UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 11, 2024

Equitrans

Midstream Corporation

(Exact name of registrant as specified in its

charter)

| Pennsylvania |

001-38629 |

83-0516635 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

2200

Energy Drive

Canonsburg,

Pennsylvania |

15317 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (724) 271-7600

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common

Stock, no par value |

ETRN |

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

As previously announced, on March 10, 2024, Equitrans Midstream Corporation

(“Equitrans”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with EQT Corporation (“EQT”),

Humpty Merger Sub Inc., an indirect wholly owned subsidiary of EQT (“Merger Sub”), and Humpty Merger Sub LLC, an indirect

wholly owned subsidiary of EQT (“LLC Sub”). Upon the terms and subject to the conditions set forth in the Merger Agreement,

Merger Sub will merge with and into Equitrans (the “First Merger”), with Equitrans surviving as an indirect wholly owned subsidiary

of EQT (the “First Step Surviving Corporation”), and as the second step in a single integrated transaction with the First

Merger, the First Step Surviving Corporation will be merged with and into LLC Sub (the “Second Merger” and, together with

the First Merger, the “Merger”), with LLC Sub surviving the Second Merger as an indirect wholly owned subsidiary of EQT.

In connection with the Merger, EQT filed a Registration Statement on

Form S-4 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) that also includes

a prospectus of EQT and a joint proxy statement of Equitrans and EQT. The Registration Statement was declared effective on June 4, 2024,

after which Equitrans filed a definitive proxy statement and EQT filed a final prospectus. Equitrans and EQT commenced mailing of the

definitive joint proxy statement/prospectus (the “Proxy Statement/Prospectus”) to their respective shareholders on or about

June 5, 2024.

In connection with the Merger Agreement and the transactions contemplated

thereby, three complaints have been filed by purported Equitrans shareholders against Equitrans, EQT, and/or members of Equitrans’

board of directors in New York and Pennsylvania state courts. The three complaints (the “Shareholder Actions”) are captioned

as follows: Zalvin v. Equitrans Midstream Corporation, et al., No. 2024-3837 (Pa. C.P. June 20, 2024), Fleming v. Equitrans

Midstream Corporation, et al., No. 653358/2024 (N.Y. Sup. Ct. July 2, 2024) and Morgan v. Equitrans Midstream Corporation, et al.,

No. 653362/2024 (N.Y. Sup. Ct. July 2, 2024). In general, the Shareholder Actions allege that the defendants violated state securities

laws, or were negligent in mispresenting or omitting material facts under New York common law or Pennsylvania common law, as applicable,

because the Proxy Statement/Prospectus allegedly omits or misstates material information. The Shareholder Actions seek, among other things,

injunctive relief preventing the consummation of the Merger, unspecified damages and attorneys’ fees.

In addition to these lawsuits, a number of purported shareholders of

Equitrans and EQT have sent demand letters alleging similar deficiencies regarding the disclosures made in the Proxy Statement/Prospectus.

Equitrans believes that the disclosures set forth in the Proxy Statement/Prospectus

comply fully with applicable law and exchange rules, that no further disclosure beyond that already contained in the Proxy Statement/Prospectus

is required under applicable law or exchange rules, and that the allegations asserted in the complaints and demand letters are entirely

without merit. However, in order to moot these disclosure claims, to avoid nuisance, cost and distraction, and to preclude any efforts

to delay the closing of the Merger, and without admitting any culpability, liability or wrongdoing and without admitting the relevance

or materiality of such disclosures, Equitrans is voluntarily supplementing the Proxy Statement/Prospectus with the supplemental disclosures

set forth below (the “Supplemental Disclosures”). Nothing in the Supplemental Disclosures shall be deemed an admission of

the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, Equitrans specifically

denies all allegations in the demand letters and the complaints that any additional disclosure was or is required. To the extent that

the information set forth herein differs from or updates information contained in the Proxy Statement/Prospectus, the information set

forth herein shall supersede or supplement the information in the Proxy Statement/Prospectus. All page references are to pages in the

Proxy Statement/Prospectus, and terms used below, unless otherwise defined, have the meanings set forth in the Proxy Statement/Prospectus.

For clarity, new text within restated disclosures from the Proxy Statement/Prospectus is highlighted with bold, underlined text,

while deleted text is bold and stricken-through.

The members of the Equitrans board unanimously recommend that Equitrans

shareholders vote “FOR” the Merger Agreement Proposal, “FOR” the Advisory Compensation Proposal and “FOR”

the Equitrans Adjournment Proposal.

SUPPLEMENTAL DISCLOSURES TO THE PROXY STATEMENT/PROSPECTUS

RELATED TO SHAREHOLDER ACTIONS

The additional disclosures in this Current Report on Form 8-K supplement

the disclosures contained in the Proxy Statement/Prospectus and should be read in conjunction with the disclosures contained in the Proxy

Statement/Prospectus, which should be read in its entirety. To the extent that information set forth in the supplemental disclosures below

differs from or updates information contained in the Proxy Statement/Prospectus, the information in this Current Report on Form 8-K shall

supersede or supplement the information contained in the Proxy Statement/Prospectus. Page references in the below disclosures are to the

Proxy Statement/Prospectus, and defined terms used but not defined herein shall have the meanings set forth in the Proxy Statement/Prospectus.

