Vertical Aerospace Ltd. (“Vertical” or the “Company”) (NYSE:

EVTL, EVTLW), a global aerospace and technology company pioneering

electric aviation, today announced a one-for-ten (1:10) reverse

share split of its issued and unissued ordinary shares (the

“ordinary shares”) and preferred shares, par value $0.0001 per

share (the “Reverse Share Split”).

The Reverse Share Split will become effective at 4:01 p.m.

Eastern Time on September 20, 2024 (the “Effective Date”). The

Company’s ordinary shares will begin trading on a split-adjusted

basis when the New York Stock Exchange (“NYSE”) opens for trading

on Monday, September 23, 2024 (i.e., the first trading day

following the Effective Date) under the existing trading symbol

“EVTL,” but the ordinary shares will trade under a new CUSIP

number, G9471C206. The Company’s outstanding public warrants will

continue to be traded under the symbol “EVTLW” and the CUSIP number

for such public warrants will remain unchanged.

The Company obtained shareholders’ approval for the Reverse

Share Split at a ratio of between 1-for-5 and 1-for-20 at the

Company’s annual general meeting of the shareholders held on

September 16, 2024, with the final decision of whether to proceed

with the Reverse Share Split, the effective time of the Reverse

Share Split, and the final reverse share split ratio to be

determined by the Company’s board of directors in its sole

discretion. On September 16, 2024, the Company’s board of directors

approved the reverse share split ratio of 1-for-10 and the

Effective Date for the Reverse Share Split.

The Reverse Share Split is intended to increase the per share

trading price of the ordinary shares to enable the Company to

regain compliance with the minimum share price criteria of Section

802.01C of the NYSE Listed Company Manual. As a result of the

Reverse Share Split, every ten issued and unissued ordinary shares

will automatically be converted into one ordinary share, and every

ten preferred shares will automatically be converted into one

preferred share. The Reverse Share Split will also result in a

proportional decrease in the number of authorized ordinary shares

and preferred shares, and a proportional increase in the par value

of the ordinary shares and preferred shares, in each case in

accordance with the reverse share split ratio. Upon effectiveness

of the Reverse Shares Split, the Company will be authorized to

issue 100,000,000 ordinary shares, par value US$0.001 per ordinary

share, and 10,000,000 preferred shares, par value US$0.001 per

preferred share.

No fractional shares will be issued as a result of the Reverse

Share Split. Instead, in lieu of any fractional shares to which a

shareholder of record would otherwise be entitled as a result of

the Reverse Share Split, the shareholder of record will be entitled

to receive a pro rata portion of the net proceeds obtained from the

aggregation and sale by the Company’s exchange agent, Continental

Stock Transfer & Trust Company, of the fractional shares

resulting from the Reverse Share Split (reduced by any customary

brokerage fees, commissions and other expenses). Except for

adjustments that may result from the treatment of fractional shares

as described below, the Reverse Share Split will affect all

shareholders uniformly. The proportionate voting rights and other

rights and preferences of the holders of the Company’s ordinary

shares will not be affected by the Reverse Share Split (other than

as a result of the payment of cash in lieu of fractional

shares).

The Reverse Share Split will also affect the ordinary shares

issuable under the Company’s 2021 Incentive Award Plan as well as

the Company’s outstanding warrants, convertible notes and options.

Generally, the documents pertaining to these instruments include

provisions providing for proportionate adjustments to be made in

the event of a reverse share split. Specifically, the exercise

price and the number of ordinary shares issuable pursuant to these

instruments will be adjusted pursuant to the terms of such

instruments in connection with the Reverse Share Split.

For the Company’s public warrants, as a result of the Reverse

Share Split, each public warrant will be automatically adjusted to

become exercisable for 1/10 of one ordinary share, meaning that ten

(10) public warrants must be exercised for a holder of public

warrants to receive one (1) ordinary share of the Company following

the Reverse Share Split. The warrant price will also be

automatically adjusted to reflect the Reverse Share Split, such

that the exercise price for a holder of public warrants to receive

one (1) ordinary share of the Company following the Reverse Share

Split will amount to $115.00. Pursuant to the terms of the public

warrants, no fractional shares will be issued upon exercise of the

public warrants following the Reverse Share Split. If, by reason of

the adjustments to the public warrants made in relation to the

Reverse Share Split, the holder of any public warrant would be

entitled, upon the exercise of such warrant, to receive a

fractional interest in a share, the Company will, upon such

exercise, round down to the nearest whole number the number of

ordinary shares to be issued to the warrant holder.

Additional information regarding the Reverse Share Split can be

found in the Company’s circular to the Company’s shareholders

furnished to the Securities and Exchange Commission on a Form 6-K

on August 16, 2024.

About Vertical Aerospace

Vertical Aerospace is a global aerospace and technology company

pioneering electric aviation.

Vertical is creating a safer, cleaner and quieter way to travel.

Vertical’s VX4 is a piloted, four passenger, Electric Vertical

Take-Off and Landing (eVTOL) aircraft, with zero operating

emissions. Vertical combines partnering with leading aerospace

companies, including GKN, Honeywell and Leonardo, with developing

its own proprietary battery and propeller technology to develop the

world’s most advanced and safest eVTOL.

Vertical has 1,500 pre-orders of the VX4 worth $6bn, with

customers across four continents, including Virgin Atlantic,

American Airlines, Japan Airlines, GOL and Bristow. Headquartered

in Bristol, the epicentre of the UK’s aerospace industry, Vertical

was founded in 2016 by Stephen Fitzpatrick, founder of the OVO

Group, Europe’s largest independent energy retailer.

Vertical’s experienced leadership team comes from top tier

automotive and aerospace companies such as Rolls-Royce, Airbus, GM

and Leonardo. Together they have previously certified and supported

over 30 different civil and military aircraft and propulsion

systems.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995 that relate to our current expectations and views of future

events. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements as

contained in Section 27A of the Securities Act and Section 21E of

the Exchange Act. Any express or implied statements contained in

this press release that are not statements of historical fact may

be deemed to be forward-looking statements, including, without

limitation, statements regarding the Company’s ability to regain

compliance with the minimum share price criteria for maintaining

its listing on the NYSE, design and manufacture of the VX4,

business strategy and plans and objectives of management for future

operations, as well as statements that include the words “expect,”

“intend,” “plan,” “believe,” “project,” “forecast,” “estimate,”

“may,” “should,” “anticipate,” “will,” “aim,” “potential,”

“continue,” “are likely to” and similar statements of a future or

forward-looking nature. Forward-looking statements are neither

promises nor guarantees, but involve known and unknown risks and

uncertainties that could cause actual results to differ materially

from those projected, including, without limitation the important

factors discussed under the caption “Risk Factors” in our Annual

Report on Form 20-F filed with the U.S. Securities and Exchange

Commission (“SEC”) on March 14, 2024, as such factors may be

updated from time to time in our other filings with the SEC. Any

forward-looking statements contained in this press release speak

only as of the date hereof and accordingly undue reliance should

not be placed on such statements. We disclaim any obligation or

undertaking to update or revise any forward-looking statements

contained in this press release, whether as a result of new

information, future events or otherwise, other than to the extent

required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240916190572/en/

Justin Bates, Head of Communications

justin.bates@vertical-aerospace.com +44 7878 357 463

Samuel Emden, Head of Investor Affairs

samuel.emden@vertical-aerospace.com +44 7816 459 904

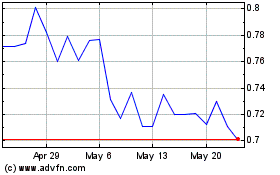

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Mar 2024 to Mar 2025