FALSE000089626400008962642024-10-222024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 22, 2024

USANA HEALTH SCIENCES, INC.

(Exact name of registrant as specified in its charter)

Utah

(State or other jurisdiction of incorporation)

| | | | | |

| 001-35024 | 87-0500306 |

| (Commission File No.) | (IRS Employer

Identification No.) |

3838 West Parkway Boulevard

Salt Lake City, Utah 84120

(Address of principal executive offices, Zip Code)

Registrant's telephone number, including area code: (801) 954-7100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | USNA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On October 22, 2024, USANA Health Sciences, Inc. (the “Company” or “USANA”) issued a press release announcing its financial results for the third quarter ended September 28, 2024. The release also announced that the Company will post a document titled “Management Commentary” on the Company’s website and that executives of the Company will hold a conference call with investors, to be broadcast over the World Wide Web and by telephone and provided access information, date and time for the conference call. The Company noted that the call will consist of brief remarks by the Company’s management team, before moving directly into questions and answers. A copy of the press release, and the Management Commentary, are furnished herewith as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K and are incorporated herein by reference. These documents will be posted on the Company’s corporate website, www.usana.com.

The information in this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report, including the exhibits, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended. The furnishing of the information in this Current Report is not intended to, and does not, constitute a representation that such furnishing is required by Regulation FD or that the information this Current Report contains is material investor information that is not otherwise publicly available.

Item 7.01 Regulation FD Disclosure

The information disclosed above under Item 2.02, as well as the exhibits attached under Item 9.01 below are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| USANA HEALTH SCIENCES, INC. |

| | |

| By: | /s/ G. Douglas Hekking |

| G. Douglas Hekking, Chief Financial Officer |

| | |

| Date: October 22, 2024 | | |

USANA Health Sciences Reports Third Quarter 2024 Results

SALT LAKE CITY, October 22, 2024 (BUSINESS WIRE)—USANA Health Sciences, Inc. (NYSE: USNA) today announced financial results for its fiscal third quarter ended September 28, 2024.

Key Financial & Operating Results

•Third quarter net sales were $200 million versus $213 million during Q3 2023.

•Third quarter diluted EPS was $0.56 as compared with $0.59 during Q3 2023.

•Company updates fiscal year 2024 net sales and diluted EPS outlook to approximately $850 million and $2.45, respectively (previously $850 million to $880 million and $2.40 to $2.55).

Q3 2024 Financial Performance

| | | | | | | | |

| Consolidated Results |

| Net Sales | $200 million | •-6% vs. Q3 2023 |

| | •No meaningful YOY FX impact |

| | •-6% sequentially |

| Diluted EPS | $0.56 | •-5% vs. Q3 2023 |

| | •+4% sequentially |

| Active Customers | 452,000 | •-3% vs. Q3 2023 |

| | •-3% sequentially |

“Third quarter operating results reflected continued top line headwinds across many of our key markets,” said Jim Brown, President and Chief Executive Officer. “Our sales force continued to face challenges in attracting new customers as consumer sentiment remained cautious, including in our largest market, mainland China. Despite these challenges, we remain confident in our direction and continue to make progress on the five key initiatives that underpin our long-term strategy. Our commercial team, which was reorganized earlier this year, has been executing on

these initiatives to enhance the overall value proposition of our business to our customers and we are beginning to see results in several of these areas.

“During the quarter, we continued to prioritize engagement with our sales leaders, highlighted by our Americas & Europe Convention in Las Vegas, Nevada during August. Training and development were key focus areas at this event, with an emphasis on actionable initiatives to help our sales leaders grow their businesses. Feedback has been positive and leaders are actively adopting these new initiatives.

“We have also prioritized our product innovation strategy with an emphasis on increasing the cadence with which we introduce new and upgraded premium products relevant to our customers’ needs. Illustrative of this effort, we launched two new products at our recent event in Las Vegas: a Celavive Resurfacing Serum and a Whey Protein Isolate.”