The second sentence of the first full paragraph on Page 51 is hereby

supplemented by amending and restating such sentence as follows:

On September 15, 2022, Equitrans and Party A executed

a mutual nondisclosure agreement that included, among other provisions, a standstill provision that terminated upon execution of the Merger

Agreement and did not prohibit the parties from making any request to amend, waive or terminate the standstill provision without

the prior consent of the other party.

The first sentence of the fourth full paragraph on Page 58 is hereby

supplemented by amending and restating such sentence as follows:

Also on September 26, 2023, Equitrans and Party

G executed a mutual nondisclosure agreement that included, among other provisions, a standstill provision that terminated upon execution

of the Merger Agreement and did not prohibit the parties from making any request to amend, waive or terminate the standstill provision

without the prior consent of the other party.

The first sentence of the sixth full paragraph on Page 58 is hereby

supplemented by amending and restating such sentence as follows:

On October 3, 2023, Equitrans and Party F executed

a mutual nondisclosure agreement that included, among other provisions, a standstill provision that terminated upon execution of the Merger

Agreement and did not prohibit the parties from making any request to amend, waive or terminate the standstill provision without

the prior consent of the other party.

The first sentence of the eighth full paragraph on Page 59 is hereby

supplemented by amending and restating such sentence as follows:

On November 6, 2023, Equitrans and Party J executed

a mutual nondisclosure agreement that included, among other provisions, a standstill provision that terminated upon execution of the Merger

Agreement and did not prohibit the parties from making any request to amend, waive or terminate the standstill provision without

the prior consent of the other party.

The following paragraph and table are hereby added following the

seventh paragraph after the sub-heading “Opinion of Barclays Capital Inc., Financial Advisor to Equitrans—Selected

Comparable Company Analysis” on page 106:

The following table sets forth the multiples

analyzed by Barclays for each of the selected comparable companies with respect to Equitrans:

| Company |

|

Enterprise

Value to 2024 Economic Adjusted EBITDA |

|

Enterprise

Value to 2025 Economic Adjusted EBITDA |

| Antero Midstream Corporation |

|

9.2x |

|

9.1x |

| DT Midstream, Inc. |

|

9.4x |

|

8.9x |

| EnLink Midstream, LLC |

|

8.6x |

|

8.3x |

| Energy Transfer LP |

|

7.9x |

|

7.6x |

| Kinder Morgan, Inc. |

|

8.8x |

|

8.7x |

| Kinetik Holdings Inc. |

|

9.6x |

|

8.9x |

| Targa Resources Corp. |

|

9.6x |

|

8.6x |

| Western Midstream Partners, LP |

|

8.7x |

|

8.4x |

| Williams Companies, Inc. |

|

10.5x |

|

9.8x |

The following paragraph and table are hereby added following the

eighth paragraph after the sub-heading “Selected Comparable Company Analysis” on Page 106:

The following table sets forth the multiples

analyzed by Barclays for each of the selected comparable companies with respect to EQT:

| |

|

Enterprise

Value to

EBITDA | |

Enterprise

Value

to Proved

Reserves | |

Enterprise

Value

to Latest Daily

Production |

|

Equity

Value to

CFFO | |

Equity

Value to

FCF |

| Company |

|

2024 | |

2025 | |

($/Bcfe) | |

($/MMcfe/d) |

|

2024 | |

2025 | |

2024 | |

2025 |

| Antero

Resources Corporation |

|

8.1x | |

5.2x | |

$0.56 | |

$2,979 |

|

8.2x | |

4.6x | |

2.8% | |

11.6% |

| Chesapeake

Energy Corporation |

|

4.5x | |

3.9x | |

$0.83 | |

$3,129 |

|

4.1x | |

3.7x | |

4.9% | |

8.1% |

| CNX

Resources Corporation |

|

5.4x | |

5.2x | |

$0.66 | |

$3,776 |

|

3.9x | |

3.8x | |

8.2% | |

11.3% |

| Comstock

Resources, Inc. |

|

4.7x | |

3.8x | |

$1.02 | |

$3,310 |

|

2.7x | |

2.2x | |

1.3% | |

2.1% |

| Range

Resources Corporation |

|

7.8x | |

6.1x | |

$0.53 | |

$4,496 |

|

7.3x | |

5.8x | |

5.6% | |

9.3% |

The first

paragraph after the sub-heading “Selected Precedent Transaction Analysis” on Page 107 is hereby supplemented by adding

the following as a new penultimate sentence:

As part of its selected precedent transaction

analysis, Barclays calculated and analyzed the ratio of enterprise value to EBITDA for a selected twelve-month period following announcement

of the transaction (“EV/EBITDA FY+1”).

