Green Dot Appoints Kim Olson as Chief Risk Offer

March 03 2025 - 8:00AM

Business Wire

Green Dot Corporation (NYSE: GDOT) today announced that Kim

Olson has joined the company as Chief Risk Officer responsible for

overseeing all aspects of Green Dot’s risk management strategy and

program execution and reporting directly to the Chief Executive

Officer.

“Kim is a proven leader with skills and experience that will

bolster our commitment to and focus on compliance and risk

management,” said George Gresham, Chief Executive Officer, Green

Dot. “We have been making great strides across all areas of our

risk management teams and processes, and we look forward to Kim

helping us further establish a strong risk management foundation

that sets Green Dot up for long-term growth and success.”

Olson joins Green Dot from Discover Financial Services where she

was the Head of the Office of Remediation, responsible for

overseeing and challenging the enterprise’s remediation of

significant regulatory matters, including consent orders, since

November 2023. She has over 30 years of deep and multi-faceted

financial services experience, previously serving as chief risk

officer and in senior risk oversight roles at leading global

banking organizations, as well as rating agency and professional

services experience advising financial institutions on risk

management, evolving regulations and strategy. Olson began her

career at the Federal Reserve Bank of New York, where she held a

variety of senior policy, regulatory and examination roles in

banking supervision.

“I am honored to join Green Dot and look forward to leading the

Risk function to strengthen risk and compliance management

practices that enable sound and sustained business growth,” said

Olson. “I am excited to help further Green Dot’s mission to provide

seamless banking and payments solutions that serve the financial

needs of businesses and consumers.”

About Green Dot

Green Dot Corporation (NYSE: GDOT) is a financial technology

platform and registered bank holding company that builds banking

and payment solutions to create value, retain and reward customers,

and accelerate growth for businesses of all sizes. For more than

two decades, Green Dot has delivered financial tools and services

that address the most pressing financial needs of consumers and

businesses, and that transform the way people and businesses manage

and move money.

Green Dot delivers a broad spectrum of financial products to

consumers and businesses through its portfolio of brands,

including: GO2bank, a leading digital and mobile bank account

offering simple, secure and useful banking for Americans living

paycheck to paycheck; the Green Dot Network (“GDN”) of more than

90,000 retail distribution and cash access locations nationwide;

Arc by Green Dot, the single-source embedded finance platform

combining all of Green Dot’s secure banking and money processing

capabilities to power businesses at all stages of growth; rapid!

wage and disbursements solutions, providing pay card and earned

wage access services to more than 6,000 businesses and their

employees; and Santa Barbara TPG (“SBTPG”), the company’s tax

division, which processes more than 14 million tax refunds

annually.

Founded in 1999, Green Dot has managed more than 80 million

accounts to date both directly and through its partners. Green Dot

Bank is a subsidiary of Green Dot Corporation and member of the

FDIC2. For more information about Green Dot’s products and

services, please visit www.greendot.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303517632/en/

Media Contact: Alison Lubert alubert@greendotcorp.com

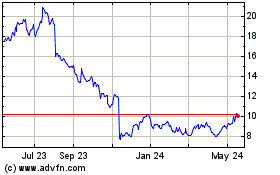

Green Dot (NYSE:GDOT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Green Dot (NYSE:GDOT)

Historical Stock Chart

From Mar 2024 to Mar 2025