NGL Energy Partners LP (NYSE:NGL) (“NGL,” ““we,” “us,” “our,” or

the “Partnership”) today reported its fourth quarter and full year

fiscal 2024 results.

Highlights for the fiscal year and quarter ended March 31, 2024

include:

- A net loss for full year Fiscal 2024 of $143.1 million,

compared to net income of $52.5 million for full year Fiscal 2023;

a net loss for the fourth quarter of Fiscal 2024 of $236.7 million,

compared to a net loss of $33.2 million for the fourth quarter of

Fiscal 2023. The fourth quarter of Fiscal 2024 includes a loss from

the impairment of goodwill, an adverse litigation judgment and call

premiums and other costs related to our refinancing.

- Adjusted EBITDA(1) for full year Fiscal 2024 of $610.1 million,

compared to $632.7 million for full year Fiscal 2023; Adjusted

EBITDA(1) for the fourth quarter of Fiscal 2024 of $147.5 million,

compared to $173.3 million for the fourth quarter of Fiscal

2023

- Record Water Solutions’ Adjusted EBITDA(1) of $508.3 million

for full year Fiscal 2024, a 10% increase over the prior year

- Record Water Solutions’ annual water disposal volumes processed

of 884.6 million for full year Fiscal 2024, a 4.1% increase over

the prior year

- On January 22, 2024, we announced that our Water Solutions

business is commencing expansion of its Lea County Express Pipeline

System from a capacity of 140,000 barrels of water per day to

340,000 barrels per day in 2024, with the ability to expand the

capacity to 500,000 barrels of water per day. This project is fully

underwritten by a recently executed minimum volume commitment

contract that includes an acreage dedication extension with an

investment grade oil and gas producer. We expect the pipeline

expansion to be completed during the second half of our 2025 fiscal

year.

- On February 2, 2024, we closed a debt refinancing transaction

of $2.9 billion consisting of a private offering of $2.2 billion of

senior secured notes, which includes $900.0 million of 8.125%

senior secured notes due 2029 and $1.3 billion of 8.375% senior

secured notes due 2032. We also entered into a new seven-year

$700.0 million senior secured term loan “B” credit facility. The

net proceeds from these transactions were used to fund the

redemption of the 2026 senior secured notes and the 2025 and 2026

senior unsecured notes.

- On February 6, 2024, the board of directors of our general

partner declared a cash distribution of 50% of the outstanding

arrearages through December 31, 2023 to the holders of the Class B

preferred units, the Class C preferred units and the Class D

preferred units. The total distribution of $178.3 million was made

on February 27, 2024 to the holders of record at the close of

trading on February 16, 2024.

Highlights for the period subsequent to March 31, 2024

included:

- On April 4, 2024, the board of directors of our general partner

declared a cash distribution of 55.4% of the outstanding

distribution arrearages through the quarter ended March 31, 2024 to

the holders of the Class B preferred units, the Class C preferred

units and the Class D preferred units. The total distribution of

$120.0 million was made on April 18, 2024 to the holders of record

at the close of trading on April 12, 2024.

- On April 5, 2024, we closed on the sale of two ranches located

in Eddy and Lea Counties, New Mexico for total consideration of

$69.3 million, including working capital.

- On April 9, 2024, the board of directors of our general partner

declared a cash distribution to fully pay the remaining

distribution arrearages to the holders of the Class B preferred

units, the Class C preferred units and the Class D preferred units.

The total distribution of $98.1 million was made on April 25, 2024

to the holders of record at the close of trading on April 19,

2024.

- During April and May 2024, we closed on the sale of certain

saltwater disposal assets in the Delaware Basin and certain real

estate located in Lea County, New Mexico for total consideration of

approximately $12.2 million.

- On June 5, 2024, the board of directors of our GP authorized a

common unit repurchase program, under which we may repurchase up to

$50.0 million of our outstanding common units from time to time in

the open market or in other privately negotiated transactions. This

program does not have a fixed expiration date.

“The Partnership ended Fiscal 2024, with Adjusted EBITDA(1)

exceeding $610 million. Water Solutions achieved record annual

water disposal volumes processed and Adjusted EBITDA(1), the

Partnership executed a global refinancing, and sold non-core assets

at attractive multiples. Fiscal 2025 holds more opportunities for

growth projects with attractive returns, and continued reduction of

our total leverage at fiscal 2025 year-end. NGL made two arrearage

catch-up payments in Fiscal 2025, and became current on all

preferred classes B, C and D’s in April,” stated Mike Krimbill,

NGL’s CEO. “We are guiding Fiscal 2025 Water Solutions Adjusted

EBITDA(1) to a range of $550 - $560 million and full year

consolidated Adjusted EBITDA(1) of $665 million. Also, we are

guiding to $210 million in total maintenance and growth capital

expenditures for Fiscal 2025,” Krimbill concluded.

