Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

September 27 2023 - 5:14AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

September 2023

Commission File Number: 001-35158

PHOENIX NEW MEDIA LIMITED

Sinolight Plaza, Floor 16

No. 4 Qiyang Road

Wangjing, Chaoyang District, Beijing, 100102

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

TABLE OF CONTENTS

Exhibit 99.1 — Press release: Phoenix New Media Announces up to US$2 Million Share Repurchase Program

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

PHOENIX NEW MEDIA LIMITED |

|

|

|

|

By: |

|

/s/ Edward Lu |

|

|

Name: |

|

Edward Lu |

|

|

Title: |

|

Chief Financial Officer |

|

Date: September 27, 2023 |

|

|

3

Exhibit 99.1

Phoenix New Media Announces up to US$2 Million Share Repurchase Program

BEIJING, China, September 27, 2023 — Phoenix New Media Limited (NYSE: FENG) (“Phoenix New Media”, “ifeng” or the “Company”), a leading new media company in China, today announced that the board of directors of the Company has approved a new share repurchase program. Under the terms of the approved program, the Company may repurchase up to US$2 million worth of its outstanding American depositary shares (“ADSs”), each representing 48 Class A ordinary shares of the Company, from time to time for a period not to exceed five (5) months starting from September 27, 2023, the effective date of the program. The Company expects to fund the repurchases made under this program from its existing cash balance. The repurchases may be made in open market transactions at prevailing market prices, including pursuant to any trading plan that may be established in compliance with Rule 10b-18 and Rule 10b5-1 under the U.S. Securities Exchange Act of 1934, as amended, or through privately negotiated transactions or block trades, or by any combination of the foregoing. The timing and extent of any repurchases will depend on market conditions, the trading price of the Company’s ADSs and other factors. The plan will be implemented in compliance with relevant United States securities laws and regulations and the Company’s securities trading policy. The Company’s board of directors will review the share repurchase program periodically and may authorize adjustment of its terms and size accordingly. The Company has no obligation to repurchase any amounts under the program.

About Phoenix New Media Limited

Phoenix New Media Limited (NYSE: FENG) is a leading new media company providing premium content on an integrated Internet platform, including PC and mobile, in China. Having originated from a leading global Chinese language TV network based in Hong Kong, Phoenix TV, the Company enables consumers to access professional news and other quality information and share user-generated content on the Internet through their PCs and mobile devices. Phoenix New Media's platform includes its PC channel, consisting of ifeng.com website, which comprises interest-based verticals and interactive services; its mobile channel, consisting of mobile news applications, mobile video application, digital reading applications and mobile Internet website; and its operations with the telecom operators that provides mobile value-added services.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the statements about the funding, timing and manner of the repurchases in this announcement contain forward-looking statements. Phoenix New Media may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (“SEC”) on Forms 20-F and 6-K, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Phoenix New Media’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s goals and strategies; the Company’s future business development, financial condition and results of operations; the expected growth of online and mobile advertising, online video and mobile paid services markets in China; the Company’s reliance on online and mobile advertising for a majority of its total revenues; the Company’s expectations regarding demand for and market acceptance of its services; the Company’s expectations regarding maintaining and strengthening its relationships with advertisers, partners and customers; the Company’s investment plans and strategies; fluctuations in the Company’s quarterly operating results; the Company’s plans to enhance its user experience, infrastructure and services offerings; competition in its industry in China; relevant government policies and regulations relating to the Company; and the effects of the COVID-19 on the economy in China in general and on the Company’s business in particular. Further information regarding these and other risks is included in the Company’s filings with the SEC, including its annual reports on Form 20-F. All information provided in this press release is as of the date of this press release, and Phoenix New Media does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries please contact:

Phoenix New Media Limited

Muzi Guo

Email: investorrelations@ifeng.com

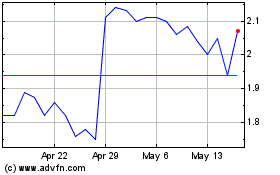

Phoenix New Media (NYSE:FENG)

Historical Stock Chart

From Feb 2025 to Mar 2025

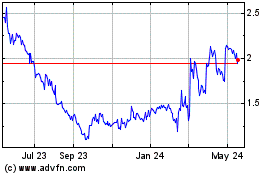

Phoenix New Media (NYSE:FENG)

Historical Stock Chart

From Mar 2024 to Mar 2025