false

0000041719

0000041719

2024-10-21

2024-10-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 21, 2024

| |

Glatfelter Corporation |

|

| |

(Exact name of registrant as specified in its charter) |

|

| Pennsylvania |

001-03560 |

23-0628360 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

| 4350

Congress Street, Suite 600, Charlotte,

North Carolina |

28209 |

| (Address of principal executive

offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: 704 885-2555

| |

(N/A) |

|

| |

Former name or former address, if changed since last report |

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Stock, $0.01 par value per share |

|

GLT |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

The information

set forth under Item 8.01 below is incorporated by reference into this Item 1.01.

As previously disclosed, Glatfelter Corporation, a Pennsylvania corporation

(“Glatfelter” or the “Company”), entered into certain definitive agreements (the “Transaction

Agreements”) with Berry Global Group, Inc., a Delaware corporation (“Berry”), and certain of their respective

subsidiaries, including Treasure Holdco, Inc, a Delaware corporation and a wholly owned subsidiary of Berry. (“Spinco”),

which provide for a series of transactions, including the spin-off of the global nonwovens and hygiene films business (the “HHNF

Business”) of Berry, which includes transfer of HHNF Business to Spinco and the distribution to Berry stockholders of the issued

and outstanding shares of common stock of Spinco held by Berry (the “Spinco Distribution”), and subsequent merger of

the HHNF Business with and into a subsidiary of Glatfelter (collectively, the “Transactions”). Upon closing of the

Transactions (the “Closing”), Glatfelter will be renamed Magnera Corporation.

In connection with the Transaction Agreements, the Company filed with

the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4, which included a preliminary

proxy statement/prospectus, on August 23, 2024, as amended (the “Registration Statement”), which was declared effective

on September 17, 2024, and a proxy statement/prospectus on September 19, 2024, which was subsequently supplemented on October 11, 2024

(the “Proxy Statement/Prospectus”). The Proxy Statement/Prospectus was first mailed to the Company’s shareholders

on September 20, 2024.

On October 21, 2024, Glatfelter and Berry waived in writing the conditions

to closing the Transactions relating to the private letter ruling (the “IRS Ruling”) from the Internal Revenue Service

(the “IRS”) regarding the intended tax treatment of the Transactions.

In addition, Glatfelter and Berry waived the conditions to closing

the Transactions relating to the delivery of opinions from tax counsel, although the agreements governing the Transactions still provide

for the delivery of tax opinions at the closing of the Transactions (including an opinion to the effect that the Spinco Distribution will

qualify as a tax-free distribution to Berry stockholders). Berry believes that, in the event that the Spinco Distribution was determined

to be taxable to Berry, the taxable gain recognized by Berry, if any, would be immaterial based on Berry’s adjusted tax basis in

the HHNF Business. In connection with the above waivers, Glatfelter is filing a legal opinion as Exhibit 8.1 to this Current Report on

Form 8-K, which legal opinion supersedes the legal opinion filed as Exhibit 8.1 to the Registration Statement.

Also on October 21, 2024, Glatfelter, Berry and Spinco entered

into an amendment (the “Amendment”) to that certain Tax Matters

Agreement, dated as of February 6, 2024, by and among Glatfelter, Berry and Spinco. The Amendment makes certain changes to take into

account the parties’ waiver of the conditions to closing of the Transactions relating to (i) the delivery of opinions from tax

counsel and (ii) the IRS Ruling regarding the intended tax treatment of the Transactions, as well as to clarify the parties’

respective liabilities for Transaction taxes and related matters. The foregoing summary of the Amendment does not purport to be complete

and is qualified in its entirety by the full text of the Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report

on Form 8-K and which is incorporated herein by reference.

In connection with the above waivers and the Amendment, Spinco filed

an amendment to its Registration Statement on Form 10 (“Form 10”) on October 21, 2024 that includes a preliminary information statement/prospectus in connection with the Transactions that

supplements (the “Supplement”) the Form 10 to reflect the foregoing. The definitive information statement/prospectus will

be distributed to Berry stockholders receiving Magnera common stock after the Form 10 has become effective and the spin-off and the Transactions

are completed.