________________________________

(1) See the “Non-GAAP Financial Measures”

section of this release for the definition of Adjusted EBITDA (as

used herein) and a discussion of this non-GAAP financial

measure.

Quarterly Results of Operations

The following table summarizes operating income (loss) and

Adjusted EBITDA(1) by reportable segment for the periods

indicated:

Quarter Ended

March 31, 2024

March 31, 2023

Operating

Income (Loss)

Adjusted

EBITDA(1)

Operating

Income (Loss)

Adjusted

EBITDA(1)

(in thousands)

Water Solutions

$

28,537

$

123,440

$

38,470

$

131,558

Crude Oil Logistics

3,279

15,339

(5,488

)

29,715

Liquids Logistics

(51,376

)

21,817

17,818

28,469

Corporate and Other

(62,707

)

(13,054

)

(20,340

)

(16,441

)

Total

$

(82,267

)

$

147,542

$

30,460

$

173,301

Water Solutions

Operating income for the Water Solutions segment decreased by

$9.9 million for the quarter ended March 31, 2024, compared to the

quarter ended March 31, 2023. The Partnership processed

approximately 2.39 million barrels of water per day during the

quarter ended March 31, 2024, a 3.0% decrease when compared to

approximately 2.46 million barrels of water per day processed

during the quarter ended March 31, 2023. The decrease in produced

water volumes processed was primarily due to certain producers in

the Delaware Basin reusing their water in their operations. Service

fees for produced water processed ($/barrel) were lower during the

quarter due to rate changes for certain existing contracts and the

expiration of certain higher fee per barrel contracts which were

replaced with lower fee per barrel contracts with an extended term.

In addition, there was a decrease in payments made by certain

producers for committed volumes not delivered which also impacted

service fees for produced water processed ($/barrel).

Revenues from recovered skim oil, including the impact from

realized skim oil hedges, totaled $28.5 million for the quarter

ended March 31, 2024, an increase of $4.0 million from the prior

year period. The increase was due primarily to an increase in skim

oil barrels sold as a result of 34,380 barrels of skim oil that

were stored as of March 31, 2023 due to tighter pipeline

specifications and higher realized crude oil prices received from

the sale of skim oil barrels.

Operating expenses in the Water Solutions segment decreased $4.5

million for the quarter ended March 31, 2024, compared to the

quarter ended March 31, 2023 due primarily to lower produced water

volumes processed, which resulted in lower chemical and utility

expense. Operating expense per produced barrel processed was $0.23

for the quarter ended March 31, 2024, compared to $0.24 in the

comparative quarter last year.

Crude Oil Logistics

Operating income for the Crude Oil Logistics segment increased

by $8.8 million for the quarter ended March 31, 2024, compared to

the quarter ended March 31, 2023. Operating income for the fourth

quarter of Fiscal 2024 includes a loss from the disposal or

impairment of assets of $0.6 million, compared to a loss of $32.4

million in the same period of the prior year. Excluding these

amounts, operating income decreased by $23.0 million for the fourth

quarter of Fiscal 2024. Product margin for crude oil sales

decreased approximately $14.3 million due to lower production on

acreage dedicated to us in the DJ Basin, lower margins realized as

the result of a contract expiration on December 31, 2023 and the

sale of the Marine business in March 2023. Operating income also

decreased due to net losses on derivative contracts of $14.2

million, which is comprised of net losses of $6.8 million in the

current quarter, versus net gains of $7.4 million in the prior year

quarter. These decreases were partially offset by $5.5 million from

lower operating expenses and lower depreciation expense primarily

due to the sale of the Marine business. During the three months

ended March 31, 2024, physical volumes on the Grand Mesa Pipeline

averaged approximately 67,000 barrels per day, compared to

approximately 76,000 barrels per day for the three months ended

March 31, 2023.

