.4

%

11.9

%

7.3

%

10.4

%

7.3

%

Net Oil-Equivalent Production

MBOED

3,350

3,364

3,392

3,338

3,120

(1) See non-GAAP reconciliation in

attachments

2024 Financial Highlights

- Reported earnings decreased compared to last year primarily due

to lower margins on refined product sales, lower realizations, and

severance charges, partially offset by the absence of charges for

decommissioning obligations for previously sold assets, higher

sales volumes and lower impairment charges.

- Worldwide and U.S. net oil-equivalent production set annual

records. Worldwide production increased 7 percent from a year ago

primarily due to nearly 18 percent growth in the Permian Basin and

a full year of legacy PDC Energy, Inc. (PDC) production.

- Year-end 2024 proved reserves were approximately 9.8 billion

barrels of net oil-equivalent, subject to final reviews. The

largest reductions were from production and the sale of oil sands

and shale and tight assets in Canada, and the largest additions

were from extensions and discoveries in the Permian and

Denver-Julesburg (DJ) Basins.

- Capex was slightly higher than 2023, primarily due to higher

upstream investments. Affiliate capex was down $1.1 billion,

primarily due to lower spend at the company’s Tengizchevroil (TCO)

affiliate in Kazakhstan.

- Cash flow from operations was lower than a year ago mainly due

to lower earnings and higher payments related to asset retirement

obligations, partially offset by favorable working capital

effects.

- Cash flow from investing improved from last year driven by $7.7

billion of proceeds from asset sales in Canada and the U.S.

- The company returned a record $27.0 billion of cash to

shareholders during the year, including share repurchases of $15.2

billion and dividends of $11.8 billion. Over the past three years,

the company has returned over $75 billion to shareholders.

- The company’s Board of Directors declared a 5 percent increase

in the quarterly dividend to one dollar and seventy-one cents

($1.71) per share, payable March 10, 2025, to all holders of common

stock as shown on the transfer records of the corporation at the

close of business on February 14, 2025.

Business Highlights and Milestones

- Started production at the industry-first 20,000 psi deepwater

Anchor project, began water injection to boost production from the

Jack/St. Malo and Tahiti fields, and started production from the

Whale semi-submersible platform in the Gulf of America.

- Started production at the Future Growth Project in January

2025, which is expected to ramp up total output to around one

million barrels of oil-equivalent per day, and completed the

Wellhead Pressure Management Project at TCO.

- Recently announced plans to jointly develop scalable power

solutions using natural gas-fired turbines with flexibility to

integrate carbon capture and storage to support growing energy

demand from U.S. data centers.

- Achieved first gas on the Sanha Lean Gas Connection project,

securing incremental natural gas supply to the Angola Liquefied

Natural Gas facility.

- Extended the Meji field offshore Nigeria with a near-field

discovery and added 20 years to the deepwater Agbami concession

through 2044.

- Upgraded the Pasadena Refinery to increase product flexibility

and expand the processing capacity of lighter crude oil by nearly

15 percent to 125,000 barrels per day.

- Increased the company’s exploration acreage position in the

Gulf of America, Angola, Brazil, Equatorial Guinea, Uruguay and

Namibia (subject to government approval).

- Completed the sale of the company’s interest in the Athabasca

Oil Sands Project and Duvernay shale assets in Canada, certain

assets in Alaska, and in 2025, the Republic of Congo.

- Progressed the company’s pending merger with Hess Corporation

by securing Hess stockholder approval and clearing Federal Trade

Commission antitrust review.

- Completed projects and operational changes designed to abate

700,000 tonnes of carbon dioxide-equivalent from the company’s

operations.

- Drilled onshore and offshore stratigraphic wells to delineate

carbon dioxide storage potential through the company’s joint

venture, Bayou Bend CCS LLC.

- Launched a $500 million Future Energy Fund III focused on

venture investments in technology-based solutions that have the

potential to enable affordable, reliable and lower carbon

energy.

