0001501134false00015011342024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: March 6, 2024

(Date of earliest event reported)

Invitae Corporation

(Exact name of the registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36847 | | 27-1701898 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. employer |

| incorporation or organization) | | File Number) | | identification number) |

1400 16th Street, San Francisco, California 94103

(Address of principal executive offices, including zip code)

(415) 374-7782

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, $0.0001 par value per share | | NVTA | | * |

* On February 21, 2024, the New York Stock Exchange (“NYSE”) filed a Form 25 relating to the delisting from the NYSE of the Company’s common stock. The delisting became effective on March 2, 2024. The deregistration of the Company’s common stock under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be effective for 90 days, or such shorter period as the Securities and Exchange Commission may determine, after filing of the Form 25. Upon deregistration of the Company’s common stock under Section 12(b) of the Exchange Act, the Company’s common stock will remain registered under Section 12(g) of the Exchange Act. The Company’s common stock will continue to trade on the OTC Pink market under the symbol “NVTA.”

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 2.02 | Results of Operations and Financial Condition. |

On March 6, 2024, Invitae Corporation (the “Company”) issued a press release announcing its estimated unaudited financial results for the fourth quarter and fiscal year ended December 31, 2023 (the “Press Release”). The full text of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be filed for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such filing.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On March 6, 2024, the Company presented the Company’s estimated unaudited financial results for the fourth quarter and fiscal year ended December 31, 2023 to its employees . A copy of the presentation materials is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2, is being furnished and shall not be deemed to be filed for the purposes of Section 18 of the the Exchange Act, or otherwise subject to the liability of that section, and shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| |

| | Press Release, dated March 6, 2024. |

| | Presentation of Fourth Quarter and Fiscal Year 2023 Estimated Financial Results (Unaudited), dated March 6, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 6, 2024

| | | | | | | | |

| | |

| INVITAE CORPORATION |

| |

| By: | | /s/ Thomas Brida |

| Name: | | Thomas Brida |

| Title: | | General Counsel |

Invitae Reports Estimated Unaudited Fourth Quarter and Full Year 2023 Financial Results

SAN FRANCISCO – March 6, 2024 – Invitae (OTC: NVTA), a leading medical genetics company, today announced estimated unaudited fourth quarter and full year 2023 revenue, gross profit, and cash burn.