The first table following the first paragraph after the sub-heading

“Selected Precedent Transaction Analysis” on Page 108 is hereby supplemented by amending and restating such table as

follows:

Gas Transmission Precedent Transactions

Date

Announced | |

Buyer | |

Seller |

|

EV/EBITDA FY+1 |

| 11/6/2023 | |

Kinder Morgan, Inc. | |

NextEra Energy Partners, LP (STX Midstream) |

|

8.6x |

| 7/24/2023 | |

Global Infrastructure Partners | |

TC Energy Corporation (40% interest in Columbia Gas and Columbia Gulf pipelines) |

|

10.5x |

| 12/15/2022 | |

The Williams Companies, Inc. | |

Southwest Gas Holdings, Inc. (MountainWest Natural Gas Transmission and Storage Business) |

|

8.0x |

| 12/11/2022 | |

I Squared Capital | |

WhiteWater Whistler (62.5% interest in pipeline) |

|

12.0x |

| 9/29/2022 | |

DT Midstream, Inc. | |

National Grid plc (26.25% interest in Millenium pipeline) |

|

10.0x |

| 1/3/2022 | |

ArcLight Capital Partners, LLC | |

Targa Resources Corp. (Gulf Coast Express pipeline) |

|

11.0x |

| 10/5/2021 | |

Southwest Gas Holdings, Inc. | |

Dominion Energy, Inc. (Questar Pipelines and affiliates) |

|

10.9x |

| 7/5/2020 | |

Berkshire Hathaway Energy | |

Dominion Energy, Inc. (substantially all of Dominion Energy, Inc.’s Gas Transmission & Storage segment assets) |

|

9.6x |

| 1/31/2019 | |

Blackstone Infrastructure Partners / GIC Private Limited | |

Tallgrass Energy |

|

11.8x |

| 7/31/2017 | |

Blackstone Energy Partners | |

Energy Transfer Partners (Rover Pipeline project) |

|

11.0x |

| 7/10/2016 | |

Southern Company | |

Kinder Morgan, Inc. (Southern Natural Gas Co. LLC) |

|

10.5x |

The second table following the first paragraph after the sub-heading

“Selected Precedent Transaction Analysis” on Page 108 is hereby supplemented by amending and restating such table as

follows:

Gas Gathering Precedent Transactions

Date

Announced | |

Buyer | |

Seller |

|

EV/EBITDA FY+1 |

| 11/30/2023 | |

The Williams Companies, Inc. | |

Tailwater Capital LLC (Cureton Front Range, LLC) and KKR & Co. Inc. (50% interest in Rocky Mountain Midstream Holdings LLC) |

|

7.0x |

| 9/5/2023 | |

Western Midstream Partners, LP | |

Meritage Midstream Services II, LLC |

|

5.5x |

| 8/16/2023 | |

Energy Transfer LP | |

Crestwood Equity Partners LP |

|

8.3x |

| 10/17/2022 | |

Summit Midstream Partners, LP | |

Outrigger Energy II LLC (Outrigger DJ Midstream LLC) and Sterling Investment Holdings LLC (Sterling Energy Investments LLC, Grasslands Energy Marketing LLC and Centennial Water Pipelines LLC) |

|

4.0x |

| 9/12/2022 | |

Antero Midstream Corporation | |

Crestwood Equity Partners LP (Marcellus gas gathering and compression assets) |

|

7.0x |

| 6/16/2022 | |

Targa Resources Corp. | |

Lucid Energy Group |

|

7.5x |

| 5/25/2022 | |

EnLink Midstream, LLC | |

Crestwood Equity Partners LP (North Texas gathering and processing assets) |

|

4.0x |

| 5/25/2022 | |

Crestwood Equity Partners LP | |

Sendero Midstream Partners, LP & First Reserve (50% interest in Crestwood Permian Basin Holdings LLC) |

|

7.0x |

| 4/11/2022 | |

Delek Logistics Partners, LP | |

3Bear Energy, LLC (3Bear Delaware Holding – NM, LLC) |

|

6.3x |

| 3/14/2022 | |

The Williams Companies, Inc. | |

Trace Midstream (Haynesville gathering and processing assets) |

|

6.0x |

| 1/10/2022 | |

Enterprise Products Partners L.P. | |

Navitas Midstream Partners, LLC |

|

7.5x |

The third table following the first paragraph after the sub-heading

“Selected Precedent Transaction Analysis” on Page 109 is hereby supplemented by amending and restating such table as

follows:

Water Precedent Transactions

| Date Announced | |

Buyer | |

Seller |

|

EV/EBITDA FY+1 |

| 4/11/2022 | |

Delek Logistics Partners, LP | |

3Bear Energy, LLC (3Bear Delaware Holding – NM, LLC) |

|

6.3x |

| 9/26/2019 | |

NGL Energy Partners LP | |

Hillstone Environmental Partners, LLC (water infrastructure assets) |

|

7.0x |

| 5/14/2019 | |

NGL Energy Partners LP | |

Mesquite Disposals Unlimited, LLC (water infrastructure assets) |

|

7.5x |

| 11/8/2018 | |

Oasis Midstream Partners | |

Oasis Petroleum Inc. (water infrastructure assets) |

|

6.8x |

| 10/31/2018 | |

WaterBridge Resources LLC | |

Halcón Resources Corporation (water infrastructure assets) |

|

10.0x |

| 2/7/2018 | |

Tallgrass Energy Partners, LP | |

Buckhorn SWD Solutions, LLC (water infrastructure assets) |

|

5.0x |

The second paragraph after the sub-heading

“Selected Precedent Transaction Analysis” on Page 109 is hereby revised by amending and restating such paragraph as

follows:

As

part of its selected precedent transaction analysis, Barclays calculated and analyzed the ratio of enterprise value to EBITDA for a selected

twelve-month period following announcement of the transaction (“EV/EBITDA FY+1”). The results of the selected

precedent transactions analysis are summarized below:

The fourth paragraph after the sub-heading

“Selected Precedent Transaction Analysis” on Page 110 is hereby supplemented by amending and restating such paragraph

as follows:

Barclays then calculated a

consolidated implied equity value range of Equitrans by adding the low ends and high ends of the value ranges of the Transmission, Gathering,

and Water segments, the Mountain Valley Pipeline, Other, and Henry Hub Upside described above to arrive at a consolidated asset value.