Segment Highlights

Upstream

U.S. Upstream

Unit

4Q 2024

3Q 2024

4Q 2023

2024

2023

Earnings / (Loss)

$ MM

$

1,420

$

1,946

$

(1,347

)

$

7,602

$

4,148

Net Oil-Equivalent Production

MBOED

1,646

1,605

1,598

1,599

1,349

Liquids Production

MBD

1,189

1,156

1,164

1,152

997

Natural Gas Production

MMCFD

2,743

2,694

2,604

2,684

2,112

Liquids Realization

$/BBL

$

53.12

$

54.86

$

58.69

$

56.24

$

59.19

Natural Gas Realization

$/MCF

$

1.62

$

0.55

$

1.62

$

1.04

$

1.67

- U.S. upstream earnings were higher than the year-ago period

primarily due to the absence of charges from decommissioning

obligations for previously sold assets in the Gulf of America and

impairment charges mainly from assets in California, partly offset

by lower realizations and severance charges.

- U.S. net oil-equivalent production was up 48,000 barrels per

day from a year earlier and set a new quarterly record, primarily

due to higher production in the Permian Basin, partly offset by

hurricane related impacts in the Gulf of America.

International Upstream

Unit

4Q 2024

3Q 2024

4Q 2023

2024

2023

Earnings / (Loss) (1)

$ MM

$

2,884

$

2,643

$

2,933

$

11,000

$

13,290

Net Oil-Equivalent Production

MBOED

1,704

1,759

1,794

1,739

1,771

Liquids Production

MBD

797

834

851

823

833

Natural Gas Production

MMCFD

5,437

5,550

5,661

5,494

5,632

Liquids Realization

$/BBL

$

67.33

$

70.59

$

74.54

$

71.38

$

71.70

Natural Gas Realization

$/MCF

$

7.67

$

7.46

$

7.31

$

7.32

$

7.69

(1) Includes foreign currency effects

$ MM

$

597

$

13

$

(162

)

$

395

$

376

- International upstream earnings were lower than a year ago

primarily due to lower realizations, higher operating expense in

part due to severance charges, impairments and lower liftings,

partly offset by favorable foreign currency effects, largely in

Australia.

- Net oil-equivalent production during the quarter was down

90,000 barrels per day from a year earlier primarily due to

downtime at TCO, Canada asset sale and withdrawal from

Myanmar.

Downstream

U.S. Downstream

Unit

4Q 2024

3Q 2024

4Q 2023

2024

2023

Earnings / (Loss)

$ MM

$

(348

)

$

146

$

470

$

531

$

3,904

Refinery Crude Unit Inputs

MBD

893

995

950

917

962

Refined Product Sales

MBD

1,257

1,312

1,298

1,286

1,287

- U.S. downstream reported a loss in fourth quarter 2024. The

results were lower than the year-ago period primarily due to lower

margins on refined product sales, higher operating expenses, in

part due to severance charges, and impairments.

- Refinery crude unit inputs, including crude oil and other

inputs, decreased 6 percent from the year-ago period primarily

related to the upgrade of the Pasadena, Texas refinery that was

completed during fourth quarter 2024.

- Refined product sales decreased 3 percent compared to the

year-ago period primarily due to lower demand for jet fuel, partly

offset by higher demand for gasoline.

International Downstream

Unit

4Q 2024

3Q 2024

4Q 2023

2024

2023

Earnings / (Loss) (1)

$ MM

$

100

$

449

$

677

$

1,196

$

2,233

Refinery Crude Unit Inputs

MBD

651

628

634

646

636

Refined Product Sales

MBD

1,557

1,507

1,437

1,495

1,445

(1) Includes foreign currency effects

$ MM

$

126

$

(55

)

$

(58

)

$

126

$

(12

)

- International downstream earnings were lower compared to a year

ago primarily due to lower margins on refined product sales and

impairments, partly offset by favorable foreign currency

effects.

