false000169033400016903342025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

|

SEACOR Marine Holdings Inc. |

(Exact Name of Registrant as Specified in Its Charter) |

|

|

|

Delaware |

001-37966 |

47-2564547 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

12121 Wickchester Lane, Suite 500, Houston, TX |

77079 |

(Address of Principal Executive Offices) |

(Zip Code) |

|

|

|

|

Registrant's telephone number, including area code |

(346) 980-1700 |

|

|

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

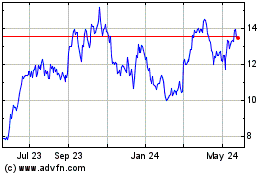

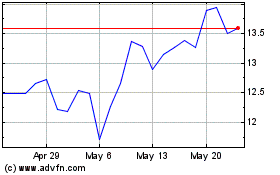

Common stock, par value $0.01 per share |

SMHI |

New York Stock Exchange (“NYSE”) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

The information set forth in (and incorporated by reference into) this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section. The information in this Item 2.02 shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On February 26, 2025, SEACOR Marine Holdings Inc. issued a press release setting forth its earnings for the three and twelve months ended December 31, 2024 (the “Earnings Release”).

A copy of the Earnings Release is attached hereto as Exhibit 99.1 and hereby incorporated by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

SEACOR Marine Holdings Inc. |

|

|

|

February 26, 2025 |

By: |

/s/ John Gellert |

|

|

|

|

|

Name: John Gellert |

|

|

Title: President and Chief Executive Officer |

Exhibit 99.1

|

|

|

PRESS RELEASE |

SEACOR MARINE ANNOUNCES FOURTH QUARTER 2024 RESULTS

Houston, Texas

February 26, 2025

FOR IMMEDIATE RELEASE - SEACOR Marine Holdings Inc. (NYSE: SMHI) (the “Company” or “SEACOR Marine”), a leading provider of marine and support transportation services to offshore energy facilities worldwide, today announced results for its fourth quarter ended December 31, 2024.

SEACOR Marine’s consolidated operating revenues for the fourth quarter of 2024 were $69.8 million, operating income was $10.6 million, and direct vessel profit (“DVP”)(1) was $23.1 million. This compares to consolidated operating revenues of $73.1 million, operating income of $22.6 million, and DVP of $29.8 million in the fourth quarter of 2023, and consolidated operating revenues of $68.9 million, operating loss of $6.5 million, and DVP of $16.0 million in the third quarter of 2024.

Notable fourth quarter items include:

•4.5% decrease in revenues from the fourth quarter of 2023 and a 1.3% increase from the third quarter of 2024.

•Average day rates of $18,901, a 4.8% increase from the fourth quarter of 2023, and flat from the third quarter of 2024.

•72% utilization, an increase from 71% in the fourth quarter of 2023 and from 67% in the third quarter of 2024.

•DVP margin of 33.1%, a decrease from 40.8% in the fourth quarter of 2023 and an increase from 23.2% in the third quarter of 2024, due in part to $3.5 million of drydocking and major repairs during the fourth quarter of 2024 compared to $1.7 million in the fourth quarter of 2023 and $8.3 million in the third quarter of 2024, all of which are expensed as incurred.

•Refinancing of $328.7 million of principal indebtedness under multiple debt facilities, including $125.0 million previously due in 2026, into a single new credit facility due in the fourth quarter of 2029.

•In connection with the refinancing, recognized a one-time loss of $31.9 million on debt extinguishment, of which $28.3 million was non-cash and primarily comprised of extinguishment of unamortized debt discounts.

•Completed the sale of two anchor handling towing supply vessels (“AHTS”) for total proceeds of $22.5 million and a gain of $15.6 million, the proceeds of which will be used to partially fund the construction payments for two new PSVs.

For the fourth quarter of 2024, net loss was $26.2 million ($0.94 loss per basic and diluted share). This compares to a net income for the fourth quarter of 2023 of $5.7 million ($0.21 earnings per basic share and $0.20 earnings per diluted share). Sequentially, the fourth quarter 2024 results compare to a net loss of $16.3 million ($0.59 loss per basic and diluted share) in the third quarter of 2024.

Chief Executive Officer John Gellert commented:

“The fourth quarter results reflect a substantial improvement in operating performance compared with the prior quarters of 2024. This performance improvement was due mostly to fewer out-of-service days for repairs and drydockings which translated into improved utilization across most segments. We also benefited from having all our premium liftboats available and employed most of the quarter and currently plan to commence the permanent repairs of one of our U.S. flag premium liftboats at the end of the third quarter of 2025, which should provide us the opportunity to maximize utilization on these liftboats as seasonal activity improves in the Gulf of America. During the quarter, we did see soft market conditions in the North Sea as well as customer delays in programmed activities in Mexico and the U.S.

Looking at the rest of 2025, we continue to see a healthy level of inquiries across most of our international markets with the notable exception of the North Sea and Mexico, where regulatory or financial hurdles are subduing demand for oil and gas services. In the U.S., we see significant challenges for offshore wind in the near term, but the backlog of mandatory maintenance and decommissioning activity in the Gulf of America should ultimately lead to increased levels of activity on the shelf. Although we are not immune to the mid-cycle lull in offshore drilling activity worldwide, I remain optimistic that our fleet mix is well positioned to meet current demand expectations.

As previously announced, during the fourth quarter we entered into a new senior secured term loan of up to $391.0 million with an affiliate of EnTrust Global, which significantly simplified our debt capital structure into a single credit facility maturing in 2029. Importantly, this new credit facility addressed $125.0 million of near-term maturities previously due in 2026 to The Carlyle Group, inclusive of $35.0 million of convertible debt, eliminating approximately 10% of dilution overhang on the Company’s common stock. It also provided us with up to $41.0 million of borrowing capacity to finance the construction of two new PSVs, which we ordered during the fourth quarter of 2024. We had to fully amortize all debt discounts and issuance costs on the refinanced debt, including the shipyard financing with affiliates of COSCO, generating a $31.9 million one-time loss, of which $28.3 million was non-cash, but, in my view, the benefits of the refinancing and its support for the Company’s order for two new PSVs far outweigh the one-time loss.