Estimated unaudited financial results for fourth quarter 2023

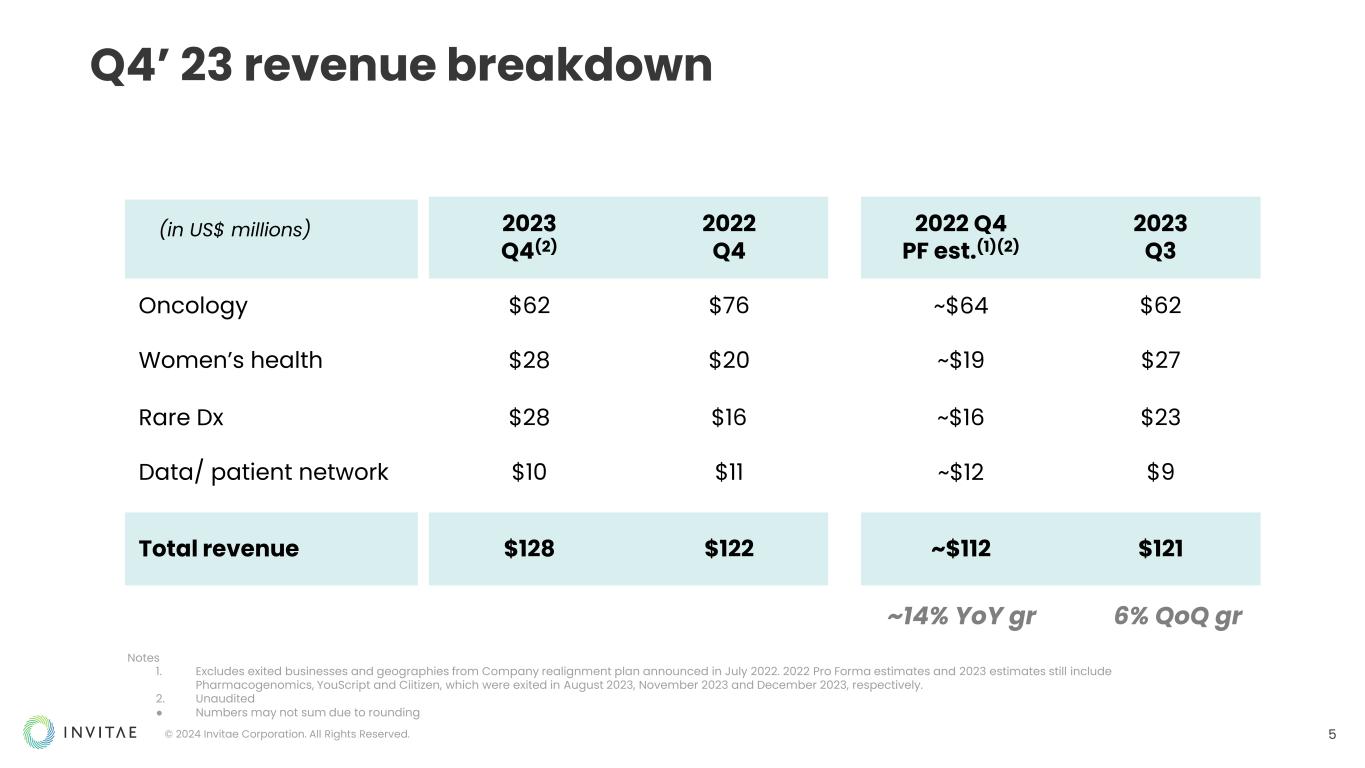

•Fourth quarter 2023 revenue was $127.8 million, an increase of approximately 4% from a year ago. After adjusting for revenue of approximately $10.5 million in the prior year period related to the discontinued businesses, fourth quarter 2023 revenue increased approximately 14% on a pro forma basis.

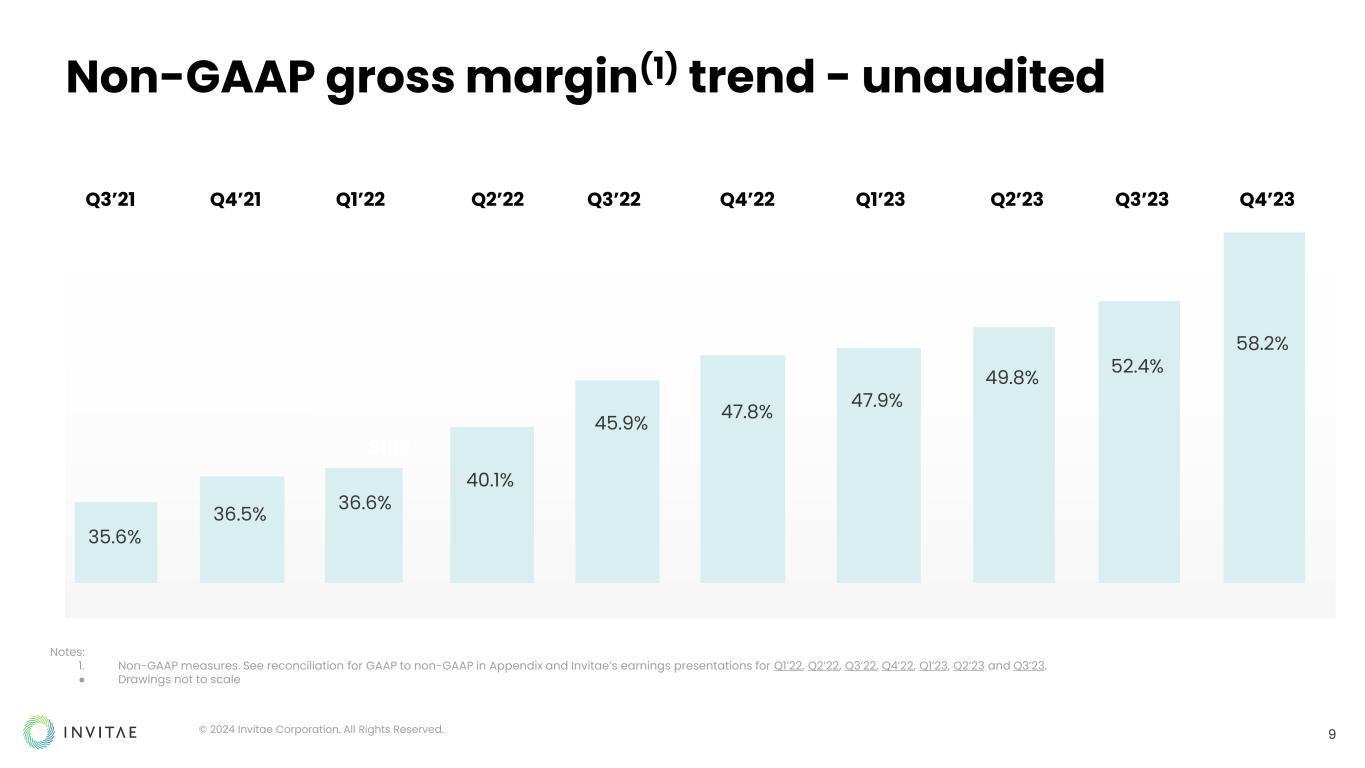

•GAAP gross profit was $74.1 million in the fourth quarter of 2023, compared to $29.6 million a year ago, representing an approximate 150% year-over-year growth. Non-GAAP gross profit was $74.4 million in the fourth quarter of 2023, compared to $58.5 million a year ago, representing year-over-year growth of approximately 27%.

•Fourth quarter GAAP gross margin was 58.0% compared to 24.2% a year ago. Non-GAAP gross margin was 58.2% in the fourth quarter of 2023, compared with 47.8% in the fourth quarter of 2022.

•In the fourth quarter of 2023, net decrease in cash, cash equivalents, restricted cash and net changes in investments was $56.5 million. Reported cash burn in the fourth quarter of 2023 was $53.6 million and included $4.0 million from asset sales related to YouScript. Excluding the asset sales related to YouScript, ongoing cash burn would have been $57.6 million.

