UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February 2025

Commission File Number 001-15030

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F o

INCORPORATION

BY REFERENCE

This report is incorporated by reference in the registration

statements on Form F-3/A filed by us and Vale Overseas Limited with the U.S. Securities and Exchange Commission (“SEC”) on April 25, 2023 (File Nos. 333-271248 and 333-271248-01), and shall be deemed to be a part thereof from the date on which this report is

furnished to the SEC, to the extent not superseded by documents or reports subsequently filed or furnished.

This report incorporates by reference our

current report on Form 6-K/A

furnished to the SEC on February 21, 2025 (SEC Accession No: 0001292814-25-000508), containing our audited consolidated

financial statements as of December 31, 2024 and for the three years ended December 31, 2024 (the

“Consolidated Financial Statements”), prepared and presented in accordance with the International Financial Reporting

Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”), our Management’s Report on Internal Control over Financial Reporting and the

related Report of Independent Registered Public Accounting Firm, which are accordingly

incorporated by reference in the registration statements on Form F-3 referred to in the preceding paragraph.

TABLE

OF CONTENTS

Results

of operations for the YEARS ended

DECEMBER 31, 2024, and DECEMBER 31, 2023

For the year ended December 31, 2024, we

recorded a net income of US$5,975 million, compared to US$8,105 million in 2023. Our Adjusted EBITDA decreased to US$14,840 million in

2024, from US$18,601 million in 2023, mainly due to lower average realized prices of iron ore fines and pellets, which had an impact

of US$3,754 million. Consolidated Adjusted EBITDA is a non-GAAP financial measure; for a reconciliation with our net income, see “—Reconciliation

of Consolidated Adjusted EBITDA” below. The decrease in average realized prices for iron ore was slightly offset by increased

volume of sales of iron ore. See “—Results of Operations by Segment – Sales Volumes” below.

For commentary on our results of operations for the year 2023 compared with 2022,

please see pages 129-136 of our Form 20-F for the year ended December 31, 2023.

Consolidated

income statement data

| |

For the year ended December 31, |

|

| |

2024 |

2023 |

% change |

| |

(US$ million, except for %) |

|

| Net operating revenue |

38,056 |

41,784 |

(8.9) |

| Cost of goods sold and services rendered |

(24,265) |

(24,089) |

0.7 |

| Gross profit |

13,791 |

17,695 |

(22.1) |

| |

|

|

|

| Operating expenses |

|

|

|

| Selling and administrative |

(622) |

(553) |

12.5 |

| Research and development |

(790) |

(723) |

9.3 |

| Pre-operating and operational stoppage |

(403) |

(450) |

(10.4) |

| (Impairment), reversal of impairment and gains (losses) on disposal of non-current assets, net |

301 |

(266) |

(213.2) |

| Other operating revenues (expenses), net |

(1,489) |

(1,498) |

(0.6) |

| Operating income |

10,788 |

14,205 |

(24.1) |

| |

|

|

|

| Financial income |

422 |

432 |

(2.3) |

| Financial expenses |

(1,473) |

(1,459) |

1.0 |

| Other financial items, net |

(2,772) |

(919) |

201.6 |

| Equity results and other results in associates and joint ventures |

(269) |

(1,108) |

(75.7) |

| Income before income taxes |

6,696 |

11,151 |

(40.0) |

| |

|

|

|

| Income taxes |

(721) |

(3,046) |

(76.3) |

| |

|

|

|

| Net income |

5,975 |

8,105 |

(26.3) |

| (Loss) net income attributable to noncontrolling interests |

(191) |

122 |

(256.6) |

| Net income attributable to Vale’s shareholders |

6,166 |

7,983 |

(22.8) |

Consolidated

Revenue

In 2024, our net operating revenue decreased by US$3,728

million, or 8.9%, to US$38,056 million, from US$41,784 million recorded in 2023. The decrease was mainly due to the 7.8% drop in the realized

average prices of iron ore fines and pellets, with an impact of US$3,754 million.

Net

operating revenue by destination

The following table summarizes, for each of the years

indicated, the distribution of our net operating revenue based on the geographical location of our customers.

| |

For the year ended December 31, |

| |

2024 |

2023 |

| |

(US$ million) |

(% of total) |

(US$ million) |

(% of total) |

| Asia |

|

|

|

|

| China(1) |

19,375 |

50.9 |

22,210 |

53.2 |

| Japan |

3,050 |

8.0 |

3,219 |

7.7 |

| Other |

2,887 |

7.6 |

2,675 |

6.4 |

| Asia – total |

25,312 |

66.5 |

28,104 |

67.3 |

| America |

|

|

|

|

| United States |

1,075 |

2.8 |

1,623 |

3.9 |

| Brazil |

3,565 |

9.4 |

3,755 |

9.0 |

| Other |

970 |

2.5 |

897 |

2.1 |

| America – total |

5,610 |

14.7 |

6,275 |

15.0 |

| Europe |

|

|

|

|

| Germany |

1,467 |

3.9 |

1,351 |

3.2 |

| Other |

3,019 |

7.9 |

3,677 |

8.8 |

| Europe – total |

4,486 |

11.8 |

5,028 |

12.0 |

| Rest of the world (2) |

2,648 |

7.0 |

2,377 |

5.7 |

| Total |

38,056 |

100.0 |

41,784 |

100.0 |

| |

|

|

|

|

(1) In

2024, corresponds to 95.8% (2023: 97.2%) for China Mainland and 4.2% for Taiwan (2023: 2.8%).

