0001674910false00016749102025-02-172025-02-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

___________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 17, 2025

__________________________________

VALVOLINE INC.

(Exact name of registrant as specified in its charter)

___________________________________ | | | | | | | | | | | | | | |

| Kentucky | | 001-37884 | | 30-0939371 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

100 Valvoline Way, Suite 100

Lexington, KY 40509

(Address of Principal Executive Offices)

(859) 357-7777

(Registrant’s telephone number, including area code)

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

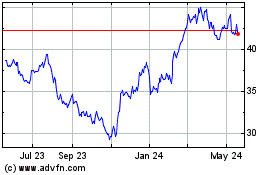

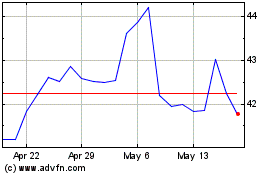

| Common stock, par value $0.01 per share | | VVV | | New York Stock Exchange |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | | | | | | | |

| | Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On February 17, 2025, Valvoline Inc., a Kentucky corporation (“Valvoline”), OCI Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of Valvoline ("Merger Sub"), OC Parent, L.P., a Delaware limited partnership ("HoldCo") and OC IntermediateCo, Inc., a Delaware corporation and wholly-owned subsidiary of HoldCo ("OC IntermediateCo"), entered into an Agreement and Plan of Merger (the "Merger Agreement"), pursuant to which Valvoline has agreed to acquire OC IntermediateCo, which, through its subsidiaries, owns and operates the Breeze Autocare business, including quick lube oil change stores operating under the Oil Changers brand (“Breeze Autocare”).

Upon the terms and subject to the conditions set forth in the Merger Agreement, at the closing (the "Closing") of the transactions contemplated by the Merger Agreement, Merger Sub will merge with and into OC IntermediateCo, with OC IntermediateCo continuing as a wholly-owned subsidiary of Valvoline (the "Merger").

Under the terms of the Merger Agreement, Valvoline will acquire OC IntermediateCo for a base purchase price of $625 million, subject to customary Closing adjustments as of the Effective Time for net working capital, cash and cash equivalents, indebtedness and unpaid transaction expenses, plus an amount equal to the consideration paid and expenses incurred by OC IntermediateCo in connection with the acquisition of certain stores expected to be acquired prior to Closing and the aggregate value of certain owned real properties that are expected to be part of sale-leaseback transactions (the "Merger Consideration"). In accordance with the terms of the Merger Agreement, $10 million of the Merger Consideration will be placed into an escrow account to secure any amounts payable for any post-Closing adjustments to the Merger Consideration.

The completion of the Merger is subject to satisfaction or waiver of certain customary Closing conditions, including, among others, (i) the expiration of the applicable waiting period (and any extension thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and (ii) the absence of any injunction or other order issued by a governmental entity making the consummation of the Merger illegal or otherwise enjoining, prohibiting or preventing the consummation of the Merger.

The Merger Agreement contains certain customary termination rights for each of Valvoline and OC IntermediateCo, including, among others, if the consummation of the Merger does not occur on or before July 1, 2025 (the "Termination Date"), except that if the conditions related to certain regulatory matters and the absence of injunctions have not been satisfied but all other conditions to Closing either have been satisfied or waived (or are capable of being satisfied at the Closing), then the Termination Date shall be automatically extended to October 1, 2025.

The Merger Agreement contains customary representations and warranties by each party. The parties have also agreed to customary covenants and agreements, including, among others, for OC IntermediateCo and its subsidiaries to use commercially reasonable efforts to conduct the business of Breeze Autocare in all material respects in the ordinary course consistent with past practice, subject to certain exceptions, during the period between the execution of the Merger Agreement and the Closing and to use commercially reasonable efforts to preserve substantially intact the business organizations, operations, material business relationships and goodwill of Breeze Autocare.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by the full text of the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1 and incorporated by reference herein.

| | | | | |

| Item 7.01. | Regulation FD Disclosure |

On February 20, 2025, Valvoline issued a press release announcing the execution of the Merger Agreement. A copy of the press release is being furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

In addition, Valvoline intends to provide supplemental information regarding the proposed Merger in connection with a presentation to investors and analysts. A copy of the Investor Presentation is being furnished herewith as Exhibit 99.2 and is incorporated by reference herein.

The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing. This Form 8-K will not be

deemed an admission as to the materiality of any information in this Item 7.01 that is required to be disclosed solely by Regulation FD.

Forward Looking Statements

Certain statements herein, other than statements of historical fact, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include, without limitation, statements about the proposed transaction to acquire Breeze Autocare, including its Oil Changers stores, the expected timetable for completing the proposed transaction, and the benefits and synergies of the proposed transaction; executing on the growth strategy to create shareholder value by driving the full potential in Valvoline’s core business, accelerating network growth and innovating to meet the needs of customers and the evolving car parc; realizing the benefits from acquisitions and refranchising transactions; and future opportunities for the stand-alone retail business; and any other statements regarding Valvoline's future operations, financial or operating results, capital allocation, debt leverage ratio, anticipated business levels, dividend policy, anticipated growth, market opportunities, strategies, competition, and other expectations and targets for future periods. Valvoline has identified some of these forward-looking statements with words such as “anticipates,” “believes,” “expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “may,” “will,” “should,” and “intends,” and the negative of these words or other comparable terminology. These forward-looking statements are based on Valvoline’s current expectations, estimates, projections, and assumptions as of the date such statements are made and are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. Additional information regarding these risks and uncertainties are described in Valvoline’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures about Market Risk” sections of Valvoline’s most recently filed periodic reports on Forms 10-K and 10-Q, which are available on Valvoline’s website at http://investors.valvoline.com/sec-filings or on the SEC’s website at http://www.sec.gov. Valvoline assumes no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future, unless required by law.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

| (d) Exhibits |

| |

| Exhibit No. | Description of Exhibit |

| 2.1* | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*The schedules to the Agreement and Plan of Merger have been omitted from this filing. Valvoline will furnish copies of such schedules to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | VALVOLINE INC. |

| | | |

| Date: February 20, 2025 | By: | /s/ Julie M. O'Daniel |

| | | Julie M. O'Daniel |

| | | Senior Vice President, Chief Legal Officer and Corporate Secretary |

AGREEMENT AND PLAN OF MERGER

BY AND AMONG

OC PARENT, L.P.,

OC INTERMEDIATECO, INC.,

VALVOLINE INC.

AND

OCI MERGER SUB INC.

DATED AS OF FEBRUARY 17, 2025

TABLE OF CONTENTS

Page

iii

1103593863\14\AMERICAS

EXHIBITS

Exhibit A - Form of Escrow Agreement

Exhibit B - Example Statement of Net Working Capital

Exhibit C - Form of Restrictive Covenant Agreement

SCHEDULES

Schedule 1.1(a) - Accounting Principles

Schedule 1.1(b) - Permitted Liens

Schedule 5.1 - Exceptions to Negative Covenants

Schedule A - Add-On Acquisitions

Schedule B - Sale-and-Lease Back Properties

Schedule C - Look Back Dates

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of February 17, 2025, is made by and among OC Parent, L.P., a Delaware limited partnership (“Holdco”), OC IntermediateCo, Inc., a Delaware corporation (the “Company”), Valvoline Inc., a Kentucky corporation (“Parent”), and OCI Merger Sub Inc., a Delaware corporation (“Merger Sub”) and a wholly owned Subsidiary of Parent. Capitalized terms used but not otherwise defined herein have the meanings ascribed to such terms in Article 1.

