0001690334false00016903342025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

|

SEACOR Marine Holdings Inc. |

(Exact Name of Registrant as Specified in Its Charter) |

|

|

|

Delaware |

001-37966 |

47-2564547 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

12121 Wickchester Lane, Suite 500, Houston, TX |

77079 |

(Address of Principal Executive Offices) |

(Zip Code) |

|

|

|

|

Registrant's telephone number, including area code |

(346) 980-1700 |

|

|

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock, par value $0.01 per share |

SMHI |

New York Stock Exchange (“NYSE”) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

The information set forth in (and incorporated by reference into) this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section. The information set forth in (and incorporated by reference into) this Item 7.01 shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On February 28, 2025, SEACOR Marine Holdings Inc. (the “Company”) posted an investor presentation to its website at https://ir.seacormarine.com/events-and-presentations. A copy of the investor presentation is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 8.01 Other Events.

The board of directors of the Company has established June 3, 2025 as the date of the Company’s 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”). The record date for the 2025 Annual Meeting will be April 14, 2025. The time and location of the 2025 Annual Meeting will be specified in the Company’s proxy statement for the 2025 Annual Meeting.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

SEACOR Marine Holdings Inc. |

|

|

|

February 28, 2025 |

By: |

/s/ Andrew H. Everett II |

|

|

|

|

|

Name: Andrew H. Everett II |

|

|

Title: Senior Vice President, General Counsel and Secretary |

SEACOR Marine Holdings Inc. Investor Update Exhibit 99.1 28 February 2025

Forward-Looking Statements Forward-Looking Statements discussed in this release as well as in other reports, materials and oral statements that SEACOR Marine Holdings Inc. (“SEACOR Marine” or the “Company”) releases from time to time to the public constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “believe,” “plan,” “target,” “forecast” and similar expressions are intended to identify forward-looking statements and includes the information on Slide 26. Such forward-looking statements concern management's expectations, strategic objectives, business prospects, anticipated economic performance and financial condition and other similar matters. Forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties such as the completion of our financial close process for the quarter, that could cause actual results to differ materially from those anticipated or expected by the management of the Company. These statements are not guarantees of future performance and actual events or results may differ significantly from these statements. Actual events or results are subject to significant known and unknown risks, uncertainties and other important factors, many of which are beyond the Company's control. It should be understood that it is not possible to predict or identify all such factors. Investors and analysts should not place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which the forward-looking statement is based, except as required by law. It is advisable, however, to consult any further disclosures the Company makes on related subjects in its filings with the U.S. Securities and Exchange Commission, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (if any). These statements constitute the Company's cautionary statements under the Private Securities Litigation Reform Act of 1995. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures. Direct Vessel Profit (defined as operating revenues less operating costs and expenses including major repairs and drydocking expenses, “DVP”), when applied to individual vessels, fleet categories or the combined fleet. DVP is a critical financial measure used by the Company to analyze and compare the operating performance of its individual vessels, fleet categories, regions and combined fleet, without regard to financing decisions (depreciation for owned vessels vs. leased-in expense for leased-in vessels). DVP is also useful when comparing the Company’s fleet performance against those of our competitors who may have differing fleet financing structures. DVP has material limitations as an analytical tool in that it does not reflect all of the costs associated with the ownership and operation of our fleet, and it should not be considered in isolation or used as a substitute for our results as reported under GAAP. Adjusted EBITDA is defined as DVP less general and administrative expenses and lease expenses. We believe that the presentation of Adjusted EBITDA provides useful information to investors and management uses it to assess our on-going operations. Our use of Adjusted EBITDA should not be viewed as an alternative to measures calculated in accordance with GAAP. Adjusted EBITDA has limitations as analytical tool such as: (i) Adjusted EBITDA does not reflect the impact of earnings or charges that we consider not to be indicative of our on-going operations, (ii) Adjusted EBITDA does not reflect interest and income tax expense; and (iii) other companies, including other companies in our industry, may calculate Adjusted EBITDA differently than we do. Net Debt is defined as total debt (the most comparable GAAP measure, calculated as long-term debt plus current portion of long-term debt excluding discount and issuance costs) less cash and cash equivalents (including restricted cash). We believe that the presentation of Net Debt provides useful information to investors and management uses it to compare total debt less cash and cash equivalents across periods on a consistent basis. Reconciliation for each of these non-GAAP measures are included as an appendix to this presentation.