Estimated unaudited financial results for fiscal year 2023

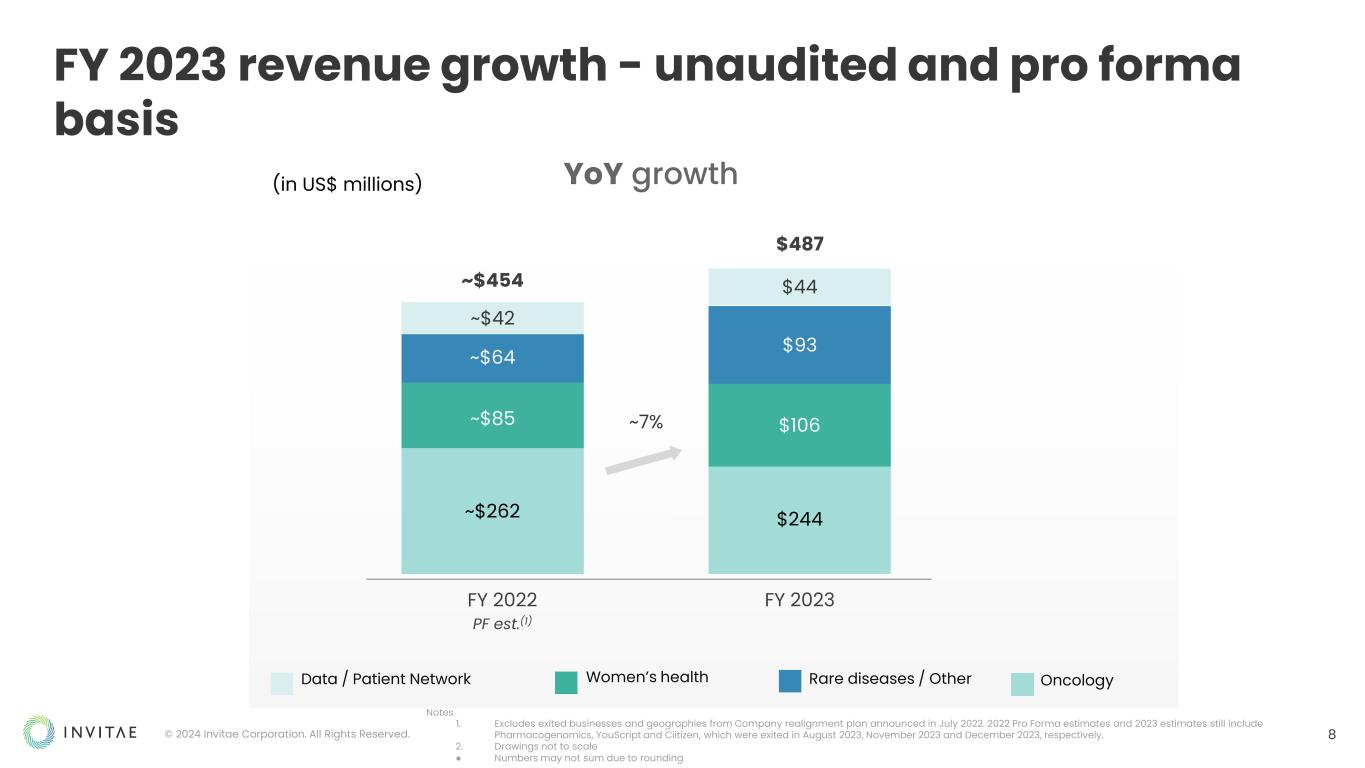

•Fiscal year 2023 revenue was $487.0 million, approximately 6% lower than $516.3 million in fiscal year 2022. The decline was due to the exited businesses and geographies. After adjusting for revenue of approximately $62.1 million in the prior year period related to those discontinued businesses, fiscal year 2023 revenue increased approximately 7% on a pro forma basis.

•GAAP gross profit was $175.2 million in 2023, compared with $99.1 million in 2022, representing approximately 77% year-over-year growth. Non-GAAP gross profit was $254.2 million in 2023, compared with $219.7 million in 2022, representing year-over-year growth of approximately 16%.

•GAAP gross margin was 36.0% in 2023, compared to 19.2% in 2022. Non-GAAP gross margin was 52.2% in 2023, compared to 42.5% in 2022.

•As of December 31, 2023, Invitae had $209.0 million of cash, cash equivalents, restricted cash and marketable securities compared to $557.1 million as of December 31, 2022. In fiscal year 2023, net decrease in cash, cash equivalents, restricted cash and net changes in investments was $355.3 million. Reported cash burn in 2023 was $365.0 million and included $143.1 million of debt repayment and prepayment fees, as well as $4.0 million from asset sales related to YouScript. Excluding the debt related payments and asset sales related to YouScript, ongoing cash burn would have been $225.9 million.

Invitae has not completed preparation of its financial statements for the fourth quarter or full year 2023. The estimated unaudited financial results presented in this press release for the fourth quarter and full year ended December 31, 2023 are based on Invitae’s current expectations and are subject to adjustment. Our independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to this estimated unaudited financial data, or the accounting treatment thereof, and does not

express an opinion or any other form of assurance with respect thereto. While we are currently unaware of any items that would require us to make adjustments to the financial information set forth herein, it is possible that we or our independent registered public accounting firm may identify such items as we complete our fourth quarter and full year 2023 financial statements, and any resulting changes could be material. Accordingly, undue reliance should not be placed on these estimates.

About Invitae

Invitae (OTC: NVTA) is a leading medical genetics company trusted by millions of patients and their providers to deliver timely genetic information using digital technology. We aim to provide accurate and actionable answers to strengthen medical decision-making for individuals and their families. Invitae's genetics experts apply a rigorous approach to data and research, serving as the foundation of their mission to bring comprehensive genetic information into mainstream medicine to improve healthcare for billions of people.

To learn more, visit invitae.com and follow for updates on LinkedIn, X, Instagram, and Facebook @Invitae.

Safe Harbor Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including the company’s 2023 estimated unaudited financial results, including revenue, gross profit, gross margin and cash burn. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: actual results for the fourth quarter and full year 2023; the year-end close process and audit of the company’s financial statements; risks and uncertainties regarding the company’s ability to successfully consummate and complete a plan of reorganization under Chapter 11; the company’s ability to continue operating in the ordinary course while the Chapter 11 cases are pending; potential adverse effects of the Chapter 11 cases on the company’s business, financial condition, liquidity and results of operations; and the other risks and uncertainties disclosed in the Company’s annual and quarterly periodic reports and other documents filed with the SEC. These forward-looking statements speak only as of the date hereof, and Invitae Corporation disclaims any obligation to update these forward-looking statements.

Non-GAAP Financial Measures

To supplement the company's estimated unaudited financial results for the fourth quarter and year ended December 31, 2023 prepared in accordance with generally accepted accounting principles in the United States (GAAP) and disclosed in this press release, the company is providing several non-GAAP measures. These non-GAAP financial measures exclude certain items that are required by GAAP. In addition, these non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies. Management believes these non-GAAP financial measures are useful to investors in evaluating the company’s ongoing operating results and trends. Management uses such non-GAAP information to manage the company’s business and monitor its performance.

Other companies, including companies in the same industry, may not use the same non-GAAP measures or may calculate these metrics in a different manner than management or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of these non-GAAP measures as comparative measures. Because of these limitations, the company's non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the non-GAAP reconciliations provided in the tables below.

Contacts for Invitae:

Investor Relations

Hoki Luk

ir@invitae.com

Public Relations

Amy Sands Hadsock

pr@invitae.com

INVITAE CORPORATION

Reconciliation of GAAP to Non-GAAP Gross Profit

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 127,847 | | | $ | 122,454 | | | $ | 486,976 | | | $ | 516,303 | |

| Cost of revenue | | 53,713 | | | 92,844 | | | 311,815 | | | 417,256 | |

| Gross profit | | 74,134 | | | 29,610 | | | 175,161 | | | 99,047 | |

| Amortization of acquired intangible assets | | — | | | 26,950 | | | 77,122 | | | 100,568 | |

| Acquisition-related stock-based compensation | | 26 | | | 156 | | | 172 | | | 581 | |

| Acquisition-related post-combination expense | | — | | | — | | | — | | | 1,053 | |

| | | | | | | | |

| Restructuring-related retention bonuses | | 105 | | | 82 | | | 250 | | | 252 | |

| Inventory and prepaid write-offs | | 92 | | | 1,712 | | | 1,454 | | | 18,179 | |

| Non-GAAP gross profit | | $ | 74,357 | | | $ | 58,510 | | | $ | 254,159 | | | $ | 219,680 | |

Reconciliation of Net (Decrease) Increase in Cash, Cash Equivalents and Restricted Cash to Cash Burn

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | Year Ended |

| | March 31, 2023 | | June 30, 2023 | | September 30, 2023 | | December 31, 2023 | | December 31, 2023 |

| Net cash used in operating activities | $ | (34,398) | | | $ | (54,905) | | | $ | (66,895) | | | $ | (50,076) | | | $ | (206,274) | |

| Net cash provided by investing activities | 73,878 | | | 116,064 | | | 5,117 | | | 72,675 | | | 267,734 | |

| Net cash (used in) provided by financing activities | (135,768) | | | 876 | | | (3,381) | | | (7,197) | | | (145,470) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (96,288) | | | 62,035 | | | (65,159) | | | 15,402 | | | (84,010) | |

| Adjustments: | | | | | | | | | |

| Net changes in investments | (75,202) | | | (117,146) | | | (7,048) | | | (71,917) | | | (271,313) | |

Loss from public offerings of common stock, net of issuance costs | — | | | — | | | 55 | | | — | | | 55 | |

| Proceeds from issuance of Series B convertible senior secured notes due 2028, net of issuance costs | (22,435) | | | 1,763 | | | 8,016 | | | 2,929 | | | (9,727) | |

Cash burn(1) | $ | (193,925) | | | $ | (53,348) | | | $ | (64,136) | | | $ | (53,586) | | | $ | (364,995) | |

| | | | | | | | | |

| (1) Cash burn for the three months ended March 31, 2023 includes $135.0 million repayment of debt, $8.1 million of prepayment fees, $3.7 million in restructuring-related cash payments, and $1.5 million of acquisition-related payments. Cash burn for the three months ended September 30, 2023 includes $4.1 million of acquisition-related payments. Cash burn for the three months ended December 31, 2023 includes $4.0 million of proceeds from the sale of YouScript. |

invitae.com© 2024 Invitae Corporation. All Rights Reserved. From genetics, Health Fourth Quarter and Full Year 2023 Estimated Unaudited Financial Results 03.06.2024