I am particularly excited about this PSV order as we expand and complement our fleet of modern and fuel efficient PSVs. This is a continuation of our asset rotation strategy aimed at renewing our fleet with high-specification, environmentally efficient assets. The vessels are scheduled to deliver in the fourth quarter of 2026 and first quarter of 2027, respectively. We will partly fund this new construction program with the $22.5 million of proceeds from the sale of our last remaining AHTS vessels, marking our exit from the AHTS asset class effective January 2025.”

___________________

|

|

(1) |

Direct vessel profit (defined as operating revenues less operating costs and expenses, “DVP”) is the Company’s measure of segment profitability. DVP is a critical financial measure used by the Company to analyze and compare the operating performance of its regions, without regard to financing decisions (depreciation and interest expense for owned vessels vs. lease expense for lease vessels). DVP is also useful when comparing the Company’s global fleet performance against those of our competitors who may have differing fleet financing structures. DVP has material limitations as an analytical tool in that it does not reflect all of the costs associated with the ownership and operation of our fleet, and it should not be considered in isolation or used as a substitute for our results as reported under GAAP. See page 4 for reconciliation of DVP to GAAP Operating Income (Loss), its most comparable GAAP measure. |

* * * * *

SEACOR Marine provides global marine and support transportation services to offshore energy facilities worldwide. SEACOR Marine operates and manages a diverse fleet of offshore support vessels that deliver cargo and personnel to offshore installations, including offshore wind farms; assist offshore operations for production and storage facilities; provide construction, well work-over, offshore wind farm installation and decommissioning support; and carry and launch equipment used underwater in drilling and well installation, maintenance, inspection and repair. Additionally, SEACOR Marine’s vessels provide emergency response services and accommodations for technicians and specialists.

Certain statements discussed in this release as well as in other reports, materials and oral statements that the Company releases from time to time to the public constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “believe,” “plan,” “target,” “forecast” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements concern management’s expectations, strategic objectives, business prospects, anticipated economic performance and financial condition and other similar matters. Forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties that could cause actual results to differ materially from those anticipated or expected by the management of the Company. These statements are not guarantees of future performance and actual events or results may differ significantly from these statements. Actual events or results are subject to significant known and unknown risks, uncertainties and other important factors, many of which are beyond the Company’s control and are described in the Company’s filings with the SEC. It should be understood that it is not possible to predict or identify all such factors. Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based, except as required by law. It is advisable, however, to consult any further disclosures the Company makes on related subjects in its filings with the Securities and Exchange Commission, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (if any). These statements constitute the Company’s cautionary statements under the Private Securities Litigation Reform Act of 1995.

Please visit SEACOR Marine’s website at www.seacormarine.com for additional information.

For all other requests, contact InvestorRelations@seacormarine.com

SEACOR MARINE HOLDINGS INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating Revenues |

|

$ |

69,808 |

|

|

$ |

73,083 |

|

|

$ |

271,361 |

|

|

$ |

279,511 |

|

Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating |

|

|

46,726 |

|

|

|

43,269 |

|

|

|

197,252 |

|

|

|

159,650 |

|

Administrative and general |

|

|

10,888 |

|

|

|

11,547 |

|

|

|

44,713 |

|

|

|

49,183 |

|

Lease expense |

|

|

347 |

|

|

|

679 |

|

|

|

1,678 |

|

|

|

2,748 |

|

Depreciation and amortization |

|

|

12,879 |

|

|

|

13,022 |

|

|

|

51,628 |

|

|

|

53,821 |

|

|

|

|

70,840 |

|

|

|

68,517 |

|

|

|

295,271 |

|

|

|

265,402 |

|

Gains on Asset Dispositions and Impairments, Net |

|

|

11,624 |

|

|

|

18,057 |

|

|

|

13,481 |

|

|

|

21,409 |

|

Operating Income (Loss) |

|

|

10,592 |

|

|

|

22,623 |

|

|

|

(10,429 |

) |

|

|

35,518 |

|

Other Income (Expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

372 |

|

|

|

222 |

|

|

|

1,768 |

|

|

|

1,444 |

|

Interest expense |

|

|

(10,001 |

) |

|

|

(10,444 |

) |

|

|

(40,627 |

) |

|

|

(37,504 |

) |

Loss on debt extinguishment |

|

|

(31,923 |

) |

|

|

— |

|

|

|

(31,923 |

) |

|

|

(2,004 |

) |

Derivative (losses) gains, net |

|

|

(536 |

) |

|

|

608 |

|

|

|

(908 |

) |

|

|

608 |

|

Foreign currency gains (losses), net |

|

|

1,308 |

|

|

|

(1,276 |

) |

|

|

(1,049 |

) |

|

|

(2,133 |

) |

Other, net |

|

|

187 |

|

|

|

— |

|

|

|

121 |

|

|

|

— |

|

|

|

|

(40,593 |

) |

|

|

(10,890 |

) |

|

|

(72,618 |

) |

|

|

(39,589 |

) |

(Loss) Income Before Income Tax (Benefit) Expense and Equity in Earnings of 50% or Less Owned Companies |

|

|

(30,001 |

) |

|

|

11,733 |

|

|

|

(83,047 |

) |

|

|

(4,071 |

) |

Income Tax (Benefit) Expense |

|

|

(2,345 |

) |

|

|

6,378 |

|

|

|

(2,615 |

) |

|

|

8,799 |

|

(Loss) Income Before Equity in Earnings of 50% or Less Owned Companies |

|

|

(27,656 |

) |

|

|

5,355 |

|

|

|

(80,432 |

) |

|

|

(12,870 |

) |

Equity in Earnings of 50% or Less Owned Companies |

|

|

1,430 |

|

|

|

374 |

|

|

|

2,308 |

|

|

|

3,556 |

|

Net (Loss) Income |

|

$ |

(26,226 |

) |

|

$ |

5,729 |

|

|

$ |

(78,124 |

) |

|

$ |

(9,314 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) Earnings Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.94 |

