SECOND QUARTER FISCAL 2024 SUMMARY

- Net Sales increased year-over-year to $284.4 million

- Net Income increased 28% year-over-year to $37.6 million

- Adjusted EBITDA* increased 4% year-over-year to $82.6

million

- Diluted EPS increased 31% year-over-year to $0.17 and adjusted

diluted EPS* increased 11% year-over-year to $0.21

- Year-to-date cash flow from operations increased 26%

year-over-year to $209.8 million

Hayward Holdings, Inc. (NYSE: HAYW) (“Hayward” or the

“Company”), a global designer, manufacturer and marketer of a broad

portfolio of pool and outdoor living technology, today announced

financial results for the second quarter ended June 29, 2024 of its

fiscal year 2024. Comparisons are to financial results for the

prior-year second fiscal quarter.

CEO COMMENTS

“I am pleased to report second quarter results consistent with

expectations,” said Kevin Holleran, Hayward’s President and Chief

Executive Officer. “We delivered record gross margins and increased

cash flow through ongoing operational execution and working capital

management. This performance enabled us to further strengthen the

balance sheet and fund our growth initiatives. During the quarter,

we reduced net leverage meaningfully while completing a voluntary

early debt repayment and strategic acquisition of ChlorKing, a

leader in commercial pool water sanitization. ChlorKing’s

innovative technologies and strong customer relationships expand

our product offering and improve access to a broader set of

customers in this growing market. The economic and interest rate

environment remains uncertain, and we are seeing progressively

leaner channel inventory positions. However, our team continues to

execute at a high level, strengthening Hayward’s leadership

position in the pool industry.”

SECOND QUARTER FISCAL 2024 CONSOLIDATED RESULTS

Net sales increased modestly to $284.4 million for the second

quarter of fiscal 2024. The modest increase in net sales during the

quarter was the result of increases in net price, partially offset

by a decline in volume. The decrease in volume resulted from market

declines in the Middle East and Asia and lower new construction and

remodels in the U.S., partially offset by growth in Europe and

Canada.

Gross profit increased by 6% to $145.1 million for the second

quarter of fiscal 2024. Gross profit margin increased 290 basis

points to 51.0%. The increase in gross profit margin was primarily

due to operational efficiencies in our manufacturing facilities and

net price increases.

Selling, general, and administrative expense (“SG&A”)

increased by 9% to $63.2 million for the second quarter of fiscal

2024. The increase in SG&A was driven by increased warranty,

incentive compensation and selling expenses. As a percentage of net

sales, SG&A increased 180 basis points to 22.2%, compared to

the prior-year period of 20.4%, driven by the factors discussed

above. Research, development, and engineering expenses were $6.1

million for the second quarter of fiscal 2024, or 2% of net sales,

as compared to $6.9 million for the prior-year period, or 2% of net

sales.

Operating income increased by 8% to $68.0 million for the second

quarter of fiscal 2024, due to the aggregated effects of the items

described above. Operating income as a percentage of net sales

(“operating margin”) was 23.9% for the second quarter of fiscal

2024, a 170 basis point increase from the 22.2% operating margin in

the prior-year period.

Interest expense, net, decreased by 12% to $16.8 million for the

second quarter of fiscal 2024 primarily due to the repayment of the

Incremental Term Loan B principal balance in April 2024 and higher

interest income on cash investment balances. Additionally, due to

the Company’s voluntary early debt repayment during the quarter,

the Company incurred a $4.9 million debt extinguishment loss.

Income tax expense for the second quarter of fiscal 2024 was

$9.4 million, for an effective tax rate of 19.9%, compared to

income tax expense of $13.8 million, for an effective tax rate of

31.9%, for the prior-year period. The change in the effective tax

rate was primarily due to the change to the Company’s permanent

reinvestment assertion for one jurisdiction during the prior-year

period and a tax benefit from a return-to-provision adjustment in

the second quarter of fiscal 2024.

Net income increased by 28% to $37.6 million for the second

quarter of fiscal 2024.

Adjusted EBITDA* increased to $82.6 million for the second

quarter of fiscal 2024 from $79.5 million in the prior-year period.

Adjusted EBITDA margin* expanded 100 basis points to 29.0%.

Diluted EPS increased by 31% to $0.17 for the second quarter of

fiscal 2024. Adjusted diluted EPS* increased by 11% to $0.21 for

the second quarter of fiscal 2024.

SECOND QUARTER FISCAL 2024 SEGMENT RESULTS

North America

Net sales increased by 2% to $241.1 million for the second

quarter of fiscal 2024. The increase was primarily driven by net

price improvement and volume growth in Canada, partially offset by

a modest decline in volume in the U.S. due to lower new

construction and remodels.

