MFA Financial, Inc. (NYSE:MFA) today provided its financial

results for the second quarter ended June 30, 2024:

- MFA generated GAAP net income for the second quarter of $33.7

million, or $0.32 per basic and diluted common share.

- Distributable earnings, a non-GAAP financial measure, were

$45.6 million, or $0.44 per basic common share. MFA paid a regular

cash dividend of $0.35 per common share on July 31, 2024.

- GAAP book value at June 30, 2024 was $13.80 per common share.

Economic book value, a non-GAAP financial measure, was $14.34 per

common share.

- Total economic return was 2.6% for the second quarter.

- Net interest spread averaged 2.16% and net interest margin was

3.01%.

- MFA closed the quarter with unrestricted cash of $289.4

million.

Commenting on the quarter, Craig Knutson, MFA’s CEO and

President, stated: “We are pleased to announce strong results for

what was yet another volatile quarter in the fixed income and

mortgage markets. We generated Distributable earnings of $0.44 per

share and our Economic book value rose to $14.34 per share. We

continued to execute our strategy of acquiring residential mortgage

assets at attractive levels. During the quarter, we purchased or

originated $688 million residential mortgage loans with an average

coupon of 9.6%. We also added $176 million of Agency MBS.”

Mr. Knutson continued: “On the liability side, we repaid the

remaining $170 million balance of our maturing convertible notes

and issued $75 million of 9.00% senior unsecured notes due in

August 2029. We completed two securitizations collateralized by

$557 million of Non-QM and Transitional loans. We also securitized

$303 million of primarily re-performing loans subsequent to

quarter-end. Finally, we once again benefited from our $3.3 billion

interest rate swap position, which generated a net positive carry

of $29 million.”

Q2 2024 Portfolio Activity

- Loan acquisitions were $688.2 million, including $422.1 million

of funded originations of business purpose loans (including draws

on Transitional loans) and $266.1 million of Non-QM loan

acquisitions, bringing MFA’s residential whole loan balance to $9.2

billion.

- Lima One funded $270.0 million of new business purpose loans

with a maximum loan amount of $412.3 million. Further, $152.2

million of draws were funded on previously originated Transitional

loans. Lima One generated $7.6 million of origination, servicing,

and other fee income.

- MFA added $175.5 million of Agency MBS during the quarter,

bringing its total Securities portfolio to $863.3 million.

- Asset dispositions included $12.4 million UPB of single-family

rental (SFR) loans and $26.9 million of MSR-related securities. MFA

also continued to reduce its REO portfolio, selling 63 properties

in the second quarter for aggregate proceeds of $25.6 million.

- 60+ day delinquencies (measured as a percentage of UPB) for

MFA’s residential loan portfolio declined to 6.5% from 6.9% in the

first quarter.

- MFA completed two loan securitizations during the quarter,

collateralized by $365.2 million UPB of Non-QM loans and $191.8

million UPB of Transitional loans, bringing its total securitized

debt to approximately $5.0 billion.

- MFA increased its position in interest rate swaps to a notional

amount of approximately $3.3 billion. At June 30, 2024, these swaps

had a weighted average fixed pay interest rate of 1.92% and a

weighted average variable receive interest rate of 5.33%.

- MFA estimates the net effective duration of its investment

portfolio at June 30, 2024 rose to 1.12 from 0.98 at March 31,

2024.

- MFA’s Debt/Net Equity Ratio was 4.7x and recourse leverage was

1.7x at June 30, 2024.

Webcast

MFA Financial, Inc. plans to host a live audio webcast of its

investor conference call on Thursday, August 8, 2024, at 10:00 a.m.

(Eastern Time) to discuss its second quarter 2024 financial

results. The live audio webcast will be accessible to the general

public over the internet at http://www.mfafinancial.com through the

“Webcasts & Presentations” link on MFA’s home page. Earnings

presentation materials will be posted on the MFA website prior to

the conference call and an audio replay will be available on the

website following the call.

About MFA Financial,

Inc.

MFA Financial, Inc. (NYSE: MFA) is a leading specialty finance

company that invests in residential mortgage loans, residential

mortgage-backed securities and other real estate assets. Through

its wholly-owned subsidiary, Lima One Capital, MFA also originates

and services business purpose loans for real estate investors. MFA

has distributed $4.7 billion in dividends to stockholders since its

initial public offering in 1998. MFA is an internally-managed,

publicly-traded real estate investment trust.

The following table presents MFA’s asset allocation as of June

30, 2024, and the second quarter 2024 yield on average

interest-earning assets, average cost of funds and net interest

rate spread for the various asset types.