) |

|

$ |

0.21 |

|

|

$ |

(2.82 |

) |

|

$ |

(0.34 |

) |

Diluted |

|

$ |

(0.94 |

) |

|

$ |

0.20 |

|

|

$ |

(2.82 |

) |

|

$ |

(0.34 |

) |

Weighted Average Common Stock and Warrants Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

27,773,200 |

|

|

|

27,182,496 |

|

|

|

27,655,289 |

|

|

|

27,082,391 |

|

Diluted |

|

|

27,773,200 |

|

|

|

28,400,684 |

|

|

|

27,655,289 |

|

|

|

27,082,391 |

|

SEACOR MARINE HOLDINGS INC.

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(in thousands, except statistics and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Dec. 31, 2024 |

|

|

Sep. 30, 2024 |

|

|

Jun. 30, 2024 |

|

|

Mar. 31, 2024 |

|

|

Dec. 31, 2023 |

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Rates Per Day |

|

$ |

18,901 |

|

|

$ |

18,879 |

|

|

$ |

19,141 |

|

|

$ |

19,042 |

|

|

$ |

18,031 |

|

|

Fleet Utilization |

|

|

72 |

% |

|

|

67 |

% |

|

|

69 |

% |

|

|

62 |

% |

|

|

71 |

% |

|

Fleet Available Days (2) |

|

|

4,870 |

|

|

|

5,026 |

|

|

|

4,994 |

|

|

|

5,005 |

|

|

|

5,170 |

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

66,095 |

|

|

$ |

63,313 |

|

|

$ |

65,649 |

|

|

$ |

59,263 |

|

|

$ |

66,498 |

|

|

Bareboat charter |

|

|

364 |

|

|

|

372 |

|

|

|

364 |

|

|

|

364 |

|

|

|

368 |

|

|

Other marine services |

|

|

3,349 |

|

|

|

5,231 |

|

|

|

3,854 |

|

|

|

3,143 |

|

|

|

6,217 |

|

|

|

|

|

69,808 |

|

|

|

68,916 |

|

|

|

69,867 |

|

|

|

62,770 |

|

|

|

73,083 |

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

|

20,365 |

|

|

|

21,940 |

|

|

|

21,566 |

|

|

|

21,670 |

|

|

|

22,080 |

|

|

Repairs and maintenance |

|

|

10,433 |

|

|

|

9,945 |

|

|

|

10,244 |

|

|

|

9,763 |

|

|

|

7,604 |

|

|

Drydocking |

|

|

2,467 |

|

|

|

6,068 |

|

|

|

6,210 |

|

|

|

6,706 |

|

|

|

2,561 |

|

|

Insurance and loss reserves |

|

|

2,473 |

|

|

|

2,584 |

|

|

|

3,099 |

|

|

|

1,738 |

|

|

|

2,944 |

|

|

Fuel, lubes and supplies |

|

|

4,884 |

|

|

|

6,574 |

|

|

|

3,966 |

|

|

|

4,523 |

|

|

|

3,683 |

|

|

Other |

|

|

6,104 |

|

|

|

5,796 |

|

|

|

4,435 |

|

|

|

3,699 |

|

|

|

4,397 |

|

|

|

|

|

46,726 |

|

|

|

52,907 |

|

|

|

49,520 |

|

|

|

48,099 |

|

|

|

43,269 |

|

|

Direct Vessel Profit (1) |

|

|

23,082 |

|

|

|

16,009 |

|

|

|

20,347 |

|

|

|

14,671 |

|

|

|

29,814 |

|

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease expense |

|

|

347 |

|

|

|

364 |

|

|

|

486 |

|

|

|

481 |

|

|

|

679 |

|

|

Administrative and general |

|

|

10,888 |

|

|

|

11,019 |

|

|

|

10,889 |

|

|

|

11,917 |

|

|

|

11,547 |

|

|

Depreciation and amortization |

|

|

12,879 |

|

|

|

12,928 |

|

|

|

12,939 |

|

|

|

12,882 |

|

|

|

13,022 |

|

|

|

|

|

24,114 |

|

|

|

24,311 |

|

|

|

24,314 |

|

|

|

25,280 |

|

|

|

25,248 |

|

|

Gains (Losses) on Asset Dispositions and Impairments, Net |

|

|

11,624 |

|

|

|

1,821 |

|

|

|

37 |

|

|

|

(1 |

) |

|

|

18,057 |

|

|

Operating Income (Loss) |

|

|

10,592 |

|

|

|

(6,481 |

) |

|

|

(3,930 |

) |

|

|

(10,610 |

) |

|

|

22,623 |

|

|

Other Income (Expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

372 |

|

|

|

358 |

|

|

|

445 |

|

|

|

593 |

|

|

|

222 |

|

|

Interest expense |

|

|

(10,001 |

) |

|

|

(10,127 |

) |

|

|

(10,190 |

) |

|

|

(10,309 |

) |

|

|

(10,444 |

) |

|

Derivative (losses) gains, net |

|

|

(536 |

) |

|

|

67 |

|

|

|

104 |

|

|

|

(543 |

) |

|

|

608 |

|

|

Loss on debt extinguishment |

|

|

(31,923 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Foreign currency gains (losses), net |