Segment income increased by 6% to $75.3 million for the second

quarter of fiscal 2024. Adjusted segment income* increased by 6% to

$81.3 million.

Europe & Rest of World

Net sales decreased by 6% to $43.3 million for the second

quarter of fiscal 2024. The decline was primarily due to a decline

in volume, partially offset by the favorable impact of net price.

The decline in volume is driven primarily by market declines in the

Middle East and Asia, partially offset by growth in Europe.

Segment income decreased by 12% to $8.3 million for the second

quarter of fiscal 2024. Adjusted segment income* decreased by 11%

to $8.6 million.

BALANCE SHEET AND CASH FLOW

As of June 29, 2024, Hayward had cash and cash equivalents of

$215.1 million and approximately $232.6 million available for

future borrowings under its revolving credit facilities. Cash flow

provided by operations for the six months ended June 29, 2024 of

$209.8 million was an increase of $43.3 million from the prior-year

period. The increase in cash provided was primarily driven by

greater cash generated by working capital compared to the

prior-year period and due to an increase in net income.

OUTLOOK

Hayward is narrowing its full-year 2024 guidance, reflecting

better than expected margins offset by a more challenging demand

environment, particularly in new construction and remodels and

certain international markets. For fiscal year 2024, Hayward now

expects net sales of $1.010 billion to $1.040 billion, or an

increase of approximately 2% to 5% from fiscal year 2023, including

a contribution from the ChlorKing acquisition of approximately 1%,

compared to our prior guidance of $1.010 billion to $1.060 billion.

We now expect Adjusted EBITDA* of $255 million to $270 million, or

an increase of approximately 3% to 9% from fiscal year 2023,

compared to our prior guidance of $255 million to $275 million.

The pool industry remains attractive and benefits from

sustainable secular demand trends in outdoor living. Hayward

continues to leverage our competitive advantages and drive

increasing adoption of our leading SmartPad™ pool equipment

products both in new construction and the aftermarket, which has

historically represented approximately 80% of net sales. Hayward is

confident in its long-term outlook for profitable growth and robust

cash flow generation, driven by its technology leadership,

operational excellence, strong brand and installed base, and

multi-channel capabilities.

Please see the Forward-Looking Statements section of this

release for a discussion of certain risks relevant to Hayward’s

outlook.

CONFERENCE CALL INFORMATION

Hayward will hold a conference call to discuss the results

today, July 30, 2024 at 9:00 a.m. (ET).

Interested investors and other parties can listen to a webcast

of the live conference call by logging onto the Investor Relations

section of the Company’s website at

https://investor.hayward.com/events-and-presentations/default.aspx.

An earnings presentation will be posted to the Investor Relations

section of the company’s website prior to the conference call.

The conference call can also be accessed by dialing (877)

423-9813 or (201) 689-8573.

For those unable to listen to the live conference call, a replay

will be available approximately two hours after the call through

the archived webcast on the Hayward website or by dialing (844)

512-2921 or (412) 317-6671. The access code for the replay is

13747810. The replay will be available until 11:59 p.m. Eastern

Time on August 13, 2024.

ABOUT HAYWARD HOLDINGS, INC.

Hayward Holdings, Inc. (NYSE: HAYW) is a leading global designer

and manufacturer of pool and outdoor living technology. With a

mission to deliver exceptional products, outstanding service and

innovative solutions to transform the experience of water, Hayward

offers a full line of energy-efficient and sustainable residential

and commercial pool equipment including pumps, heaters, sanitizers,

filters, LED lighting, water features, and cleaners all digitally

connected through Hayward’s intuitive IoT-enabled SmartPad™.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains certain statements that are

“forward-looking statements” as that term is defined under the

Private Securities Litigation Reform Act of 1995 (the “Act”) and

releases issued by the Securities and Exchange Commission (the

“SEC”). Such forward-looking statements relating to Hayward are

based on the beliefs of Hayward’s management as well as assumptions

made by, and information currently available to it. These

forward-looking statements include, but are not limited to,

statements about Hayward’s strategies, plans, objectives,

expectations, intentions, expenditures and assumptions and other

statements contained in or incorporated by reference in this

earnings release that are not historical facts. When used in this

document, words such as “guidance,” “outlook,” “may,” “will,”

“should,” “could,” “intend,” “potential,” “continue,” “anticipate,”

“believe,” “estimate,” “expect,” “plan,” “target,” “predict,”

“project,” “seek” and similar expressions as they relate to Hayward

are intended to identify forward-looking statements. Hayward

believes that it is important to communicate its future

expectations to its stockholders, and it therefore makes

forward-looking statements in reliance upon the safe harbor

provisions of the Act. However, there may be events in the future

that Hayward is not able to accurately predict or control, and

actual results may differ materially from the expectations it

describes in its forward-looking statements.

