10/30/20240000799292false00007992922024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

| | |

| CURRENT REPORT |

| Pursuant to Section 13 or 15(d) of Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): October 30, 2024

| | | | | | | | | | | | | | |

| M/I HOMES, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Ohio | | 1-12434 | | 31-1210837 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

4131 Worth Avenue, Suite 500 Columbus, OH 43219

(Address of principal executive offices) (Zip Code)

(614) 418-8000

(Telephone Number)

| | |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a.12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $.01 | MHO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 2 FINANCIAL INFORMATION

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On October 30, 2024, M/I Homes, Inc. (the “Company”) issued a press release reporting financial results for the three- and nine-months ended September 30, 2024. A copy of this press release, including information concerning forward-looking statements and factors that may affect our future results, is attached hereto as Exhibit 99.1.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description of Exhibit |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document).* |

*Submitted electronically with this Report in accordance with the provisions of Regulation S-T.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 30, 2024

M/I Homes, Inc.

| | | | | |

By: | /s/ Ann Marie W. Hunker |

| Ann Marie W. Hunker |

| VP, Chief Accounting Officer and Controller |

| |

Exhibit 99.1

M/I Homes Reports

2024 Third Quarter Results

Columbus, Ohio (October 30, 2024) - M/I Homes, Inc. (NYSE:MHO) announced results for the three and nine months ended September 30, 2024.

2024 Third Quarter Highlights:

•Record third quarter homes delivered, revenue, and income

•Homes delivered increased 8% to 2,271

•Revenue increased 9% to $1.1 billion

•Pre-tax income increased 6% to $188.7 million, 16.5% of revenue

•Net income increased 5% to $145.4 million ($5.10 per diluted share)

•Shareholders’ equity reached an all-time record $2.8 billion, a 17% increase from a year ago, with book

value per share of $105

•New contracts were 2,023, compared to 2,021 in last year’s third quarter

•Repurchased $50 million of common stock

•Return on equity of 20%

The Company reported pre-tax income of $188.7 million and net income of $145.4 million ($5.10 per diluted share), both third quarter records. This compares to pre-tax income of $178.0 million and net income of $139.0 million, or $4.82 per diluted share, for the third quarter of 2023. For the nine months ended September 30, 2024, pre-tax income increased to a record $563.1 million and net income increased to a record $430.3 million, or $14.99 per diluted share, compared to $469.3 million and $360.1 million, or $12.58 per diluted share, for the same period of 2023, respectively.

Homes delivered in 2024's third quarter increased 8% to a third quarter record of 2,271 homes. This compares to 2,096 homes delivered in 2023’s third quarter. Homes delivered for the nine months ended September 30, 2024 increased 9% to 6,653 from 2023’s deliveries of 6,093 which represents an all-time record. New contracts were 2,023 for the third quarter of 2024 compared to 2,021 in last year’s third quarter. For the first nine months of 2024, new contracts increased 7% to 6,825 compared to 6,389 in 2023. Homes in backlog at September 30, 2024 had a total sales value of $1.73 billion, a 1% decrease from a year ago. Backlog units at September 30, 2024 decreased 8% to 3,174 homes, with an all-time record average sales price of $544,000. At September 30, 2023, backlog sales value was $1.75 billion, with backlog units of 3,433 and an average sales price of $510,000. M/I Homes had 217 communities at September 30, 2024 compared to 204 communities at September 30, 2023. The Company's cancellation rate was 10% in both the third quarter of 2024 and the third quarter of 2023.

Robert H. Schottenstein, Chief Executive Officer and President, commented, “We had a very strong third quarter,

highlighted by record homes delivered, record revenue, and record income. We increased homes delivered by 8% to a record 2,271, increased revenue by 9% to a record $1.1 billion, increased pre-tax income by 6% to a record $188.7 million and we continued to generate strong returns. Pre-tax income equaled 16.5% of revenue. Our gross margin was strong at 27% and our return on equity was 20%.

Mr. Schottenstein continued, “Our financial condition is excellent. We ended the quarter with record shareholders’ equity of $2.8 billion, an increase of 17% from a year ago, book value of $105 per share, cash of $720 million, a homebuilding debt to capital ratio of 20%, and a net-debt-to-capital ratio of negative 1%. Given our performance through three quarters of this year, along with the strength of our balance sheet, low debt levels, diverse product offerings and well-located communities, we are positioned to have a very strong 2024.”

The Company will broadcast live its earnings conference call today at 10:00 A.M. Eastern Time. To listen to the call live, log on to the M/I Homes’ website at mihomes.com, click on the “Investors” section of the site, and select “Listen to the Conference Call.” A replay of the call will continue to be available on our website through October 2025.

