false

0000823768

WASTE MANAGEMENT INC

0000823768

2025-02-25

2025-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2025

Waste

Management, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

1-12154 |

|

73-1309529 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 800

Capitol Street, Suite

3000, Houston,

Texas |

|

77002 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s Telephone number, including

area code: (713) 512-6200

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common

Stock, $0.01 par value |

WM |

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Annual incentive awards were granted on February

25, 2025 to each of the named executive officers of Waste Management, Inc. (the “Company”), as identified in the Company’s

most recent proxy statement (collectively, the “Executives”), pursuant to action by the Management Development and Compensation

Committee (the “Committee”) of the Board of Directors of the Company.

Each

of the Executives, which includes James C. Fish, Jr., President and Chief Executive Officer; John J. Morris, Jr., Executive Vice President

and Chief Operating Officer; Devina A. Rankin, Executive Vice President and Chief Financial Officer; Tara J. Hemmer, Senior Vice President

and Chief Sustainability Officer; and Rafael E. Carrasco, Senior Vice President – Enterprise Strategy and President, WM Healthcare

Solutions, received performance share units (“PSUs”) and stock options under the Company’s 2023 Stock Incentive Plan.

The number of PSUs granted to each of the Executives is as follows: Mr. Fish — 43,636; Mr. Morris — 11,272; Ms. Rankin —

9,818; Ms. Hemmer — 7,636 and Mr. Carrasco — 7,636. The material terms of the PSUs are described below.

| PSUs |

|

|

| Performance Calculation Date (“PCD”) |

|

As of December 31, 2027; award (if any) paid out after certification by the Committee of actual level of achievement (“payment date”). |

| |

|

|

| Performance Measure |

|

50% of the PSUs will have a cash flow generation performance measure, and 50% of the PSUs will have a total shareholder return relative to the S&P 500 performance measure, in each case as set forth in the award agreement filed as Exhibit 10.1. |

| |

|

|

| Range of Possible Awards |

|

0 — 200% of targeted amount, plus accrued dividend equivalents, based on actual results achieved. |

| |

|

|

| Termination of Employment |

|

Payable in full on payment date based on actual results as if participant had remained an active employee through PCD. |

| |

|

|

| Death or Disability before PCD |

|

|

| |

|

|

| Involuntary Termination for Cause or Voluntary Resignation before PCD |

|

Immediate forfeiture. |

| |

|

|

| Involuntary Termination other than for Cause before PCD |

|

Payable on payment date based on actual results, prorated based on portion of performance period completed prior to termination of employment. |

| |

|

|

| Retirement (as defined in the award agreement) before PCD |

|

If Retirement occurs on or after December 31, 2025, payable in full on payment date based on actual results as if participant had remained an active employee through PCD. If Retirement occurs before December 31, 2025, payable on payment date based on actual results, prorated based on the number of days worked during 2025 (the first year of the performance period) divided by 365. |

| |

|

|

| Change in Control before PCD |

|

Performance measured prior to the change in control and paid on prorated basis on actual results achieved up to such date. Thereafter, participant also generally receives a replacement award of restricted stock units in the successor entity generally equal to the number of PSUs that would have been earned had no change in control occurred and target performance levels had been met from the time of the change of control through December 31, 2027, adjusted for any conversion factors in the change in control transaction. The new restricted stock units in the successor entity would vest on December 31, 2027. |

The Committee granted stock options to the Executives to purchase the

following number of shares of the Company’s common stock: Mr. Fish — 50,580; Mr. Morris — 13,066; Ms. Rankin —

11,380; Ms. Hemmer – 8,851 and Mr. Carrasco – 8,851. The material terms of the stock options are described below.

| Stock Options |

|

|

| Vesting Schedule |

|

34% on first anniversary;

33% on second anniversary; and

33% on third anniversary. |

| |

|

|

| Term |

|

10 years from date of grant. |

| |

|

|

| Exercise Price |

|

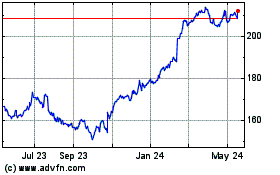

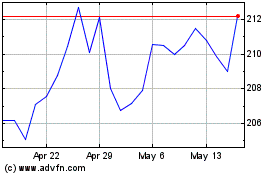

Fair Market Value on date of grant - $231.195. |

| |

|

|

| Termination of Employment |

|

|

| |

|

|

| Death or Disability |

|

All options immediately vest and remain exercisable for one year, but in no event later than the original term. |

| |

|

|

| Qualifying Retirement |

|

Continued vesting and exercisability for three years, but in no event later than the original term. |

| |

|

|

| Involuntary Termination other than for Cause or Voluntary Resignation |

|

All vested options remain exercisable for 90 days, but in no event later than the original term. |

| |

|

|

| Involuntary Termination for Cause |

|

All options are forfeited, whether or not exercisable. |

| |

|

|

| Involuntary Termination or Resignation for Good Reason following a Change in Control |

|

All options immediately vest and remain exercisable for three years, but in no event later than the original term. |

