Form 8-K - Current report

October 27 2023 - 3:30PM

Edgar (US Regulatory)

0001929589

false

00-0000000

0001929589

2023-10-23

2023-10-23

0001929589

us-gaap:CommonStockMember

2023-10-23

2023-10-23

0001929589

us-gaap:WarrantMember

2023-10-23

2023-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 23, 2023

MariaDB plc

(Exact name of registrant as specified in its

charter)

| Ireland |

|

001-41571 |

|

N/A |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

699 Veterans Blvd

Redwood City, CA 94063

(Address of principal executive offices, including

zip code)

(855) 562-7423

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Ordinary

Shares, nominal value $0.01 per share |

|

MRDB |

|

New

York Stock Exchange |

| Warrants,

each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share |

|

MRDBW |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing |

As

previously disclosed, on October 17, 2023, MariaDB plc, an Irish public limited corporation (the “Company”),

notified the New York Stock Exchange (“NYSE”) that the Company is deficient in meeting the requirement under

Section 303A.07(a) of the NYSE’s Listed Company Manual (the “Manual”), which requires NYSE audit

committees to be comprised of at least three independent directors. On October 20, 2023, the Company further notified the NYSE that

it was deficient with respect to Section 303A.01 of the Manual.

On October 23, 2023, the Company received

written notice (the “Notice”) from the NYSE that the Company was not in compliance with the corporate governance

listing standards set forth in Section 303A.01 and 303A.07(a) of the Manual because the Company does not have a majority of

independent directors and does not have three independent members on the audit committee. If the Company does not cure the deficiencies

by October 30, 2023, a below compliance (“BC”) indicator will be disseminated over the consolidated tape and displayed

on the Company’s NYSE profile starting November 1, 2023. Such indicator and website references will be removed when the Company

regains compliance with all NYSE quantitative and corporate governance listing standards. The Company is currently considering its next

steps regarding compliance.

As previously disclosed in the Company’s

Current Report on Form 8-K filed on September 22, 2023, the Company received written notice from the NYSE on September 19,

2023 that it was not in compliance with Section 802.01B of the Manual because the average global market capitalization of the Company

over a consecutive 30 trading-day period was less than $50 million and, at the same time, the Company’s last reported stockholders’

equity was less than $50 million. In connection with the September notice, the Company intends to submit a plan to return to compliance

with the NYSE continued listing standard with respect to the deficiency under Section 802.01B within 45 days of the September notice.

As previously disclosed in the Company’s Current Report on Form 8-K filed on June 30, 2023, the Company also received

written notice from the NYSE on June 28, 2023 that it was not in compliance with Section 802.01C of the Manual because the average

closing price of the Company’s ordinary shares was less than $1.00 over a consecutive 30 trading-day period. In connection with

the June notice, the Company notified the NYSE that it intends to cure the stock price deficiency and to return to compliance with

the NYSE continued listing standard with respect to the deficiency under Section 802.01C. The Company is currently within the six-month

cure period for this deficiency following receipt of the June notice.

Proposals and Director Nominations for the

2024 Annual Meeting of Members

The Company is expected to hold its 2024 annual

meeting of members (the “2024 Annual Meeting”) on March 12, 2024. Further details about the 2024 Annual

Meeting, including the time and location, will be set forth in the Company’s proxy statement when filed.

Pursuant to Rule 14a-8 under the Securities

Exchange Act of 1934, as amended, shareholders of the Company may present proposals for inclusion in the Company’s proxy statement

for the 2024 Annual Meeting by submitting their proposals to the Company a reasonable time before it begins to print and send its proxy

materials. MariaDB has set November 10, 2023 as the deadline for receipt of shareholder proposals for inclusion in the Company’s

proxy statement pursuant to Rule 14a-8.

For any director nominations and shareholder proposals

to be properly brought before the 2024 Annual Meeting, shareholders must deliver to the Company Secretary their nominations and proposals

pursuant to the Amended Memorandum and Articles of Association of MariaDB (the “Amended Memorandum and Articles of Association”).

To be timely, notice by a shareholder of any such nomination or proposal must have been provided not earlier than the open of business

on December 13, 2023 and not later than the close of business on January 12, 2024 and must otherwise comply with the applicable

requirements in the Amended Memorandum and Articles of Association.

All proposals by shareholders and notices of nominations and other

general business should be sent to: MariaDB, 699 Veterans Blvd, Redwood City, CA 94063, Attention: Company Secretary.

Forward-Looking Statements

Certain statements in this periodic report are

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words indicating

future events and actions, such as “will,” “intend,” “plan,” and “may,” and variations

of such words, and similar expressions and future-looking language identify forward-looking statements, but their absence does not mean

that the statement is not forward-looking. The forward-looking statements in this periodic report include statements regarding our continued

listing of securities on the NYSE and related actions and events. Forward-looking statements are not guarantees of future events and actions,

which may vary materially from those expressed or implied in such statements. Differences may result from, among other things, actions

taken by the Company or its management or board or third parties (including the NYSE), including those beyond the Company’s control.

Such differences and uncertainties and related risks include, but are not limited to, the possibility that our securities may be suspended

or delisted from the NYSE, the possibility that the Company may not file a plan with the NYSE that is acceptable, even if the NYSE accepts

the Company’s plan there may be negative effects due to actions taken pursuant to the plan on the market price of Company securities

and the Company in general, and there may potentially be significant related costs to structuring and implementing the plan. The foregoing

list of differences and risks and uncertainties is illustrative, but by no means exhaustive. For more information on factors that may

affect the continued listing of Company securities on NYSE and related actions and events, please review “Risk Factors” described

in the Company’s filings and records filed with the United States Securities and Exchange Commission. These forward-looking statements

reflect the Company’s expectations as of the date hereof. The Company undertakes no obligation to update the information provided

herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MariaDB plc |

| Dated: October 27, 2023 |

|

| |

By: |

/s/ Paul O’Brien |

| |

|

Paul O’Brien |

| |

|

Chief Executive Officer |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

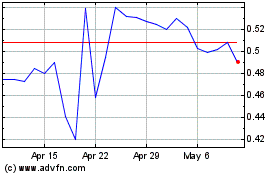

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Apr 2024 to May 2024

MariaDB (NYSE:MRDB)

Historical Stock Chart

From May 2023 to May 2024