GAMCO: Glass Lewis Firmly Opposes Dril-Quip Merger

August 26 2024 - 3:15PM

Business Wire

GAMCO Asset Management Inc. (“GAMCO”), an affiliate of GAMCO

Investors, Inc. (OTCQX: GAMI), on behalf of its clients and certain

of its affiliates owns approximately 2,872,654 shares of Dril-Quip,

Inc. (NYSE: DRQ) (“Dril-Quip”), representing 8.34% of the

34,452,230 outstanding shares. GAMCO intends to vote “Against” the

proposed merger with Innovex Downhole Solutions (“Innovex”).

On August 23, 2024, Glass, Lewis & Co. LLC (“Glass Lewis”)

published its report regarding Dril-Quip’s merger with Innovex.

Glass Lewis recommends that stockholders vote “Against”

all proposals at Dril-Quip’s Special

Meeting of Stockholders scheduled for September 5, 2024. The

report cites “problematic merger provisions” and a “significant

loss of value” amongst the key reasons for their opposition. GAMCO

commends Glass Lewis for its diligent analysis and attention to

these critical issues.

Late Proxy Amendment: Today, Dril-Quip amended its proxy

statement to remove the requirement that the approval of the

proposal to amend Dril-Quip’s certificate of incorporation be

passed as a condition to closing the merger. This material change

was communicated just 11 days before shareholders are scheduled to

vote on the future direction of Dril-Quip. GAMCO views the removal

of this proposal as a desperate attempt by Dril-Quip and Innovex to

take advantage of ISS’s (Institutional Shareholder Services Inc.)

mixed and confusing recommendation to push the merger across the

finish line. Further, although Dril-Quip has withdrawn certain

problematic governance-related proposals, the fact that these

provisions were initially included raises serious questions about

the future governance of the merged entity. This casts a shadow

over the merger, as the potential for future governance issues

remains a significant risk, potentially leading to decisions that

could negatively impact shareholder interests and long-term

value.

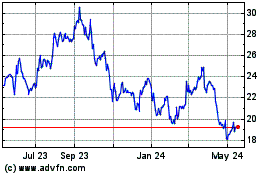

Shareholder Value Erosion: Since the announcement of this

merger, shareholder value has been significantly eroded, while

current Dril-Quip management stands to exit with lucrative golden

parachutes. When Dril-Quip announced its intention to merge with

Innovex, the stock price was $23.73. As of August 26, 2024,

Dril-Quip’s stock price has declined by 32%, compared to a much

smaller 6% decline in the VanEck Oil Services ETF (OIH) over the

same period. This stark contrast underscores the negative market

reaction to the proposed merger and the potential long-term

consequences for shareholders. Amendment No. 2 to Form S-4 (filed

on August 5, 2024) indicated that the merger of Dril-Quip with

Innovex constitutes a change of control. As a result of this change

of control, we estimate that Dril-Quip’s CEO, Jeff Bird, and CFO,

Kyle McClure, will receive compensation totaling $8.1 million and

$3.8 million, respectively.

Undervalued Shares: GAMCO believes that Dril-Quip shares are

significantly undervalued and believes that rejecting this merger

will allow Dril-Quip’s true value to be realized, free from the

constraints and risks posed by the proposed transaction.

(1) Permission to use quotes were neither sought nor

obtained.

GAMCO Investors, Inc., through its subsidiaries, manages assets

of private advisory accounts (GAMCO), mutual funds and closed-end

funds (Gabelli Funds, LLC) and is known for its Private Market

Value with a Catalyst™ style of investment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240826512743/en/

Robert Leininger Chair, Proxy Voting Committee (914)

921-7754

For further information please visit www.gabelli.com

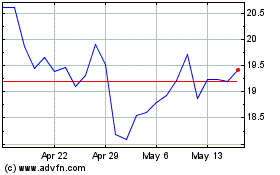

Dril Quip (NYSE:DRQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dril Quip (NYSE:DRQ)

Historical Stock Chart

From Mar 2024 to Mar 2025