Each of the Executives was also granted an

annual cash incentive award on February 25, 2025. Annual cash incentive awards are targeted at a percentage of the

Executive’s base salary, and payouts can range from zero to 200% of the targeted amount based on achievement of performance

measures. Performance measures for the 2025 annual cash incentive awards include (i) operating EBITDA, (ii) income from operations

excluding depreciation and amortization margin and (iii) internal revenue growth. Payouts of annual cash incentives based on the

performance measures can be increased or decreased by up to 10%, depending on achievement calculated using a sustainability

scorecard. The Committee has discretion to increase or decrease an Executive’s annual cash incentive award by up to 25% based

on individual performance. Subject to the terms of any individual written employment, change in control or severance agreement,

recipients must be employed by an affiliate of the Company on December 31, 2025 to be eligible to receive payment of an annual cash

incentive award; provided, however, in the event of death, the recipient’s beneficiaries will receive a prorated award based

on the number of days worked in 2025.

The above descriptions of the material terms of the awards are qualified in their entirety by reference to the appropriate award agreement

filed as an exhibit hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

WASTE MANAGEMENT, INC. |

| |

|

|

| Date: February 28, 2025 |

By: |

/s/ Charles C. Boettcher |

| |

|

Charles C. Boettcher |

| |

|

Executive Vice President and Chief Legal Officer |

EXHIBIT 10.1

Long Term Incentive Compensation

PSU Award Agreement

under the

Waste Management, Inc. 2023

Stock Incentive Plan

This

Award Agreement (this “Agreement”) is entered

into effective as of [●] (the

“Grant Date”), by and between Waste Management,

Inc., a Delaware corporation (the “Company”) (together with its Subsidiaries

and Affiliates, “WM”), and [●]

(“Employee”).

At all times, the Awards under this Agreement are subject to the terms and conditions of the Waste Management, Inc. 2023 Stock Incentive

Plan (the “Plan”), this Agreement, and all applicable

administrative interpretations and practices. A copy of the Plan and the Plan Prospectus is available online at www.benefits.ml.com. Please

also see the Company’s Form 10-K included in its most recent Annual Report, available on the Investor Relations page of www.wm.com

under Financial Reporting – Annual Reports, for information about the Company. By executing this Agreement, you consent to receipt

of the Plan, the Prospectus, and the Annual Reports by electronic access as

set forth in this paragraph.

You

must execute this Agreement in full, online in accordance with the instructions below, prior to [●], in order for this Agreement

to become effective. If you do not execute this Agreement by correctly following the instructions below, your Awards may

be cancelled.

Important Instructions for

Executing this Agreement

If you are a new equity award participant, you must

open a Limited Individual Investor Account (LIIA) before you can accept your awards. To open your LIIA, log in to www.benefits.ml.com

at the secure website maintained by the third-party stock administrator. Once logged in, follow the prompts to “Open a Brokerage

Account”. When you have successfully created your account, follow the online instructions, and complete all the steps required to

accept the award.

If you have previously received a stock-based incentive

award, log on to www.benefits.ml.com at the secure website maintained by the third-party stock administrator. Follow the online instructions

and complete all the steps required to accept the award.

Performance Share Units

| 1. | PSU Grant. The Company hereby grants to Employee a Performance-based Restricted Stock Unit Award of

[●] units subject to performance-based vesting conditions (a “PSU Award”), as provided in the Notice of

Long-Term Incentive Award (the “Notice”). Each Restricted Stock Unit subject to performance-based vesting conditions

(a “Performance Share Unit” or “PSU”) is a notational unit of measurement denominated

in Common Stock. |

| a. | The Performance Period for this PSU Award is the 36-month period beginning January 1, 2025,

and ending on December 31, 2027. Vesting and payout of your PSU Award is based upon the level of achievement of the Performance

Goals that have been set by the Committee. The Performance Goals set by the Committee for your PSU Awards are described in paragraph

