0001841761FALSE00018417612024-11-212024-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 21, 2024

GROVE COLLABORATIVE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40263 | | 88-2840659 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

1301 Sansome Street San Francisco, California | | 94111 |

| (Address of principal executive offices) | | (Zip Code) |

(800) 231-8527

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 | | GROV | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On November 21, 2024, Grove Collaborative Holdings, Inc., a Delaware public benefit corporation (“Holdings”), and Grove Collaborative, Inc., a Delaware public benefit corporation (“Grove”), in their capacity as borrowers (Holdings and Grove, collectively, the “Borrowers”) under that certain Loan and Security Agreement, dated as of March 10, 2023 (as amended by that certain Amendment No. 1 to Loan and Security Agreement, dated as of July 16, 2024, the “ABL Loan Agreement”), by and among the Borrowers and Siena Lending Group LLC, a Delaware limited liability company, as lender (in such capacity, the “ABL Lender”), entered into that certain Amendment No. 2 to Loan and Security Agreement, dated as of November 21, 2024 (the “Amendment”), by and among the ABL Lender and the Borrowers, which amends the ABL Loan Agreement to, among other things, (i) reduce the liquidity and excess availability thresholds for triggering a cash dominion event and additional appraisal requirements, (ii) reduce the liquidity threshold for the availability block, (iii) cause the maturity date to no longer be coterminous with the Term Loan Agreement (as defined below), (iv) reduce the liquidity and excess availability requirements for permitted acquisitions and earnout and deferred compensation payments, (v) revise the financial covenant to reduce the minimum liquidity requirement thereunder and to remove the step up in required liquidity previously triggered by certain events relating to the Term Loan Agreement (as defined below) and (vi) update the reporting requirements under the ABL Loan Agreement.

The foregoing description of the Amendment is subject to and qualified in its entirety by reference to the full text of the Amendment, a copy of which is included as Exhibit 10.1 hereto, and the terms of which are incorporated herein by reference.

Item 1.02 Termination of a Material Definitive Agreement

On November 21, 2024, the Borrowers, in their capacity as borrowers under that certain Loan and Security Agreement, dated as of December 21, 2022 (as amended by that certain Amendment No. 1 to Loan and Security Agreement, dated as of March 10, 2023, and by that certain Amendment No. 2 to Loan and Security Agreement, dated as of July 16, 2024, the “Term Loan Agreement”), among the Borrowers, Ocean II PLO LLC, a California limited liability company, as administrative and collateral agent, and the lending institutions party thereto (collectively, the “Term Loan Lenders”), voluntarily repaid and discharged in full all obligations in the amount of $30,349,672.50 (other than inchoate indemnity obligations or other obligations that expressly survive termination) under the Term Loan Agreement and terminated the Term Loan Agreement and the other Loan Documents as defined in the Term Loan Agreement.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Exhibit

No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | |

GROVE COLLABORATIVE HOLDINGS, INC. | |

| | |

| By: | /s/ Sergio Cervantes | |

| Name: | Sergio Cervantes | |

| Title: | Chief Financial Officer | |

Dated: November 25, 2024

AMENDMENT NO. 2

TO

LOAN AND SECURITY AGREEMENT

This Amendment No. 2 to Loan and Security Agreement (this “Amendment”) is made effective as of November 21, 2024 (the “Amendment Date”) by and among Siena Lending Group LLC (“Lender”), Grove Collaborative Holdings, Inc., a Delaware public benefit corporation (“Holdings”), and Grove Collaborative, Inc., a Delaware public benefit corporation (“Grove” and, together with Holdings, each a “Borrower” and together, “Borrowers”).

Recitals

WHEREAS, on March 10, 2023, Borrowers and Lender entered into that certain Loan and Security Agreement, which together with all exhibits, schedules, documents and agreements attached thereto, is referred to herein as the “Loan Agreement”; and

WHEREAS, Borrowers and Lender desire to modify and amend certain of the terms and conditions of the Loan Agreement as set forth in this Amendment.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants herein contained, and without limiting or amending any other provisions of the Loan Agreement, the parties hereby agree to modify the Loan Agreement and to perform such other covenants and conditions as follows:

I.Amendments to Loan Agreement.