WHEREAS, subject to the terms and conditions set forth herein, and in accordance with the Delaware General Corporation Law (the “DGCL”), Parent desires that Merger Sub be merged with and into the Company, with the Company surviving the Merger as a wholly owned Subsidiary of Parent;

WHEREAS, the board of directors of the Company has, upon the terms and subject to the conditions set forth herein, (i) approved this Agreement and the consummation of the transactions contemplated hereby in accordance with the DGCL, (ii) determined that this Agreement and the transactions contemplated hereby are advisable, and (iii) recommended adoption of this Agreement by the Company’s stockholder;

WHEREAS, the board of directors of Parent and Merger Sub has each, upon the terms and subject to the conditions set forth herein, (i) approved this Agreement and the consummation of the transactions contemplated hereby in accordance with the DGCL, and (ii) determined that this Agreement and the transactions contemplated hereby are advisable;

WHEREAS, the Company has obtained and delivered to Parent a true, correct and complete copy of an irrevocable written consent of the sole stockholder of the Company evidencing the approval and adoption of this Agreement, signed by Holdco as the sole stockholder of the Company in accordance with the DGCL; and

WHEREAS, Parent has obtained and delivered to the Company a true, correct and complete copy of an irrevocable written consent of the sole stockholder of Merger Sub evidencing the approval and adoption of this Agreement, signed by Parent as the sole stockholder of Merger Sub in accordance with the DGCL.

NOW, THEREFORE, in consideration of the premises and the mutual promises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Holdco, the Company, Parent and Merger Sub hereby agree as follows:

ARTICLE 1

CERTAIN DEFINITIONS

Section 1.1 Certain Definitions. As used in this Agreement, the following terms have the respective meanings set forth below.

“Accounting Firm” has the meaning set forth in Section 2.10(c)(ii).

“Accounting Principles” means the methods, policies, practices, procedures and classifications set forth on Schedule 1.1(a) hereto.

“Action” means any claim, complaint, cause of action, charge, demand, notice, assessment, proceeding, suit, arbitration, litigation, mediation, hearing, investigation, audit, inquiry, contest, examination, inquest, summons, prosecution, review or other action (whether at law or in equity, whether civil, commercial, investigative, appellate, administrative, regulatory, criminal or judicial, whether formal or informal, whether public or private) commenced, brought, conducted or heard by or before or by any Governmental Entity.

“Actual Adjustment” means (a) the amount by which the Merger Consideration as finally determined pursuant to Section 2.10(c) exceeds the Estimated Merger Consideration or (b) the amount by which the Merger Consideration as finally determined pursuant to Section 2.10(c) is less than the Estimated Merger Consideration, as applicable; provided that any amount which is calculated pursuant to clause (b) above shall be a negative number.

“Actual Fraud” means an actual and intentional fraud with respect to the making of, or omission from, the representations and warranties (a) made pursuant to Article 3 (in the case of the Company) or Article 4 (in the case of Parent and Merger Sub) or (b) contained in any certificate delivered pursuant to Section 6.2(d) (in the case of the Company) or Section 6.3(c) (in the case of Parent and Merger Sub); provided that such actual and intentional fraud shall only be deemed to exist if the party making or omitting such representations and warranties had actual knowledge (as opposed to imputed or constructive knowledge) that the representations and warranties made or omitted were false when made or omitted; provided that such actual and intentional fraud does not include equitable fraud, constructive fraud, promissory fraud, unfair dealings fraud, unjust enrichment, or any torts (including fraud), securities fraud or other claim based on negligence or recklessness (including based on constructive knowledge or negligent misrepresentation).

“Add-On Acquisitions” means any transaction by the Company or its Subsidiaries pursuant to which Company or its Subsidiaries have acquired or have committed (including through an executed letter of intent or binding agreement) to acquire the assets or business of any target entity (whether by purchase of equity interests or assets, merger or otherwise) set forth on Schedule A; provided, that, after the date hereof and prior to the Closing, the Company may update Schedule A to reflect any additional transactions entered into by the Company or its Subsidiaries following the date hereof and prior to the Closing only with Parent’s express prior written consent (not to be unreasonably conditioned, withheld or delayed).

“Add-On Amount” means the aggregate amount of consideration actually paid, and all expenses incurred, that the Company has provided Parent written evidence of prior to the Closing Date with respect to any Add-On Acquisition (as may be updated from time to time in accordance with the terms hereunder).

“Affiliate” means, with respect to any Person, any other Person who directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise, and the terms “controlled” and “controlling” have meanings correlative thereto. For the avoidance of doubt, employees of the Group Companies are not Affiliates of the Group Companies and employees of Parent and its Affiliates are not Affiliates of Parent or its Affiliates. Notwithstanding the foregoing, no Person, assets or business acquired in connection with the Add-On Acquisitions will constitute an Affiliate of the Company for purposes of the representations and warranties in Article 3.

“Affiliate Transaction” has the meaning set forth in Section 3.22.

“Agreement” has the meaning set forth in the preamble to this Agreement.

“AI Technologies” means any current product, service or tool that relies on or otherwise utilizes artificial intelligence, machine learning, large language models or other similar or successor technologies, in whole or in part, to (a) create, generate, or modify content of any kind; (b) make decisions or facilitate decision-making; (c) replace or provide analysis of information to assist human decision-making; or (d) that is regulated as an “artificial intelligence system” or comparable term under applicable Legal Requirements.

“Ancillary Documents” means the Escrow Agreement, the Restrictive Covenant Agreement and each other agreement, document, instrument and/or certificate contemplated by this Agreement to be executed in connection with the transactions contemplated by this Agreement.

“Anti-Bribery Laws” has the meaning set forth in Section 3.21(a).

“Antitrust Laws” means any federal, state, provincial, territorial, local or foreign statutes, rules, regulations, Orders, administrative and judicial doctrines and other Applicable Laws that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade or lessening of competition through merger or acquisition.

“Applicable Law” means, with respect to any Person, any provision of federal, state, provincial, territorial, supranational, local or foreign law, act, code, statute, rule, regulation, legislation, constitution, guideline, directive, principle of common law, Order, treaty or ordinance of any Governmental Entity applicable to such Person or its properties or assets.

“Attorney-Client Communication” means any confidential and attorney client privileged communication occurring on or prior to the Closing between the Law Firm, on the one hand, and the Group Companies, Holdco or any of their respective Affiliates, on the other hand, to the extent it relates to the transactions contemplated by or leading to this Agreement (including the negotiation, preparation, execution and delivery of this Agreement, the Ancillary Documents and related agreements, and the consummation of the transactions contemplated hereby or thereby), including any representation, warranty or covenant of any party under this Agreement, the Ancillary Documents, any related agreement or the matters upon which a representation or warranty is made.

“Audited Financial Statements” has the meaning set forth in Section 3.9(a).

“Balance Sheet Date” has the meaning set forth in Section 3.9(a).

“Base Purchase Price” means $625,000,000.

“Bring Down Date” means the date that is the second (2nd) Business Day following satisfaction (or, to the extent permitted by Applicable Law, waiver by the parties entitled to benefits thereof) of all the conditions set forth in Section 6.1, Section 6.2(a), Section 6.2(b), Section 6.2(c) and the delivery of a draft Payoff Letter with respect to any Closing Indebtedness set forth on Schedule 6.2(h).

“Business Day” means a day, other than a Saturday or Sunday, on which commercial banks in New York City are open for the general transaction of business.

“Business Permits” has the meaning set forth in Section 3.12.

“Canceled Shares” has the meaning set forth in Section 2.9(c).