3 below. |

| b. | The performance measure selected by the Committee to serve as the Performance Goal for half (50%) of your

Target PSU Award is Cash Flow Generation (as defined below). The performance measure selected by the Committee to serve

as the Performance Goal for the other half (50%) of your Target PSU Award is Total Shareholder Return Relative to the S&P 500,

or TSR (as defined below). To determine the payout (if any) under your PSU Award, the Committee will determine the level

of the Performance Goal reached (“Achievement”) and the corresponding payout percentage applicable to each half

of your Target PSU Award under paragraph 3 below. The Committee’s determinations, and the related calculations, including the calculation

of Cash Flow Generation and TSR, are made by, and in the sole discretion of, the Committee, and are final and not subject to appeal. |

| c. | Cash Flow Generation is the net cash flow provided by operating activities of WM for the Performance

Period, less capital expenditures, with the following adjustments: |

| i. | Payments related to costs (including legal costs) associated with labor disruptions (e.g., strikes) and actual

or potential multiemployer plan withdrawal liability(ies) are excluded as expenditures required as a result of past labor commitments

combined with changing economic conditions of the present business climate; |

| ii. | Strategic acquisition, restructuring, transformation and reorganization costs are excluded in recognition

of WM’s goals to increase customer and business base while minimizing operating costs; and |

| iii. | If any accounting rule or tax law change occurs that was not anticipated in setting the Cash Flow Generation

target, any material impact of that change will be disregarded in calculating the Cash Flow Generation result. |

In addition to the above, the following

adjustments will be made when the aggregate impact of the following items has a greater than 5% impact on attainment:

| iv. | Impacts from strategic acquisitions or divestitures of assets or businesses are excluded (EBITDA, capital

expenditures, working capital, and proceeds from divestitures) (Impacts from normal course of business acquisitions and divestitures are

included); |

| v. | Impacts from discrete growth capital investment projects made to support the long-term organic growth of

the business that were not specifically planned for in setting the Cash Flow Generation target are excluded; and |

| vi. | Material changes in the realization of earnings and cash flow contributions for growth capital investments

caused by items outside of WM’s control will be excluded. |

The Committee, solely in its discretion,

is permitted to make other adjustments to reflect management’s performance consistent with maximizing shareholder value; provided that

such other adjustments shall not reduce the Cash Flow Generation amount.

| d. | TSR is the percentile performance of the Company as compared to the other S&P 500 Companies

for the Performance Period. For these purposes: |

i. S&P

500 Companies means all the entities listed on the Standard & Poor’s 500 Composite Index, including the Company, on

the date which is 30 trading days prior to the commencement of the Performance Period, with the following modifications:

A. except as provided

below, only those entities that continue to trade throughout the Performance Period without interruption on a National Exchange

shall be included; and

B. any such entity

that files for bankruptcy (“Bankrupt Peer”) during the Performance Period shall continue to be included.

For these purposes National Exchange

shall mean a securities exchange that has registered with the SEC under Section 6 of the Securities Exchange Act of 1934.

ii. Total

Shareholder Return is the result of dividing (1) the sum of the cumulative value of an entity’s dividends for the Performance

Period, plus the entity’s Ending Price, minus the Beginning Price, by (2) the Beginning Price. For purposes of determining the cumulative

value of an entity’s dividends during the Performance Period, it will be assumed that all dividends declared and paid with respect

to a particular entity during the Performance Period were reinvested in such entity at the ex-dividend date, using the closing price on

such date. The aggregate shares, or fractional shares thereof, that will be assumed to be

purchased as part of the reinvestment calculation

will be multiplied by the Ending Price to determine the cumulative value of an entity’s dividends for the Performance Period. For

these purposes:

| A. | Price is the per share closing price, as reported by the Bloomberg L.P. (or any other publicly

available reporting service that the Committee may designate from time to time) of a share or share equivalent on the applicable stock

exchange. |

| B. | Beginning Price is the average Price for the period of 20 trading days immediately preceding

the first day of the Performance Period. |

| C. | Ending Price is the average Price for the period of 20 trading days immediately preceding and

including the final day of the Performance Period. |

| D. | Bankrupt Peer: Notwithstanding anything in the foregoing to the contrary, any Bankrupt Peer

shall have a Total Shareholder return of negative one hundred percent (-100%). |

iii. Relative

TSR Percentile Rank is the percentile performance of the Company as compared to the S&P 500 Companies. Relative TSR Percentile