The foregoing summary of the Supplement filed by Spinco does not

purport to be complete and is qualified in its entirety by the full text of the Supplement, filed as Exhibit 99.1 to the Form 10 amendment by Spinco.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

Cautionary Statement Concerning Forward-Looking Statements

Statements in this Current Report on Form 8-K that are not historical,

including statements relating to the expected timing, completion and effects of the proposed transaction between Berry and Glatfelter,

are considered “forward-looking” within the meaning of the federal securities laws and are presented pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements because they contain

words such as “believes,” “expects,” “may,” “will,” “should,” “would,”

“could,” “seeks,” “approximately,” “intends,” “plans,” “estimates,”

“projects,” “outlook,” “anticipates” or “looking forward,” or similar expressions that

relate to strategy, plans, intentions, or expectations. All statements relating to estimates and statements about the expected timing

and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, benefits of the transaction,

including future financial and operating results, executive and Board transition considerations, the combined company’s plans, objectives,

expectations and intentions, and other statements that are not historical facts are forward-looking statements. In addition, senior management

of Berry and Glatfelter, from time to time may make forward-looking public statements concerning expected future operations and performance

and other developments.

Actual results may differ materially from those that are expected due

to a variety of factors, including without limitation: the occurrence of any event, change or other circumstances that could give rise

to the termination of the proposed transaction; the risk that the Glatfelter shareholders may not approve the transaction proposals; the

risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated or

may be delayed; risks that any of the other closing conditions to the proposed transaction may not be satisfied in a timely manner; risks

that the anticipated tax treatment of the proposed transaction is not obtained; risks related to potential litigation brought in connection

with the proposed transaction; uncertainties as to the timing of the consummation of the proposed transaction; unexpected costs, charges

or expenses resulting from the proposed transaction; risks and costs related to the implementation of the separation of the HHNF Business

into Spinco, including timing anticipated to complete the separation; any changes to the configuration of the businesses included in the

separation if implemented; the risk that the integration of the combined company is more difficult, time consuming or costly than expected;

risks related to financial community and rating agency perceptions of each of Berry and Glatfelter and its business, operations, financial

condition and the industry in which they operate; risks related to disruption of management time from ongoing business operations due

to the proposed transaction; failure to realize the benefits expected from the proposed transaction; effects of the announcement, pendency

or completion of the proposed transaction on the ability of the parties to retain customers and retain and hire key personnel and maintain

relationships with their counterparties, and on their operating results and businesses generally; and other risk factors detailed from

time to time in Glatfelter’s and Berry’s reports filed with the SEC, including annual reports on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. These risks, as well as other risks associated with

the proposed transaction, are more fully discussed in the Proxy Statement/Prospectus, the Registration Statement and the Form 10 filed

with the SEC in connection with the proposed transaction. The foregoing list of important factors may not contain all of the material

factors that are important to you. New factors may emerge from time to time, and it is not possible to either predict new factors or assess

the potential effect of any such new factors. Accordingly, readers should not place undue reliance on those statements. All forward-looking

statements are based upon information available as of the date hereof. All forward-looking statements are made only as of the date hereof

and neither Berry nor Glatfelter undertake any obligation to update or revise any forward-looking statement as a result of new information,

future events or otherwise, except as otherwise required by law.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect

of the proposed transaction between Berry and Glatfelter. In connection with the proposed transaction, Glatfelter filed the Registration

Statement with the SEC which was declared effective on September 17, 2024. Glatfelter has also filed a Proxy Statement/Prospectus which

was sent to Glatfelter’s shareholders on or about September 20, 2024. In addition, Spinco filed the Form 10 in connection with its

separation from Berry. The Form 10 has not yet been declared effective. This communication is not a substitute for the Registration Statement,

Form 10, Proxy Statement/Prospectus or any other document which Berry and/or Glatfelter may file with the SEC. STOCKHOLDERS OF BERRY AND

GLATFELTER ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT, THE FORM 10, any

amendments or supplements thereto, AND PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. Investors and security holders will be able to obtain copies of the Registration Statement, the Form 10 and Proxy Statement/Prospectus

as well as other filings containing information about Berry and Glatfelter, as well as Spinco, without charge, at the SEC’s website,

www.sec.gov. Copies of documents filed with the SEC by Berry or Spinco are available free of charge on Berry’s investor relations

website at ir.berryglobal.com, including the Form 10, as amended. Copies of documents filed with the SEC by Glatfelter are available free

of charge on Glatfelter’s investor relations website at www.glatfelter.com/investors.

