Gatos Silver, Inc. (NYSE/TSX: GATO) (“Gatos Silver” or the

“Company”) today announced production results for the quarter and

year ended December 31, 2024 at its 70%-owned Cerro Los Gatos

(“CLG”) mine in Mexico. Silver production was at the top end of the

2024 guidance range and silver equivalent production was slightly

above the top end of the 2024 guidance range. Guidance for both

metrics was upwardly revised in October 2024.

Dale Andres, CEO of Gatos Silver, commented:

“The CLG mine delivered another excellent quarter of production to

end another very strong year in 2024. We achieved our eighth

consecutive quarterly record for mill throughput in the fourth

quarter of 2024, with an average throughput rate of above 3,300

tonnes per day, which is 33% above the original design capacity.

Production across all of our metals met or slightly exceeded the

top end of our upwardly revised 2024 guidance ranges, which is a

testament to the dedication and effort of our CLG operating team.

The solid progress we made in 2024 on increasing mining and milling

rates and on our near mine and greenfield exploration programs

position the Company well to deliver significant value into the

combination with First Majestic.”

2024 CLG Production Results Compared

with Guidance (100% basis)

|

Contained Metal |

Original 2024 Guidance |

Updated 2024 Guidance |

2024Actual |

|

Silver ounces (millions) |

8.4 – 9.2 |

9.2 – 9.7 |

9.68 |

|

Zinc pounds - in zinc conc. (millions) |

61 – 69 |

61 – 69 |

69.7 |

|

Lead pounds - in lead conc. (millions) |

40 – 46 |

40 – 46 |

46.4 |

|

Gold ounces - in lead conc. (thousands) |

4.5 – 5.5 |

4.5 – 5.5 |

5.53 |

|

Silver Equivalent ounces (millions)1 |

13.5 – 15.0 |

14.7 – 15.5 |

15.57 |

1 Silver equivalent production is calculated using prices of

US$23/oz silver, US$1.20/lb zinc, US$0.90/lb lead and US$1,800/oz

gold to “convert” zinc, lead and gold production contained in

concentrate to “equivalent” silver ounces (contained metal,

multiplied by price, divided by silver price).

As shown in the table above, 2024 silver production was 9.68

million ounces, compared with guidance as upwardly revised in

October 2024, of 9.2 million ounces to 9.7 million ounces. Silver

equivalent production was 15.57 million ounces, slightly above the

high end of guidance at 15.5 million ounces as upwardly revised in

October 2024. Zinc production of 69.7 million pounds, lead

production of 46.4 million pounds, and gold production of 5.53

thousand ounces were all slightly above the high end of guidance,

which did not change during 2024.

Production Results (100%

basis)

CLG comparative production highlights are

summarized below:

|

|

Three Months Ended December

31, |

Year EndedDecember 31, |

|

CLG Production |

2024 |

2023 |

2024 |

2023 |

|

Tonnes milled (dmt) |

305,807 |

277,318 |

1,191,377 |

1,071,400 |

|

Tonnes milled per day (dmt) |

3,324 |

3,014 |

3,255 |

2,935 |

|

Feed Grades |

|

|

|

|

|

Silver (g/t) |

294 |

318 |

284 |

299 |

|

Zinc (%) |

4.28 |

3.86 |

4.22 |

3.90 |

|

Lead (%) |

2.17 |

1.86 |

2.00 |

1.85 |

|

Gold (g/t) |

0.26 |

0.30 |

0.29 |

0.29 |

|

Contained Metal |

|

|

|

|

|

Silver ounces (millions) |

2.58 |

2.56 |

9.68 |

9.21 |

|

Zinc pounds - in zinc conc. (millions) |

18.3 |

14.6 |

69.7 |

57.3 |

|

Lead pounds - in lead conc. (millions) |

12.9 |

10.2 |

46.4 |

38.9 |

|

Gold ounces - in lead conc. (thousands) |

1.33 |

1.39 |

5.53 |

5.26 |

|

Silver Equivalent ounces (millions)1 |

4.15 |

3.88 |

15.57 |

14.33 |

|

Recoveries |

|

|

|

|

|

Silver - in both lead and zinc concentrates |

89.4% |

90.3% |

88.9% |

89.4% |

|

Zinc - in zinc concentrate |

63.3% |

61.8% |

63.0% |

62.1% |

|

Lead - in lead concentrate |

88.0% |

89.8% |

88.6% |

88.7% |

|

Gold - in lead concentrate |

51.2% |

51.6% |

50.4% |

52.4% |

1 Silver equivalent production for 2024 is calculated using

prices of US$23/oz silver, US$1.20/lb zinc, US$0.90/lb lead and

US$1,800/oz gold to “convert” zinc, lead and gold production

contained in concentrate to “equivalent” silver ounces (contained

metal, multiplied by price, divided by silver price). Silver

equivalent production for 2023 is calculated using prices of

US$22/oz silver, US$1.20/lb zinc, US$0.90/lb lead and US$1,700/oz

gold.