Q3 2024 Regional Results:

| | | | | | | | |

| Asia Pacific Region |

| Net Sales | $160 million | •-6% vs. Q3 2023 |

| | •No meaningful YOY FX impact |

| | •-6% sequentially |

| | •80% of consolidated net sales |

| Active Customers | 360,000 | •-1% vs. Q3 2023 |

| | •-2% sequentially |

| Asia Pacific Sub-Regions |

| Greater China |

| Net Sales | $102 million | •-4% vs. Q3 2023 |

| | •-5% constant currency vs. Q3 2023 |

| | •-11% sequentially |

| Active Customers | 243,000 | •+6% vs. Q3 2023 |

| | •-3% sequentially |

| North Asia |

| Net Sales | $21 million | •-15% vs. Q3 2023 |

| | •-12% constant currency vs. Q3 2023 |

| | •+4% sequentially |

| Active Customers | 41,000 | •-16% vs. Q3 2023 |

| | •-2% sequentially |

| Southeast Asia Pacific |

| | | | | | | | |

| Net Sales | $37 million | •-5% vs. Q3 2023 |

| | •-6% constant currency vs. Q3 2023 |

| | •+5% sequentially |

| Active Customers | 76,000 | •-8% vs. Q3 2023 |

| | •-1% sequentially |

| | | | | | | | |

| Americas and Europe Region |

| Net Sales | $40 million | •-7% vs. Q3 2023 |

| | •-6% constant currency vs. Q3 2023 |

| | •-5% sequentially |

| | •20% of consolidated net sales |

| Active Customers | 92,000 | •-10% vs. Q3 2023 |

| | •-7% sequentially |

Balance Sheet and Share Repurchase Activity

The Company generated $30 million in operating cash flow during the third quarter and ended the quarter with $365 million in cash and cash equivalents while remaining debt-free. The Company did not repurchase any shares during the quarter. As of the end of the third quarter, the Company had approximately $62 million remaining under the current share repurchase authorization.

Fiscal Year 2024 Outlook

The Company is updating its net sales and earnings per share outlook for fiscal year 2024, as follows:

| | | | | | | | |

Fiscal Year 2024 Outlook |

| Target | Previous Range |

| Consolidated Net Sales | $850 million | $850 - $880 million |

| Diluted EPS | $2.45 | $2.40 - $2.55 |

“Third quarter net sales were modestly below expectations as we continue to see downward pressure on customer acquisition and consumer spending in several key markets, resulting in lower customer counts and average spend per customer,” said Doug Hekking, Chief Financial Officer. “We are monitoring the recently-announced stimulus initiatives in China, but we do not expect them to meaningfully impact our near-term operating results. Accordingly, we have adjusted our fiscal 2024 guidance to reflect year-to-date operating performance as well as

promotional activity planned for the fourth quarter. Notwithstanding the macroeconomic challenges we have faced in 2024, our business fundamentals remain strong. We’ve generated $47 million of free cash flow year-to-date and our balance sheet remains pristine with $365 million of cash and no debt.”

Management Commentary Document and Conference Call

For further information on the USANA’s operating results, please see the Management Commentary document, which has been posted on the Company’s website (http://ir.usana.com) under the Investor Relations section. USANA’s management team will hold a conference call and webcast to discuss today’s announcement with investors on Wednesday, October 23, 2024 at 11:00 AM Eastern Time. Investors may listen to the call by accessing USANA’s website at http://ir.usana.com. The call will consist of brief opening remarks by the Company’s management team, followed by a questions and answers session.

Non-GAAP Financial Measures

The Company prepares its financial statements using U.S. generally accepted accounting principles (“GAAP”). Constant currency net sales, earnings, EPS and other currency-related financial information (collectively, “Financial Results”) are non-GAAP financial measures that remove the impact of fluctuations in foreign-currency exchange rates (“FX”) and help facilitate period-to-period comparisons of the Company’s Financial Results that we believe provide investors an additional perspective on trends and underlying business results. Constant currency Financial Results are calculated by translating the current period's Financial Results at the same average exchange rates in effect during the applicable prior-year period and then comparing this amount to the prior-year period's Financial Results.

About USANA

USANA develops and manufactures high-quality nutritional supplements, functional foods and personal care products that are sold directly to Associates and Preferred Customers throughout the United States, Canada, Australia, New Zealand, Hong Kong, China, Japan, Taiwan, South Korea, Singapore, Mexico, Malaysia, the Philippines, the Netherlands, the United Kingdom,

Thailand, France, Belgium, Colombia, Indonesia, Germany, Spain, Romania, Italy, and India. More information on USANA can be found at www.usana.com.