2© 2023 Invitae Corporation. All Rights Reserved. Safe harbor statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding Invitae Corporation’s (“Invitae”) 2023 preliminary financial results, including revenue, gross profit, gross margin and cash burn. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: actual results for the fourth quarter and full year 2023; the year-end close process and audit of Invitae's financial statements; risks and uncertainties regarding Invitae's ability to successfully consummate and complete a plan of reorganization under Chapter 11; Invitae's ability to continue operating in the ordinary course while the Chapter 11 cases are pending; potential adverse effects of the Chapter 11 cases on Invitae's business, financial condition, liquidity and results of operations; and the risks and uncertainties disclosed in Invitae's annual and quarterly period reports and other documents filed with the U.S. Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof, and Invitae disclaims any obligation to update these forward-looking statements. Estimated Operating Results (Unaudited) Invitae has not completed preparation of its financial statements for the fourth quarter or the full year ended December 31, 2023. Invitae has included in this presentation certain operating results representing Invitae's estimates as of and for the fourth quarter and the full year ended December 31, 2023, which are based only on currently available information and do not present all necessary information for an understanding of Invitae's financial condition as of December 31, 2023 or Invitae's results of operations for the year ended December 31, 2023. This financial information has been prepared by and is the responsibility of Invitae's management, and Invitae's independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to this preliminary financial data or the accounting treatment thereof and does not express an opinion or any other form of assurance thereto. While we are currently unaware of any items that would require us to make adjustments to the financial information set forth herein, it is possible that we or our independent registered public accounting firm may identify such items as we complete our fourth quarter and full year 2023 financial statements and any resulting changes could be material. Accordingly, undue reliance should not be placed on these estimated operating results.

3© 2023 Invitae Corporation. All Rights Reserved. Non-GAAP financial measures To supplement Invitae’s estimated unaudited financial results for the fourth quarter and year ended December 31, 2023 prepared in accordance with generally accepted accounting principles in the United States (GAAP) and disclosed in this presentation, the company is providing several non-GAAP measures. These non-GAAP financial measures exclude certain items that are required by GAAP. In addition, these non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies. Management believes these non-GAAP financial measures are useful to management and investors in evaluating the company's ongoing operating results and trends. Management uses such non-GAAP information to manage the company’s business and monitor its performance. Other companies, including companies in the same industry, may not use the same non-GAAP measures or may calculate these metrics in a different manner than management or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of these non-GAAP measures as comparative measures. Because of these limitations, the company's non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the GAAP to non-GAAP reconciliations provided in this presentation and on the company’s website.

4© 2024 Invitae Corporation. All Rights Reserved. Q4 and FY 2023 estimated unaudited key financials

5© 2024 Invitae Corporation. All Rights Reserved. Q4’ 23 revenue breakdown 2023 Q4(2) 2022 Q4 $62 $76 $28 $20 $28 $16 $10 $11 $128 $122 2022 Q4 PF est.(1)(2) 2023 Q3 ~$64 $62 ~$19 $27 ~$16 $23 ~$12 $9 ~$112 $121 Oncology Women’s health Rare Dx Data/ patient network Total revenue (in US$ millions) Notes 1. Excludes exited businesses and geographies from Company realignment plan announced in July 2022. 2022 Pro Forma estimates and 2023 estimates still include Pharmacogenomics, YouScript and Ciitizen, which were exited in August 2023, November 2023 and December 2023, respectively. 2. Unaudited ● Numbers may not sum due to rounding ~14% YoY gr 6% QoQ gr

6© 2024 Invitae Corporation. All Rights Reserved. Q4’23 revenue growth (in US$ millions) 2023 Q4(2) Rare diseases / Other OncologyData / Patient Network Women’s health 2022 Q4 PF est.(1)(2) ~14% 2023 Q4(2) $128 $62 $28 $28 $10 2023 Q3 6% $121 $27 $23 $9 $128 $62 $28 $28 $10 ~$64 ~$112 YoY growth QoQ growth ~$19 ~$16 ~$12 Notes 1. Excludes exited businesses and geographies from Company realignment plan announced in July 2022. 2022 Pro Forma estimates and 2023 estimates still include Pharmacogenomics, YouScript and Ciitizen, which were exited in August 2023, November 2023 and December 2023, respectively. 2. Unaudited ● Numbers may not sum due to rounding $62

