* Net Income of $99 million versus a net loss of $10 million for

the second quarter of 2005 ATLANTA, Aug. 9 /PRNewswire-FirstCall/

-- Mirant Corporation (NYSE:MIR) today reported net income of $99

million for the quarter ended June 30, 2006, as compared to a net

loss of $10 million for the same period in 2005. For the first six

months of 2006, Mirant reported net income of $566 million,

compared to $1 million for the first six months of 2005. Earnings

per share for the quarter ended June 30, 2006, were $0.32 per

diluted share and for the first six months of 2006 were $1.84 per

diluted share. Excluding unrealized mark-to-market gains of $108

million, a $72 million write off of a deferred tax asset related to

the Philippines business, and other non-recurring charges, Mirant

reported adjusted net income for the second quarter of 2006 of $68

million, resulting in adjusted earnings per diluted share of $0.22.

Adjusted net income for the first six months of 2006 was $210

million, resulting in adjusted earnings per diluted share of $0.68.

Adjusted EBITDA for the quarter was $255 million, compared to $119

million for the same period in 2005. For the first six months of

2006, adjusted EBITDA was $595 million, compared to $288 million

for the same period in 2005. The period over period increases for

the quarter and the first half of the year resulted primarily from

the strong performance of the U.S. business. "Our U.S. business

performed well during the quarter and the first half of 2006. This

performance is due primarily to hedges entered into in earlier

periods, which protected Mirant from lower market prices during the

first half of the year resulting from milder than normal weather in

many parts of the country and a significant drop in natural gas

prices," said Edward R. Muller, chairman and chief executive

officer. "The company's hedging strategy continues to be effective

in helping to produce predictable financial results." Net cash

provided by operating activities during the second quarter was $132

million. Adjusting for bankruptcy payments during the period, net

cash provided by operating activities was $643 million in the first

six months of 2006. As of June 30, 2006, the company had cash and

cash equivalents of $1.8 billion, total available liquidity of

$2.13 billion, and total outstanding debt of $4.5 billion. Asset

Sales Today Mirant announced an auction process to sell various

U.S. intermediate and peaking gas fired assets. The U.S. assets to

be sold are the following intermediate and peaking gas fired

plants: Zeeland (837 MW), West Georgia (605 MW), Shady Hills (468

MW), Sugar Creek (535 MW), Bosque (532 MW) and Apex (527 MW),

representing a total of 3,504 MW. In 2005, on a pro-forma basis,

these assets contributed $77 million in adjusted EBITDA. For the

first six months of 2006, on a pro-forma basis, these assets

contributed $25 million in adjusted EBITDA. Initial estimates

indicate that an impairment loss will need to be recorded in the

third quarter of 2006 to reduce the carrying value of these assets

to fair value. While the amount of the impairment loss has not yet

been determined, the company currently estimates the total

impairment loss for the six plants will range from $500 to $700

million. JPMorgan will serve as financial advisor for the sale of

these U.S. assets. The decision announced today is in addition to

the one announced on July 11, 2006, to commence auction processes

to sell Mirant's international businesses in the Philippines (2,203

MW) and the Caribbean (1,050 MW). In 2005, on a pro-forma basis,

the Philippines and Caribbean businesses contributed $371 million

and $155 million in adjusted EBITDA, respectively. For the first

six months of 2006, on a pro-forma basis, the Philippines and

Caribbean businesses contributed $206 million and $92 million in

adjusted EBITDA, respectively. Certain of the sales will be subject

to regulatory and other approvals and consents. The planned sales