|

|

1,308 |

|

|

|

(1,717 |

) |

|

|

(560 |

) |

|

|

(80 |

) |

|

|

(1,276 |

) |

|

Other, net |

|

|

187 |

|

|

|

29 |

|

|

|

— |

|

|

|

(95 |

) |

|

|

— |

|

|

|

|

|

(40,593 |

) |

|

|

(11,390 |

) |

|

|

(10,201 |

) |

|

|

(10,434 |

) |

|

|

(10,890 |

) |

|

(Loss) Income Before Income Tax (Benefit) Expense and Equity in Earnings (Losses) of 50% or Less Owned Companies |

|

|

(30,001 |

) |

|

|

(17,871 |

) |

|

|

(14,131 |

) |

|

|

(21,044 |

) |

|

|

11,733 |

|

|

Income Tax (Benefit) Expense |

|

|

(2,345 |

) |

|

|

(513 |

) |

|

|

(682 |

) |

|

|

925 |

|

|

|

6,378 |

|

|

(Loss) Income Before Equity in Earnings (Losses) of 50% or Less Owned Companies |

|

|

(27,656 |

) |

|

|

(17,358 |

) |

|

|

(13,449 |

) |

|

|

(21,969 |

) |

|

|

5,355 |

|

|

Equity in Earnings (Losses) of 50% or Less Owned Companies |

|

|

1,430 |

|

|

|

1,012 |

|

|

|

966 |

|

|

|

(1,100 |

) |

|

|

374 |

|

|

Net (Loss) Income |

|

$ |

(26,226 |

) |

|

$ |

(16,346 |

) |

|

$ |

(12,483 |

) |

|

$ |

(23,069 |

) |

|

$ |

5,729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) Earnings Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.94 |

) |

|

$ |

(0.59 |

) |

|

$ |

(0.45 |

) |

|

$ |

(0.84 |

) |

|

$ |

0.21 |

|

|

Diluted |

|

$ |

(0.94 |

) |

|

$ |

(0.59 |

) |

|

$ |

(0.45 |

) |

|

$ |

(0.84 |

) |

|

$ |

0.20 |

|

|

Weighted Average Common Stock and Warrants Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

27,773 |

|

|

|

27,773 |

|

|

|

27,729 |

|

|

|

27,344 |

|

|

|

27,182 |

|

|

Diluted |

|

|

27,773 |

|

|

|

27,773 |

|

|

|

27,729 |

|

|

|

27,344 |

|

|

|

28,401 |

|

|

Common Shares and Warrants Outstanding at Period End |

|

|

28,950 |

|

|

|

28,950 |

|

|

|

28,941 |

|

|

|

28,906 |

|

|

|

28,489 |

|

|

(1)See full description of footnote above.

(2)Includes available days for a bareboat charter for one PSV, which has been excluded from days worked and average day rates.

SEACOR MARINE HOLDINGS INC.

UNAUDITED DIRECT VESSEL PROFIT (“DVP”) BY SEGMENT

(in thousands, except statistics)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Dec. 31, 2024 |

|

|

Sep. 30, 2024 |

|

|

Jun. 30, 2024 |

|

|

Mar. 31, 2024 |

|

|

Dec. 31, 2023 |

|

|

United States, primarily Gulf of America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average rates per day worked |

|

$ |

26,116 |

|

|

$ |

17,188 |

|

|

$ |

22,356 |

|

|

$ |

28,156 |

|

|

$ |

22,584 |

|

|

Fleet utilization |

|

|

45 |

% |

|

|

42 |

% |

|

|

37 |

% |

|

|

27 |

% |

|

|

50 |

% |

|

Fleet available days |

|

|

920 |

|

|

|

920 |

|

|

|

921 |

|

|

|

927 |

|

|

|

1,152 |

|

|

Out-of-service days for repairs, maintenance and drydockings |

|

|

75 |

|

|

|

116 |

|

|

|

179 |

|

|

|

137 |

|

|

|

61 |

|

|

Out-of-service days for cold-stacked status (2) |

|

|

184 |

|

|

|

175 |

|

|

|

127 |

|

|

|

182 |

|

|

|

254 |

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

10,744 |

|

|

$ |

6,593 |

|

|

$ |

7,697 |

|

|

$ |

6,957 |

|

|

$ |

12,929 |

|

|

Other marine services |

|

|

1,114 |

|

|

|

1,188 |

|

|

|

480 |

|

|

|

1,026 |

|

|

|

5,346 |

|

|

|

|

|

11,858 |

|

|

|

7,781 |

|

|

|

8,177 |

|

|

|

7,983 |

|

|

|

18,275 |

|

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

|

6,097 |

|

|

|

6,297 |

|

|

|

6,284 |

|

|

|

5,781 |

|

|

|

6,906 |

|

|

Repairs and maintenance |

|

|

1,680 |

|

|

|

1,655 |

|

|

|

1,879 |

|

|

|

1,404 |

|

|

|

819 |

|

|

Drydocking |

|

|

1,451 |

|

|

|

2,615 |

|

|

|

2,570 |

|

|

|

1,968 |

|

|

|

303 |

|

|

Insurance and loss reserves |

|

|

854 |

|

|

|

799 |

|

|

|

943 |

|

|

|

396 |

|

|

|

1,297 |

|

|

Fuel, lubes and supplies |

|

|

854 |

|

|

|

964 |

|

|

|

866 |

|

|

|

667 |

|

|

|

1,032 |

|

|

Other |

|

|

229 |

|

|

|

225 |

|

|

|

226 |

|

|

|

(171 |

) |

|

|

475 |

|

|

|

|

|

11,165 |

|

|

|

12,555 |

|

|

|

12,768 |

|

|

|

10,045 |

|

|

|

10,832 |

|

|

Direct Vessel Profit (Loss) (1) |

|

$ |

693 |

|

|

$ |

(4,774 |

) |

|

$ |

(4,591 |

) |

|

$ |

(2,062 |

) |

|

$ |

7,443 |

|

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease expense |

|

$ |

136 |

|

|

$ |

140 |

|

|

$ |

141 |

|

|

$ |

138 |

|

|

$ |

141 |

|

|

Depreciation and amortization |

|

|

3,196 |

|

|

|

3,194 |

|

|

|

3,194 |

|

|

|

2,750 |

|

|

|

3,479 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Africa and Europe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average rates per day worked |