- Refinery crude unit inputs, including crude oil and other

inputs, increased 3 percent from the year-ago period primarily due

to the absence of a turnaround in Singapore.

- Refined product sales increased 8 percent from the year-ago

period primarily due to increased trading volumes.

All Other

All Other

Unit

4Q 2024

3Q 2024

4Q 2023

2024

2023

Net charges (1)

$ MM

$

(817

)

$

(697

)

$

(474

)

$

(2,668

)

$

(2,206

)

(1) Includes foreign currency effects

$ MM

$

(1

)

$

(2

)

$

(259

)

$

(1

)

$

(588

)

- All Other consists of worldwide cash management and debt

financing activities, corporate administrative functions, insurance

operations, real estate activities and technology companies.

- Net charges increased compared to a year ago primarily due to

higher employee benefit costs, severance charges and higher

interest expense, partly offset by the absence of prior year

unfavorable foreign currency effects.

Chevron is one of the world’s leading integrated energy

companies. We believe affordable, reliable and ever-cleaner energy

is essential to enabling human progress. Chevron produces crude oil

and natural gas; manufactures transportation fuels, lubricants,

petrochemicals and additives; and develops technologies that

enhance our business and the industry. We aim to grow our oil and

gas business, lower the carbon intensity of our operations and grow

lower carbon businesses in renewable fuels, carbon capture and

offsets, hydrogen and other emerging technologies. More information

about Chevron is available at www.chevron.com.

NOTICE

Chevron’s discussion of fourth quarter 2024 earnings with

security analysts will take place on Friday, January 31, 2025, at

10:00 a.m. CT. A webcast of the meeting will be available in a

listen-only mode to individual investors, media, and other

interested parties on Chevron’s website at www.chevron.com under

the “Investors” section. Prepared remarks for today’s call,

additional financial and operating information and other

complementary materials will be available prior to the call at

approximately 5:30 a.m. CT and located under “Events and

Presentations” in the “Investors” section on the Chevron website.

Chevron also publishes a “Sensitivities and Forward Guidance”

document with consolidated guidance and sensitivities that is

updated quarterly and posted to the Chevron website the month prior

to earnings calls.

As used in this news release, the term “Chevron” and such terms

as “the company,” “the corporation,” “our,” “we,” “us” and “its”

may refer to Chevron Corporation, one or more of its consolidated

subsidiaries, or to all of them taken as a whole. All of these

terms are used for convenience only and are not intended as a

precise description of any of the separate companies, each of which

manages its own affairs. Structural cost reductions describe

decreases in operating expenses from operational efficiencies,

divestments, and other cost saving measures that are expected to be

sustainable compared with 2024 levels.

Please visit Chevron’s website and Investor Relations page at

www.chevron.com and www.chevron.com/investors, LinkedIn:

www.linkedin.com/company/chevron, X: @Chevron, Facebook:

www.facebook.com/chevron, and Instagram: www.instagram.com/chevron,

where Chevron often discloses important information about the

company, its business, and its results of operations.

Non-GAAP Financial Measures - This news release includes

adjusted earnings/(loss), which reflect earnings or losses

excluding significant non-operational items including impairment

charges, write-offs, decommissioning obligations from previously

sold assets, severance costs, gains on asset sales, unusual tax

items, effects of pension settlements and curtailments, foreign

currency effects and other special items. We believe it is useful

for investors to consider this measure in comparing the underlying

performance of our business across periods. The presentation of

this additional information is not meant to be considered in

isolation or as a substitute for net income (loss) as prepared in

accordance with U.S. GAAP. A reconciliation to net income (loss)

attributable to Chevron Corporation is shown in Attachment 4.

