SCHEDULE 13D/A

DATE OF EVENT WHICH REQUIRES FILING OF THIS STATEMENT

03/01/2022

1. NAME OF REPORTING PERSON

Bulldog Investors, LLP

2. CHECK THE BOX IF MEMBER OF A GROUP a[ ]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

DE

7. SOLE VOTING POWER

0

8. SHARED VOTING POWER

144,363

9. SOLE DISPOSITIVE POWER

0

10. SHARED DISPOSITIVE POWER

144,363

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

144,363 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

7.82%

14. TYPE OF REPORTING PERSON

IA

1. NAME OF REPORTING PERSON

Phillip Goldstein

2. CHECK THE BOX IF MEMBER OF A GROUP a[]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

7. SOLE VOTING POWER

0

8. SHARED VOTING POWER

199,678

9. SOLE DISPOSITIVE POWER

0

10. SHARED DISPOSITIVE POWER

199,678

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

199,678 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

10.82%

14. TYPE OF REPORTING PERSON

IN

1. NAME OF REPORTING PERSON

Andrew Dakos

2. CHECK THE BOX IF MEMBER OF A GROUP a[]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

7. SOLE VOTING POWER

0

8. SHARED VOTING POWER

199,678

9. SOLE DISPOSITIVE POWER

0

10. SHARED DISPOSITIVE POWER

199,678

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

199,678 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

10.82%

14. TYPE OF REPORTING PERSON

IN

Item 1. SECURITY AND ISSUER

This statement constitutes Amendment #2 to the schedule 13d

filed May 10, 2021. Except as specifically set forth

herein, the Schedule 13d remains unmodified.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

(a) As per the N-CSR filed on 2/8/2022, there were 1,846,000 shares

of common stock outstanding as of 11/30/2021. The percentages set forth

herein were derived using such number. Phillip Goldstein and Andrew Dakos

own Bulldog Investors, LLP, a registered investment advisor.

As of March 2, 2022 Bulldog Investors, LLP is deemed to be the beneficial

owner of 144,363 shares of NDP (representing 7.82% of NDP's outstanding

shares) solely by virtue of Bulldog Investors LLP's power to direct the

vote of,and dispose of, these shares.

Such shares are also beneficially owned by clients of Bulldog Investors,

LLP who are not members of any group.

As of March 2, 2022, each of Messrs. Goldstein and Dakos is deemed to be

the beneficial owner of 199,678 shares of NDP (representing 10.82% of NDP's

outstanding shares) by virtue of their power to direct the vote of, and

dispose of, these shares.

(b)Bulldog Investors,LLP has sole power to dispose of and vote 0 shares.

Bulldog Investors, LLP has shared power to dispose of and vote 144,363

shares. Certain of Bulldog Investors, LLP's clients (none of whom

beneficially own more than 5% of NDP's shares) share this power with

Bulldog Investors, LLP. Messrs. Goldstein and Dakos are partners of Bulldog

Investors, LLP. Messrs. Goldstetin and Dakos have shared power to dispose

of and vote an additional 55,315 shares.

c) During the past 60 days the following shares of NDP were Sold.

Date Shares Price

3/2/2022 (9,900) 28.3085

3/1/2022 (2,200) 27.6865

3/1/2022 (5,700) 27.8100

2/28/2022 (13,500) 27.3071

2/7/2022 (3,800) 27.7698

2/7/2022 (1,195) 27.8239

2/4/2022 (305) 27.5000

|

d) Clients of Bulldog Investors, LLP and an account managed by Messrs.

Goldstein and Dakos are entitled to receive any dividends or sales

proceeds.

e) N/A

ITEM 6. CONTRACTS,ARRANGEMENTS,UNDERSTANDINGS OR RELATIONSHIPS

WITH RESPECT TO SECURITIES OF THE ISSUER.

N/A

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

None.

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this

statement is true, complete and correct.

Dated: 3/3/2022

By: /S/ Phillip Goldstein

Name: Phillip Goldstein

By: /S/ Andrew Dakos

Name: Andrew Dakos

Bulldog Investors, LLP

By: /s/ Andrew Dakos

Andrew Dakos, Partner

Footnote 1: The reporting persons disclaim beneficial ownership except

to the extent of any pecuniary interest therein.

|

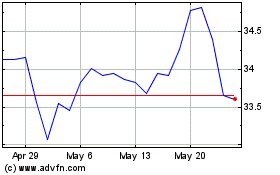

Tortoise Energy Independ... (NYSE:NDP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Tortoise Energy Independ... (NYSE:NDP)

Historical Stock Chart

From Jan 2024 to Jan 2025