No Offer or Solicitation

This communication is for informational purposes only and is not intended

to and does not constitute an offer to sell, or the solicitation of an offer to sell, subscribe for or buy, or a solicitation of any vote

or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer,

sale or solicitation would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction. No

offer or sale of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act

of 1933, as amended, and otherwise in accordance with applicable law.

Participants in Solicitation

Berry and its directors and executive officers, and Glatfelter and

its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Glatfelter common

stock and/or the offering of securities in respect of the proposed transaction. Information about the directors and executive officers

of Berry, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth under the caption

“Security Ownership of Beneficial Owners and Management” in the definitive proxy statement for Berry’s 2024 Annual Meeting

of Stockholders, which was filed with the SEC on January 4, 2024 (www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001378992/000110465924001073/tm2325571d6_def14a.htm).

Information about the directors and executive officers of Glatfelter including a description of their direct or indirect interests, by

security holdings or otherwise, is set forth under the caption “Security Ownership of Certain Beneficial Owners and Management”

in the proxy statement for Glatfelter’s 2024 Annual Meeting of Shareholders, which was filed with the SEC on March 26, 2024 (www.sec.gov/ix?doc=/Archives/edgar/data/0000041719/000004171924000013/glt-20240322.htm).

Additional information regarding the interests of these participants can also be found in the Registration Statement and the Proxy Statement/Prospectus

filed by Glatfelter with the SEC and the Form 10 filed by Spinco with the SEC.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Glatfelter Corporation |

| |

|

| |

|

|

| October 21, 2024 |

By: |

/s/ Jill L. Urey |

| |

|

Name: Jill L. Urey |

| |

|

Title: Vice President, General Counsel & Compliance |

Exhibit 8.1

October 21, 2024

Treasure Holdco, Inc.

101 Oakley Street

Evansville, Indiana 47710

Re: Exhibit 8.1 Opinion

of Bryan Cave Leighton Paisner LLP as to certain tax matters for the Registration Statement on Form S-4 (No. 333-281733), for Glatfelter

Corporation (“Glatfelter”).

Ladies and Gentlemen:

We have acted as counsel to

Treasure Holdco, Inc., a Delaware corporation (the “Company”), in connection with filing the Registration Statement on Form

10 (the “Securities Registration Statement”), as well as in connection with certain transactions entered into by the Company,

as reflected within the Registration Statement on Form S-4 (No. 333--281733) (the “Registration Statement”, and collectively

with the Securities Registration Statement, the “Statements”). The Statements were filed with the Securities and Exchange

Commission (the “Commission”) on August 23, 2024, and the Registration Statement, as amended, was declared effective by the

Commission on September 17, 2024, and the proxy statement/prospectus in connection with the Registration Statement was filed with the

Commission on September 19, 2024 (the “Proxy Statement/Prospectus”). This opinion is delivered in connection with a

supplement to the Securities Registration Statement to be filed with the Commission by the Company on Form 10. The securities are being

registered in connection with a Reverse Morris Trust transaction, pursuant to the RMT Transaction Agreement, dated as of February 6, 2024,

by and among Glatfelter, Treasure Merger Sub I, Inc., Treasure Merger Sub II, LLC, Berry Global Group, Inc., and the Company (“RMT

Transaction Agreement”). Specifically, the Reverse Morris Trust Transaction consists of the mergers of (a) Treasure Merger Sub I,