|

$ |

16,895 |

|

|

$ |

18,875 |

|

|

$ |

18,580 |

|

|

$ |

15,197 |

|

|

$ |

15,233 |

|

|

Fleet utilization |

|

|

73 |

% |

|

|

77 |

% |

|

|

74 |

% |

|

|

76 |

% |

|

|

82 |

% |

|

Fleet available days |

|

|

1,856 |

|

|

|

1,990 |

|

|

|

1,969 |

|

|

|

1,775 |

|

|

|

1,748 |

|

|

Out-of-service days for repairs, maintenance and drydockings |

|

|

180 |

|

|

|

203 |

|

|

|

203 |

|

|

|

238 |

|

|

|

124 |

|

|

Out-of-service days for cold-stacked status |

|

|

— |

|

|

|

58 |

|

|

|

91 |

|

|

|

91 |

|

|

|

92 |

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

22,999 |

|

|

$ |

28,809 |

|

|

$ |

27,047 |

|

|

$ |

20,555 |

|

|

$ |

21,791 |

|

|

Other marine services |

|

|

1,027 |

|

|

|

3,048 |

|

|

|

1,028 |

|

|

|

169 |

|

|

|

189 |

|

|

|

|

|

24,026 |

|

|

|

31,857 |

|

|

|

28,075 |

|

|

|

20,724 |

|

|

|

21,980 |

|

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

|

5,654 |

|

|

|

6,083 |

|

|

|

4,969 |

|

|

|

5,181 |

|

|

|

6,007 |

|

|

Repairs and maintenance |

|

|

3,712 |

|

|

|

3,455 |

|

|

|

3,161 |

|

|

|

3,209 |

|

|

|

2,807 |

|

|

Drydocking |

|

|

835 |

|

|

|

681 |

|

|

|

1,226 |

|

|

|

2,032 |

|

|

|

1,298 |

|

|

Insurance and loss reserves |

|

|

577 |

|

|

|

599 |

|

|

|

819 |

|

|

|

334 |

|

|

|

416 |

|

|

Fuel, lubes and supplies |

|

|

2,226 |

|

|

|

2,514 |

|

|

|

1,170 |

|

|

|

1,287 |

|

|

|

623 |

|

|

Other |

|

|

3,748 |

|

|

|

3,975 |

|

|

|

2,801 |

|

|

|

2,199 |

|

|

|

2,267 |

|

|

|

|

|

16,752 |

|

|

|

17,307 |

|

|

|

14,146 |

|

|

|

14,242 |

|

|

|

13,418 |

|

|

Direct Vessel Profit (1) |

|

$ |

7,274 |

|

|

$ |

14,550 |

|

|

$ |

13,929 |

|

|

$ |

6,482 |

|

|

$ |

8,562 |

|

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease expense |

|

$ |

82 |

|

|

$ |

75 |

|

|

$ |

172 |

|

|

$ |

178 |

|

|

$ |

289 |

|

|

Depreciation and amortization |

|

|

4,477 |

|

|

|

4,540 |

|

|

|

4,565 |

|

|

|

3,915 |

|

|

|

3,747 |

|

|

(1)See full description of footnote above.

(2)Includes one liftboat and one FSV cold-stacked in this region as of December 31, 2024.

SEACOR MARINE HOLDINGS INC.

UNAUDITED DIRECT VESSEL PROFIT (“DVP”) BY SEGMENT (continued)

(in thousands, except statistics)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Dec. 31, 2024 |

|

|

Sep. 30, 2024 |

|

|

Jun. 30, 2024 |

|

|

Mar. 31, 2024 |

|

|

Dec. 31, 2023 |

|

Middle East and Asia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average rates per day worked |

