0001529864false00015298642025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 04, 2025 |

ENOVA INTERNATIONAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

1-35503 |

45-3190813 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

175 West Jackson Boulevard |

|

Chicago, Illinois |

|

60604 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 312 568-4200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.00001 par value per share |

|

ENVA |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 4, 2025, Enova International, Inc. (the “Company”) issued a press release to announce its consolidated financial results for the three months ended December 31, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information included or incorporated by reference in this Current Report on Form 8-K under this Item 2.02 is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are furnished as part of this Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Enova International, Inc. |

|

|

|

|

Date: |

February 4, 2025 |

By: |

/s/ Sean Rahilly |

|

|

|

Sean Rahilly

General Counsel & Secretary |

Enova Reports Fourth Quarter and Full Year 2024 Results

•Originations rose 20% and total company revenue increased 25% from the fourth quarter of 2023

•Diluted earnings per share of $2.30 increased 104% and adjusted earnings per share1 of $2.61 rose 43% compared to the fourth quarter of 2023

•Net revenue margin of 57% in the fourth quarter of 2024, compared to 56% in the fourth quarter of 2023, was in line with our expectations and reflects continued strong credit performance

•Liquidity, including cash and marketable securities and available capacity on facilities, totaled $1.3 billion at December 31

CHICAGO, February 4, 2025 /PRNewswire/ -- Enova International (NYSE: ENVA), a leading financial services company powered by machine learning and world-class analytics, today announced financial results for the fourth quarter and full year ended December 31, 2024.

“We are pleased to report our strongest year yet with full year 2024 originations, revenue and adjusted EPS all reaching the highest levels in our company’s history. This success was driven by our world class team, strong competitive position and dedication to unit economics” said David Fisher, Enova’s CEO. “Our portfolio expanded to nearly $4 billion, as a result of continued strength in both our SMB and consumer businesses. Looking ahead, we believe we have significant momentum heading into 2025 and are confident in our ability to continue meeting our customer needs while creating value for our shareholders.”

Fourth Quarter 2024 Summary

•Total revenue of $730 million increased 25% from $584 million in the fourth quarter of 2023.

•Net revenue margin of 57% was consistent with 56% in the fourth quarter of 2023, reflecting continued solid credit performance.

•Net income of $64 million, or $2.30 per diluted share, increased 83% from $35 million, or $1.13 per diluted share, in the fourth quarter of 2023.

•Adjusted EBITDA1 of $174 million increased 34% from $130 million in the fourth quarter of 2023.

•Adjusted earnings per share1 of $2.61 increased 43% from $1.83 per diluted share in the fourth quarter of 2023.

•Total company combined loans and finance receivables1 increased 20% from the end of the fourth quarter of 2023 to a record $4.0 billion with total company originations of $1.7 billion in the quarter.

•Repurchased $51 million of common stock under the company’s share repurchase program.

Full Year 2024 Summary

•Total revenue of $2.7 billion increased 26% from $2.1 billion in 2023.

•Net revenue margin of 58% was flat compared to 2023.

•Net income of $209 million, or $7.43 per diluted share, increased 20% from $175 million, or $5.49 per diluted share, in 2023.

•Adjusted EBITDA1 of $657 million increased 31% from $503 million in 2023.

•Adjusted earnings per share1 of $9.15 increased 34% from $6.85 in 2023.

1 Non-GAAP measure. Refer to “Non-GAAP Financial Measures,” “Loans and Finance Receivables Financial and Operating Data,”

and “Reconciliation of GAAP to Non-GAAP Financial Measures” below for additional information.

“We are proud to close out 2024 with record top- and bottom-line results,” said Steve Cunningham, CFO of Enova. “Our strong financial results for the fourth quarter and full-year 2024 continue to showcase the powerful combination of our diversified product offerings, scalable operating model, world-class risk management capabilities and balance sheet flexibility that have driven our ability to deliver consistently strong financial results.”

Conference Call

Enova will host a conference call to discuss its fourth quarter and full year 2024 results at 4 p.m. Central Time / 5 p.m. Eastern Time today, February 4th. The live webcast of the call can be accessed at the Enova Investor Relations website at http://ir.enova.com, along with the company's earnings press release and supplemental financial information. The U.S. dial-in for the call is 1-855-560-2575 (1-412-542-4161 for non-U.S. callers). Please ask to join the Enova International call. A replay of the conference call will be available until February 11, 2025, at 10:59 p.m. Central Time / 11:59 p.m. Eastern Time, while an archived version of the webcast will be available on the Enova International Investor Relations website for 90 days. The U.S. dial-in for the conference call replay is 1-877-344-7529 (1-412-317-0088). The replay access code is 6182379.