M/I Homes, Inc. is one of the nation’s leading homebuilders of single-family homes. The Company has homebuilding operations in Columbus and Cincinnati, Ohio; Indianapolis, Indiana; Chicago, Illinois; Minneapolis/St. Paul, Minnesota; Detroit, Michigan; Tampa, Sarasota, Fort Myers/Naples and Orlando, Florida; Austin, Dallas/Fort Worth, Houston and San Antonio, Texas; Charlotte and Raleigh, North Carolina and Nashville, Tennessee.

Certain statements in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects,” “anticipates,” “targets,” “envisions,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements. These statements involve a number of risks and uncertainties. Any forward-looking statements that we make herein and in any future reports and statements are not guarantees of future performance, and actual results may differ materially from those in such forward-looking statements as a result of various factors, including, without limitation, factors relating to the economic environment, interest rates, availability of resources, competition, market concentration, land development activities, construction defects, product liability and warranty claims and various governmental rules and regulations, as more fully discussed in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as the same may be updated from time to time in our subsequent filings with the Securities and Exchange Commission. All forward-looking statements made in this press release are made as of the date hereof, and the risk that actual results will differ materially from expectations expressed herein will increase with the passage of time. We undertake no duty to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures made on related subjects in our subsequent filings, releases or presentations should be consulted.

Contact M/I Homes, Inc.

Ann Marie W. Hunker, Vice President, Chief Accounting Officer and Controller, (614) 418-8225

Mark Kirkendall, Vice President, Treasurer, (614) 418-8021

M/I Homes, Inc. and Subsidiaries

Summary Statement of Income (unaudited)

(Dollars and shares in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| New contracts | 2,023 | | | 2,021 | | | 6,825 | | | 6,389 | |

| Average community count | 214 | | | 200 | | | 215 | | | 199 | |

| Cancellation rate | 10 | % | | 10 | % | | 9 | % | | 11 | % |

| Backlog units | 3,174 | | | 3,433 | | | 3,174 | | | 3,433 | |

| Backlog sales value | $ | 1,725,423 | | | $ | 1,751,442 | | | $ | 1,725,423 | | | $ | 1,751,442 | |

| Homes delivered | 2,271 | | | 2,096 | | | 6,653 | | | 6,093 | |

| Average home closing price | $ | 489 | | | $ | 481 | | | $ | 481 | | | $ | 486 | |

| | | | | | | |

| Homebuilding revenue: | | | | | | | |

| Housing revenue | $ | 1,111,389 | | | $ | 1,008,356 | | | $ | 3,199,946 | | | $ | 2,963,500 | |

| Land revenue | 1,550 | | | 14,424 | | | 11,753 | | | 23,276 | |

| Total homebuilding revenue | $ | 1,112,939 | | | $ | 1,022,780 | | | $ | 3,211,699 | | | $ | 2,986,776 | |

| | | | | | | |

| Financial services revenue | 29,970 | | | 23,591 | | | 87,694 | | | 74,138 | |

| Total revenue | $ | 1,142,909 | | | $ | 1,046,371 | | | $ | 3,299,393 | | | $ | 3,060,914 | |

| | | | | | | |

| Cost of sales - operations | 833,468 | | | 764,638 | | | 2,397,329 | | | 2,286,371 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin | $ | 309,441 | | | $ | 281,733 | | | $ | 902,064 | | | $ | 774,543 | |

| General and administrative expense | 68,285 | | | 55,867 | | | 188,363 | | | 162,481 | |

| Selling expense | 59,163 | | | 53,735 | | | 171,598 | | | 154,686 | |

| Operating income | $ | 181,993 | | | $ | 172,131 | | | $ | 542,103 | | | $ | 457,376 | |

| | | | | | | |

| Other income | — | | | 1 | | | — | | | (34) | |

Interest income, net of interest expense | (6,680) | | | (5,834) | | | (20,948) | | | (11,893) | |

| | | | | | | |

| Income before income taxes | $ | 188,673 | | | $ | 177,964 | | | $ | 563,051 | | | $ | 469,303 | |

| Provision for income taxes | 43,224 | | | 38,948 | | | 132,795 | | | 109,220 | |

| Net income | $ | 145,449 | | | $ | 139,016 | | | $ | 430,256 | | | $ | 360,083 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 5.26 | | | $ | 4.98 | | | $ | 15.45 | | | $ | 12.97 | |

| Diluted | $ | 5.10 | | | $ | 4.82 | | | $ | 14.99 | | | $ | 12.58 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 27,644 | | | 27,909 | | | 27,857 | | | 27,769 | |

| Diluted | 28,534 | | | 28,837 | | | 28,703 | | | 28,631 | |

M/I Homes, Inc. and Subsidiaries

Summary Balance Sheet and Other Information (unaudited)

(Dollars in thousands, except per share amounts)

| | | | | | | | | | | |

| As of |

| September 30, |

| 2024 | | 2023 |

| Assets: | | | |

Total cash, cash equivalents and restricted cash (1) | $ | 719,920 | | | $ | 736,252 | |

| Mortgage loans held for sale | 242,812 | | | 207,181 | |

| Inventory: | | | |

| Lots, land and land development | 1,558,300 | | | 1,355,622 | |

| Land held for sale | 3,859 | | | 6,881 | |

| Homes under construction | 1,401,260 | | | 1,218,256 | |

| Other inventory | 169,275 | | | 159,769 | |

| Total Inventory | $ | 3,132,694 | | | $ | 2,740,528 | |

| | | |

| Property and equipment - net | 34,714 | | | 36,015 | |

| Investments in joint venture arrangements | 63,095 | | | 44,866 | |

| Operating lease right-of-use assets | 55,259 | | | 58,304 | |

| Goodwill | 16,400 | | | 16,400 | |

| Deferred income tax asset | 15,313 | | | 18,019 | |

| Other assets | 179,650 | | | 145,803 | |

| Total Assets | $ | 4,459,857 | | | $ | 4,003,368 | |

| | | |

| Liabilities: | | | |

| Debt - Homebuilding Operations: | | | |

| | | |

| | | |

| Senior notes due 2028 - net | $ | 397,459 | | | $ | 396,685 | |

| Senior notes due 2030 - net | 297,243 | | | 296,739 | |

| | | |

| | | |

| | | |

| | | |

| Total Debt - Homebuilding Operations | $ | 694,702 | | | $ | 693,424 | |

| | | |

| | | |

| Notes payable bank - financial services operations | 235,441 | | | 200,619 | |

| Total Debt | $ | 930,143 | | | $ | 894,043 | |

| | | |

| Accounts payable | 256,708 | | | 250,937 | |

| Operating lease liabilities | 56,667 | | | 59,433 | |

| Other liabilities | 370,983 | | | 373,243 | |

| Total Liabilities | $ | 1,614,501 | | | $ | 1,577,656 | |

| | | |

| Shareholders’ Equity | 2,845,356 | | | 2,425,712 | |

| Total Liabilities and Shareholders’ Equity | $ | 4,459,857 | | | $ | 4,003,368 | |

| | | |

| Book value per common share | $ | 104.59 | | | $ | 87.10 | |

Homebuilding debt to capital ratio (2) | 20 | % | | 22 | % |

(1)Includes $0.2 million of restricted cash and cash held in escrow for the quarter ended September 30, 2023.

(2)The ratio of homebuilding debt to capital is calculated as the carrying value of our homebuilding debt outstanding divided by the sum of the carrying value of our homebuilding debt outstanding plus shareholders’ equity.

M/I Homes, Inc. and Subsidiaries

Selected Supplemental Financial and Operating Data (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| Cash (used in) provided by operating activities | $ | (67,942) | | | $ | 79,541 | | | $ | 75,341 | | | $ | 497,230 | |

| Cash used in by investing activities | $ | (17,496) | | | $ | (11,330) | | | $ | (45,037) | | | $ | (14,132) | |

Cash used in financing activities | $ | (32,100) | | | $ | (246) | | | $ | (43,188) | | | $ | (58,388) | |

| | | | | | | |

| Land/lot purchases | $ | 138,711 | | | $ | 105,860 | | | $ | 365,553 | | | $ | 247,574 | |

| Land development spending | $ | 180,753 | | | $ | 151,222 | | | $ | 444,659 | | | $ | 352,555 | |

| Land sale revenue | $ | 1,550 | | | $ | 14,424 | | | $ | 11,753 | | | $ | 23,276 | |

Land sale gross profit | $ | 72 | | | $ | 2,115 | | | $ | 3,318 | | | $ | 3,004 | |

| | | | | | | |

| Financial services pre-tax income | $ | 12,936 | | | $ | 9,878 | | | $ | 39,648 | | | $ | 33,678 | |

M/I Homes, Inc. and Subsidiaries

Non-GAAP Financial Results (1)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 145,449 | | | $ | 139,016 | | | $ | 430,256 | | | $ | 360,083 | |

| Add: | | | | | | | |

| Provision for income taxes | 43,224 | | | 38,948 | | | 132,795 | | | 109,220 | |