Liquids Logistics

Operating income for the Liquids Logistics segment decreased by

$69.2 million for the quarter ended March 31, 2024, compared to the

quarter ended March 31, 2023. Operating income for the fourth

quarter of Fiscal 2024 includes an impairment loss of $69.2

million, compared to an impairment loss of $10.1 million in the

same period of the prior year. Excluding these amounts, operating

income decreased by $10.1 million for the fourth quarter of Fiscal

2024. This decrease is primarily due to lower propane margins due

to a decrease in volumes as a result of the closure or sale of

several terminals earlier in the fiscal year and warmer than

average temperatures compared to the prior year quarter. Refined

products decreased as the demand for gasoline was weak, relative to

supply, which led to lower margins. These decreases were partially

offset by higher butane margins (excluding the impact of

derivatives), as we had a stronger blending market from January

through mid-February during the quarter ended March 31, 2024. For

the current quarter, we recognized $6.0 million of gains from net

derivative activity, compared to $2.3 million in losses in the

prior year quarter.

Capitalization and Liquidity

Total liquidity (cash plus available capacity on our asset-based

revolving credit facility (“ABL Facility”)) was approximately

$539.4 million as of March 31, 2024. On March 31, 2024, there were

no borrowings under the ABL Facility, compared to $138.0 million in

outstanding borrowings at March 31, 2023. The ABL Facility was paid

off with funds from the debt refinancing transaction in February

2024.

As of March 31, 2024, the Partnership is in compliance with all

of its debt covenants and has no significant current debt

maturities before February 2029.

Fourth Quarter Conference Call Information

A conference call to discuss NGL’s results of operations is

scheduled for 4:00 pm Central Time on Thursday, June 6, 2024.

Analysts, investors, and other interested parties may join the

webcast via the event link:

https://www.webcaster4.com/Webcast/Page/2808/50611 or by dialing

(888) 506-0062 and providing access code: 410412. An archived audio

replay of the call will be available for 14 days, which can be

accessed by dialing (877) 481-4010 and providing replay passcode

50611.

NGL filed its Annual Report on Form 10-K for the year ended

March 31, 2024 with the Securities and Exchange Commission after

market on June 6, 2024. A copy of the Form 10-K can be found on the

Partnership’s website at www.nglenergypartners.com. Unitholders may

also request, free of charge, a hard copy of our Form 10-K and our

complete audited financial statements.

Non-GAAP Financial Measures

We define EBITDA as net income (loss) attributable to NGL Energy

Partners LP, plus interest expense, income tax expense (benefit),

and depreciation and amortization expense. We define Adjusted

EBITDA as EBITDA excluding net unrealized gains and losses on

derivatives, lower of cost or net realizable value adjustments,

gains and losses on disposal or impairment of assets, gains and

losses on early extinguishment of liabilities, equity-based

compensation expense, revaluation of liabilities and other. We also

include in Adjusted EBITDA certain inventory valuation adjustments

related to certain refined products businesses within our Liquids

Logistics segment as discussed below. EBITDA and Adjusted EBITDA

should not be considered as alternatives to net (loss) income,

(loss) income before income taxes, cash flows from operating

activities, or any other measure of financial performance

calculated in accordance with GAAP, as those items are used to

measure operating performance, liquidity or the ability to service

debt obligations. We believe that EBITDA provides additional

information to investors for evaluating our ability to make

quarterly distributions to our unitholders and is presented solely

as a supplemental measure. We believe that Adjusted EBITDA provides

additional information to investors for evaluating our financial

performance without regard to our financing methods, capital

structure and historical cost basis. Further, EBITDA and Adjusted

EBITDA, as we define them, may not be comparable to EBITDA,

Adjusted EBITDA, or similarly titled measures used by other

entities.

Other than for certain businesses within our Liquids Logistics

segment, for purposes of our Adjusted EBITDA calculation, we make a

distinction between realized and unrealized gains and losses on

derivatives. During the period when a derivative contract is open,

we record changes in the fair value of the derivative as an

unrealized gain or loss. When a derivative contract matures or is

settled, we reverse the previously recorded unrealized gain or loss

and record a realized gain or loss. We do not draw such a

distinction between realized and unrealized gains and losses on

derivatives of certain businesses within our Liquids Logistics

segment. The primary hedging strategy of these businesses is to

hedge against the risk of declines in the value of inventory over

the course of the contract cycle, and many of the hedges cover

extended periods of time. The “inventory valuation adjustment” row

in the reconciliation table reflects the difference between the

market value of the inventory of these businesses at the balance

sheet date and its cost. We include this in Adjusted EBITDA because

the unrealized gains and losses associated with derivative

contracts associated with the inventory of this segment, which are

intended primarily to hedge inventory holding risk and are included

in net income, also affect Adjusted EBITDA. In our Crude Oil

Logistics segment, we purchase certain crude oil barrels using the

West Texas Intermediate (“WTI”) calendar month average (“CMA”)