Examples of forward-looking statements include, among others,

statements Hayward makes regarding: Hayward’s 2024 guidance;

business plans and objectives; general economic and industry

trends; business prospects; future product development and

acquisition strategies; future channel stocking levels; and growth

and expansion opportunities. The forward-looking statements in this

earnings release are only predictions. Hayward may not achieve the

plans, intentions or expectations disclosed in Hayward’s

forward-looking statements, and you should not place significant

reliance on its forward-looking statements. Hayward has based these

forward-looking statements largely on its current expectations and

projections about future events and financial trends that it

believes may affect its business, financial condition and results

of operations. Moreover, neither Hayward nor any other person

assumes responsibility for the accuracy and completeness of

forward-looking statements taken from third-party industry and

market reports.

Important factors that could affect Hayward’s future results and

could cause those results or other outcomes to differ materially

from those indicated in its forward-looking statements include the

following: its relationships with and the performance of

distributors, builders, buying groups, retailers and servicers who

sell Hayward’s products to pool owners; impacts on Hayward’s

business from the sensitivity of its business to seasonality and

unfavorable economic business and weather conditions; competition

from national and global companies, as well as lower-cost

manufacturers; Hayward’s ability to develop, manufacture and

effectively and profitably market and sell its new planned and

future products; its ability to execute on its growth strategies

and expansion opportunities; Hayward’s exposure to credit risk on

its accounts receivable, impacts on Hayward’s business from

political, regulatory, economic, trade, and other risks associated

with operating foreign businesses, including risks associated with

geopolitical conflict; its ability to maintain favorable

relationships with suppliers and manage disruptions to its global

supply chain and the availability of raw materials; Hayward’s

ability to identify emerging technological and other trends in its

target end markets; failure of markets to accept new product

introductions and enhancements; the ability to successfully

identify, finance, complete and integrate acquisitions; its

reliance on information technology systems and susceptibility to

threats to those systems, including cybersecurity threats, and

risks arising from its collection and use of personal information

data; regulatory changes and developments affecting Hayward’s

current and future products; volatility in currency exchange rates

and interest rates; Hayward’s ability to service its existing

indebtedness and obtain additional capital to finance operations

and its growth opportunities; Hayward’s ability to establish,

maintain and effectively enforce intellectual property protection

for its products, as well as its ability to operate its business

without infringing, misappropriating or otherwise violating the

intellectual property rights of others; the impact of material cost

and other inflation; Hayward’s ability to attract and retain senior

management and other qualified personnel; the impact of changes in

laws, regulations and administrative policy, including those that

limit U.S. tax benefits, impact trade agreements and tariffs, or

address the impacts of climate change; the outcome of litigation

and governmental proceedings; impacts on Hayward’s product

manufacturing disruptions, including as a result of catastrophic

and other events beyond its control; uncertainties related to

distribution channel inventory practices and the impact on net

sales volumes; Hayward’s ability to realize cost savings from

restructuring activities; Hayward’s and its customers’ ability to

manage product inventory in an effective and efficient manner; and

other factors set forth in Hayward’s most recent Annual Report on

Form 10-K and Quarterly Report on Form 10-Q.

Many of these factors are macroeconomic in nature and are,

therefore, beyond Hayward’s control. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, Hayward’s actual results, performance

or achievements may vary materially from those described in this

earnings release as anticipated, believed, estimated, expected,

intended, planned or projected. The forward-looking statements

included in this earnings release are made only as of the date of

this earnings release. Unless required by United States federal

securities laws, Hayward neither intends nor assumes any obligation

to update these forward-looking statements for any reason after the

date of this earnings release to conform these statements to actual

results or to changes in Hayward’s expectations.

*NON-GAAP FINANCIAL MEASURES

This earnings release includes certain financial measures not

presented in accordance with the generally accepted accounting

principles in the United States (“GAAP”) including adjusted net

income, adjusted basic EPS, adjusted diluted EPS, EBITDA, adjusted

EBITDA, adjusted EBITDA margin, total segment income, adjusted

total segment income, adjusted total segment income margin,

adjusted segment income and adjusted segment income margin. These

financial measures are not measures of financial performance in

accordance with GAAP and may exclude items that are significant in

understanding and assessing the Company’s financial results.