Safe Harbor

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. Our actual results could differ materially from those projected in these forward-looking statements, which involve a number of risks and uncertainties, including: global economic conditions generally, including continued inflationary pressure around the world and negative impact on our operating costs, consumer demand and consumer behavior in general; reliance upon our network of independent Associates; risk that our Associate compensation plan, or changes that we make to the compensation plan, will not produce desired results, benefit our business or, in some cases, could harm our business; risk associated with governmental regulation of our products, manufacturing and direct selling business model in the United States, China and other key markets; potential negative effects of deteriorating foreign and/or trade relations between or among the United States, China and other key markets; potential negative effects from geopolitical relations and conflicts around the world, including the Russia-Ukraine conflict and the conflict in Israel; compliance with data privacy and security laws and regulations in our markets around the world; potential negative effects of material breaches of our information technology systems to the extent we experience a material breach; material failures of our information technology systems; adverse publicity risks globally; risks associated with commencing operations in India and future international expansion and operations; uncertainty relating to the fluctuation in U.S. and other international currencies; and the potential for a resurgence of COVID-19, or another pandemic, in any of our markets in the future and any related impact on consumer health, domestic and world economies, including any negative impact on discretionary spending, consumer demand, and consumer behavior in general. The contents of this release should be considered in conjunction with the risk factors, warnings, and cautionary statements that are contained in our most recent filings with the Securities and Exchange Commission. The forward-looking statements in this press release set forth our beliefs as of the date hereof. We do not undertake any obligation to update any forward-looking statement after the date hereof or to conform such statements to actual results or changes in the Company’s expectations, except as required by law.

Investor contact: Andrew Masuda

Investor Relations

(801) 954-7201

investor.relations@usanainc.com

Media contact: (801) 954-7280

media@usanainc.com

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | |

| Quarter Ended | |

| September 28,

2024 | | September 30,

2023 | |

| Net sales | $ | 200,221 | | | $ | 213,365 | | |

| Cost of sales | 39,257 | | | 42,529 | | |

| Gross profit | 160,964 | | | 170,836 | | |

| Operating expenses: | | | | |

| Associate incentives | 84,068 | | | 89,926 | | |

| Selling, general and administrative | 61,295 | | | 63,303 | | |

| Total operating expenses | 145,363 | | | 153,229 | | |

| Earnings from operations | 15,601 | | | 17,607 | | |

| Other income (expense): | | | | |

| Interest income | 3,142 | | | 2,733 | | |

| Interest expense | (49) | | | (43) | | |

| Other, net | (86) | | | 234 | | |

| Other income (expense), net | 3,007 | | | 2,924 | | |

| Earnings before income taxes | 18,608 | | | 20,531 | | |

| Income taxes | 8,001 | | | 9,184 | | |

| Net earnings | $ | 10,607 | | | $ | 11,347 | | |

| | | | |

| Earnings per common share | | | | |

| Basic | $ | 0.56 | | | $ | 0.59 | | |

| Diluted | $ | 0.56 | | | $ | 0.59 | | |

| | | | |

| Weighted average common shares outstanding | | | | |

| Basic | 19,078 | | 19,245 | |

| Diluted | 19,083 | | 19,372 | |

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| As of

September 28,

2024 | | As of

December 30,

2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 364,889 | | | $ | 330,420 | |

| Inventories | 63,984 | | | 61,454 | |

| Prepaid expenses and other current assets | 22,318 | | | 25,872 | |

| Total current assets | 451,191 | | | 417,746 | |

| Property and equipment, net | 98,033 | | | 99,814 | |

| Goodwill | 17,196 | | | 17,102 | |

| Intangible assets, net | 29,237 | | | 29,919 | |

| Deferred tax assets | 16,823 | | | 13,284 | |

Other assets* | 58,828 | | | 54,892 | |

| Total assets | $ | 671,308 | | | $ | 632,757 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 7,041 | | | $ | 10,070 | |

| Line of credit - short term | — | | | 786 | |

| Other current liabilities | 107,738 | | | 107,989 | |

| Total current liabilities | 114,779 | | | 118,845 | |

| Deferred tax liabilities | 4,727 | | | 4,552 | |

| Other long-term liabilities | 18,715 | | | 12,158 | |

| | | |

| Stockholders' equity | 533,087 | | | 497,202 | |

| Total liabilities and stockholders' equity | $ | 671,308 | | | $ | 632,757 | |

*Other assets include noncurrent inventories of $2,938 and $3,128 as of 28-Sep-24 and 30-Dec-23, respectively. Total inventories were $66,922 and $64,582 as of 28-Sep-24 and 30-Dec-23, respectively.

