Hyatt Hotels Corporation ("Hyatt," "the Company," "we," "us," or

"our") (NYSE: H) today reported fourth quarter and full year 2024

results. Highlights include:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250213945165/en/

Hyatt Full Year 2024 Infographic

- Comparable system-wide hotels RevPAR growth was 5.0% in

the fourth quarter and 4.6% for the full year of 2024, compared to

the same periods in 2023

- Comparable system-wide all-inclusive resorts Net Package

RevPAR growth was 2.9% in the fourth quarter and 4.4% for the

full year of 2024

- Net rooms growth was 7.8% for the full year of 2024, in

line with the full year outlook for 2024

- Net income (loss) was $(56) million in the fourth

quarter and $1,296 million for the full year of 2024. Adjusted net

income was $40 million in the fourth quarter and $375 million for

the full year of 2024

- Diluted EPS was $(0.58) in the fourth quarter and $12.65

for the full year of 2024. Adjusted Diluted EPS was $0.42 in the

fourth quarter and $3.66 for the full year of 2024

- Adjusted EBITDA was $255 million in the fourth quarter

and $1,096 million for the full year of 2024

- Pipeline of executed management or franchise contracts

was approximately 138,000 rooms

- Repurchased approximately 8 million shares of Class A

and Class B common stock for an aggregate purchase price of $1,190

million for the full year of 2024, returning $1,250 million to

shareholders through dividends and share repurchases

- 2025 full year comparable system-wide hotels RevPAR

growth is projected to increase 2.0% to 4.0% on a constant

currency basis, compared to the full year of 2024

- 2025 full year net rooms growth is projected to be 6.0%

to 7.0%, compared to the full year of 2024

- 2025 full year net income is projected between $190

million and $240 million

- 2025 full year Adjusted EBITDA is projected between

$1,100 million and $1,150 million

Mark S. Hoplamazian, President and Chief Executive Officer of

Hyatt, said, "The purposeful evolution of our business model

and strong brand focus has accelerated our network effect

benefiting each of our stakeholders. Our fourth quarter results

demonstrate the strength of our commercial offerings, as evidenced

by the growth of the World of Hyatt loyalty program, which reached

approximately 54 million members. Our operating results and

industry leading net rooms growth allowed us to achieve record

levels of gross fees while returning over $1.2 billion to

shareholders in 2024."

Fourth Quarter Results and

Highlights

(in millions)

Three Months Ended

December 31,

2024

2023

Change (%)

Management and franchising

$

219

$

205

7.2

%

Owned and leased

57

90

(36.5

)%

Distribution

20

6

199.6

%

Overhead

(41

)

(52

)

21.8

%

Eliminations

—

—

(51.4

)%

Adjusted EBITDA

$

255

$

249

2.4

%

Adjusted EBITDA increased 20.3% in the fourth quarter of 2024,

compared to the same period in 2023, when adjusted for the net

impact of asset sales.

- Management and franchising: Results reflected strong

business and leisure transient travel while group demand during the

fourth quarter was impacted by the shift of the Jewish holidays and

the U.S. election in November. In the United States, performance

was driven by the continued recovery in business transient travel.

Greater China hotels RevPAR growth was flat to last year, a

significant improvement from third quarter 2024 results as business

transient travel benefited Mainland China hotels. International

inbound travel continues to be a driver of growth in Asia Pacific

excluding Greater China.

- Owned and leased: Adjusted EBITDA increased 5.1% in the

fourth quarter, compared to the same period in 2023, when adjusted

for the net impact of transactions. Comparable owned and leased

margin increased to 20.5%, up 70 bps, in the fourth quarter driven

by strong rates compared to the same period in 2023.

- Distribution: Results for the fourth quarter were

impacted by Hurricane Milton and lower booking volumes, partially

offset by lower overhead costs. Excluding the impact of the UVC

Transaction, Adjusted EBITDA decreased $4 million.

Openings and Development

In the fourth quarter, 81 new hotels (or 20,721 rooms) joined

Hyatt's portfolio, inclusive of properties acquired through the

Standard International and Bahia Principe transactions. Notable

openings included Grand Hyatt Deer Valley, Dreams Madeira Resort

Spa & Marina, Park Hyatt London River Thames, Thompson Palm

Springs, and nine UrCove properties.

