false

0001862068

0001862068

2024-07-01

2024-07-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 1, 2024

Rubicon Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40910 |

|

88-3703651 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

950 E Paces Ferry Rd NE

Suite 810

Atlanta, GA |

|

30326 |

| (Address of principal executive offices) |

|

(Zip Code) |

(844) 479-1507

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

RBTC* |

|

* |

|

* |

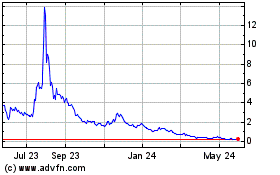

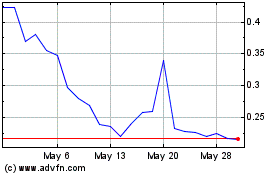

On June 7, 2024, our Class A common stock was suspended from trading on the New York Stock Exchange and began trading under the symbol “RBTC” on the OTC Pink Marketplace maintained by the OTC Markets Group, Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Chief Executive Officer

On June 27, 2024, Mr. Phil Rodoni and the Company entered into a Separation Agreement (the “Separation Agreement”) wherein Mr. Rodoni resigned from his role as Chief Executive Officer of Rubicon Technologies, Inc. (the “Company”), effective June 28, 2024. The Company sincerely thanks Mr. Rodoni for his leadership and contributions to the Company. The Separation Agreement is attached hereto and incorporated herein as Exhibit 10.1 to this Current Report on Form 8-K.

Appointment of Interim Chief Executive Officer

On June 27, 2024, the Company entered into an Employment Agreement (the “Employment Agreement”) entered into between the Company and Mr. Osman H. Ahmed, wherein the Company offered Mr. Ahmed the position of Interim Chief Executive Officer. The Employment Agreement is attached hereto and incorporated herein as Exhibit 10.2 to this Current Report on Form 8-K.

Prior to his appointment to the position of Interim Chief Executive Officer, Mr. Ahmed served on the Company’s board since August 2022. Mr. Ahmed is a Co-Founder of New Circle Capital LLC. Mr. Ahmed is also a Senior Advisor at 10X Capital, having previously served as Managing Director and Head of Private Equity. He has over 15 years of principal investment, and operating experience. Mr. Ahmed has served as member of the board of African Agriculture Holdings Inc. (NASDAQ: AAGR) since December 2023. Prior to joining 10X Capital, Mr. Ahmed was the CEO of Founder SPAC, a $321M special purpose acquisition company focused on digital transformation. Previously, Mr. Ahmed was an investor at KCK Group, a private markets investor. He also served as CFO of Beehive Industries, a KCK Group Portfolio company. Mr. Ahmed previously has held roles at Volition Capital, Scale Venture Partners, and Stifel Financial (NYSE: SF). Throughout his career, Mr. Ahmed has executed leveraged buyout, special situations, and growth equity investments in technology, business services, industrials, and healthcare. Prior closed deals include: Harvest Food Distributors, Sherwood Food Distributors, Hibernia Networks (acquired by GTT), RingCentral (NYSE: RNG), TraceLink, Al Fakher Tobacco, Better.com (NASDAQ: BETR), and others. Mr. Ahmed holds a B.S. in Computer Science from the University of Southern California and an M.B.A. from the University of Chicago Booth School of Business.

Item 7.01. Regulation FD Disclosure.

On July 1, 2024, the Company issued both a shareholder letter (the “Shareholder Letter”) and a press release announcing the departure of Mr. Rodoni and the appointment of Mr. Ahmed. The Shareholder Letter and the press release are attached hereto and incorporated herein as Exhibits 10.3 and 99.1 to this Current Report on Form 8-K, respectively.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibits 10.3 and 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Rubicon Technologies, Inc. |

|

| |

|

| By: |

/s/ Grant Deans |

|

| |

Name: |

Grant Deans |

|

| |

Title: |

Interim Chief Financial Officer |

|

Date: July 1, 2024

Exhibit 10.1

General Release and Separation Agreement

This General Release and Separation Agreement (hereinafter the “Agreement”) is made and entered into by and between Rubicon Technologies Holdings, LLC, a Delaware limited liability company (the “Company” or “Rubicon”), and Phil Rodoni (“Executive”), on the date fully executed by the Company and Executive below. This Agreement

is entered into pursuant to that certain Employment Agreement, dated on or about March 20, 2023, between Company and Executive, including all subsequent amendments thereto

(the “Employment Agreement”), and extinguishes all of Rubicon’s obligations to Executive whether under the Employment Agreement or otherwise except

as set forth in this Agreement.

WITNESSETH:

WHEREAS, Executive’s employment with the Company will end as of the Separation Date (as defined below

in Paragraph 1); and

WHEREAS, Executive and the Company desire to resolve any and all matters arising from Executive’s employment and/or separation on mutually satisfactory terms as set forth herein;

NOW, THEREFORE, in consideration of the terms and mutual promises set forth herein,

the parties agree as follows:

1. Separation Date. Executive has resigned his employment with the Company and resigned from the Company’s Board of Directors (the “Board”), and any other positions that Executive holds or

has held for the Company and/or any parent, subsidiary and/or affiliate of the Company

effective June 28, 2024 (the “Separation Date”). The Company and the Board have accepted Executive’s resignation effective upon the Separation Date.

2.

Final Wages; Restricted Stock Unit Awards. Executive will be paid all wages earned and accrued as of the Separation Date. Executive

will not accrue any additional fringe benefits subsequent to the Separation Date, except as expressly provided in Paragraph 3 of this

Agreement. Executive acknowledges and agrees that Executive has received payment in full for all of the compensation, wages, benefits

and/or payments of any kind otherwise due from the Company, including, but not limited to compensation, bonuses, commissions, lost wages,

expense reimbursements, payments to benefit plans, unused accrued vacation leave and personal time, sick pay or any other payment or

benefit under a Company plan, program, policy, practice or promise as of the date of Executive’s signing of this Agreement and

that no other compensation, bonuses, commissions, lost wages, expense reimbursements, payments to benefit plans, unused accrued vacation

leave and personal time, sick pay or any other payment or benefit under a Company plan, program, policy, practice or promise are due

to him except for the Separation Consideration set forth in Paragraph 3, which Executive will receive only if he executes and does not

revoke this Agreement. None of the foregoing payments (except for the Separation Consideration set forth in Paragraph 3) constitute consideration

for the releases and covenants set forth herein. The wages referred to in this Paragraph 2 have been or will be paid to Executive regardless

of whether Executive signs this Agreement. To the extent that Executive claims any additional wages are due, there is a bona fide dispute

as to such claims, and Executive agrees that the valuable consideration that Executive acknowledges and accepts by signing this Agreement

compensates for and resolves any and all possible claims and disputes he may have against the Company.

Executive shall retain all Restricted Stock Units (“RSUs”) vested as of March 12, 2024. However, Executive expressly waives all rights he may have to any additional

RSUs (whether granted or ungranted), including any right to acceleration of unvested

RSUs, and all unvested RSUs are forfeited pursuant to the terms of the Rubicon Technologies,

Inc. 2022 Equity Incentive Plan.

3. Separation Consideration. In consideration of the covenants and agreements by Executive as described in this

Agreement, including, without limitation, the covenants set forth in Paragraphs 7,

8, 9, and 11 and the releases as set forth in Paragraphs 4 and 5, the Company will

pay Executive a total of Three Million Six Hundred Thousand Dollars and Zero Cents

($3,600,000.00) (the “Separation Consideration”).

