Rio Tinto investing for a stronger, more diversified portfolio

December 03 2024 - 11:57PM

Business Wire

Rio Tinto will today hold its 2024 Investor Seminar in London,

where it will provide updates on its strategy of investing for a

stronger, more diversified and growing portfolio to ensure the

long-term delivery of attractive shareholder returns.

Rio Tinto Chief Executive Jakob Stausholm said: “We have all the

building blocks we need to become a global leader in energy

transition materials, and we have a clear plan for a decade of

profitable growth.

“We remain focused on our four objectives which ensure our

progress is aligned with societies’ interests. We are moving the

dial on impeccable ESG, our ability to excel in development and we

continue to deepen our social licence, while we intensify our

efforts to become Best Operator to ensure we can deliver growth

safely, efficiently and profitably for our stakeholders.

“As we ramp up the Oyu Tolgoi underground copper mine, deliver

the Simandou high-grade iron ore project in Guinea, and build out

our lithium business through the proposed acquisition of Arcadium1,

we are underwriting a decade of profitable growth. We plan to

utilise our strong balance sheet to unlock and accelerate

Arcadium’s tier one projects, timed to meet future demand

growth.

“We have reached a new era in our decarbonisation journey. This

year we have committed to carbon abatement projects representing

more than 3 million tonnes of annual emissions, accelerating our

progress toward our targets while also investing for the necessary

net zero breakthroughs.

“We are executing our strategy of delivering a stronger, more

diversified, and growing business, underpinned by our belief in the

demand for materials which are essential for the global energy

transition. With improved performance we can afford both growth and

our decarbonisation, and continue our dividend policy and practice

while preserving a strong balance sheet.”

Executives will detail progress made in 2024 and outline their

ambition for a period of sustained growth over three time horizons

until 2033, with an expected Compound Annual Growth Rate of

~3%.

Progress in shaping Rio Tinto’s portfolio for the future

includes:

- Iron Ore: Driving a system wide improvement at our

cornerstone Pilbara business to achieve Best Operator. Our Safe

Production System has been rolled out across all iron ore operating

assets and is on track to deliver a further 5 million tonne

year-on-year uplift in 2024 and 2025, a cumulative 15 million tonne

uplift over three years.

- Aluminium: We have stabilised our assets and have a

clear pathway to deliver greater returns through growth and

decarbonisation.

- Copper: Targeting annual production of 1 million tonnes

of copper by the end of this decade underpinned by an increase in

output from Oyu Tolgoi in Mongolia where production is expected to

increase more than 50% next year.

- Minerals:

- Potential to accelerate investment in near-term production

assets of Arcadium in Argentina and Canada following completion of

the transaction.

- Advancing the Rincon 3000 starter project in Argentina which

delivered first lithium2 last week ahead of a final investment

decision for the full 60,000 tonne per annum3 Rincon project

expected by year-end.

- Simandou: Significant progress in construction of mine,

port and rail infrastructure at Simandou in Guinea, which remains

on-track for first ore next year and to reach full capacity by

2028.

- Decarbonisation: Substantial progress has been made

toward meeting our targets4. Guidance of capital spending on

decarbonisation projects to 2030 is maintained at $5 to $6 billion

(lower end).

Production guidance across Rio Tinto’s portfolio is being

released for 2025.

Production guidance - Rio Tinto share

unless otherwise stated

2024

2025

Pilbara iron ore5 (shipments, 100%

basis) (Mt)

323 – 338

323 – 338

Copper

Mined copper6 (consolidated basis)

(kt)

660 - 720

780 - 8507

Aluminium

Bauxite (Mt)

53 – 56

57 – 59

Alumina (Mt)

7.0 – 7.3

7.4 – 7.8

Aluminium (Mt)

3.2 – 3.4

3.25 – 3.45

Minerals

Titanium dioxide slag (Mt)

0.9 – 1.1

1.0 – 1.2

IOC pellets and concentrate8 (Mt)

9.8 – 11.5

9.7 – 11.4

Boric acid equivalent (Mt)

~0.5

~0.5

Capex guidance

2024

2025

Mid-term (per year)

Total Group

~$9.5bn

~$11.0bn

~$10-11.0bn

The presentation slides and the live webcast, which begins at

0800 GMT | 1900 AEDT, can be accessed at

https://www.riotinto.com/en/invest/investor-seminars.

- Rio Tinto’s acquisition of Arcadium Lithium plc is conditional

upon approval by Arcadium Lithium shareholders and the Royal Court

of Jersey and customary regulatory approvals and other closing

conditions. Closing is expected in mid-2025.

- First battery grade lithium production expected in 2025.

- Subject to the receipt of permits. Capacity of 60ktpa is

comprised of 3ktpa starter plant, 50ktpa full scale plant and 7ktpa

additional optimisation.

- Reduction of Scope 1 and 2 emissions of 50% by 2030 and net

zero emissions by 2050.

- Pilbara shipments guidance remains subject to weather, market

conditions and management of cultural heritage.

- Includes Oyu Tolgoi on a 100% consolidated basis and continues

to reflect our 30% share of Escondida.

- For 2025, we are updating our methodology to report copper

production as a single metric.

- Iron Ore Company of Canada.

This announcement is authorised for release to the market by

Andy Hodges, Rio Tinto’s Group Company Secretary.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203384924/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, United Kingdom David

Outhwaite M +44 7787 597 493

Media Relations, Australia Matt Chambers

M +61 433 525 739 Michelle Lee M +61 458 609

322 Rachel Pupazzoni M +61 438 875 469

Media Relations, Canada Simon Letendre

M +1 514 796 4973 Malika Cherry M +1 418 592

7293 Vanessa Damha M +1 514 715 2152

Media Relations, US Jesse Riseborough

M +1 202 394 9480

Investor Relations, United Kingdom David

Ovington M +44 7920 010 978 Laura Brooks M

+44 7826 942 797 Wei Wei Hu M +44 7825 907 230

Investor Relations, Australia Tom Gallop

M +61 439 353 948 Amar Jambaa M +61 472 865

948

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN

96 004 458 404

riotinto.com Category: General

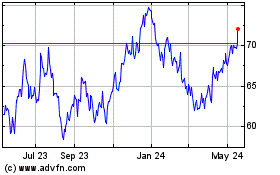

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

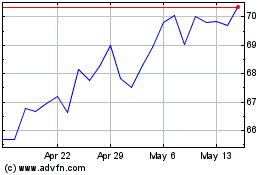

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024