Barclays valued Mountain Valley Pipeline based on 100% of Mountain Valley Pipeline’s 2025 “Adjusted EBITDA,” which is

EBITDA adjusted for certain nonrecurring and non-cash items, and then adjusted for Mountain Valley Pipeline’s remaining 2024 capital

expenditures; Equitrans’ attributed value then was allocated to Equitrans based on its ownership interest in Mountain Valley Pipeline.

Barclays then subtracted from the result Equitrans management’s estimate of consolidated net debt and preferred equity, each

as of March 31, 2024, and together totaling approximately $8.3 billion. Barclays then divided the resulting consolidated

equity value range by the number of approximately 444.8 million fully diluted shares of Equitrans common

stock outstanding, as provided by Equitrans management, to derive a range of implied prices per share of Equitrans common

stock of $7.50 to $11.00.

The fifth paragraph after the sub-heading “Selected

Precedent Transaction Analysis” on Page 110 is hereby supplemented by adding the following as a new penultimate sentence:

As part of its selected

precedent transaction analysis, Barclays calculated and analyzed the EV/EBITDA FY+1 for each precedent transaction.

The first table following the fifth paragraph after the sub-heading

“Selected Precedent Transaction Analysis” on Page 110 is hereby supplemented by amending and restating such table as

follows:

Date

Announced | |

Acquirer | |

Seller |

|

EV/EBITDA FY+1 |

| 2/21/2024 | |

Chord Energy Corporation | |

Enerplus Corporation |

|

4.5x |

| 2/12/2024 | |

Diamondback Energy, Inc. | |

Endeavor Energy Resources, L.P. |

|

5.6x |

| 1/11/2024 | |

Chesapeake Energy Corporation | |

Southwestern Energy Company |

|

4.2x |

| 1/4/2024 | |

APA Corporation | |

Callon Petroleum Company |

|

3.3x |

| 10/11/2023 | |

Exxon Mobil Corporation | |

Pioneer Natural Resources Company |

|

6.1x |

| 8/21/2023 | |

Permian Resources Corporation | |

Earthstone Energy, Inc. |

|

3.1x |

| 5/22/2023 | |

Chevron Corporation | |

PDC Energy, Inc. |

|

2.8x |

| 5/24/2021 | |

Cabot Oil & Gas Corporation | |

Cimarex Energy Co. |

|

5.0x |

| 10/20/2020 | |

Pioneer Natural Resources Company | |

Parsley Energy Inc. |

|

5.8x |

| 10/19/2020 | |

ConocoPhillips | |

Concho Resources Inc. |

|

5.6x |

| 9/28/2020 | |

Devon Energy Corporation | |

WPX Energy, Inc. |

|

4.5x |

| 7/20/2020 | |

Chevron Corporation | |

Noble Energy, Inc. |

|

6.5x |

The sixth paragraph after the sub-heading “Selected

Precedent Transaction Analysis” on Page 110 is hereby revised by amending and restating such paragraph as follows:

As

part of its selected precedent transactions analysis, for each of the selected transactions for which public information was available,

Barclays calculated and analyzed the EV/EBITDA FY + 1. The results of the selected precedent transactions analysis

are summarized below:

The second paragraph after the sub-heading

“Discounted Cash Flow Analysis” on Page 111 is hereby supplemented by amending and restating such paragraph as follows:

To calculate the estimated

enterprise value range of Equitrans using the discounted cash flow method, Barclays added (i) projected after-tax unlevered free cash

flows for 2Q 2024 through calendar year 2028 based on the Equitrans Projections to (ii) the “terminal value” of Equitrans,

as of December 31, 2028, and discounted such amount to its present value using a range of selected after-tax discount rates. Specifically,

Barclays used an after-tax discount rate range of 9.0% to 11.0%. The after-tax discount rates were based on Barclays’ analysis of

the weighted average cost of capital for Equitrans as well as the weighted average cost of capital for the Equitrans selected comparable

companies. The after-tax unlevered free cash flows were calculated by taking the earnings before interest, preferred cash dividend, tax

expense, depreciation and amortization and adjusting for non-controlling interest, cash taxes, distributions from the Mountain Valley

Pipeline, deferred revenue, changes in net working capital, and capital expenditures. The residual value of Equitrans at the end of the

forecast period, or “terminal value,” was estimated by selecting a range of terminal value multiples based on EBITDA for the

period ending December 31, 2028, of 8.00x to 9.00x, which was derived by Barclays utilizing its professional judgment and experience

and by analyzing the results from the selected comparable company analysis and precedent transaction analysis and applying such

range to Equitrans’ 2028 Economic Adjusted EBITDA, which was further adjusted to (x) deduct the Mountain Valley Pipeline’s

Adjusted EBITDA excluding the proportionate effects of any non-controlling/minority interests and (y) add distributions received from

the Mountain Valley Pipeline, as set out in the Equitrans Projections. Barclays then calculated a range of implied prices per share of

Equitrans common stock by subtracting an Equitrans management provided estimate of net debt and preferred equity, each as of March 31,

2024, and together totaling approximately $8.3 billion, from the estimated enterprise value using the discounted cash flow

method and dividing such amount by the approximately 444.8 million fully diluted number of shares

of Equitrans common stock outstanding, as provided by Equitrans management. This analysis implied a range of prices per

share of Equitrans common stock of $9.75 to $13.50.