Table 1 - Asset Allocation

At June 30, 2024

Business purpose loans

(1)

Non-QM loans

Legacy RPL/NPL loans

Securities, at fair

value

Other, net (2)

Total

(Dollars in Millions)

Asset Amount

$

4,016

$

3,994

$

1,123

$

863

$

778

$

10,774

Financing Agreements with

Non-mark-to-market Collateral Provisions

(931

)

—

—

—

—

(931

)

Financing Agreements with Mark-to-market

Collateral Provisions

(651

)

(796

)

(479

)

(731

)

(72

)

(2,729

)

Securitized Debt

(1,843

)

(2,747

)

(457

)

—

(1

)

(5,048

)

Senior Notes

—

—

—

—

(183

)

(183

)

Net Equity Allocated

$

591

$

451

$

187

$

132

$

522

$

1,883

Debt/Net Equity Ratio (3)

5.8 x

7.9 x

5.0 x

5.5 x

4.7 x

For the Quarter

Ended June 30, 2024

Yield on Average Interest Earning Assets

(4)

7.99

%

5.49

%

8.72

%

7.03

%

6.79

%

Less Average Cost of Funds (5)

(5.80

)

(3.55

)

(3.70

)

(3.84

)

(4.63

)

Net Interest Rate Spread

2.19

%

1.94

%

5.02

%

3.19

%

2.16

%

(1)

Includes $1.2 billion of Single-family transitional loans, $1.2

billion of Multifamily transitional loans and $1.6 billion of

Single-family rental loans.

(2)

Includes $289.4 million of cash and cash equivalents, $252.0

million of restricted cash, $53.4 million of Other loans and $18.3

million of capital contributions made to loan origination partners,

as well as other assets and other liabilities.

(3)

Total Debt/Net Equity ratio represents the sum of borrowings under

our financing agreements as a multiple of net equity allocated.

(4)

Yields reported on our interest earning assets are calculated based

on the interest income recorded and the average amortized cost for

the quarter of the respective asset. At June 30, 2024, the

amortized cost of our Securities, at fair value, was $846.8

million. In addition, the yield for residential whole loans was

6.91%, net of one basis point of servicing fee expense incurred

during the quarter. For GAAP reporting purposes, such expenses are

included in Loan servicing and other related operating expenses in

our statement of operations.

(5)

Average cost of funds includes interest on financing agreements,

Convertible Senior Notes, 8.875% Senior Notes, 9.00% Senior Notes,

and securitized debt. Cost of funding also includes the impact of

the net carry (the difference between swap interest income received

and swap interest expense paid) on our interest rate swap

agreements (or Swaps). While we have not elected hedge accounting

treatment for Swaps and accordingly net carry is not presented in

interest expense in our consolidated statement of operations, we

believe it is appropriate to allocate net carry to the cost of

funding to reflect the economic impact of our Swaps on the funding

costs shown in the table above. For the quarter ended June 30,

2024, this decreased the overall funding cost by 127 basis points

for our overall portfolio, 128 basis points for our Residential

whole loans, 92 basis points for our Business purpose loans, 163

basis points for our Non-QM loans, 107 basis points for our Legacy

RPL/NPL loans and 190 basis points for our Securities, at fair

value.

The following table presents the activity for our residential

mortgage asset portfolio for the three months ended June 30,

2024:

Table 2 - Investment Portfolio Activity Q2 2024

(In Millions)

March 31, 2024

Runoff (1)

Acquisitions (2)

Other (3)

June 30, 2024

Change

Residential whole loans and REO

$

9,225

$

(624

)

$

688

$

5

$

9,294

$

69

Securities, at fair value

737

(19

)

176

(31

)

863

126

Totals

$

9,962

$

(643

)

$

864

$

(26

)

$

10,157

$

195

(1)

Primarily includes principal repayments and sales of REO.

(2)

Includes draws on previously originated Transitional loans.

(3)

Primarily includes sales, changes in fair value and changes in the

allowance for credit losses.

The following tables present information on our investments in

residential whole loans:

Table 3 - Portfolio Composition/Residential Whole

Loans

Held at Carrying Value

Held at Fair Value

Total

(Dollars in Thousands)

June 30, 2024

December 31, 2023

June 30, 2024

December 31, 2023

June 30, 2024

December 31, 2023

Business purpose loans:

Single-family transitional loans (1)

$

27,857

$

35,467

$

1,190,699

$

1,157,732

$

1,218,556

$

1,193,199

Multifamily transitional loans

—

—

1,155,198

1,168,297

1,155,198

1,168,297

Single-family rental loans

129,471

172,213

1,514,219

1,462,583

1,643,690

1,634,796

Total Business purpose loans

$

157,328

$

207,680

$

3,860,116

$

3,788,612

$

4,017,444

$

3,996,292

Non-QM loans

791,746

843,884

3,203,845

2,961,693

3,995,591

3,805,577

Legacy RPL/NPL loans

477,826

498,671

655,230

705,424

1,133,056

1,204,095

Other loans

—

—

53,416

55,779

53,416

55,779

Allowance for Credit Losses

(13,271

)

(20,451

)

—

—

(13,271

)

(20,451

)

Total Residential whole loans

$

1,413,629

$

1,529,784

$

7,772,607

$

7,511,508

$

9,186,236

$

9,041,292

Number of loans

5,973

6,326

19,848

19,075

25,821

25,401

(1)

Includes $476.9 million and $471.1 million of loans collateralized

by new construction projects at origination as of June 30, 2024 and

December 31, 2023, respectively.