(2) Corresponds

to Middle East, Africa, and Oceania

Consolidated

Operating Costs and Expenses

Our cost of goods sold and services rendered totaled

US$24,265 million in 2024, an increase from US$24,089 million recorded in 2023, mainly due to higher spot freight prices of iron ore fines

and pellets, with an impact of US$498 million, partially offset by lower costs associated with the acquisition of third-party products,

with an impact of US$295 million.

Our research and development expenses totaled US$790

million in 2024, a 9.3% or US$67 million increase from US$723 million recorded in 2023, mainly due to projects related to decarbonization,

efficiency and environmental innovation, development of mega hubs and mineral exploration.

Our pre-operating

and operational stoppage expenses totaled US$403 million in 2024, a 10.4% or US$47 million decrease from US$450 million recorded in 2023,

mainly due to the resumption of operations at Viga, Mutuca, Capão Xavier and Vargem Grande.

Impairment or reversal

of impairment and gains or losses on disposal of non-current assets, net, totaled a gain of US$301 million compared to a loss of US$266

million recorded in 2023, mainly due to the gain from the divestments in PT Vale Indonesia Tbk and Vale Oman Distribution Center in the

amounts of US$1,059 million and US$1,222 million, respectively, net of the impairment losses on nickel assets in Thompson and Newfoundland

and Labrador in the amounts of US$1,405 million and US$540 million, respectively.

Our other operating expenses, net, totaled US$1,489

million in 2024, in line with US$1,498 million recorded in 2023.

For a description of our other operating expenses,

see note 6 (c) to our Consolidated Financial Statements.

Results

of Operations by Segment

Sales

volumes

The following table sets forth our principal products

and the total volumes sold of each product in each of the years indicated:

| |

For the year ended December 31, |

|

| |

2024 |

2023 |

% change |

| |

(thousand metric tons, except for %) |

|

| Iron Solutions |

|

|

|

| Iron ore fines |

260,314 |

256,789 |

1.4 |

| Iron ore pellets |

38,300 |

35,840 |

6.9 |

| ROM (run of mine) |

8,038 |

8,290 |

(3.0) |

| Energy Transition Metals |

|

|

|

| Nickel and other products |

155 |

168 |

(7.7) |

| Copper |

250 |

234 |

6.8 |

| Copper as nickel co-product |

77 |

74 |

4.1 |

| |

|

|

|

Average

realized prices

The following table sets forth our average realized

prices for our principal products for each of the years indicated. We determine average realized prices based on our net operating revenues,

which consist of the price charged to customers, excluding certain items that we deduct in arriving at net operating revenues, mainly

value-added tax.

| |

For the year ended December 31, |

|

| |

2024 |

2023 |

% change |

| |

(US$ per metric ton, except for %) |

|

| Iron Solutions |

|

|

|

| Iron ore fines |

95 |

108 |

(12.0) |

| Iron ore pellets |

155 |

162 |

(4.9) |

| Energy Transition Metals |

|

|

|

| Nickel |

17,078 |

21,830 |

(21.8) |

| Copper |

8,811 |

7,960 |

10.7 |

| Copper as nickel by-product |

8,413 |

7,720 |

9.0 |

| |

|

|

|

We discuss below, for each segment, the changes in

our net operating revenues, cost of goods sold and services rendered (excluding depreciation, depletion and amortization) and Adjusted

EBITDA. The expenses incurred in connection with remediation, indemnification and donations in respect of the Brumadinho dam failure are

not directly related to our operating activities and are therefore not allocated to any operating segment.