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

SALES BY REGION

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Change from prior

year | | Percent change | | Currency impact on

sales | | % change

excluding currency

impact |

| September 28, 2024 | | September 30, 2023 | | | | |

| Asia Pacific | | | | | | | | | | | | | | | |

| Greater China | $ | 102,261 | | | 51.1 | % | | $ | 106,609 | | | 50.0 | % | | $ | (4,348) | | | (4.1 | %) | | $ | 865 | | | (4.9 | %) |

| Southeast Asia Pacific | 37,267 | | | 18.6 | % | | $ | 39,151 | | | 18.3 | % | | (1,884) | | | (4.8 | %) | | 561 | | | (6.2 | %) |

| North Asia | 20,541 | | | 10.2 | % | | $ | 24,244 | | | 11.4 | % | | (3,703) | | | (15.3 | %) | | (721) | | | (12.3 | %) |

| Asia Pacific Total | 160,069 | | | 79.9 | % | | 170,004 | | | 79.7 | % | | (9,935) | | | (5.8 | %) | | 705 | | | (6.3 | %) |

| Americas and Europe | 40,152 | | | 20.1 | % | | 43,361 | | | 20.3 | % | | (3,209) | | | (7.4 | %) | | (727) | | | (5.7 | %) |

| $ | 200,221 | | | 100.0 | % | | $ | 213,365 | | | 100.0 | % | | $ | (13,144) | | | (6.2 | %) | | $ | (22) | | | (6.2 | %) |

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

ACTIVE ASSOCIATES AND ACTIVE PREFERRED CUSTOMERS BY REGION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

Active Associates by Region(1) |

| (unaudited) |

| As of

September 28, 2024 | | As of

September 30, 2023 |

| Asia Pacific: | | | | | | | |

| Greater China | 65,000 | | 34.6 | % | | 69,000 | | 34.0 | % |

| Southeast Asia Pacific | 52,000 | | 27.6 | % | | 55,000 | | 27.1 | % |

| North Asia | 28,000 | | 14.9 | % | | 33,000 | | 16.2 | % |

| Asia Pacific Total | 145,000 | | 77.1 | % | | 157,000 | | 77.3 | % |

| | | | | | | |

| Americas and Europe | 43,000 | | 22.9 | % | | 46,000 | | 22.7 | % |

| 188,000 | | 100.0 | % | | 203,000 | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Active Preferred Customers by Region(2) |

| (unaudited) |

| As of

September 28, 2024 | | As of

September 30, 2023 |

| Asia Pacific: | | | | | | | |

| Greater China | 178,000 | | 67.4 | % | | 161,000 | | 61.7 | % |

| Southeast Asia Pacific | 24,000 | | 9.1 | % | | 28,000 | | 10.7 | % |

| North Asia | 13,000 | | 4.9 | % | | 16,000 | | 6.1 | % |

| Asia Pacific Total | 215,000 | | 81.4 | % | | 205,000 | | 78.5 | % |

| | | | | | | |

| Americas and Europe | 49,000 | | 18.6 | % | | 56,000 | | 21.5 | % |

| 264,000 | | 100.0 | % | | 261,000 | | 100.0 | % |

(1) Associates are independent distributors of our products who also purchase our products for their personal use. We only count as active those Associates who have purchased from us any time during the most recent three-month period, either for personal use or resale.

(2) Preferred Customers purchase our products strictly for their personal use and are not permitted to resell or to distribute the products. We only count as active those Preferred Customers who have purchased from us any time during the most recent three-month period. China utilizes a Preferred Customer program that has been implemented specifically for that market.

USANA Health Sciences, Inc. October 22, 2024

Q3 2024 Management Commentary

Key Financial & Operating Results

•Third quarter net sales were $200 million versus $213 million during Q3 2023.