Table 4 - Yields and Average Balances/Residential Whole

Loans

For the Three-Month Period

Ended

(Dollars in Thousands)

June 30, 2024

March 31, 2024

June 30, 2023

Interest

Average Balance

Average Yield

Interest

Average Balance

Average Yield

Interest

Average Balance

Average Yield

Business purpose loans:

Single-family transitional loans

$

30,242

$

1,241,300

9.75

%

$

28,018

$

1,239,558

9.04

%

$

18,749

$

885,057

8.47

%

Multifamily transitional loans

25,291

1,213,450

8.34

%

25,198

1,209,393

8.33

%

13,872

769,528

7.21

%

Single-family rental loans

27,564

1,703,334

6.47

%

27,102

1,746,058

6.21

%

23,141

1,587,636

5.83

%

Total business purpose loans

$

83,097

$

4,158,084

7.99

%

$

80,318

$

4,195,009

7.66

%

$

55,762

$

3,242,221

6.88

%

Non-QM loans

58,749

4,280,761

5.49

%

55,861

4,149,257

5.39

%

45,518

3,879,175

4.69

%

Legacy RPL/NPL loans

23,346

1,070,629

8.72

%

20,969

1,100,553

7.62

%

26,250

1,208,036

8.69

%

Other loans

525

67,771

3.10

%

517

68,490

3.02

%

518

72,875

2.84

%

Total Residential whole loans

$

165,717

$

9,577,245

6.92

%

$

157,665

$

9,513,309

6.63

%

$

128,048

$

8,402,307

6.10

%

Table 5 - Net Interest Spread/Residential Whole Loans

For the Three-Month Period

Ended

June 30, 2024

March 31, 2024

June 30, 2023

Business purpose loans

Net Yield (1)

7.99

%

7.66

%

6.88

%

Cost of Funding (2)

5.80

%

5.67

%

5.01

%

Net Interest Spread

2.19

%

1.99

%

1.87

%

Non-QM loans

Net Yield (1)

5.49

%

5.39

%

4.69

%

Cost of Funding (2)

3.55

%

3.44

%

3.07

%

Net Interest Spread

1.94

%

1.95

%

1.62

%

Legacy RPL/NPL loans

Net Yield (1)

8.72

%

7.62

%

8.69

%

Cost of Funding (2)

3.70

%

3.44

%

2.96

%

Net Interest Spread

5.02

%

4.18

%

5.73

%

Total Residential whole loans

Net Yield (1)

6.92

%

6.63

%

6.10

%

Cost of Funding (2)

4.54

%

4.43

%

3.83

%

Net Interest Spread

2.38

%

2.20

%

2.27

%

(1)

Reflects annualized interest income on Residential whole loans

divided by average amortized cost of Residential whole loans.

Excludes servicing costs.

(2)

Reflects annualized interest expense divided by average balance of

agreements with mark-to-market collateral provisions (repurchase

agreements), agreements with non-mark-to-market collateral

provisions, and securitized debt. Cost of funding shown in the

table above includes the impact of the net carry (the difference

between swap interest income received and swap interest expense

paid) on our Swaps. While we have not elected hedge accounting

treatment for Swaps, and, accordingly, net carry is not presented

in interest expense in our consolidated statement of operations, we

believe it is appropriate to allocate net carry to the cost of

funding to reflect the economic impact of our Swaps on the funding

costs shown in the table above. For the quarter ended June 30,

2024, this decreased the overall funding cost by 128 basis points

for our Residential whole loans, 92 basis points for our Business

purpose loans, 163 basis points for our Non-QM loans, and 107 basis

points for our Legacy RPL/NPL loans. For the quarter ended March

31, 2024, this decreased the overall funding cost by 132 basis

points for our Residential whole loans, 227 basis points for our

Business purpose loans, 168 basis points for our Non-QM loans, and

238 basis points for our Legacy RPL/NPL loans. For the quarter

ended June 30, 2023, this decreased the overall funding cost by 144

basis points for our Residential whole loans, 222 basis points for

our Business purpose loans, 175 basis points for our Non-QM loans,

and 297 basis points for our Legacy RPL/NPL loans.

Table 6 - Credit-related Metrics/Residential Whole

Loans

June 30,

2024

Asset Amount

Fair Value

Unpaid Principal Balance

(“UPB”)

Weighted Average Coupon

(1)

Weighted Average Term to

Maturity (Months)

Weighted Average LTV Ratio

(2)

Weighted Average Original FICO

(3)

Aging by UPB

60+ DQ %

60+

LTV (4)

Past Due Days

(Dollars In Thousands)

Current

30-59

60-89

90+

Business purpose loans:

Single-family transitional (4)

$

1,217,255

$

1,217,599

$

1,226,736

10.39

%

6

67

%

748

$

1,100,554

$

20,416

$

8,837

$

96,929

8.6

%

87

%

Multifamily transitional (4)