(a)Section 4.8 of the Loan Agreement is hereby amended to read in its entirety as follows:

“4.8 Appraisals. Each Loan Party will permit Lender and each of its representatives or agents to conduct appraisals and valuations of the Collateral at such times and intervals as Lender may designate. Such appraisals and valuations shall be at Borrowers’ expense; provided, (a) so long as (i) no Event of Default shall be in existence and (ii) Liquidity is greater than $20,000,000, Borrowers shall only be required to reimburse Lender for up to one (1) appraisal and valuation in any Fiscal Year, (b) so long as (i) no Event of Default shall be in existence and (ii) Liquidity is greater than $10,000,000 and less than or equal to $20,000,000, Borrowers shall only be required to reimburse Lender for up to two (2) appraisals and valuations in any Fiscal Year, (c) so long as (i) no Event of Default shall be in existence and (ii) Liquidity is less than or equal to $10,000,000, Borrowers shall only be required to reimburse Lender for up to three (3) appraisals and valuations in any Fiscal Years, and (d) during the existence of an Event of Default, Borrowers shall be required to reimburse Lender for all appraisals and valuations that are conducted.”

(b)Section 5.25(j) of the Loan Agreement is hereby amended to read in its entirety as follows:

“(j) pay any contingent “earn-outs” and deferred consideration incurred in connection with a Permitted Acquisition or Permitted Investment unless immediately before and after giving effect to such payment Borrowers and the other Loan Parties shall have Liquidity in an amount of not less than $10,000,000 and Excess Availability of not less than $2,500,000;”

(c)Schedule A of the Loan Agreement is hereby amended to revise clause (f) of Section 1 and Section 6 to read in their entirety as follows:

| | | | | |

“(f) Availability Block | (i) If Borrowers’ Liquidity is less than $10,000,000, then $3,500,000 and (ii) otherwise, $0.” |

“6. Scheduled Maturity Date: | March 10, 2026” |

(d)Schedule B of the Loan Agreement is hereby amended to revise the definitions of “Cash Dominion Event”, “Liquidity” and “Qualified Cash” to read in their entirety as follows:

““Cash Dominion Event” means the occurrence of any of the following: (a) Borrowers’ Liquidity is less than $10,000,000, (b) Excess Availability is less than $2,500,000 or (c) an Event of Default has occurred and is continuing.”

““Liquidity” means as of any date of determination, the sum of (a) Excess Availability as of such date plus (b) Qualified Cash as of such date plus (c) solely for the purposes of calculating Liquidity to determine Borrowers’ expense reimbursement obligations in connection with appraisals and valuations pursuant to Section 4.8, the Approved Equity Availability Amount as of such date.”

““Qualified Cash” of any Borrower, means cash or Cash Equivalents of such Borrower, (a) that are not, and are not required to be, designated as “restricted” on the financial statements of such Borrower (other than as a result of the Liens permitted under clause (b) below) and (b) in which no Person other than Lender has a first priority Lien (other than as provided in clause (g) of Permitted Liens), and (c) that are held in a Deposit Account or Securities Account that is subject to a Control Agreement in favor of the Lender or, for a period of 30 days after the Amendment No. 2 Effective Date (or such longer period as Lender may agree), any other Deposit Account or Securities Account of a Borrower that is required to be subject to a Control Agreement in favor of Lender within 30 days of the Amendment No. 2 Effective Date (or such longer period as Lender may agree).”

(e)Schedule B of the Loan Agreement is hereby amended to revise clause (h) of the definition of “Permitted Acquisition” to read in its entirety as follows:

“(h) immediately before and after giving effect to such acquisition Borrowers and the other Loan Parties shall have Liquidity in an amount of not less than $10,000,000 and Excess Availability of not less than $2,500,000;”

(f)Schedule B of the Loan Agreement is hereby amended to add the following definition in appropriate alphabetical order:

““Amendment No. 2 Effective Date” means November 21, 2024.”

(g)Schedule D of the Loan Agreement is hereby amended in its entirety to read as set forth on Schedule D to this Amendment.