will result in these businesses and assets being reported as

discontinued operations beginning in the third quarter of 2006. The

sales are expected to close by mid-2007. Asset Sale Proceeds and

Continuing Business The continuing business of Mirant will consist

of 10,657 MW that are well positioned in key U.S. markets in the

Mid-Atlantic, the Northeast and California. As previously

announced, Mirant plans to continue returning cash to its

shareholders upon completion of the planned sales. The amount of

cash returned will be determined based on the outlook for the

continuing business (1) to preserve the credit profile of the

continuing business, (2) to maintain adequate liquidity for

expected cash requirements including, among other things, capital

expenditures for the continuing business, and (3) to retain

sufficient working capital to manage fluctuations in commodity

prices. Proceeds from the sales of the Zeeland and Bosque plants

will be utilized pursuant to the covenants contained in the Mirant

North America debt instruments. Guidance Mirant provided adjusted

EBITDA guidance for 2006 of $1.282 billion, which is comprised of

$645 million for the continuing business and $637 million for the

assets and businesses to be sold. For 2007, Mirant provided

adjusted EBITDA guidance of $1.585 billion, which is comprised of

$924 million for the continuing business and $661 million for the

assets and businesses to be sold. The guidance provided for 2007

includes the adjusted EBITDA for the full year of the businesses

and assets to be sold, even though the sales are expected to close

by mid-2007. The actual financial results for 2007 will depend on

the closing dates of the sales of those businesses and assets.

Earnings Call Mirant is hosting an earnings call today to discuss

its second quarter 2006 financial results and outline business

priorities. The call will be held from 9:00 a.m. to 10:00 a.m. EDT.

The conference call can be accessed via the investor relations

section of the company's website at http://www.mirant.com/ or

analysts are invited to listen to the call by dialing 800.811.7286

(International 913.981.4902) and entering pass code 7976945.

Presentation slides for the analyst call have been posted to the

company's website. The presentation may include certain non-GAAP

financial measures as defined under SEC rules. In such event, a

reconciliation of those measures to the most directly comparable

GAAP measures will also be available via the investor relations

section of the company's website at http://www.mirant.com/. A

recording of the event will be available for playback on the

company's website beginning today at 12 p.m. EDT. A replay also

will be available by dialing 888.203.1112 (International

719.457.0820) and entering the pass code 7976945. Mirant is a

competitive energy company that produces and sells electricity in

the United States, the Caribbean, and the Philippines. Mirant owns

or leases approximately 17,310 megawatts of electric generating

capacity globally. The company operates an asset management and

energy marketing organization from its headquarters in Atlanta. For

more information, please visit http://www.mirant.com/. Regulation G

Reconciliations As Reported Adjusted Net Income and Adjusted EBITDA

Quarter Ending June 30, 2006 (in millions) EPS(1) Net income $99

$0.32 Mark-to-market gains (108) (0.35) Gain on sales of assets,

net (6) (0.02) Bankruptcy charges and pre-petition dispute 11 0.04

Write-off of Philippines deferred tax asset 72 0.23 Adjusted net

income $68 $0.22 Provision for income taxes 42 Interest, net 66

Depreciation and amortization 79 Adjusted EBITDA $255 (1) Total

diluted shares: 308 million Adjusted net income and adjusted EBITDA

are non-GAAP financial measures. Management and some members of the

investment community utilize adjusted net income and adjusted

EBITDA to measure financial performance on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not