(a) The Separation Consideration will be paid as follows:

i. the

Company will pay Executive over a period of twelve (12) months a separation payment of One Million Two Hundred Thousand Dollars and Zero

Cents ($1,200,000.00), subject to standard deductions and withholdings (the “First Separation Payment”), in

equal installments pursuant to the Company’s regular payroll schedule beginning as soon as administratively practicable after the

Effective Date but no later than twenty-one (21) days following the Effective Date and concluding twelve (12) months after the first

payment is made (the “Severance Period”); and

ii. the

Company will pay Executive an additional one (1) time separation payment of One Million Dollars and Zero Cents ($1,000,000.00),

subject to standard deductions and withholdings (the “Second Separation Payment”), within twenty-one (21)

days of the expiration of the Severance Period;

iii. the Company will pay Executive a separation payment of One Million Dollars and Zero

Cents ($1,000,000.00), subject to standard deductions and withholdings (the “Third Separation Payment”), in equal monthly installments beginning as soon as administratively practicable

after the Severance Period but no later than twenty-one (21) days following the expiration

of the Severance Period and concluding by February 28, 2026 (the “Second Severance Period”); and

iv. the Company will pay Executive a separation payment of Four Hundred Thousand Dollars

and Zero Cents ($400,000.00), subject to standard deductions and withholdings (the

“Fourth Separation Payment”), in equal monthly installments beginning as soon as administratively practicable

after the Second Severance Period but no later than twenty-one (21) days following

the expiration of the Second Severance Period and concluding by December 31, 2026.

(b) In

the event that there is a single Sale of Assets Event (as defined in Appendix A) or two Change in Control Events (as defined in Appendix

A) completed (i) on or after the date on which the first installment of the First Separation Payment is made and (ii) before all of the

separation payments as described above in Paragraph 3(a)(i)-(iv) are completed, then any Separation Consideration that is unpaid as of

the first completed Sale of Assets Event or the second completed Change in Control Event will be paid within thirty (30) business days

of the first completed Sale of Assets Event or the second completed Change in Control Event, as applicable; except that if there is no

Change in Control Event before or on March 7, 2025, then the occurrence of only one Change in Control Event is necessary to trigger

the acceleration contemplated in this Paragraph 3(b). In no event shall the Separation Consideration exceed Three Million Six Hundred

Thousand Dollars and Zero Cents ($3,600,000.00) nor shall the Company ever pay more than Three Million Six Hundred Thousand Dollars and

Zero Cents ($3,600,000.00) under this Agreement.

(c) Furthermore, the entirety of the then unpaid Separation Consideration shall be accelerated in the event that the Company fails

to make any of the payments required in Section 3(a) above or otherwise materially breaches the terms of this Agreement; provided that

Executive shall provide the Company with written notice of such alleged non-compliance,

citing to the provision(s) of this Agreement and the known facts relied upon by Executive

as the basis for the Company’s alleged non-compliance, and provide the Company with a period of thirty (30) days

to cure any alleged non-compliance (the “Company Cure Period”). Upon the expiration of the Company Cure Period, Executive shall have a period

of ten (10) days to then provide the Company with written notice of the Company’s ongoing breach and failure to cure such breach, at which time the then unpaid portion

of the Separation Consideration shall be immediately due and payable, or alternatively

that the Company’s breach has been cured. Nothing in this Paragraph 3(c), however, shall preclude the

Company from legally challenging or raising any defenses to any breach alleged by

Executive.

(d)

Executive acknowledges and agrees that Executive would not receive the Separation Consideration except for Executive’s

execution of this Agreement and the fulfillment of the promises contained herein. The Separation Consideration described in this

Paragraph 3 is expressly contingent upon the Executive’s material compliance with the terms of this Agreement and those

provisions of the Employment Agreement that survive Executive’s separation of employment. Should Executive fail to comply with

the terms of this Agreement or the Employment Agreement, then the Company shall provide Executive with written notice of such

alleged material non-compliance, citing to the provision(s) of this Agreement and/or Employment Agreement and the known facts relied

upon by the Company as the basis for Executive’s alleged non-compliance, and provide Executive with a period of thirty (30)

days to cure any alleged non-compliance (the “Executive Cure Period”). During the Executive Cure Period,

any payments due in accordance with Paragraph 3(a) above shall be suspended. Upon the expiration of the Executive Cure Period, the

Company shall have a period of ten (10) days to then provide Executive with written notice of Executive’s ongoing breach and

failure to cure such breach, or alternatively that Executive’s breach has been cured, at which time the Company shall resume

the payment of the Separation Consideration, including making a catch-up payment of all payments suspended during the Executive Cure

Period. In the event that the Company declares a breach in accordance with this Paragraph 3(d), then Executive shall forfeit rights

to receive unpaid Separation Consideration amounts (except that Executive shall retain the right to receive a single payment of one

hundred dollars and zero cents ($100.00)), and Executive shall immediately return to the Company the net-of-tax amounts of any

payments already made to him, except that Executive may retain one hundred dollars ($100.00) of the net-of-tax payments already made

to him. In the event of such a breach, Executive consents and agrees to the following written statement: “Executive has not

claimed a FICA refund or credit of the amount of the overcollection, or if he has, such claim has been rejected, and Executive will

not claim a FICA refund or credit of the amount.” Further, in the event of such a breach, to the extent the Company is unable

to obtain a refund of any income taxes already withheld, Executive shall be responsible for repayment of such income taxes. Nothing

in this Paragraph 3(d), however, shall preclude Executive from legally challenging or raising any defenses to any breach alleged by

the Company.

4. Release of Claims. In consideration of the promises and payments set forth herein, and as a material

inducement for the parties to enter into this Agreement, the parties state as follows:

(a) Executive,

on behalf of himself and his representatives, heirs, successors, assigns, devisees and executors, hereby unconditionally releases, acquits,

and forever discharges the Company, Rubicon Technologies, Inc., Rubicon Technologies, LLC, Rubicon Technologies International, Inc.,

Rubicon Global, LLC, Cleanco LLC, Charter Waste Management, Inc., Rubicon Technologies Germany UG, and RiverRoad Waste Solutions, Inc.

and each of their current, former and future parents, subsidiaries, affiliates, estates, divisions, successors, insurers and assigns,

attorneys and all of their owners, stockholders, general or limited partners, agents, directors, managers, officers, trustees, employees,

representatives, executives, the subrogees of all of the above, and all successors and assigns thereof (collectively, the “Releasees”),

from any and all claims, charges, complaints, demands, liabilities, obligations, promises, agreements, controversies, damages, actions,

causes of action, suits, rights, entitlements, costs, losses, debts, and expenses (including attorneys’ fees and legal expenses)

of any nature whatsoever, known or unknown, which Executive now has, had, or may hereafter claim to have had against the Releasees and/or

any of them by reason of any matter, act, omission, transaction, occurrence, or event that has occurred or is alleged to have occurred

up to and including the Effective Date (as defined in Paragraph 6) of this Agreement (the “Release”). Notwithstanding

the foregoing, this Release shall not operate as a release of: (i) any obligations set forth in this Agreement; (ii) any vested rights

held by Executive under any fringe benefit plan maintained by the Company or any of its parents, subsidiaries, and/or affiliates (except

as expressly set forth in Paragraph 2 above with respect to Executive’s RSUs, each in accordance with the terms and provisions

of such plan; (iii) any rights to indemnification that Executive may have under any bylaws or agreements with the Company and/or its

parents, subsidiaries and/or affiliates, or under any insurance policy maintained by the Company and/or its parents, subsidiaries and/or

affiliates, including, without limitation, under the Directors and Officers Liability Insurance policy referenced in Section 10

of the Employment Agreement; and/or (iv) any claims that may not be released by operation of law. Any reference to a “general

release” in this Agreement shall not operate as a release of the claims in subparts (i) through (iv) herein.

