Cheniere and SandRidge Shares Jump as Natural Gas Prices Rally

June 18 2012 - 7:20AM

Marketwired

Natural Gas companies received a boost Thursday as U.S. natural gas

supplies showed a lower than expected weekly rise. Natural gas

futures rallied over 15 percent Thursday on the surprisingly

bullish inventory numbers. "The market was wrong-footed ahead of

the EIA number and the new shorts that piled in have turned and

covered," said Eugene McGillan, a broker and trader at Tradition

Energy. "Now we're triggering fresh technical buying." The Paragon

Report examines investing opportunities in the Natural Gas Industry

and provides equity research on Cheniere Energy, Inc. (NYSE: LNG)

and SandRidge Energy Inc. (NYSE: SD).

Access to the full company reports can be found at:

www.ParagonReport.com/LNG

www.ParagonReport.com/SD

The Energy Department's Energy Information Administration on

Thursday reported that for the week ended June 8 natural gas in

storage increased by 67 billion cubic feet. Analysts had expected a

jump of 71 billion to 75 billion cubic feet according to a survey

from Platts. Storage levels over the same period last year rose by

72 BCF. Natural gas futures on Thursday hit $2.46 per million

British Thermal Units (BTUs).

T. Boone Pickens earlier this week stated that natural gas

prices have bottomed and by next summer would rise to $3 or more.

Pickens stated that supplies have significantly been reduced as the

number of natural gas rigs in operation has dropped from 800 to

500.

Paragon Report releases regular market updates on the Natural

Gas Industry so investors can stay ahead of the crowd and make the

best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.ParagonReport.com and get

exclusive access to our numerous stock reports and industry

newsletters.

Cheniere Energy is a Houston-based energy company primarily

engaged in LNG-related businesses. The company owns and operates

the Sabine Pass LNG receiving terminal and Creole Trail pipeline in

Louisiana. The terminal has sent out capacity of 4.0 Bcf/d and

storage capacity of 16.9 Bcfe. Shares of Cheniere jumped 4.24

percent Thursday.

SandRidge Energy is an oil exploration and production company

headquartered in Oklahoma City, Oklahoma. SandRidge's drilling

activities are focused on its oil properties in the Mid-Continent

and Permian Basin. The company reported oil and natural gas revenue

increased 28 percent to $341 million in first quarter 2012 from

$267 million in the same period of 2011.

Paragon Report provides Market Research focused on equities that

offer growth opportunities, value, and strong potential return. We

strive to provide the most up-to-date market activities. We

constantly create research reports and newsletters for our members.

The Paragon Report has not been compensated by any of the

above-mentioned companies. We act as independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.ParagonReport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

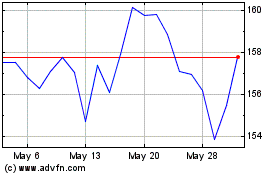

Cheniere Energy (NYSE:LNG)

Historical Stock Chart

From Jun 2024 to Jul 2024

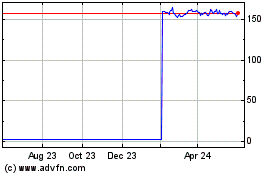

Cheniere Energy (NYSE:LNG)

Historical Stock Chart

From Jul 2023 to Jul 2024