I. Company Overview

SEACOR Marine – Global OSV Owner with Modern Fleet Company Overview Leading provider of marine and support transportation services to offshore energy facilities worldwide with one of the youngest fleets in the industry Headquartered in Houston, TX, and listed on the NYSE (ticker: SMHI) with a market capitalization of $164.9M (1) Owns and operates a fleet of 51 offshore support vessels (“OSVs”) (2) including Platform Supply Vessels (“PSVs”), Fast Support Vessels (“FSVs”) and Liftboats that provides crew transportation, supply, accommodation and maintenance support Global footprint with presence in all major offshore basins outside of Asia, serving a diverse range of customers in the oil and gas and offshore wind sectors Adopter of leading-edge technology (hybrid power, walk-to-work, etc.) to enhance sustainable operations Recent Developments: November 2024: Announced a comprehensive refinancing of SMHI’s debt capital structure with a new 5-year, $391.0M senior secured term loan November 2024: Signed an $82.0M order for two newbuild PSVs (+ four options) with 1,000m2 deck space, delivery Q4 2026 and Q1 2027 December 2024: Continued its asset rotation strategy by divesting out of older, lower specification Anchor Handling Tug and Supply vessels (“AHTSs”) and exiting the AHTS asset class February 2025: Won the Offshore Support Journal 2025 Environmental Award for its significant contribution to a reduction in the environmental footprint of the OSV industry Global Presence SEACOR Marine locations 13 vessels 9 vessels 10 vessels 19 vessels Middle East & Asia West Africa & Europe Latin America United States Fleet Composition (2) 51 Vessels – Average Age of 9.9 Years Region / Asset Type PSV FSV Liftboat United States (primarily Gulf of America) 2 3 5 Latin America 6 2 1 Africa & Europe 8 11 - Middle East & Asia 5 6 2 Total 21 22 8 35 international flag / 16 U.S. flag (Jones Act compliant) Bloomberg, as of market close on February 27, 2025. Fleet Composition as of December 31, 2024. Fleet Composition excludes 1 FSV and 2 AHTSs managed for third-parties.

High-Quality and Young Fleet 51 OSVs plus 2 Newbuild PSVs under Construction (1) PSVs FSVs Liftboats 21 PSVs and 2 newbuilds under construction (+ 4 options) Average age of 7.1 years Newbuilds with deck space of 1,000m2 and integrated hybrid power Fleet Composition: 22 FSVs Average age of 11.2 years Aluminum hulls, DP-2 or DP-3, up to 150 passengers 25-40 knots speed Fleet Composition: 8 Liftboats Average age of 13.3 years Working water depth up to 275 feet Accommodation up to 150 passengers Fleet Composition: SEACOR Marine also manages 1 FSV and 2 AHTSs for third-parties. In addition, SEACOR Marine has 4 planned PSV conversions to hybrid power. Number Deck Space Avg. Age Hybrid Power 11 PSVs > 800m2 5.4 years 7 (2) 10 PSVs < 700m2 8.9 years - Number Type Avg. Age Horsepower 16 FSVs Monohull 11.0 years 7-14k 6 FSVs Catamarans 11.8 years 13-16k Number Type Avg. Age Leg Length 4 Liftboats Premium 10.0 years 300-335 feet 4 Liftboats Standard 16.5 years 235-245 feet

Shallow water and deepwater activities Delivery of cargo, drilling fluids, fuel and water to rigs Construction, maintenance support and standby Accommodation and walk-to-work Offshore wind support Support drilling and production operations High-speed cargo transport to offshore facilities Transport of personnel at high-speed and comfort Walk-to-work capable Emergency response services Self-elevating and self-propelled work platforms Accommodation, offshore wind support Well workover, maintenance and production enhancement Decommissioning, plug and abandonment Midstream: commissioning and repair of pipelines and offshore gas facilities Diversified Asset Base Working Across the Energy Universe PSVs FSVs Liftboats Crew Transfer Maintenance Production Development Drilling Exploration Drilling Plug & Abandonment Decommissioning Offshore Wind PSV X X X X X FSV X X X X X Liftboat X X X X X