About Enova

Enova International (NYSE: ENVA) is a leading financial services company with powerful online lending that serves small businesses and consumers who are underserved by traditional banks. Through its world-class analytics and machine learning algorithms, Enova has provided more than 11.8 million customers with over $59 billion in loans and financing. You can learn more about the company and its portfolio of businesses at www.enova.com.

SOURCE Enova International, Inc.

For further information:

Public Relations Contact:

Erin Yeager

Email: media@enova.com

Investor Relations Contact:

Lindsay Savarese

Office: (212) 331-8417

Email: IR@enova.com

Cassidy Fuller

Office: (415) 217-4168

Email: IR@enova.com

Cautionary Statement Concerning Forward Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the business, financial condition and prospects of Enova. These forward-looking statements give current expectations or forecasts of future events and reflect the views and assumptions of Enova's senior management with respect to the business, financial condition and prospects of Enova as of the date of this release and are not guarantees of future performance. The actual results of Enova could differ materially from those indicated by such forward-looking statements because of various risks and uncertainties applicable to Enova's business, including, without limitation, those risks and uncertainties indicated in Enova's filings with the Securities and Exchange Commission ("SEC"), including our annual report on Form 10-K, quarterly reports on Forms 10-Q and current reports on Forms 8-K. These risks and uncertainties are beyond the ability of Enova to control, and, in many cases, Enova cannot predict all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements. When used in this release, the words "believes," "estimates," "plans," "expects," "anticipates" and similar expressions or variations as they relate to Enova or its management are intended to identify forward-looking statements. Enova cautions you not to put undue reliance on these statements. Enova disclaims any intention or obligation to update or revise any forward-looking statements after the date of this release.

Non-GAAP Financial Measures

In addition to the financial information prepared in conformity with generally accepted accounting principles in the United States, or GAAP, Enova provides historical non-GAAP financial information. Enova presents non-GAAP financial information because such measures are used by management in understanding the activities and business metrics of Enova's operations. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of Enova's business that, when viewed with its GAAP results, provide a more complete understanding of factors and trends affecting its business.

Management provides non-GAAP financial information for informational purposes and to enhance understanding of Enova's GAAP consolidated financial statements. Readers should consider the information in addition to, but not instead of or superior to, Enova's financial statements prepared in accordance with GAAP. This non-GAAP financial information may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes.

Combined Loans and Finance Receivables

The combined loans and finance receivables measures are non-GAAP measures that include loans and finance receivables that Enova owns or has purchased and loans that Enova guarantees. Management believes these non-GAAP measures provide management and investors with important information needed to evaluate the magnitude of potential receivable losses and the opportunity for revenue performance of the loans and finance receivable portfolio on an aggregate basis. Management also believes that the comparison of the aggregate amounts from period to period is more meaningful than comparing only the amounts reflected on Enova's consolidated balance sheet since revenue is impacted by the aggregate amount of receivables owned by Enova and those guaranteed by Enova as reflected in its consolidated financial statements.

Adjusted Earnings Measures

Enova provides adjusted earnings and adjusted earnings per share, or, collectively, the Adjusted Earnings Measures, which are non-GAAP measures. Management believes that the presentation of these measures provides investors with greater transparency and facilitates comparison of operating results across a broad spectrum of companies with varying capital structures, compensation strategies, derivative instruments and amortization methods, which can provide a more complete understanding of Enova's financial performance, competitive position and prospects for the future. Management utilizes, and also believes that investors utilize, the Adjusted Earnings Measures to assess operating performance, recognizing that such measures may highlight trends in Enova's business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. In addition, management believes that the Adjusted Earnings Measures are useful to management and investors in comparing Enova's financial results during the periods shown without the effect of certain items that are not indicative of Enova’s core operating performance or results of operations.