1,155,198

1,155,198

1,184,613

8.87

%

11

66

%

748

1,097,323

33,188

15,544

38,558

4.6

%

69

%

Single-family rental

1,643,081

1,642,760

1,712,879

6.62

%

330

69

%

739

1,637,918

12,197

4,627

58,137

3.7

%

112

%

Total Business purpose loans

$

4,015,534

$

4,015,557

$

4,124,228

8.39

%

68

%

$

3,835,795

$

65,801

$

29,008

$

193,624

5.4

%

Non-QM loans

3,994,236

3,949,676

4,183,917

6.16

%

341

64

%

735

3,975,323

82,676

34,121

91,797

3.0

%

62

%

Legacy RPL/NPL loans

1,123,050

1,140,736

1,284,232

5.12

%

257

56

%

647

874,319

134,000

43,974

231,939

21.5

%

64

%

Other loans

53,416

53,416

65,671

3.44

%

326

66

%

758

65,671

—

—

—

—

%

—

%

Residential whole loans, total or weighted

average

$

9,186,236

$

9,159,385

$

9,658,048

6.98

%

64

%

$

8,751,108

$

282,477

$

107,103

$

517,360

6.5

%

(1)

Weighted average is calculated based on the interest bearing

principal balance of each loan within the related category. For

loans acquired with servicing rights released by the seller,

interest rates included in the calculation do not reflect loan

servicing fees. For loans acquired with servicing rights retained

by the seller, interest rates included in the calculation are net

of servicing fees.

(2)

LTV represents the ratio of the total unpaid principal balance of

the loan to the estimated value of the collateral securing the

related loan as of the most recent date available, which may be the

origination date. Excluded from the calculation of weighted average

LTV are certain low value loans secured by vacant lots, for which

the LTV ratio is not meaningful. 60+ LTV has been calculated on a

consistent basis.

(3)

Excludes loans for which no Fair Isaac Corporation (“FICO”) score

is available.

(4)

For Single-family and Multifamily transitional loans, the LTV

presented is the ratio of the maximum unpaid principal balance of

the loan, including unfunded commitments, to the estimated “after

repaired” value of the collateral securing the related loan, where

available. At June 30, 2024, for certain Single-family and

Multifamily Transitional loans totaling $467.2 million and $498.7

million, respectively, an after repaired valuation was not

available. For these loans, the weighted average LTV is calculated

based on the current unpaid principal balance and the as-is value

of the collateral securing the related loan.

Table 7 - Shock Table

The information presented in the following “Shock Table”

projects the potential impact of sudden parallel changes in

interest rates on the value of our portfolio, including the impact

of Swaps and securitized debt, based on the assets in our

investment portfolio at June 30, 2024. Changes in portfolio value

are measured as the percentage change when comparing the projected

portfolio value to the base interest rate scenario at June 30,

2024.

Change in Interest Rates

Percentage Change

in Portfolio Value

Percentage Change

in Total Stockholders’

Equity

+100 Basis Point Increase

(1.37

)%

(7.96

)%

+ 50 Basis Point Increase

(0.62

)%

(3.62

)%

Actual at June 30, 2024

—

%

—

%

- 50 Basis Point Decrease

0.50

%

2.90

%

-100 Basis Point Decrease

0.87

%

5.08

%

MFA FINANCIAL, INC.

CONSOLIDATED BALANCE

SHEETS

(In Thousands, Except Per Share

Amounts)

June 30, 2024

December 31,

2023

(unaudited)

Assets:

Residential whole loans, net ($7,772,607

and $7,511,508 held at fair value, respectively) (1)

$

9,186,236

$

9,041,292

Securities, at fair value

863,289

746,090

Cash and cash equivalents

289,412

318,000

Restricted cash

252,015

170,211

Other assets

485,973

497,097

Total Assets

$

11,076,925

$

10,772,690

Liabilities:

Financing agreements ($5,082,181 and

$4,633,660 held at fair value, respectively)

$

8,891,042

$

8,536,745

Other liabilities

302,641

336,030

Total Liabilities

$

9,193,683

$

8,872,775

Stockholders’ Equity:

Preferred stock, $0.01 par value; 7.5%

Series B cumulative redeemable; 8,050 shares authorized; 8,000

shares issued and outstanding ($200,000 aggregate liquidation

preference)

$

80

$

80

Preferred stock, $0.01 par value; 6.5%

Series C fixed-to-floating rate cumulative redeemable; 12,650

shares authorized; 11,000 shares issued and outstanding ($275,000

aggregate liquidation preference)

110

110

Common stock, $0.01 par value; 874,300 and

874,300 shares authorized; 102,083 and 101,916 shares issued and

outstanding, respectively

1,021

1,019

Additional paid-in capital, in excess of

par

3,707,886

3,698,767

Accumulated deficit

(1,843,507

)

(1,817,759

)

Accumulated other comprehensive income

17,652

17,698

Total Stockholders’ Equity

$

1,883,242

$

1,899,915

Total Liabilities and Stockholders’

Equity

$

11,076,925

$

10,772,690

(1)

Includes approximately $6.0 billion and $5.7 billion of Residential

whole loans transferred to consolidated variable interest entities

(“VIEs”) at June 30, 2024 and December 31, 2023, respectively. Such

assets can be used only to settle the obligations of each

respective VIE.