Inc., a Delaware corporation and a wholly owned Subsidiary of Glatfelter, with and into the Company, with the Company being the surviving

corporation and a wholly owned Subsidiary of Glatfelter, and immediately thereafter (b) the Company with and into Treasure Merger Sub

II, LLC, a Delaware limited liability company and a wholly owned Subsidiary of Glatfelter, with Treasure Merger Sub II, LLC being the

surviving limited liability company and a wholly owned Subsidiary of Glatfelter, pursuant to the RMT Transaction Agreement. Unless otherwise

indicated, each defined term has the meaning ascribed to it in the Agreement. The Merger will be preceded by the Separation, the Contribution,

the Initial Spin, the Spinco Distribution, the Spinco Special Cash Payment, and the reverse stock split.

In rendering our opinion:

(i) we have examined and relied upon the Statements and such other agreements, instruments, documents and records of the Company as we

have deemed necessary or appropriate for the purposes of our opinion; (ii) we have assumed and relied upon the authenticity of, and the

genuineness of all signatures on, all documents, the conformity to original or certified documents of all copies submitted to us as conformed

or reproduction copies, and the legal capacity of all natural persons executing documents; and (iii) we have relied upon the following

additional assumptions (a) the transactions will be consummated in accordance with the provisions of the RMT Transaction Agreement and

the other Agreements as described in the Statements, (b) the statements concerning the transactions and the parties thereto set forth

in the RMT Transaction Agreement and the other Agreements and Statements are true, complete and correct as of the date hereof and will

remain true, complete and correct at all times up to and including the effective times of the Contribution, the Distribution, the reverse

stock split, and the Merger and each of the Statements is true, complete and correct and will remain true, complete and correct at all

times up to and including the effective times of the Separation, the Contribution, the Initial Spin, the Spinco Distribution, the Spinco

Special Cash Payment, the reverse stock split, and the Merger, (c) the statements and representations (which statements and representations

we have neither investigated nor verified) made by SpinCo, Remainco, RMT Partner, Merger Sub 1, and Merger Sub 2 in their respective Representation

Letters are true, complete and correct as of the date hereof and will remain true, complete and correct at all times up to and including

the effective time of the Separation, the Contribution, the Initial Spin, the Spinco Distribution, the Spinco Special Cash Payment, the

reverse stock split, and the Merger, (d) all statements and representations qualified by knowledge, expectation, belief, materiality or

comparable qualification are and will be true, complete and correct as if made without such qualification, (e) all documents submitted

to us as originals are authentic, all documents submitted to us as copies conform to the originals, all relevant documents have been or

will be duly executed in the form presented to us and all natural persons who have executed such documents are of legal capacity, and

(f) all applicable reporting requirements have been or will be satisfied.

|

To: Treasure Holdco, Inc.

Date: October 21, 2024

Page: 2 |

|

In addition, in rendering

our opinion, we have considered the applicable provisions of (a) the Internal Revenue Code of 1986 as in effect on the date hereof (the

“Code”), (b) the applicable Treasury Regulations as in effect on the date hereof (the “Regulations”), (c) current

administrative interpretations by the Internal Revenue Service (the “Service”) of the Regulations and the Code, (d) existing

judicial decisions, (e) such other authorities as we have considered relevant, and (f) our interpretation of the foregoing authorities,

all of which preceding authorities are subject to change or modification at any time (possibly with retroactive effect). A change in applicable

law may affect our opinion. In addition, our opinion is based solely on the documents that we have examined, and the facts and assumptions

set forth above. Any variation or difference in such documents or inaccuracies of such assumptions may affect our opinion. Our opinion

cannot be relied upon if any of our assumptions are inaccurate in any material respect. We assume no responsibility to inform you of any

subsequent changes in the matters stated or represented in the documents described above or assumed herein or in statutory, regulatory,

and judicial authority and interpretations thereof. We express our opinion only as to those matters specifically addressed in this letter,

and no opinion has been expressed or should be inferred as to the tax consequences of the Spinco Distribution, the Merger, or the reverse

stock split under any state, local or foreign laws or with respect to other areas of U.S. Federal taxation.