(b) Executive

also specifically agrees that the parties intend the Release to be general and comprehensive in nature and to release all claims and

potential claims against the Releasees to the maximum extent permitted by law. The Release includes a knowing and voluntary waiver

and release of any and all claims including, but not limited to, claims relating to any Special Bonus (as defined in the Employment

Agreement) and claims for nonpayment of wages, overtime or bonuses or any other claims relating to compensation or Executive’s

employment, breach of contract, fraud, loss of consortium, emotional distress, personal injury, injury to reputation, injury to

property, intentional torts, negligence, wrongful termination, constructive discharge, retaliation, discrimination, harassment,

non-payment of equity in the Company, and any and all claims for recovery of lost wages or back pay, fringe benefits, pension

benefits, liquidated damages, front pay, compensatory and/or punitive damages, attorneys’ fees, injunctive or equitable

relief, or any other form of relief under any federal, state, or local constitution, statute, law, rule, regulation, judicial

doctrine, contract, or common law. Specifically included, without limitation, in this Release is a knowing and voluntary waiver and

release of all claims, including without limitation all claims of employment discrimination, harassment, or retaliation or relating

to any manner of employee benefits, under: the Americans With Disabilities Act Amendments Act of 2008; Title VII of the Civil Rights

Act of 1964 and the Civil Rights Act of 1991; the Age Discrimination in Employment Act; the National Labor Relations Act; the Family

and Medical Leave Act; the Occupational Safety and Health Act; the Executive Retirement Income Security Act of 1974; the Lilly

Ledbetter Fair Pay Act of 2009; the California Equal Pay Law; the California Fair Employment and Housing Act; the California

Business and Professions Code; the California Family Rights Act; the California Pregnancy Disability Leave Law; the California

Government Code; the California Labor Code (including, but not limited to, sections 203, 204, 206, 210, 216, 218, 218.5, 218.6,

225.5, 226, 226.3, 226.7, 246, 246.5, 247, 247.5, 248, 248.1, 510, 512, 558, 1050 et seq., 1102.5 et seq., 1194,

1194.2, 1197, 1197.1, 1198, 1400 et seq., and/or 2698 et seq.); any California Industrial Welfare Commission Wage

Order; the California Military & Veterans Code; the California Civil Code; the Unruh Civil Rights Act; the California Domestic

Violence and Sexual Assault Victim Leave Act; the California Worker Adjustment and Retraining Notification Act; the California

Whistleblower Law; any other state and local laws of California that may be lawfully waived by agreement; and any federal, state, or

local constitution, statute, law, rule, ordinance, regulation, judicial doctrine, contract, common law, or other theory arising out

of any matter, act, omission, transaction, occurrence, or event that has occurred or is alleged to have occurred up to and including

the Effective Date of this Agreement.

(c) Executive expressly acknowledges that this Agreement may be pled as a complete defense

and may bar any and all claims, known or unknown, against any or all the Releasees

based on any matter, act, omission, transaction, occurrence, or event that has occurred

or is alleged to have occurred up to and including the Effective Date of this Agreement.

(d) Executive specifically acknowledges that he is aware of and familiar with the provisions

of California Civil Code Section 1542, which provides as follows:

“A GENERAL RELEASE

DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME

OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR

OR RELEASED PARTY.”

Executive, being aware of this section, hereby expressly waives and relinquishes all

rights and benefits he may have under this section as well as any other statutes or common law principles of a similar effect.

(e) Executive acknowledges that this general release extends also to claims that Executive

does not know or suspect to exist in Executive’s favor at the time of executing this Agreement which, if known by Executive, might

have materially affected Executive’s decision to execute this Agreement.

(f) Executive hereby knowingly and voluntarily waives and relinquishes all rights and

benefits which Executive may have under applicable law with respect to such general

release provisions.

(g) The

Company represents and warrants that it is not presently aware of any facts or information that would give rise to any claims,

charges, complaints, demands, actions, causes of action, or lawsuits against Executive. In addition to the foregoing, the Company,

on behalf of itself and its parents, subsidiaries, and affiliates, hereby releases Executive and agrees to indemnify, hold harmless

and defend Executive from any and all claims that in any way relate to the Company’s dispute with Cass Information

Systems.

5. Release of Claims under the Age Discrimination in Employment Act (“ADEA”) and Older Workers Benefit Protection Act (“OWBPA”). Executive understands and acknowledges that before signing this Agreement:

(a) He has read and been given ample opportunity to study this Agreement;

(b) He has been and hereby is advised in writing to consult with an attorney before signing

this Agreement, he has in fact consulted with an attorney prior to signing this Agreement

or has voluntarily chosen to forgo advice of counsel in connection with signing this

Agreement;

(c) He is waiving

any rights he may have under the ADEA and OWBPA, 29 U.S.C. § 621 et. seq.;

(d) He is receiving

consideration for this waiver beyond that to which he is otherwise entitled;

(e) He is signing this Agreement voluntarily with full knowledge that it is intended,

to the maximum extent permitted by law, as a complete and final release and waiver

of any and all claims, including, but not limited to, age discrimination claims;

(f) He has been provided the opportunity to consider this Agreement for twenty-one (21)

days before signing it and, in the event that he decides to execute this Agreement

in fewer than twenty-one (21) days, he does so with the express understanding that

he was given and declined the opportunity to consider this Agreement for twenty-one

(21) days; and

(g) He may revoke this Agreement at any time during the seven (7) days following the date

he signs this Agreement, and the Agreement shall not become effective or enforceable

until the revocation period has expired without the revocation of Executive’s agreement. Any revocation must be in writing and delivered by electronic mail to

Rubicon, attention Osman H. Ahmed, osmanhahmed@gmail.com. Failure to revoke within seven (7) days will result in the release of his claims being permanent. If Executive revokes within 7 days, the entire Agreement is

void and Executive will have no entitlement to the payments and/or benefits described

in Paragraph 3, or any other amount or benefit, from Rubicon.

6. Effective Date of Agreement and Opportunity to Review. This Agreement shall not become effective or enforceable until the “Effective Date,” defined as the date when the last of the following events occurs: (i) Executive

executes the Agreement; (ii) the period for revoking the Agreement, as described in

Paragraph 5(g), has passed without Executive’s revocation of the Agreement; (iii) receipt by the Company of a scanned copy of this

Agreement executed by Executive containing Executive’s ink signature; and (iv) the occurrence of the Separation Date. Executive shall provide copies of the

executed Agreement to the Company by electronic mail, Attn: Osman H. Ahmed, osmanhahmed@gmail.com.

