Easterly Government Properties Amends 2016 Senior Unsecured Term Loan Agreement

January 14 2025 - 7:00AM

Business Wire

- Increased Term Loan borrowing capacity grows by $100

million

- Extended maturity by up to five years and fixed future cost of

borrowing

Easterly Government Properties, Inc. (NYSE: DEA) (the “Company”

or “Easterly”), a fully integrated real estate investment trust

focused primarily on the acquisition, development and management of

Class A commercial properties leased to the U.S. Government and its

adjacent partners, today announced it has amended its $100 million

senior unsecured term loan agreement, executed in 2016 (the

“Amended 2016 Term Loan”).

Easterly extended the maturity date of the Amended 2016 Term

Loan from January 30, 2025 to January 28, 2028. Further, the

Company may exercise at its discretion two one-year extension

options, subject to certain conditions, thus extending the maturity

date as late as January 28, 2030. Easterly further secured

increased borrowing capacity on the accordion feature from $150

million to $250 million.

“We are very pleased to have amended our 2016 Term Loan under

such favorable terms,” said Allison Marino, Easterly’s Chief

Financial and Chief Accounting Officer. “Thanks to our strong

banking relationships and superior credit profile, we have extended

the duration of our liabilities while maintaining a strong balance

sheet and long-term debt capacity. This enables us to remain

focused on executing a disciplined investment strategy and

delivering growth to shareholders.”

In connection with the Amended 2016 Term Loan, the Company also

entered into an interest rate swap to effectively fix SOFR at

3.8569% annually. By executing this swap, the Company provides

greater certainty over its interest rate exposure. Borrowings under

the Amended 2016 Term Loan will continue to bear interest at a rate

of SOFR, a credit spread adjustment of 0.10%, plus a spread of

1.20% to 1.70%, depending on the Company's leverage ratio. Given

the Company's current leverage ratio, the Amended 2016 Term Loan’s

initial spread to SOFR is set at 1.35%.

PNC Capital Markets LLC, U.S. Bank National Association, and

Truist Securities, Inc. served as joint lead arrangers and joint

bookrunners. PNC Bank, National Association served as the

administrative agent.

About Easterly Government Properties, Inc.

Easterly Government Properties, Inc. (NYSE:DEA) is based in

Washington, D.C. and focuses primarily on the acquisition,

development and management of Class A commercial properties that

are leased to the U.S. Government. With a long-stated goal of being

the partner of choice to the United States Government, Easterly’s

experienced management team brings specialized insight into the

strategy and needs of mission-critical U.S. Government agencies for

properties leased to such agencies either directly or through the

U.S. General Services Administration (GSA). For further information

on the company and its properties, please visit

www.easterlyreit.com.

This press release contains forward-looking statements within

the meaning of federal securities laws and regulations. These

forward-looking statements are identified by their use of terms and

phrases such as “believe,” “expect,” “intend,” “project,”

“anticipate,” “position,” and other similar terms and phrases,

including references to assumptions and forecasts of future

results. Forward-looking statements are not guarantees of future

performance and involve known and unknown risks, uncertainties and

other factors which may cause the actual results to differ

materially from those anticipated at the time the forward-looking

statements are made. These risks include, but are not limited to

those risks and uncertainties associated with our business

described from time to time in our filings with the Securities and

Exchange Commission, including our Annual Report on Form 10-K filed

on February 27, 2024. Although we believe the expectations

reflected in such forward-looking statements are based upon

reasonable assumptions, we can give no assurance that the

expectations will be attained or that any deviation will not be

material. All information in this release is as of the date of this

release, and we undertake no obligation to update any

forward-looking statement to conform the statement to actual

results or changes in our expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114250102/en/

Easterly Government Properties, Inc. Lindsay S. Winterhalter

Senior Vice President, Investor Relations & Operations

202-596-3947 ir@easterlyreit.com

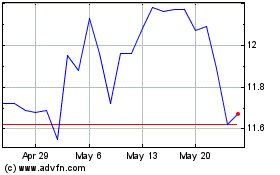

Easterly Government Prop... (NYSE:DEA)

Historical Stock Chart

From Dec 2024 to Jan 2025

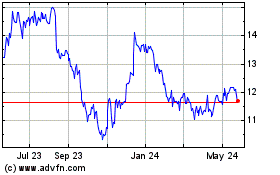

Easterly Government Prop... (NYSE:DEA)

Historical Stock Chart

From Jan 2024 to Jan 2025