“Cash and Cash Equivalents” means (x) the sum (expressed in United States dollars) of all cash and cash equivalents (including marketable securities, bank deposits, and short term investments) held by members of the Group Companies as of the Measurement Time, and (a) net of any outstanding checks not older than three (3) years from the Measurement Time, wires and bank overdrafts of the Group Companies, (b) excluding any “restricted cash”, where “restricted cash” means any cash and cash equivalents that are not freely usable by and available to the Group Companies due to requirements of Applicable Law, or because they are subject to bond guarantees, collateral reserve accounts, or similar accounts with respect to which amounts held therein are restricted to use for a specific purpose, and (c) excluding all cash and cash equivalents that are otherwise included in the Sale-and-Lease Back Transaction Amount (to avoid duplication with part (y)), in each case, calculated in accordance with the Accounting Principles plus (y) the Sale-and-Lease Back Transaction Amount; provided that, if any Group Company receives any Sale-and-Lease Back Transaction Amount prior to the Closing and assigns, transfers, or conveys the cash associated with such Sale-and-Lease Back Transaction Amount to any Person other than a Group Company, such Sale-and-Lease Back Transaction Amount shall not be included in this definition.

“CBA” has the meaning set forth in Section 3.7(c).

“CERCLA” means the Comprehensive Environmental Response, Compensation, and Liability Act of 1980.

“Certificate of Merger” has the meaning set forth in Section 2.4.

“Closing” has the meaning set forth in Section 2.2.

“Closing Date” has the meaning set forth in Section 2.2.

“Closing Indebtedness” means the Indebtedness as of the Measurement Time.

“COBRA” means Part 6 of Subtitle B of Title I of ERISA, Section 4980B of the Code or similar state Applicable Law.

“Code” means the U.S. Internal Revenue Code of 1986.

“Common Stock” means the Company’s Common Stock, par value $0.01 per share.

“Company” has the meaning set forth in the preamble to this Agreement.

“Company Common Shares” means all shares of Common Stock.

“Company Employees” means employees of the Group Companies who are employed at the Closing.

“Company’s Knowledge” and any derivations thereof, mean, as of the applicable date, the actual knowledge, after reasonable inquiry, of Eric Frankenberger, Kabir Merchant, Aimann Hafez, James Scerbo, and Efrain Corona, none of whom shall have any personal Liability regarding such knowledge.

“Company Material Adverse Effect” means any effect, event, circumstance, occurrence, fact, condition, development, result, change or combination of the foregoing that is, or could reasonably be expected to become, individually or in the aggregate, materially adverse to (a) the business, results of operations, condition (financial or otherwise), assets, Liabilities or capitalization of the Group Companies taken as a whole, or (b) the ability of Holdco, the Company, or the Group Companies as a whole, to consummate the Merger; provided, however, that “Company Material Adverse Effect” shall not include any effect, event, circumstance, occurrence, fact, condition, development, result, change or combination of the foregoing, directly or indirectly, arising out of or attributable to: (a) conditions generally affecting the economy, the regulatory environment or credit, securities, currency, financial, commodity, banking or capital markets (including any disruption thereof and any decline in the price of any security or any market index or any changes in interest rates or exchange rates) in the United States or elsewhere in the world, (b) any national, international or supranational political, geopolitical or social conditions (including civil commotion, civil disorder, or any other type of civil unrest (including government shutdowns, riots, public demonstrations, protests, looting, and revolutions) and any government responses thereto (e.g., shutdowns, furloughs, curfews)) and including the threatening of, any engagement in, or escalation of, hostilities or war, whether or not pursuant to the declaration of a national emergency or war, or the occurrence of any military or cyber-attack or terrorist attack, or any epidemics or pandemics or outbreaks, earthquakes, hurricanes, tornadoes or any other natural disasters (whether or not caused by any Person or any force majeure event), (c) changes in GAAP, accounting standards or in the interpretation or enforcement thereof, (d) changes in any Applicable Law or any action required to be taken under any Applicable Law by which any Group Company (or any of their respective assets or properties) is bound, (e) any change that is generally applicable to the industries or markets in which the Group Companies operate or in which products or services of any Group Company are produced, distributed or sold, (f) the negotiation, execution, announcement of this Agreement or the consummation of the transactions contemplated by this Agreement (including by reason of the identity of Parent, Merger Sub or their Affiliates), (g) any failure, in and of itself, by any Group Company to meet any internal or published projections, forecasts, estimates or predictions of revenue, earnings, cash flow or cash position and any seasonal changes in the results of operations of the Group Companies for any period ending on or after the date hereof (it being understood that the underlying causes of, or factors contributing to, the failure to meet such projections, forecasts, estimates or predictions may be taken into account in determining whether a Company Material Adverse Effect has occurred unless otherwise excluded under this definition), or (h) the taking of any action expressly permitted or required by this Agreement and/or the Ancillary Documents, or any failure to take any action by a Group Company that is expressly prohibited by this Agreement, including the completion of the transactions contemplated hereby and thereby (including the obtaining of approval or consent from any Governmental Entity), except in the case of clauses (a), (b), (c), (d) and (e) above, to the extent that such effect, event, circumstance, occurrence, fact, condition, development, result, change or combination of the foregoing has a material and disproportionate impact on the business, results of operations, condition (financial or otherwise), assets, Liabilities or capitalization of any Group Company as compared to other industry participants.

“Company Personnel” has the meaning set forth in Section 3.8(i).

“Competing Transaction” means, other than the transactions contemplated by this Agreement, any sale, assignment, transfer, conveyance, purchase, acquisition, merger, consolidation, share exchange,

exchange or tender offer, recapitalization, business combination, investment in, liquidation, dissolution, equity financing or issuance, spin-off, joint venture or other similar transaction, directly or indirectly, of any Group Company or their equity interests, businesses or assets (other than sales of inventory in the ordinary course of business and the sale leaseback of the Sale-and-Lease Back Properties).

“Confidentiality Agreement” means that certain Confidentiality Agreement, dated as of May 17, 2024, by and between Oil Changer, Inc., a California corporation, and Valvoline LLC, a Delaware limited liability company.

“Contract” means any legally binding contract, agreement, license, sublicense, lease, sublease, deed, mortgage, note, undertaking, indenture, bond, loan, conditional sales contract, franchise, instrument, commitment, or other binding arrangement.

“Credit Agreement” means that certain Credit Agreement, dated February 8, 2021, by and among OC Merger Sub, Inc., Oil Changer Holding Corporation, OC Holding, Inc., Guggenheim Credit Services, LLC (as Administrative Agent and Collateral Agent), Webster Bank, National Association and the Lender Parties thereto, as amended by Amendment No. 1, dated March 22, 2022, Amendment No. 2, dated May 31, 2023, Amendment No. 3, dated December 6, 2023 and Amendment No. 4, dated November 21. 2024.

“Damages” means any and all damages, Liabilities, obligations, penalties, fines, Actions, Orders, deficiencies, losses, costs, wages, liquidated damages, assessments, payments (including those arising out of any settlement or Order), fees, costs of remediation and expenses of any kind (including income and other Taxes, interest, and reasonable attorneys’, accountants’ and other professional advisors’ fees, expenses and disbursements incurred or paid in the investigation, defense, settlement or enforcement thereof and the cost of pursuing any providers of insurance).

“Data Privacy and Security Laws” means (a) each applicable Legal Requirement concerning the privacy, secrecy, security, protection, disposal, international transfer or other Processing of Personal Information, and/or use of “cookies” or similar technologies, including (i) state data privacy Legal Requirements, including the California Consumer Protection Act of 2018; (ii) each applicable Legal Requirement applicable to direct marketing, e-mails, communication by text messages or initiation, transmission, monitoring, recording, or receipt of communications (in any format, including voice, video, email, phone, text messaging, or otherwise), the Telephone Consumer Protection Act and the Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003; and (iii) Legal Requirements governing or relating to the Processing of biometric data or biometric information, including the Illinois Biometric Information Privacy Act; or (b) guidance having legal effect issued by a Governmental Entity that pertains to one of the Legal Requirements outlined in clause (a).