price and sell the crude oil barrels using the WTI CMA price plus

the Argus CMA Differential Roll Component (“CMA Differential Roll”)

per our contracts. To eliminate the volatility of the CMA

Differential Roll, we entered into derivative instrument positions

in January 2021 to secure a margin of approximately $0.20 per

barrel on 1.5 million barrels per month from May 2021 through

December 2023. Due to the nature of these positions, the cash flow

and earnings recognized on a GAAP basis differed from period to

period depending on the current crude oil price and future

estimated crude oil price which were valued utilizing third-party

market quoted prices. We recognized in Adjusted EBITDA the gains

and losses from the derivative instrument positions entered into in

January 2021 to properly align with the physical margin we hedged

each month through the term of this transaction. This

representation aligns with management’s evaluation of the

transaction. The derivative instrument positions we entered into

related to the CMA Differential Roll expired as of December 31,

2023, and we have not entered into any new derivative instrument

positions related to the CMA Differential Roll.

Distributable Cash Flow is defined as Adjusted EBITDA minus

maintenance capital expenditures, income tax expense, cash interest

expense, preferred unit distributions and other. Maintenance

capital expenditures represent capital expenditures necessary to

maintain the Partnership’s operating capacity. For the CMA

Differential Roll transaction, as discussed above, we have included

an adjustment to Distributable Cash Flow to reflect, in the period

for which they relate, the actual cash flows for the positions that

settled that are not being recognized in Adjusted EBITDA.

Distributable Cash Flow is a performance metric used by senior

management to compare cash flows generated by the Partnership

(excluding growth capital expenditures and prior to the

establishment of any retained cash reserves by the board of

directors of our general partner) to the cash distributions

expected to be paid to unitholders. Using this metric, management

can quickly compute the coverage ratio of estimated cash flows to

planned cash distributions. This financial measure also is

important to investors as an indicator of whether the Partnership

is generating cash flow at a level that can sustain, or support an

increase in, quarterly distribution rates. Actual distribution

amounts are set by the board of directors of our general

partner.

We do not provide a reconciliation for non-GAAP estimates on a

forward-looking basis where we are unable to provide a meaningful

calculation or estimation of reconciling items and the information

is not available without unreasonable effort. This is due to the

inherent difficulty of forecasting the timing or amount of various

items that would impact the most directly comparable

forward-looking U.S. GAAP financial measure that have not yet

occurred, are out of the Partnership’s control and/or cannot be

reasonably predicted. Forward-looking non-GAAP financial measures

provided without the most directly comparable U.S. GAAP financial

measures may vary materially from the corresponding U.S. GAAP

financial measures.

Forward-Looking Statements

This press release includes “forward-looking statements.” All

statements other than statements of historical facts included or

incorporated herein may constitute forward-looking statements.

Actual results could vary significantly from those expressed or

implied in such statements and are subject to a number of risks and

uncertainties. While NGL believes such forward-looking statements

are reasonable, NGL cannot assure they will prove to be correct.

The forward-looking statements involve risks and uncertainties that

affect operations, financial performance, and other factors as

discussed in filings with the Securities and Exchange Commission.

Other factors that could impact any forward-looking statements are

those risks described in NGL’s Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and other public filings. You are

urged to carefully review and consider the cautionary statements

and other disclosures made in those filings, specifically those

under the heading “Risk Factors.” NGL undertakes no obligation to

publicly update or revise any forward-looking statements except as

required by law.

NGL provides Adjusted EBITDA guidance that does not include

certain charges and costs, which in future periods are generally

expected to be similar to the kinds of charges and costs excluded

from Adjusted EBITDA in prior periods, such as income taxes,

interest and other non-operating items, depreciation and

amortization, net unrealized gains and losses on derivatives, lower

of cost or net realizable value adjustments, gains and losses on

disposal or impairment of assets, gains and losses on early

extinguishment of liabilities, equity-based compensation expense,

acquisition expense, revaluation of liabilities and items that are

unusual in nature or infrequently occurring. The exclusion of these

charges and costs in future periods will have a significant impact

on the Partnership’s Adjusted EBITDA, and the Partnership is not

able to provide a reconciliation of its Adjusted EBITDA guidance to

net income (loss) without unreasonable efforts due to the

uncertainty and variability of the nature and amount of these

future charges and costs and the Partnership believes that such

reconciliation, if possible, would imply a degree of precision that

would be potentially confusing or misleading to investors.