be viewed as an alternative to GAAP measures of performance. In

evaluating these adjusted measures, the reader should be aware that

in the future Mirant may incur expenses similar to the adjustments

set forth above. As Reported Adjusted Net Income and Adjusted

EBITDA Year to Date June 30, 2006 (in millions) EPS(1) Net income

$566 $1.84 Mark-to-market gains (406) (1.32) Gain on sales of

assets, net (46) (0.15) Impairment losses on minority owned

affiliates 7 0.02 Bankruptcy charges and pre-petition dispute 17

0.06 Write-off of Philippines deferred tax asset 72 0.23 Adjusted

net income $210 $0.68 Provision for income taxes 89 Interest, net

142 Depreciation and amortization 154 Adjusted EBITDA $595 (1)

Total diluted shares: 308 million Adjusted net income and adjusted

EBITDA are non-GAAP financial measures. Management and some members

of the investment community utilize adjusted net income and

adjusted EBITDA to measure financial performance on an ongoing

basis. These measures are not recognized in accordance with GAAP

and should not be viewed as an alternative to GAAP measures of

performance. In evaluating these adjusted measures, the reader

should be aware that in the future Mirant may incur expenses

similar to the adjustments set forth above. As Reported Adjusted

Net Loss and Adjusted EBITDA Quarter Ending June 30, 2005 (in

millions) Net loss $(10) Mark-to-market gains (81) Loss on sales of

assets, net 28 Other impairment losses and restructuring 8 Other,

net 6 Reorganization items, net 33 Discontinued operations 1

Adjusted net loss $(15) Provision for income taxes 35 Interest, net

25 Amortization of transition power agreements (2) Depreciation and

amortization 76 Adjusted EBITDA $119 Adjusted net loss and adjusted

EBITDA are non-GAAP financial measures. Management and some members

of the investment community utilize adjusted net loss and adjusted

EBITDA to measure financial performance on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not

be viewed as an alternative to GAAP measures of performance. In

evaluating these adjusted measures, the reader should be aware that

in the future Mirant may incur expenses similar to the adjustments

set forth above. As Reported Adjusted Net Income and Adjusted

EBITDA Year to Date June 30, 2005 (in millions) Net income $1

Mark-to-market gains (70) Loss on sales of assets, net 25 Gain on

sale of investments (1) Other impairment losses and restructuring

10 Other, net 7 Reorganization items, net 94 Discontinued

operations (2) Adjusted net income $64 Provision for income taxes

32 Interest, net 51 Amortization of transition power agreements

(12) Depreciation and amortization 153 Adjusted EBITDA $288

Adjusted net income and adjusted EBITDA are non-GAAP financial

measures. Management and some members of the investment community

utilize adjusted net income and adjusted EBITDA to measure

financial performance on an ongoing basis. These measures are not

recognized in accordance with GAAP and should not be viewed as an

alternative to GAAP measures of performance. In evaluating these

adjusted measures, the reader should be aware that in the future

Mirant may incur expenses similar to the adjustments set forth

above. As Reported Adjusted Net Cash Provided by Operating

Activities (in millions) 3 Months Ended 6 Months Ended June 30,

2006 June 30, 2006 Net cash provided by (used in) operating

activities $132 $(114) Bankruptcy payments 11 757 Adjusted net cash

provided by operating activities $143 $643 Adjusted net cash

provided by operating activities is a non-GAAP financial measure.

Management and some members of the investment community utilize

adjusted net cash provided by operating activities to measure

financial performance on an ongoing basis. This measure is not

recognized in accordance with GAAP and should not be viewed as an

alternative to GAAP measures of performance. Cash and Cash

Equivalents to Liquidity At June 30, 2006 (in millions) Cash and

cash equivalents $1,796 Less reserved cash required for operating,

working capital or other purposes or restricted by the

subsidiaries' debt agreements (482) Available under credit

facilities 818 Total available liquidity $2,132 Liquidity is a

non-GAAP financial measure. Management and some members of the

investment community utilize liquidity to measure financial

performance on an ongoing basis. This measure is not recognized in

accordance with GAAP and should not be viewed as an alternative to

GAAP measures of performance. Pro Forma Adjusted Net Income and

Adjusted EBITDA Year to Date June 30, 2006 (in millions) Businesses

and Assets to be Sold U.S. U.S. Assets Business to be Sub to be

sold Philippines Caribbean Total Retained Total Net income (loss)

$(8) $(1) $15 $6 $560 $566 Pro forma adjustments(1) 12 10 11 33

(33) - Pro forma net income $4 $9 $26 $39 $527 $566 Mark-to-market

gains (4) - - (4) (402) (406) Loss (gain) on sales of assets, net -

2 - 2 (48) (46) Impairment losses on minority owned affiliates - 7

- 7 - 7 Bankruptcy charges and pre-petition dispute - - - - 17 17

Write-off of Philippines deferred tax asset - 72 - 72 - 72 Adjusted

net income $- $90 $26 $116 $94 $210 Provision for income taxes - 76

11 87 2 89 Interest, net 4 1 30 35 107 142 Depreciation and

amortization 21 39 25 85 69 154 Adjusted EBITDA $25 $206 $92 $323

$272 $595 Adjusted net income and adjusted EBITDA are non-GAAP

financial measures. Management and some members of the investment

community utilize adjusted net income and adjusted EBITDA to

measure financial performance on an ongoing basis. These measures

are not recognized in accordance with GAAP and should not be viewed

as an alternative to GAAP measures of performance. In evaluating

these adjusted measures, the reader should be aware that in the

future Mirant may incur expenses similar to the adjustments set

forth above. (1) Pro-forma adjustments represent the

reclassification of corporate overhead expenses that will occur

when the assets and businesses to be sold are reclassified to

discontinued operations. Pro Forma Adjusted Net Income &

Adjusted EBITDA Year-end December 31, 2005 (in millions) Businesses

and Assets to be Sold U.S. Assets Business to be Sub to be sold

Philippines Caribbean Total Retained Total Net income (loss) $(99)

$98 $46 $45 $(1,352) $(1,307) Pro forma adjustments (1) 29 19 14 62

(62) 0 Pro forma net income (loss) $(70) $117 $60 $107 $(1,414)

$(1,307) Mark-to-market losses - - - - 17 17 Other impairment loss

and restructuring - 23 23 Loss (gain) on sales of assets, net - (1)

- (1) 8 7 Gain on sale of investments, net - - (45) (45) Impairment

losses on minority owned affiliates - 23 23 - 23 Other, net - 1 (6)

(5) 64 59 Reorganization items, net 90 - - 90 (18) 72 Income from

discontinued operations, net - - - - 20 20 Cumulative effect of a

change in accounting principle - - 16 16 Adjusted net income (loss)

$20 $140 $54 $214 $(1,329) $(1,115) Provision (benefit) for income

taxes - 131 6 137 (14) 123 Interest, net 12 21 52 85 1,395 1,480

Amortization of transition power agreements (5) - - (5) (9) (14)

Depreciation and amortization 50 79 43 172 135 307 Adjusted EBITDA

$77 $371 $155 $603 $178 $781 Adjusted net income and adjusted

EBITDA are non-GAAP financial measures. Management and some members

of the investment community utilize adjusted net income and

adjusted EBITDA to measure financial performance on an ongoing

basis. These measures are not recognized in accordance with GAAP

and should not be viewed as an alternative to GAAP measures of

performance. In evaluating these adjusted measures, the reader

should be aware that in the future Mirant may incur expenses

similar to the adjustments set forth above. (1) Pro-forma

adjustments represent the reclassification of corporate overhead

expenses that will occur when the assets and businesses to be sold

are reclassified to discontinued operations. Pro Forma Adjusted

EBITDA Guidance to Cash Flow from Operations For the years ending

December 31, 2006 and 2007 (in millions) Year Ending Year Ending

December 31, 2006 December 31, 2007 Continuing Discon- Consol-

Continuing Discon- Consol- Business tinued idated Business tinued

idated Adjusted EBITDA $645 $637 $1,282 $924 $661 $1,585 Interest

payments, net (203) (98) (301) (221) (109) (330) Income tax paid 0

(237) (237) (10) (163) (173) Working capital changes 479 2 481 119

(37) 82 Adjusted cash flow from operations $921 $304 $1,225 $812

$352 $1,164 Cash payments under plan of reorganization (998) (998)

Cash flow from operations $(77) $304 $227 $812 $352 $1,164 Adjusted

EBITDA and adjusted cash flow from operations are non-GAAP

financial measures. Management and some members of the investment

community utilize adjusted EBITDA and adjusted cash flow from

operations to measure financial performance on an ongoing basis.

These measures are not recognized in accordance with GAAP and

should not be viewed as an alternative to GAAP measures of

performance. Cautionary Language Regarding Forward-Looking

Statements Some of the statements included herein involve

forward-looking information. Mirant cautions that these statements

involve known and unknown risks and that there can be no assurance

that such results will occur. There are various important factors

that could cause actual results to differ materially from those

indicated in the forward-looking statements, such as, but not

limited to, legislative and regulatory initiatives regarding

deregulation, regulation or restructuring of the electric utility

industry; changes in state, federal and other regulations

(including rate regulations); changes in, or changes in the

application of, environmental and other laws and regulations to

which Mirant and its subsidiaries and affiliates are or could

become subject; the failure of Mirant's assets to perform as

expected; Mirant's pursuit of potential business strategies,

including the acquisition of additional assets or the disposition

or alternative utilization of existing assets; changes in market

conditions, including developments in energy and commodity supply,

demand, volume and pricing or the extent and timing of the entry of

additional competition in the markets of Mirant's subsidiaries and

affiliates; increased margin requirements, market volatility or

other market conditions that could increase Mirant's obligations to

post collateral beyond amounts which are expected; Mirant's

inability to access effectively the over- the-counter and

exchange-based commodity markets or changes in commodity market

liquidity or other commodity market conditions, which may affect

Mirant's ability to engage in asset hedging and optimization

activities as expected; our inability to enter into intermediate

and long-term contracts to sell power and procure fuel, including

its transportation, on terms and prices acceptable to us; weather

and other natural phenomena, including hurricanes and earthquakes;

war, terrorist activities or the occurrence of a catastrophic loss;

environmental regulations that restrict Mirant's ability to operate

its business; deterioration in the financial condition of Mirant's

customers or counterparties and the resulting failure to pay

amounts owed to Mirant or to perform obligations or services due to

Mirant; the disposition of the pending litigation described in

Mirant's Form 10-K for the year ended December 31, 2005, and Form

10-Q for the quarter ended June 30, 2006, filed with the Securities

and Exchange Commission; political factors that affect Mirant's

international operations, such as political instability, local

security concerns, tax increases, expropriation of property,

cancellation of contract rights and environmental regulations; the

inability of Mirant's operating subsidiaries to generate sufficient

cash flow and Mirant's inability to access that cash flow to enable

Mirant to make debt service and other payments; the resolution of

claims and obligations that were not resolved during the Chapter 11

process that may have a material adverse effect on Mirant's results

of operations and other factors discussed in Mirant's Form 10-K for

the year ended December 31, 2005, and its Form 10-Q for the quarter

ended June 30, 2006. Mirant undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. The Adjusted EBITDA

guidance is an estimate as of today's date, August 9, 2006, and is

based on assumptions believed to be reasonable as of such date.

Mirant expressly disclaims any current intention to update such

guidance. The foregoing review of factors that could cause Mirant's

actual results to differ materially from those contemplated in the

forward looking statements included in this news release should be

considered in connection with information regarding risks and

uncertainties that may affect Mirant's future results included in

Mirant's filings with the Securities and Exchange Commission at

http://www.sec.gov/. Stockholder inquiries: 678 579 777 DATASOURCE:

Mirant CONTACT: Media, Corry Leigh, +1-678-579-3111, or , or

Investor Relations, Mary Ann Arico, +1-678-579-7553, or , or Sarah

Stashak, +1-678-579-6940, or , or Stockholder inquiries,

+1-678-579-7777, all of all of Mirant Web site:

http://www.mirant.com/

Copyright

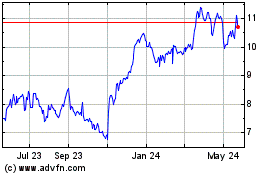

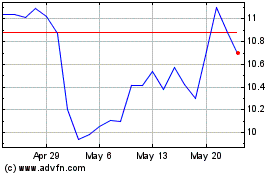

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024