Hayward believes these non-GAAP measures provide analysts,

investors and other interested parties with additional insight into

the underlying trends of its business and assist these parties in

analyzing the Company’s performance across reporting periods on a

consistent basis by excluding items that it does not believe are

indicative of its core operating performance, which allows for a

better comparison against historical results and expectations for

future performance. Management uses these non-GAAP measures to

understand and compare operating results across reporting periods

for various purposes including internal budgeting and forecasting,

short and long-term operating planning, employee incentive

compensation, and debt compliance. Therefore, these measures should

not be considered in isolation or as an alternative to net income,

segment income or other measures of profitability, performance or

financial condition under GAAP. You should be aware that the

Company’s presentation of these measures may not be comparable to

similarly titled measures used by other companies, which may be

defined and calculated differently. See the appendix for a

reconciliation of historical non-GAAP measures to the most directly

comparable GAAP measures.

Reconciliation of full fiscal year 2024 adjusted EBITDA outlook

to the comparable GAAP measure is not being provided, as Hayward

does not currently have sufficient data to accurately estimate the

variables and individual adjustments for such reconciliation.

Adjusted EBITDA outlook for full year 2024 is calculated in a

manner consistent with the historical presentation of this measure

in the appendix.

Hayward Holdings, Inc. Unaudited

Condensed Consolidated Balance Sheets (In thousands)

June 29, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

215,056

$

178,097

Short-term investments

—

25,000

Accounts receivable, net of allowances of

$2,993 and $2,870, respectively

148,233

270,875

Inventories, net

213,559

215,180

Prepaid expenses

15,789

14,331

Income tax receivable

—

9,994

Other current assets

17,579

11,264

Total current assets

610,216

724,741

Property, plant, and equipment, net of

accumulated depreciation of $103,894 and $95,917, respectively

160,657

158,979

Goodwill

951,879

935,013

Trademark

736,000

736,000

Customer relationships, net

218,252

206,308

Other intangibles, net

95,656

94,082

Other non-current assets

90,011

91,161

Total assets

$

2,862,671

$

2,946,284

Liabilities and Stockholders’

Equity

Current liabilities

Current portion of long-term debt

$

14,261

$

15,088

Accounts payable

69,392

68,943

Accrued expenses and other liabilities

148,813

155,543

Income taxes payable

2,974

109

Total current liabilities

235,440

239,683

Long-term debt, net

959,840

1,079,280

Deferred tax liabilities, net

242,608

248,967

Other non-current liabilities

67,385

66,896

Total liabilities

1,505,273

1,634,826

Stockholders’ equity

Preferred stock, $0.001 par value,

100,000,000 authorized, no shares issued or outstanding as of June

29, 2024 and December 31, 2023

—

—

Common stock $0.001 par value, 750,000,000

authorized; 243,738,167 issued and 215,071,798 outstanding at June

29, 2024; 242,832,045 issued and 214,165,676 outstanding at

December 31, 2023

244

243

Additional paid-in capital

1,086,680

1,080,894

Common stock in treasury; 28,666,369 and

28,666,369 at June 29, 2024 and December 31, 2023, respectively

(358,110

)

(357,755

)

Retained earnings

628,330

580,909

Accumulated other comprehensive income

254

7,167

Total stockholders’ equity

1,357,398

1,311,458

Total liabilities, redeemable stock, and

stockholders’ equity

$

2,862,671

$

2,946,284

Hayward Holdings, Inc. Unaudited

Condensed Consolidated Statements of Operations (Dollars in

thousands, except per share data)

Three Months Ended

Six Months Ended

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net sales

$

284,393

$

283,543

$

496,962

$

493,679

Cost of sales

139,306

147,033

247,296

259,278

Gross profit

145,087

136,510

249,666

234,401

Selling, general and administrative

expense

63,155

57,716

123,169

112,603

Research, development and engineering

expense

6,119

6,873

12,421

12,850

Acquisition and restructuring related

expense

839

1,309

1,343

2,872

Amortization of intangible assets

6,949

7,637

13,849

15,254

Operating income

68,025

62,975

98,884

90,822

Interest expense, net

16,799

19,130

35,391

38,491

Loss on debt extinguishment

4,926

—

4,926

—

Other (income) expense, net

(646

)

625

(1,284

)

(134

)

Total other expense

21,079

19,755

39,033

38,357

Income from operations before income

taxes

46,946

43,220

59,851

52,465

Provision for income taxes

9,365

13,767

12,430

14,602

Net income

$

37,581

$

29,453

$

47,421

$

37,863

Earnings per share

Basic

$

0.17

$

0.14

$

0.22

$

0.18

Diluted

$

0.17

$

0.13

$

0.21

$

0.17

Weighted average common shares

outstanding

Basic

214,915,338

212,861,564

214,637,930

212,692,393

Diluted

221,259,232

220,503,544

221,159,419

220,506,921

Hayward Holdings, Inc. Unaudited

Condensed Consolidated Statements of Cash Flows (In

thousands)