Net

operating revenue by segment

The following table summarizes our net operating

revenue by product for the years indicated.

| |

For the year ended December 31, |

|

| |

2024 |

2023 |

% change |

| |

(US$ million, except for %) |

| Iron Solutions |

|

|

|

| Iron ore |

24,805 |

27,760 |

(10.6) |

| Iron ore pellets |

5,921 |

5,803 |

2.0 |

| Other ferrous products and services |

718 |

516 |

39.1 |

| Iron Solutions – total |

31,444 |

34,079 |

(7.7) |

| Energy Transition Metals |

|

|

|

| Nickel and other products |

3,666 |

5,193 |

(29.4) |

| Copper |

2,805 |

2,376 |

18.1 |

| Other energy transition metals |

141 |

- |

n.m. |

| Energy Transition Metals – total |

6,612 |

7,569 |

(12.6) |

| Other (1) |

- |

136 |

(100.0) |

| Total |

38,056 |

41,784 |

(8.9) |

| |

|

|

|

| (1) | The effects previously presented as “Other” were allocated to each segment starting from the

year ended December 31, 2024. For more information, see “—Adjusted EBITDA by segment.” |

Net

operating revenues from sales of:

Iron

Solutions. Total of US$31,444

million in 2024, a 7.7% or US$2,635 million decrease from US$34,079 million in 2023, mainly reflecting the 7.8%

drop in the average realized prices of iron ore fines and pellets, with an impact of US$ 3,754

million, partially offset by the 2.0% increase in the sales volumes of iron ore fines and pellets,

with an impact of US$917 million.

Energy Transition

Metals. Total of US$6,612 million in 2024, a 12.6% or US$957 million decrease from US$7,569 million in 2023, mainly reflecting

the 21.8% drop in the realized prices of nickel, with an impact of US$787 million, and a 7.7% decrease in nickel sales volumes due to

planned maintenance in Ontario and furnace overhaul in Onça Puma, with an impact of US$112 million.

Cost

of goods sold and services rendered by segment (excluding depreciation, depletion and amortization)

The following table presents, for each year indicated,

our cost of goods sold and services rendered (excluding depreciation, depletion and amortization) by segment and the percentage change

from year to year.

| |

For the year ended December 31, |

|

| |

2024 |

2023 |

% change |

| |

(US$ million, except for %) |

| Iron Solutions |

|

|

|

| Iron ore |

12,846 |

12,357 |

4.0 |

| Iron ore pellets |

2,920 |

2,759 |

5.8 |

| Other ferrous products and services |

556 |

335 |

66.0 |

| Iron Solutions – total |

16,322 |

15,451 |

5.6 |

| Energy Transition Metals |

|

|

|

| Nickel and other products |

3,414 |

4,169 |

(18.1) |

| Copper |

1,472 |

1,357 |

8.5 |

| Other energy transition metals |

154 |

- |

n.m. |

| Energy Transition Metals – total |

5,040 |

5,526 |

(8.8) |

| Other(1) |

- |

196 |

(100.0) |

| Total (excluding depreciation, depletion and amortization) |

21,362 |

21,173 |

0.9 |

| Depreciation, depletion and amortization |

2,903 |

2,916 |

(0.4) |

| Total (including depreciation, depletion and amortization) |

24,265 |

24,089 |

0.7 |

| (1) | The effects previously presented as “Other”

were allocated to each segment starting from the year ended December 31, 2024. For more information, see “— Adjusted EBITDA

by segment.” |

Cost of goods sold and

services rendered from:

Iron

Solutions (excluding depreciation, depletion and amortization). Increased

by 5.6% or US$871 million in 2024 to US$16,322 million from US$15,451 million in 2023. This increase primarily reflects higher spot freight

prices (impact of US$338 million) and improvements to the production process mainly in the North and Southeast system (impact of US$286

million).

Energy Transition

Metals (excluding depreciation, depletion and amortization). Decreased by 8.8% or US$486

million in 2024 to US$5,040 million from US$5,526 million in 2023. This decrease primarily reflects lower costs associated with the acquisition

of third-party products (impact of US$295 million) and a 7.7% decrease in nickel sales volume due to planned maintenance in Ontario and

furnace overhaul in Onça Puma (impact of US$123 million).

Adjusted

EBITDA by segment

Our management uses Adjusted EBITDA as the measure

to assess the contribution of each segment to our performance and to support decision-making in allocating resources. Adjusted EBITDA

for each segment is defined as operating income or loss, for such segment, (a) adding the EBITDA from interests in associates and joint

ventures and (b) excluding (i) depreciation, depletion and amortization and (ii) (impairment), reversal of impairment and gains (losses)

on disposal of non-current assets, net and other.

In 2024, our chief operating decision maker

(CODM) changed our Adjusted EBITDA definition, as compared to the definition we used in 2023 and prior years, to replace, for each

segment, “dividends received from associates and joint ventures” with the “EBITDA from associates and joint

ventures”, which is a measure of our “equity results” excluding (i) net finance costs; (ii) depreciation,

depletion, and amortization; (iii) taxation and (iv) (impairment), reversal of impairment and gains (losses) on disposal of

non-current assets, net.

The comparative information in our Consolidated Financial

Statements was revised to reflect this change in the Adjusted EBITDA definition. The effect of the inclusion of the “EBITDA from

associates and joint ventures” and the exclusion of “dividends received from associates and joint ventures” in our Consolidated

Adjusted EBITDA for the years ended December 31, 2024, and December 31, 2023, is US$940 million and US$844 million, respectively.