This news release also includes cash flow from operations

excluding working capital, free cash flow and free cash flow

excluding working capital. Cash flow from operations excluding

working capital is defined as net cash provided by operating

activities less net changes in operating working capital, and

represents cash generated by operating activities excluding the

timing impacts of working capital. Free cash flow is defined as net

cash provided by operating activities less capital expenditures and

generally represents the cash available to creditors and investors

after investing in the business. Free cash flow excluding working

capital is defined as net cash provided by operating activities

excluding working capital less capital expenditures and generally

represents the cash available to creditors and investors after

investing in the business excluding the timing impacts of working

capital. The company believes these measures are useful to monitor

the financial health of the company and its performance over time.

Reconciliations of cash flow from operations excluding working

capital, free cash flow and free cash flow excluding working

capital are shown in Attachment 3.

This news release also includes net debt ratio. Net debt ratio

is defined as total debt less cash and cash equivalents, time

deposits and marketable securities as a percentage of total debt

less cash and cash equivalents, time deposits and marketable

securities, plus Chevron Corporation stockholders’ equity, which

indicates the company’s leverage, net of its cash balances. The

company believes this measure is useful to monitor the strength of

the company’s balance sheet. A reconciliation of net debt ratio is

shown in Attachment 2.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR”

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT

OF 1995

This news release contains forward-looking statements relating

to Chevron’s operations and strategy that are based on management’s

current expectations, estimates, and projections about the

petroleum, chemicals, and other energy-related industries. Words or

phrases such as “anticipates,” “expects,” “intends,” “plans,”

“targets,” “advances,” “commits,” “drives,” “aims,” “forecasts,”

“projects,” “believes,” “approaches,” “seeks,” “schedules,”

“estimates,” “positions,” “pursues,” “progress,” “may,” “can,”

“could,” “should,” “will,” “budgets,” “outlook,” “trends,”

“guidance,” “focus,” “on track,” “goals,” “objectives,”

“strategies,” “opportunities,” “poised,” “potential,” “ambitions,”

“aspires” and similar expressions, and variations or negatives of

these words, are intended to identify such forward-looking

statements, but not all forward-looking statements include such

words. These statements are not guarantees of future performance

and are subject to numerous risks, uncertainties and other factors,

many of which are beyond the company’s control and are difficult to

predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in such

forward-looking statements. The reader should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this news release. Unless legally required, Chevron

undertakes no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Among the important factors that could cause actual results to

differ materially from those in the forward-looking statements are:

changing crude oil and natural gas prices and demand for the

company’s products, and production curtailments due to market

conditions; crude oil production quotas or other actions that might

be imposed by the Organization of Petroleum Exporting Countries and

other producing countries; technological advancements; changes to

government policies in the countries in which the company operates;

public health crises, such as pandemics and epidemics, and any

related government policies and actions; disruptions in the

company’s global supply chain, including supply chain constraints

and escalation of the cost of goods and services; changing

economic, regulatory and political environments in the various

countries in which the company operates; general domestic and

international economic, market and political conditions, including

the military conflict between Russia and Ukraine, the conflict in

the Middle East and the global response to these hostilities;

changing refining, marketing and chemicals margins; the company’s

ability to realize anticipated cost savings and efficiencies

associated with enterprise structural cost reduction initiatives;