Six Months Ended

June 29, 2024

July 1, 2023

Cash flows from operating

activities

Net income

$

47,421

$

37,863

Adjustments to reconcile net income to net

cash provided by operating activities

Depreciation

9,067

8,590

Amortization of intangible assets

17,046

18,543

Amortization of deferred debt issuance

fees

2,294

2,242

Stock-based compensation

4,632

4,146

Deferred income taxes

(6,631

)

(1,673

)

Allowance for bad debts

81

(879

)

Loss on debt extinguishment

4,926

—

(Gain) loss on sale of property, plant and

equipment

(504

)

137

Changes in operating assets and

liabilities

Accounts receivable

124,537

63,801

Inventories

6,384

50,234

Other current and non-current assets

7,803

15,225

Accounts payable

(562

)

(427

)

Accrued expenses and other liabilities

(6,655

)

(31,286

)

Net cash provided by operating

activities

209,839

166,516

Cash flows from investing

activities

Purchases of property, plant, and

equipment

(10,706

)

(15,703

)

Acquisitions, net of cash acquired

(62,367

)

—

Proceeds from sale of property, plant, and

equipment

48

5

Proceeds from short-term investments

25,000

—

Net cash used in investing activities

(48,025

)

(15,698

)

Cash flows from financing

activities

Proceeds from revolving credit

facility

—

144,100

Payments on revolving credit facility

—

(144,100

)

Proceeds from issuance of long-term

debt

2,856

1,827

Payments of long-term debt

(129,401

)

(6,153

)

Proceeds from issuance of short-term notes

payable

6,340

5,347

Payments of short-term notes payable

(2,888

)

(3,542

)

Other, net

(514

)

(360

)

Net cash used in financing activities

(123,607

)

(2,881

)

Effect of exchange rate changes on cash

and cash equivalents

(1,248

)

888

Change in cash and cash equivalents

36,959

148,825

Cash and cash equivalents, beginning of

period

178,097

56,177

Cash and cash equivalents, end of

period

$

215,056

$

205,002

Supplemental disclosures of cash flow

information

Cash paid-interest

$

36,601

$

37,223

Cash paid-income taxes

6,221

6,779

Equipment financed under finance

leases

630

—

Reconciliations Consolidated Reconciliations Adjusted EBITDA

and Adjusted EBITDA Margin Reconciliations (Non-GAAP) Following is

a reconciliation from net income to adjusted EBITDA:

(Dollars in thousands)

Three Months Ended

Six Months Ended

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net income

$

37,581

$

29,453

$

47,421

$

37,863

Depreciation

4,757

4,228

9,067

8,590

Amortization

8,503

9,289

17,046

18,543

Interest expense

16,799

19,130

35,391

38,491

Income taxes

9,365

13,767

12,430

14,602

Loss on debt extinguishment

4,926

—

4,926

—

EBITDA

81,931

75,867

126,281

118,089

Stock-based compensation (a)

230

375

420

732

Currency exchange items (b)

(180

)

1,205

(126

)

1,131

Acquisition and restructuring related

expense, net (c)

839

1,309

1,343

2,872

Other (d)

(206

)

722

(263

)

1,583

Total Adjustments

683

3,611

1,374

6,318

Adjusted EBITDA

$

82,614

$

79,478

$

127,655

$

124,407

Adjusted EBITDA margin

29.0

%

28.0

%

25.7

%

25.2

%

(a)

Represents non-cash stock-based

compensation expense related to equity awards issued to management,

employees, and directors. The adjustment includes only expense

related to awards issued under the 2017 Equity Incentive Plan,

which were awards granted prior to the effective date of Hayward’s

initial public offering (the “IPO”).

(b)

Represents unrealized non-cash (gains)

losses on foreign denominated monetary assets and liabilities and

foreign currency contracts.

(c)

Adjustments in the three months ended June

29, 2024 are primarily driven by $0.6 million of transaction costs

associated with the acquisition of ChlorKing HoldCo, LLC and

related entities (“ChlorKing”) and $0.3 million of separation and

other costs associated with the centralization of operations in

Europe. Adjustments in the three months ended July 1, 2023 are

primarily driven by $0.5 million of separation costs associated

with the enterprise cost-reduction program initiated in 2022, $0.5

million of integration costs from prior acquisitions and $0.3

million of costs associated with the relocation of the corporate

headquarters.

