False000031361600003136162025-01-132025-01-130000313616us-gaap:CommonStockMember2025-01-132025-01-130000313616dhr:A0.2SeniorNotesDue2026Member2025-01-132025-01-130000313616dhr:A2.1SeniorNotesDue2026Member2025-01-132025-01-130000313616dhr:A1.2SeniorNotesDue2027Member2025-01-132025-01-130000313616dhr:A0.45SeniorNotesDue2028Member2025-01-132025-01-130000313616dhr:A2.5SeniorNotesDue2030Member2025-01-132025-01-130000313616dhr:A0.75SeniorNotesDue2031Member2025-01-132025-01-130000313616dhr:A1.35SeniorNotesDue2039Member2025-01-132025-01-130000313616dhr:A1.8SeniorNotesDue2049Member2025-01-132025-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 8-K

__________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 13, 2025

__________________

| | | | | | | | |

| DANAHER CORPORATION |

| (Exact Name of Registrant as Specified in Its Charter) | |

__________________

| | | | | | | | | | | |

| Delaware | 001-08089 | 59-1995548 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 2200 Pennsylvania Avenue, N.W., | | 20037-1701 |

| Suite 800W | |

| Washington, | DC | |

| (Address of Principal Executive Offices) | | (Zip Code) |

202-828-0850

(Registrant’s Telephone Number, Including Area Code)

| | | | | |

Not applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

__________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value | DHR | New York Stock Exchange |

| | |

| 0.200% Senior Notes due 2026 | DHR/26 | New York Stock Exchange |

| 2.100% Senior Notes due 2026 | DHR 26 | New York Stock Exchange |

| 1.200% Senior Notes due 2027 | DHR/27 | New York Stock Exchange |

| 0.450% Senior Notes due 2028 | DHR/28 | New York Stock Exchange |

| 2.500% Senior Notes due 2030 | DHR 30 | New York Stock Exchange |

| 0.750% Senior Notes due 2031 | DHR/31 | New York Stock Exchange |

| 1.350% Senior Notes due 2039 | DHR/39 | New York Stock Exchange |

| 1.800% Senior Notes due 2049 | DHR/49 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On January 13, 2025, in advance of a public webcast presentation at the J.P. Morgan Healthcare Conference on January 14, 2025 Danaher Corporation issued a press release regarding the Company’s estimated financial performance for the fourth quarter of 2024 and furnished pursuant to Item 2.02 of Form 8-K such press release as well as the presentation slides attached hereto, each of which is incorporated by reference herein. The presentation slides attached hereto contain certain information regarding Danaher’s estimated financial performance for 2024.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | | | | |

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

| | |

| (c) | Exhibits: |

| | |

| Exhibit No. | | Description |

| |

| 99.1 | | | |

| 99.1PRE | | |

| 104 | | | Cover Page Interactive Data File (formatted as inline XBRL with applicable taxonomy extension information contained in Exhibits 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | DANAHER CORPORATION |

| | | |

| Date: | January 13, 2025 | By: | /s/ Matthew R. McGrew |

| | | Matthew R. McGrew |

| | | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Innovation at the speed of life

Danaher CEO to Comment on Financial Performance

WASHINGTON, D.C., January 13, 2025 -- Danaher Corporation (NYSE: DHR) (the "Company") announced that its President and Chief Executive Officer, Rainer M. Blair, will comment tomorrow on the Company’s fourth quarter 2024 performance in a presentation at the J.P. Morgan Healthcare Conference at 11:15 a.m. PT.

•For the fourth quarter 2024, estimated revenues are anticipated to increase in the low-single digit percent range year-over-year.

•Estimated non-GAAP core revenue for the fourth quarter of 2024 is expected to be essentially flat year-over-year, which would be above the Company’s previously announced guidance of a low-single digit percent decline.

As previously announced, Danaher will hold its quarterly earnings conference call for the fourth quarter and full year 2024 on Wednesday, January 29, 2025 at 8:00 a.m. ET.

ABOUT DANAHER

Danaher is a leading global life sciences and diagnostics innovator, committed to accelerating the power of science and technology to improve human health. Our businesses partner closely with customers to solve many of the most important health challenges impacting patients around the world. Danaher's advanced science and technology - and proven ability to innovate - help enable faster, more accurate diagnoses and help reduce the time and cost needed to sustainably discover, develop and deliver life-changing therapies. Focused on scientific excellence, innovation and continuous improvement, our approximately 63,000 associates worldwide help ensure that Danaher is improving quality of life for billions of people today, while setting the foundation for a healthier, more sustainable tomorrow. Explore more at www.danaher.com.

NON-GAAP MEASURE AND SUPPLEMENTAL MATERIAL

This release contains the non-GAAP financial measure of core revenue. A calculation of this measure, an explanation of what the measure represents and the reasons why we believe this measure provides useful information to investors, a reconciliation of the measure to the most directly comparable GAAP measure and other information relating to the non-GAAP measure are included in the supplemental reconciliation schedule attached.

In addition, this earnings release (including the supplemental reconciliation schedule) and a note containing details of Danaher’s estimated financial performance have been posted to the “Investors” section of Danaher’s website (www.danaher.com).

FORWARD-LOOKING STATEMENTS

Statements in this release that are not strictly historical, including the statements regarding the estimated financial results for the fourth quarter of 2024 and any other statements regarding events or developments that we believe or anticipate will or may occur in the future are "forward-looking" statements within the meaning of the federal securities laws. There are a number of important factors that could cause actual results, developments and business decisions to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include, among other things: unanticipated, further declines in demand for our COVID-19 related products, the impact of global health crises, the impact of our debt obligations on our operations and liquidity, deterioration of or instability in the global economy, the markets we serve and the financial markets, uncertainties with respect to the development, deployment, and use of artificial intelligence in our business and products, uncertainties relating to national laws or policies, including laws or policies to protect or promote domestic interests and/or address foreign competition, contractions or growth rates and cyclicality of markets we serve, competition, our ability to develop and successfully market new products and technologies and expand into new markets, the potential for improper conduct by our employees, agents or business partners, our compliance with applicable laws and regulations (including rules relating to off-label marketing and other regulations relating to medical devices and the health care industry), the results of our clinical trials and perceptions thereof, our ability to effectively address cost reductions and other changes in the health care industry, our ability to successfully identify and consummate appropriate acquisitions and strategic investments, our ability to integrate the businesses we acquire and achieve the anticipated growth, synergies and other benefits of such acquisitions, contingent liabilities and other risks relating to acquisitions, investments, strategic relationships and divestitures (including tax-related and other contingent liabilities relating to past and future IPOs, split-offs or spin-offs), security breaches or other disruptions of our information technology systems or violations of data privacy laws, the impact

of our restructuring activities on our ability to grow, risks relating to potential impairment of goodwill and other intangible assets, currency exchange rates, tax audits and changes in our tax rate and income tax liabilities, changes in tax laws applicable to multinational companies, litigation and other contingent liabilities including intellectual property and environmental, health and safety matters, the rights of the United States government with respect to our production capacity in times of national emergency or with respect to intellectual property/production capacity developed using government funding, risks relating to product, service or software defects, product liability and recalls, risks relating to our manufacturing operations and fluctuations in the cost and availability of the supplies we use (including commodities) and labor we need for our operations, our relationships with and the performance of our channel partners, uncertainties relating to collaboration arrangements with third-parties, the impact of deregulation on demand for our products and services, the impact of climate change, legal or regulatory measures to address climate change and our ability to address stakeholder expectations relating to climate change, labor matters and our ability to recruit, retain and motivate talented employees representing diverse backgrounds, experiences and skill sets, non-U.S. economic, political, legal, compliance, social and business factors (including the impact of military conflicts), disruptions and other impacts relating to man-made and natural disasters, inflation and the impact of our By-law exclusive forum provisions. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in our SEC filings, including our 2023 Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the third quarter of 2024. These forward-looking statements speak only as of the date of this release and except to the extent required by applicable law, the Company does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise.

CONTACT

John T. Bedford, Vice President, Investor Relations, investor.relations@danaher.com

Danaher Corporation, 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037, Telephone: (202) 828-0850, Fax: (202) 828-0860

Estimated Sales Growth and Core Sales Growth

| | | | | | | |

| % Estimated Change Three-Month Period Ended December 31, 2024 vs. Comparable 2023 Period | | |

| Total sales growth (GAAP) | +Low-single digit | | |

| Impact of: | | | |

| Acquisitions/divestitures | -Low-single digit | | |

| Currency exchange rates | +Essentially flat | | |

| Core sales growth (non-GAAP) | +Essentially flat | | |

| | | |

| | | |

Statement Regarding Non-GAAP Measures

Core sales growth should be considered in addition to, and not as a replacement for or superior to, sales growth, and may not be comparable to similarly titled measures reported by other companies. Management believes that this measure provides useful information to investors by offering additional ways of viewing Danaher Corporation’s (“Danaher” or the “Company”) results that, when reconciled to sales growth, help our investors identify underlying growth trends in our business and compare our sales performance with prior and future periods and to our peers.

Management uses core sales growth to measure the Company’s operating and financial performance, and uses core sales growth as one of the performance measures in the Company’s executive short-term cash incentive program.

With respect to this non-GAAP measure, we exclude (1) the impact of currency translation because it is not under management’s control, is subject to volatility and can obscure underlying business trends, and (2) the effect of acquisitions and divested product lines because the timing, size, number and nature of such transactions can vary dramatically from period-to-period and between us and our peers, which we believe may obscure underlying business trends and make comparisons of long-term performance difficult.

2 Forward Looking Statements Statements in this presentation that are not strictly historical, including any statements regarding Danaher’s estimated or anticipated financial performance and any other statements regarding events or developments that we believe or anticipate will or may occur in the future are "forward looking" statements within the meaning of the federal securities laws. There are a number of important factors that could cause actual results, developments and business decisions to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include, among other things: unanticipated, further declines in demand for our COVID-19 related products, the impact of global health crises, the impact of our debt obligations on our operations and liquidity, deterioration of or instability in the global economy, the markets we serve and the financial markets, uncertainties with respect to the development, deployment, and use of artificial intelligence in our business and products, uncertainties relating to national laws or policies, including laws or policies to protect or promote domestic interests and/or address foreign competition, contractions or growth rates and cyclicality of markets we serve, competition, our ability to develop and successfully market new products and technologies and expand into new markets, the potential for improper conduct by our employees, agents or business partners, our compliance with applicable laws and regulations (including rules relating to off-label marketing and other regulations relating to medical devices and the health care industry), the results of our clinical trials and perceptions thereof, our ability to effectively address cost reductions and other changes in the health care industry, our ability to successfully identify and consummate appropriate acquisitions and strategic investments, our ability to integrate the businesses we acquire and achieve the anticipated growth, synergies and other benefits of such acquisitions, contingent liabilities and other risks relating to acquisitions, investments, strategic relationships and divestitures (including tax- related and other contingent liabilities relating to past and future IPOs, split-offs or spin-offs), security breaches or other disruptions of our information technology systems or violations of data privacy laws, the impact of our restructuring activities on our ability to grow, risks relating to potential impairment of goodwill and other intangible assets, currency exchange rates, tax audits and changes in our tax rate and income tax liabilities, changes in tax laws applicable to multinational companies, litigation and other contingent liabilities including intellectual property and environmental, health and safety matters, the rights of the United States government with respect to our production capacity in times of national emergency or with respect to intellectual property/production capacity developed using government funding, risks relating to product, service or software defects, product liability and recalls, risks relating to our manufacturing operations and fluctuations in the cost and availability of the supplies we use (including commodities) and labor we need for our operations, our relationships with and the performance of our channel partners, uncertainties relating to collaboration arrangements with third-parties, the impact of deregulation on demand for our products and services, the impact of climate change, legal or regulatory measures to address climate change and our ability to address stakeholder expectations relating to climate change, labor matters and our ability to recruit, retain and motivate talented employees representing diverse backgrounds, experiences and skill sets, non-U.S. economic, political, legal, compliance, social and business factors (including the impact of military conflicts), disruptions and other impacts relating to man-made and natural disasters, inflation and the impact of our By-law exclusive forum provisions. Additional information regarding the factors that may cause actual results to differ materially from these forward looking statements is available in our SEC filings, including our 2023 Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the third quarter of 2024. These forward-looking statements speak only as of the date of this presentation and except to the extent required by applicable law, the Company does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise. With respect to the non-GAAP financial measures referenced in the following presentation, calculations of these measures, explanations of what these measures represent, the reasons why we believe these measures provide useful information to investors, a reconciliation of these measures to the most directly comparable GAAP measures, as applicable, and other information relating to these non- GAAP measures can be found in this presentation or in the “Investors” section of Danaher’s web site, www.danaher.com. All references in this presentation (1) to financial metrics relate only to the continuing operations of Danaher’s business, unless otherwise noted; (2) to “growth” or other period-to-period changes refer to year-over-year comparisons unless otherwise indicated; and (3) to operating profit below the segment level exclude amortization. We may also describe certain products and devices which have applications submitted and pending for certain regulatory approvals.

3

4 Current Update Great execution drove a strong finish to 2024 Q4 2024 results consistent with our expectations Q4 core revenue expected to be essentially flat, exceeding our expectations • Bioprocessing performance in line with expectations • Diagnostics slightly above expectations, led by higher respiratory at Cepheid • Life Sciences modestly better-than-anticipated, driven by instrumentation Expect Q4 adjusted operating profit margin consistent with prior guidance • Better-than-expected operational performance offset by FX headwinds

5 Danaher Today All financial metrics reflect FY2024E results 2024E Total Revenue ~$24B DiagnosticsLife Sciences Biotechnology Biotechnology ~$6.8B Life Sciences ~$7.3B Diagnostics ~$9.8B Differentiated positioning, attractive end markets, improved financial profile

6 Dx EAS D ental LS Portfolio Transformation Into a Stronger, Better Danaher Financial profile has improved significantly vs. pre-pandemic 2018 Dx BT LS Total Revenue ~$24B 2024EPortfolio Exits Total Revenue ~$20B ~$2.8B Dental revenue at 2019 IPO ~$4.8B EAS revenue at 2023 spin MSD ~56% ~21% ~$4B Acquisitions Market Expansion HSD ~60% ~29% >$6B Long-Term Core Revenue Growth (anticipated) Gross Profit Margin Adjusted Operating Profit Margin Operating Cash Flow Annual Revenue Divested ~($7.6B) Cytiva 2024E Revenue ~$5B Incremental Annual Respiratory Revenue >$1B 1 Aldevron & Abcam 2024E Revenue ~$1B 1. Reflects reported revenue for 2018 prior to the presentation of the Dental and Environmental & Applied Solutions businesses as discontinued operations. 2. Reflects reported revenue for the last full year prior to separation. 3. Reflects 2023 actual results Long-Term Core Revenue Growth (anticipated) Gross Profit Margin Adjusted Operating Profit Margin Operating Cash Flow 2 3 3 3

7 Enhanced with innovation & DBS to accelerate growth & earnings Leading positions in attractive, fast-growing end markets • Long-term, strong secular growth drivers • Regulatory requirements High-Quality Businesses in Attractive End Markets Pie charts are a % of 2024E total revenue Strategic End-Market Exposure Pharma & BioPharma Molecular Dx Clinical Dx Rsrch./ Acad. Applied United by a common business model • Steady consumables stream off extensive installed base • High value, ‘mission-critical’ applications Razor/Razor-blade Spec’d in Service ~80% Recurring Revenue

9 Cell expansion & production Clarification Capture Viral inactivation Intermediate Polishing Viral filtration Formulation & sterile filtration Bulk fill Drug product fill Leading Bioprocessing Franchise Cell Culture & SUT Chromatography Filtration Drug Product Cytiva well-positioned for HSD long-term core revenue growth 9 2024E Bioprocessing Revenue~$6B >90% Global mAb production volume supported by Cytiva % of revenue from monoclonal antibodies (mAbs)>75%

10 Well-Positioned in Life Sciences Pie chart percentages are % of 2024E revenues Expect HSD long-term core revenue growth with opportunity for margin expansion Research & Academic Pharma & Biopharma Applied Clinical Genomics2024E Revenue ~$7.3B • Differentiated positions in genomics, proteomics & analytical instrumentation Strategic End-Market Exposure • >60% recurring revenue • Long-term margin expansion opportunities Attractive Business Models • Accelerating proteomic & genomic research • Helping reduce drug development timelines Breakthrough Innovation

17

v3.24.4

Document And Entity Information Document And Entity Information

|

Jan. 13, 2025 |

| Cover [Abstract] |

|

| Document type |

8-K

|

| Document period end date |

Jan. 13, 2025

|

| Entity registrant name |

DANAHER CORPORATION

|

| Entity incorporation, state |

DE

|

| Entity file number |

001-08089

|

| Entity tax identification number |

59-1995548

|

| Entity address, address line one |

2200 Pennsylvania Avenue, N.W.,

|

| Entity address, address line two |

Suite 800W

|

| Entity address, city |

Washington,

|

| Entity address, state |

DC

|

| Entity address, postal zip code |

20037-1701

|

| City area code |

202

|

| Local phone number |

828-0850

|

| Written communications |

false

|

| Soliciting material |

false

|

| Pre-commencement tender offer |

false

|

| Pre-commencement issuer tender offer |

false

|

| Entity emerging growth company |

false

|

| Entity Listings [Line Items] |

|

| Amendment flag |

false

|

| Entity central index key |

0000313616

|

| Common stock, $0.01 par value |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

Common stock, $0.01 par value

|

| Trading symbol |

DHR

|

| Security exchange name |

NYSE

|

| 0.200% Senior Notes due 2026 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

0.200% Senior Notes due 2026

|

| Trading symbol |

DHR/26

|

| Security exchange name |

NYSE

|

| 2.100% Senior Notes due 2026 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

2.100% Senior Notes due 2026

|

| Trading symbol |

DHR 26

|

| Security exchange name |

NYSE

|

| 1.200% Senior Notes due 2027 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

1.200% Senior Notes due 2027

|

| Trading symbol |

DHR/27

|

| Security exchange name |

NYSE

|

| 0.450% Senior Notes due 2028 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

0.450% Senior Notes due 2028

|

| Trading symbol |

DHR/28

|

| Security exchange name |

NYSE

|

| 2.500% Senior Notes due 2030 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

2.500% Senior Notes due 2030

|

| Trading symbol |

DHR 30

|

| Security exchange name |

NYSE

|

| 0.750% Senior Notes due 2031 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

0.750% Senior Notes due 2031

|

| Trading symbol |

DHR/31

|

| Security exchange name |

NYSE

|

| 1.350% Senior Notes due 2039 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

1.350% Senior Notes due 2039

|

| Trading symbol |

DHR/39

|

| Security exchange name |

NYSE

|

| 1.800% Senior Notes due 2049 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) security |

1.800% Senior Notes due 2049

|

| Trading symbol |

DHR/49

|

| Security exchange name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dhr_A0.2SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dhr_A2.1SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dhr_A1.2SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dhr_A0.45SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dhr_A2.5SeniorNotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dhr_A0.75SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dhr_A1.35SeniorNotesDue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dhr_A1.8SeniorNotesDue2049Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

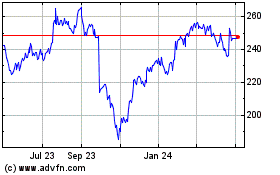

Danaher (NYSE:DHR)

Historical Stock Chart

From Jan 2025 to Feb 2025

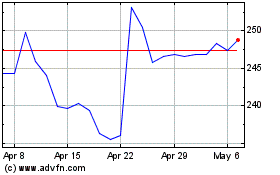

Danaher (NYSE:DHR)

Historical Stock Chart

From Feb 2024 to Feb 2025