MFA FINANCIAL, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

Three Months Ended

June 30,

Six Months Ended

June 30,

(In Thousands, Except Per Share

Amounts)

2024

2023

2024

2023

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Interest Income:

Residential whole loans

$

165,717

$

128,048

$

323,382

$

247,558

Securities, at fair value

13,629

9,948

26,621

17,256

Other interest-earning assets

1,177

2,622

2,340

4,973

Cash and cash equivalent investments

6,308

3,732

11,319

6,768

Interest Income

$

186,831

$

144,350

$

363,662

$

276,555

Interest Expense:

Asset-backed and other collateralized

financing arrangements

$

126,755

$

95,884

$

250,197

$

184,764

Other interest expense

6,587

3,961

12,162

7,917

Interest Expense

$

133,342

$

99,845

$

262,359

$

192,681

Net Interest Income

$

53,489

$

44,505

$

101,303

$

83,874

Reversal/(Provision) for Credit Losses

on Residential Whole Loans

$

1,079

$

(294

)

$

1,539

$

(281

)

Reversal/(Provision) for Credit Losses

on Other Assets

(26

)

—

(1,135

)

—

Net Interest Income after

Reversal/(Provision) for Credit Losses

$

54,542

$

44,211

$

101,707

$

83,593

Other Income/(Loss), net:

Net gain/(loss) on residential whole loans

measured at fair value through earnings

$

16,430

$

(130,703

)

$

4,917

$

(1,529

)

Impairment and other net gain/(loss) on

securities and other portfolio investments

(2,842

)

(4,569

)

(7,618

)

(1,638

)

Net gain/(loss) on real estate owned

1,880

2,153

2,871

6,095

Net gain/(loss) on derivatives used for

risk management purposes

16,087

60,451

66,028

39,243

Net gain/(loss) on securitized debt

measured at fair value through earnings

(10,642

)

27,394

(33,104

)

(24,331

)

Lima One - origination, servicing and

other fee income

7,619

11,477

15,547

20,453

Net realized gain/(loss) on residential

whole loans held at carrying value

—

—

418

—

Other, net

1,317

5,492

3,192

8,506

Other Income/(Loss), net

$

29,849

$

(28,305

)

$

52,251

$

46,799

Operating and Other Expense:

Compensation and benefits

$

21,747

$

21,771

$

47,215

$

42,401

Other general and administrative

expense

10,835

11,522

22,830

21,199

Loan servicing, financing and other

related costs

8,717

7,598

15,759

17,137

Amortization of intangible assets

800

1,300

1,600

2,600

Operating and Other Expense

$

42,099

$

42,191

$

87,404

$

83,337

Income/(loss) before income

taxes

$

42,292

$

(26,285

)

$

66,554

$

47,055

Provision for/(benefit from) income

taxes

$

346

$

(357

)

$

1,395

$

199

Net Income/(Loss)

$

41,946

$

(25,928

)

$

65,159

$

46,856

Less Preferred Stock Dividend

Requirement

$

8,218

$

8,218

$

16,437

$

16,437

Net Income/(Loss) Available to Common

Stock and Participating Securities

$

33,728

$

(34,146

)

$

48,722

$

30,419

Basic Earnings/(Loss) per Common

Share

$

0.32

$

(0.34

)

$

0.47

$

0.30

Diluted Earnings/(Loss) per Common

Share

$

0.32

$

(0.34

)

$

0.46

$

0.29

Segment Reporting

At June 30, 2024, the Company’s reportable segments include (i)

mortgage-related assets and (ii) Lima One. The Corporate column in

the table below primarily consists of corporate cash and related

interest income, investments in loan originators and related

economics, general and administrative expenses not directly

attributable to Lima One, interest expense on unsecured convertible

senior notes, securitization issuance costs, and preferred stock

dividends.

The following tables summarize segment financial information,

which in total reconciles to the same data for the Company as a

whole:

(In Thousands)

Mortgage-Related

Assets

Lima One

Corporate

Total

Three months ended June 30,

2024

Interest Income

$

101,216

$

81,780

$

3,835

$

186,831

Interest Expense

70,009

56,746

6,587

133,342

Net Interest Income/(Expense)

$

31,207

$

25,034

$

(2,752

)

$

53,489

Reversal/(Provision) for Credit Losses on

Residential Whole Loans

1,079

—

—

1,079

Reversal/(Provision) for Credit Losses on

Other Assets

(26

)

—

—

(26

)

Net Interest Income/(Expense) after

Reversal/(Provision) for Credit Losses

$

32,260

$

25,034

$

(2,752

)

$

54,542

Net gain/(loss) on residential whole loans

measured at fair value through earnings

$

28,474

$

(12,044

)

$

—

$

16,430

Impairment and other net gain/(loss) on

securities and other portfolio investments

(1,358

)

—

(1,484

)

(2,842

)

Net gain on real estate owned

2,167

(287

)