The third paragraph after the sub-heading “Discounted

Cash Flow Analysis” on Page 112 is hereby supplemented by amending and restating such paragraph as follows:

To calculate the estimated

enterprise value of EQT using the discounted cash flow method, Barclays added (i) projected after-tax unlevered free cash flows for 2Q

2024 through calendar year 2028 based on the EQT Projections to (ii) the “terminal value” of EQT, as of December 31, 2028,

and discounted such amount to its present value using a range of selected after-tax discount rates. Specifically, Barclays used an after-tax

discount rate range of 8.0% to 9.0%. The after-tax discount rates were based on Barclays’ analysis of the weighted average cost

of capital for EQT as well as the weighted average cost of capital for the EQT selected comparable companies. The after-tax unlevered

free cash flows were calculated by taking the earnings before interest, tax expense, depreciation and amortization and subtracting cash

taxes, other income (expense), capital expenditures and adjusting for changes in working capital. The terminal value was estimated by

selecting a range of terminal value multiples based on EBITDA for the period ending December 31, 2028, of 4.00x to 5.00x, which was derived

by Barclays utilizing its professional judgment and experience and by analyzing the results from the selected comparable

company analysis and precedent transaction analysis and applying such range to EQT’s 2028 estimated EBITDA, as set out in the EQT

Projections. Barclays then calculated a range of implied prices per share of EQT common stock by subtracting an EQT management estimate

of net debt and preferred equity, each as of March 31, 2024, and together totaling approximately $5.0 billion, from the

estimated enterprise value using the discounted cash flow method and dividing such amount by the approximately 446.8 million

fully diluted number of shares of EQT common stock, as provided by EQT management. This analysis

implied a range of prices per share of EQT common stock of $35.00 to $44.25.

The third sentence of the third paragraph after

the sub-heading “Net Asset Valuation Analysis” on Page 112 is hereby supplemented by amending and restating such sentence

as follows:

Specifically, Barclays,

utilizing its professional judgment and experience, used a discount rate range of 8.0% to 9.0%.

The second sentence of the first paragraph

after the sub-heading “Leveraged Acquisition Analysis” on Page 113 is hereby supplemented by amending and restating

such sentence as follows:

Based

upon its professional judgment and experience and taking into account then-current market conditions, Barclays assumed

the following in its analysis: (i) the existing capital structure, as of the date of Barclays’ opinion, (ii) an equity investment

that would achieve an internal rate of return of 17.50% to 22.50% on equity invested during a 4.75-year period, and (iii) a projected

EBITDA terminal value multiple of 8.00x to 9.00x for such period. Based upon these assumptions, Barclays calculated a range of implied

prices per share of Equitrans common stock of $8.00 to $10.50.

The second sentence of the first paragraph

after the sub-heading “Equity Research Price Target Analysis” on Page 113 is hereby supplemented by amending and restating

such sentence as follows:

The range of price targets

for Equitrans common stock was $10.00 to $15.00 per share as of March 8, 2024, with a median price target of $11.50 and a mean price

target of $11.87, and the range of price targets for EQT common stock was $28.39 to $55.00 per share as of March 8, 2024,

with a median price target of $45.00 and a mean price target of $43.22.

The second paragraph after the sub-heading

“General” on Page 113 is hereby supplemented by adding the following as a new last sentence:

In addition, the Equitrans

Board has been made aware that EQT is currently contemplating an increase in the size of its existing credit facility and, on July 11,

2024, Equitrans consented to Barclays’ potential participation as a lender in such potential increase (pursuant to which Barclays

would expect to receive additional fees from EQT if Barclays participates).

The second sentence of the eleventh paragraph

after the sub-heading “Opinion of Citigroup Global Markets Inc., Financial Advisor to Equitrans” on Page 117 is hereby

supplemented by amending and restating such sentence as follows:

No

company, business or transaction reviewed is identical or directly comparable to Equitrans, EQT or the Merger nor, except as otherwise

disclosed, were individual multiples derived from the selected public companies or selected precedent transactions

independently determinative of the results of such analyses, and an evaluation of these analyses is not entirely mathematical;

rather, the analyses involve complex considerations and judgments concerning financial and operating characteristics and other factors

that could affect the public trading, acquisition or other values of the companies, businesses or transactions reviewed or the results

of any particular analysis.