“Data Security Requirements” means, collectively, all of the following to the extent relating to the Processing of Personal Information or otherwise relating to privacy, security, or security breach notification requirements and applicable to the Company or any of the Group Companies: (a) any applicable Group Company Privacy Policies and the Company’s and any of the Group Company’s own published written rules and procedures (whether physical or technical in nature, or otherwise), (b) all applicable Data Privacy and Security Laws, (c) applicable provisions of Contracts the Company or any of the Group Companies have entered into or by which they are bound, and (d) industry self-regulatory principles, certifications, frameworks, standards, or codes of conduct relating to privacy or information security and/or otherwise relating to the Processing of Personal Information that are adopted by any industry organization to which the applicable Group Company belongs or with which it has in writing agreed to comply or represented compliance, including the PCI DSS.

“Data Subject Requests” has the meaning set forth in Section 3.25(h).

“Debt Commitment Letter” shall have the meaning set forth in Section 4.5(b).

“Debt Financing” shall have the meaning set forth in Section 4.5(b).

“Debt Financing Agreement” and “Debt Financing Agreements” shall have the meaning set forth in Section 9.21.

“Debt Financing Sources” means the Persons that have committed to provide or arrange any debt financings in connection with the transactions contemplated hereby, including the parties to any commitment letters, engagement letters, joinder agreements, indentures or credit agreements entered pursuant thereto or relating thereto (the foregoing are collectively referred to as the “Lenders”), together with their respective Affiliates, and their and their respective Affiliates’ officers, directors, employees, attorneys, partners (general or limited), trustees, controlling parties, advisors, members, managers, accountants, consultants, agents, representatives and funding sources and, in each case, their respective permitted successors and assigns.

“Debt Letters” shall have the meaning set forth in Section 4.5(b).

“DGCL” has the meaning set forth in the recitals to this Agreement.

“Disputed Items” has the meaning set forth in Section 2.10(c)(ii).

“Effective Time” has the meaning set forth in Section 2.4.

“Employee Plan” shall mean each “employee benefit plan,” as such term is defined in Section 3(3) of ERISA (whether or not subject to ERISA), and each pension, employment, severance, individual consulting, transaction, retention, bonus, commission, deferred compensation, incentive compensation, equity purchase, equity option, equity appreciation, phantom equity, other equity or equity-based, savings, profit sharing, Code Section 125, Code Section 501(c)(9), severance or termination pay, salary continuation, health, dental, vision, life, accident or disability insurance, retirement, sick leave, paid time off, vacation, tuition assistance, adoption assistance, fringe benefit, perquisite and any other benefit or compensation plan, policy program, agreement or arrangement maintained or contributed to, or required to be contributed to, by any Group Company for the benefit of any of current or former employee, director or individual service provider of any Group Company or their respective dependents or beneficiaries, or that is sponsored, maintained or contributed to (or required to be contributed to) by any Group Company, or with respect to which any Group Company has any Liability (other than any such plan or arrangement maintained or to which contributions are required by any Governmental Entity).

“Environmental Laws” means all Applicable Laws concerning pollution, human health or safety (to the extent relating to exposure to Hazardous Materials), protection of the environment or relating to the use, handling, transport, Release, treatment, storage, or disposal of Hazardous Materials.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“ERISA Affiliate” shall mean any Person that, together with any Group Company, is (or at any relevant time was) treated as a single employer under Section 414 of the Code.

“Escrow Account” means the account established under the Escrow Agreement for purposes of the post-Closing adjustment contemplated by Sections 2.10(c) and 2.10(d).

“Escrow Agent” means Citibank, N.A.

“Escrow Agreement” means that certain escrow agreement by and among Parent, Holdco and the Escrow Agent, substantially in the form attached hereto as Exhibit A.

“Escrow Amount” means $10,000,000.

“Estimated Closing Statement” has the meaning set forth in Section 2.10(a).

“Estimated Merger Consideration” has the meaning set forth in Section 2.10(a).

“Ex-Im Laws” means all U.S. and applicable non-U.S. Legal Requirements relating to export, reexport, transfer, and import controls, including the Export Administration Regulations and the customs and import Applicable Laws administered by U.S. Customs and Border Protection.

“Example Statement of Net Working Capital” means the statement of Net Working Capital as of the close of business on December 31, 2024, and attached as Exhibit B hereto.

“Exchange Act” means the U.S. Securities Exchange Act of 1934.

“Financial Statements” has the meaning set forth in Section 3.9(a).

“Fleet Customer” has the meaning set forth in Section 3.20(a).

“GAAP” means United States generally accepted accounting principles consistently applied as in effect from time to time.

“General Enforceability Exceptions” has the meaning set forth in Section 3.2(a).

“Governing Documents” means the legal document(s) by which any Person (other than an individual) establishes its legal existence, or which govern its internal affairs. For example, the “Governing Documents” of a corporation are its certificate or articles of incorporation, as applicable, and by-laws, the “Governing Documents” of a limited partnership are its limited partnership agreement and certificate of limited partnership, and the “Governing Documents” of a limited liability company are its operating agreement and certificate of formation.

“Governmental Entity” means any federal, state, provincial, territorial, supranational, local or foreign governmental, regulatory or administrative authority, agency, instrumentality, commission or political subdivision, or any judicial or arbitral body (public or private) or court of competent jurisdiction, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations, or orders of such organization or authority have the force of law).

“Group Companies” means, collectively, the Company and each of its Subsidiaries.

“Group Company Data” means any and all information or data that is proprietary, sensitive, regulated, or confidential (including all Personal Information) that is Processed by or on behalf of any Group Company or otherwise in the possession or control of any Group Company.

“Group Company Privacy Policy” means each external or internal written privacy policy, notice or similar of, or any external written representation or statement made by, any Group Company relating or made pursuant to any Data Security Requirements, including any such policy, notice, representation or statement, relating to: (a) the Processing of any Personal Information; or (b) any Personal Information of any actual or prospective employee, contractor, consultant or other staff members.

“Group Company Released Party” has the meaning set forth in Section 9.7(a).

“Group Company Releasor” has the meaning set forth in Section 9.7(b).

“Hazardous Material” shall mean any hazardous or toxic pollutant, contaminant, material, substance or waste which is listed under or regulated by, or for which Liability or standards of conduct are imposed pursuant to, Environmental Law, including friable asbestos, polychlorinated biphenyls, poly- and per-fluoroalkyl substances, radiation or any petroleum or petroleum products.

“Holdco Released Party” has the meaning set forth in Section 9.7(b).

“Holdco Releasor” has the meaning set forth in Section 9.7(a).

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

“Income Tax” means any Tax imposed on or determined by reference to net income or profits, including any nonresident withholding Tax or franchise, margin or similar Tax (or any other Tax imposed in lieu thereof).

“Income Tax Liability Amount” means, without duplication and which amount may not be reduced below zero (0) in any jurisdiction, an amount equal to the accrued and unpaid Income Taxes of any Group Company for any Pre-Closing Tax Period that are due and payable following the Closing Date with respect to any Income Tax Return that is not yet due (taking into account any applicable extensions) and with respect to solely those jurisdictions in which such Group Company is currently filing Income Tax Returns or commenced business operations or activities after December 31, 2023, which for such purpose shall be determined (a) by including Transaction Tax Deductions in Pre-Closing Tax Periods of the Group Companies to the extent permitted under Applicable Law at a “more likely than not” or greater level of comfort, (b) by taking into account any prepayment or overpayment (including any estimated Tax payments) of Income Taxes for such Pre-Closing Tax Periods of any Group Company, (c) in accordance with past practice of the Group Companies in preparing Income Tax Returns (including any reporting positions, elections or accounting methods) to the extent permitted under Applicable Law, (d) by excluding any deferred Tax Liabilities or any Liabilities for accruals or reserves established or required to be established in accordance with GAAP for contingent Taxes or uncertain Tax positions, (e) by excluding any Income Taxes attributable to actions taken by the Group Companies on the Closing Date and after the Closing (other than actions contemplated by this Agreement) or otherwise arising as a result of any financing or refinancing arrangements entered into at the direction of Parent or its Affiliates, and (f) applying the conventions set forth in Section 8.5 for purposes of determining the amount of any Income Taxes allocable to the Pre-Closing Tax Period in the case of any Straddle Period.

“Income Tax Return” means any Tax Return with respect to Income Taxes.

“Indebtedness” means, as of any time, without duplication, the outstanding principal amount of, accrued and unpaid interest on, and all premiums and penalties (including any prepayment penalties) with respect to, any obligations of any Group Company consisting of (a) indebtedness for borrowed money, (b) indebtedness evidenced by any note, bond, debenture, indenture or other similar financing instrument or Contract or debt security, (c) any principal obligations under capitalized leases of any Group Company to the extent recorded as long-term Liabilities in accordance with the Accounting Principles, (d) the net Liability in respect of any interest rate, currency, hedging or other derivative instrument or Contract, (e) obligations to pay the deferred purchase price (including earn-outs) of any business or assets constituting a business, in each case for the maximum potential amount payment, whether or not matured, (f) solely to the extent the Wage and Hour Dispute Amount has not yet been paid in connection with the Wage and Hour Dispute, the Wage and Hour Dispute Amount, (g) all reimbursement and other obligations with respect to performance bonds, letters of credit, bank guarantees, bankers’ acceptances, note purchase facilities, or other similar instruments, but only to the extent that such performance bonds, letters of credit, bank guarantees, bankers’ acceptances, note purchase facilities, or other similar instruments have been drawn upon, (h) the Income Tax Liability Amount, (i) indebtedness created or arising under any purchase money mortgage or other purchase money lien or conditional sale or other title retention agreement with respect to property acquired (even though the right and remedies of the person or lender under such agreement in the event of default are limited to repossession or sale of such property), (j) all transferred unfunded pension and similar defined benefit obligations including jubilees and medical schemes, (k) all declared and unpaid dividends or distributions; or (l) guarantees of any indebtedness of a third party of the type described in the foregoing clauses (a) through (k), in each case, as of such time. Notwithstanding the foregoing, Indebtedness shall not include any (i) undrawn letters of credit, performance bonds or similar instruments, (ii) obligations under operating leases, (iii) amounts included as Transaction Expenses, Cash and Cash Equivalents or Net Working Capital, (iv) amounts owed by one Group Company to any other Group Company, or (v) trade or account payables incurred in the ordinary course of business.

“Insurance Policies” has the meaning set forth in Section 3.16.

“Intellectual Property Rights” means all inventions (whether patentable or unpatentable and whether or not reduced to practice), all improvements thereto, all patents and patent applications, together with all reissues, continuations, continuations-in-part, revisions, divisionals, extensions, and reexaminations in connection therewith, trademarks, whether registered or unregistered, logos, brand names, trade-dress rights, service marks and trade names (and all goodwill associated therewith and all registrations, renewals and applications therefor), all copyrights and works of authorship, including all rights in Software and technology of the Group Companies (and all registrations, renewals and applications therefor), internet domain names, corporate names, trade secrets, and other confidential and proprietary business information, know-how, discoveries, concepts, ideas, research and development, formulae, inventions, compositions, manufacturing and production processes and techniques, technical data, procedures, designs, drawings, specifications, in each case, to the extent protectable by Applicable Law, including any of the foregoing rights in Software, data, databases or documentation therefor, all advertising and promotional materials, and all copies and tangible embodiments thereof (in whatever form or medium).

“Interim Financial Statements” has the meaning set forth in Section 3.9(a).

“Investment Advisors” means Jefferies LLC and Piper Sandler & Co.

“IRS” means the U.S. Internal Revenue Service.

“IT Systems” shall mean Software, computer firmware, computer hardware, electronic data Processing, telecommunications networks, network equipment, interfaces, platforms, peripherals, computer systems, and information contained therein or transmitted thereby, in each case, owned, licensed, or used by the Company or any of the Group Companies in the operation of the Group Companies’ respective businesses.

“Law Firm” has the meaning set forth in Section 9.20(a).

“Leased Premises” shall mean any land, buildings, structures, improvements, fixtures or other interest in real property held by the Company or any Group Company pursuant to any leasehold or subleasehold estates or any other rights to use or occupy such real property.

“Legal Requirements” means any and all Applicable Laws and any Contracts with any Governmental Entity.

“Lender” has the meaning assigned to such term in the definition of “Debt Financing Sources”.

“Lender Protective Provisions” means Section 9.2, Section 9.10, Section 9.12, Section 9.13, and Section 9.21, in each case, as such provisions relate to the Debt Financing and the Debt Financing Sources.

“Liability” means any direct or indirect liability, indebtedness, guaranty, assurance, claim, loss, damage, cost, expense, obligation, penalty, fine, deficiency, commitment or obligation of any kind or nature, whether accrued, unaccrued, absolute, contingent, mature, unmature or otherwise and whether known or unknown, fixed or unfixed, asserted or unasserted, due or to become due, reflected on a balance sheet or otherwise, choate or inchoate, liquidated or unliquidated, secured or unsecured, whenever or however arising.

“Lien” means any mortgage, pledge, security interest, encumbrance, lien (statutory or otherwise), license, lease, sublease, covenant, charge, claim, condition, option, security interest, mortgage, deed of trust, deed to secure debt, community property interest, equitable interest, easement, encroachment, right of way, right of first refusal or first offer, right to acquire, right of preemption, servitude, restriction on transfer of title or voting, restriction on use, or any other restriction of any kind or nature whatsoever, whether absolute or contingent, whether relating to any property or right or the income or profits therefrom.

“Look Back Date” means, with respect to the Group Companies, assets, Liabilities and properties set forth on Schedule C hereto, the date set forth in the column titled “Date” on Schedule C hereto.

“Malicious Code” means any “back door,” “drop dead device,” “time bomb,” “Trojan horse,” “virus” or “worm” (as such terms are commonly understood in the software industry) or any other code designed or intended to have any of the following functions: (a) disrupting, disabling, harming or otherwise impeding in any manner the operation of, or providing unauthorized access to, a computer system or network or other device on which such code is stored or installed; (b) compromising the privacy or data security of a user or damaging or destroying any data or file without the user’s consent; or (c) transmitting data, in the case of each of clauses (a), (b) and (c), either automatically, with the passage of time or upon command by any Person other than the proper user.

“Material Contract” has the meaning set forth in Section 3.15(a).

“Material Independent Contractor” means any consultant or other independent contractor, whether operating through a legal entity or as an individual in their personal capacity, who, since the Look Back Date, has either (a) provided over 200 hours of services relating to the Group Companies or (b) received more than $50,000 in compensation for services relating to the Group Companies.

“Measurement Time” means 12:01 a.m. Eastern Time on the Closing Date.

“Merger” has the meaning set forth in Section 2.1.