actions of competitors or regulators; timing of exploration

expenses; timing of crude oil liftings; the competitiveness of

alternate-energy sources or product substitutes; development of

large carbon capture and offset markets; the results of operations

and financial condition of the company’s suppliers, vendors,

partners and equity affiliates; the inability or failure of the

company’s joint-venture partners to fund their share of operations

and development activities; the potential failure to achieve

expected net production from existing and future crude oil and

natural gas development projects; potential delays in the

development, construction or start-up of planned projects; the

potential disruption or interruption of the company’s operations

due to war, accidents, political events, civil unrest, severe

weather, cyber threats, terrorist acts, or other natural or human

causes beyond the company’s control; the potential liability for

remedial actions or assessments under existing or future

environmental regulations and litigation; significant operational,

investment or product changes undertaken or required by existing or

future environmental statutes and regulations, including

international agreements and national or regional legislation and

regulatory measures related to greenhouse gas emissions and climate

change; the potential liability resulting from pending or future

litigation; the risk that regulatory approvals and clearances

related to the Hess Corporation (Hess) transaction are not obtained

or are obtained subject to conditions that are not anticipated by

the company and Hess; potential delays in consummating the Hess

transaction, including as a result of the ongoing arbitration

proceedings regarding preemptive rights in the Stabroek Block joint

operating agreement; risks that such ongoing arbitration is not

satisfactorily resolved and the potential transaction fails to be

consummated; uncertainties as to whether the potential transaction,

if consummated, will achieve its anticipated economic benefits,

including as a result of risks associated with third party

contracts containing material consent, anti-assignment, transfer or

other provisions that may be related to the potential transaction

that are not waived or otherwise satisfactorily resolved; the

company’s ability to integrate Hess’ operations in a successful

manner and in the expected time period; the possibility that any of

the anticipated benefits and projected synergies of the potential

transaction will not be realized or will not be realized within the

expected time period; the company’s future acquisitions or

dispositions of assets or shares or the delay or failure of such

transactions to close based on required closing conditions; the

potential for gains and losses from asset dispositions or

impairments; government mandated sales, divestitures,

recapitalizations, taxes and tax audits, tariffs, sanctions,

changes in fiscal terms or restrictions on scope of company

operations; foreign currency movements compared with the U.S.

dollar; higher inflation and related impacts; material reductions

in corporate liquidity and access to debt markets; changes to the

company’s capital allocation strategies; the effects of changed

accounting rules under generally accepted accounting principles

promulgated by rule-setting bodies; the company’s ability to

identify and mitigate the risks and hazards inherent in operating

in the global energy industry; and the factors set forth under the

heading “Risk Factors” on pages 20 through 26 of the company’s 2023

Annual Report on Form 10-K and in subsequent filings with the U.S.

Securities and Exchange Commission. Other unpredictable or unknown

factors not discussed in this news release could also have material

adverse effects on forward-looking statements.

Attachment 1

CHEVRON CORPORATION -

FINANCIAL REVIEW

(Millions of Dollars, Except

Per-Share Amounts)

(unaudited)

CONSOLIDATED

STATEMENT OF INCOME

Three Months Ended

December 31,

Year Ended December

31,

REVENUES AND OTHER INCOME

2024

2023

2024

2023

Sales and other operating revenues

$

48,334

$

48,933

$

193,414

$

196,913

Income (loss) from equity affiliates

688

990

4,596

5,131

Other income (loss)

3,204

(2,743

)

4,782

(1,095

)

Total Revenues and Other Income

52,226

47,180

202,792

200,949

COSTS AND OTHER DEDUCTIONS

Purchased crude oil and products

30,148

28,477

119,206

119,196

Operating expenses (1)

9,257

7,523

32,493

29,240

Exploration expenses

449

254

995

914

Depreciation, depletion and

amortization

4,973

6,254

17,282

17,326

Taxes other than on income

1,141

1,062

4,716

4,220

Interest and debt expense

199

120

594

469

Total Costs and Other

Deductions

46,167

43,690

175,286

171,365

Income (Loss) Before Income Tax

Expense

6,059

3,490

27,506

29,584

Income tax expense (benefit)

2,800

1,247

9,757

8,173

Net Income (Loss)

3,259

2,243

17,749

21,411

Less: Net income (loss) attributable to

noncontrolling interests

20

(16

)

88

42

NET INCOME (LOSS) ATTRIBUTABLE TO

CHEVRON CORPORATION

$

3,239

$

2,259

$

17,661

$

21,369

(1) Includes operating expense, selling,

general and administrative expense, and other components of net

periodic benefit costs.