The fifth paragraph after the sub-heading “Selected

Public Companies Analyses” on Page 119 is hereby supplemented by amending and restating such paragraph as follows:

Citi applied (i) selected

ranges of calendar year 2024 and calendar year 2025 estimated EBITDA multiples derived from the Equitrans selected companies of 8.6x to

9.2x (with particular focus on the overall low and median calendar year 2024 estimated EBITDA multiples observed for the Equitrans

selected companies) and 8.2x to 9.7x (with particular focus on the overall low calendar year 2025 estimated EBITDA multiple

observed for the Equitrans selected companies and the calendar year 2025 estimated adjusted EBITDA multiple observed for Equitrans),

respectively, to the calendar year 2024 and calendar year 2025 estimated economic adjusted EBITDA of Equitrans, respectively, and (ii) selected

ranges of calendar year 2024 and calendar year 2025 estimated CAFD multiples derived from the Equitrans selected companies of 6.2x to

7.5x (with particular focus on the overall low and median calendar year 2024 estimated CAFD multiples observed for the Equitrans

selected companies) and 5.8x to 7.0x (with particular focus on the overall low and median calendar year 2025 estimated CAFD

multiples observed for the Equitrans selected companies), respectively, to corresponding data of Equitrans, in each case based

on financial forecasts and other information and data relating to Equitrans.

The tenth paragraph after the sub-heading “Selected

Public Companies Analyses” on Page 119 is hereby supplemented by amending and restating such paragraph as follows:

Citi applied (i) selected

ranges of calendar year 2024 and calendar year 2025 estimated EBITDA multiples derived from the EQT selected companies of 6.5x to 8.1x

(with particular focus on the calendar year 2024 estimated EBITDA multiple observed for EQT and the overall high calendar year 2024

estimated EBITDA multiple observed for the EQT selected companies) and 4.3x to 6.1x (with particular focus on the calendar

year 2025 estimated EBITDA multiple observed for EQT and the overall high calendar year 2025 estimated EBITDA multiple observed for the

EQT selected companies), respectively, to corresponding data of EQT and (ii) selected ranges of calendar year 2024 and calendar

year 2025 estimated CFPS multiples derived from the EQT selected companies of 5.7x to 8.2x (with particular focus on the calendar

year 2024 estimated CFPS multiple observed for EQT and the overall high calendar year 2024 estimated CFPS multiple observed for the EQT

selected companies) and 4.1x to 5.8x (with particular focus on the calendar year 2025 estimated CFPS multiple observed for

EQT and the overall high calendar year 2025 estimated CFPS multiple observed for the EQT selected companies), respectively, to

corresponding data of EQT, in each case based on financial forecasts and other information and data relating to EQT.

The second sentence of the fourth paragraph

after the sub-heading “Equitrans Selected Precedent Transaction Analysis” on Page 121 is hereby supplemented by amending

and restating such sentence as follows:

Citi applied a selected range

of next 12 months estimated EBITDA multiples derived from the selected G&P transactions of 6.3x to 8.0x (with particular

focus on the overall median and high next 12 months estimated EBITDA multiples observed for the selected G&P transactions) to

the calendar year 2024 estimated economic adjusted EBITDA attributable to each of Equitrans’ natural gas gathering system and joint

venture interest in Eureka.

The second sentence of the seventh paragraph

after the sub-heading “Equitrans Selected Precedent Transaction Analysis” beginning on Page 121 is hereby supplemented

by amending and restating such sentence as follows:

Citi applied a selected range

of next 12 months estimated EBITDA multiples derived from the selected T&S transactions of 9.7x to 11.0x (with particular

focus on the overall 25th percentile and 75th percentile next 12 months estimated EBITDA multiples observed for the selected T&S transactions)

to the calendar year 2024 estimated economic adjusted EBITDA attributable to each of Equitrans’ transmission and storage

system and joint venture interest in MVP.

The second sentence of the tenth paragraph

after the sub-heading “Equitrans Selected Precedent Transaction Analysis” on Page 122 is hereby supplemented by amending

and restating such sentence as follows:

Citi applied a selected range

of next 12 months estimated EBITDA multiples derived from the selected water transactions of 3.2x to 5.0x (with particular

focus on the overall 25th percentile and 75th percentile next 12 months estimated EBITDA multiples observed for the selected water transactions)

to the calendar year 2024 estimated economic adjusted EBITDA attributable to Equitrans’ water network.

The second sentence of the first paragraph

after the sub-heading “EQT Net Asset Value Analysis” on Page 122 is hereby supplemented by amending and restating such

sentence as follows:

The present values (as of

January 1March 31, 2024) of the cash flows were then calculated using a selected range of discount

rates of 9.5% to 10.3% derived from a weighted average cost of capital calculation.

The third sentence of the second paragraph

after the sub-heading “Discounted Cash Flow Analyses” on Page 123 is hereby supplemented by amending and restating

such sentence as follows:

Citi calculated terminal values

for Equitrans by applying to Equitrans’ fiscal year 2028 estimated economic adjusted EBITDA a selected range

of EBITDA multiples of 8.0x to 9.0x selected based on Citi’s professional judgment.

The fourth sentence of the second paragraph

after the sub-heading “Discounted Cash Flow Analyses” on Page 123 is hereby supplemented by amending and restating

such sentence as follows:

The present values (as of

March 31, 2024) of the cash flows and terminal values were then calculated using a selected range of discount rates of 9.3% to 10.2%

derived from a weighted average cost of capital calculation.