Adjusted EBITDA Measures

Enova provides Adjusted EBITDA and Adjusted EBITDA margin, or, collectively, the Adjusted EBITDA measures, which are non-GAAP measures. Adjusted EBITDA is a non-GAAP measure that Enova defines as earnings excluding depreciation, amortization, interest, foreign currency transaction gains or losses, taxes, stock-based compensation and certain other items, as appropriate, that are not indicative of our core operating performance. Adjusted EBITDA margin is a non-GAAP measure that Enova defines as Adjusted EBITDA as a percentage of total revenue. Management utilizes, and also believes that investors utilize, Adjusted EBITDA Measures to analyze operating performance and evaluate Enova's ability to incur and service debt and Enova's capacity for making capital expenditures. Enova believes that Adjusted EBITDA is useful to management and investors in comparing Enova’s financial results during the periods shown without the effect of certain non-cash items and certain items that are not indicative of Enova’s core operating performance or results of operations. Adjusted EBITDA Measures are also useful to investors to help assess Enova's estimated enterprise value.

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

73,910 |

|

|

$ |

54,357 |

|

Restricted cash |

|

|

248,758 |

|

|

|

323,082 |

|

Loans and finance receivables at fair value |

|

|

4,386,444 |

|

|

|

3,629,167 |

|

Income taxes receivable |

|

|

40,690 |

|

|

|

44,129 |

|

Other receivables and prepaid expenses |

|

|

63,752 |

|

|

|

71,982 |

|

Property and equipment, net |

|

|

119,956 |

|

|

|

108,705 |

|

Operating lease right-of-use asset |

|

|

18,201 |

|

|

|

14,251 |

|

Goodwill |

|

|

279,275 |

|

|

|

279,275 |

|

Intangible assets, net |

|

|

10,951 |

|

|

|

19,005 |

|

Other assets |

|

|

24,194 |

|

|

|

41,583 |

|

Total assets |

|

$ |

5,266,131 |

|

|

$ |

4,585,536 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

249,970 |

|

|

$ |

261,156 |

|

Operating lease liability |

|

|

32,165 |

|

|

|

27,042 |

|

Deferred tax liabilities, net |

|

|

223,590 |

|

|

|

113,350 |

|

Long-term debt |

|

|

3,563,482 |

|

|

|

2,943,805 |

|

Total liabilities |

|

|

4,069,207 |

|

|

|

3,345,353 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

Common stock, $0.00001 par value, 250,000,000 shares authorized, 46,520,916 and 45,339,814 shares issued and 25,808,096 and 29,089,258 outstanding as of December 31, 2024 and 2023, respectively |

|

|

— |

|

|

|

— |

|

Preferred stock, $0.00001 par value, 25,000,000 shares authorized, no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

Additional paid in capital |

|

|

328,268 |

|

|

|

284,256 |

|

Retained earnings |

|

|

1,697,754 |

|

|

|

1,488,306 |

|

Accumulated other comprehensive loss |

|

|

(13,691 |

) |

|

|

(6,264 |

) |

Treasury stock, at cost (20,712,820 and 16,250,556 shares as of December 31, 2024 and 2023, respectively) |