PER SHARE OF

COMMON STOCK

Net Income (Loss) Attributable to

Chevron Corporation

- Basic

$

1.85

$

1.23

$

9.76

$

11.41

- Diluted

$

1.84

$

1.22

$

9.72

$

11.36

Weighted Average Number of Shares

Outstanding (000's)

- Basic

1,770,310

1,861,474

1,809,583

1,872,737

- Diluted

1,777,366

1,868,101

1,816,602

1,880,307

Note: Shares outstanding (excluding 14

million associated with Chevron’s Benefit Plan Trust) were 1,755

million and 1,851 million at December 31, 2024, and December 31,

2023, respectively.

EARNINGS BY MAJOR

OPERATING AREA

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Upstream

United States

$

1,420

$

(1,347

)

$

7,602

$

4,148

International

2,884

2,933

11,000

13,290

Total Upstream

4,304

1,586

18,602

17,438

Downstream

United States

(348

)

470

531

3,904

International

100

677

1,196

2,233

Total Downstream

(248

)

1,147

1,727

6,137

All Other

(817

)

(474

)

(2,668

)

(2,206

)

NET INCOME (LOSS) ATTRIBUTABLE TO

CHEVRON CORPORATION

$

3,239

$

2,259

$

17,661

$

21,369

Attachment 2

CHEVRON CORPORATION -

FINANCIAL REVIEW

(Millions of Dollars)

(unaudited)

SELECTED BALANCE

SHEET ACCOUNT DATA (Preliminary)

December 31,

2024

December 31,

2023

Cash and cash equivalents

$

6,781

$

8,178

Time Deposits

$

4

$

—

Marketable securities

$

—

$

45

Total assets

$

256,938

$

261,632

Total debt

$

24,541

$

20,836

Total Chevron Corporation stockholders’

equity

$

152,318

$

160,957

Noncontrolling interests

$

839

$

972

SELECTED

FINANCIAL RATIOS

Total debt plus total stockholders’

equity

$

176,859

$

181,793

Debt ratio (Total debt / Total debt

plus stockholders’ equity)

13.9

%

11.5

%

Adjusted debt (Total debt less cash and

cash equivalents, time deposits and marketable securities)

$

17,756

$

12,613

Adjusted debt plus total stockholders’

equity

$

170,074

$

173,570

Net debt ratio (Adjusted debt /

Adjusted debt plus total stockholders’ equity)

10.4

%

7.3

%

RETURN ON CAPITAL

EMPLOYED (ROCE)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Total reported earnings

$

3,239

$

2,259

$

17,661

$

21,369

Noncontrolling interest

20

(16

)

88

42

Interest expense (A/T)

181

111

539

432

ROCE earnings

3,440

2,354

18,288

21,843

Annualized ROCE earnings

13,760

9,416

18,288

21,843

Average capital employed (1)

180,285

184,786

180,232

183,173

ROCE

7.6

%

5.1

%

10.1

%

11.9

%

(1) Capital employed is the sum of Chevron

Corporation stockholders’ equity, total debt and noncontrolling

interest. Average capital employed is computed by averaging the sum

of capital employed at the beginning and the end of the period.

Three Months Ended

December 31,

Year Ended December

31,

CAPEX BY

SEGMENT

2024

2023

2024

2023

United States

Upstream

$

2,355

$

2,608

$

9,481

$

9,842

Downstream

327

418

1,443

1,536

Other

132

133

406

351

Total United States

2,814

3,159

11,330

11,729

International

Upstream

1,388

1,094

4,850

3,836

Downstream

127

93

251

237

Other

9

15

17

27

Total International

1,524

1,202

5,118

4,100

CAPEX

$

4,338

$

4,361

$

16,448

$

15,829

AFFILIATE CAPEX

(not included above)

Upstream

$

341

$

517

$

1,451

$

2,310

Downstream

294

333

998

1,224

AFFILIATE CAPEX

$

635

$

850

$

2,449

$

3,534

Attachment 3

CHEVRON CORPORATION -

FINANCIAL REVIEW

(Billions of Dollars)

(unaudited)

SUMMARIZED

STATEMENT OF CASH FLOWS (Preliminary) (1)