7. Non-Disparagement and Non-Interference.

For and in consideration of the payments, promises, and other consideration described in this Agreement, and as a significant material

inducement for the Company and Executive to enter into this Agreement, Executive covenants and agrees that, except as inconsistent with

Paragraph 10 or applicable law, Executive will not disparage or defame the Company, including its officers, directors, management, executives,

employees, suppliers, products and services. Executive understands and agrees that this restriction prohibits Executive from making disparaging

or defamatory remarks toward or about the Company, its officers, board, board of advisors, management, executives, employees, suppliers,

or products in their capacities as such (1) to any member of the general public, including, but not limited to, any customer or vendor

of the Company; (2) to any current or former officer, manager, executive, or employee of the Company; or (3) to any member of the press

or other media. If Executive receives a subpoena or other legal document concerning Executive’s employment with the Company, then,

to the extent permitted by law and provided it is consistent with Paragraph 10 of this Agreement, Executive agrees to notify the Board

within ten (10) business days of receipt of the legal document requiring Executive to provide this information and to cooperate with

any reasonable efforts by the Company, at its own cost and expense, to limit the production of any such information, including conditioning

any such production on the entry of a confidentiality and/or protective order(s).

This Paragraph does not in any way restrict or impede Executive from exercising protected

rights (to the extent Executive is deemed to have such rights under applicable law),

including rights under: (i) the National Labor Relations Act and the right to file

unlawful labor practice (ULP) charges or participate, assist, or cooperate in ULP

investigations; and (ii) the federal securities laws, including the right to report

possible securities law violations to the SEC, without notice to the Company. Moreover,

nothing in this Agreement is intended to or does in any way: (i) prevent Executive

from discussing or disclosing information about unlawful acts in the workplace, such

as harassment (including sexual harassment), discrimination, sexual assault, or any

other conduct that Executive has reason to believe is unlawful; (ii) waive any rights

which cannot be waived by agreement; (iii) prevent Executive from engaging in lawful

competition in connection with Executive’s business endeavors following the Separation Date; or (iv) prevent Executive from

otherwise disclosing information as permitted or required by law. This Paragraph also

does not prevent Executive from complying with any applicable law or regulation or

a valid order of a court of competent jurisdiction or an authorized government agency,

provided that such compliance does not exceed that required by the law, regulation,

or order.

In exchange for Executive’s promises in this Section 7, the Company agrees to instruct its Board to not disparage or defame Executive: (1)

to any member of the general public, including, but not limited to, any customer or

vendor of the Company; (2) to any current or former officer, manager, executive, or

employee of the Company; or (3) to any member of the press or other media. Moreover,

Executive must direct any recruiter or prospective employer of Executive to the Vice

President of Human Resources of the Company who shall confirm Executive’s last position and salary held with the Company and that Executive voluntarily resigned

from his employment. Executive agrees that the Company shall have no obligations under

this Paragraph to the extent that the recruiter or prospective employer of Executive

contacts anyone other than the Vice President of Human Resources of the Company.

8.

Return to Company. Executive warrants, represents, covenants, and agrees that as of the Effective Date, Executive has returned

to the Company all Company documents, records, property, and information, in any form, including, but not limited to, Company files,

electronic messages, notes, drawings, records, business plans and forecasts, financial information, specifications, business planning

or strategy information, information about the Company’s executives, customer identity information, tangible property including,

but not limited to, computers, intellectual property, credit cards, key fobs, mobile telephones, entry cards, identification badges and

keys; and any materials of any kind which contain or embody trade secrets or other confidential information of the Company (and all embodiments,

copies, or extracts thereof), which Executive has acquired or possessed during Executive’s employment. Executive also warrants,

represents, covenants, and agrees that Executive has not made or retained and shall not make or retain any embodiment, copy, or extract

thereof. Executive will not copy, delete, or alter any information contained upon Executive’s Rubicon computer or Rubicon equipment

before Executive returns it to Rubicon. Notwithstanding the foregoing, Executive may retain copies of any agreements and documents related

to his compensation and benefits provided by the Company.

9. Cooperation. Executive agrees to be reasonably available to the Company to respond to reasonable requests by the Company for information pertaining to or relating to the

Company and/or any of the Releasees or any of their agents, officers, directors, managers,

executives, or employees which may be within the knowledge of Executive. Executive

will cooperate fully with the Company in connection with any and all existing or future

depositions, litigations and/or investigations (including internal investigations) brought by or against the Company or any of the Releasees or any of their agents,

officers, directors, managers, executives or employees, whether administrative, civil

or criminal in nature, in which and to the extent the Company, in its sole discretion,

deems Executive’s cooperation necessary. This cooperation may include without limitation making himself

reasonably available to participate in any proceeding, inquiry, and/or investigation

involving any of the Releasees, allowing himself to be interviewed by representatives

of the Releasees, participating as requested in interviews and/or preparation by any

of the Releasees of other witnesses, appearing for depositions and testimony without

requiring a subpoena, and producing and/or providing any documents and/or information. Executive also understands and agrees to provide only honest, accurate, and complete

information in connection with any and all existing or future depositions, litigations

and/or investigations (including internal investigations) brought by or against the

Company or any of the Releasees in which and to the extent the Company deems Executive’s cooperation necessary. Executive also represents and agrees that he has not and

will not withhold, tamper with or fail to communicate relevant information and will

provide and maintain all relevant information as directed by the Releasees. Executive

hereby further agrees to execute all truthful documents and take such other actions

as the Company may reasonably request in order to accomplish the purposes of this

Agreement. The Company will reimburse Executive for reasonable out-of-pocket expenses

incurred as a result of such cooperation (this does not include an hourly fee), provided that

Executive complies with all Company policies and/or directions for submission of expense

reimbursement requests. The prior sentence is not intended to affect the substance

of any testimony or cooperation that Executive provides. In connection with Executive’s cooperation under this Paragraph 9, the Company agrees to take reasonable measures,

to the extent possible under the circumstances, not to interfere with Executive’s professional and personal obligations.

10. Cooperation

with Government Agencies and Regulatory Organizations. Nothing in this Agreement (or any other policy, plan, or program of the Company)

is intended to, or shall be deemed to, prohibit or restrict Executive in any way from communicating directly with, reporting to, cooperating

with, responding to any inquiry from, or providing testimony before, the Securities and Exchange Commission, FINRA, or any other self-regulatory

organization, or any other federal or state regulatory authority, or governmental agency or entity, regarding any possible securities

violation or other possible violation of law or this Agreement or its underlying facts and circumstances. In addition, nothing in this

Agreement is intended, or shall be deemed, to interfere with Executive’s ability to file a charge or complaint with the Equal Employment

Opportunity Commission or any other federal, state, or local government agency or commission, including those agencies responsible for

enforcing equal opportunity laws or limit Executive’s ability to participate in any investigation or proceeding conducted by any

such agency or commission. Moreover, Executive is not required to provide advance notice to, or have prior authorization from, the Company

in order to engage in any of the foregoing activity referenced in this Paragraph. Without prior authorization of the Board, however,

the Company does not authorize Executive to disclose to any third party (including any government official or any attorney Executive

may retain) any communication that is covered by the Company’s attorney-client or other privilege. Executive further acknowledges

and agrees that the consideration paid to him under this Agreement represents full and complete satisfaction of any monetary recovery

against any of the Releasees that could be sought by or awarded to him in any judicial, administrative, or arbitral proceeding with respect

to any claim released under this Agreement and that he will not be able to obtain any monetary relief or any other remedy, including

costs or attorneys’ fees in connection with any proceeding initiated or maintained by the EEOC or any state or local government

agency responsible for enforcing equal employment opportunity laws. For the avoidance of doubt, this Agreement does not limit Executive’s

eligibility to receive an award out of monetary sanctions collected by any government agency as provided by applicable whistle-blower

programs.