Adjustments in the six months ended June

29, 2024 are primarily driven by $0.7 million of separation and

other costs associated with the centralization of operations in

Europe and $0.6 million of transaction costs associated with the

acquisition of ChlorKing. Adjustments in the six months ended July

1, 2023 are primarily driven by $1.3 million of separation costs

associated with the enterprise cost-reduction program initiated in

2022, $0.8 million of integration costs from prior acquisitions and

$0.6 million of costs associated with the relocation of the

corporate headquarters.

(d)

Adjustments in the three months ended June

29, 2024 are primarily driven by $0.5 million of gains on the sale

of assets, partially offset by $0.2 million of costs incurred

related to litigation. Adjustments in the three months ended July

1, 2023 primarily include $0.3 million of costs incurred related to

the selling stockholder offering of shares in May 2023, which are

reported in SG&A in the unaudited condensed consolidated

statement of operations, and other miscellaneous items the Company

believes are not representative of its ongoing business

operations.

Adjustments in the six months ended June

29, 2024 are primarily driven by $0.5 million of gains on the sale

of assets, partially offset by $0.3 million of costs incurred

related to litigation. Adjustments in the six months ended July 1,

2023 primarily includes $0.6 million of costs associated with

follow-on equity offerings, $0.4 million of transitional expenses

incurred to enable go-forward public company regulatory compliance

and other miscellaneous items the Company believes are not

representative of its ongoing business operations.

Following is a reconciliation from net income to adjusted EBITDA

for the last twelve months:

(Dollars in thousands)

Last Twelve Months(e)

Fiscal Year

June 29, 2024

December 31, 2023

Net income

$

90,245

$

80,687

Depreciation

16,460

15,983

Amortization

35,582

37,079

Interest expense

70,484

73,584

Income taxes

18,228

20,400

Loss on debt extinguishment

4,926

—

EBITDA

235,925

227,733

Stock-based compensation (a)

958

1,270

Currency exchange items (b)

(471

)

786

Acquisition and restructuring related

expense, net (c)

11,684

13,213

Other (d)

2,425

4,271

Total Adjustments

14,596

19,540

Adjusted EBITDA

$

250,521

$

247,273

Adjusted EBITDA margin

25.2

%

24.9

%

(a)

Represents non-cash stock-based

compensation expense related to equity awards issued to management,

employees, and directors. The adjustment includes only expense

related to awards issued under the 2017 Equity Incentive Plan,

which were awards granted prior to the effective date of the

IPO.

(b)

Represents unrealized non-cash (gains)

losses on foreign denominated monetary assets and liabilities and

foreign currency contracts.

(c)

Adjustments in the last twelve months

ended June 29, 2024 include $6.7 million of costs related to the

discontinuation of a product line leading to an impairment of the

associated fixed assets, inventory and intangible assets, $3.0

million related to programs to centralize and consolidate

operations and professional services in Europe, $1.5 million of

costs associated with the relocation of the corporate headquarters

and $0.6 million of transaction costs associated with the

acquisition of ChlorKing.

Adjustments in the year ended December 31,

2023 primarily include $6.7 million of costs related to the

discontinuation of a product line leading to an impairment of the

associated fixed assets, inventory and intangible assets, $2.4

million related to programs to centralize and consolidate

operations and professional services in Europe, $1.9 million of

costs associated with the relocation of the corporate headquarters,

$1.2 million separation costs associated with the 2022 cost

reduction program and $0.8 million of costs associated with

integration costs from prior acquisitions.

(d)

Adjustments in the last twelve months

ended June 29, 2024 primarily include $1.3 million of costs related

to inventory and fixed assets as part of the centralization of

operations in Europe, $0.8 million of costs associated with

follow-on equity offerings and $0.3 million of costs incurred

related to litigation.

Adjustments in the year ended December 31,

2023 primarily include $1.8 million related to inventory and fixed

asset write-offs in Europe and $1.5 million of costs incurred

related to the selling stockholder offerings of shares in March,

May and August 2023, which are reported in SG&A in our

consolidated statements of operations.

(e)

Items for the last twelve months ended

June 29, 2024 are calculated by adding the items for the six months

ended June 29, 2024 plus fiscal year ended December 31, 2023 and

subtracting the items for the six months ended July 1, 2023.