7© 2024 Invitae Corporation. All Rights Reserved. FY23 revenue breakdown FY 2023(2) FY 2022 $244 $308 $106 $96 $93 $66 $44 $46 $487 $516 FY 2022 PF est.(1)(2) ~$262 ~$85 ~$64 ~$42 ~$454 Oncology Women’s health Rare Dx Data/ patient network Total revenue (in US$ millions) Notes 1. Excludes exited businesses and geographies from Company realignment plan announced in July 2022. 2022 Pro Forma estimates and 2023 estimates still include Pharmacogenomics, YouScript and Ciitizen, which were exited in August 2023, November 2023 and December 2023, respectively. 2. Unaudited ● Numbers may not sum due to rounding ~7% YoY gr

8© 2024 Invitae Corporation. All Rights Reserved. FY 2023 revenue growth - unaudited and pro forma basis (in US$ millions) Rare diseases / Other OncologyData / Patient Network Women’s health FY 2023 $487 $244 $106 $93 $44 FY 2022 PF est.(1) ~7% ~$454 ~$85 ~$64 ~$42 YoY growth Notes 1. Excludes exited businesses and geographies from Company realignment plan announced in July 2022. 2022 Pro Forma estimates and 2023 estimates still include Pharmacogenomics, YouScript and Ciitizen, which were exited in August 2023, November 2023 and December 2023, respectively. 2. Drawings not to scale ● Numbers may not sum due to rounding ~$262

© 2024 Invitae Corporation. All Rights Reserved. 9 Notes: 1. Non-GAAP measures. See reconciliation for GAAP to non-GAAP in Appendix and Invitae’s earnings presentations for Q1’22, Q2’22, Q3’22, Q4’22, Q1’23, Q2’23 and Q3’23. ● Drawings not to scale Non-GAAP gross margin(1) trend - unaudited Q1’22 Q2’22Q4’21 Q3’22 Q4’22 Q1’23 $169 35.6% Q2’23Q3’21 36.5% 36.6% 40.1% 45.9% 47.8% 47.9% 49.8% Q3’23 52.4% Q4’23 58.2%

© 2024 Invitae Corporation. All Rights Reserved. 10 Notes 1. Ongoing cash burn includes cash, cash equivalents, marketable securities, and restricted cash and excludes certain items listed in the footnotes below. 2. Cash items in Q3’22: outflow of $43.2 million related to restructuring-related cash payments and acquisition-related payments. 3. Cash items in Q4'22: outflow of $9.3 million related to realignment, $0.1 million acquisition-related payments, and an inflow of $44.5 million related to the selected assets sale of the RUO kitted solutions. 4. Cash items in Q1'23: outflows of $135.0 million repayment of debt and $8.1 million of prepayment fees. Q1’23 benefited from accounts receivable reductions of ~$13 million associated with the realignment of the previous Archer business. 5. Cash items in Q4'23: inflow of $4.0 million related to the asset sale of Youscript ● Non-GAAP measures. See reconciliation for GAAP to non-GAAP in Appendix and Invitae’s earnings presentations for Q1’22, Q2’22, Q3’22, Q4’22, Q1’23, Q2’23 and Q3’23. ● Drawings not to scale. Numbers may not sum due to rounding Ongoing cash burn(1) trend - unaudited Q1’22 Q2’22Q4’21 Q3’222 Q4’223 Q1’234 Ongoing cash burn(1) $169 $147 $196 $108 $77 $51 Change in cash/ investments $169 $147$196 $142 $42 $172 ($ in millions) Q2’23 $55 $53 Q3’23 $72 $64 Q4’235 $57 $58

© 2024 Invitae Corporation. All Rights Reserved.

Appendix

© 2023 Invitae Corporation. All Rights Reserved. 13 Reconciliation of GAAP Revenue to Non-GAAP Gross Profit for Q4 2023 and Full Year 2023

© 2023 Invitae Corporation. All Rights Reserved. 14 Reconciliation of Cash, Cash Equivalents and Restricted Cash to Cash Burn

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Invitae (NYSE:NVTA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Invitae (NYSE:NVTA)

Historical Stock Chart

From Jan 2024 to Jan 2025