11. Mandatory Binding Arbitration.

11.1 Mandatory Arbitration of All Disputes. This Paragraph 11 shall be governed by and interpreted in accordance with the Federal Arbitration Act. Executive

and the Company agree that any controversy, claim, or dispute between or among them

that cannot be resolved shall be adjudicated exclusively by final and binding individual

arbitration in San Francisco, California or another agreed-upon location. The parties

agree that the American Arbitration Association (the “AAA”) shall be the exclusive provider for all arbitrations, and Executive and the Company

agree not to file, institute, or maintain any arbitration other than with the AAA. The arbitration will be

governed by the AAA Employment Arbitration Rules and Mediation Procedures (available

at www.adr.org/employment) and subject to the AAA Employment Due Process Protocol, if applicable, except as they

are modified by the parties. Unless otherwise agreed by the parties, the arbitration

will be submitted to a single arbitrator selected in accordance with AAA rules. The

arbitrator must follow applicable law and may award only those remedies (including,

without limitation, attorney’s fees and costs) that would have been available had the claim(s) been heard in court.

In addition, the arbitrator is required to issue a written arbitration award setting

forth the essential findings and conclusions on which any award is based. The Company

will pay all arbitration administrative fees (including filing fees), the arbitrator’s fees and costs, and any other fees or costs unique to arbitration. The Company will

pay the arbitration administrative fees, the arbitrator’s fees and costs, and any other fees or costs unique to arbitration within one hundred

eighty (180) days of receipt of an invoice from the AAA setting forth the full amount

of unique arbitration fees and costs due. Each party shall be responsible for paying

her/its own litigation costs for the arbitration, including, but not limited to, attorneys’ fees, witness fees, transcript fees, or other litigation expenses that each party

would otherwise be required to bear in a court action, subject to any relief awarded

by the arbitrator in accordance with applicable law.

The parties shall be entitled to

conduct adequate and reasonable discovery in accordance with the AAA Rules and the applicable provisions of the California Code of

Civil Procedure. The arbitrator has the authority to resolve all discovery disputes and limit the form and amount of discovery to

that reasonably necessary to arbitrate the dispute or claim presented.

11.2 Covered Disputes. Except as expressly set forth below, the foregoing shall apply to the following

“Covered Disputes”: (i) all disputes and claims related to the Release and all other disputes and claims

of any nature that Executive may have against the Releasees, including any and all

statutory, contractual, and common law claims unless prohibited by applicable law,

(ii) all disputes and claims of any nature that the Releasees may have against Executive

or that Executive may have against any Releasee(s), (iii) all disputes and claims related to any breach of this Agreement or any post-employment

obligation under the Employment Agreement, (iv) all disputes and claims concerning

the validity and/or enforceability of the Agreement, and (v) all disputes concerning

the validity, enforceability, or the applicability of this Paragraph 11 to any dispute

or claim. The term “Covered Disputes” does not include, and this Paragraph 11 does

not apply to: (a) claims seeking unemployment insurance benefits, state disability

insurance benefits, or workers’ compensation benefits, except that claims for retaliation pursuant to these laws

shall be subject to arbitration under this Paragraph 11; (b) claims for benefits under

ERISA, which must be resolved in accordance with the terms and procedures set forth

in the applicable plan documents; (c) Sarbanes-Oxley Act, Consumer Financial Protection

Bureau, and Commodity Futures Trading Commission whistleblower claims; or (d) any

other claims that are not permitted to be subject to a pre-dispute arbitration agreement

under applicable federal law and/or federal regulation.

11.3 Delegation. The arbitrator shall have the exclusive power to rule on his or her own jurisdiction,

including any objections with respect to the existence, scope, or validity of this

Paragraph 11 and/or to the arbitrability of any claim or counterclaim.

11.4 Charges/Complaints with Government Agencies. Nothing in this Paragraph 11 affects Executive’s right to file a charge with, make a complaint to, or participate in an investigation

or other proceeding of the EEOC (or any similar state or local bodies), the National

Labor Relations Board, or any other administrative, law enforcement, or regulatory

body. Notwithstanding the foregoing, Executive may seek monetary relief with respect

to a dispute or claim covered by this Paragraph 11 only through an arbitration conducted

pursuant to this Paragraph 11.

11.5 Enforcement of Arbitration Award. Either party may bring an action in any court of competent jurisdiction to compel

arbitration under this Paragraph 11 and to enforce an arbitration award.

11.6 Waiver of Class, Collective, and Representative Actions. To the extent permitted by law, Executive and the Releasees waive any right or authority

to have any Covered Disputes heard as a class, collective, or representative action.

Executive and the Releasees must bring any Covered Dispute in an individual capacity,

and not as a plaintiff, “opt-in”, or class member in any purported class, collective,

or representative proceeding. The arbitrator may not join or adjudicate the claims

or interests of any other person or employee in the arbitration proceeding, nor may the arbitrator otherwise

order any consolidation of actions or arbitrations or any class, collective, or representative

arbitration.

11.7 Confidentiality

of Proceedings. Executive and the Company agree that the resolution of Covered Disputes likely would involve information that each

considers to be sensitive, personal, confidential, and/or proprietary and that Executive and the Releasees intend to resolve the Covered

Disputes in a non-public forum. Accordingly, except as provided by Paragraph 10, Executive and the Company agree that all information

regarding the Covered Dispute or arbitration proceedings, including the arbitration award, will not be disclosed by Executive, the Company,

any arbitrator, or the AAA to any third party without the written consent of both Executive and the Company, except as necessary to comply

with a subpoena, court order or other legal requirement, to prosecute or to defend a claim, to enforce an arbitration award, or to meet

a reasonable business need of the Company. To the extent that either party files any suit, complaint, or proceeding with any court or

other public forum with respect to a Covered Dispute (including, but not limited to, proceedings to challenge the arbitrability of a

matter, to compel arbitration or to enforce an arbitration award or for injunctive relief pending arbitration), such party shall take

all measures and use best efforts to file such complaint or proceeding under seal or in other manner designed to protect the confidentiality

of the Covered Dispute to the maximum extent possible.

11.8 Injunctive Relief Pending Arbitration. Notwithstanding the foregoing, Executive and/or the Company may seek any injunctive

relief (including without limitation temporary and preliminary injunctive relief)

necessary in order to maintain (or restore) the status quo and/or to prevent the possibility

of irreversible or irreparable harm during the pendency of any arbitration.

11.9 Governing Terms. In the event there is any conflict between this Paragraph 11 and any provisions in the Employment Agreement providing for arbitration, the provisions of

this Paragraph shall supersede and govern.

12. Code Section 409A. Certain compensation and benefits payable under this Agreement are intended to be

exempt from the requirements of Section 409A of the Internal Revenue Code of 1986, as amended, and regulations and other official

guidance thereunder (“Code Section 409A”), and other compensation and payments are intended to comply with Code Section 409A. The provisions of this Agreement shall be construed and interpreted in a manner

that compensation and benefits are either exempt from or compliant with the application

of Code Section 409A, and which does not result in additional tax or interest to Executive under Code

Section 409A. Notwithstanding any other provision of this Agreement to the contrary, if upon

Executive’s termination of employment Executive is a specified employee, as defined in Code

Section 409A(a)(2)(B), and if any portion of the payments or benefits to be received by Executive

upon separation from service would be considered deferred compensation under Code

Section 409A, then such payments shall be delayed until the earliest of (a) the date that is

at least six months after Executive terminates employment for reasons other than Executive’s death, (b) the date of Executive’s death, or (c) any earlier specified date that does not result in additional tax

or interest to Executive under Code Section 409A. As soon as practicable after the expiration of such period, the entire amount

of the delayed payments shall be paid to Executive in a single lump sum.

