Amended Statement of Beneficial Ownership (sc 13d/a)

April 04 2023 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO

FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No.26)*

Safehold Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

78645L 100

(CUSIP Number)

Geoffrey M. Dugan

iStar Inc.

1114 Avenue of the Americas

New York, New York 10036

(212) 930-9400

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

March 31, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7

for other parties to whom copies are to be sent.

* The

remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on

the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange

Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

CUSIP NO. 78649D104

| 1 |

NAME OF REPORTING PERSON

Safehold Inc. (f/k/a iStar Inc.) |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Maryland |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON

0 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

0 |

| 14 |

TYPE OF REPORTING PERSON

CO |

| |

|

|

|

This Amendment No. 26 on Schedule

13D (the "Schedule 13D") relating to shares of common stock, $0.01 par value per share (the "Shares"), of Safehold

Inc., a Maryland corporation (the "Issuer"), is being filed by Safehold Inc. (f/k/a iStar Inc.), a Maryland corporation (the

"Reporting Person"), and supplements and amends the statement on Schedule 13D originally filed with the Commission on June 27,

2017 (as amended, the "Statement").

| Item 4. |

Purpose of Transaction |

On March 31, 2023, the Reporting

Person and the Issuer completed the merger of the Issuer with and into the Reporting Person (the "Merger") pursuant to the Agreement

and Plan of Merger, dated as of August 10, 2022, between the Reporting Person and the Issuer (the "Merger Agreement"). In the

Merger, each Share owned by the Reporting Person at the effective time of the Merger (the "Effective Time") was cancelled. Prior

to the Effective Time and in connection with the Merger, the Reporting Person (i) contributed 13,522,651 Shares to Star Holdings, a former

subsidiary of the Reporting Person that was spun off to the Reporting Person's stockholders on March 31, 2023; (ii) sold 5,405,406

Shares to a third party purchaser at a price of $37.00 per Share in a previously announced private sale transaction; (iii) terminated

all of its performance incentive plans known as "iPIP" and paid amounts due to iPIP participants, including 2,357,118 net Shares;

and (iv) granted retention awards of 129,193 net Shares to certain of the Reporting Person's employees.

In connection with the Merger,

the Amended and Restated Management Agreement, dated as of January 2, 2019, among the Reporting Person, the Issuer and certain other parties,

as amended, the Stockholder Agreement between the Reporting Person and the Issuer, dated as of January 2, 2019, as amended, the Exclusivity

and Expense Reimbursement Agreement between the Reporting Person and the Issuer, dated as of January 2, 2019, as amended, and the Amended

and Restated Registration Rights Agreement between the Reporting Person and the Issuer, dated January 2, 2019, as amended, were terminated.

The foregoing descriptions

of the Merger and the Merger Agreement do not purport to be complete and are qualified entirely by reference to the Merger Agreement,

a copy of which is included as an exhibit hereto and is incorporated by reference into this Statement.

| Item 5. |

Interest in Securities of the Issuer |

| (a) | After giving effect to the Merger, the Reporting Person beneficially owns no securities of the Issuer. |

| (b) | During the past 60 days, the Reporting Person disposed of all of the Shares in the Merger and the other

transactions described in Item 4. |

| (c) | the Reporting Person ceased to be the beneficial owner of all Shares as of March 31, 2023. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

The information in Item 4

is incorporated by reference.

| Item 7. |

Materials to be Filed as Exhibits |

1. Agreement

and Plan of Merger, dated as of August 10, 2023 (incorporated by reference to Exhibit 2.1 to Safehold Inc.'s (f/k/a iStar) Current Report

on Form 8-K filed on August 11, 2022).

SIGNATURE

After reasonable inquiry and

to the best of his or her knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: April 4, 2023

| |

iSTAR INC. |

| |

|

| |

/s/ Geoffrey M. Dugan |

| |

Geoffrey M. Dugan

General Counsel, Corporate and Secretary |

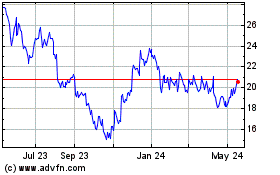

Safehold (NYSE:SAFE)

Historical Stock Chart

From Dec 2024 to Jan 2025

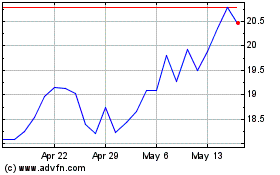

Safehold (NYSE:SAFE)

Historical Stock Chart

From Jan 2024 to Jan 2025