“Merger Consideration” means (a) the Base Purchase Price, plus (b) the Net Working Capital Adjustment (which may be a negative number), plus (c) the amount of Cash and Cash Equivalents, minus (d) the amount of Closing Indebtedness, minus (e) the amount of Unpaid Transaction Expenses, plus (f) the Add-On Amount.

“Merger Consideration Dispute Notice” has the meaning set forth in Section 2.10(c)(ii).

“Merger Sub” has the meaning set forth in the preamble to this Agreement.

“Net Working Capital” means, with respect to the Group Companies, the aggregate value of the current assets of the Group Companies less the aggregate value of the current Liabilities of the Group Companies, in each case, determined on a consolidated basis without duplication as of the Measurement Time and calculated in accordance with the Accounting Principles and (a) taking into account only those assets and Liabilities and reflecting other adjustments of the type and kind included in the line items set forth in the Example Statement of Net Working Capital and (b) establishing levels of reserves and materiality using the same principles, practices, methodologies and procedures and in the same manner as such levels were established in preparing the Example Statement of Net Working Capital. Notwithstanding anything to the contrary contained herein, in no event shall “Net Working Capital” include any amounts with respect to (i) current or deferred Tax assets or Liabilities relating to Income Taxes or other deferred Tax assets or Liabilities, (ii) any changes in assets or Liabilities as a result of the transactions associated with the Merger, including any purchase accounting adjustment, (iii) Cash and Cash Equivalents (and any amounts expressly excluded from the definition thereof), (iv) Transaction Expenses (and any amounts expressly excluded from the definition thereof), and (v) Indebtedness (and any amounts expressly excluded from the definition thereof). Further, no fact, event or occurrence on or after the Closing shall be taken into account when calculating the Net Working Capital.

“Net Working Capital Adjustment” means either: (a) the amount (which shall be a negative number), if any, by which Net Working Capital is less than the Target Net Working Capital; or (b) the amount (which shall be a positive number), if any, by which Net Working Capital is more than the Target Net Working Capital.

“New Plans” has the meaning set forth in Section 5.8(b).

“Non-Party Affiliates” has the meaning set forth in Section 9.19.

“OCH” Oil Changer Holding Corporation, a Delaware corporation.

“Open Source Materials” means Software that is publicly distributed (or otherwise made publicly available) in source code format under a licensing or distribution model that relies on the GNU General Public License (GPL), GNU Lesser General Public License (LGPL), Mozilla Public License (MPL), BSD licenses, the Artistic License, the Netscape Public License, the Sun Community Source License (SCSL), the Sun Industry Standards Source License (SISSL), the Apache License, or other open source license that requires as a condition of use, modification or distribution of such Software that such Software or other Software that is combined or distributed with it be: (a) disclosed or distributed in source code form; (b) licensed to any Person for the purposes of making derivative works thereof; (c) redistributable at no charge; or (d) licensed subject to a patent non-assert or royalty-free patent license or covenant not to sue.

“Order” means any writ, judgment, injunction, consent, order, decree, stipulation, award, ruling, determination, settlement, assessment or executive order of or by any Governmental Entity.

“Owned Real Property” shall mean all land, together with all buildings, structures, improvements and fixtures located thereon, and all easements and other rights and interests appurtenant thereto, owned by the Company or any Group Company.

“Parent” has the meaning set forth in the preamble to this Agreement.

“Parent Arrangements” has the meaning set forth in Section 5.8(c).

“Parent Credit Agreement” means that certain Amended and Restated Credit Agreement, dated as of December 12, 2022, and effective as of March 1, 2023 and as may be amended, supplemented or otherwise modified from time to time, by and among the Parent, the lenders and L/C issuers from time to time party thereto and the Bank of Nova Scotia, as administrative agent.

“Payoff Letters” means customary payoff letters in connection with the repayment of the Indebtedness set forth on Schedule 6.2(h), stating the aggregate amount of the Indebtedness thereunder required for payoff as of the date specified in such letter (together with a customary per diem for payment following such date), the instructions for payment of the same to discharge such obligations and, if such Indebtedness is secured by any Lien, all Lien terminations and instruments of discharge releasing and terminating such Lien, as applicable, upon the receipt of the applicable payoff amounts.

“PCI DSS” means the Payment Card Industry Data Security Standard, issued by the Payment Card Industry Security Standards Council.

“Permits” means permits, licenses, variances, franchises, registrations (including product registrations), certificates, exemptions, authorizations, orders, consents, concessions, warrants, waivers and approvals obtained or required to be obtained from or with any Governmental Entity.

“Permitted Liens” means (a) mechanic’s, materialmen’s, carriers’, repairers’ and other Liens arising or incurred in the ordinary course of business consistent with past practice for amounts that are not yet due and payable or that are being contested in good faith and for which adequate reserves have been established in accordance with GAAP, (b) Liens for Taxes, assessments or other governmental charges that are not yet due and payable or that are being contested in good faith by appropriate proceedings and for which adequate reserves have been established in accordance with GAAP, (c) encumbrances and restrictions on any property (including easements, covenants, conditions, rights of way and similar matters affecting title to the real property and other title defects) that do not materially impair or interfere with the Group Companies’ present uses or occupancy of such property, (d) Liens that would not

reasonably be expected to be material to the Group Companies, taken as a whole, (e) Liens granted to any Lender at the Closing in connection with any Debt Financing, (f) zoning, building codes and other land use laws regulating the use or occupancy of real property or the activities conducted thereon which are imposed by any Governmental Entity having jurisdiction over such real property and which are not violated by the current use or occupancy of such real property or the operation of the businesses of the Group Companies, (g) matters that would be disclosed by an accurate survey or inspection of real property to the extent that they do not materially impair or interfere with the Group Companies’ present use or occupancy of such property, (h) any mortgage of a lessor or sublessor on any of the Leased Premises and the interests of lessors and sublessors of any of the Leased Premises under the Real Property Leases, (i) pledges or deposits in the ordinary course of business and on a basis consistent with past practice in connection with workers’ compensation, unemployment insurance or other social security legislation, (j) non-monetary Liens that do not, individually or in the aggregate, materially impair the continued or contemplated operation of the property to which they relate, (k) any Liens created by Parent or Merger Sub following the Effective Time, (l) non-exclusive licenses for commercial off-the-shelf Software or non-exclusive trademark licenses granted by any Group Company in the ordinary course of business, and (m) Liens described on Schedule 1.1(b).

“Person” means an individual, partnership, corporation, limited liability company, joint stock company, unincorporated organization or association, trust, joint venture, association or other similar entity, whether or not a legal entity.

“Personal Information” means (a) any information that may reasonably be used to identify a natural Person, including a natural Person’s social security number or tax identification number, driver’s license number, credit card number, bank information, or customer or account number; and (b) any information that is defined as “personally identifiable information,” “personal information,” “personal data,” or other similar terms by the Data Security Requirements.

“Pre-Closing Tax Period” means any taxable period (or portion thereof) ending on or before the Closing Date, including the portion of any Straddle Period ending on and including the Closing Date.

“Process,” “Processed,” “Processes,” or “Processing” means any operation or set of operations performed on Group Company Data that constitutes Personal Information, whether or not by automatic means, such as receipt, collection, monitoring, maintenance, creation, recording, organization, structuring, storage, adaptation or alteration, retrieval, consultation, use, processing, analysis, transfer, transmission, disclosure, dissemination or otherwise making available, alignment or combination, blocking, erasure, destruction, privacy or security or any other operation that is considered “processing” or similar term under Data Security Requirements.

“Proposed Closing Date Calculations” has the meaning set forth in Section 2.10(c)(i).

“R&W Insurance Policy” has the meaning set forth in Section 5.9.

“Real Property Leases” shall mean all leases, subleases, licenses, concessions and other agreements (written or oral) pursuant to which the Company or any Group Company holds any Leased Premises.

“Redacted Fee Letter” shall have the meaning set forth in Section 4.5(b).

“Registered Intellectual Property Rights” has the meaning set forth in Section 3.17.

“Release” means any release, spill, emission, leaking, pumping, dumping, injection, pouring, deposit, discharge, dispersal, leaching, escaping or migration on, into or through the environment (including ambient or indoor air, surface water, groundwater, sediments, land surface or subsurface strata).

“Representatives” means, with respect to any Person, the directors, members, limited or general partners, equityholders, officers, employees, agents, advisors, Affiliates, representatives, investment bankers, consultants, attorneys, accountants and other agent of such Person.

“Required Amount” has the meaning set forth in Section 4.5(a).

“Restrictive Covenant Agreement” means that certain restrictive covenant agreement by and between Parent, on one hand, and each of Greenbriar Equity Fund V, L.P., a Delaware limited partnership, and Greenbriar Co-Investment Partners V, L.P., a Delaware limited partnership, substantially in the form attached hereto as Exhibit C.

“Sale-and-Lease Back Properties” means each of the properties set forth on Schedule B hereto, which shall be amended following the date hereof and prior to the Closing by the Company, if any Sale-and-Lease Back Property is sold to a third party and is no longer owned by the Group Companies, such that any such sold Sale-and-Lease Back Property (including the value set forth in the column titled “Value” for the Sale-and-Lease Back Property) shall be removed from Schedule B.

“Sale-and-Lease Back Transaction Amount” means the aggregate amount of, at the Closing, the values set forth in the column titled “Value” for the Sale-and-Lease Back Properties on Schedule B hereto (as amended pursuant to the terms of this Agreement); provided that, the parties may mutually agree to revise Schedule B to reflect any change in the column titled “Value” on Schedule B for the Sale-and-Lease Back Properties prior to the Closing Date.

“Sanctioned Country” means any country or region or government thereof that is, or has been since April 24, 2019, the subject or target of a comprehensive embargo under Sanctions Laws (including Cuba, Iran, North Korea, Syria, Venezuela, the Crimea region of Ukraine, the so-called “Donetsk People’s Republic,” and the so-called “Luhansk People’s Republic”).

“Sanctioned Person” means any Person that is the subject or target of sanctions or restrictions under Ex-Im Laws or Sanctions Laws, including: (i) any Person listed on any U.S. or non-U.S. sanctions- or export-related restricted party list, including the List of Specially Designated Nationals and Blocked Persons maintained by the U.S. Department of the Treasury Office of Foreign Assets Control (“OFAC”) and the Entity List maintained by the U.S. Department of Commerce Bureau of Industry and Security; (ii) any Person that is, in the aggregate, 50 percent or greater owned, directly or indirectly, or otherwise controlled by, a Person or Persons described in clause (i); or (iii) any person organized or ordinarily resident in a Sanctioned Country.

“Sanctions Laws” shall mean all U.S. and applicable non-U.S. Legal Requirements relating to economic or trade sanctions, including the Applicable Laws administered or enforced by the United States (including by OFAC or the U.S. Department of State) and the United Nations Security Council.

“Schedules” means the disclosure schedules to this Agreement.

“Security Incident” means (a) any actual unauthorized, unlawful, or accidental loss of, damage to, access to, acquisition of, use, alteration, acquisition, encryption, theft, modification, destruction, unavailability, disclosure of, or other unauthorized Processing of Group Company Data, (b) any damage to, or unauthorized, unlawful, or accidental access to, or use of, any IT System, including any ransomware or malware attack, or (c) any incident defined as a “personal data breach,” “security breach,” “security incident,” “data breach” or similar term by Data Security Requirements.

“Software” means computer software programs, including all databases, reports, software tool sets, compilers, and related documentation, whether in source code, object code or human readable form.

“Solvent” means, with respect to any Person and as of any date of determination, (a) the amount of the present fair saleable value of the assets of such Person, will, as of such date, exceed the amount of all Liabilities of such Person, contingent or otherwise, as of such date, (b) the present fair saleable value of the assets of such Person will, as of such date, be greater than the amount that will be required to pay the Liability of such Person on its indebtedness as its indebtedness becomes absolute and matured, (c) such Person will not have, as of such date, an unreasonably small amount of capital with which to conduct its business and (d) such Person will be able to pay its indebtedness as it matures. For purposes of the foregoing definition only, “indebtedness” means a Liability in connection with another Person’s right to payment, whether or not such a right is reduced to judgment, liquidated, unliquidated, fixed, contingent, matured, unmatured, disputed, undisputed, legal, equitable, secured or unsecured.

“Straddle Period” means any taxable period beginning on or before and ending after the Closing Date.

“Subsidiary” means, with respect to any Person, any corporation, limited liability company, partnership, association, or other business entity of which (a) if a corporation, a majority of the total voting power of shares of stock entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees thereof is at the time owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person or a combination thereof or (b) if a limited liability company, partnership, association, or other business entity (other than a corporation), a majority of the partnership or other similar ownership interests thereof is at the time owned or controlled, directly or indirectly, by such Person or one or more Subsidiaries of such Person or a combination thereof, and for this purpose, a Person or Persons own a majority ownership interest in such a business entity (other than a corporation) if such Person or Persons shall be allocated a majority of such business entity’s gains or losses or shall be a, or control any, managing director or general partner of such business entity (other than a corporation). The term “Subsidiary” shall include all Subsidiaries of such Subsidiary. For the avoidance of doubt, no Person, assets or business acquired in connection with an Add-On Acquisition is a Subsidiary of the Company or a member of the Group Companies for purposes of the representations and warranties in Article 3.

“Substitute Debt Financing” shall have the meaning set forth in Section 5.11(e).

“Surviving Corporation” has the meaning set forth in Section 2.1.

“Surviving Corporation Bylaws” has the meaning set forth in Section 2.6(b).

“Surviving Corporation Certificate of Incorporation” has the meaning set forth in Section 2.6(a).

“Target Net Working Capital” means negative $8,734,158.

“Tax” means all U.S. federal, state, local, and non-U.S. income, gross receipts, payroll, employment, excise, severance, stamp, occupation, windfall or excess profits, profits, customs, duties, capital stock, withholding, social security, unemployment, disability, real property, personal property, sales, use, transfer, value added, alternative or add-on minimum, capital gains, ad valorem, franchise, estimated, goods and services, environmental taxes, and any other similar fees, assessments, or charges in the nature of a tax, including all interest, penalties, assessments and additions imposed by any Taxing Authority with respect to the foregoing.

“Tax Contest” has the meaning set forth in Section 8.3.

“Tax Proceeding” means any Action with respect to Taxes.

“Tax Refund” has the meaning set forth in Section 8.6.

“Tax Return” means all tax returns, declarations, reports, claims for refund, information returns, or other documents filed or required to be filed with a Taxing Authority in respect of Taxes, including any attachments or schedules thereto and any amendments thereof.

“Taxing Authority” means any Governmental Entity having jurisdiction over the assessment, determination, collection, administration or imposition of any Tax.

“Termination Date” has the meaning set forth in Section 7.1(d).

“Trade Control Laws” has the meaning set forth in Section 3.21(b).

“Trade Secrets” shall mean confidential and proprietary information of each Group Company, as applicable, including technical or nontechnical data, formulas, patterns, compilations, programs, financial data, financial plans, product or service plans or lists of actual or potential customers or underwriters which, in each case (a) derives economic value, actual or potential, from not being generally known to, and not being readily ascertainable by proper means by, other persons who can obtain economic value from its disclosure or use, and (b) is the subject of efforts that are reasonable under the circumstances to maintain its secrecy.

“Transaction Expenses” means, without duplication, the aggregate amount of all fees, costs and expenses of any kind accrued or incurred by or on behalf of any of the Group Companies or Holdco (to the extent such amounts are a Liability of any Group Company) in connection with the sale process for the Group Companies and their businesses, assets and Liabilities and the preparation, negotiation, execution, and performance of this Agreement and the Ancillary Documents, and the performance and consummation of the Merger and the other transactions contemplated by this Agreement and the Ancillary Documents, including (i) the fees, costs and expenses of counsel, accountants, investment bankers, consultants, financial advisors and other Representatives (including the Investment Advisors and Kirkland & Ellis LLP ); and (ii) any “single-trigger” success, change of control or similar bonuses payable to any employee or director solely upon the consummation of the transactions contemplated hereunder (including, in each case, the employer portion of any associated payroll, social security or similar Taxes related to any such payments as of the Closing Date), in each case other than by reason of actions affirmatively taken by Parent or the Group Companies on the Closing Date and after the Closing (other than actions contemplated by this Agreement) or by Parent or Merger Sub (or at the direction of Parent or Merger Sub) on or prior to the Closing. Notwithstanding anything to the contrary contained herein, in no event shall Transaction Expenses include any amounts with respect to (i) the “tail” policy

pursuant to and in accordance with Section 5.4, (ii) filing fees under the HSR Act and any other applicable Antitrust Laws or (iii) Transfer Taxes. Notwithstanding the foregoing, Transaction Expenses shall not include any amounts to the extent such amounts are included in the calculation of Closing Indebtedness, Cash and Cash Equivalents or Net Working Capital.

“Transaction Tax Deductions” means, without duplication, the sum of any and all items of loss, deduction or credit for applicable Income Tax purposes resulting from or otherwise attributable to any payment made by or on behalf of the Group Companies in connection with the transactions contemplated herein, including but not limited to (a) the Transaction Expenses (regardless of whether such items remain unpaid as of Closing), (b) the repayment of any Closing Indebtedness required to be paid at Closing or as otherwise contemplated to be repaid at Closing by this Agreement (including any capitalized financing fees, costs and expenses that become currently deductible as a result thereof), and (c) any other expenses or costs incurred in connection with the transactions contemplated hereby. For such purpose, the parties agree to apply the election under IRS Rev. Proc. 2011-29 to treat seventy percent (70%) of any “success-based fees” within the meaning of Treasury Regulation Section 1.263(a)-5(f) and IRS Rev. Proc. 2011-29, as deductible in Pre-Closing Tax Periods of the Group Companies.

“Transfer Taxes” has the meaning set forth in Section 8.4.

“Treasury Regulations” means the regulations promulgated under the Code by the U.S. Department of the Treasury.

“Unpaid Transaction Expenses” means the aggregate amount of Transaction Expenses that are incurred and unpaid as of immediately prior to the Closing.

“Vendor” has the meaning set forth in Section 3.20.

“Wage and Hour Dispute” has the meaning set forth on Schedule 3.6.

“Wage and Hour Dispute Amount” has the meaning set forth on Schedule 3.6.

“WARN Act” means the Worker Adjustment and Retraining Notification Act of 1988, and any similar Legal Requirement.

ARTICLE 2

THE MERGER

Section 2.1 Merger. Upon the terms and subject to the conditions set forth in this Agreement, and in accordance with the DGCL, Merger Sub shall be merged with and into the Company (the “Merger”) at the Effective Time. Following the Effective Time, the separate existence of Merger Sub shall cease, and the Company shall continue as the surviving corporation of the Merger (the “Surviving Corporation”) and a wholly owned Subsidiary of Parent and shall succeed to and assume all the rights and obligations of Merger Sub in accordance with the DGCL.

Section 2.2 Closing of the Merger. Subject to the terms and conditions of this Agreement, the closing of the Merger (the “Closing”) shall take place at 10:00 a.m., Eastern Time on the second (2nd) Business Day after satisfaction (or waiver) of the conditions set forth in Article 6 (not including conditions which are to be satisfied by actions taken at the Closing or which by their nature can be satisfied only on the Closing Date), remotely by the electronic exchange of documents and signatures,

unless another time, date or place is agreed to in writing by the parties hereto. Notwithstanding the foregoing, in no event shall the Closing take place prior to April 1, 2025. The “Closing Date” shall be the date on which the Closing takes place.

Section 2.3 Deliveries of the Company and Holdco at the Closing. Prior to or at the Closing, the Company and Holdco shall have delivered the following documents:

(a) a certificate from the Company, in form and substance as prescribed by Treasury Regulations promulgated under Section 1445 of the Code, stating that the Company is not, and has not been during the relevant period specified in Section 897(c)(1)(ii) of the Code, a “United States real property holding corporation” within the meaning of Section 897(c) of the Code, together with a signed notice contemplated by Treasury Regulations Section 1.897-2(h); provided, that the sole remedy of Parent and any of its respective Affiliates or paying and withholding agents for the Company’s failure to provide such certificate and notice shall be to make an appropriate deduction or withholding in accordance with Section 2.9(d);

(b) unless otherwise requested by Parent, written resignations from, or evidence of removal of, directors, managers and officers of the Group Companies;

(c) resolutions of the board of directors of the Company approving this Agreement and the consummation of the transactions contemplated hereby and recommending adoption of this Agreement and the consummation of the transactions contemplated hereby to the Company’s equity holders;

(d) evidence of the assignment of Holdco’s rights under the agreements set forth on Schedule 2.3(d) to the Company; and

(e) any books and records of the Group Companies in Holdco’s possession not already in possession of the Group Companies at the Closing Date (if any).

Section 2.4 Effective Time. Subject to the terms and conditions set forth in this Agreement, on the Closing Date (or on such other date as Parent and the Company may agree), the parties hereto shall cause a certificate of merger (the “Certificate of Merger”) to be executed and filed with the Secretary of State of the State of Delaware in such form as required by, and in accordance with applicable provisions of, the DGCL. The Merger shall become effective at the time that the Certificate of Merger is accepted for filing by the Secretary of State of the State of Delaware or at such later date and time as specified in the Certificate of Merger (the time the Merger becomes effective being referred to herein as the “Effective Time”).

Section 2.5 Effects of the Merger. The Merger shall have the effects set forth in Sections 251 and 259 of the DGCL. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the property, rights, privileges, powers and franchises of the Company and Merger Sub shall vest in the Surviving Corporation, and all Liabilities, restrictions and disabilities of each of the Company and Merger Sub shall become the Liabilities, restrictions and disabilities of the Surviving Corporation.

Section 2.6 Certificate of Incorporation; Bylaws.

(a) At the Effective Time, the certificate of incorporation of Merger Sub in effect immediately prior to the Effective Time shall become the certificate of incorporation of the Surviving Corporation, except that (a) the name of the Surviving Corporation shall be “OC IntermediateCo, Inc.” and (b) such certificate of incorporation shall be revised to the extent necessary to comply with Section 5.4 (the “Surviving Corporation Certificate of Incorporation”) until thereafter changed or amended as provided therein or by Applicable Law.

(b) At the Effective Time, the bylaws of Merger Sub in effect immediately prior to the Effective Time shall become the bylaws of the Surviving Corporation, except that (a) the name of the Surviving Corporation shall be “OC IntermediateCo, Inc.” and (b) such bylaws shall be revised to the extent necessary to comply with Section 5.4 (the “Surviving Corporation Bylaws”) until thereafter changed or amended as provided therein or by Applicable Law.