About NGL Energy Partners LP

NGL Energy Partners LP, a Delaware master limited partnership,

is a diversified midstream energy partnership that transports,

treats, recycles and disposes of produced and flowback water

generated as part of the energy production process as well as

transports, stores, markets and provides other logistics services

for crude oil and liquid hydrocarbons.

For further information, visit the Partnership’s website at

www.nglenergypartners.com.

NGL ENERGY PARTNERS LP AND

SUBSIDIARIES

Unaudited Consolidated Balance

Sheets

(in Thousands, except unit

amounts)

March 31,

2024

2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

38,909

$

5,431

Accounts receivable-trade, net of

allowance for expected credit losses of $1,671 and $1,964,

respectively

814,087

1,033,956

Accounts receivable-affiliates

1,501

12,362

Inventories

130,907

142,607

Prepaid expenses and other current

assets

126,933

98,089

Assets held for sale

66,597

—

Total current assets

1,178,934

1,292,445

PROPERTY, PLANT AND EQUIPMENT, net of

accumulated depreciation of $1,011,274 and $898,184,

respectively

2,096,702

2,223,380

GOODWILL

634,282

712,364

INTANGIBLE ASSETS, net of accumulated

amortization of $332,560 and $580,860, respectively

939,978

1,058,668

INVESTMENTS IN UNCONSOLIDATED ENTITIES

20,305

21,090

OPERATING LEASE RIGHT-OF-USE ASSETS

97,155

90,220

OTHER NONCURRENT ASSETS

52,738

57,977

Total assets

$

5,020,094

$

5,456,144

LIABILITIES AND EQUITY

CURRENT LIABILITIES:

Accounts payable-trade

$

707,536

$

927,591

Accounts payable-affiliates

37

65

Accrued expenses and other payables

213,757

133,616

Advance payments received from

customers

17,313

14,699

Current maturities of long-term debt

7,000

—

Operating lease obligations

31,090

34,166

Liabilities held for sale

614

—

Total current liabilities

977,347

1,110,137

LONG-TERM DEBT, net of debt issuance costs

of $49,178 and $30,117, respectively, and current maturities

2,843,822

2,857,805

OPERATING LEASE OBLIGATIONS

70,573

58,450

OTHER NONCURRENT LIABILITIES

129,185

111,226

CLASS D 9.00% PREFERRED UNITS, 600,000 and

600,000 preferred units issued and outstanding, respectively

551,097

551,097

EQUITY:

General partner, representing a 0.1%

interest, 132,645 and 132,059 notional units, respectively

(52,834

)

(52,551

)

Limited partners, representing a 99.9%

interest, 132,512,766 and 131,927,343 common units issued and

outstanding, respectively

134,807

455,564

Class B preferred limited partners,

12,585,642 and 12,585,642 preferred units issued and outstanding,

respectively

305,468

305,468

Class C preferred limited partners,

1,800,000 and 1,800,000 preferred units issued and outstanding,

respectively

42,891

42,891

Accumulated other comprehensive loss

(499

)

(450

)

Noncontrolling interests

18,237

16,507

Total equity

448,070

767,429

Total liabilities and equity

$

5,020,094

$

5,456,144

NGL ENERGY PARTNERS LP AND

SUBSIDIARIES

Unaudited Consolidated

Statements of Operations

(in Thousands, except unit and

per unit amounts)

Three Months Ended March

31,

Year Ended March 31,

2024

2023

2024

2023

REVENUES:

Water Solutions

$

172,971

$

185,807

$

730,818

$

697,038

Crude Oil Logistics

276,667

493,055

1,656,064

2,464,822

Liquids Logistics

1,179,956

1,369,972

4,569,689

5,533,044

Total Revenues

1,629,594

2,048,834

6,956,571

8,694,904

COST OF SALES:

Water Solutions

3,874

421

11,294

14,100

Crude Oil Logistics

254,546

442,474

1,521,190

2,250,934

Liquids Logistics

1,144,463

1,326,449

4,435,247

5,383,809

Corporate and Other

2

1,181

(937

)

1,181

Total Cost of Sales

1,402,885

1,770,525

5,966,794

7,650,024

OPERATING COSTS AND EXPENSES:

Operating

72,000

76,354

305,185

313,725

General and administrative

66,160

21,217

121,881

71,818

Depreciation and amortization

66,421

69,516

266,523

273,621

Loss on disposal or impairment of assets,

net

101,715

71,097

115,936

86,888

Revaluation of liabilities

2,680

9,665

2,680

9,665

Operating (Loss) Income

(82,267

)

