Deluxe Announces Pricing of Senior Secured Notes Offering

November 19 2024 - 3:44PM

Business Wire

Deluxe (NYSE: DLX), a Trusted Payments and Data company (the

“Company”), today announced the pricing of $450 million aggregate

principal amount of its senior secured notes due 2029 (the

“Notes”). The size of the offering was upsized from $400 million to

$450 million. The offering is expected to close on December 3,

2024, subject to customary closing conditions. The Notes will pay

interest semi-annually at a rate of 8.125% per annum. The Notes are

being offered in a private placement to persons reasonably believed

to be qualified institutional buyers pursuant to Rule 144A under

the Securities Act of 1933, as amended (the "Securities Act"), and

to persons outside the United States in accordance with Regulation

S under the Securities Act.

The Company intends to use the net proceeds from the Notes

offering, together with borrowings under the Company’s new senior

secured credit facilities, to (i) refinance its term A loan

facility (the “Existing Term A Loan Facility”) and its revolving

credit facility (the “Existing Revolving Credit Facility”) and (ii)

pay transaction fees and expenses. The offering of the Notes is

conditioned on the closing of an amendment and restatement of the

Company's existing credit agreement governing the Existing Term A

Loan Facility and the Existing Revolving Credit Facility to provide

for new senior secured credit facilities consisting of a revolving

credit facility in an aggregate committed amount of $400 million

and a term A loan facility in an aggregate principal amount of $500

million and extending maturity to February 1, 2029. Amounts

outstanding under the new senior secured credit facilities are

expected to bear interest at the Company’s option, at (i) adjusted

SOFR (including a credit spread adjustment of 0.10%), plus 1.50% to

2.75% (depending on the Company’s consolidated total leverage

ratio) or (ii) the greater of (x) the prime rate, (y) the federal

funds rate plus 0.50% or (z) adjusted SOFR (including a credit

spread adjustment of 0.10%) plus 1.00%, plus 0.50% to 1.75%,

depending on the Company’s consolidated total leverage ratio, all

subject to a 1.00% floor.

This press release does not and will not constitute an offer to

sell or the solicitation of an offer to buy the Notes or any other

securities, nor will there be any sale of the Notes or any other

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. The Notes and related

note guarantees have not been and will not be registered under the

Securities Act or any state or other jurisdiction’s securities laws

and may not be offered or sold in the United States to, or for the

benefit of, U.S. persons absent registration or an applicable

exemption from the registration requirements of the Securities Act

and applicable securities laws of any state or other

jurisdiction.

About Deluxe

Deluxe, a Trusted Payments and Data company, champions business

so communities thrive. Our solutions help businesses pay, get paid,

and grow. For more than 100 years, Deluxe customers have relied on

our solutions and platforms at all stages of their lifecycle, from

start-up to maturity. Our powerful scale supports millions of small

businesses, thousands of vital financial institutions and hundreds

of the world’s largest consumer brands, while processing more than

$2 trillion in annual payment volume. Our reach, scale and

distribution channels position Deluxe to be our customers’ most

trusted business partner.

Cautionary Statement Regarding Forward-Looking

Statements

Statements made in this press release concerning the Company,

the Company’s or management’s intentions, expectations, outlook or

predictions about future results or events are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements reflect management’s current

intentions or beliefs and are subject to risks and uncertainties

that could cause actual results or events to vary from stated

expectations, which variations could be material and adverse.

Factors that could produce such a variation include, but are not

limited to, the following: changes in local, regional, national and

international economic or political conditions, including those

resulting from heightened inflation, rising interest rates, a

recession, or intensified international hostilities, and the impact

they may have on the Company, its data, customers, or demand for

the Company’s products and services; the effect of proposed and

enacted legislative and regulatory actions affecting the Company or

the financial services industry as a whole; continuing cost

increases and/or declines in the availability of data, materials

and other services; the Company’s ability to execute its

transformational strategy and to realize the intended benefits; the

inherent unreliability of earnings, revenue and cash flow

predictions due to numerous factors, many of which are beyond the

Company’s control; declining demand for the Company’s checks,

check-related products and services and business forms; risks that

the Company’s strategies intended to drive sustained revenue and

earnings growth, despite the continuing decline in checks and

forms, are delayed or unsuccessful; intense competition; continued

consolidation of financial institutions and/or bank failures,

thereby reducing the number of potential customers and referral

sources and increasing downward pressure on the Company’s revenue

and gross profit; risks related to acquisitions, including

integration-related risks and risks that future acquisitions will

not be consummated; risks that any such acquisitions do not produce

the anticipated results or synergies; risks that the Company’s cost

reduction initiatives will be delayed or unsuccessful; risks

related to any divestitures contemplated or undertaken by the

Company; performance shortfalls by one or more of the Company’s

major suppliers, licensors, data or service providers; continuing

supply chain and labor supply issues; unanticipated delays, costs

and expenses in the development and marketing of products and

services, including financial technology and treasury management

solutions; the failure of such products and services to deliver the

expected revenues and other financial targets; risks related to

security breaches, computer malware or other cyber-attacks; risks

of interruptions to the Company’s website operations or information

technology systems; and risks of unfavorable outcomes and the costs

to defend litigation and other disputes. The Company’s

forward-looking statements speak only as of the time made, and

management assumes no obligation to publicly update any such

statements. Additional information concerning these and other

factors that could cause actual results and events to differ

materially from the Company’s current expectations are contained in

the Company’s Form 10-K for the year ended December 31, 2023 and in

the Company’s Form 10-Q for the quarters ended March 31, 2024, June

30, 2024 and September 30, 2024. The Company undertakes no

obligation to update or revise any forward-looking statements to

reflect subsequent events, new information or future

circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119294332/en/

Brian Anderson, VP, Strategy & Investor Relations

651-447-4197 brian.anderson@deluxe.com

Keith Negrin, VP, Communications 612-669-1459

keith.negrin@deluxe.com

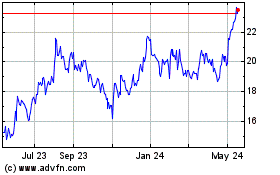

Deluxe (NYSE:DLX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Deluxe (NYSE:DLX)

Historical Stock Chart

From Nov 2023 to Nov 2024