Based upon the foregoing and

subject to the assumptions, exceptions, limitations and qualifications set forth herein and in the Registration Statement under the heading

“Material U.S. Federal Income Tax Consequences,” we are of the opinion that, for U.S. federal income tax purposes, (a) the

Distribution, taken together with certain related Transactions, will qualify as a tax-free distribution under Section 355 of the Code,

with the U.S. federal income tax consequences to U.S. Holders (as defined in the Registration Statement) of Remainco common stock as described

under “Material U.S. Federal Income Tax Consequences—The Distribution” in the Registration Statement, (b) the Merger

will qualify as a “reorganization” under Section 368(a) of the Code, with the U.S. federal income tax consequences to U.S.

Holders (as defined in the Registration Statement) of Spinco common stock as described under “Material U.S. Federal Income Tax Consequences—The

Merger” in the Registration Statement, and (c) the reverse stock split will qualify as a “recapitalization” under Section

368(a)(1)(E) of the Code, with the U.S. federal income tax consequences to U.S. Holders (as defined in the Registration Statement) of

Glatfelter common stock as described under “Material U.S. Federal Income Tax Consequences—The Reverse Stock Split” in

the Registration Statement. We express no opinion on any issue or matter relating to the tax consequences of the transactions related

to the Statements, other than the opinion set forth above. We do not express any opinion herein concerning any law other than the laws

of the United States to the extent specifically referred to herein. Our opinion is expressed as of the date hereof, and we are under no

obligation to advise you of, supplement or revise our opinion to reflect any changes (including changes that have retroactive effect)

(a) in applicable law or (b) that would cause any statement, representation or assumption herein to no longer be true or correct. This

opinion represents judgments concerning complex and uncertain issues and is not binding upon the Internal Revenue Service or any other

taxing authority. No assurance can be given that our opinion will not be challenged by the Internal Revenue Service or any other taxing

authority, or that any such challenge will not be successful.

|

To: Treasure Holdco, Inc.

Date: October 21, 2024

Page: 3 |

|

We hereby consent to the filing of this opinion

as Exhibit 8.1 to the Statements dated on or about the date hereof with the Commission as an exhibit to the Statements. In giving such

consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act

of 1933, as amended.

Very truly yours,

/s/ Bryan Cave Leighton Paisner LLP

Bryan Cave Leighton Paisner LLP

Exhibit 10.1

FIRST AMENDMENT TO

TAX MATTERS AGREEMENT

This FIRST Amendment

TO TAX MATTERS AGREEMENT (this “Amendment”) is made on this 21st

day of October, 2024, by and among BERRY GLOBAL GROUP, INC., a Delaware corporation (“Remainco”), TREASURE HOLDCO,

INC., a Delaware corporation and a wholly owned indirect Subsidiary of Remainco (“Spinco”), and GLATFELTER CORPORATION,

a Pennsylvania corporation (“RMT Partner”).

RECITALS

WHEREAS, Remainco,

Spinco, and RMT Partner are parties to that certain Tax Matters Agreement dated February 6, 2024 (as amended, the “TMA”),

that certain Separation and Distribution Agreement, dated February 6, 2024 (the “Separation Agreement”), and that certain

RMT Transaction Agreement dated February 6, 2024 (the “RMT Transaction Agreement”);

WHEREAS, Remainco and

RMT Partner have waived certain conditions to Closing in the RMT Transaction Agreement, including with respect to receiving the Private

Letter Ruling and any tax opinions (the “Waiver”);

WHEREAS, Remainco,

Spinco and RMT Partner desire to amend, among other things, Section 2.01(a) of the TMA; and

WHEREAS, amendment

of the TMA is permitted pursuant to Section 13.04 thereof with the written consent of each of Remainco, Spinco and RMT Partner.

AGREEMENT

NOW, THEREFORE, in

consideration of the foregoing and the mutual agreements, provisions and covenants contained in this Amendment, the Parties, intending

to be legally bound hereby, agree as follows:

1. Sections

2.01(a)(v) and (vi) of the TMA are hereby deleted in their entirety, and the following Sections 2.01(a)(v), (vi) and (vii) are inserted

in lieu thereof:

(v) any

Taxes of any member of the Spinco Group arising as a result of any carryback of a Tax Attribute (including any adjustment or disallowance

thereof) from any Remainco Ownership Period to any Tax Period (or portion thereof);

(vi) any

Transaction Taxes; and

(vii) any

Taxes arising in connection with the application of Section 355(e) of the Code as a result of an acquisition of Remainco that is part

of a plan (or series of related transactions) pursuant to which 1 or more persons acquire, directly or indirectly, stock representing

a 50-percent or greater interest in Remainco.

2. Sections

6.01(a) through (d) of the TMA are hereby deleted in their entirety, and the following Sections 6.01(a), (b), (c) and (d) are inserted

in lieu thereof:

(a) Spinco. Spinco hereby represents and warrants or covenants

and agrees, as appropriate, that the facts presented and the representations made by Spinco in the Spinco Tax Representation Letters,

to the extent that such facts and representations (A) are descriptive of the Spinco Group (including the business purposes for the Spinco

Distribution) to the extent they relate to the Spinco Group and the plans, proposals, intentions and policies of the Spinco Group after

the Effective Time, or (B) relate to the actions or non-actions of the Spinco Group to be taken (or not taken, as the case may be) after

the Effective Time, are, or will be from the time presented or made through and including the Effective Time (and thereafter as relevant)

true, correct and complete in all material respects; provided that, notwithstanding anything to the contrary in this Agreement,

neither RMT Partner nor Spinco (after the Effective Time) shall be responsible for (i) the accuracy of any such representation, warranty

or covenant with respect to periods prior to the Effective Time and (ii) the accuracy of any such representation, warranty or covenant

in the Spinco Tax Representation Letters that has not been consented to by RMT Partner (such consent not to be unreasonably withheld,

conditioned or delayed).

(b) RMT

Partner. RMT Partner hereby represents and warrants or covenants and agrees, as appropriate, that the facts presented and the representations

made by RMT Partner in the RMT Partner Tax Representation Letters, to the extent descriptive of the RMT Group at any time (but not including

the plans, proposals, intentions and policies of the RMT Group at any time), are, or will be at the time presented or made (and, if applicable,

through and including the Effective Time and thereafter as relevant), true, correct and complete in all material respects.

(c) Remainco. Remainco hereby represents and warrants or covenants

and agrees, as appropriate, that the facts presented and the representations made by Remainco in the Remainco Tax Representation Letters,

to the extent descriptive of (A) the Remainco Group at any time or (B) the Spinco Group at any time at or prior to the Effective Time

including, in each case, the business purpose for the Spinco Distribution described in the Remainco Tax Representation Letters to the

extent that they relate to the Remainco Group at any time or the Spinco Group at any time at or prior to the Effective Time are, or will

be from the time presented or made through and including the Effective Time (and thereafter as relevant) true, correct and complete in

all material respects.

(d) No Contrary Knowledge. Each of Remainco, RMT Partner and

Spinco represents and warrants that it is not aware of the existence of any reason, or has taken or agreed to take any action, that would

reasonably be expected to prevent or impede the Contribution, the Initial Spin, the Spinco Distribution, the Spinco Special Cash Payment

or the Merger from qualifying for the Intended Tax Treatment.

3. Section

6.02(c) of the TMA is hereby deleted in its entirety and the following is inserted in lieu thereof:

(c) RMT Partner agrees that the RMT Group shall not refinance or assume the Spinco Financing (excluding any guarantee by RMT Partner

or any of its Affiliates and, for the avoidance of doubt, excluding any repayment or prepayment) within ninety (90) days after the Spinco

Distribution; unless prior to taking any such action, RMT Partner shall have received (A) an Unqualified Tax Opinion in form and substance

reasonably satisfactory to Remainco, (B) a Ruling in form and substance reasonably satisfactory to Remainco, or (C) Remainco shall have

waived in writing the requirement to obtain such Unqualified Tax Opinion or Ruling; provided that, for the avoidance of doubt, this

Section 6.02(c) shall not apply to the assumption by RMT Partner of the 7.250% Senior Secured Notes Due 2031 issued by Treasure Escrow

Corporation.

4. Section

6.03 of the TMA is hereby deleted in its entirety and the following is inserted in lieu thereof:

6.03 Restrictions

on Remainco. Remainco agrees that it will not take or fail to take, or permit any member of the Remainco Group, as the case may be,

to take or fail to take, as applicable, any action where such action or failure to act would reasonably be expected to cause any material

representation, warranty or covenant of any member of the Remainco Group in any Remainco Tax Representation Letter or in this Agreement

to be untrue in any material respect.

5. Section

7.01(b) of the TMA is hereby deleted in its entirety and the following is inserted in lieu thereof:

(b) The

Remainco Group and RMT Group shall cooperate in good faith to minimize the impacts of the ATB Obligations following the Spinco Distribution,

including by cooperating in good faith to obtain Tax Opinions with respect to transactions implicating the ATB Obligations occurring

after the Spinco Distribution.

6. The

Parties agree and acknowledge that “Excluded Liabilities” in the Separation Agreement shall include any and all Liabilities

(determined without regard to the last sentence of the definition of “Liabilities” in the Separation Agreement) suffered or

incurred by Glatfelter and its subsidiaries and their Affiliates (including, following Closing, SpinCo and its subsidiaries and their

Affiliates) relating to, in connection with or arising out of the Waiver, this Amendment and the supplement to the information statement

dated the date hereof, filed by Spinco with its Registration Statement on Form 10, and the circumstances giving rise to such documents,

whether asserted or claimed prior to, at or after the date of this Amendment, and the indemnity with respect thereto set forth in the

Separation Agreement and the TMA shall extend to the defense thereof.

7. This

Amendment may be executed in any number of counterparts, each such counterpart being deemed to be an original instrument, and all such

counterparts shall together constitute the same agreement. A signed copy of this Amendment delivered by facsimile, email or other means

of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Amendment.

8. Including

as amended hereby, the TMA remains in full force and effect, is valid and binding on, and otherwise ratified by, the parties.

9. This

Amendment, and the application or interpretation hereof, shall be governed exclusively by its terms and the Laws of the State of Delaware

without regard to conflict of laws principles thereof (or any other jurisdiction) to the extent that such principles would direct a matter

to another jurisdiction.

IN WITNESS WHEREOF,

Remainco, Spinco, and RMT Partner have caused this First Amendment to Tax Matters Agreement to be duly executed as of the date first above

written.

| |

BERRY GLOBAL GROUP, INC. |

| |

|

|

|

| |

|

|

|

| |

By |

|

/s/ Jason K. Greene |

| |

Name: |

|

Jason K. Greene |

| |

Title: |

|

Chief Legal Officer |

| |

|

|

|

| |

|

|

|

| |

TREASURE HOLDCO, INC. |

| |

|

|

|

| |

|

|

|

| |

By |

|

/s/ Jason K. Greene |

| |

Name: |

|

Jason K. Greene |

| |

Title: |

|

Director |

| |

|

|

|

| |

|

|

|

| |

GLATFELTER CORPORATION |

| |

|

|

|

| |

|

|

|

| |

By |

|

/s/ Jill L. Urey |

| |

Name: |

|

Jill L. Urey |

| |

Title: |

|

VP, General Counsel & Compliance |

| |

|

|

|

[Signature Page to First Amendment to Tax Matters Agreement]

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

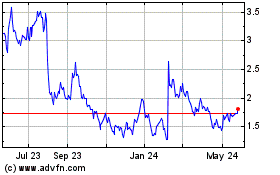

Glatfelter (NYSE:GLT)

Historical Stock Chart

From Jan 2025 to Feb 2025

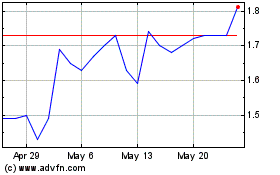

Glatfelter (NYSE:GLT)

Historical Stock Chart

From Feb 2024 to Feb 2025