30,460

177,572

289,163

OTHER INCOME (EXPENSE):

Equity in earnings of unconsolidated

entities

2,340

1,026

4,120

4,120

Interest expense

(94,553

)

(63,917

)

(269,923

)

(275,445

)

(Loss) gain on early extinguishment of

liabilities, net

(62,152

)

(631

)

(55,281

)

6,177

Other income, net

1,662

17

2,793

28,748

(Loss) Income Before Income Taxes

(234,970

)

(33,045

)

(140,719

)

52,763

INCOME TAX EXPENSE

(1,769

)

(158

)

(2,405

)

(271

)

Net (Loss) Income

(236,739

)

(33,203

)

(143,124

)

52,492

LESS: NET INCOME ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

(27

)

(316

)

(631

)

(1,106

)

NET (LOSS) INCOME ATTRIBUTABLE TO NGL

ENERGY PARTNERS LP

$

(236,766

)

$

(33,519

)

$

(143,755

)

$

51,386

NET LOSS ALLOCATED TO COMMON

UNITHOLDERS

$

(272,169

)

$

(67,661

)

$

(283,116

)

$

(73,232

)

BASIC AND DILUTED LOSS PER COMMON UNIT

$

(2.05

)

$

(0.51

)

$

(2.14

)

$

(0.56

)

BASIC AND DILUTED WEIGHTED AVERAGE COMMON

UNITS OUTSTANDING

132,512,766

131,631,271

132,146,477

131,007,171

EBITDA, ADJUSTED EBITDA AND

DISTRIBUTABLE CASH FLOW RECONCILIATION

(Unaudited)

The following table reconciles NGL’s net

(loss) income to NGL’s EBITDA, Adjusted EBITDA and Distributable

Cash Flow for the periods indicated:

Three Months Ended March

31,

Year Ended March 31,

2024

2023

2024

2023

(in thousands)

Net (loss) income

$

(236,739

)

$

(33,203

)

$

(143,124

)

$

52,492

Less: Net income attributable to

noncontrolling interests

(27

)

(316

)

(631

)

(1,106

)

Net (loss) income attributable to NGL

Energy Partners LP

(236,766

)

(33,519

)

(143,755

)

51,386

Interest expense

94,552

63,932

270,004

275,505

Income tax expense

1,769

158

2,405

271

Depreciation and amortization

66,282

69,519

266,287

273,544

EBITDA

(74,163

)

100,090

394,941

600,706

Net unrealized losses (gains) on

derivatives

7,145

6,492

63,762

(50,438

)

CMA Differential Roll net losses (gains)

(1)

—

(15,877

)

(71,285

)

3,547

Inventory valuation adjustment (2)

1,972

(1,030

)

(3,419

)

(7,795

)

Lower of cost or net realizable value

adjustments

(1,932

)

177

1,337

(11,534

)

Loss on disposal or impairment of assets,

net

101,651

71,097

115,555

86,872

Loss (gain) on early extinguishment of

liabilities, net

62,152

631

55,281

(6,177

)

Equity-based compensation expense

—

852

1,098

2,718

Revaluation of liabilities (3)

2,680

9,665

2,680

9,665

Other (4)

48,037

1,204

50,131

5,111

Adjusted EBITDA

$

147,542

$

173,301

$

610,081

$

632,675

Less: Cash interest expense (5)

91,773

59,707

254,709

258,679

Less: Income tax expense

1,769

158

2,405

271

Less: Maintenance capital expenditures

13,189

20,599

54,854

61,649

Less: CMA Differential Roll (6)

—

(14,439

)

(27,165

)

(27,652

)

Less: Preferred unit distributions

paid

178,299

—

178,299

—

Less: Other (7)

—

220

222

391

Distributable Cash Flow

$

(137,488

)

$

107,056

$

146,757

$

339,337

___________

(1)

Adjustment to align, within Adjusted

EBITDA, the net gains and losses of the Partnership’s CMA

Differential Roll derivative instruments positions with the

physical margin being hedged. See “Non-GAAP Financial Measures”

section above for a further discussion.

(2)

Amounts represent the difference between

the market value of the inventory at the balance sheet date and its

cost. See “Non-GAAP Financial Measures” section above for a further

discussion.

(3)

Amounts represent the non-cash valuation

adjustment of contingent consideration liabilities, offset by the

cash payments, related to royalty agreements acquired as part of

acquisitions in our Water Solutions segment.