Adjusted Net Income and Adjusted EPS Reconciliation

(Non-GAAP)

Following is a reconciliation of net income to adjusted net

income and earnings per share to adjusted earnings per share:

(Dollars in thousands)

Three Months Ended

Six Months Ended

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net income

$

37,581

$

29,453

$

47,421

$

37,863

Tax adjustments (a)

(1,624

)

3,046

(1,771

)

1,498

Other adjustments and amortization:

Stock-based compensation (b)

230

375

420

732

Currency exchange items (c)

(180

)

1,205

(126

)

1,131

Acquisition and restructuring related

expense, net (d)

839

1,309

1,343

2,872

Other (e)

(206

)

722

(263

)

1,583

Total other adjustments

683

3,611

1,374

6,318

Loss on debt extinguishment

4,926

—

4,926

—

Amortization

8,503

9,289

17,046

18,543

Tax effect (f)

(3,304

)

(3,200

)

(5,539

)

(6,284

)

Adjusted net income

$

46,765

$

42,199

$

63,457

$

57,938

Weighted average number of common shares

outstanding, basic

214,915,338

212,861,564

214,637,930

212,692,393

Weighted average number of common shares

outstanding, diluted

221,259,232

220,503,544

221,159,419

220,506,921

Basic EPS

$

0.17

$

0.14

$

0.22

$

0.18

Diluted EPS

$

0.17

$

0.13

$

0.21

$

0.17

Adjusted basic EPS

$

0.22

$

0.20

$

0.30

$

0.27

Adjusted diluted EPS

$

0.21

$

0.19

$

0.29

$

0.26

(a)

Tax adjustments for the three and six

months ended June 29, 2024 reflect a normalized tax rate of 23.4%

and 23.7%, respectively, compared to the Company’s effective tax

rate of 19.9% and 20.8%, respectively. The Company’s effective tax

rate for the three months ended June 29, 2024 includes the tax

benefits resulting from stock compensation and the six months ended

June 29, 2024 additionally include a tax benefit resulting from a

return-to-provision adjustment. Tax adjustments for the three and

six months ended July 1, 2023 reflect a normalized tax rate of

24.8% and 25.0%, respectively, compared to the Company's effective

tax rate of 31.9% and 27.8%, respectively. The Company’s effective

tax rate for the three and six months ended July 1, 2023 includes

the impact of a discrete tax expense related to a change in the

indefinite reinvestment assertion for one jurisdiction, partially

offset by a tax benefit resulting from the exercise of stock

options.

(b)

Represents non-cash stock-based

compensation expense related to equity awards issued to management,

employees, and directors. The adjustment includes only expense

related to awards issued under the 2017 Equity Incentive Plan,

which were awards granted prior to the effective date of the

IPO.

(c)

Represents unrealized non-cash (gains)

losses on foreign denominated monetary assets and liabilities and

foreign currency contracts.

(d)

Adjustments in the three months ended June

29, 2024 are primarily driven by $0.6 million of transaction costs

associated with the acquisition of ChlorKing HoldCo, LLC and

related entities (“ChlorKing”) and $0.3 million of separation and

other costs associated with the centralization of operations in

Europe. Adjustments in the three months ended July 1, 2023 are

primarily driven by $0.5 million of separation costs associated

with the enterprise cost-reduction program initiated in 2022, $0.5

million of integration costs from prior acquisitions and $0.3

million of costs associated with the relocation of the corporate

headquarters.

Adjustments in the six months ended June

29, 2024 are primarily driven by $0.7 million of separation and

other costs associated with the centralization of operations in

Europe and $0.6 million of transaction costs associated with the

acquisition of ChlorKing. Adjustments in the six months ended July

1, 2023 are primarily driven by $1.3 million of separation costs

associated with the enterprise cost-reduction program initiated in

2022, $0.8 million of integration costs from prior acquisitions and

$0.6 million of costs associated with the relocation of the

corporate headquarters.

(e)

Adjustments in the three months ended June

29, 2024 are primarily driven by $0.5 million of gains on the sale

of assets, partially offset by $0.2 million of costs incurred

related to litigation. Adjustments in the three months ended July

1, 2023 primarily include $0.3 million of costs incurred related to

the selling stockholder offering of shares in May 2023, which are

reported in SG&A in the unaudited condensed consolidated

statement of operations, and other miscellaneous items the Company

believes are not representative of its ongoing business

operations.

Adjustments in the six months ended June

29, 2024 are primarily driven by $0.5 million of gains on the sale

of assets, partially offset by $0.3 million of costs incurred

related to litigation. Adjustments in the six months ended July 1,

2023 primarily includes $0.6 million of costs associated with

follow-on equity offerings, $0.4 million of transitional expenses

incurred to enable go-forward public company regulatory compliance

and other miscellaneous items the Company believes are not

representative of its ongoing business operations.

(f)

The tax effect represents the immediately

preceding adjustments at the normalized tax rates as discussed in

footnote (a) above.

Segment Reconciliations

Following is a reconciliation from segment income to adjusted

segment income for the North America (“NAM”) and Europe & Rest

of World (“E&RW”) segments:

(Dollars in thousands)

Three Months Ended

Three Months Ended

June 29, 2024

July 1, 2023

Total

NAM

E&RW

Total

NAM

E&RW

Net sales

$

284,393

$

241,113

$

43,280

$

283,543

$

237,352

$

46,191

Gross profit

$

145,087

$

127,430

$

17,657

$

136,510

$

118,442

$

18,068

Gross profit margin %

51.0

%

52.9

%

40.8

%

48.1

%

49.9

%

39.1

%

Income from operations before income

taxes

$

46,946

$

43,220

Expenses not allocated to segments

Corporate expense, net

7,811

8,425

Acquisition and restructuring related

expense

839

1,309

Amortization of intangible assets

6,949

7,637

Interest expense, net

16,799

19,130

Loss on debt extinguishment

4,926

—

Other (income) expense, net

(646

)

625

Segment income

$

83,624

$

75,335

$

8,289

$

80,346

$

70,962

$

9,384

Segment income margin %

29.4

%

31.2

%

19.2

%

28.3

%

29.9

%

20.3

%

Depreciation

$

4,591

$

4,328

$

263

$

4,068

$

3,837

$

231

Amortization

1,554

1,554

—

1,651

1,651

—

Stock-based compensation

57

57

—

192

180

12

Other (a)

—

—

—

290

290

—

Total adjustments

6,202

5,939

263

6,201

5,958

243

Adjusted segment income

$

89,826

$

81,274

$

8,552

$

86,547

$

76,920

$

9,627

Adjusted segment income margin %

31.6

%

33.7

%

19.8

%

30.5

%

32.4

%

20.8

%

(a)

The three months ended July 1, 2023

includes miscellaneous items the Company believes are not

representative of its ongoing business operations.

(Dollars in thousands)

Six Months Ended

Six Months Ended

June 29, 2024

July 1, 2023

Total

NAM

E&RW

Total

NAM

E&RW

Net sales

$

496,962

$

414,542

$

82,420

$

493,679

$

400,056

$

93,623

Gross profit

$

249,666

$

217,307

$

32,359

$

234,401

$

197,455

$

36,946

Gross profit margin %

50.2

%

52.4

%

39.3

%

47.5

%

49.4

%

39.5

%

Income from operations before income

taxes

$

59,851

$

52,465

Expenses not allocated to segments

Corporate expense, net

15,326

14,524

Acquisition and restructuring related

expense

1,343

2,872

Amortization of intangible assets

13,849

15,254

Interest expense, net

35,391

38,491

Loss on debt extinguishment

4,926

—

Other (income) expense, net

(1,284

)

(134

)

Segment income

$

129,402

$

115,077

$

14,325

$

123,472

$

104,238

$

19,234

Segment income margin %

26.0

%

27.8

%

17.4

%

25.0

%

26.1

%

20.5

%

Depreciation

$

8,735

$

8,215

$

520

$

8,373

$

7,925

$

448

Amortization

3,197

3,197

—

3,288

3,288

—

Stock-based compensation

79

69

10

365

342

23

Other (a)

19

19

—

388

388

—

Total adjustments

12,030

11,500

530

12,414

11,943

471

Adjusted segment income

$

141,432

$

126,577

$

14,855

$

135,886

$

116,181

$

19,705

Adjusted segment income margin %

28.5

%

30.5

%

18.0

%

27.5

%

29.0

%

21.0

%

(a)

The six months ended June 29, 2024

represents losses on the sale of assets. The six months ended July

1, 2023 includes miscellaneous items the Company believes are not

representative of its ongoing business operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730598272/en/

Investor Relations: Kevin Maczka investor.relations@hayward.com

Media Relations: Tanya McNabb tmcnabb@hayward.com

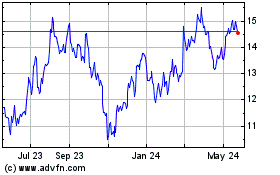

Hayward (NYSE:HAYW)

Historical Stock Chart

From Dec 2024 to Jan 2025

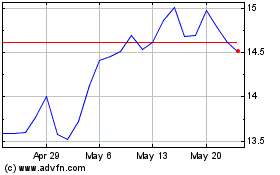

Hayward (NYSE:HAYW)

Historical Stock Chart

From Jan 2024 to Jan 2025