—

1,880

Net gain/(loss) on derivatives used for

risk management purposes

11,296

4,791

—

16,087

Net gain/(loss) on securitized debt

measured at fair value through earnings

(6,620

)

(4,022

)

—

(10,642

)

Lima One - origination, servicing and

other fee income

—

7,619

—

7,619

Net realized gain/(loss) on residential

whole loans held at carrying value

—

—

—

—

Other, net

(85

)

914

488

1,317

Other Income/(Loss), net

$

33,874

$

(3,029

)

$

(996

)

$

29,849

Compensation and benefits

$

—

$

10,765

$

10,982

$

21,747

Other general and administrative

expense

115

4,936

5,784

10,835

Loan servicing, financing and other

related costs

4,796

615

3,306

8,717

Amortization of intangible assets

—

800

—

800

Income/(loss) before income taxes

$

61,223

$

4,889

$

(23,820

)

$

42,292

Provision for/(benefit from) income

taxes

$

—

$

—

$

346

$

346

Net Income/(Loss)

$

61,223

$

4,889

$

(24,166

)

$

41,946

Less Preferred Stock Dividend

Requirement

$

—

$

—

$

8,218

$

8,218

Net Income/(Loss) Available to Common

Stock and Participating Securities

$

61,223

$

4,889

$

(32,384

)

$

33,728

(Dollars in Thousands)

Mortgage-Related

Assets

Lima One

Corporate

Total

June 30, 2024

Total Assets

$

6,575,888

$

4,167,768

$

333,269

$

11,076,925

December 31, 2023

Total Assets

$

6,370,237

$

4,000,932

$

401,521

$

10,772,690

Reconciliation of GAAP Net Income to non-GAAP Distributable

Earnings

“Distributable earnings” is a non-GAAP financial measure of our

operating performance, within the meaning of Regulation G and Item

10(e) of Regulation S-K, as promulgated by the Securities and

Exchange Commission. Distributable earnings is determined by

adjusting GAAP net income/(loss) by removing certain unrealized

gains and losses, primarily on residential mortgage investments,

associated debt, and hedges that are, in each case, accounted for

at fair value through earnings, certain realized gains and losses,

as well as certain non-cash expenses and securitization-related

transaction costs. The transaction costs are primarily comprised of

costs only incurred at the time of execution of our securitizations

and include costs such as underwriting fees, legal fees, diligence

fees, bank fees and other similar transaction related expenses.

These costs are all incurred prior to or at the execution of our

securitizations and do not recur. Recurring expenses, such as

servicing fees, custodial fees, trustee fees and other similar

ongoing fees are not excluded from distributable earnings.

Management believes that the adjustments made to GAAP earnings

result in the removal of (i) income or expenses that are not

reflective of the longer term performance of our investment

portfolio, (ii) certain non-cash expenses, and (iii) expense items

required to be recognized solely due to the election of the fair

value option on certain related residential mortgage assets and

associated liabilities. Distributable earnings is one of the

factors that our Board of Directors considers when evaluating

distributions to our shareholders. Accordingly, we believe that the

adjustments to compute Distributable earnings specified below

provide investors and analysts with additional information to

evaluate our financial results.

Distributable earnings should be used in conjunction with

results presented in accordance with GAAP. Distributable earnings

does not represent and should not be considered as a substitute for

net income or cash flows from operating activities, each as

determined in accordance with GAAP, and our calculation of this

measure may not be comparable to similarly titled measures reported

by other companies.

The following table provides a reconciliation of our GAAP net

income/(loss) used in the calculation of basic EPS to our non-GAAP

Distributable earnings for the quarterly periods below:

Quarter Ended

(In Thousands, Except Per Share

Amounts)

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

GAAP Net income/(loss) used in the

calculation of basic EPS

$

33,614

$

14,827

$

81,527

$

(64,657

)

$

(34,146

)

Adjustments:

Unrealized and realized gains and losses

on:

Residential whole loans held at fair

value

(16,430

)

11,513

(224,272

)

132,894

130,703

Securities held at fair value

4,026

4,776

(21,371

)

13,439

3,698

Residential whole loans and securities at

carrying value

(2,668

)

(418

)

332

—

—

Interest rate swaps

10,237

(23,182

)

97,400

(9,433

)

(37,018

)

Securitized debt held at fair value

7,597

20,169

108,693

(40,229

)

(30,908

)

Investments in loan origination

partners

1,484

—

254

722

872

Expense items:

Amortization of intangible assets

800

800

800

800

1,300

Equity based compensation

3,899

6,243

3,635

4,447

3,932

Securitization-related transaction

costs

3,009

1,340

2,702

3,217

2,071

Total adjustments

11,954

21,241

(31,827

)

105,857

74,650

Distributable earnings

$

45,568

$

36,068

$

49,700

$

41,200

$

40,504

GAAP earnings/(loss) per basic common

share

$

0.32

$

0.14

$

0.80

$

(0.64

)

$

(0.34

)