The third sentence of the third paragraph after

the sub-heading “Discounted Cash Flow Analyses” on Page 123 is hereby supplemented by amending and restating such sentence

as follows:

Citi calculated terminal values

for EQT by applying to EQT’s fiscal year 2028 estimated EBITDA a selected range of EBITDA multiples of 4.9x

to 6.2x selected based on Citi’s professional judgment.

The fourth sentence of the third paragraph

after the sub-heading “Discounted Cash Flow Analyses” on Page 123 is hereby supplemented by amending and restating

such sentence as follows:

The present values (as of

March 31, 2024) of the cash flows and terminal values were then calculated using a selected range of discount rates of 9.5% to 10.3%

derived from a weighted average cost of capital calculation.

The third bullet point of the fourth paragraph

after the sub-heading “Certain Additional Information” on Page 124 is hereby supplemented by amending and restating

such paragraph as follows:

| · | the

implied premiums paid or proposed to be paid in 15 selected merger and acquisition transactions announced during the ten-year

period ended March 8, 2024 involving target companies with operations in the midstream energy industry; applying a selected range

of implied premiums of 0.0% to 22.0% (reflecting the 25th and 75th percentile implied premiums derived from such transactions based

on the closing share or unit prices of the target companies involved in such transactions one day prior to consummation of the applicable

transaction) to the closing price of Equitrans common stock on March 8, 2024 of $11.15 per share indicated an approximate implied

equity value reference range for Equitrans of approximately $11.15 to $13.60 per share. |

The second sentence of the second paragraph

after the sub-heading “Miscellaneous” on Page 124 is hereby supplemented by amending and restating such sentence as

follows:

As the Equitrans Board also

was aware, Citi and its affiliates in the past have provided, currently are providing and in the future may provide investment banking,

commercial banking and other similar financial services to EQT and/or certain of its affiliates, for which services Citi and its affiliates

received and expect to receive compensation, including, during the approximately two-year period prior to the date of Citi’s opinion,

having acted or acting as (i) co-syndication agent, co-documentation agent, joint lead arranger and/or bookrunner for, and as a lender

under, certain credit facilities of EQT, including in connection with an existing credit facility of EQT, the principal amount of

which is currently contemplated by EQT to be increased for which allocated commitments have not yet been determined but pursuant to which

Citi would expect to receive additional fees from EQT if Citi were to participate as a lender (and with respect to which Citi’s potential participation

has been consented to by Equitrans and the Equitrans Board), and (ii) joint book-running manager for certain

debt securities offerings of EQT, for which services described in the foregoing clauses (i) and (ii) Citi and its affiliates received

aggregate fees during such period of approximately $2 million.

The second paragraph after the sub-heading

“Miscellaneous” on Page 124 hereby supplemented by adding the following as a new fourth sentence:

As of March 8, 2024,

Citi and its affiliates held approximately 538,872 shares of Equitrans common stock (with an implied aggregate value of approximately

$6 million based on the closing price of Equitrans common stock on March 8, 2024 of $11.15 per share) and approximately 767,060 shares

of EQT common stock (with an implied aggregate value of approximately $28.8 million based on the closing price of EQT common stock on

March 8, 2024 of $37.52 per share).

The first paragraph after the heading “Board

of Directors and Management of EQT Following Completion of the Merger” on Page 131 is hereby supplemented by adding the following

as a new final sentence

Other officers of Equitrans

may continue employment with EQT following the Closing, but terms of their continued employment were not discussed prior to the date of

the Merger Agreement.

Cautionary Statements Regarding Forward-Looking Statements

This report (this report) contains “forward-looking statements”

within the meaning of the federal securities laws. Forward-looking statements may be identified by words such as “anticipates,”

“believes,” “cause,” “continue,” “could,” “depend,” “develop,”

“estimates,” “expects,” “forecasts,” “goal,” “guidance,” “have,”

“impact,” “implement,” “increase,” “intends,” “lead,” “maintain,”

“may,” “might,” “plans,” “potential,” “possible,” “projected,”

“reduce,” “remain,” “result,” “scheduled,” “seek,” “should,” “will,”

“would” and other similar words or expressions. The absence of such words or expressions does not necessarily mean the statements

are not forward-looking. Forward-looking statements are not statements of historical fact and reflect Equitrans’ and EQT’s

current views about future events. These forward-looking statements include, but are not limited to, statements regarding the Merger and

the timing thereof. Although Equitrans believes the forward-looking statements are reasonable, statements made regarding future results

are not guarantees of future performance and are subject to numerous assumptions, uncertainties and risks that are difficult to predict.

Actual outcomes and results may be materially different from the results stated or implied in such forward-looking statements included

in this report.

