Equinor to take full ownership in Empire Wind through a swap transaction with bp in the US

January 25 2024 - 2:00PM

Equinor (OSE: EQNR, NYSE: EQNR) has entered into a swap

transaction with bp, under which Equinor will take full ownership

of the Empire Wind lease and projects and bp will take full

ownership of the Beacon Wind lease and projects.

Under the agreement, Equinor will take 100% ownership of Empire

Offshore Wind Holdings LLC. Subject to certain conditions, Equinor

will also take over bp’s 50% share of the South Brooklyn Marine

Terminal (SBMT) lease. Bp will take over Beacon Wind Holdings LLC

and the associated project company that holds the Astoria Gateway

for Renewable Energy site and will become the operator of the

Beacon Wind projects. The transaction will be cash neutral, except

for standard settlements of cash and working capital items.

The agreement provides Equinor and bp with the flexibility to

pursue their respective priorities under their corporate

strategies. Equinor has more than 20 years’ experience with

offshore wind and entered the US offshore wind market already in

2017 – and has also built a strong offshore wind portfolio with

assets in key markets like UK, Poland, Germany, and South

Korea.

Following the signing of the agreement, a bid was submitted for

the Empire Wind 1 project in New York’s fourth offshore wind

solicitation round, which closed at 3pm ET today 25 January 2024.

It has also been agreed with the New York State Energy Research and

Development Authority (NYSERDA) to terminate the Offshore Wind

Renewable Energy Certificate (OREC) Purchase and Sale Agreement for

the Beacon Wind 1 project. Subject to closing the transaction,

Equinor will take the Empire Wind projects forward on a 100%

ownership basis and will continue to develop its strong offshore

wind organization in the US. Bp will take the Beacon projects

forward on a 100% ownership basis.

“We aspire to be a leading company in the energy transition.

Building on our experience as a leading player in US offshore wind,

we now take full ownership of a mature, large-scale offshore wind

project in a key energy market, where we have built a strong local

organization,” says Pål Eitrheim, executive vice president of

Renewables in Equinor.

“Empire Wind 1 is ready to deliver on New York’s climate and

energy goals, with numerous permits and supplier contracts secured.

The strong commitment by the state to develop this industry is

reflected in the NY4 rapid rebid offering, providing an opportunity

to improve value creation for the project,” says Molly Morris,

senior vice president for Renewables in the Americas in

Equinor.

Both Empire Wind 1 and 2 have been impacted by industry-wide

macroeconomic effects, and while Empire Wind 1 is bidding into the

NY4 solicitation, Empire Wind 2 will be matured for future

solicitation rounds. Subject to the award of a new OREC contract in

the NY4 solicitation, the project is expected to deliver a real

base project return towards the lower end of the guided range for

renewable projects of 4-8% on a forward-looking basis.

Upon closing, the assets will be fully consolidated into

Equinor’s balance sheet. Taking 100% ownership in the Empire Wind

projects and SBMT lease is expected to increase near term reported

capital expenditure for Equinor. The increase is around USD 1.2

billion for 2024 and around USD 1.5 billion for 2025, before any

project financing. Development of Empire Wind 1 is contingent upon

a positive result in the NY4 solicitation, and a final investment

decision is expected mid-2024. Equinor intends to use project

financing and to bring in a partner at the right time to enhance

value and reduce ownership share and exposure. The reset for Empire

Wind 2 and the exit from Beacon Wind reduces expected capital

expenditure from 2027 to 2030.

The transaction is subject to regulatory approval. The agreed

effective date is 1 January 2024 and closing is expected in Q2 or

Q3 2024. The transaction is expected to result in a combined

reported loss estimated to around USD 200 million for Equinor,

assuming a positive outcome of the NY4 solicitation. This has no

cash effect and will not impact adjusted earnings.

About Empire & Beacon Wind

- The Empire Wind lease was awarded to Equinor in 2017. It is

being developed in two projects, Empire Wind 1, with a potential

capacity of 810 MW, and Empire wind 2, with a potential capacity of

above 1,200 MW.

- The Beacon Wind lease was awarded to Equinor in 2019. It is

being developed in two projects, Beacon Wind 1 1,230 MW with a

potential capacity of and Beacon Wind 2 with a potential capacity

of 1,360 MW.

- In 2020, bp farmed into a 50% share of the Empire Wind and

Beacon Wind assets for a total consideration of USD 1.1 bn.

- Equinor won an offtake contract with the state of New York for

Empire Wind 1 in 2019 and in 2021 Equinor and bp were awarded

offtake contracts for the Empire Wind 2 and Beacon Wind 1 projects

in New York’s second solicitation round.

Recent developments

- In 2022, an agreement was signed to transform the South

Brooklyn Marine Terminal (SBMT) into a world-class offshore wind

hub.

- In 2023 Beacon Wind purchased the site of the Astoria Gas

Turbines, with the potential to transform the site into The Astoria

Gateway for Renewable Energy.

- In 2023, Equinor and bp were among more than 100 renewables

project developers that filed petitions with the State of New York

to provide additional price support for their projects, due to

industry-wide impacts from extraordinary macroeconomic effects. The

petition was denied.

- After the announcement of the denied petitions, the Governor of

New York released a 10-point action plan which included an

expedited renewable energy procurement process – New York’s fourth

offshore wind solicitation round, NY4.

- The Empire Wind 1 and Empire Wind 2 projects recently reached a

key federal permitting milestone, having received the federal

Record of Decision from BOEM. Last month, Empire Wind 1 also

received its Article VII Certificate of Environmental Compatibility

and Public Need in New York.

Further information from:

Investor relations:Bård Glad Pedersen, Senior

vice president, Head of Investor Relationsbgp@equinor.com+47 918 01

791

Media:Magnus Frantzen Eidsvold, Media

spokesperson, Renewables, marketing and

midstreammfei@equinor.com+47 975 28 604

This information is subject to the disclosure requirements

pursuant to Section 5-12 the Norwegian Securities Trading Act.

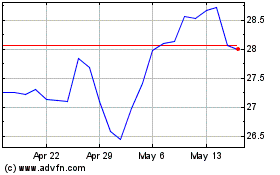

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Jan 2024 to Jan 2025