Vitura Announces the Sale of a Majority Stake in the Passy Kennedy and Office Kennedy Holding Companies

July 10 2024 - 12:00AM

Business Wire

Regulatory News:

Vitura (Paris:VTR) today announced the sale of a majority stake

in the companies holding the Passy Kennedy and Office Kennedy

properties to a European asset manager for an amount of

approximately €14 million, including €10 million paid at closing.

Following the transaction, Vitura is to retain a minority stake and

could be entitled to a share of the value created by the

restructured assets.

The sale will help to finance the works plan aimed at

repositioning Passy Kennedy and Office Kennedy as a 34,000 sq.m

top-class property complex offering a broad range of upscale

amenities including food services, conference facilities, a gym as

well as wellness and social areas. The complex will feature a large

space dedicated to low-carbon mobility and will meet the highest

environmental standards.

As part of this operation, new bank financing of €270 million is

arranged by the companies holding the Passy Kennedy and Office

Kennedy properties.

In particular, the operation will enable the repayment of the

€139 million debt incurred on the acquisition of Passy Kennedy,

which was extended to July 15, 2024.

In Vitura’s financial statements, the transaction will result in

a capital loss of around €80 million on the shares of the companies

holding the Passy Kennedy and Office Kennedy assets. The accounting

impact on the Group will be disclosed in the 2024 interim financial

report.

With this transaction, Vitura is fulfilling a threefold

objective: continuing the redevelopment of the Kennedy property

complex, refinancing a short debt maturity and entering into a

partnership with an investor to finance future renovation work.

Unaudited figures.

Investor Calendar: First-half 2024 results, August 1st,

2024

About Vitura

Created in 2006, Vitura is a listed real estate company (“SIIC”)

that invests in prime office properties in Paris and Greater Paris.

The total value of the portfolio was estimated at €1,307 million at

December 31, 2023 (excluding transfer duties).

Thanks to its strong commitment to sustainable development, the

Company's leadership position is recognized by ESG rating agencies.

Vitura has held a GRESB (Global Real Estate Sustainability

Benchmark) 5-star rating since 2014 and has been ranked world

number 1 (Global Sector Leader) in the listed office property

companies category four times. It has also received two Gold Awards

from the European Public Real Estate Association (EPRA) for the

quality and transparency of its financial and non-financial

reporting. Vitura is ISO 14001-certified.

Vitura is a REIT listed on Euronext Paris since 2006, in

compartment B (ISIN: FR0010309096).

Visit our website to find out more: www.vitura.fr/en

Find us on: LinkedIn / X

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240709750883/en/

Investor relations Charlotte de Laroche info@vitura.fr +33 1 42

25 76 38

Media relations Aliénor Miens alienor.miens@margie.fr +33 6 64

32 81 75

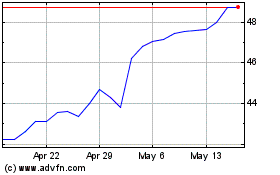

Ventas (NYSE:VTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

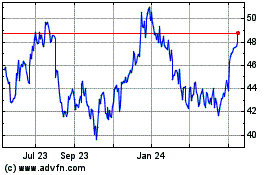

Ventas (NYSE:VTR)

Historical Stock Chart

From Jul 2023 to Jul 2024