(4)

Amounts represent accretion expense for

asset retirement obligations, unrealized gains/losses on marketable

securities and expenses incurred related to legal and advisory

costs associated with acquisitions and dispositions, including the

accrued judgment related to the LCT Capital, LLC legal matter,

excluding interest, and the write-off of the legal costs related to

the LCT Capital, LLC legal matter that were originally allocated to

the Partnership’s general partner as reported in the footnotes to

our consolidated financial statements included in the Partnership’s

Annual Report on Form 10-K for the year ended March 31, 2024. Also,

the amount for the year ended March 31, 2023 includes the write off

of an asset acquired in a prior period acquisition and non-cash

operating expenses related to our Grand Mesa Pipeline.

(5)

Amounts represent interest expense payable

in cash, excluding changes in the accrued interest balance.

(6)

Amounts represent the cash portion of the

adjustments of the Partnership’s CMA Differential Roll derivative

instrument positions, as discussed above, that settled during the

period.

(7)

Amounts represent cash paid to settle

asset retirement obligations.

ADJUSTED EBITDA RECONCILIATION BY

SEGMENT

(Unaudited)

Three Months Ended March 31,

2024

Water

Solutions

Crude Oil

Logistics

Liquids

Logistics

Corporate

and Other

Consolidated

(in thousands)

Operating income (loss)

$

28,537

$

3,279

$

(51,376

)

$

(62,707

)

$

(82,267

)

Depreciation and amortization

55,361

8,058

2,337

665

66,421

Amortization recorded to cost of sales

—

—

65

—

65

Net unrealized losses on derivatives

2,354

4,113

678

—

7,145

Inventory valuation adjustment

—

—

1,972

—

1,972

Lower of cost or net realizable value

adjustments

—

(785

)

(1,147

)

—

(1,932

)

Loss (gain) on disposal or impairment of

assets, net

31,799

623

69,298

(5

)

101,715

Other income (expense), net

194

(1

)

5

1,464

1,662

Adjusted EBITDA attributable to

unconsolidated entities

2,419

—

7

(13

)

2,413

Adjusted EBITDA attributable to

noncontrolling interest

(371

)

—

—

—

(371

)

Revaluation of liabilities

2,680

—

—

—

2,680

Other

467

52

(22

)

47,542

48,039

Adjusted EBITDA

$

123,440

$

15,339

$

21,817

$

(13,054

)

$

147,542

Three Months Ended March 31,

2023

Water

Solutions

Crude Oil

Logistics

Liquids

Logistics

Corporate

and Other

Consolidated

(in thousands)

Operating income (loss)

$

38,470

$

(5,488

)

$

17,818

$

(20,340

)

$

30,460

Depreciation and amortization

53,315

11,384

3,107

1,710

69,516

Amortization recorded to cost of sales

—

—

69

—

69

Net unrealized losses (gains) on

derivatives

—

7,286

(1,973

)

1,179

6,492

CMA Differential Roll net losses

(gains)

—

(15,877

)

—

—

(15,877

)

Inventory valuation adjustment

—

—

(1,030

)

—

(1,030

)

Lower of cost or net realizable value

adjustments

—

—

177

—

177

Loss on disposal or impairment of assets,

net

28,496

32,365

10,232

4

71,097

Equity-based compensation expense

—

—

—

852

852

Other income (expense), net

60

(60

)

—

17

17

Adjusted EBITDA attributable to

unconsolidated entities

1,190

—

30

42

1,262

Adjusted EBITDA attributable to

noncontrolling interest

(617

)

—

—

—

(617

)

Revaluation of liabilities

9,665

—

—

—

9,665

Other

979

105

39

95

1,218

Adjusted EBITDA

$

131,558

$

29,715

$

28,469

$

(16,441

)

$

173,301

Year Ended March 31,

2024

Water

Solutions

Crude Oil

Logistics

Liquids

Logistics

Corporate

and Other

Consolidated

(in thousands)

Operating income (loss)

$

231,256

$

52,074

$

2,481

$

(108,239

)

$

177,572

Depreciation and amortization

214,480

36,922

10,372

4,749

266,523

Amortization recorded to cost of sales

—

—

260

—

260

Net unrealized losses (gains) on

derivatives

385

65,786

(1,230

)

(1,179

)

63,762

CMA Differential Roll net losses

(gains)

—

(71,285

)

—

—

(71,285

)

Inventory valuation adjustment

—

—

(3,419

)

—

(3,419

)