For

purposes of this Agreement, references to a termination of employment shall be construed consistently with the definition of a “separation

from service” under Code Section 409A. With respect to any taxable reimbursements or in-kind benefits provided for under this

Agreement or otherwise payable to Executive, the Company (a) shall make all such reimbursements no later than Executive’s taxable

year following the taxable year in which the expense was incurred, (b) the amount of expenses eligible for reimbursement, or in-kind

benefits provided, during any calendar year shall not affect the expenses eligible for reimbursement, or in-kind benefits to be provided,

in any other calendar year, and (c) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchange for

other benefits. Each payment and benefit payable under this Agreement is intended to constitute separate payments for purposes of Section

l.409A-2(b)(2) of the Treasury Regulations.

13. Code Section 280G. In the event amounts payable hereunder are contingent on a change in control for purposes of Code Section 280G and it is determined by a tax practitioner retained by the Company that any payments

made or provided to the Executive in connection with this Agreement or otherwise (“Total Payments”) would be subject to the excise tax under Code Section 4999 (the “Parachute Tax”), such payments otherwise to be paid under this Plan will be payable in full or,

if applicable, in such lesser amount which would result in no portion of the Total

Payments being subject to the Parachute Tax, whichever of the foregoing amounts, taking

into account the applicable federal, state and local income taxes and the Parachute

Tax, results in the receipt by the Executive, on an after-tax basis, of the greatest

amount of Total Payments. The reporting and payment of any Parachute Tax will be the responsibility of the Executive and neither the Company nor any

other member of Rubicon will provide a gross-up or any other payment to compensate

the Executive for the payment of the Parachute Tax. The Company will withhold from

such payments any amounts it reasonably determines is required under Code Section 4999(c).

14. Tax Consequences. Executive shall be responsible for any tax consequences of any payment, benefit, or reimbursement made or provided pursuant to this Agreement. Executive

shall indemnify the Company and hold it harmless for any tax liability (including

any penalties and/or attorneys’ fees) incurred as a result of any payment, benefit, or reimbursement described herein.

Executive acknowledges and agrees that the Company is not undertaking to advise Executive

with respect to any tax consequences of this Agreement, and that Executive is solely

responsible for determining those consequences and satisfying all applicable tax obligations

resulting from any payment described herein.

15. Non-Admission of Liability or Wrongdoing. The furnishing of the consideration for this Agreement shall not be deemed or construed as an admission of liability, responsibility,

or wrongdoing by the Company or Executive for any purpose. The Company expressly denies

that it (or any other entity or individual of the Company) ever engaged in any wrongdoing

in relation to Executive’s employment with the Company or otherwise, and expressly denies liability for any

and all claims alleged, or that may be alleged, by Executive.

16. No

Assignment by Executive. Executive represents and warrants that Executive has not assigned to any other person, and that no other

person is entitled to assert on Executive’s behalf, any claim against any of the Releasees based on matters released in this Agreement.

Executive shall indemnify and hold the Company harmless from and against any liability, costs, or expenses (including any penalties and/or

attorneys’ fees) incurred in the defense or as a result of any such claims or the breach of the representation and warranty made

by Executive in this Paragraph. Executive further represents and warrants that he may not assign this Agreement. Without limiting the

foregoing, the Company may assign its rights and delegate its duties hereunder in whole or in part and/or to any transferee of all or

a portion of the assets or business to which this Agreement relates. Any such assignment, however, shall not operate to limit the Company’s

obligations to Executive under this Agreement.

17. Successors and Assigns. Executive expressly agrees that this Agreement, including the rights and obligations hereunder, maybe transferred and/or assigned by Rubicon without

the further consent of Executive, and that this Agreement is for the benefit of and

may be enforced by Rubicon, its present and future successors, assigns, subsidiaries,

affiliates, and purchasers, but it is not assignable by Executive.

18. Waiver of Breach. The failure of the Company or Executive at any time to require performance of any provision of this Agreement shall in no way affect its or his right

thereafter to enforce the same, nor shall the waiver by the Company or Executive of

any breach of any provision of this Agreement be taken or held to be a waiver of any

succeeding breach of any provision, or as a waiver of the provision itself.

19. Binding Agreement. This Agreement is a contract between Executive and the Company and not merely a recital. Executive acknowledges that any breach by the Company of

any contractual, statutory, or other legal obligation to Executive shall not excuse

or terminate Executive’s obligations hereunder or otherwise preclude the Company from seeking relief pursuant

to any provision of this Agreement, except as expressly set forth in this Agreement.

The Company likewise acknowledges that any breach by Executive of any contractual,

statutory, or other legal obligation to the Company shall not excuse or terminate

the Company’s obligations hereunder or otherwise preclude Executive from seeking relief pursuant

to any provision of this Agreement, except as expressly set forth in this Agreement.

20. Modification. No change or modification to this Agreement shall be valid or binding unless the same is in writing and signed by the parties hereto.

21. Severability. The terms, conditions, covenants, restrictions, and other provisions contained in this Agreement are separate, severable, and divisible. If any term, provision,

covenant, restriction, or condition of this Agreement or part thereof, or the application

thereof to any person, place, or circumstance, shall be held to be invalid, unenforceable,

or void, the remainder of this Agreement and such term, provision, covenant, or condition

shall remain in full force and effect to the greatest extent permissible by law, and

any such invalid, unenforceable, or void term, provision, covenant, or condition shall be deemed, without further action on the part of the parties

hereto, modified, amended, limited, or deleted to the extent necessary to render the

same and the remainder of this Agreement valid, enforceable, and lawful.

22. Complete

Agreement. Except as provided herein, this Agreement supersedes all previous or contemporaneous agreements, whether oral or written,

between and among the parties hereto, if any, with respect to the subject matter referred to herein. Executive affirms that the only

consideration for executing this Agreement is the payments, promises, and other consideration expressly contained or described herein.

Executive further represents and acknowledges that, in executing this Agreement, Executive does not rely and has not relied upon any

promise, inducement, representation, or statement by the Company or any of the Releasees or their respective agents, representatives,

or attorneys about the subject matter, meaning, or effect of this Agreement that is not stated in this document. For avoidance of doubt,

all provisions in the Employment Agreement which by their terms survive the termination of employment shall survive as provided in the

Employment Agreement (and, if applicable, as modified by this Agreement) and shall not be extinguished or superseded by this Agreement;

provided that, all provisions providing for compensation (including but not limited to in the event of any sale event or change in control),

RSUs, equity, and bonuses (including but not limited to annual bonuses, incentive bonuses, special bonuses, and retention bonuses) are

extinguished and superseded by this Agreement.

23. Construction. The language of all parts of this Agreement shall in all cases be construed as a

whole, according to its fair meaning, and not strictly for or against any of the parties.

The paragraph headings contained in this Agreement are for reference purposes only and shall not affect the

meaning or interpretation of this Agreement.

24. Governing Law. This Agreement shall be governed, construed, and interpreted under and in accordance with the laws of the State of California, without regard to any

conflict of laws principles that would direct the application of another jurisdiction’s laws.