Our CODM believes this revision provides investors

with a better view of the performance of our operating segments, as it reflects our proportional interest in the performance of our associates

and joint ventures operating in the same segment. For more information, see note 5 to our Consolidated Financial Statements.

Additionally, as a result of the reorganization

of assets and the governance structure established for the Energy Transition Metals segment, following the sale of a noncontrolling interest

in this segment (for more information, see note 17(e) to our Consolidated Financial Statements), the “Other” segment was

reorganized to better allocate the effects thereunder to each of the Iron Solutions and Energy Transition Metals segments. These effects

have been allocated to each segment starting from the year ended December 31, 2024.

The following table summarizes our Adjusted EBITDA

for each of our segments.

| |

For the year ended December 31, |

|

| |

2024 |

2023 |

% change |

| |

(US$ million, except for %) |

|

| Iron Solutions |

|

|

|

| Iron ore |

11,598 |

15,205 |

(23.7) |

| Iron ore pellets |

3,166 |

3,136 |

1.0) |

| Other ferrous products and services |

321 |

473 |

(32.1) |

| Iron Solutions – total |

15,085 |

18,814 |

(19.8) |

| Energy Transition Metals |

|

|

|

| Nickel |

114 |

851 |

(86.6) |

| Copper |

1,521 |

1,100 |

38.3 |

| Other energy transition metals |

(182) |

12 |

(1,616.7) |

| Energy Transition Metals – total |

1,453 |

1,963 |

(26.0) |

| Other (1) |

(1,698) |

(2,176) |

(22.0) |

| Adjusted EBITDA |

14,840 |

18,601 |

(20.2) |

| (1) | Includes revenues and expenses of other products, services,

research and development, investments in joint ventures and associates of other business and corporate expenses unallocated to the reportable

segments, as well the costs related to the Brumadinho event. |

Adjusted

EBITDA from:

Iron

Solutions. Total of US$15,085 million in 2024, a decrease

of US$3,729 million or 19.8%, when compared to our Adjusted EBITDA of US$18,814 million in 2023. This decrease mainly reflects lower

average realized prices of iron ore fines and pellets, which had an impact of US$3,754 million.

Energy

Transition Metals. Total

of US$1,453 million in 2024, a decrease of US$510 million or 26.0%, when compared to our Adjusted EBITDA of US$1,963 million in 2023.

This reduction mainly reflects

lower average realized prices of nickel, with an impact of US$787 million, offset by an increase in the average realized prices of copper,

with an impact of US$214 million.

FINANCIAL

RESULTS

The following table details our financial results

for the years indicated.

| |

For the year ended December 31, |

|

| |

2024 |

2023 |

% change |

| |

(US$ million, except for %) |

|

| Financial income (1) |

422 |

432 |

(2.3) |

| Financial expenses (2) |

(1,473) |

(1,459) |

1.0 |

| Foreign exchange and indexation gains (losses), net |

(1,388) |

(1,643) |

(15.5) |

| Participative shareholders' debentures |

(175) |

(179) |

(2.2) |

| Derivatives financial instruments, net |

(1,209) |

903 |

(233.9) |

| Total |

(3,823) |

(1,946) |

96.5 |

| (1) | Includes short-term investments and other financial

income (see note 7 to our Financial Statements). |

| (2) | Includes loans and borrowings interest, interest on supplier

finance arrangements, interest expenses of REFIS (a tax settlement program), interest on lease liabilities and others financial expenses

(see note 7 to our Financial Statements). |

In 2024, our financial results were mostly impacted

by a loss of US$1,209 million related to mark-to-market adjustments in our derivatives financial instruments, following the Brazilian real depreciation

by 27.9% against the U.S. dollar in 2024, compared to a gain of US$903 million associated with a 7.2% appreciation of the Brazilian real against

the U.S. dollar in 2023. These derivatives financial instruments are swaps primarily used to convert debt denominated in Brazilian reais into

U.S. dollars to protect our cash flow from exchange rate volatility.

EQUITY

RESULTS AND OTHER RESULTS IN ASSOCIATES AND JOINT VENTURES

In 2024, we recorded a loss in equity results and

other results in associates and joint ventures of US$269 million, a reduction of US$839 million compared to a loss of US$1,108 million

in 2023. In 2024, our equity results and other results in associates and joint ventures were mostly impacted by an expense of US$956 million

associated to the increase in the provision relating to Samarco’s dam failure due to the Definitive Settlement (as defined below),

partially offset by a gain of US$305 million from the remeasurement to fair value of the equity interest we previously held in connection

with the acquisition of Aliança Geração de Energia S.A., compared to an expense of US$1,200 million in 2023 associated

to the increase in the provision relating to Samarco’s dam failure due to changes in estimates based on all information available

at that time about the status of a potential settlement agreement.