Interest income - net | (10,089) | | | (8,469) | | | (30,542) | | | (19,122) | |

| Interest amortized to cost of sales | 7,632 | | | 8,778 | | | 23,872 | | | 25,552 | |

| Depreciation and amortization | 4,816 | | | 4,227 | | | 13,890 | | | 12,890 | |

| Non-cash charges | 6,750 | | | 2,682 | | | 14,099 | | | 7,056 | |

| Adjusted EBITDA | $ | 197,782 | | | $ | 185,182 | | | $ | 584,370 | | | $ | 495,679 | |

(1) We believe these non-GAAP financial measures are relevant and useful to investors in understanding our operations and may be helpful in comparing us with other companies in the homebuilding industry to the extent they provide similar information. These non-GAAP financial measures should be used to supplement our GAAP results in order to provide a greater understanding of the factors and trends affecting our operations.

M/I Homes, Inc. and Subsidiaries

Selected Supplemental Financial and Operating Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NEW CONTRACTS |

| | Three Months Ended | | | Nine Months Ended |

| | September 30, | | | September 30, |

| | | | | | % | | | | | | | % |

| Region | | 2024 | | 2023 | | Change | | | 2024 | | 2023 | | Change |

| Northern | | 890 | | | 885 | | | 1 | % | | | 3,054 | | | 2,662 | | | 15 | % |

| Southern | | 1,133 | | | 1,136 | | | — | % | | | 3,771 | | | 3,727 | | | 1 | % |

| Total | | 2,023 | | | 2,021 | | | — | % | | | 6,825 | | | 6,389 | | | 7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOMES DELIVERED |

| | Three Months Ended | | | Nine Months Ended |

| | September 30, | | | September 30, |

| | | | | | % | | | | | | | % |

| Region | | 2024 | | 2023 | | Change | | | 2024 | | 2023 | | Change |

| Northern | | 1,015 | | | 741 | | | 37 | % | | | 2,809 | | | 2,321 | | | 21 | % |

| Southern | | 1,256 | | | 1,355 | | | (7) | % | | | 3,844 | | | 3,772 | | | 2 | % |

| Total | | 2,271 | | | 2,096 | | | 8 | % | | | 6,653 | | | 6,093 | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BACKLOG |

| September 30, 2024 | | | September 30, 2023 |

| | | Dollars | | Average | | | | | Dollars | | Average |

| Region | Units | | (millions) | | Sales Price | | | Units | | (millions) | | Sales Price |

| Northern | 1,493 | | | $ | 803 | | | $ | 538,000 | | | | 1,397 | | | $ | 727 | | | $ | 521,000 | |

| Southern | 1,681 | | | $ | 923 | | | $ | 549,000 | | | | 2,036 | | | $ | 1,024 | | | $ | 503,000 | |

| Total | 3,174 | | | $ | 1,726 | | | $ | 544,000 | | | | 3,433 | | | $ | 1,751 | | | $ | 510,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| LAND POSITION SUMMARY |

| September 30, 2024 | | | September 30, 2023 |

| Lots | Lots Under | | | | Lots | Lots Under | |

| Region | Owned | Contract | Total | | | Owned | Contract | Total |

| Northern | 6,528 | | 10,885 | | 17,413 | | | | 7,341 | | 8,385 | | 15,726 | |

| Southern | 17,114 | | 17,678 | | 34,792 | | | | 15,835 | | 13,267 | | 29,102 | |

| Total | 23,642 | | 28,563 | | 52,205 | | | | 23,176 | | 21,652 | | 44,828 | |

v3.24.3

Cover Page Cover Page

|

Oct. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2024

|

| Entity Registrant Name |

M/I HOMES, INC.

|

| Entity Incorporation, State or Country Code |

OH

|

| Entity File Number |

1-12434

|

| Entity Tax Identification Number |

31-1210837

|

| Entity Address, Address Line One |

4131 Worth Avenue

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Columbus

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43219

|

| City Area Code |

614

|

| Local Phone Number |

418-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, par value $.01

|

| Trading Symbol |

MHO

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000799292

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

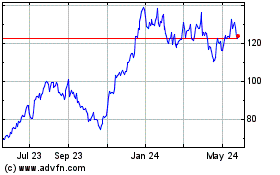

MI Homes (NYSE:MHO)

Historical Stock Chart

From Dec 2024 to Jan 2025

MI Homes (NYSE:MHO)

Historical Stock Chart

From Jan 2024 to Jan 2025