25. Acknowledgments. Executive acknowledges and represents that the waiver and release of claims in this Agreement are knowing and voluntary and are given only in exchange

for new consideration that is in addition to anything of value to which Executive

already is entitled absent this Agreement. Executive acknowledges that the language

of this Agreement is understandable to Executive and is understood by Executive, and

that Executive has been given a reasonable period within which to consider the Agreement

before executing it. Executive further acknowledges that Executive has been and is hereby

advised to consult, and has in fact consulted or had a reasonable opportunity to consult,

an attorney of Executive’s choosing before executing the Agreement, and that Executive has obtained all advice

and counsel Executive needs to understand all terms and conditions of this Agreement.

26. Notices. All notices, requests, demands and other communications required or permitted hereunder shall be in writing and be deemed to have been duly given if delivered

or three days after mailing if mailed, first class, certified mail, postage prepaid:

To the Company:

Rubicon Technologies Holdings, LLC

335 Madison Avenue

Floor 4, Suite A

New York, New York 10017

Attn: Board of Directors

To the Executive:

Phil Rodoni

PO Box 1296

Point Reyes Station, CA 94956

With a copy, via electronic mail, to:

Henry M. Perlowski

Arnall Golden Gregory LLP

Henry.Perlowski@agg.com

Any party may change the address to which notices, requests, demands and other communications

shall be delivered or mailed by giving notice thereof to the other party in the same

manner provided herein.

27.

Execution. This Agreement may be executed in one or more counterparts as originals, all of which constitute one original.

AS PROVIDED IN PARAGRAPH 6, THIS AGREEMENT SHALL NOT BECOME EFFECTIVE OR ENFORCEABLE

UNTIL RECEIPT BY THE COMPANY OF A SCANNED COPY OF THIS AGREEMENT EXECUTED (AND NOT REVOKED) BY EXECUTIVE CONTAINING EXECUTIVE’S INK SIGNATURE.

THE UNDERSIGNED HAVE CAREFULLY READ THIS AGREEMENT; THEY KNOW AND UNDERSTAND ITS CONTENTS;

THEY FREELY AND VOLUNTARILY AGREE TO ABIDE BY ITS TERMS; AND THEY HAVE NOT BEEN COERCED

INTO SIGNING THIS AGREEMENT.

| PHIL

RODONI |

|

RUBICON

TECHNOLOGIES HOLDINGS, LLC |

| |

|

|

|

|

By: |

/s/

Osman H. Ahmed |

| |

|

|

Osman

H. Ahmed |

|

|

|

Title: |

Lead

Independent Director |

| |

|

|

|

|

| Date: |

June 27,

2024 |

|

Date: |

June 27,

2024 |

APPENDIX A

DEFINITIONS

For the purposes of Paragraph 3(b) of this Agreement, the following terms shall have

the following meanings:

(a) “Affiliate” means any organization, firm, or entity (i) in respect of which Company has or shall

have during the term of this Agreement, an ownership interest of fifty percent (50%)

or more; or (ii) which directly or indirectly through one or more intermediates, controls,

is controlled by, or is in common control with Company.

(b) “Change in Control Event” shall mean the occurrence of any of the following:

(i) any sale, directly or indirectly, of more than 50% of the equity securities of the Company to any Person or group of Persons acting in concert excluding

a sale to any Affiliate of the Company;

(ii) any merger or consolidation of the Company with or into any Person where those

Persons who, directly or indirectly, own equity securities in the Company immediately

prior to the effective date of the merger or consolidation and their Affiliates own,

directly or indirectly, less than 50% of the equity securities in the entity surviving

the merger or consolidation;

(iii) the meaning ascribed in the Company’s Operating Agreement, as amended and includes a transaction pursuant to which a special

purpose acquisition company or other similar vehicle (or, in either case, a subsidiary

thereof) acquires ownership of the Company or its operating subsidiaries, whether

by merger, purchase or otherwise; or

(iv) a minority recapitalization of the business with an investor investing new capital

into the Company and, upon such investment, then owning more than forty percent (40%)

of the Company’s common stock.

For the avoidance of doubt, any transfer, directly or indirectly, of equity securities

of the Company by gift or bequest shall not constitute a Change of Control. Notwithstanding

the foregoing, a transaction shall not be deemed a Change of Control unless the transaction

qualifies as a Change of Control event within the meaning of Code Section 409A, as it has been and may be amended from time to time, and any proposed or final

Treasury Regulations and Internal Revenue Service guidance that has been promulgated

or may be promulgated thereunder from time to time.

(c) “Person(s)” mean all individuals, partnerships, corporations, limited liability companies, firms,

businesses, and other entities, other than the Company or an Affiliate of the Company.

(d) “Sale

of Assets Event” means a sale(s) of all or substantially all of the Company’s assets to any Person, excluding any Affiliate

of the Company.

Exhibit 10.2

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT

(this “Agreement”), dated as of June 27, 2024, is made by and between Rubicon Technologies, Inc., a Delaware

corporation (the “Company”), and Osman H. Ahmed (“Executive”). This Agreement shall govern the

relationship between Executive and the Company from and after June 28, 2024 (the “Start Date”).

WHEREAS, the Company desires to employ Executive pursuant to the terms and conditions set forth in this Agreement; and

WHEREAS, Executive is willing and able to be employed by the Company and desires to do so on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the above recitals incorporated herein and the mutual covenants and promises contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby expressly acknowledged, the parties agree as follows:

1. Retention and Duties.

(a) The Company hereby engages and employs Executive for the Term (as defined in Section 2) on the terms and conditions expressly set forth in this Agreement. Executive hereby accepts and agrees to such engagement and employment, on the terms and conditions expressly set forth in this Agreement.

(b) During the Term, Executive shall serve as the Interim Chief Executive Officer (the “Interim CEO”) of the Company, and shall perform such duties consistent with such position and as may from time to time be assigned to Executive by the Company’s Board of Directors (the “Board”) or the Board’s designee. As the Interim CEO Officer of the Company, Executive shall report to the Board or the Board’s designee. In addition, the Board may from time to time, in its sole discretion, assign to the Executive such other duties, authorities and responsibilities that are not inconsistent with the Executive’s position as the Interim CEO of the Company, including without limitation, service as an officer and/or on the boards of directors and committees of one or more of the Company’s subsidiaries, in each case, without additional compensation.

(c) Executive shall be located and perform his principal duties hereunder remotely at Executive’s principal residence located in the State of New York. Notwithstanding the foregoing, Executive agrees and acknowledges that significant travel may be part of the performance of his services hereunder.

(d) During the Term, Executive shall devote his entire working time, attention, and energies to the Company and shall not be engaged in any other business activity, whether or not such business activity is pursued for gain, profit or other pecuniary advantage, without the prior written consent of the Board. While Executive serves as Interim CEO of the Company, the foregoing is not intended to restrict Executive’s ability to serve on the boards of civic, for-profit or charitable organizations; provided, that the foregoing activities are not competitive with the business of the Company and do not interfere or conflict with Executive’s duties and obligations on behalf of the Company or create a potential business or fiduciary conflict of interest. Executive agrees to use best efforts to perform his duties and responsibilities within, and agrees to abide by, the Company’s written general employment policies and practices and such other reasonable policies, practices and restrictions as the Company shall from time to time establish and maintain for its executives.