Mill throughput averaged 3,324 tonnes per day

during the fourth quarter of 2024, an increase of 10% compared to

the fourth quarter of 2023, and averaged 3,255 tonnes per day

during 2024, an increase of 11% compared to 2023.

Metal production in 2024 was higher than 2023

across all metals, supported by higher mill throughput rates.

Silver production in 2024 increased by 5%, despite lower silver

grades as expected in the mine plan. Zinc production in 2024

increased by 22% and lead production by 20% as a result of both the

higher mill throughput rates and higher zinc and lead grades. Gold

production increased by 5%.

Silver production in the fourth quarter of 2024

was 2.58 million ounces, 1% above the 2.56 million ounces in the

fourth quarter of 2023. Zinc and lead production increased by 25%

and 26%, respectively, compared with the fourth quarter of 2023.

Gold production decreased by 5%.

Increased fourth quarter and 2024 mill

throughput rates were driven by continued debottlenecking and

optimization efforts focused on achieving higher mining rates

through increased productivity and improved mine plan

flexibility.

During December, mill throughput averaged 3,760

tonnes per day with good metallurgical performance, and the mine

achieved an average mining rate of 3,502 tonnes per day.

Important Information for Investors and Stockholders

about the Merger and Where to Find It

This news release is not intended to and does

not constitute an offer to buy or sell or the solicitation of an

offer to subscribe for or buy or an invitation to purchase or

subscribe for any securities of First Majestic or Gatos Silver or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities of

First Majestic or Gatos Silver in any jurisdiction in contravention

of applicable law. This news release may be deemed to be soliciting

material relating to First Majestic’s proposed acquisition of all

of the issued and outstanding shares of common stock of Gatos

Silver.

In connection with the proposed Merger between

First Majestic and Gatos Silver pursuant to the previously

announced Agreement and Plan of Merger (the “Merger Agreement”),

First Majestic filed with the U.S. Securities and Exchange

Commission (the “SEC”) a registration statement on Form F-4 that

includes a Proxy Statement of Gatos Silver that also constitutes a

Prospectus of First Majestic (the “Proxy Statement/Prospectus”) and

other documents. Each of First Majestic and Gatos Silver may also

file other relevant documents with the SEC regarding the proposed

Merger. The registration statement on Form F-4 was declared

effective by the SEC on December 2, 2024. Gatos Silver filed a

Proxy Statement/Prospectus with the SEC on December 3, 2024 which

it commenced mailing on December 6, 2024 to its stockholders in

connection with the proposed Merger. First Majestic filed the

Information Circular in connection with the proposed Merger with

applicable Canadian securities regulatory authorities on December

10, 2024 and commenced mailing the meeting materials to its

shareholders on December 10, 2024. This news release is not a

substitute for any registration statement, proxy statement,

prospectus or other document First Majestic or Gatos Silver has

filed or may file with the SEC or Canadian securities regulatory

authorities in connection with the pending Merger. INVESTORS AND

SECURITY HOLDERS OF GATOS SILVER AND FIRST MAJESTIC ARE URGED TO

READ THE PROXY STATEMENT/PROSPECTUS AND MANAGEMENT PROXY CIRCULAR,

RESPECTIVELY, AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED

WITH THE SEC OR CANADIAN SECURITIES REGULATORY AUTHORITIES AS WELL

AS ANY AMENDMENTS OR SUPPLEMENTS THERETO CAREFULLY IN THEIR

ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING

OR INVESTMENT DECISION WITH RESPECT TO THE MERGER BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT FIRST MAJESTIC,

GATOS SILVER, THE TRANSACTION AND RELATED MATTERS. Investors and

security holders are able to obtain free copies of the Proxy

Statement/Prospectus, the filings with the SEC that are and will be

incorporated by reference into the Proxy Statement/Prospectus and

other documents filed with the SEC by First Majestic and Gatos

Silver containing important information about First Majestic or

Gatos Silver and the Transaction through the website maintained by

the SEC at www.sec.gov. Investors are also able to obtain free

copies of the management proxy circular and other documents filed

with Canadian securities regulatory authorities by First Majestic,

through the website maintained by the Canadian Securities

Administrators at www.sedarplus.com. In addition, investors and

security holders are able to obtain free copies of the documents

filed by First Majestic with the SEC and Canadian securities

regulatory authorities on First Majestic’s website at

www.firstmajestic.com or by contacting First Majestic’s investor

relations team. Copies of the documents filed with the SEC by Gatos

Silver are available free of charge on Gatos Silver’s website or by

contacting Gatos Silver’s investor relations team.