Three Months Ended

December 31,

Year Ended December

31,

OPERATING ACTIVITIES

2024

2023

2024

2023

Net Income (Loss)

$

3.3

$

2.2

$

17.7

$

21.4

Adjustments

Depreciation, depletion and

amortization

5.0

6.3

17.3

17.3

Distributions more (less) than income from

equity affiliates

0.1

1.4

(0.4

)

(0.9

)

Loss (gain) on asset retirements and

sales

(1.4

)

—

(1.7

)

(0.1

)

Net foreign currency effects

(0.7

)

0.7

(0.6

)

0.6

Deferred income tax provision

(0.3

)

(1.0

)

1.2

0.3

Net decrease (increase) in operating

working capital

3.4

1.0

1.2

(3.2

)

Other operating activity

(0.6

)

1.9

(3.3

)

0.2

Net Cash Provided by Operating

Activities

$

8.7

$

12.4

$

31.5

$

35.6

INVESTING ACTIVITIES

Acquisition of businesses, net of cash

acquired

—

—

—

0.1

Capital expenditures (Capex)

(4.3

)

(4.4

)

(16.4

)

(15.8

)

Proceeds and deposits related to asset

sales and returns of investment

7.1

0.3

7.7

0.7

Other investing activity

(0.1

)

—

(0.2

)

(0.1

)

Net Cash Provided by (Used for)

Investing Activities

$

2.7

$

(4.1

)

$

(8.9

)

$

(15.2

)

FINANCING ACTIVITIES

Net change in debt

(1.4

)

—

3.6

(4.1

)

Cash dividends — common stock

(2.9

)

(2.8

)

(11.8

)

(11.3

)

Shares issued for share-based

compensation

0.1

—

0.3

0.3

Shares repurchased (2)

(4.6

)

(3.4

)

(15.4

)

(14.9

)

Distributions to noncontrolling

interests

—

—

(0.2

)

—

Net Cash Provided by (Used for)

Financing Activities

$

(8.8

)

$

(6.2

)

$

(23.5

)

$

(30.1

)

EFFECT OF EXCHANGE RATE CHANGES ON

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

(0.1

)

0.1

(0.1

)

(0.1

)

NET CHANGE IN CASH, CASH EQUIVALENTS

AND RESTRICTED CASH

$

2.5

$

2.3

$

(1.0

)

$

(9.8

)

RECONCILIATION OF

NON-GAAP MEASURES (1)

Net Cash Provided by Operating

Activities

$

8.7

$

12.4

$

31.5

$

35.6

Less: Net decrease (increase) in operating

working capital

3.4

1.0

1.2

(3.2

)

Cash Flow from Operations Excluding

Working Capital

$

5.3

$

11.4

$

30.3

$

38.8

Net Cash Provided by Operating

Activities

$

8.7

$

12.4

$

31.5

$

35.6

Less: Capital expenditures

4.3

4.4

16.4

15.8

Free Cash Flow

$

4.4

$

8.1

$

15.0

$

19.8

Less: Net decrease (increase) in operating

working capital

3.4

1.0

1.2

(3.2

)

Free Cash Flow Excluding Working

Capital

$

1.0

$

7.1

$

13.8

$

23.0

(1) Totals may not match sum of parts due

to presentation in billions.

(2) Three months and year ended December

31, 2024 includes $145 million of excise tax payments for 2023

shares repurchases.