•Third quarter diluted EPS was $0.56 as compared with $0.59 during Q3 2023.

•Company updates fiscal year 2024 net sales and diluted EPS outlook to approximately $850 million and $2.45, respectively (previously $850 million to $880 million and $2.40 to $2.55).

Overview

Sales performance in the third quarter was modestly below our expectations as the operating environment in many of our markets remained challenging. Consumer spending in many of our markets remained under pressure due to macroeconomic factors, which created difficulty for our Associates to build momentum attracting new customers, particularly in our largest market, mainland China.

Notwithstanding the challenging environment, we continued to execute upon our long-term strategic initiatives. Our commercial team, which was reorganized earlier this year, has been executing on these initiatives to enhance the overall value proposition of our business to our customers and we are beginning to see results in several of these areas.

We continued our engagement efforts with our sales leaders during the quarter, highlighted by our Americas & Europe Convention in Las Vegas, Nevada. Training, development and recognition were key focus areas at this event, with an emphasis on actionable initiatives to help our sales leaders grow their businesses. Additionally, we previewed improved digital tools aimed

at enhancing the overall selling and shopping experience. Feedback has been positive and leaders are actively adopting these new initiatives.

At our Americas & Europe convention, we launched two new products: Celavive Resurfacing Serum and Whey Protein Isolate. These product launches are illustrative of the early stages of our product innovation strategy and Associate-first approach, which includes increasing the cadence of new and upgraded high-quality, relevant, and premium products. In addition to benefits anticipated from product innovation, the new commercial team is also driving shorter timelines from formulation to commercialization as well as exploring enhanced selling strategies to support our Associate-first approach.

For the fourth quarter, we expect the operating environment in many of our markets to remain challenging. We plan to modestly increase promotional activity to help offset these market pressures and to drive sales momentum. Although we are monitoring the recently-announced stimulus initiatives in China, we do not expect them to have a meaningful positive impact on our fourth quarter operating results.

We remain focused on executing the five key initiatives that underpin our long-term strategy. These include (i) leveraging performance from our restructured commercial team, (ii) expanding product innovation and commercialization, (iii) increasing our efforts to engage our sales leaders with an Associate-first approach, (iv) growing our India market, and (v) evaluating more business development activities. These initiatives are a meaningful multi-year endeavor and are focused on making USANA’s overall value proposition more compelling, ultimately driving long-term performance and stakeholder value creation.

Q3 2024 Financial Performance

| | | | | | | | |

| Consolidated Results |

| Net Sales | $200 million | •-6% vs. Q3 2023 |

| | •No meaningful YOY FX impact |

| | •-6% sequentially |

| Diluted EPS | $0.56 | •-5% vs. Q3 2023 |

| | •+4% sequentially |

| Active Customers | 452,000 | •-3% vs. Q3 2023 |

| | •-3% sequentially |

Balance Sheet and Share Repurchase Activity

We generated $30 million in operating cash flow during the third quarter and ended the quarter with $365 million in cash and cash equivalents while remaining debt-free.

As of September 28, 2024, inventories were $67 million, or 4% higher compared to the year-end balance in fiscal 2023. The modest increase in inventory can be attributed to strategic buying of certain raw materials during the quarter. Our in-house sourcing and manufacturing capabilities provide us with better control of inventory levels and help to mitigate supply chain risks while providing a meaningful contribution to delivering the highest quality nutritional products.

We did not repurchase any shares during the quarter. As of September 28, 2024, we had approximately $62 million remaining under the current share repurchase authorization.

Quarterly Income Statement Discussion

Gross margin increased 30 basis points from the prior year to 80.4% of net sales. The increase is largely attributed to lower material costs, favorable change in market mix and price increases, partially offset by the negative impact of foreign currency exchange rates.

Associate Incentives decreased 10 basis points from the prior year to 42.0% of net sales. The decrease largely reflects lower incentive and promotional expenses in the current year quarter.

Selling, General and Administrative expenses increased 90 basis points from the prior year to 30.6% as a percentage of net sales. The relative increase is primarily due to a loss of leverage on

lower year-over-year net sales. On an absolute basis, SG&A expenses decreased $2.0 million year-over-year, which can be attributed primarily to lower event and advertising-related expenses.

The year-to-date effective tax rate increased to 43.0% from the 38.0% reported in the comparable period of 2023. The higher effective tax rate can be attributed primarily to: 1) China’s increased relative share of USANA’s sales portfolio, 2) a concentration of infrastructure costs at our corporate headquarters in the U.S., and 3) generally softer operating performance, including the impact of unfavorable exchange rates in our other markets around the world.

Q3 2024 Regional Results:

| | | | | | | | |

| Asia Pacific Region |

| Net Sales | $160 million | •-6% vs. Q3 2023 |

| | •No meaningful YOY FX impact |

| | •-6% sequentially |

| | •80% of consolidated net sales |

| Active Customers | 360,000 | •-1% vs. Q3 2023 |

| | •-2% sequentially |

| Asia Pacific Sub-Regions |

| Greater China |

| Net Sales | $102 million | •-4% vs. Q3 2023 |

| | •-5% constant currency vs. Q3 2023 |

| | •-11% sequentially |

| Active Customers | 243,000 | •+6% vs. Q3 2023 |

| | •-3% sequentially |

| North Asia |

| Net Sales | $21 million | •-15% vs. Q3 2023 |

| | •-12% constant currency vs. Q3 2023 |

| | •+4% sequentially |

| Active Customers | 41,000 | •-16% vs. Q3 2023 |

| | •-2% sequentially |

| Southeast Asia Pacific |

| Net Sales | $37 million | •-5% vs. Q3 2023 |

| | •-6% constant currency vs. Q3 2023 |

| | •+5% sequentially |

| Active Customers | 76,000 | •-8% vs. Q3 2023 |

| | •-1% sequentially |

Greater China: Net sales and local currency sales in mainland China decreased 4% and 5% year-over-year, respectively. Active Customers in this market increased 7% year-over-year against a favorable comparison. Sequentially, regional performance was impacted by our mainland China market, where net sales and Active Customers decreased 13% and 3%, respectively. The primary driver of year-over-year and sequential performance is largely attributable to weakening macroeconomic conditions, which is negatively impacting consumer discretionary income and contributed to lower average spend per customer during the quarter.

North Asia: Net sales and local currency sales in South Korea declined 15% and 13% year-over-year, respectively, and Active Customers declined 17%. On a sequential basis, net sales and local currency sales increased 4% and 3%, respectively, while Active Customers declined 2%. Year-over-year declines reflect, in great part, a challenging environment due to macroeconomic weakness. We did, however, report sequential sales growth in this region through continued investments in promotional activity designed to support and generate positive growth momentum.

Southeast Asia Pacific: Net sales and local currency sales in Malaysia decreased 3% and 6% year-over-year, respectively, while Active Customers declined 17% year-over-year. Sequentially, net sales in Malaysia increased 6% (flat in local currency) and Active Customers decreased 4%. Year-over-year results reflect lower relative promotional activity. In the Philippines, net sales and local currency sales declined 11% and 9% year-over-year, respectively, while Active Customers were 5% lower. Sequentially, net sales and local currency sales in the Philippines grew 4% and 3%, respectively, while Active Customers increased 6%. Year-over-year results reflect cautious consumer sentiment in this market while sequential results reflect relatively stable levels of sales and customer counts since the beginning of the year.

| | | | | | | | |

| Americas and Europe Region |

| Net Sales | $40 million | •-7% vs. Q3 2023 |

| | •-6% constant currency vs. Q3 2023 |

| | •-5% sequentially |

| | •20% of consolidated net sales |

| Active Customers | 92,000 | •-10% vs. Q3 2023 |

| | •-7% sequentially |

Americas and Europe Region: Net sales and local currency sales in Canada decreased 6% and 4%, respectively, while Active Customers decreased 6%. Both net sales and Active Customers in the United States declined 9% year-over-year. Sequentially, net sales and local currency sales in Canada decreased 7% and 8%, respectively, while Active Customers declined 9%. In the United States, net sales declined 1% sequentially while Active Customers were 5% lower. Results in both markets reflect a challenging environment for attracting new customers as consumer discretionary spending remains pressured.