Actual outcomes and results may differ materially from those included

in the forward-looking statements in this report due to a number of factors, including, but not limited to: the occurrence of any event,

change or other circumstances that could give rise to the termination of the Merger Agreement; the possibility that shareholders of EQT

may not approve the issuance of EQT common stock or the amendment to EQT’s charter in connection with the Merger; the possibility

that the shareholders of Equitrans may not adopt the Merger Agreement; the risk that required governmental and regulatory approvals may

delay the Merger or result in the imposition of conditions that could cause the parties to abandon the Merger; the risk that the parties

may not be able to satisfy the conditions to the Merger in a timely manner or at all; risks related to disruption of management’s

time from ongoing business operations due to the Merger; the risk that any announcements relating to the Merger could have adverse effects

on the market price of EQT common stock or Equitrans common stock; the risk of any unexpected costs or expenses resulting from the Merger;

the risk of any litigation relating to the Merger; the risk that the Merger and its announcement could have an adverse effect on the ability

of Equitrans and EQT to retain and hire key personnel, on the ability of EQT or Equitrans to attract third-party customers and maintain

their relationships with derivatives and joint venture counterparties and on EQT’s and Equitrans’ operating results and businesses

generally; the risk that problems may arise in successfully integrating the businesses of Equitrans and EQT, which may result in the combined

company not operating as effectively and efficiently as expected; the risk that the combined company may be unable to achieve synergies

or other anticipated benefits of the Merger or it may take longer than expected to achieve those synergies or benefits and other important

factors that could cause actual results to differ materially from those projected; the volatility in commodity prices for crude oil and

natural gas; Equitrans’ ability to satisfy the condition in the Merger Agreement relating to the Federal Energy Regulatory

Commission authorization regarding in service of the Mountain Valley Pipeline project as of the closing date of the Merger; the effect

of future regulatory or legislative actions on Equitrans and EQT or the industry in which they operate, including the risk of new restrictions

with respect to oil and natural gas development activities; the risk that the credit ratings of the combined business may be different

from what Equitrans and EQT expect; the ability of management to execute its plans to meet its goals and other risks inherent in Equitrans’

and EQT’s businesses; public health crises, such as pandemics and epidemics, and any related government policies and actions; the

potential disruption or interruption of EQT’s or Equitrans’ operations due to war, accidents, political events, civil unrest,

severe weather, cyber threats, terrorist acts, or other natural or human causes beyond EQT’s or Equitrans’ control; the combined

company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and other

factors detailed in EQT’s and Equitrans’ Annual Reports on Form 10-K for the year ended December 31, 2023 and subsequent Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. All such factors are difficult to predict and are beyond EQT’s and Equitrans’

control. Additional risks or uncertainties that are not currently known to EQT or Equitrans, that EQT or Equitrans currently deem to be

immaterial, or that could apply to any company could also cause actual outcomes and results to differ materially from those included in

the forward-looking statements in this report. Equitrans and EQT undertake no obligation to publicly correct or update the forward-looking

statements in this report, in other documents or on their respective websites to reflect new information, future events or otherwise,

except as required by applicable law. All such statements are expressly qualified by this cautionary statement. Readers are cautioned

not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Important

Information for Investors and Shareholders; Additional Information and Where to Find It

In connection with the Merger, EQT filed with the U.S. Securities and Exchange Commission (the SEC) a registration statement on Form

S-4 (the registration statement) that includes a joint proxy statement of Equitrans and EQT and that also constitutes a prospectus of

EQT. The registration statement was declared effective by the SEC on June 4, 2024, and Equitrans and EQT commenced mailing the definitive

joint proxy statement/prospectus (the joint proxy statement/prospectus) to their respective shareholders on or around June 5, 2024. Equitrans

and EQT also intend to file other documents regarding the Merger with the SEC. This document is not a substitute for the joint proxy

statement/prospectus or the registration statement or any other document that Equitrans or EQT may file with the SEC. BEFORE MAKING ANY

VOTING DECISION, INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER

RELEVANT DOCUMENTS FILED OR THAT MAY BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THOSE DOCUMENTS, AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT EQUITRANS, EQT, THE MERGER,

THE RISKS THERETO AND RELATED MATTERS. Investors will be able to obtain free copies of the registration statement and joint proxy statement/prospectus

and other relevant documents filed or that will be filed with the SEC by Equitrans or EQT through the website maintained by the SEC at www.sec.gov.

Copies of the documents filed with the SEC by Equitrans may be obtained free of charge on Equitrans’ website at www.ir.equitransmidstream.com.

Copies of the documents filed with the SEC by EQT may be obtained free of charge on EQT’s website at www.ir.eqt.com/investor-relations.

No Offer

or Solicitation

This report relates to the Merger. This report is for informational purposes only and shall not constitute an offer to sell

or exchange, or the solicitation of an offer to buy or exchange, any securities or a solicitation of any vote or approval, in any jurisdiction,

pursuant to the report or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this

document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EQUITRANS MIDSTREAM CORPORATION |

| |

|

| Date: July 11, 2024 |

|

By: |

/s/ Kirk R. Oliver |

| |

|

Name: |

Kirk R. Oliver |

| |

|

Title: |

Executive Vice President and Chief Financial Officer |

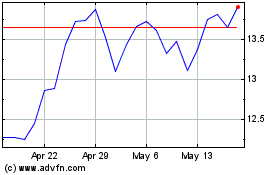

Equitrans Midstream (NYSE:ETRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

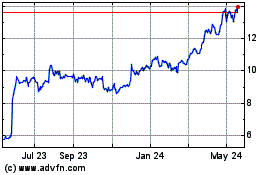

Equitrans Midstream (NYSE:ETRN)

Historical Stock Chart

From Jul 2023 to Jul 2024