FICO UK Credit Card Market Report: October 2024

December 18 2024 - 3:00AM

Business Wire

Payments to balance unexpectedly increase –

albeit marginally – as spend and balances fall in typical seasonal

patterns

Following expected seasonal trends between summer and Christmas,

October 2024 saw sales and credit card balances drop,

month-on-month according to data from global analytics software

leader FICO. However, the high cost of living that has been a

feature of 2024 means spending remained 1% higher than the same

period in 2023.

In contrast, the percentage of balance paid went against the

usual trend of dropping from August until the end of the year, with

marginal month-on-month increases seen in September and October. In

September, there was a 1.3% increase, while October showed a 0.3%

increase, taking the percentage of balance paid to 37.2%. However,

again reflecting the financial pressure on households in 2024, both

months are lower than the previous year, by 2.5% and 1.5%

respectively.

Highlights

- Sales dropped 5.5% month on month to an average of £790 in

October but have increased by 1% on the previous year

- After a 0.5% increase in September, average balances

experienced the usual pre-Christmas drop – down 0.9% to an average

of £1,815 in October

- Bucking the usual annual trend, there were marginal increases

in the percentage of balance paid in September and October

- The pattern of late payments has also stabilised year-on-year,

with an increase only in the percentage of cardholders missing

three payments compared to October 2023

- The percentage of customers using cash on credit cards dropped

in October to 3.45%, having peaked in September at 3.54%

FICO Comment

Compared to all vintages of credit card holders, veteran

customers (who have had their credit card for five years or more)

have the highest delinquent balances for those missing two or three

payments. This group also has the highest average credit limit.

Whilst it is expected that this group of customers may have higher

credit limits as they have had their cards for longer and will

probably have been offered limit increases at some point, their

average active balance is lower than for the new or established

groups of card holders.

Given the continued financial pressures affecting households,

risk managers should review both limit management and collections

contact strategies, with a particular focus on the veteran customer

group. These customers may be missing payments for the first time

and may need more tailored support.

For habitual late payers, they may have become accustomed to the

same collections contact methods each time they miss payments.

Shuffling when treatment is actioned for these customers, and

incorporating different communications channels by adding in rules

looking at ‘number of times missed one / two / three payments last

12 months’, could help improve collection performance on higher

balances.

Key Trend Indicators – UK Cards October

2024

Metric

Amount

Month-on-Month Change

Year-on-Year Change

Average UK Credit Card Spend

£790

-5.5%

+1%

Average Card Balance

£1,815

-0.9%

+5.2%

Percentage of Payments to Balance

37.17%

+0.3%

-1.5%

Accounts with One Missed Payment

1.46%

+3.8%

-8.6%

Accounts with Two Missed Payments

0.32%

+0.3%

-4.9%

Accounts with Three Missed Payments

0.2%

-3.1%

0.3%

Average Credit Limit

£5,765

+0.2%

+2.8%

Average Overlimit Spend

£90

+4.6%

+1.1%

Cash Sales as a % of Total Sales

0.87%

-3.7%

-7.6%

Source: FICO

These card performance figures are part of the data shared with

subscribers of the FICO® Benchmark Reporting Service. The data

sample comes from client reports generated by the FICO® TRIAD®

Customer Manager solution in use by some 80% of UK card

issuers. For more information on these trends, contact FICO.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 80 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency. Learn more at

www.fico.com.

FICO and TRIAD are registered trademarks of Fair Isaac

Corporation in the U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241218301439/en/

For further press information please contact: FICO UK

PR Team Wendy Harrison/Parm Heer ficoteam@harrisonsadler.com

0208 977 9132

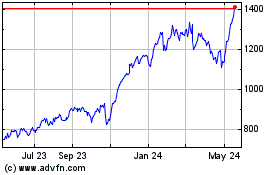

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Nov 2024 to Dec 2024

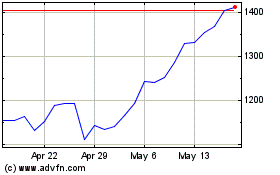

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Dec 2023 to Dec 2024