Rank is determined by ranking the Company and all other S&P 500 Companies according to their respective Total Shareholder Return for

the Performance Period. The ranking is in order from minimum-to-maximum, with the lowest performing entity assigned a rank of one. The

Company’s ranking is then divided by the total number of entities within the S&P 500 Companies to get the Relative TSR Percentile

Rank.

| a. | The Performance Goals are the levels of performance set by the Committee on the Grant Date

with respect to each measure of performance. |

| b. | The Target PSU Award for this Agreement is based on the target number of PSUs granted by the

Committee and announced in the Notice. If Achievement falls between two levels of Achievement, the resulting payout percentage will be

straight line interpolated (rounding to the nearest 0.1 percent) between the payout percentages for those two levels of Achievement. |

Achievement Levels and Corresponding Payouts

for PSUs Dependent on Cash Flow Generation Performance Measure

| Level of Achievement |

Cash Flow

Generation Over

the Performance

Period |

Payout Percentage for the

applicable half of your

Target PSU Award |

| Threshold Performance (the minimum level of Achievement to qualify for any payout of the Cash Flow Generation half of your Target PSU Award.) |

$9.140 Billion |

50% |

| Target Performance (the level of Achievement to qualify for 100% payout of the Cash Flow Generation half of your Target PSU Award.) |

$9.890 Billion |

100% |

| Maximum Performance (the maximum level of Achievement that results in an increased number of PSUs paid out under the Cash Flow Generation half of your Target PSU Award.) |

$10.640 Billion |

200% |

Achievement Levels and Corresponding Payouts

for PSUs Dependent on TSR

| Total Shareholder Return Relative to the S&P 500 over the Performance Period |

|

Level of Achievement |

Relative TSR

Percentile Rank |

Payout Percentage for the

applicable half of your Target

PSU Award |

| Threshold Performance (the minimum level of Achievement to qualify for any payout of the TSR half of your Target PSU Award.) |

25th |

50% |

Total

Shareholder Return Relative to the S&P 500 over the Performance Period |

| Target Performance (the level of Achievement to qualify for 100% payout of the TSR half of your Target PSU Award.) |

50th |

100% |

| Maximum Performance (the maximum level of Achievement that results in an increased number of PSUs paid out under the TSR half of your Target PSU Award.) |

75th |

200% |

| 4. | Timing and Form of Payment of PSU Award. After the

close of the Performance Period, the Committee will certify (with respect to each portion of your Target PSU Award relating to the separate

Performance Goals) Achievement and determine the corresponding payout percentage of the PSU Award by multiplying the applicable half of

the PSU Award by the applicable payout percentage. The results will sum to the total number of shares of Common Stock that you are entitled

to receive (the “PSU Awarded Shares”). Unless

you have a valid deferral in place for your PSU Award (see paragraph 8 under “Important Award Details” for further information

on permitted deferrals), the Company will deliver the PSU Awarded Shares and payment of the corresponding Dividend Equivalent as soon

as administratively feasible (and no later than 74 days after the end of the Performance Period) after the Committee’s certification

and determination. |

Important Award Details

Your Awards under this Agreement are subject to

important terms and conditions set forth below. Please read them carefully and seek advice from your own legal and tax advisors before

executing this Agreement.

| 1. | Death or Disability. Upon Employee’s death or disability (as determined by the Committee and

within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended, and the Treasury Regulations issued thereunder (“Section

409A”) and specifically Section 409A(a)(2)(C) (“Disability”)), Employee (or in the case of Employee’s

death, Employee’s beneficiary) shall, subject to paragraph 2.e below, be entitled to receive the PSU Awarded Shares and related

Dividend Equivalents that Employee would have been entitled to under this Agreement if Employee had remained employed until the last day

of the Performance Period and determined based upon actual Achievement through the end of the Performance Period, which shall be paid

no later than 74 days following the end of the Performance Period. |

| 2. | Treatment of PSU Awards Upon Retirement or Involuntary Termination of Employment Without Cause by WM. |

| a. | Upon an involuntary Termination of Employment by WM without Cause, Employee shall, subject to the requirements

below, be entitled to receive the PSU Awarded Shares and related Dividend Equivalents that Employee would have been entitled to under

this Agreement if Employee had remained employed until the last day of the Performance Period and determined based upon actual Achievement

through the end of the Performance Period multiplied by the fraction which has as its numerator the total number of days that Employee

was employed by WM during the Performance Period and has as its denominator 1095 (which amount shall be issued and paid as soon as practicable

and no later than 74 days following the end of the Performance Period). |

| b. | Upon Employee’s Retirement, Employee shall be entitled to receive the PSU Awarded Shares and related