|

$ |

17,337 |

|

|

$ |

17,825 |

|

|

$ |

17,083 |

|

|

$ |

16,934 |

|

|

$ |

17,590 |

|

Fleet utilization |

|

|

88 |

% |

|

|

71 |

% |

|

|

82 |

% |

|

|

71 |

% |

|

|

69 |

% |

Fleet available days |

|

|

1,266 |

|

|

|

1,288 |

|

|

|

1,296 |

|

|

|

1,365 |

|

|

|

1,461 |

|

Out-of-service days for repairs, maintenance and drydockings |

|

|

30 |

|

|

|

229 |

|

|

|

168 |

|

|

|

224 |

|

|

|

360 |

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

19,385 |

|

|

$ |

16,411 |

|

|

$ |

18,073 |

|

|

$ |

16,477 |

|

|

$ |

17,729 |

|

Other marine services |

|

|

635 |

|

|

|

375 |

|

|

|

619 |

|

|

|

350 |

|

|

|

539 |

|

|

|

|

20,020 |

|

|

|

16,786 |

|

|

|

18,692 |

|

|

|

16,827 |

|

|

|

18,268 |

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

|

5,470 |

|

|

|

5,769 |

|

|

|

6,930 |

|

|

|

5,963 |

|

|

|

5,522 |

|

Repairs and maintenance |

|

|

3,574 |

|

|

|

3,318 |

|

|

|

3,443 |

|

|

|

2,712 |

|

|

|

2,590 |

|

Drydocking |

|

|

(226 |

) |

|

|

832 |

|

|

|

707 |

|

|

|

1,483 |

|

|

|

624 |

|

Insurance and loss reserves |

|

|

804 |

|

|

|

927 |

|

|

|

798 |

|

|

|

618 |

|

|

|

1,022 |

|

Fuel, lubes and supplies |

|

|

840 |

|

|

|

1,043 |

|

|

|

1,103 |

|

|

|

1,198 |

|

|

|

1,242 |

|

Other |

|

|

1,305 |

|

|

|

1,131 |

|

|

|

989 |

|

|

|

1,000 |

|

|

|

1,133 |

|

|

|

|

11,767 |

|

|

|

13,020 |

|

|

|

13,970 |

|

|

|

12,974 |

|

|

|

12,133 |

|

Direct Vessel Profit (1) |

|

$ |

8,253 |

|

|

$ |

3,766 |

|

|

$ |

4,722 |

|

|

$ |

3,853 |

|

|

$ |

6,135 |

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease expense |

|

$ |

72 |

|

|

$ |

73 |

|

|

$ |

71 |

|

|

$ |

85 |

|

|

$ |

158 |

|

Depreciation and amortization |

|

|

3,272 |

|

|

|

3,261 |

|

|

|

3,247 |

|

|

|

3,496 |

|

|

|

3,643 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latin America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average rates per day worked |

|

$ |

21,390 |

|

|

$ |

21,984 |

|

|

$ |

22,437 |

|

|

$ |

28,308 |

|

|

$ |

20,745 |

|

Fleet utilization |

|

|

73 |

% |

|

|

63 |

% |

|

|

71 |

% |

|

|

58 |

% |

|

|

84 |

% |

Fleet available days (2) |

|

|

828 |

|

|

|

828 |

|

|

|

808 |

|

|

|

938 |

|

|

|

809 |

|

Out-of-service days for repairs, maintenance and drydockings |

|

|

20 |

|

|

|

94 |

|

|

|

41 |

|

|

|

1 |

|

|

|

— |

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

12,967 |

|

|

$ |

11,500 |

|

|

$ |

12,832 |

|

|

$ |

15,274 |

|

|

$ |

14,049 |

|

Bareboat charter |

|

|

364 |

|

|

|

372 |

|

|

|

364 |

|

|

|

364 |

|

|

|

368 |

|

Other marine services |

|

|

573 |

|

|

|

620 |

|

|

|

1,727 |

|

|

|

1,598 |

|

|

|

143 |

|

|

|

|

13,904 |

|

|

|

12,492 |

|

|

|

14,923 |

|

|

|

17,236 |

|

|

|

14,560 |

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

|

3,144 |

|

|

|

3,791 |

|

|

|

3,383 |

|

|

|

4,745 |

|

|

|

3,645 |

|

Repairs and maintenance |

|

|

1,467 |

|

|

|

1,517 |

|

|

|

1,761 |

|

|

|

2,438 |

|

|

|

1,388 |

|

Drydocking |

|

|

407 |

|

|

|

1,940 |

|

|

|

1,707 |

|

|

|

1,223 |

|

|

|

336 |

|

Insurance and loss reserves |

|

|

238 |

|

|

|

259 |

|

|

|

539 |

|

|

|

390 |

|

|

|

209 |

|

Fuel, lubes and supplies |

|

|

964 |

|

|

|

2,053 |

|

|

|

827 |

|

|

|

1,371 |

|

|

|

786 |

|

Other |

|

|

822 |

|

|

|

465 |

|

|

|

419 |

|

|

|

671 |

|

|

|

522 |

|

|

|

|

7,042 |

|

|

|

10,025 |

|

|

|

8,636 |

|

|

|

10,838 |

|

|

|

6,886 |

|

Direct Vessel Profit (1) |

|

$ |

6,862 |

|

|

$ |

2,467 |

|

|

$ |

6,287 |

|

|

$ |

6,398 |

|

|

$ |

7,674 |

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease expense |

|

$ |

57 |

|

|

$ |

76 |

|

|

$ |

102 |

|

|

$ |

80 |

|

|

$ |

91 |

|

Depreciation and amortization |

|

|

1,934 |

|

|

|

1,933 |

|

|

|

1,933 |

|

|

|

2,721 |

|

|

|

2,153 |

|

(1)See full description of footnote above.

(2)Includes available days for a bareboat charter for one PSV, which has been excluded from days worked and average day rates.

SEACOR MARINE HOLDINGS INC.

UNAUDITED PERFORMANCE BY VESSEL CLASS

(in thousands, except statistics)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Dec. 31, 2024 |

|

|

Sep. 30, 2024 |

|

|

Jun. 30, 2024 |

|

|

Mar. 31, 2024 |

|

|

Dec. 31, 2023 |

|

|

AHTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average rates per day worked |

|

$ |

10,410 |

|

|

$ |

10,316 |

|

|

$ |

8,125 |

|

|

$ |

8,538 |

|

|

$ |

8,937 |

|

|

Fleet utilization |

|

|

79 |

% |

|

|

46 |

% |

|

|

49 |

% |

|

|

75 |

% |

|

|

64 |

% |

|

Fleet available days |

|

|

178 |

|

|

|

334 |

|

|

|

364 |

|

|

|

364 |

|

|

|

368 |

|

|

Out-of-service days for repairs, maintenance and drydockings |

|

|

28 |

|

|

|

87 |

|

|

|

29 |

|

|

|

— |

|

|

|

41 |

|

|

Out-of-service days for cold-stacked status |

|

|

— |

|

|

|

58 |

|

|

|

91 |

|

|

|

91 |

|

|

|

92 |

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

1,465 |

|

|

$ |

1,576 |

|

|

$ |

1,459 |

|

|

$ |

2,331 |

|

|

$ |

2,102 |

|

|

Other marine services |

|

|

— |

|

|

|

13 |

|

|

|

219 |

|

|

|

— |

|

|

|

6 |

|

|

|

|

|

1,465 |

|

|

|

1,589 |

|

|

|

1,678 |

|

|

|

2,331 |

|

|

|

2,108 |

|

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

$ |

595 |

|

|

$ |

981 |

|

|

$ |

1,045 |

|

|

$ |

1,064 |

|

|

$ |

944 |

|

|

Repairs and maintenance |

|

|

128 |

|

|

|

239 |

|

|

|

465 |

|

|

|

220 |

|

|

|

612 |

|

|

Drydocking |

|

|

5 |

|

|

|

436 |

|

|

|

280 |

|

|

|

68 |

|

|

|

58 |

|

|

Insurance and loss reserves |

|

|

49 |

|

|

|

66 |

|

|

|

97 |

|

|

|

43 |

|

|

|

73 |

|

|

Fuel, lubes and supplies |

|

|

25 |

|

|

|

90 |

|

|

|

69 |

|

|

|

616 |

|

|

|

375 |

|

|

Other |

|

|

210 |

|

|

|

263 |

|

|

|

230 |

|

|

|

287 |

|

|

|

295 |

|

|

|

|

|

1,012 |

|

|

|

2,075 |

|

|

|

2,186 |

|

|

|

2,298 |

|

|

|

2,357 |

|

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease expense |

|

$ |

7 |

|

|

$ |

4 |

|

|

$ |

164 |

|

|

$ |

171 |

|

|

$ |

253 |

|

|

Depreciation and amortization |

|

|

122 |

|

|

|

175 |

|

|

|

175 |

|

|

|

175 |

|

|

|

175 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FSV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average rates per day worked |

|

$ |

13,643 |

|

|

$ |

13,102 |

|

|

$ |

12,978 |

|

|

$ |

11,834 |

|

|

$ |

11,841 |

|

|

Fleet utilization |

|

|

72 |

% |

|

|

81 |

% |

|

|

80 |

% |

|

|

72 |

% |

|

|

74 |

% |

|

Fleet available days |

|

|

2,024 |

|

|

|

2,024 |

|

|

|

2,002 |

|

|

|

2,002 |

|

|

|

2,105 |

|

|

Out-of-service days for repairs, maintenance and drydockings |

|

|

118 |

|

|

|

96 |

|

|

|

128 |

|

|

|

216 |

|

|

|

337 |

|

|

Out-of-service days for cold-stacked status |

|

|

92 |

|

|

|

83 |

|

|

|

36 |

|

|

|

91 |

|

|

|

92 |

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

19,992 |

|

|

$ |

21,606 |

|

|

$ |

20,698 |

|

|

$ |

17,081 |

|

|

$ |

18,502 |

|

|

Other marine services |

|

|

416 |

|

|

|

1,012 |

|

|

|

516 |

|

|

|

126 |

|

|

|

163 |

|

|

|

|

|

20,408 |

|

|

|

22,618 |

|

|

|

21,214 |

|

|

|

17,207 |

|

|

|

18,665 |

|

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

$ |

5,078 |

|

|

$ |

5,637 |

|

|

$ |

5,829 |

|

|

$ |

5,649 |

|

|

$ |

5,320 |

|

|

Repairs and maintenance |

|

|

4,480 |

|

|

|

4,378 |

|

|

|

4,572 |

|

|

|

3,093 |

|

|

|

2,691 |

|

|

Drydocking |

|

|

426 |

|

|

|

448 |

|

|

|

457 |

|

|

|

1,869 |

|

|

|

1,710 |

|

|

Insurance and loss reserves |

|

|

422 |

|

|

|

532 |

|

|

|

546 |

|

|

|

277 |

|

|

|

507 |

|

|

Fuel, lubes and supplies |

|

|

1,586 |

|

|

|

1,962 |

|

|

|

993 |

|

|

|

1,051 |

|

|

|

1,441 |

|

|

Other |

|

|

2,456 |

|

|

|

2,238 |

|

|

|

1,850 |

|

|

|

1,649 |

|

|

|

1,632 |

|

|

|

|

|

14,448 |

|

|

|

15,195 |

|

|

|

14,247 |

|

|

|

13,588 |

|

|

|

13,301 |

|

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

4,746 |

|

|

$ |

4,744 |

|

|

$ |

4,746 |

|

|

$ |

4,744 |

|

|

$ |

4,879 |

|

|

SEACOR MARINE HOLDINGS INC.

UNAUDITED PERFORMANCE BY VESSEL CLASS (continued)

(in thousands, except statistics)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Dec. 31, 2024 |

|

|

Sep. 30, 2024 |

|

|

Jun. 30, 2024 |

|

|

Mar. 31, 2024 |

|

|

Dec. 31, 2023 |

|

|

PSV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average rates per day worked |