Distributable earnings per basic common

share

$

0.44

$

0.35

$

0.49

$

0.40

$

0.40

Weighted average common shares for basic

earnings per share

103,446

103,175

102,266

102,255

102,186

The following table presents our non-GAAP Distributable earnings

by segment for the quarterly periods below:

(In Thousands)

Mortgage-Related

Assets

Lima One

Corporate

Total

Three months ended June 30,

2024

GAAP Net income/(loss) used in the

calculation of basic EPS

$

61,223

$

4,876

$

(32,485

)

$

33,614

Adjustments:

Unrealized and realized gains and losses

on:

Residential whole loans held at fair

value

(28,474

)

12,044

—

(16,430

)

Securities held at fair value

4,026

—

—

4,026

Residential whole loans and securities at

carrying value

(2,668

)

—

—

(2,668

)

Interest rate swaps

7,863

2,374

—

10,237

Securitized debt held at fair value

4,179

3,418

—

7,597

Investments in loan origination

partners

—

—

1,484

1,484

Expense items:

Amortization of intangible assets

—

800

—

800

Equity based compensation

—

279

3,620

3,899

Securitization-related transaction

costs

(197

)

—

3,206

3,009

Total adjustments

$

(15,271

)

$

18,915

$

8,310

$

11,954

Distributable earnings

$

45,952

$

23,791

$

(24,175

)

$

45,568

(In Thousands)

Mortgage-Related

Assets

Lima One

Corporate

Total

Three Months Ended March 31,

2024

GAAP Net income/(loss) used in the

calculation of basic EPS

$

36,363

$

10,655

$

(32,191

)

$

14,827

Adjustments:

Unrealized and realized gains and losses

on:

Residential whole loans held at fair

value

8,699

2,814

—

11,513

Securities held at fair value

4,776

—

—

4,776

Residential whole loans and securities at

carrying value

(418

)

—

—

(418

)

Interest rate swaps

(17,068

)

(6,114

)

—

(23,182

)

Securitized debt held at fair value

9,591

10,578

—

20,169

Investments in loan origination

partners

—

—

—

—

Expense items:

Amortization of intangible assets

—

800

—

800

Equity based compensation

—

261

5,982

6,243

Securitization-related transaction

costs

197

—

1,143

1,340

Total adjustments

$

5,777

$

8,339

$

7,125

$

21,241

Distributable earnings

$

42,140

$

18,994

$

(25,066

)

$

36,068

Reconciliation of GAAP Book Value per Common Share to

non-GAAP Economic Book Value per Common Share

“Economic book value” is a non-GAAP financial measure of our

financial position. To calculate our Economic book value, our

portfolios of Residential whole loans and securitized debt held at

carrying value are adjusted to their fair value, rather than the

carrying value that is required to be reported under the GAAP

accounting model applied to these financial instruments. These

adjustments are also reflected in the table below in our end of

period stockholders’ equity. Management considers that Economic

book value provides investors with a useful supplemental measure to

evaluate our financial position as it reflects the impact of fair

value changes for all of our investment activities, irrespective of

the accounting model applied for GAAP reporting purposes. Economic

book value does not represent and should not be considered as a

substitute for Stockholders’ Equity, as determined in accordance

with GAAP, and our calculation of this measure may not be

comparable to similarly titled measures reported by other

companies.

The following table provides a reconciliation of our GAAP book

value per common share to our non-GAAP Economic book value per

common share as of the quarterly periods below:

Quarter Ended:

(In Millions, Except Per Share

Amounts)

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

GAAP Total Stockholders’ Equity

$

1,883.2

$

1,884.2

$

1,899.9

$

1,848.5

$

1,944.8

Preferred Stock, liquidation

preference

(475.0

)

(475.0

)

(475.0

)

(475.0

)

(475.0

)

GAAP Stockholders’ Equity for book value

per common share

1,408.2

1,409.2

1,424.9

1,373.5

1,469.8

Adjustments:

Fair value adjustment to Residential whole

loans, at carrying value

(26.8

)

(35.4

)

(35.6

)

(85.3

)

(58.3

)

Fair value adjustment to Securitized debt,

at carrying value

82.3

88.4

95.6

122.5

129.8

Stockholders’ Equity including fair value

adjustments to Residential whole loans and Securitized debt held at

carrying value (Economic book value)

$

1,463.7

$

1,462.2

$

1,484.9

$

1,410.7

$

1,541.3

GAAP book value per common share

$

13.80

$

13.80

$

13.98

$

13.48

$

14.42

Economic book value per common share

$

14.34

$

14.32

$

14.57

$

13.84

$

15.12

Number of shares of common stock

outstanding

102.1

102.1

101.9

101.9

101.9

Cautionary Note Regarding

Forward-Looking Statements

When used in this press release or other written or oral

communications, statements that are not historical in nature,

including those containing words such as “will,” “believe,”

“expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,”