Participants in the Merger Solicitation

First Majestic, Gatos Silver and certain of

their respective directors, executive officers and employees may be

considered participants in the solicitation of proxies in

connection with the proposed Merger. Information regarding the

persons who may, under the rules of the SEC, be deemed participants

in the solicitation of the shareholders of First Majestic and the

stockholders of Gatos Silver in connection with the Merger,

including a description of their respective direct or indirect

interests, by security holdings or otherwise, is included in the

Proxy Statement/Prospectus described above and other relevant

documents filed with the SEC and Canadian securities regulatory

authorities in connection with the Merger. Additional information

regarding First Majestic’s directors and executive officers is also

included in First Majestic’s Notice of Annual Meeting of

Shareholders and 2024 Proxy Statement, which was filed with the SEC

and Canadian securities regulatory authorities on April 15, 2024,

and information regarding Gatos Silver’s directors and executive

officers is also included in Gatos Silver’s Annual Report on Form

10-K for the year ended December 31, 2023 filed with the SEC on

February 20, 2024, as amended by Amendment No. 1 to such annual

report filed with the SEC on May 6, 2024 and Gatos Silver’s 2024

Proxy Statement for its 2024 Annual Meeting of Stockholders, which

was filed with the SEC on April 25, 2024. These documents are

available free of charge as described above.

About Gatos Silver

Gatos Silver is a silver dominant exploration,

development and production company that discovered a new silver and

zinc-rich mineral district in southern Chihuahua State, Mexico. As

a 70% owner of the LGJV, the Company is primarily focused on

operating the Cerro Los Gatos mine and on growth and development of

the Los Gatos district. The LGJV includes approximately 103,000

hectares of mineral rights, representing a highly prospective and

under-explored district with numerous silver-zinc-lead epithermal

mineralized zones identified as priority targets.

On September 5, 2024, Gatos Silver and First

Majestic Silver Corp. (“First Majestic”) announced that they

entered into a definitive merger agreement pursuant to which First

Majestic will acquire all of the issued and outstanding common

shares of Gatos Silver (the “Merger”). The proposed Merger would

consolidate three world-class, producing silver mining districts in

Mexico to create a leading intermediate primary silver producer.

Information relating to the proposed Merger can be found at the

Company’s website at www.gatossilver.com.

Qualified Person

Scientific and technical disclosure in this

press release was approved by Anthony (Tony) Scott, P.Geo., Senior

Vice President of Corporate Development and Technical Services of

Gatos Silver who is a “Qualified Person” as defined in S-K 1300 and

NI 43-101.

Forward-Looking Statements

This press release contains statements that

constitute “forward looking information” and “forward-looking

statements” within the meaning of U.S. and Canadian securities

laws. All statements other than statements of historical facts

contained in this press release, including statements regarding the

potential for the Company to deliver value into First Majestic

following completion of the Merger are forward-looking statements.

Forward-looking statements are based on management’s beliefs and

assumptions and on information currently available to management.

Such statements are subject to risks and uncertainties, and actual

results may differ materially from those expressed or implied in

the forward-looking statements, and such other risks and

uncertainties described in our filings with the U.S. Securities and

Exchange Commission and Canadian securities commissions. Gatos

Silver expressly disclaims any obligation or undertaking to update

the forward-looking statements contained in this press release to

reflect any change in its expectations or any change in events,

conditions, or circumstances on which such statements are based

unless required to do so by applicable law. No assurance can be

given that such future results will be achieved. Forward-looking

statements speak only as of the date of this press release.

Investors and Media Contact

André van NiekerkChief Financial

Officerinvestors@gatossilver.com(604) 424-0984

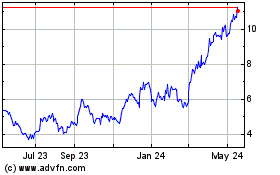

Gatos Silver (NYSE:GATO)

Historical Stock Chart

From Dec 2024 to Jan 2025

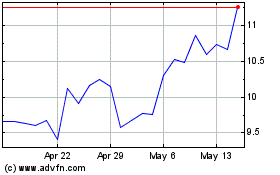

Gatos Silver (NYSE:GATO)

Historical Stock Chart

From Jan 2024 to Jan 2025