Attachment 4

CHEVRON CORPORATION -

FINANCIAL REVIEW

(Millions of Dollars)

(unaudited)

RECONCILIATION OF

NON-GAAP MEASURES

Three Months Ended

December 31, 2024

Three Months Ended

December 31, 2023

Year Ended December 31,

2024

Year Ended December 31,

2023

REPORTED

EARNINGS

Pre- Tax

Income Tax

After- Tax

Pre- Tax

Income Tax

After- Tax

Pre- Tax

Income Tax

After- Tax

Pre- Tax

Income Tax

After- Tax

U.S. Upstream

$

1,420

$

(1,347

)

$

7,602

$

4,148

Int'l Upstream

2,884

2,933

11,000

13,290

U.S. Downstream

(348

)

470

531

3,904

Int'l Downstream

100

677

1,196

2,233

All Other

(817

)

(474

)

(2,668

)

(2,206

)

Net Income (Loss) Attributable to

Chevron

$

3,239

$

2,259

$

17,661

$

21,369

SPECIAL

ITEMS

U.S. Upstream

Write-offs & impairments

$

—

$

—

$

—

$

(2,324

)

$

559

$

(1,765

)

$

—

$

—

$

—

$

(2,324

)

$

559

$

(1,765

)

Decommissioning obligations

—

—

—

(2,561

)

611

(1,950

)

—

—

—

(2,561

)

611

(1,950

)

Severance

(240

)

57

(183

)

—

—

—

(240

)

57

(183

)

—

—

—

Int'l Upstream

Write-offs & impairments

(164

)

39

(125

)

—

—

—

(164

)

39

(125

)

—

—

—

Tax items

—

—

—

—

—

—

—

—

—

—

655

655

Severance

(197

)

78

(119

)

—

—

—

(197

)

78

(119

)

—

—

—

U.S. Downstream

Write-offs & impairments

(118

)

28

(90

)

—

—

—

(118

)

28

(90

)

—

—

—

Severance

(247

)

59

(188

)

—

—

—

(247

)

59

(188

)

—

—

—

Int'l Downstream

Write-offs & impairments

(243

)

58

(185

)

—

—

—

(243

)

58

(185

)

—

—

—

Severance

(22

)

5

(17

)

—

—

—

(22

)

5

(17

)

—

—

—

All Other

Pension settlement costs

—

—

—

—

—

—

—

—

—

(53

)

13

(40

)

Severance

(274

)

66

(208

)

—

—

—

(274

)

66

(208

)

—

—

—

Total Special Items

$

(1,505

)

$

390

$

(1,115

)

$

(4,885

)

$

1,170

$

(3,715

)

$

(1,505

)

$

390

$

(1,115

)

$

(4,938

)

$

1,838

$

(3,100

)

FOREIGN CURRENCY

EFFECTS

Int'l Upstream

$

597

$

(162

)

$

395

$

376

Int'l Downstream

126

(58

)

126

(12

)

All Other

(1

)

(259

)

(1

)

(588

)

Total Foreign Currency Effects

$

722

$

(479

)

$

520

$

(224

)

ADJUSTED

EARNINGS/(LOSS) (1)

U.S. Upstream

$

1,603

$

2,368

$

7,785

$

7,863

Int'l Upstream

2,531

3,095

10,849

12,259

U.S. Downstream

(70

)

470

809

3,904

Int'l Downstream

176

735

1,272

2,245

All Other

(608

)

(215

)

(2,459

)

(1,578

)

Total Adjusted Earnings/(Loss)

$

3,632

$

6,453

$

18,256

$

24,693

Total Adjusted Earnings/(Loss) per

share

$

2.06

$

3.45

$

10.05

$

13.13

(1) Adjusted Earnings/(Loss) is defined as

Net Income (loss) attributable to Chevron Corporation excluding

special items and foreign currency effects.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131236681/en/

Randy Stuart -- +1 713-283-8609

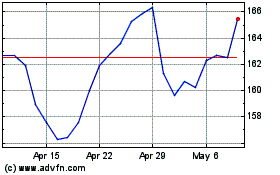

Chevron (NYSE:CVX)

Historical Stock Chart

From Dec 2024 to Jan 2025

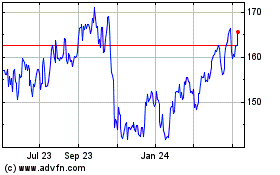

Chevron (NYSE:CVX)

Historical Stock Chart

From Jan 2024 to Jan 2025