Fiscal Year 2024 Outlook

The Company is updating its net sales and earnings per share outlook for fiscal year 2024, as follows:

| | | | | | | | |

Fiscal Year 2024 Outlook |

| Target | Previous Range |

| Consolidated Net Sales | $850 million | $850 - $880 million |

| Diluted EPS | $2.45 | $2.40 - $2.55 |

Our updated outlook for the year reflects:

•An unfavorable currency exchange rate impact on net sales of around $11 million (previously unfavorable impact of approximately $20 million).

•An operating margin of approximately 8.5% (previously 8.0% to 8.8)

•An annual effective tax rate of approximately 43.5% (previously 43% to 44%)

•An annualized diluted share count of 19.1 million (previously 19.2 million)

Despite the challenging macroeconomic environment, USANA is well positioned to benefit from the growing consumer focus on personal health and wellness. We will continue to invest in

organic strategic initiatives with an Associate-first mentality, expand and enhance our best-in-class products, and evaluate accretive business development opportunities. While it will take time to fully realize the rewards of these efforts, we are confident that the successful execution of these strategies will position USANA to return to sustainable long-term growth.

Jim Brown

President and CEO

Douglas Hekking

CFO

Safe Harbor

This Management Commentary contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. Our actual results could differ materially from those projected in these forward-looking statements, which involve a number of risks and uncertainties, including: global economic conditions generally, including continued inflationary pressure around the world and negative impact on our operating costs, consumer demand and consumer behavior in general; reliance upon our network of independent Associates; risk that our Associate compensation plan, or changes that we make to the compensation plan, will not produce desired results, benefit our business or, in some cases, could harm our business; risk associated with governmental regulation of our products, manufacturing and direct selling business model in the United States, China and other key markets; potential negative effects of deteriorating foreign and/or trade relations between or among the United States, China and other key markets; potential negative effects from geopolitical relations and conflicts around the world, including the Russia-Ukraine conflict and the conflict in Israel; compliance with data privacy and security laws and regulations in our markets around the world; potential negative effects of material breaches of our information technology systems to the extent we experience a material breach; material failures of our information technology systems; adverse publicity risks globally; risks associated with commencing operations in India and future international expansion and operations; uncertainty relating to the fluctuation in U.S. and other international currencies; and the potential for a resurgence of COVID-19, or another pandemic, in any of our markets in the future and any related impact on consumer health, domestic and world economies, including any negative impact on discretionary spending, consumer demand, and consumer behavior in general. The contents of this Management Commentary should be considered in conjunction with the risk factors, warnings, and cautionary statements that are contained in our most recent filings with the Securities and Exchange Commission. The forward-looking statements in this Management Commentary set forth our beliefs as of the date hereof. We do not undertake any obligation to update any forward-looking statement after the date hereof or to conform such statements to actual results or changes in the Company’s expectations, except as required by law.

Non-GAAP Financial Measures

The Company prepares its financial statements using U.S. generally accepted accounting principles (“U.S. GAAP” or “GAAP”). Constant currency net sales, earnings, EPS and other currency-related financial information (collectively, “Financial Results”) are non-GAAP financial measures that remove the impact of fluctuations in foreign-currency exchange rates (“FX”) and help facilitate period-to-period comparisons of the Company’s Financial Results that we believe provide investors an additional perspective on trends and underlying business results. Constant currency Financial Results are calculated by translating the current period's Financial Results at the same average exchange rates in effect during the applicable prior-year period and then comparing this amount to the prior-year period's Financial Results.

| | | | | |

| |

| Investor contact: | Andrew Masuda |

| Investor Relations |

| (801) 954-7210 |

| investor.relations@usanainc.com |

| |

| Media contact: | 801-954-7280 |

| media@usanainc.com |

| |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

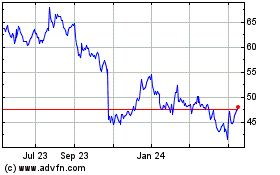

USANA Health Sciences (NYSE:USNA)

Historical Stock Chart

From Dec 2024 to Jan 2025

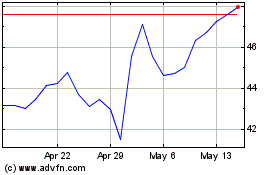

USANA Health Sciences (NYSE:USNA)

Historical Stock Chart

From Jan 2024 to Jan 2025