As of December 31, 2024, the Company had a pipeline of executed

management or franchise contracts for approximately 720 hotels (or

approximately 138,000 rooms), representing pipeline expansion of

approximately 9% year over year.

Transactions and Capital

Strategy

During the fourth quarter of 2024, the Company:

- Acquired Standard International, as previously announced, on

October 1, 2024 for approximately $150 million and up to an

additional $185 million of contingent consideration.

- Closed the Bahia Principe Transaction on December 27, 2024 for

€359 million (approximately $374 million). Additional deferred

consideration of €60 million is payable at future dates.

- Completed the asset acquisition of three Alua properties on

November 15, 2024 for €117 million (approximately $123 million) and

assumed $53 million of long-term debt as part of the transaction.

The Company intends to sell these assets and has begun the

marketing process.

- Sold Hyatt Regency O'Hare Chicago for gross proceeds of $40

million on December 10, 2024 to an unrelated third party and

entered into a long-term franchise agreement. The Company provided

$20 million of seller financing and committed to loan up to $45

million for a future renovation.

- Sold its ownership interests in two unconsolidated hospitality

ventures, Park Hyatt Los Cabos at Cabo Del Sol hotel and residences

on December 13, 2024 and Hyatt Centric Downtown Nashville on

December 17, 2024, and retained long-term management

agreements.

On February 10, 2025, the Company announced it entered into an

agreement to acquire all outstanding shares of Playa Hotels &

Resorts N.V. ("Playa") for $13.50 per share, or approximately $2.6

billion, inclusive of approximately $900 million of debt, net of

cash ("Playa Transaction"). At closing, the Company expects to

announce a new commitment to realize at least $2.0 billion of

proceeds from asset sales by the end of 2027. This commitment may

include existing assets owned by Hyatt and properties owned by

Playa. The Company expects its asset-light earnings mix to exceed

90% on a pro forma basis in 2027. At closing, the Company expects

to fund 100% of the acquisition with new debt financing, and,

following the close of the transaction, the Company expects to pay

down over 80% of that financing with anticipated proceeds from the

aforementioned asset sales.

Balance Sheet and

Liquidity

As of December 31, 2024, the Company reported the following:

- Total debt of $3,782 million.

- Pro rata share of unconsolidated hospitality venture debt of

$370 million, substantially all of which is non-recourse to Hyatt

and a portion of which Hyatt guarantees pursuant to separate

agreements.

- Total liquidity of approximately $2.9 billion with $1,383

million of cash and cash equivalents and short-term investments,

and borrowing availability of $1,497 million under Hyatt's

revolving credit facility, net of letters of credit

outstanding.

On November 20, 2024, the Company issued and sold $150 million

of senior notes due 2029 at an issue price of 99.693%, forming a

single series of an aggregate $600 million of 5.250% senior notes

due 2029, of which $450 million principal amount was issued on June

17, 2024, and $450 million of 5.375% senior notes due 2031 at an

issue price of 99.745%. In the fourth quarter, the Company received

approximately $594 million of net proceeds, after deducting

underwriting discounts and other offering expenses, and intends to

use the net proceeds from the offering to repay all of the 5.375%

senior notes due 2025 at or prior to their maturity on April 23,

2025.

The Company repurchased a total of 69,194 shares of Class A

common stock for approximately $11 million in the fourth quarter

and repurchased a total of 4,362,776 shares of Class A and

3,629,480 shares of Class B common stock for approximately $1,190

million for the full year of 2024. The Company ended the fourth

quarter with 42,613,090 Class A and 53,531,579 Class B shares

issued and outstanding. During the full year of 2024, the Company

returned $1,250 million to shareholders, inclusive of dividends and

share repurchases. As of December 31, 2024, the Company has

approximately $971 million remaining under its share repurchase

authorization.

The Company's board of directors has declared a cash dividend of

$0.15 per share for the first quarter of 2025. The dividend is

payable on March 12, 2025 to Class A and Class B stockholders of

record as of February 28, 2025.

2025 Outlook

The Company is providing the following outlook for the 2025

fiscal year. Refer to slide 13 in the fourth quarter and full year

2024 investor presentation for Adjusted EBITDA outlook growth,

adjusted for asset sales. The Company is not providing an outlook

for capital returns to shareholders at this time due to the pending

Playa Transaction.

Full Year 2025 vs.