2. Term. The “Term” shall be the period commencing on the Start Date and ending at the close of business on the date following six (6) months following the Start Date, unless Executive’s employment with the Company terminates earlier pursuant to Section 5. The Term shall be extended automatically by successive one (1) month periods unless either party provides the other party with written notice of an intention to terminate the Agreement at least thirty (30) days prior to such termination or renewal date. The “Term” shall include any such automatic one (1) month extensions. The Term may be modified only by a written agreement between the parties and in such case, the term “Term” shall be deemed to mean the Term as so modified. Notwithstanding anything to the contrary in this Agreement, Executive’s employment with the Company shall be “at will.”

3. Compensation and Reimbursement of Expenses.

(a) Base Salary. During the Term, Executive’s annual base salary (the “Base Salary”) shall be $500,000, payable in accordance with the Company’s regular payroll practices in effect from time to time and subject to all applicable taxes and withholdings, but no less frequently than in semi-monthly installments. The Base Salary may be adjusted upward by the Compensation Committee of the Board (the “Compensation Committee”) in its sole discretion. The parties acknowledge and agree that a portion of Executive’s Base Salary shall constitute consideration for Executive’s compliance with the restrictions and covenants set forth in Section 6 of this Agreement.

(b) Transaction Bonus. Executive will be entitled to a cash transaction bonus (the “Transaction Bonus”) equal to $500,000 upon a Change of Control that occurs during the Term or within six (6) months thereafter. For purposes of this Agreement, “Change of Control” shall mean the earliest of the following events: (i) a sale, lease, license, transfer, conveyance or disposition, in one transaction or a series of related transactions, of substantially all of the Company’s assets to any buyer(s) or (ii) a transaction or series of related transactions (including by way of merger, consolidation, recapitalization, reorganization or sale of securities) which requires shareholder consent under the Company’s Organizational Documents or Applicable Law and results in a third-party’s acquisition of the equity or assets of the Company that constitutes more than fifty percent (50%) of the total fair market value or total voting power of the equity of the Company. If earned, the Transaction Bonus shall be paid to Executive within 21 days following the consummation of the Change of Control. For the avoidance of doubt, a buyer or third-party acquiror may include a current investor in the Company.

(c) Reimbursement of Business Expenses. Executive is authorized to incur reasonable expenses in carrying out his duties hereunder and shall, upon receipt by the Company of proper documentation with respect thereto (setting forth the amount, business purpose and establishing payment) be reimbursed for all such reasonable business expenses incurred during the Term, subject to the Company’s written expense reimbursement policies and any written pre-approval policies in effect from time to time.

4. Employee Benefits.

(a) Company Employee Benefit Plans. During the Term, Executive shall be provided the opportunity to participate in all standard employee benefit programs made available by the Company to the Company’s senior executive employees generally, in accordance with the terms and conditions of such plans, including the eligibility and participation provisions of such plans and programs, as such plans or programs may be in effect from time to time. The Company reserves the right to amend any employee benefit plan, policy, program or arrangement from time to time, or to terminate such plan, policy, program or arrangement, consistent with the terms thereof at any time and for any reason without providing Executive with notice.

(b) Vacation and Other Leave. During the Term, Executive shall be entitled to take up to ten (10) business days of paid vacation time during the Term, or such greater amount as may be provided pursuant to the Company’s vacation policies in effect from time to time. Such paid vacation time will accrue on a monthly basis, but Executive may take the paid vacation time anytime in the Term, prior to or following accrual thereof (to the extent not previously used). Executive shall also be eligible for all other holiday and leave pay generally available to other executives of the Company.

5. Termination of Employment.

(a) Termination by the Company; Termination Due to Death. Executive’s employment with the Company, and the Term, may be terminated by the Company immediately upon notice to Executive for an involuntary termination of employment for Cause (as defined in Section 5(f)(ii)), without Cause or due to Executive’s Disability (as defined in Section 5(f)(iii)). Executive’s employment with the Company, and the Term, shall automatically terminate upon Executive’s death.

(b) Termination by Executive. Executive’s employment with the Company, and the Term, may be terminated by Executive for any reason with no less than thirty (30) calendar days’ advance written notice to the Company.

(c) Benefits Upon Termination. If Executive’s employment with the Company is terminated during the Term for any reason by the Company or by Executive, the Company shall have no further obligation to make or provide to Executive, and Executive shall have no further right to receive or obtain from the Company, any payments or benefits except as follows:

(i) Any Termination. The Company shall pay Executive (or, in the event of his death, Executive’s estate) any Accrued Obligations (as defined in Section 5(f)(i)) within the thirty (30) day period (or such earlier period as required by law) following the date Executive’s employment terminates (the “Separation Date”), and Executive shall receive any vested accrued benefits for which Executive remains eligible under the Company’s employee welfare benefit and defined contribution retirement plans, payable according to the terms of such plans.

(ii) Non-Renewal by the Company; Without Cause; For Good Reason. If Executive’s employment with the Company ends as a result of a non-renewal of the Term by the Company (and conditions for a Cause termination do not otherwise exist), an involuntary termination by the Company without Cause or due to Executive’s resignation for Good Reason, then, in addition to the amounts payable under Section 5(c)(i), subject to Executive’s timely execution, delivery, and non-revocation of the general release described in Section 5(e) (the “General Release”) and the other conditions and limitations herein, the Company shall pay or provide Executive with the cash severance equal to $300,000 (the “Severance Payment”), payable in substantially equal installments over the eight (8) months following the Separation Date in accordance with the Company’s regular payroll payment schedule; provided, that no installment or portion of the Severance Payment shall be payable or paid prior to the expiration of the applicable revocation period for the General Release; and provided further, that if the Severance Payment is subject to Section 409A (as defined in Section 5(f)(v)) and the timing of Executive’s execution and delivery of the General Release could affect the calendar year in which any amount of the Severance Payment is paid because the Separation Date occurred toward the end of a calendar year, then no portion of the Severance Payment shall be paid until the Company’s first payroll payment date in the year following the year in which the Separation Date occurs, and any amount that is not paid prior to such date due to such restriction shall be paid (subject to the applicable conditions) along with the installment scheduled to be paid on that date. The Board may, in its sole discretion, require executive to provide reasonable advisory services to the Company during the severance period and for no additional consideration beyond the severance payment.

(d) Cooperation Upon Termination. Upon the Executive’s termination of employment for any reason, Executive shall cooperate as reasonably requested by the Board to effect an orderly transition.

(e) Release; No Other Severance Benefits.

(i) This Section 5(e) shall apply notwithstanding anything else in this Agreement to the contrary. As a condition precedent to any Company obligation pursuant to Section 5(c)(ii) (collectively, the “Severance Benefits”), Executive shall provide the Company with a valid, executed General Release in substantially the form attached hereto as Exhibit A (as reasonably revised by the Company to comply with applicable law changes or interpretations or as otherwise necessary to ensure or bolster enforceability or tax effectiveness), and not revoke such General Release prior to the expiration of any revocation rights afforded under applicable law. The Company shall provide Executive with the General Release prior to the Separation Date, and Executive must deliver the executed General Release to the Company within twenty-one (21) calendar days (or, if greater, the minimum period required by applicable law) after the Separation Date, failing which Executive will forfeit all rights to the Severance Benefits.

(ii) Executive agrees that the Severance Benefits shall be in lieu of any other severance benefit or other right or remedy to which Executive would otherwise be entitled under the Company’s plans, policies or programs in effect on the Start Date or thereafter. Executive acknowledges and agrees that in the event Executive breaches any provision of Section 6 or the General Release, his right to receive the Severance Benefits shall automatically terminate and Executive shall repay, return and restore any and all Severance Benefits received.

(f) Certain Defined Terms. As used in this Agreement: