Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

February 14 2024 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

The Walt Disney Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

The Walt Disney Company will begin distribution of the following brochure to shareholders:

The Walt Disney Company 2024 Disney Shareholder

FOR MORE INFORMATION, VISIT VOTEDISNEY.COM YOUR VOTE MATTERS! Join us to elect Disney’s Board of Directors to build on our legacy, accelerate growth and deliver long-term shareholder value Disney’s board

includes a range of leadership experience that closely aligns with the key drivers of our business, including media and entertainment, direct-toconsumer expertise, strategic transformation, technology and innovation, and 360-degree brand

activation. We recommend discarding any blue proxy card from the Trian Group or green proxy card from Blackwells. COMPANY NOMINEES Recommended by your board Mary T. Barra Safra A. Catz Amy L. Chang D. Jeremy Darroch Carolyn N. Everson Michael

B.G. Froman James P. Gorman Robert A . Iger Maria Elena Lagomasino Calvin R. McDonald Mark G. Parker Derica W. Rice FOR Withhold WHITE CARD TRIAN GROUP NOMINEES Opposed by the company BLACKWELLS NOMINEES Opposed by the company Use the WHITE

proxy card to vote “FOR” ONLY Disney’s 12 nominees Remember, voting “FOR” more than 12 nominees will invalidate your vote on Proposal 1 — please be careful when indicating your vote. If you need help voting your shares, please call our proxy

solicitor, Innisfree M&A Incorporated, TOLL-FREE at 1(877) 456-3463 (from U.S. and Canada) or at +1(412) 232-3651 (from other countries).

R IN GLOBAL ENTERTAINMENT.

CHARTING A COURSE FOR DISNEY’S FUTURE…We are building for the future to drive meaningful growth and create enduring shareholder value.

WITH WORLD CLASS CREATIVITY & INNOVATION…“One of the things that truly sets Disney apart is our unique ability to turn top quality IP into top quality experiences, leading to significant

growth.”-BOB IGER

…DELIVERING WORLD-RENOWNED ENTERTAINMENT & LONG-TERM SHAREHOLDER VALUE AVATAR: THE WAY OF WATER IS 3RD BIGGEST FILM OF ALL TIME 4 OF THE 10 TOP GROSSING FILMS #1 MOST VISITED THEME PARK IN

THE WORLD 9 GAMES FRANCHISES EXCEED $1B IN SALES AHSOKA PREMIERE 14M VIEWS IN 5 DAYS 60 CRITICS CHOICE NOMINATIONS LOKI SEASON 2 PREMIERE 10.9M VIEWS IN 3 DAYS 163 TOTAL EMMY AWARD NOMINATIONS BEST CRUISE LINE FOR FAMILIES 5 GOLDEN GLOBE WINS 2024

UPCOMING MAY 10, 2024 JUNE 14, 2024 JULY 26, 2024 AUGUST 16, 2024 NOVEMBER 27, 2024 DECEMBER 20, 2024

DISNEY HAS A STRONG BOARD WITH A CLEAR VISION… Delivering ambitious growth plans requires leadership with a deep understanding of the Company’s current strengths and assets. Disney’s board has

the range of talent, skill sets, experiences, and professional backgrounds that are particularly relevant to the Company’s business and strategic objectives. AND THE RIGHT STRATEGIC PLAN… With Bob Iger at the helm, alongside the Board of Directors

and senior leaders, the Company is intensely focused on building for the future. Central to our success are four priorities: Positioning streaming for growth and profitability Reinvigorating Disney’s film studios Fortifying ESPN for the future

Turbocharging Disney Parks and Experiences

…THAT’S ALREADY DELIVERING RESULTS We have aggressively executed our key strategic priorities to make Disney’s businesses more efficient and effective, reinvigorated our creative engines, and

sharpened our focus on our greatest brand and franchise assets. Expect FY24 Diluted EPS excluding certain items to INCREASE BY AT LEAST 20% over prior year* $7.5 BILLION cost cutting target Approved new share repurchase program; targeting $3B in

FY24 Declared a cash dividend payable in July 2024 of $.45/SHARE; 50% HIGHER than January payment *Diluted EPS excluding certain items is a non-GAAP financial measure. The most comparable GAAP measure is diluted EPS. See how we define and calculate

this measure and why Disney is not providing a forward-looking quantitative reconciliation to the most comparable GAAP measure in the legal notices included with this letter.

TOGETHER, WE MAKE DISNEY MAGICAL THANK YOU FOR INVESTING IN THE WALT DISNEY COMPANY AND SECURING ITS FUTURE AS THE LEADER IN GLOBAL ENTERTAINMENT.

Forward-Looking Statements Certain statements in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,

including statements regarding the Company’s expectations; beliefs; plans; strategies; business or financial prospects or outlook; future shareholder value; expected growth and value creation; expected drivers and guidance; profitability;

investments; cost reductions and efficiencies; capital allocation, including dividends or share repurchases; content offerings; priorities or performance and other statements that are not historical in nature. These statements are made on the basis

of the Company’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. The Company does not undertake any obligation to update these statements unless required by applicable laws or

regulations, and you should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied. Such differences may result from actions taken by the Company, including restructuring or

strategic initiatives (including capital investments, asset acquisitions or dispositions, new or expanded business lines or cessation of certain operations), our execution of our business plans (including the content we create and IP we invest in,

our pricing decisions, our cost structure and our management and other personnel decisions), our ability to quickly execute on cost rationalization while preserving revenue, the discovery of additional information or other business decisions, as well

as from developments beyond the Company’s control, including: the occurrence of subsequent events; deterioration in domestic or global economic conditions or failure of conditions to improve as anticipated, including heightened inflation, capital

market volatility, interest rate and currency rate fluctuations and economic slowdown or recession; deterioration in or pressures from competitive conditions, including competition to create or acquire content, competition for talent and competition

for advertising revenue, consumer preferences and acceptance of our content and offerings, pricing model and price increases, and corresponding subscriber additions and churn, and the market for advertising and sales on our direct-to-consumer

services and linear networks; health concerns and their impact on our businesses; international, political or military developments; regulatory or legal developments; technological developments; labor markets and activities, including work stoppages;

adverse weather conditions or natural disasters; and availability of content. Such developments may further affect entertainment, travel and leisure businesses generally and may, among other things, affect (or further affect, as applicable): our

operations, business plans or profitability, including direct-to-consumer profitability; our expected benefits of the composition of the Board; demand for our products and services; the performance of the Company’s content; our ability to create or

obtain desirable content at or under the value we assign the content; the advertising market for programming; income tax expense; and performance of some or all Company businesses either directly or through their impact on those who distribute our

products. Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended September 30, 2023, including under the captions “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and “Business”, and subsequent filings with the Securities and Exchange Commission (the “SEC”), including, among others, quarterly reports on Form 10-Q. Additional Information and Where to Find it Disney has filed with the SEC a

definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Disney’s 2024 Annual Meeting of Shareholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY DISNEY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and

security holders may obtain copies of these documents and other documents filed with the SEC by Disney free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Disney are also available free of charge

by accessing Disney’s website at www.thewaltdisneycompany.com. Participants Disney, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation

by Disney. Information about Disney’s executive officers and directors is available in Disney’s definitive proxy statement for its 2024 Annual Meeting, which was filed with the SEC on February 1, 2024. To the extent holdings by our directors and

executive officers of Disney securities reported in the proxy statement for the 2024 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents

are or will be available free of charge at the SEC’s website at www.sec.gov. Non-GAAP Financial Measures Diluted EPS excluding certain items is a non-GAAP financial measure calculated as diluted EPS, which is the most directly comparable GAAP

measure, less certain items affecting comparability of results from period to period and amortization of TFCF and Hulu intangible assets, including purchase accounting step-up adjustments for released content. Disney’s management believes that

information about diluted EPS excluding certain items allows investors to evaluate the performance of Disney’s operations exclusive of these items, which is how senior management evaluate segment performance. Disney is not providing forward-looking

measures for diluted EPS, or a quantitative reconciliation of the forward-looking diluted EPS excluding certain items to that most directly comparable GAAP measure. Disney is unable to predict or estimate with reasonable certainty the ultimate

outcome of certain items required for the GAAP measure without unreasonable effort. Information about other adjusting items that is currently not available to Disney could have a potentially unpredictable and significant impact on its future GAAP

financial results.

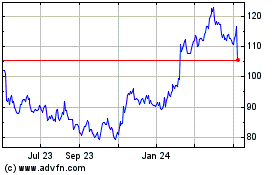

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

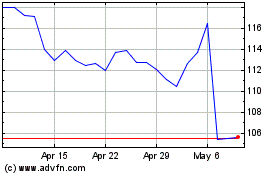

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Apr 2023 to Apr 2024