|

|

(815,407 |

) |

|

|

(526,115 |

) |

Total stockholders' equity |

|

|

1,196,924 |

|

|

|

1,240,183 |

|

Total liabilities and stockholders' equity |

|

$ |

5,266,131 |

|

|

$ |

4,585,536 |

|

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

$ |

729,551 |

|

|

$ |

583,592 |

|

|

$ |

2,657,800 |

|

|

$ |

2,117,639 |

|

Change in Fair Value |

|

|

(316,515 |

) |

|

|

(258,556 |

) |

|

|

(1,128,351 |

) |

|

|

(887,717 |

) |

Net Revenue |

|

|

413,036 |

|

|

|

325,036 |

|

|

|

1,529,449 |

|

|

|

1,229,922 |

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing |

|

|

151,178 |

|

|

|

122,226 |

|

|

|

523,569 |

|

|

|

414,460 |

|

Operations and technology |

|

|

58,431 |

|

|

|

47,089 |

|

|

|

224,391 |

|

|

|

194,905 |

|

General and administrative |

|

|

38,035 |

|

|

|

49,148 |

|

|

|

156,524 |

|

|

|

160,265 |

|

Depreciation and amortization |

|

|

10,196 |

|

|

|

9,034 |

|

|

|

40,207 |

|

|

|

38,157 |

|

Total Operating Expenses |

|

|

257,840 |

|

|

|

227,497 |

|

|

|

944,691 |

|

|

|

807,787 |

|

Income from Operations |

|

|

155,196 |

|

|

|

97,539 |

|

|

|

584,758 |

|

|

|

422,135 |

|

Interest expense, net |

|

|

(76,989 |

) |

|

|

(57,208 |

) |

|

|

(290,442 |

) |

|

|

(194,779 |

) |

Foreign currency transaction (loss) gain, net |

|

|

(902 |

) |

|

|

49 |

|

|

|

(1,064 |

) |

|

|

57 |

|

Equity method investment income (loss) |

|

|

92 |

|

|

|

1,251 |

|

|

|

(16,460 |

) |

|

|

116 |

|

Other nonoperating expenses |

|

|

— |

|

|

|

(3 |

) |

|

|

(5,691 |

) |

|

|

(282 |

) |

Income before Income Taxes |

|

|

77,397 |

|

|

|

41,628 |

|

|

|

271,101 |

|

|

|

227,247 |

|

Provision for income taxes |

|

|

13,702 |

|

|

|

6,860 |

|

|

|

61,653 |

|

|

|

52,126 |

|

Net income |

|

$ |

63,695 |

|

|

$ |

34,768 |

|

|

$ |

209,448 |

|

|

$ |

175,121 |

|

Earnings Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

2.44 |

|

|

$ |

1.17 |

|

|

$ |

7.78 |

|

|

$ |

5.71 |

|

Diluted |

|

$ |

2.30 |

|

|

$ |

1.13 |

|

|

$ |

7.43 |

|

|

$ |

5.49 |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

26,141 |

|

|

|

29,687 |

|

|

|

26,920 |

|

|

|

30,673 |

|

Diluted |

|

|

27,666 |

|

|

|

30,887 |

|

|

|

28,202 |

|

|

|

31,921 |

|

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows provided by operating activities |

|

$ |

1,538,576 |

|

|

$ |

1,166,869 |

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

Loans and finance receivables |

|

|

(1,867,773 |

) |

|

|

(1,449,417 |

) |

Property and equipment additions |

|

|

(43,422 |

) |

|

|

(45,241 |

) |

Total cash flows used in investing activities |

|

|

(1,911,195 |

) |

|

|

(1,494,658 |

) |

Cash flows provided by financing activities |

|

|

318,882 |

|

|

|

526,541 |

|

Effect of exchange rates on cash |

|

|

(1,034 |

) |

|

|

287 |

|

Net change in cash and cash equivalents and restricted cash |

|

|

(54,771 |

) |

|

|

199,039 |

|

Cash, cash equivalents and restricted cash at beginning of year |

|

|

377,439 |

|

|

|

178,400 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

322,668 |

|

|

$ |

377,439 |

|

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

LOANS AND FINANCE RECEIVABLES FINANCIAL AND OPERATING DATA

(dollars in thousands)

The following table includes financial information for loans and finance receivables, which is based on loan and finance receivable balances for the three months ended December 31, 2024 and 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31 |

|

2024 |

|

|

2023 |

|

|

Change |

|

Ending combined loan and finance receivable principal balance: |

|

|

|

|

|

|

|

|

|

|

|

|

Company owned |

|

$ |

3,810,444 |

|

|

$ |

3,154,735 |

|

|

$ |

655,709 |

|

Guaranteed by the Company(a) |

|

|

19,859 |

|

|

|

13,537 |

|

|

|

6,322 |

|

Total combined loan and finance receivable principal balance(b) |

|

$ |

3,830,303 |

|

|

$ |

3,168,272 |

|

|

$ |

662,031 |

|

Ending combined loan and finance receivable fair value balance: |

|

|

|

|

|

|

|

|

|

|

|

|

Company owned |

|

$ |

4,386,444 |

|

|

$ |

3,629,167 |

|

|

$ |

757,277 |

|

Guaranteed by the Company(a) |

|

|

28,414 |

|

|

|

18,534 |

|

|

|

9,880 |

|

Ending combined loan and finance receivable fair value balance(b) |

|

$ |

4,414,858 |

|

|

$ |

3,647,701 |

|

|

$ |

767,157 |

|

Fair value as a % of principal(c) |

|

|

115.3 |

% |

|

|

115.1 |

% |

|

|

0.2 |

% |

Ending combined loan and finance receivable balance, including principal and accrued fees/interest outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Company owned |