(h)Schedule E of the Loan Agreement is hereby amended in its entirety to read as set forth on Schedule E to this Amendment.

II.Conditions Precedent to the Effectiveness to this Amendment.

The effectiveness of this Amendment is subject to the fulfillment of each and every of the following conditions precedent in form and substance satisfactory to the Lender in its sole discretion:

(a)This Amendment shall have been duly executed and delivered by Borrowers.

(b)Borrowers shall have prepaid in full the obligations outstanding under the Term Debt Documents (other than inchoate indemnity obligations or other obligations that expressly survive termination of the Term Debt Documents) and Lender shall have received customary payoff documentation providing for, inter alia, the release of Liens granted to the Term Debt Agent under the Term Debt Documents.

(c)Borrowers shall have paid to Lender a consent fee in the amount of $50,000 and such fee shall be non-refundable once paid.

III.Additional and Terms and Conditions.

(a)Representations and Warranties of Borrowers. Borrowers represent, warrant and covenant to Lender as of the date hereof as follows:

(i)This Amendment has been duly executed and delivered by the Borrowers and each applicable Loan Party and constitutes legal, valid and binding obligations of the applicable Loan Party, enforceable in accordance with its terms, except as the enforceability thereof may be limited by bankruptcy, insolvency or other similar laws of general application relating to or affecting the enforcement of creditors’ rights or by general principal of equity.

(ii)The execution, delivery and performance by Borrowers of this Amendment and any other agreements or instruments required hereunder (x) have been duly authorized, and are not in conflict with nor constitute a breach of any provision of the Borrowers’ organizational documents and (y) do not (1) require any authorization, consent or approval by any Governmental Authority, in each case other than has already been obtained or given will have been obtained or given prior to the time when required, (2) conflict with or result in a breach of any law or regulation, order, writ, injunction or decree of any court or Governmental Authority, except where such conflict or resulting breach would not reasonably be expected to cause a Material Adverse Effect, or (3) require the approval, authorization or consent of any trustee or holder of any indebtedness or obligation of Borrowers or of any other Person under any material agreement, contract, lease or license or similar document or instrument to which any Loan Party is a party or by which any Loan Party is bound.

(iii)The representations and warranties contained in the Loan Agreement and each other Loan Document are true and correct in all material respects (without duplication of materiality qualifiers therein) (or to the extent any representations or warranties are expressly made solely as of an earlier date, such representations and warranties are true and correct in all material respects (without duplication of materiality qualifiers therein) as of such earlier date).

(iv)No event has occurred and is continuing that constitutes a Default or an Event of Default.

(b)No Waiver. No course of dealing on the part of Lender or any employees, officers or directors of Lender, nor any failure or delay in the exercise of any right by Lender, shall operate as a waiver thereof, and any single or partial exercise of any such right shall not preclude any later exercise of any such right. Any failure of Lender at any time to require strict performance by Borrowers of any provision shall not affect any right of Lender thereafter to demand strict compliance and performance. Any suspension or waiver of a right must be in writing signed by an officer of Lender.

IV.Post-Closing Covenant.

On or before thirty (30) days after the Amendment No. 2 Effective Date (or such later date as Lender may agree in its sole discretion), Borrowers shall deliver to Lender, in form and substance satisfactory to the Lender, (1) an amendment to that certain Deposit Account Control Agreement, dated as of March 20, 2023, among Silicon

Valley Bank, a division of First-Citizens Bank & Trust Company (“Bank”), Lender and Grove to add the Deposit Accounts with account numbers ending xxxxx, xxxxx, and xxxxx to such Control Agreement and (2) a Control Agreement with respect to the Securities Account of Grove with account number ending in xxxx maintained by U.S. Bank National Association and pursuant to which SVB Asset Management acts as Grove’s registered investment advisor with respect to such Securities Account, each in accordance with Section 4.1 of the Loan Agreement.

V.Integration Clause.

The Loan Agreement, as amended by this Amendment, and each of the other Loan Documents taken together constitute and contain the entire agreement among Borrowers and Lender and supersede any and all prior agreements, negotiations, correspondence, understandings and communications between the parties, whether written or oral, respecting the subject matter hereof. NONE OF THE LOAN AGREEMENT OR THIS AMENDMENT MAY BE MODIFIED EXCEPT BY A WRITING SIGNED BY THE LENDER AND BORROWERS IN ACCORDANCE WITH THE LOAN AGREEMENT. Each provision hereof shall be severable from every other provision when determining its legal enforceability under this Amendment and the Loan Agreement, as amended by this Amendment, may be enforced to the maximum extent permitted under applicable law. This Amendment shall be binding upon, and inure to the benefit of, each party’s respective permitted successors and assigns. This Amendment may be executed in counterpart originals, all of which, when taken together, shall constitute one and the same original document. In the event of any contradiction or inconsistency among the terms and conditions of this Amendment or the Loan Agreement the terms and conditions of this Amendment shall prevail.

VI.Miscellaneous.

Unless otherwise defined, all initially capitalized terms in this Amendment shall be as defined in the Loan Agreement. The Loan Agreement, as amended hereby, shall be and remain in full force and effect in accordance with its respective terms and hereby is ratified and confirmed in all respects. Except as expressly set forth herein, the execution, delivery, and performance of this Amendment shall not operate as a waiver of, or as an amendment of, any right, power, or remedy of Lender under the Loan Agreement, as in effect prior to the date hereof. Except as amended hereby, the Loan Agreement remains unmodified and unchanged. This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one instrument. This Amendment and any amendments or waivers hereto, to the extent signed and delivered by means of facsimile, photocopy, scan by e-mail delivery of a “.pdf” format data file, or any electronic signature valid under the Electronic Signatures in Global and National Commerce Act, 15 U.S.C. § 7001, et. seq such as DocuSign shall be treated in all manner and respects as an original agreement or instrument and shall be considered to have the same binding legal effect as if it were the original signed version thereof delivered in person. No party hereto or to any such agreement or instrument shall raise the use of signature delivered or provided in that manner as a defense to the formation of a contract and each party hereto forever waives any such defense. The terms of Sections 10.14 (Governing Law) and 10.15 (Waivers and Jurisdiction) of the Loan Agreement are incorporated herein by reference, mutatis mutandis, and the parties hereto agree to such terms.

[Remainder of the page intentionally left blank. Signature pages to follow.]

In Witness Whereof, the parties hereto have caused this Amendment to be executed as of the date first above written.

| | | | | |

| BORROWERS: Grove Collaborative Holdings, Inc., a Delaware public benefit corporation

By: /s/ Sergio Cervantes Name: Sergio Cervantes Title: Chief Financial Officer and Treasurer

Grove Collaborative, Inc., a Delaware public benefit corporation

By: /s/ Sergio Cervantes Name: Sergio Cervantes Title: Chief Financial Officer and Treasurer |

In Witness Whereof, the parties hereto have caused this Amendment to be executed as of the date first above written.

| | | | | |

| LENDER:

Siena Lending Group LLC

By: /s/ Michael Sessa Name: Michael Sessa Title: Authorized Signatory

By: /s/ Steven Sanicola Name: Steven Sanicola Title: Authorized Signatory |

|

|

Schedule D

Provide Lender with each of the documents set forth below at the following times in form satisfactory to Lender:

| | | | | |

| No later than the date that is 45 days after the Closing Date | •a historical financial model for Passport 6.0, (i) in the form delivered by Borrowers to Lender prior to the Closing Date (it being understood that a form substantially similar to the form attached hereto as Exhibit G shall be acceptable) or (ii) in another form reasonably satisfactory to Lender |

Monthly (no later than the 20th day of each fiscal month or such later time as Lender shall agree in its sole discretion); provided, however, that during any time at which (x) Borrowers’ Liquidity is less than $10,000,000 or (y) Excess Availability is less than $2,500,000, such reporting shall be delivered no later than the earlier of (a) the second Business Day of each week (based on the previous week then-ended) or (b) the date of each Revolving Loan requested | •a detailed fiscal month-end (or week-end, as applicable) aging, by total, of Borrowers’ Accounts, together with a monthly Account roll-forward with respect to Borrowers’ Accounts, in a format acceptable to Lender in its discretion, tied to the beginning and ending Account balances of Borrowers’ general ledger (delivered electronically in an acceptable format) •a fiscal month-end (or week-end, as applicable) summary aging, by vendor, of each Loan Party’s accounts payable and any book overdraft and an aging, by vendor, of any held checks (delivered electronically in an acceptable format) •a fiscal month-end (or week-end, as applicable) detailed Inventory perpetual report with respect to Borrowers’ Inventory together with a listing by category and location of Inventory (delivered electronically in an acceptable format) •a detailed calculation of Inventory of Borrowers that is not eligible for the Borrowing Base (delivered electronically in an acceptable format). •At any time Excess Availability is less than $5,000,000 and upon Lender’s request, copies of invoices together with corresponding shipping and delivery documents, and credit memos together with corresponding supporting documentation, with respect to invoices and credit memos in excess of $100,000 (or such other amount as determined in Lender’s Permitted Discretion, from time to time) •Calculation of the unused commitment/amount available for purchase under the Yorkville Purchase Agreement •a reconciliation of Accounts, trade accounts payable, and Inventory of Borrowers’ fiscal month-end general ledger accounts to its monthly financial statements including any book reserves related to each category •a monthly (or weekly, as applicable) sales backlog report •a detailed list of all accruals at calendar month-end (or week-end, as applicable) •a monthly (or weekly, as applicable) report of sales tax accruals |

| | | | | |

| Monthly (no later than the 30 days after the end of each calendar month), as set forth in Section 5.15(b) | •the unaudited interim financial statements of each Loan Party as of the end of such month and of the portion of such Fiscal Year then elapsed •a Monthly Financial Model and trial balance (referred to as the “FTA”) for Passport 6.0, in a form to be determined by Lender •a Compliance Certificate |

| Bi-Annually (in January and in July of each calendar year) | •a detailed list of each Loan Party’s retail customers, with address and contact information •a detailed list of each Loan Party’s material vendors, with address and contact information •an updated Information Certificate(s), true and correct in all material respects as of the date of delivery, accompanied by a certificate executed by an Authorized Officer of Borrowers and substantially in the form of Exhibit F hereto (it being understood and agreed that no such update shall serve to cure any existing Event of Default, including any Event of Default resulting from any failure to provide any such disclosure to Lender on an earlier date or any breach of any earlier made representation and/or warranty). |

| Yearly (no later than 120 days after the end of each Fiscal Year of Borrowers), as set forth in Section 5.15(a) | •unqualified, audited financial statements of each Loan Party as of the end of such Fiscal Year •a Compliance Certificate |

| Yearly (no later than 60 days after the end of each Fiscal Year of Borrowers), as set forth in Section 5.15(d) | •quarterly business projections for the following Fiscal Year for the Loan Parties on a consolidated basis |

| Promptly upon (but in no event later than two Business Days after) delivery or receipt, as applicable, thereof | •copies of any and all written notices (including notices of default or acceleration), reports and other deliveries received by or on behalf of any Loan Party from or sent by or on behalf of any Loan Party to, any holder, agent or trustee with respect to any or all of the Subordinated Debt (in such holder’s, agent’s or trustee’s capacity as such) |

Schedule E

Financial Covenants

(a) Minimum Liquidity. Borrowers shall not permit Liquidity, as of any date, to be less than $5,000,000; provided, that on no more than four (4) occasions while the Obligations remain outstanding, Borrowers failure to comply with this clause (a) shall not constitute an Event of Default so long as Borrowers cure such Default within three (3) Business Days after the earlier of a Borrower receiving notice thereof or any Authorized Officer of a Borrower becoming aware thereof; provided, further, that no Loans or Letters of Credit shall be issued by Lender until such Default shall have been cured or waived.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

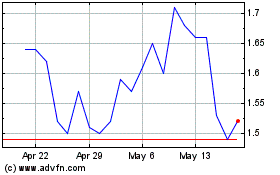

Grove Collaborative (NYSE:GROV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Grove Collaborative (NYSE:GROV)

Historical Stock Chart

From Jan 2024 to Jan 2025