Lower of cost or net realizable value

adjustments

—

—

1,337

—

1,337

Loss (gain) on disposal or impairment of

assets, net

53,639

3,094

59,923

(720

)

115,936

Equity-based compensation expense

—

—

—

1,098

1,098

Other income, net

1,110

105

12

1,566

2,793

Adjusted EBITDA attributable to

unconsolidated entities

4,393

—

(12

)

124

4,505

Adjusted EBITDA attributable to

noncontrolling interest

(1,821

)

—

—

—

(1,821

)

Revaluation of liabilities

2,680

—

—

—

2,680

Other

2,186

191

230

47,533

50,140

Adjusted EBITDA

$

508,308

$

86,887

$

69,954

$

(55,068

)

$

610,081

Year Ended March 31,

2023

Water

Solutions

Crude Oil

Logistics

Liquids Logistics

Corporate

and Other

Consolidated

(in thousands)

Operating income (loss)

$

198,924

$

81,524

$

66,624

$

(57,909

)

$

289,163

Depreciation and amortization

207,081

46,577

13,301

6,662

273,621

Amortization recorded to cost of sales

—

—

274

—

274

Net unrealized (gains) losses on

derivatives

(4,464

)

(50,104

)

2,951

1,179

(50,438

)

CMA Differential Roll net losses

(gains)

—

3,547

—

—

3,547

Inventory valuation adjustment

—

—

(7,795

)

—

(7,795

)

Lower of cost or net realizable value

adjustments

—

(2,247

)

(9,287

)

—

(11,534

)

Loss (gain) on disposal or impairment of

assets, net

46,431

31,086

10,283

(912

)

86,888

Equity-based compensation expense

—

—

—

2,718

2,718

Other income (expense), net

70

330

(1,665

)

30,013

28,748

Adjusted EBITDA attributable to

unconsolidated entities

4,759

—

27

176

4,962

Adjusted EBITDA attributable to

noncontrolling interest

(2,269

)

—

—

—

(2,269

)

Revaluation of liabilities

9,665

—

—

—

9,665

Other

2,894

203

1,933

95

5,125

Adjusted EBITDA

$

463,091

$

110,916

$

76,646

$

(17,978

)

$

632,675

OPERATIONAL DATA

(Unaudited)

Three Months Ended

Year Ended

March 31,

March 31,

2024

2023

2024

2023

(in thousands, except per day

amounts)

Water Solutions:

Produced water processed (barrels per

day)

Delaware Basin

2,086,047

2,169,690

2,123,337

2,042,777

Eagle Ford Basin

161,976

135,552

142,374

119,458

DJ Basin

143,237

147,033

150,426

150,619

Other Basins

—

12,555

740

14,483

Total

2,391,260

2,464,830

2,416,877

2,327,337

Recycled water (barrels per day)

87,129

76,056

84,212

118,847

Total (barrels per day)

2,478,389

2,540,886

2,501,089

2,446,184

Skim oil sold (barrels per day)

4,217

3,785

3,992

3,764

Crude Oil Logistics:

Crude oil sold (barrels)

3,338

6,069

20,068

25,497

Crude oil transported on owned pipelines

(barrels)

6,091

6,882

25,611

27,714

Crude oil storage capacity - owned and

leased (barrels) (1)

5,232

5,232

Crude oil inventory (barrels) (1)

573

684

Liquids Logistics:

Refined products sold (gallons)

185,832

202,154

817,634

769,151

Propane sold (gallons)

287,028

379,251

811,035

1,018,937

Butane sold (gallons)

142,897

130,521

537,015

539,658

Other products sold (gallons)

102,179

96,758

379,077

391,723

Natural gas liquids and refined products

storage capacity - owned and leased (gallons) (1)

130,441

160,329

Refined products inventory (gallons)

(1)

1,872

1,003

Propane inventory (gallons) (1)

35,177

48,379

Butane inventory (gallons) (1)

17,790

17,409

Other products inventory (gallons) (1)

20,112

12,893

___________

(1)

Information is presented as of March 31,

2024 and March 31, 2023, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240606989751/en/

David Sullivan, 918-495-4631 Vice President - Finance

David.Sullivan@nglep.com

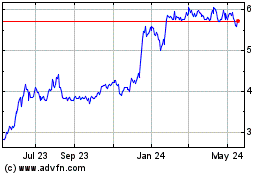

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

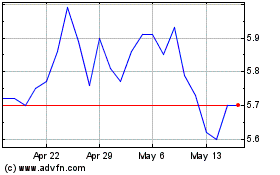

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Dec 2023 to Dec 2024