|

$ |

3,966,486 |

|

|

$ |

3,297,082 |

|

|

$ |

669,404 |

|

Guaranteed by the Company(a) |

|

|

23,826 |

|

|

|

16,351 |

|

|

|

7,475 |

|

Ending combined loan and finance receivable balance(b) |

|

$ |

3,990,312 |

|

|

$ |

3,313,433 |

|

|

$ |

676,879 |

|

Average combined loan and finance receivable balance, including principal and accrued fees/interest outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Company owned(d) |

|

$ |

3,842,144 |

|

|

$ |

3,141,479 |

|

|

$ |

700,665 |

|

Guaranteed by the Company(a)(d) |

|

|

22,060 |

|

|

|

16,341 |

|

|

|

5,719 |

|

Average combined loan and finance receivable balance(a)(d) |

|

$ |

3,864,204 |

|

|

$ |

3,157,820 |

|

|

$ |

706,384 |

|

Installment loans as percentage of average combined loan and finance receivable balance |

|

|

44.9 |

% |

|

|

50.2 |

% |

|

|

(5.3 |

)% |

Line of credit accounts as percentage of average combined loan and finance receivable balance |

|

|

55.1 |

% |

|

|

49.8 |

% |

|

|

5.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

719,410 |

|

|

$ |

574,721 |

|

|

$ |

144,689 |

|

Change in fair value |

|

|

(314,091 |

) |

|

|

(256,412 |

) |

|

|

(57,679 |

) |

Net revenue |

|

|

405,319 |

|

|

|

318,309 |

|

|

|

87,010 |

|

Net revenue margin |

|

|

56.3 |

% |

|

|

55.4 |

% |

|

|

0.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Combined loan and finance receivable originations and purchases |

|

$ |

1,714,919 |

|

|

$ |

1,425,785 |

|

|

$ |

289,134 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delinquencies: |

|

|

|

|

|

|

|

|

|

|

|

|

>30 days delinquent |

|

$ |

297,832 |

|

|

$ |

263,524 |

|

|

$ |

34,308 |

|

>30 days delinquent as a % of loan and finance receivable balance(c) |

|

|

7.5 |

% |

|

|

8.0 |

% |

|

|

(0.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Charge-offs: |

|

|

|

|

|

|

|

|

|

|

|

|

Charge-offs (net of recoveries) |

|

$ |

342,183 |

|

|

$ |

305,436 |

|

|

$ |

36,747 |

|

Charge-offs (net of recoveries) as a % of average loan and finance receivable balance(d) |

|

|

8.9 |

% |

|

|

9.7 |

% |

|

|

(0.8 |

)% |

(a) Represents loans originated by third-party lenders through the CSO programs, which are not included in our consolidated balance sheets.

(b) Non-GAAP measure.

(c) Determined using period-end balances.

(d) The average combined loan and finance receivable balance is the average of the month-end balances during the period.

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(dollars in thousands, except per share data)

Adjusted Earnings Measures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income |

|

$ |

63,695 |

|

|

$ |

34,768 |

|

|

$ |

209,448 |

|

|

$ |

175,121 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction-related costs(a) |

|

|

— |

|

|

|

755 |

|

|

|

327 |

|

|

|

755 |

|

Lease termination and cease use costs(b) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,698 |

|

Equity method investment (income) loss(c) |

|

|

(92 |

) |

|

|

(1,251 |

) |

|

|

16,460 |

|

|

|

(116 |

) |

Other nonoperating expenses(d) |

|

|

— |

|

|

|

3 |

|

|

|

5,691 |

|

|

|

282 |

|

Intangible asset amortization |

|

|

2,014 |

|

|

|

2,014 |

|

|

|

8,055 |

|

|

|

8,385 |

|

Stock-based compensation expense |

|

|

8,297 |

|

|

|

7,458 |

|

|

|

31,816 |

|

|

|

26,738 |

|

Foreign currency transaction loss (gain), net |

|

|

902 |

|

|

|

(49 |

) |

|

|

1,064 |

|

|

|

(57 |

) |

Cumulative tax effect of adjustments |

|

|

(2,608 |

) |

|

|

(2,293 |

) |

|

|

(14,789 |

) |

|

|

(9,456 |

) |

Regulatory settlement(e) |

|

|

— |

|

|

|

15,201 |

|

|

|

— |

|

|

|

15,201 |

|

Adjusted earnings |

|

$ |

72,208 |

|

|

$ |

56,606 |

|

|

$ |

258,072 |

|

|

$ |

218,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

2.30 |

|

|

$ |

1.13 |

|

|

$ |

7.43 |

|

|

$ |

5.49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings per share |

|

$ |

2.61 |

|

|

$ |

1.83 |

|

|

$ |

9.15 |

|

|

$ |

6.85 |

|

Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income |

|

$ |

63,695 |

|

|

$ |

34,768 |

|

|

$ |

209,448 |

|

|

$ |

175,121 |

|

Depreciation and amortization expenses |

|

|

10,196 |

|

|

|

9,034 |

|

|

|

40,207 |

|

|

|

38,157 |

|

Interest expense, net |

|

|

76,989 |

|

|

|

57,208 |

|

|

|

290,442 |

|

|

|

194,779 |

|

Foreign currency transaction loss (gain), net |

|

|

902 |

|

|

|

(49 |

) |

|

|

1,064 |

|

|

|

(57 |

) |

Provision for income taxes |

|

|

13,702 |

|

|

|

6,860 |

|

|

|

61,653 |

|

|

|

52,126 |

|

Stock-based compensation expense |

|

|

8,297 |

|

|

|

7,458 |

|

|

|

31,816 |

|

|

|

26,738 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction-related costs(a) |

|

|

— |

|

|

|

755 |

|

|

|

327 |

|

|

|

755 |

|

Equity method investment (income) loss(c) |

|

|

(92 |

) |

|

|

(1,251 |

) |

|

|

16,460 |

|

|

|

(116 |

) |

Regulatory settlement(e) |

|

|

— |

|

|

|

15,201 |

|

|

|

— |

|

|

|

15,201 |

|

Other nonoperating expenses(d) |

|

|

— |

|

|

|

3 |

|

|

|

5,691 |

|

|

|

282 |

|

Adjusted EBITDA |

|

$ |

173,689 |

|

|

$ |

129,987 |

|

|

$ |

657,108 |

|

|

$ |

502,986 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA margin calculated as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

|

$ |

729,551 |

|

|

$ |

583,592 |

|

|

$ |

2,657,800 |

|

|

$ |

2,117,639 |

|

Adjusted EBITDA |

|

|

173,689 |

|

|

|

129,987 |

|

|

|

657,108 |

|

|

|

502,986 |

|

Adjusted EBITDA as a percentage of total revenue |

|

|

23.8 |

% |

|

|

22.3 |

% |

|

|

24.7 |

% |

|

|

23.8 |

% |

(a)In the first quarter of 2024 and the fourth quarter of 2023, the Company recorded $0.3 million ($0.2 million net of tax) and $0.8 million ($0.6 million net of tax), respectively, of costs related to a consent solicitation for the Senior Notes due 2025.

(b)In the first quarter of 2023, the Company recorded a loss of $1.7 million ($1.3 million net of tax) related to the exit of leased office space.

(c)In the third quarter of 2024, the Company recorded an equity method investment loss of $16.6 million ($13.3 million net of tax) related to the write-down of its investment in Linear.

(d)In the twelve-month periods ended December 31, 2024 and 2023, the Company recorded other nonoperating expenses of $5.7 million ($4.3 million net of tax) and $0.3 million ($0.2 million net of tax), respectively, related to early extinguishment of debt.

(e)In the fourth quarter of 2023, the Company reached an agreement with the Consumer Financial Protection Bureau, or the CFPB, pursuant to which it agreed to pay a civil money penalty of $15.0 million, which is nondeductible for tax purposes.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

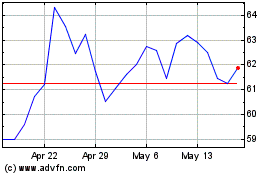

Enova (NYSE:ENVA)

Historical Stock Chart

From Jan 2025 to Feb 2025

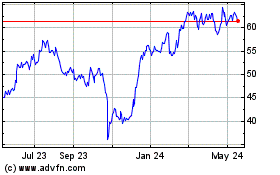

Enova (NYSE:ENVA)

Historical Stock Chart

From Feb 2024 to Feb 2025