Income

taxes

In 2024, we recorded an income tax expense of US$721

million, a reduction of US$2,325 million compared to the income tax expense of US$3,046 million recorded in 2023, mainly due to a 40%

reduction in taxable income following the recognition of gains arising from acquisitions and divestitures, which has no tax impacts. The

reconciliation of taxes calculated at nominal tax rates and the amount of taxes recorded at effective rate is presented in note 9 to our

Financial Statements.

Net

income and losses

For the reasons discussed above, our net income attributable

to our shareholders in 2024 was US$6,166 million, compared to US$7,983 million in 2023.

Reconciliation

of consolidated adjusted EBITDA

Adjusted EBITDA is a non-GAAP measure, which is calculated

based on the operating income or loss and (a) adding the EBITDA from interests in associates and joint ventures and (b) excluding (i)

depreciation, depletion and amortization and (ii) (impairment), reversal of impairment and gains (losses) on disposal of non-current assets,

net. Our management uses Adjusted EBITDA as an additional measure of our consolidated performance.

In 2024, our CODM changed our Adjusted EBITDA

definition. For more information, see “—Adjusted EBITDA by segment” and note 5 to our Consolidated Financial Statements.

The table below shows a reconciliation of

our consolidated Adjusted EBITDA with our consolidated net income or loss for the years indicated.

| |

For the year ended December 31, |

| |

2024 |

2023 |

| |

(US$ million) |

| Net income attributable to Vale’s shareholders |

6,166 |

7,983 |

| (Loss) net income attributable to non-controlling interests |

(191) |

122 |

| Net income |

5,975 |

8,105 |

| Income taxes |

721 |

3,046 |

| Equity results and other results in associates and joint ventures |

269 |

1,108 |

| Financial results, net |

3,823 |

1,946 |

| Depreciation, depletion and amortization |

3,057 |

3,070 |

| EBITDA from associates and joint ventures |

940 |

844 |

| (Impairment), reversal of impairment and gains (losses) on disposal of non-current assets, net and other (1) |

55 |

482 |

| Adjusted EBITDA |

14,840 |

18,601 |

| (1) | Includes an adjustment of US$356 million for the year ended December 31, 2024 (2023: US$216 million),

to reflect the performance of streaming transactions at market prices. |

In 2024, our consolidated Adjusted EBITDA

decreased to US$14,840 million from US$18,601 million in 2023, mainly due to the 7.8% drop in the realized average prices of iron ore

fines and pellets, with an impact of US$3,754 million.

Liquidity

and Capital Resources

Our principal funding requirements are for

capital expenditures, dividends payments, share buybacks, debt service, tax payments, dam de-characterization and satisfaction of our

obligations relating to the remediation and compensation of damages in connection with the Brumadinho dam failure and any contribution

we may be required to make in connection with the Fundão dam failure, pursuant to the Definitive Settlement (as defined below).

We expect to meet these requirements, in line with our historical practice, by using cash generated from operating activities and financing

activities.

Our investment guidance for capital expenditures

in 2025 and thereafter is approximately US$6.2 billion. A principal amount of US$836 million of our debt matures in 2025. We expect to

incur a total amount of US$3,113 million relating to the remediation and compensation in connection with the Brumadinho and Fundão

dam failures and de-characterization of dams in 2025 and after 2025 our aggregate expected expenses with provision is US$6,253 million.

We have an aggregate principal amount of US$2,690 million debt maturing between 2026 and 2028, and US$11,082 million maturing after 2028.

We expect that our existing cash and cash equivalents and our operating cash flows will be sufficient to satisfy our obligations due in

2025 and thereafter. We are constantly evaluating opportunities for additional cash generation. Finally, we are committed to further reducing

our costs and expenses, and maintaining sound leverage levels and discipline in capital allocation.

Sources

of funds

Our principal sources of funds are our operating

cash flow and financing activities. In 2024, the net cash flow generated by operating activities was US$9,366 million, compared to US$13,165

million in 2023. The amount of operating cash flow is strongly affected by global prices for our products, and this decrease in 2024

was mainly due to the decline in the average realized prices for iron ore fines and pellets and nickel, with an impact of US$4,541 million,

partially offset by the increase in the volume of iron ore fines and pellets, with an impact of US$917 million.

As of December 31, 2024, our cash, cash equivalents

and short-term investments totaled US$5,006 million compared to US$3,660 million as of December 31, 2023.