2024

System-Wide Hotels RevPAR1 Growth

2.0% to 4.0%

Net Rooms Growth

6.0% to 7.0%

(in millions)

Full Year 2025

Net Income

$190 - $240

Gross Fees

$1,200 - $1,230

Adjusted G&A Expenses2, 3

$450 - $460

Adjusted EBITDA2

$1,100 - $1,150

Capital Expenditures

Approx. $150

Adjusted Free Cash Flow2

$450 - $500

1 RevPAR is based on constant currency

whereby previous periods are translated based on the current period

exchange rate. System-wide hotels RevPAR growth percentage for 2025

vs. 2024 is based on comparable hotels.

2 Refer to the tables on schedule A-11 for

a reconciliation of estimated net income attributable to Hyatt

Hotels Corporation to Adjusted EBITDA, G&A expenses to Adjusted

G&A Expenses, and net cash provided by operating activities to

Free Cash Flow and Adjusted Free Cash Flow.

3 During the year ended December 31, 2024,

the Company revised its definition of Adjusted EBITDA to exclude

transaction and integration costs and recast prior-period results

to provide comparability. Refer to page A-6 of the schedules for

additional detail.

No disposition or acquisition activity

beyond what has been completed as of the date of this release has

been included in the 2025 Outlook. The Company's 2025 Outlook is

based on a number of assumptions that are subject to change and

many of which are outside the control of the Company. If actual

results vary from these assumptions, the Company's expectations may

change. There can be no assurance that Hyatt will achieve these

results.

Refer to the table on schedule A-8 for a summary of special

items impacting Adjusted Net Income (Loss) and Adjusted Diluted EPS

in the three months and year ended December 31, 2024 and December

31, 2023.

Note: All RevPAR growth and ADR growth percentage changes are in

constant dollars. All Net Package RevPAR growth and Net Package ADR

growth percentage changes are in reported dollars. This release

includes references to non-GAAP financial measures. Refer to the

non-GAAP reconciliations included in the schedules and the

definitions of the non-GAAP measures presented beginning on

schedule A-6.

Conference Call

Information

The Company will hold an investor conference call this morning,

February 13, 2025, at 9:00 a.m. CT.

Participants may listen to a simultaneous webcast of the

conference call, which may be accessed through the Company's

website at investors.hyatt.com. Alternatively, participants may

access the live call by dialing: 800.715.9871 (U.S. Toll-Free) or

646.307.1963 (International Toll Number) using conference ID#

2303828 approximately 15 minutes prior to the scheduled start

time.

A replay of the call will be available Thursday, February 13,

2025 at 12:00 p.m. CT until Wednesday, February 19, 2025 at 10:59

p.m. CT by dialing: 800.770.2030 (U.S. Toll-Free) or 647.362.9199

(International Toll Number) using conference ID# 2303828. An

archive of the webcast will be available on the Company's website

for 90 days.

Forward-Looking

Statements

Forward-Looking Statements in this press release, which are not

historical facts, are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These

statements include statements about the Company's plans,

strategies, outlook, the number of properties we expect to open in

the future, the expected timing and payment of dividends, the

Company's 2025 outlook, including the Company's expected

System-wide Hotels RevPAR Growth, Net Rooms Growth, Net Income,

Gross Fees, Adjusted G&A Expenses, Adjusted EBITDA, Capital

Expenditures, and Adjusted Free Cash Flow, the proposed Playa

acquisition and our ability to consummate and finance the

acquisition, method of financing the acquisition, outcomes of the

proposed acquisition, including impact on asset-light earnings mix,

our ability to reduce our owned real estate asset base within

targeted timeframes and at expected values, financial performance,

prospective or future events and involve known and unknown risks

that are difficult to predict. As a result, the Company's actual

results, performance or achievements may differ materially from

those expressed or implied by these forward-looking statements. In

some cases, you can identify forward-looking statements by the use

of words such as "may," "could," "expect," "intend," "plan,"

"seek," "anticipate," "believe," "estimate," "predict,"

"potential," "continue," "likely," "will," "would" and variations

of these terms and similar expressions, or the negative of these

terms or similar expressions. Such forward-looking statements are

necessarily based upon estimates and assumptions that, while

considered reasonable by the Company and the Company's management,

are inherently uncertain. Factors that may cause actual results to

differ materially from current expectations include, but are not

limited to: the effects that the announcement or pendency of the

proposed Playa acquisition may have on us, Playa and our respective

business and ability to retain and hire key personnel and maintain

relationships with customers, suppliers and others with whom we or

they do business; inability to obtain required regulatory or

government approvals or to obtain such approvals on satisfactory

conditions; inability to obtain sufficient stockholder tender of

Playa ordinary shares, stockholder approval or to satisfy other

closing conditions; inability to obtain financing; the occurrence

of any event, change or other circumstance that could give rise to

the termination of the definitive agreement; the effects that any

termination of the definitive agreement may have on us or our

business; failure to successfully complete the proposed

acquisition; legal proceedings that may be instituted related to

the proposed acquisition; significant and unexpected costs, charges

or expenses related to the proposed acquisition; risks associated

with potential divestitures, including of Playa real estate or

business; ability or failure to successfully integrate the

acquisition with existing operations; ability to realize

anticipated synergies or obtain the results anticipated; general

economic uncertainty in key global markets and a worsening of

global economic conditions or low levels of economic growth; the

rate and pace of economic recovery following economic downturns;

global supply chain constraints and interruptions, rising costs of

construction-related labor and materials, and increases in costs

due to inflation or other factors that may not be fully offset by

increases in revenues in our business; risks affecting the luxury,

resort, and all-inclusive lodging segments; levels of spending in

business, leisure, and group segments, as well as consumer

confidence; declines in occupancy and average daily rate; limited

visibility with respect to future bookings; loss of key personnel;

domestic and international political and geopolitical conditions,

including political or civil unrest or changes in trade policy;

hostilities, or fear of hostilities, including future terrorist

attacks, that affect travel; travel-related accidents; natural or

man-made disasters, weather and climate-related events, such as

hurricanes, earthquakes, tsunamis, tornadoes, droughts, floods,

wildfires, oil spills, nuclear incidents, and global outbreaks of

pandemics or contagious diseases, or fear of such outbreaks; our

ability to successfully achieve specified levels of operating

profits at hotels that have performance tests or guarantees in

favor of our third-party owners; the impact of hotel renovations

and redevelopments; risks associated with our capital allocation

plans, share repurchase program, and dividend payments, including a

reduction in, or elimination or suspension of, repurchase activity

or dividend payments; the seasonal and cyclical nature of the real

estate and hospitality businesses; changes in distribution

arrangements, such as through internet travel intermediaries;

changes in the tastes and preferences of our customers;

relationships with colleagues and labor unions and changes in labor

laws; the financial condition of, and our relationships with,

third-party owners, franchisees, and hospitality venture partners;

the possible inability of third-party owners, franchisees, or

development partners to access the capital necessary to fund

current operations or implement our plans for growth; risks

associated with potential acquisitions and dispositions and our

ability to successfully integrate completed acquisitions with

existing operations; failure to successfully complete proposed

transactions (including the failure to satisfy closing conditions

or obtain required approvals); our ability to maintain effective

internal control over financial reporting and disclosure controls

and procedures; declines in the value of our real estate assets;

unforeseen terminations of our management and hotel services

agreements or franchise agreements; changes in federal, state,

local, or foreign tax law; increases in interest rates, wages, and

other operating costs; foreign exchange rate fluctuations or

currency restructurings; risks associated with the introduction of

new brand concepts, including lack of acceptance of new brands or

innovation; general volatility of the capital markets and our

ability to access such markets; changes in the competitive

environment in our industry, industry consolidation, and the

markets where we operate; our ability to successfully grow the

World of Hyatt loyalty program and manage the Unlimited Vacation

Club paid membership program; cyber incidents and information

technology failures; outcomes of legal or administrative

proceedings; and violations of regulations or laws related to our

franchising business and licensing businesses and our international

operations; and other risks discussed in the Company's filings with

the SEC, including our annual reports on Form 10-K and quarterly

reports on Form 10-Q, which filings are available from the SEC. All

forward-looking statements attributable to the Company or persons

acting on our behalf are expressly qualified in their entirety by

the cautionary statements set forth above. We caution you not to

place undue reliance on any forward-looking statements, which are

made only as of the date of this press release. We do not undertake

or assume any obligation to update publicly any of these

forward-looking statements to reflect actual results, new

information or future events, changes in assumptions or changes in

other factors affecting forward-looking statements, except to the

extent required by applicable law. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements.

Non-GAAP Financial

Measures

The Company refers to certain financial measures that are not

recognized under U.S. generally accepted accounting principles

(GAAP) in this press release, including: Adjusted Net Income;

Adjusted Diluted EPS; Adjusted EBITDA; Adjusted G&A Expenses;

Free Cash Flow; and Adjusted Free Cash Flow. See the schedules to

this earnings release, including the "Definitions" section, for

additional information and reconciliations of such non-GAAP

financial measures.

Availability of Information on Hyatt's

Website and Social Media Channels

Investors and others should note that Hyatt routinely announces

material information to investors and the marketplace using U.S.

Securities and Exchange Commission (SEC) filings, press releases,

public conference calls, webcasts, and the Hyatt Investor Relations

website. The Company uses these channels as well as social media

channels (e.g., the Hyatt Facebook account (facebook.com/hyatt);

the Hyatt Instagram account (instagram.com/hyatt); the Hyatt

LinkedIn account (linkedin.com/company/hyatt); the Hyatt TikTok

account (tiktok.com/@hyatt); the Hyatt X account (x.com/hyatt); and

the Hyatt YouTube account (youtube.com/user/hyatt)) as a means of

disclosing information about the Company's business to its guests,

customers, colleagues, investors, and the public. While not all of

the information that the Company posts to the Hyatt Investor

Relations website or on the Company's social media channels is of a

material nature, some information could be deemed to be material.

Accordingly, the Company encourages investors, the media, and

others interested in Hyatt to review the information that it shares

at the Investor Relations link located at the bottom of the page on

hyatt.com and on the Company's social media channels. Users may

automatically receive email alerts and other information about the

Company when enrolling an email address by visiting "Investor Email

Alerts" in the "Resources" section of Hyatt's website at

investors.hyatt.com. The contents of these websites are not

incorporated by reference into this press release or any report or

document Hyatt files with the SEC, and any references to the

websites are intended to be inactive textual references only.

About Hyatt Hotels

Corporation

Hyatt Hotels Corporation, headquartered in Chicago, is a leading

global hospitality company guided by its purpose – to care for

people so they can be their best. As of December 31, 2024, the

Company's portfolio included more than 1,400 hotels and

all-inclusive properties in 79 countries across six continents. The

Company's offering includes brands in the Luxury Portfolio,

including Park Hyatt®, Alila®, Miraval®,

Impression by Secrets, and The Unbound Collection by

Hyatt®; the Lifestyle Portfolio, including Andaz®,

Thompson Hotels®, The Standard®, Dream®

Hotels, The StandardX, Breathless Resorts &

Spas®, JdV by Hyatt®, Bunkhouse® Hotels,

and Me and All Hotels; the Inclusive Collection, including

Zoëtry® Wellness & Spa Resorts, Hyatt

Ziva®, Hyatt Zilara®, Secrets® Resorts &

Spas, Dreams® Resorts & Spas, Hyatt Vivid

Hotels & Resorts, Sunscape® Resorts &

Spas, and Alua Hotels & Resorts®; the Classics

Portfolio, including Grand Hyatt®, Hyatt Regency®,

Destination by Hyatt®, Hyatt Centric®, Hyatt

Vacation Club®, and Hyatt®; and the Essentials

Portfolio, including Caption by Hyatt®, Hyatt Place®,

Hyatt House®, Hyatt Studios, and UrCove.

Subsidiaries of the Company operate the World of Hyatt® loyalty

program, ALG Vacations®, Mr & Mrs Smith, Unlimited Vacation

Club®, Amstar® DMC destination management services, and Trisept

Solutions® technology services. For more information, please visit

www.hyatt.com.

HHC-FIN

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213945165/en/

Investor Contacts Adam

Rohman, 312.780.5834, adam.rohman@hyatt.com Ryan Nuckols,

312.780.5784, ryan.nuckols@hyatt.com Media

Contact Franziska Weber, 312.780.6106,

franziska.weber@hyatt.com

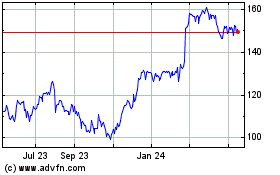

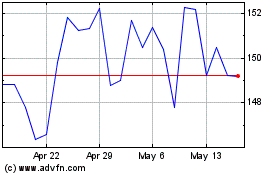

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Feb 2024 to Feb 2025