|

$ |

17,912 |

|

|

$ |

21,819 |

|

|

$ |

20,952 |

|

|

$ |

19,133 |

|

|

$ |

19,778 |

|

|

Fleet utilization |

|

|

72 |

% |

|

|

58 |

% |

|

|

66 |

% |

|

|

53 |

% |

|

|

77 |

% |

|

Fleet available days (1) |

|

|

1,932 |

|

|

|

1,932 |

|

|

|

1,900 |

|

|

|

1,911 |

|

|

|

1,902 |

|

|

Out-of-service days for repairs, maintenance and drydockings |

|

|

117 |

|

|

|

349 |

|

|

|

291 |

|

|

|

307 |

|

|

|

109 |

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

24,865 |

|

|

$ |

24,488 |

|

|

$ |

26,390 |

|

|

$ |

19,390 |

|

|

$ |

29,140 |

|

|

Bareboat charter |

|

|

364 |

|

|

|

372 |

|

|

|

364 |

|

|

|

364 |

|

|

|

368 |

|

|

Other marine services |

|

|

1,561 |

|

|

|

2,855 |

|

|

|

2,266 |

|

|

|

416 |

|

|

|

595 |

|

|

|

|

|

26,790 |

|

|

|

27,715 |

|

|

|

29,020 |

|

|

|

20,170 |

|

|

|

30,103 |

|

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

$ |

8,999 |

|

|

$ |

9,360 |

|

|

$ |

8,979 |

|

|

$ |

8,850 |

|

|

$ |

9,017 |

|

|

Repairs and maintenance |

|

|

4,101 |

|

|

|

3,798 |

|

|

|

3,151 |

|

|

|

4,393 |

|

|

|

3,520 |

|

|

Drydocking |

|

|

1,046 |

|

|

|

2,629 |

|

|

|

2,616 |

|

|

|

3,386 |

|

|

|

472 |

|

|

Insurance and loss reserves |

|

|

618 |

|

|

|

636 |

|

|

|

1,037 |

|

|

|

395 |

|

|

|

690 |

|

|

Fuel, lubes and supplies |

|

|

2,379 |

|

|

|

3,594 |

|

|

|

1,575 |

|

|

|

1,889 |

|

|

|

1,027 |

|

|

Other |

|

|

2,566 |

|

|

|

2,821 |

|

|

|

1,850 |

|

|

|

1,395 |

|

|

|

1,922 |

|

|

|

|

|

19,709 |

|

|

|

22,838 |

|

|

|

19,208 |

|

|

|

20,308 |

|

|

|

16,648 |

|

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease expense |

|

$ |

— |

|

|

$ |

(3 |

) |

|

$ |

3 |

|

|

$ |

— |

|

|

$ |

— |

|

|

Depreciation and amortization |

|

|

4,122 |

|

|

|

4,117 |

|

|

|

4,128 |

|

|

|

4,073 |

|

|

|

4,073 |

|

|

(1)Includes available days for a bareboat charter for one PSV, which has been excluded from days worked and average day rates.

SEACOR MARINE HOLDINGS INC.

UNAUDITED PERFORMANCE BY VESSEL CLASS (continued)

(in thousands, except statistics)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Dec. 31, 2024 |

|

|

Sep. 30, 2024 |

|

|

Jun. 30, 2024 |

|

|

Mar. 31, 2024 |

|

|

Dec. 31, 2023 |

|

|

Liftboats |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Charter Statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average rates per day worked |

|

$ |

39,326 |

|

|

$ |

36,423 |

|

|

$ |

43,204 |

|

|

$ |

53,506 |

|

|

$ |

40,181 |

|

|

Fleet utilization |

|

|

68 |

% |

|

|

58 |

% |

|

|

54 |

% |

|

|

53 |

% |

|

|

52 |

% |

|

Fleet available days |

|

|

736 |

|

|

|

736 |

|

|

|

728 |

|

|

|

728 |

|

|

|

795 |

|

|

Out-of-service days for repairs, maintenance and drydockings |

|

|

41 |

|

|

|

109 |

|

|

|

143 |

|

|

|

78 |

|

|

|

60 |

|

|

Out-of-service days for cold-stacked status |

|

|

92 |

|

|

|

92 |

|

|

|

91 |

|

|

|

91 |

|

|

|

162 |

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time charter |

|

$ |

19,773 |

|

|

$ |

15,643 |

|

|

$ |

17,102 |

|

|

$ |

20,461 |

|

|

$ |

16,754 |

|

|

Other marine services |

|

|

1,177 |

|

|

|

1,142 |

|

|

|

666 |

|

|

|

1,772 |

|

|

|

4,666 |

|

|

|

|

|

20,950 |

|

|

|

16,785 |

|

|

|

17,768 |

|

|

|

22,233 |

|

|

|

21,420 |

|

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

$ |

5,678 |

|

|

$ |

5,926 |

|

|

$ |

6,842 |

|

|

$ |

6,140 |

|

|

$ |

5,316 |

|

|

Repairs and maintenance |

|

|

1,722 |

|

|

|

1,531 |

|

|

|

2,054 |

|

|

|

2,035 |

|

|

|

769 |

|

|

Drydocking |

|

|

990 |

|

|

|

2,555 |

|

|

|

2,857 |

|

|

|

1,383 |

|

|

|

321 |

|

|

Insurance and loss reserves |

|

|

1,384 |

|

|

|

1,334 |

|

|

|

1,482 |

|

|

|

1,282 |

|

|

|

1,554 |

|

|

Fuel, lubes and supplies |

|

|

894 |

|

|

|

928 |

|

|

|

1,329 |

|

|

|

967 |

|

|

|

838 |

|

|

Other |

|

|

860 |

|

|

|

473 |

|

|

|

519 |

|

|

|

343 |

|

|

|

531 |

|

|

|

|

|

11,528 |

|

|

|

12,747 |

|

|

|

15,083 |

|

|

|

12,150 |

|

|

|

9,329 |

|

|

Other Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

3,866 |

|

|

|

3,866 |

|

|

|

3,865 |

|

|

|

3,866 |

|

|

|

3,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Activity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other marine services |

|

$ |

195 |

|

|

$ |

209 |

|

|

$ |

187 |

|

|

$ |

829 |

|

|

$ |

787 |

|

|

|

|

|

195 |

|

|

|

209 |

|

|

|

187 |

|

|

|

829 |

|

|

|

787 |

|

|

Direct Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel |

|

$ |

15 |

|

|

$ |

36 |

|

|

$ |

(1,129 |

) |

|

$ |

(33 |

) |

|

$ |

1,483 |

|

|

Repairs and maintenance |

|

|

2 |

|

|

|

(1 |

) |

|

|

2 |

|

|

|

22 |

|

|

|

12 |

|

|

Insurance and loss reserves |

|

|

— |

|

|

|

16 |

|

|

|

(63 |

) |

|

|

(259 |

) |

|

|

120 |

|

|

Fuel, lubes and supplies |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

Other |

|

|

12 |

|

|

|

1 |

|

|

|

(14 |

) |

|

|

25 |

|

|

|

17 |

|

|

|

|

|

29 |

|

|

|

52 |

|

|

|