In 2024, we borrowed US$4,855 million, including

(a) an amount in Brazilian reais equivalent to approximately US$1,000 million in Brazilian debentures, in three series, at a rate of IPCA

plus 6.38% to 6.44% per year, maturing in 2034, 2036 and 2039, (b) US$1,000 million in bonds, with a 6.400% coupon per year, maturing

in 2054; and (c) other loans and borrowings, mainly indexed to SOFR plus a spread, maturing from 2024 to 2035. In 2023, we borrowed US$1,950

million, including (a) US$1,500 million in bonds, with a 6.125% coupon per year, maturing in 2033, and (b) other loans and borrowings,

at a rate of SOFR plus a spread, maturing in 2028.

Uses

of funds

Reparation

obligations

In 2024, we used a total amount of cash of

US$1,287 million (US$1,814 million in 2023) in matters related to the Brumadinho dam failure, of which US$583 million were used in connection

with obligations assumed under settlement agreements (US$1,004 million in 2023), US$326 million in individual indemnification and other

commitments (US$326 million in 2023) and US$378 million in connection to incurred expenses (US$484 million in 2023).

In 2024, we used a total of US$808 million in cash

for remediation obligations related to Samarco’s dam failure, compared to US$553 million in 2023. For more information, see note

27(a) to our Financial Statements.

In 2024, we also used US$533 million in cash for

matters related to the de-characterization of dams, compared to US$458 million in 2023. For more information, see note 28 to our Financial

Statements.

Acquisition

of property, plant and equipment and intangible assets

Our acquisition of property, plant and equipment

and intangible assets in 2024 totaled US$6.4 billion, compared to US$5.9 billion in 2023, including US$4.5 billion (compared to US$4.3

billion in 2023) dedicated to sustaining our existing operations and US$1.5 billion (compared to US$1.7 billion in 2023) allocated to

project execution (construction in progress).

Our investment guidance for acquisition of property,

plant and equipment and intangible assets in 2025 is approximately US$6.2 billion, to sustain our production, support our low-carbon agenda

initiatives, and seize accretive growth opportunities.

Distributions

and share buyback

Distributions. In

2024, we approved dividends and interest on capital to our shareholders totaling US$4,360 million. On February 19, 2025, the Board of

Directors approved remuneration to shareholders in the total amount of US$1,596 million.

Share buyback.

In 2024, we repurchased 30,923,573 common shares (including common shares in the form of ADRs) at an average price of US$13.23 per share,

totaling US$409 million. On February 19, 2025, the Board of Directors has approved, a new share buyback program for the acquisition of

up to 120 million common shares within a period of 18 months.

Tax

payments

We paid US$1,462 million in income tax in 2024, excluding

the payments in connection with REFIS (a tax settlement program), compared to US$1,487 million in income tax in 2023. In 2024, we paid

a total of US$397 million in connection with the REFIS, compared to US$403 million in 2023.

Liability

Management

In 2024, we repaid US$2,605 million (compared to

US$658 million in 2023) under our financing agreements.

Debt

As of December 31, 2024, our total outstanding

debt (including loans and borrowings) was US$14,792 million (including US$14,608 million of principal and US$184 million of accrued charges)

compared to US$12,471 million as of December 31, 2023.

As of December 31, 2024, we had loans and

borrowings amounting to US$1,091 million secured by fixed assets and the weighted average of the remaining term of our debt was 8.7 years,

compared to 7.9 years in 2023.

As of December 31, 2024, our current loans

and borrowings was US$1,020 million compared to US$824 million in 2023, including accrued interest.

Our major categories of non-current loans and borrowings

are described below. The principal amounts shown below, excluding accrued interest.

| · | U.S. dollar-denominated fixed rate notes as of December 31, 2024,

was US$7,187 million compared to US$7,157 million as of December 31, 2023. We have issued in public offerings several series of fixed

rate debt securities, directly by Vale and through our wholly owned finance subsidiary Vale Overseas Limited (debt securities guaranteed

by Vale) totaling US$6,908 million, compared to US$6,878 million in 2023. Our subsidiary Vale Canada has outstanding fixed rate note in the amount

of US$279 million as of December 31, 2024, compared to US$279 million as of December 31, 2023. |

| · | U.S. dollar-denominated debt

contracts in the international market as of December 31, 2024, was US$5,042 million compared to US$3,945 million as of December 31,

2023. This category includes export financing lines, loans from export credit agencies, and loans from commercial banks and multilateral

organizations. |

| · | Other debt as of December 31,

2024, was US$1,543 million compared to US$545 million as of December 31, 2023. We have outstanding debt, principally owed to BNDES, Brazilian

commercial banks and holders of infrastructure debentures, denominated in Brazilian reais and other currencies. |

As of December 31, 2024, we have two revolving

credit facilities with syndicates of international banks, which will mature in 2026 and 2029. The revolving credit lines, which are committed,

allow more efficient cash management, consistent with our strategic focus on reducing cost of capital. We currently have US$5 billion

available under these two revolving credit lines which can be drawn by Vale, Vale Canada and Vale International.

Some of our long-term debt instruments contain

financial covenants and most include cross acceleration provisions. 18.2% of the aggregate principal amount of our total debt require

that we maintain, as of the end of each fiscal year, (i) a consolidated ratio of total debt to adjusted EBITDA for the past 12 months

not exceeding 4.5 to one and (ii) a consolidated interest coverage ratio of at least 2.0 to one. These covenants appear in our financing

agreements with BNDES, with other export and development agencies and with some other lenders. We complied with these covenants as of

December 31, 2024, and 2023.

As of December 31, 2024, the corporate financial

guarantees we provided (within the limit of our direct or indirect interest) for certain associates and joint ventures totaled US$210

million, compared to US$274 million in 2023.

Recent

Developments

Novo

CarajÁs program

In February 2025, we launched the Novo Carajás

Program. This program focuses on optimizing our iron ore production and accelerating copper production growth in the Carajás region,

a mineral-rich province critical to global decarbonization and energy transition. The initiative encompasses strategic investments in

technology, health and safety protocols, operations and equipment maintenance, and sustainability measures, leveraging our operational

expertise in the region. These investments support our previously announced production guidance and strengthen our commitment to sustainable

mining practices.

DEFINITIVE

SETTLEMENT RELATING TO SAMARCO

In October 2024, we, together with Samarco and BHP

Brasil Ltda., entered into an agreement with the federal government, the governments of the states of Minas Gerais and Espírito

Santo, the Federal and State Public Prosecutors’ Offices, and the Federal and State Public Defender’s Offices of the states

of Minas Gerais and Espírito Santo and other federal and state governmental authorities, providing for the complete and definitive

conclusion of the reparation and compensation process relating to the Fundão’s dam failure (the “Definitive Settlement”).

In November 2024, the Federal Supreme Court (Supremo Tribunal Federal – STF) ratified the Definitive Settlement. For a more detailed

discussion of the Definitive Settlement, see notes 3 and 27 to our Consolidated Financial Statements.

Pursuant to the Definitive Settlement, several existing

lawsuits against us and Samarco were extinguished. In addition,

Fundação Renova was dissolved, and

its liquidation process was initiated, with a 12-month transition period for the completion of the transfer of rights and obligations

to Samarco. Samarco remains the primary responsible party for fulfilling payment and performance obligations set forth in the Definitive

Settlement, including the completion of certain outstanding programs previously managed by Fundação Renova. As a shareholder

of Samarco, we committed to paying up to 50% of any amounts that Samarco fails to fund as the primary obligor.

Agreement

with BHP regarding UK and Netherlands Claims

In July 2024, we entered into an agreement with BHP

Group Limited and BHP Group (UK) Ltd (“BHP Defendants”) and BHP Brasil, regarding legal proceedings in the United Kingdom

and the Netherlands related to the failure of Samarco’s Fundão dam. Under this agreement, which was reached without any admission

of liability, the BHP Defendants agreed to withdraw the contribution claim that they had filed against us in connection with the group

action in the UK, and the parties agreed that any potential liability that may be imposed in either the group action against BHP in the

UK or proceedings against us in the Netherlands would be shared equally between BHP Brasil or the BHP Defendants, on one hand, and Vale,

on the other hand.

RAILWAY

CONCESSION CONTRACTS RENEGOTIATION

In December 2024, we established with the federal

government (through the Ministry of Transportation and the Brazilian National Land Transportation Agency – ANTT), the general framework

for the renegotiation of the concession contracts for the Carajás Railway (“EFC”) and the Vitória a Minas Railway

(“EFVM”). The renegotiation will be carried out in accordance with the terms of the concession contracts renewed in 2020,

which remain in force, aiming to promote their modernization and updating. Under this general framework, we have committed to a maximum

global contribution of approximately US$1,890 million, related to the EFC and EFVM’s asset base review, the optimization of contractual

obligations and investment replanning. As a result of the agreed conditions, we recognized an additional provision of US$256 million related

to the railway concessions in 2024. The general framework established for the renegotiation of the concession contracts will comply with

usual formalities and will be submitted to the relevant authorities for evaluation and approval.

Changes

in our Management

Board

of Directors

In November 2024, our shareholders approved the nomination

of Mrs. Heloisa Belotti Bedicks and Mr. Reinaldo Duarte Castanheira Filho as new independent Board members. Both directors took office

to serve the term of the current Board of Directors, which will hold office until our general shareholders’ meeting to be held in

April 2025. Listed below are the current members of our Board of Directors:

| · | Daniel André Stieler

(chairperson) |

| · | Marcelo Gasparino da Silva

(vice-chairperson) |

| · | Fernando Jorge Buso Gomes |

| · | Luis Henrique Cals de Beauclair

Guimarães |

| · | Manuel Lino Silva de Sousa

Oliveira |

| · | Paulo Cesar Hartung Gomes |

| · | Reinaldo Duarte Castanheira

Filho |

Audit

and Risks Committee

In November 2024, our Board of Directors elected

two new members of our Audit and Risks Committee, Mrs. Heloísa Belotti Bedicks and Mr. Reinaldo Duarte Castanheira Filho. Mr. Manuel

Lino Silva de Sousa Oliveira, appointed in July 2024, continued serving as coordinator and financial expert. Listed below are the current

members of our Audit and Risks Committee, which continues to be composed entirely of independent members:

| · | Manuel Lino Silva de Sousa

Oliveira (financial expert) |

| · | Reinaldo Duarte Castanheira

Filho |

Executive

Officers

On September 20, 2024, our Board of Directors

elected Mr. Gustavo Pimenta as our new Chief Executive Officer, who took office on October 1, 2024. Mr. Pimenta had previously served

as our Executive Vice-President of Finance and Investor Relations since 2021. On November 28, 2024, Mr. Rogério Tavares Nogueira

was elected Executive Vice President Commercial and New Business, and took office on December 1, 2024, and on October 24, 2024, Mr. Marcelo

Feriozzi Bacci was elected Executive Vice-President, Finance and Investor Relations, and took office on December 2, 2024. Listed below

are our current executive officers, and biographies of newly appointed officers.

| · | Gustavo Duarte Pimenta (Chief

Executive Officer) |

| · | Marcelo Feriozzi Bacci (Executive

Vice-President, Finance and Investor Relations) |

| · | Alexandre Silva D’Ambrósio

(Executive Vice-President, Corporate and Affairs) |

| · | Carlos Henrique Senna Medeiros

(Executive Vice-President, Operations) |

| · | Rafael Jabur Bittar (Executive

Vice-President, Technical) |

| · | Rogério Tavares Nogueira (Executive

Vice-President Commercial and New Business) |

Marcelo Feriozzi Bacci

Business Experience: For the last 10 years, Mr. Bacci

was the Executive Vice-president of Finance and Investor Relations at Suzano S.A. He also served as Chairman and member of the Board of

Directors of companies in the Suzano Group and other companies in the Brazilian market, such as Energisa S.A. and BRF S.A.

Education: Bachelor’s degree in public administration

from Fundação Getulio Vargas, and MBA degrees from Stanford Graduate School of Business and IBMEC – Brazilian Capital

Market Institute.

Rogério Tavares Nogueira

Business Experience: Mr. Nogueira served as Head

of Business and Product Development at Vale and had previously held the positions of Head of Marketing & Strategic Planning and Head

of Controlling & Investor Relations. Before joining Vale, Mr. Nogueira worked for BHP Billiton having held the positions of Vice-President

Iron Ore Americas and Vice-President West-Africa Iron Ore. He was Executive Director of Tupy Fundições and also served as

an Associate Principal at McKinsey & Company.

Education: Mr. Nogueira holds an MBA from the University

of Texas at Austin and both a bachelor’s and a master’s degree in metallurgical engineering from the University of Minas Gerais

(UFMG).

EXHIBIT

INDEX

Exhibit 99: Consent of PricewaterhouseCoopers Auditores Independentes

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VALE S.A.

|

| |

|

| |

|

|

| |

By: |

/s/ Adriana Barbosa Areias |

| |

|

Name: Adriana Barbosa Areias

Title: Attorney-in-fact |

| |

|

|

| |

|

|

| |

By: |

/s/ Rodrigo Sebollela Duque Estrada Regis |

| |

|

Name: Rodrigo Sebollela Duque Estrada Regis

Title: Attorney-in-fact |

| |

|

|

| Date: February 24, 2025 |

|

|

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent

to the incorporation by reference in the Registration Statements on Form F-3 of Vale S.A. (No. 333-271248) and Vale Overseas Limited

(No. 333-271248-01) of our report dated February 19, 2025 relating to the consolidated financial statements and the effectiveness of

internal control over financial reporting, which appears in Vale S.A.'s Form 6-K/A dated February 21, 2025 (No. 001-15030).

We also consent to the reference to us under the heading “Experts” in such Registration Statements.

| |

|

| /s/ PricewaterhouseCoopers Auditores Independentes Ltda. |

|

| Rio de Janeiro, Brazil |

|

| February 24, 2025 |

|

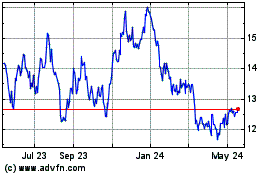

Vale (NYSE:VALE)

Historical Stock Chart

From Jan 2025 to Feb 2025

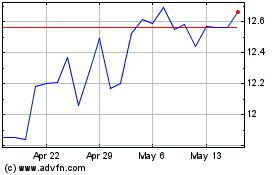

Vale (NYSE:VALE)

Historical Stock Chart

From Feb 2024 to Feb 2025