“should,” “could,” “would,” “may,” the negative of these words or

similar expressions, are intended to identify “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, and, as such, may involve known and unknown

risks, uncertainties and assumptions. These forward-looking

statements include information about possible or assumed future

results with respect to MFA’s business, financial condition,

liquidity, results of operations, plans and objectives. Among the

important factors that could cause our actual results to differ

materially from those projected in any forward-looking statements

that we make are: general economic developments and trends and the

performance of the housing, real estate, mortgage finance, broader

financial markets; inflation, increases in interest rates and

changes in the market (i.e., fair) value of MFA’s residential whole

loans, MBS, securitized debt and other assets, as well as changes

in the value of MFA’s liabilities accounted for at fair value

through earnings; the effectiveness of hedging transactions;

changes in the prepayment rates on residential mortgage assets, an

increase of which could result in a reduction of the yield on

certain investments in its portfolio and could require MFA to

reinvest the proceeds received by it as a result of such

prepayments in investments with lower coupons, while a decrease in

which could result in an increase in the interest rate duration of

certain investments in MFA’s portfolio making their valuation more

sensitive to changes in interest rates and could result in lower

forecasted cash flows; credit risks underlying MFA’s assets,

including changes in the default rates and management’s assumptions

regarding default rates and loss severities on the mortgage loans

in MFA’s residential whole loan portfolio; MFA’s ability to borrow

to finance its assets and the terms, including the cost, maturity

and other terms, of any such borrowings; implementation of or

changes in government regulations or programs affecting MFA’s

business; MFA’s estimates regarding taxable income, the actual

amount of which is dependent on a number of factors, including, but

not limited to, changes in the amount of interest income and

financing costs, the method elected by MFA to accrete the market

discount on residential whole loans and the extent of prepayments,

realized losses and changes in the composition of MFA’s residential

whole loan portfolios that may occur during the applicable tax

period, including gain or loss on any MBS disposals or whole loan

modifications, foreclosures and liquidations; the timing and amount

of distributions to stockholders, which are declared and paid at

the discretion of MFA’s Board of Directors and will depend on,

among other things, MFA’s taxable income, its financial results and

overall financial condition and liquidity, maintenance of its REIT

qualification and such other factors as MFA’s Board of Directors

deems relevant; MFA’s ability to maintain its qualification as a

REIT for federal income tax purposes; MFA’s ability to maintain its

exemption from registration under the Investment Company Act of

1940, as amended (or the “Investment Company Act”), including

statements regarding the concept release issued by the Securities

and Exchange Commission (“SEC”) relating to interpretive issues

under the Investment Company Act with respect to the status under

the Investment Company Act of certain companies that are engaged in

the business of acquiring mortgages and mortgage-related interests;

MFA’s ability to continue growing its residential whole loan

portfolio, which is dependent on, among other things, the supply of

loans offered for sale in the market; targeted or expected returns

on our investments in recently-originated mortgage loans, the

performance of which is, similar to our other mortgage loan

investments, subject to, among other things, differences in

prepayment risk, credit risk and financing costs associated with

such investments; risks associated with the ongoing operation of

Lima One Holdings, LLC (including, without limitation, industry

competition, unanticipated expenditures relating to or liabilities

arising from its operation (including, among other things, a

failure to realize management’s assumptions regarding expected

growth in business purpose loan (BPL) origination volumes and

credit risks underlying BPLs, including changes in the default

rates and management’s assumptions regarding default rates and loss

severities on the BPLs originated by Lima One)); expected returns

on MFA’s investments in nonperforming residential whole loans

(“NPLs”), which are affected by, among other things, the length of

time required to foreclose upon, sell, liquidate or otherwise reach

a resolution of the property underlying the NPL, home price values,

amounts advanced to carry the asset (e.g., taxes, insurance,

maintenance expenses, etc. on the underlying property) and the

amount ultimately realized upon resolution of the asset; risks

associated with our investments in MSR-related assets, including

servicing, regulatory and economic risks; risks associated with our

investments in loan originators; risks associated with investing in

real estate assets generally, including changes in business

conditions and the general economy; and other risks, uncertainties

and factors, including those described in the annual, quarterly and

current reports that we file with the SEC. These forward-looking

statements are based on beliefs, assumptions and expectations of

MFA’s future performance, taking into account information currently

available. Readers and listeners are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date on which they are made. New risks and uncertainties

arise over time and it is not possible to predict those events or

how they may affect MFA. Except as required by law, MFA is not

obligated to, and does not intend to, update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Category: Earnings

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806453574/en/

INVESTOR CONTACT: InvestorRelations@mfafinancial.com

212-207-6488 www.mfafinancial.com MEDIA CONTACT: H/Advisors

Abernathy Tom Johnson 212-371-5999

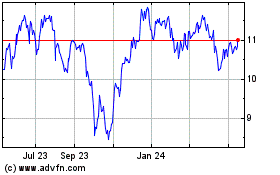

MFA Financial (NYSE:MFA)

Historical Stock Chart

From Dec 2024 to Jan 2025

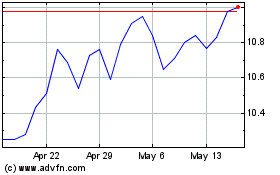

MFA Financial (NYSE:MFA)

Historical Stock Chart

From Jan 2024 to Jan 2025