Newbuilding Order to Position SMHI’s Fleet for the Future Type & Design: Specifications: Shipyard: Propulsion: Delivery Dates: Total Investment: Two PSVs (Z 4423 Breeze Design) 4,650 DWT / 1,000 m2 Deck Space / 88.0m Loa / 20.0m Beam Fujian Mawei Shipyard Ltd., P.R. China Diesel Electric + Integrated Batteries Hybrid Propulsion October 2026 / January 2027 $82.0M On November 27, 2024, SMHI signed two shipbuilding contracts for the construction of two PSVs (plus four options) Key Specifications Strategic Rationale Class / Notations Highlights: ABS / FFV-1, SPS, ESS-LiBattery, DPS-2, ENVIRO, HAB (WB) Competitive pricing relative to second-hand vessels, coupled with attractive delivery dates Investment underpinned by strong market fundamentals and limited orderbook Aligns with SEACOR Marine’s asset rotation strategy, aimed at renewing its fleet with high-specification assets in replacement of older / lower specification assets Adopts state-of-the-art green technology aimed at fuel efficiency and reduction in emissions Strong design and operating capabilities will allow the vessels to work across the offshore energy universe, ranging from traditional offshore oilfield support and drilling support and operations, to walk-to-work, light subsea construction, ROV support, and offshore wind support Design Highlights: Moonpool and offshore crane-ready for subsea and geotechnical operations Safety and Compliance: highest standards including SPS Code 2008 Integrated batteries hybrid propulsion: highly efficient, operation with shore power connectivity DPS-2 azimuth propulsion with three bow thrusters for enhanced maneuverability Flexibility to upgrade to ROV support, subsea crane and helideck In Numbers PSV Fleet Hybrid Geographical Footprint High Earnings Potential 10% increase in the PSV fleet, reducing the average age of the PSV fleet from 9.1 years to 8.3 years by delivery of the vessels 100% of the 800+ m2 PSVs will be equipped with hybrid propulsion Vessels capable of serving all major offshore basins Leading edge day rates of $40,000+ according to Clarksons Research

Funding of Newbuild Program Back-Loaded Payment Terms Capex Funding Bridge (1) The sale of non-core AHTSs will fund the first milestone payment The new senior secured term loan is available to fund up to 50% of the total contract price The remaining capex of $18.6M will be funded from cash flow from operations Flexibility built into the new senior secured credit facility to use proceeds from asset sales towards funding newbuild capex Milestone Signing Q4 2024 Steel Cutting Q2 2025 / Q3 2025 Keel Laying Q4 2025 / Q1 2026 Launch Q2 2026 / Q3 2026 Delivery Q4 2026 / Q1 2027 % of Contract Cost 20% 20% 10% 10% 40% Total Capex $16.4M $16.4M $8.2M $8.2M $32.8M (1) On December 10, 2024, the Company completed the sale of non-core AHTSs for total proceeds of $22.5M.

Strengthening Revenue Backlog Contract Backlog (1) of $368.0M including Options (vs. $343.0M per September 30, 2024) Revenue Backlog (incl. Options) by Year & Asset Class Revenue Backlog (incl. Options) by Region Revenue Backlog (incl. Options) by Asset Class Firm vs. Options Key Figures 2025 2026 2027+ Firm 91% 87% 17% Options 9% 13% 83% Revenue Backlog as of December 31, 2024, and only includes charters with a duration of at least 30 days, including options. Average Backlog Contract Duration: 0.7 years Average Backlog Day Rates: $19,874 PSV $18,925 FSV $15,414 Liftboat $48,083 Recently Achieved Day Rates: PSV $32,000 FSV $23,000 Liftboat $53,000 Customer Name % of FY 2024 Total Revenue Azule Energy (BP / ENI Joint Venture) 21% Saudi Aramco 19% ExxonMobil 7% MexMar 6% Delta Logistics 5% Chevron 4% Milaha 4% LLOG 4% Aqueos 3% BP 3%

II. Market Outlook

Supportive Industry Fundamentals Global Offshore Project Capex by FID Year Commentary: 2024 saw a decline in offshore project capex leading to a dip in OSV demand across most offshore basins Global offshore project capex expected to increase significantly in 2025 and 2026 which provides a supportive environment for the OSV sector in the long-term Source: Clarksons Research Services, Rystad Energy. Commentary: Outlook for offshore oil and gas projects remains positive, with forecasted stable offshore exploration capex over the next several years Capex allocation towards deepwater regions, likely to drive demand for larger, high-spec OSVs and subsea Offshore Exploration Capex by Region

Balanced Supply / Demand OSV Demand Commentary Source: Clarksons Research Services. Despite exploration capex remaining low in a historical context, vessel activity has remained stable despite a limited recovery in offshore spending OSV demand has remained relatively flat in 2024, seeing increased demand in Brazil and West Africa, offset by a weaker chartering environment in the North Sea On the back of increased FIDs, the market is expected to tighten in 2026/2027 with a focus on high-specification OSVs

Continued Supply Side Constraints Aging Stacked Fleet PSV Orderbook Commentary: PSV stacking is on the rise again due to recent more muted demand; With a modest 2% growth in demand in 2026/2027, utilization levels could restore peaks reached in 2024 The PSV orderbook has grown over the last twelve months (3% of total fleet), but vessel attrition could drive negative fleet growth even with 69 vessels on order (43 excluding Brazil and Russia) 535 stacked OSVs per FYE 2024 Delivery Schedule (Firm Vessels only): 12 PSVs in 2025 35 PSVs in 2026 22 PSVs in 2027 Source: Clarksons Research Services.

Positive Long-Term Fundamentals Global PSV Average Day Rates Global PSV Average Utilization OSV demand expected to remain flat in 2025 following limited day rate growth and a dip in global utilization in 2024 Source: Clarksons Research Services.

Hybrid Power for PSVs Source: Spinergie OSV Monthly (December 2024), SEACOR Marine. Highlights: Total fleet of 87 hybrid PSVs of which 76 have been retrofitted, according to Spinergie 14 and 6 conversions took place in 2023 and 2024, respectively Electrifying a PSV reduces fuel dependence and associated emissions, but also prolongs engines longevity and reduces maintenance costs over time Hybrid PSVs can also be equipped with closed bus dynamic positioning (DP) operations, a next step in optimizing hybrid battery technology by further reducing fuel consumption and engine hours while providing safe ride-through capabilities already announced

III. Financial Highlights

Financial Highlights FY 2022 FY 2023 Fleet Average Utilization Fleet Average Day Rate Revenues Direct Vessel Profit (2) 75% 75% $12,673 $16,375 $217.3M $279.5M $45.3M $119.9M FY 2024 Fleet Count / Average Age (1) 60 / 8.6 years 58 / 9.4 years Adjusted EBITDA (3) $0.6M $67.9M 67% $18,989 $271.4M $74.1M 51 / 10.3 years $27.7M FY 2024 saw Fleet Average Day Rate grow by 16% year-on-year, offset by lower utilization of 67% driven by weaker market demand, repositioning of vessels and higher maintenance activity Fleet Count and Average Age includes 2 managed vessels and 3 leased-in vessels in 2022, 3 managed vessels and 1 leased-in vessel in 2023. 2024 excludes 3 managed vessels. Direct Vessel Profit is a non-GAAP financial measure. See Slide 2 for a discussion of Direct Vessel Profit and the Appendix to this presentation for a reconciliation to GAAP. Adjusted EBITDA is a non-GAAP financial measure. See Slide 2 for a discussion of Adjusted EBITDA and the Appendix to this presentation for a reconciliation to GAAP.

Key Financial Metrics Total Revenue, DVP (1) & DVP Margin Total Debt, Cash & Cash Equivalents & Equity Ratio FY 2024 Commentary Direct Vessel Profit is a non-GAAP financial measure. See Slide 2 for a discussion of Direct Vessel Profit and the Appendix to this presentation for a reconciliation to GAAP. FY 2024 Total Revenue of $271.4M, down 3.0% y-o-y, with higher average day rates at $18,989 (+16% y-o-y) offset by lower utilization (-8 percentage points y-o-y) due to: (1) Delays in long-term contracts, (2) Lower spot market activity in the North Sea and U.S. Gulf of America, and (3) Higher downtime for repairs and maintenance Increased Operating Expenses (+23.6% y-o-y) driven by inflation and higher drydocking activity FY 2024 Net Loss of $78.1M includes $28.3M non-recurring, non-cash loss on debt extinguishment in connection with the debt refinancing closed in December 2024 FY 2024 Gain on Asset Dispositions of $13.5M driven by sale of AHTS fleet (three vessels) resulting in $17.2M gains, offset by $3.7M impairment charge on one hull under construction previously deferred indefinitely and now abandoned Day Rate and Utilization Progression FY 2022 FY 2023 FY 2024 Day Rate $12,673 $16,375 $18,989 Utilization 75% 75% 67% Gains on Asset Dispositions $1.4M $21.4M $13.5M Operating Income (Loss) -$54.0M $35.5M -$10.4M Net Income (Loss) -$71.7M -$9.3M -$78.1M

DVP Breakdown by Asset Class & Region FY 2022 FY 2023 FY 2024 PSV Day Rate $13,246 $18,031 $19,888 Utilization 76% 77% 62% PSV - Direct Vessel Profit (1) $11.4M $39.5M $21.6M FSV Day Rate $9,425 $11,273 $12,901 Utilization 85% 84% 76% FSV - Direct Vessel Profit (1) $20.4M $34.2M $24.0M Liftboat Day Rate $27,010 $37,523 $42,665 Utilization 55% 50% 58% Liftboat - Direct Vessel Profit (1) $4.9M $43.5M $26.2M AHTS Day Rate $8,975 $9,201 $9,156 Utilization 69% 70% 60% AHTS - Direct Vessel Profit (1) $3.8M $0.4M -$0.5M Miscellaneous - Direct Vessel Profit (1) $4.8M $2.3M $2.8M Average Fleet Day Rate $12,673 $16,375 $18,989 Average Fleet Utilization 75% 75% 67% Total - Direct Vessel Profit (1) $45.3M $119.9M $74.1M DVP (1) Breakdown by Asset Class Direct Vessel Profit is a non-GAAP financial measure. See Slide 2 for a discussion of Direct Vessel Profit and the Appendix to this presentation for a reconciliation to GAAP. DVP (1) Breakdown by Region FY 2022 FY 2023 FY 2024 United States (primarily Gulf of America) Day Rate $19,876 $20,967 $23,076 Utilization 49% 45% 38% Direct Vessel Profit (1) $10.2M $17.1M -$10.7M Africa and Europe Day Rate $11,127 $14,612 $17,453 Utilization 85% 87% 75% Direct Vessel Profit (1) $15.5M $38.7M $42.2M Middle East and Asia Day Rate $10,003 $15,003 $17,285 Utilization 80% 76% 78% Direct Vessel Profit (1) $3.2M $31.8M $20.6M Latin America Day Rate $13,948 $18,937 $23,462 Utilization 91% 88% 66% Direct Vessel Profit (1) $16.4M $32.3M $22.0M Average Fleet Day Rate $12,673 $16,375 $18,989 Average Fleet Utilization 75% 75% 67% Total - Direct Vessel Profit (1) $45.3M $119.9M $74.1M

Fleet Maintenance and Capital Expenditures Unfunded Capital Commitments 2025 2026 2027 Newbuilding program – 2 PSVs $36.9M $29.4M $16.4M Hybrid battery power systems – 4x PSVs $2.2M - $2.2M DP-2 upgrade – 1x Liftboat $1.9M $0.5M - Miscellaneous Equipment $0.6M - - Total $41.6M $29.9M $18.6M Historical Major Repairs and Drydocking Expenses SMHI Fleet Age Distribution (1) Capital Expenditures as of December 31, 2024 Fleet Age Distribution as of December 31, 2024. Fleet Age Distribution excludes 1 FSV and 2 AHTSs managed for third-parties.

IV. Appendix

Financials – Income and Loss Statement Income and Loss Statement (in $ thousands) Source: Company filings. FY 2024 FY 2023 FY 2022 Operating Revenues 271,361 279,511 217,325 Costs and Expenses: Operating 197,252 159,650 171,985 Administrative and General 44,713 49,183 40,911 Lease Expense 1,678 2,748 3,869 Depreciation and Amortization 51,628 53,821 55,957 295,271 265,402 272,722 Gains (Losses) on Asset Dispositions and Impairments, Net 13,481 21,409 1,398 Operating Income (Loss) (10,429) 35,518 (53,999) Other Income (Expense): Interest Income 1,768 1,444 784 Interest Expense (40,627) (37,504) (29,706) Gains (Losses) on Debt Extinguishment (31,923) (2,004) 10,429 Derivative Gains (Losses), Net (908) 608 - Foreign Currency Gains (Losses), Net (1,049) (2,133) 1,659 Other, Net 121 - 755 (72,618) (39,589) (16,079) Income (Loss) from Continuing Operations Before Tax Expense (Benefit) and Equity in Earnings (Losses) of 50% or Less Owned Companies (83,047) (4,071) (70,078) Income Tax Expense (Benefit): Current 11,067 13,860 8,485 Deferred (13,682) (5,061) 97 (2,615) 8,799 8,582 Income (Loss) Before Equity in Earnings (Losses) of 50% or Less Owned Companies (80,432) (12,870) (78,660) Equity in Earnings (Losses) of 50% or Less Owned Companies, Net of Tax 2,308 3,556 7,011 Net Income (Loss) (78,124) (9,314) (71,649) Net Income (Loss) Attributable to Noncontrolling Interests in Subsidiaries - - 1 Net Income (Loss) attributable to SEACOR Marine Holdings Inc. (78,124) (9,314) (71,650)

Financials – Balance Sheet and Debt Overview (1) Assets FY 2024 FY 2023 FY 2022 Current Assets: Cash and Cash Equivalents, including Restricted Cash 76,140 84,131 43,045 Other Current Assets 97,511 80,555 89,268 Total Current Assets 173,651 164,686 132,313 Property and Equipment, net of Depreciation 532,966 594,682 656,905 Construction in Progress 11,904 10,362 8,111 Net Property and Equipment 544,870 605,044 665,016 Leases and Other Assets 8,590 10,606 18,038 Total Assets 727,111 780,336 815,367 Liabilities and Equity FY 2024 FY 2023 FY 2022 Current Liabilities: Current Portion of Lease Liabilities 623 1,626 2,826 Current Portion of Long-Term Debt 27,500 28,365 61,512 Other Current Liabilities 56,919 47,095 56,824 Total Current Liabilities 85,042 77,086 121,162 Long-Term Lease Liabilities 3,002 3,535 11,520 Long-Term Debt 317,339 287,544 260,119 Other Long-Term Liabilities 23,406 37,947 43,420 Total Liabilities 428,789 406,112 436,221 Total Equity 298,322 374,224 379,146 Total Liabilities and Equity 727,111 780,336 815,367 Balance Sheet (in $ thousands) Debt Overview (in $ thousands) Assumes $41.0M newbuilding tranche (Tranche B) to be fully drawn by the delivery date of the two newbuild PSVs. Source: Company filings. Debt Facility Final Maturity Principal Outstanding 2024 SMFH Credit Facility December 2029 350,000 Total Debt 350,000 Discount / Issuance Costs (1) (5,161) Total Debt net of Discount / Issuance Costs 344,839

Financials – Cash Flow Statement Cash Flow Statement (in $ thousands) FY 2024 FY 2023 FY 2022 Cash Flows from Continuing Operating Activities: Net Income (Loss) (78,124) (9,314) (71,649) Adjustments to Reconcile Net Income (Loss) to Net Cash Provided by (used in) Operating Activities: Depreciation and Amortization 51,628 53,821 55,957 Debt Discount and Deferred Financing Cost Amortization 8,923 8,340 6,701 Stock-based Compensation Expense 6,458 6,000 4,597 Allowance for Credit Losses 202 3,519 489 (Gains) Losses from Equipment Sales, Retirements or Impairments, Investments in 50% or Less Owned Companies (13,481) (21,409) (1,398) (Gains) Losses on Debt Extinguishment 28,252 177 (12,700) Derivative (Gains) Losses 908 (608) - Interest on Finance Lease 3 202 244 Settlements on Derivative Transactions, Net 164 577 (749) Currency (Gains) Losses 1,049 2,133 (1,659) Deferred Income Taxes (13,682) (5,061) 97 Equity (Earnings) Losses (2,308) (3,556) (7,011) Dividends Received from Equity Investees 2,916 2,241 3,057 Changes in Operating Assets and Liabilities: Accounts Receivables (4,600) (17,215) (652) Other Assets (1,315) 2,288 2,559 Accounts Payable and Accrued Liabilities 2,745 (13,188) 7,501 Net Cash provided by (used in) Operating Activities (10,262) 8,947 (14,616) Cash Flows from Continuing Investing Activities: Purchases of Property and Equipment (7,294) (10,604) (462) Proceeds/Cash Impact from Disposition/Sale of Property and Equipment 24,858 44,730 6,734 Cash Flow related to Investments in 50% or Less Owned Companies and Equity Investees - - 66,528 Notes Due from Others - - (28,831) Principal Payments on Notes due from Others - 15,000 13,831 Net Cash provided by Investing Activities 17,564 49,126 57,800 Source: Company filings.

Financials – Cash Flow Statement (Continued) Cash Flow Statement (in $ thousands) FY 2024 FY 2023 FY 2022 Cash Flows from Continuing Financing Activities: Payments on Long-Term Debt (24,312) (29,165) (38,152) Payments on Debt Extinguishment (328,712) (131,604) - Payments on Debt Extinguishment Costs (3,671) (1,827) (2,271) Proceeds from issuance of Long-Term Debt, net of Issue Costs 345,192 148,475 - Proceeds from issuance of Common Stock, net of Issue Costs - 24 - Proceeds from Exercise of Stock Options and Warrants 140 6 151 Payments on Finance Lease (41) (531) (351) Acquisition of Common Shares for Tax Withholding Obligations (3,889) (2,368) (732) Net Cash used in Financing Activities (15,293) (16,990) (41,355) Effects of Exchange Rates - 3 (4) Net Increase (Decrease) in Cash, Cash Equivalents and Restricted Cash (7,991) 41,086 1,825 Cash, Cash Equivalents and Restricted Cash, Beginning of Period 84,131 43,045 41,220 Cash, Cash Equivalents and Restricted Cash, End of Period 76,140 84,131 43,045 Source: Company filings.

Financial Reconciliations Adjusted EBITDA Reconciliation (in $ thousands) FY 2024 FY 2023 FY 2022 Net Income (Loss) attributable to SEACOR Marine Holdings Inc. (78,124) (9,314) (71,650) Depreciation and Amortization 51,628 53,821 55,957 Interest Expense 40,627 37,504 29,706 Interest Income (1,768) (1,444) (784) Taxes (2,615) 8,799 8,562 Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) 9,748 89,366 21,811 (Gains) Losses on Asset Dispositions and Impairments, Net (13,481) (21,409) (1,398) (Gains) Losses on Debt Extinguishment 31,923 2,004 (10,429) Derivative (Gains) Losses, Net 908 (608) - Foreign Currency (Gains) Losses, Net 1,049 2,133 (1,659) Other, Net (121) - (755) Equity in (Earnings) Losses of 50% or Less Owned Companies (2,308) (3,556) (7,011) Net Income (Loss) attributable to Noncontrolling Interests in Subsidiaries - - 1 Adjusted EBITDA 27,718 67,930 560 DVP Reconciliation (in $ thousands) FY 2024 FY 2023 FY 2022 Operating Income (Loss) (10,429) 35,518 (53,999) (Gains) Losses on Asset Dispositions and Impairments, Net (13,481) (21,409) (1,398) Depreciation and Amortization 51,628 53,821 55,957 Lease Expense 1,678 2,748 3,869 Administrative and General 44,713 49,183 40,911 Direct Vessel Profit (DVP) 74,109 119,861 45,340 Source: Company filings.

Financial Reconciliations (continued) Net Debt Reconciliation (in $ thousands) FY 2024 FY 2023 FY 2022 Current Portion of Long-Term Debt 27,500 28,365 61,512 Long-Term Debt 317,339 287,544 260,119 Discount and Issuance Costs 5,161 37,115 42,163 Total Debt 350,000 353,024 363,794 Cash and Cash Equivalents, including Restricted Cash 76,140 84,131 43,045 Net Debt 273,860 268,893 320,749 DVP to Adjusted EBITDA Reconciliation (in $ thousands) FY 2024 FY 2023 FY 2022 Operating Revenues 271,361 279,511 217,325 Operating Expenses 197,252 159,650 171,985 Direct Vessel Profit (DVP) 74,109 119,861 45,340 Administrative and General 44,713 49,183 40,911 Lease Expense 1,678 2,748 3,869 Adjusted EBITDA 27,718 67,930 560 Source: Company filings.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

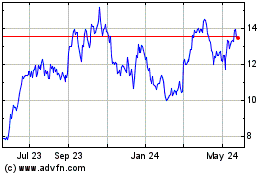

SEACOR Marine (NYSE:SMHI)

Historical Stock Chart

From Feb 2025 to Mar 2025

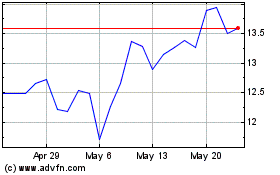

SEACOR Marine (NYSE:SMHI)

Historical Stock Chart

From Mar 2024 to Mar 2025