Dividend Equivalents that Employee would have been entitled to under this Agreement if Employee had remained employed until the last day

of the Performance Period and determined based upon actual Achievement through the end of the Performance Period multiplied by the fraction

which has as its numerator the total number of days that Employee was employed by WM during the first 12 months of the Performance Period

and has as its denominator 365 (which amount shall be issued and paid as soon as practicable and no later than 74 days following the end

of the Performance Period). To illustrate the application of the preceding sentence, if Employee’s Retirement is on or after December

31, 2025, he or she shall be eligible to receive a full payout at the end of the Performance Period (based upon actual Achievement). |

| c. | In the event Employee is employed by a subsidiary of the Company that is sold by the Company in a transaction

(i) that would not constitute a Corporate Change, but (ii) that would constitute a Corporate Change with the subsidiary substituted for

Company thereunder, such transaction shall be deemed to constitute an involuntary Termination of Employment by WM without Cause as of

the effective date of such Transaction and Employee’s termination. |

| d. | The following terms shall have the meanings set forth below for purposes of this Agreement: |

| i. | Retirement means Termination of Employment due to the voluntary resignation of employment by

Employee, after Employee (1) has reached age 55 or greater; (2) has a sum of age plus years of Service (as defined in paragraph ii. below)

with WM equal to 65 or greater; and (3) has completed at least 5 consecutive full years of Service with WM during the 5-year period immediately

preceding the resignation; provided, that Employee is not receiving severance benefits pursuant to the severance pay plans of WM

in connection with such Termination of Employment. |

| ii. | Service is measured from Employee’s original date of hire by WM, except as provided below.

In the case of a break of employment by Employee from WM of one year or more in length, Employee’s service before the break of employment

is not considered Service. Service with an entity acquired by WM is considered Service so long as Employee remained continuously employed

with such predecessor company(ies) and WM. In the case of a break of employment between a predecessor company and WM of any length, Employee’s

Service shall be measured from the original date of hire by WM and shall not include any service with any predecessor company. |

| iii. | Termination of Employment means the termination of Employee’s employment or other service

relationship with WM as determined by the Committee. Temporary absences from employment because of illness, vacation or leave of absence

and transfers among the Company and its Subsidiaries and Affiliates will not be considered a Termination of Employment. Any question as

to whether and when there has been a Termination of Employment, and the cause of such termination, shall be determined by and in the sole

discretion of the Committee and such determination shall be final. |

| iv. | Cause means any of the following: (1) willful or deliberate and continual refusal to materially

perform Employee’s duties reasonably requested by WM after receipt of written notice to Employee of such failure to perform, specifying

such failure (other than as a result of Employee’s sickness, illness, injury, death or disability) and Employee fails to cure such

nonperformance within ten (10) days of receipt of said written notice; (2) breach of any statutory or common law duty of loyalty to WM;

(3) Employee has been convicted of, or pleaded nolo contendre to, any felony; (4) Employee willfully or intentionally caused material

injury to WM, its property, or its assets; (5) Employee disclosed to unauthorized person(s) proprietary or confidential information of

WM that causes a material injury to WM; or (6) any material violation or a repeated and willful violation of WM’s policies or procedures,

including but not limited to, WM’s Code of Business Conduct and Ethics (or any successor policy) then in effect. |

| e. | In order to receive any of the vesting or exercisability benefits upon termination described in paragraphs

1, 2, and 3 (except resignation), Employee (or, if applicable, Employee’s estate) must (x) execute and not revoke a general release

of claims in favor of WM and its affiliates in a form that is acceptable to WM and which has become effective and irrevocable prior to

the payment date set forth above (or such earlier deadline set by WM) and (y) continue to abide by all ongoing obligations to WM under

any restrictive covenant agreement. |

| 3. | Termination of Employment for Other Reasons. |

| a. | PSU Awards in the Event of Involuntary Termination with Cause or Resignation by Employee. Except as

provided in paragraphs 1 through 2 above and 5 below, Employee must be an employee of WM continuously from the Grant Date through the

close of business on last day of the Performance Period for PSUs to be entitled to receive payment of any PSU Award. Upon Termination

of Employment on or before the last day of the Performance Period for PSUs, Employee shall immediately forfeit the PSU Award and any related

Dividend Equivalents without payment of any consideration by WM. |

| i. | Notwithstanding any provisions in the Plan or this Agreement to the contrary, any portion of the payments

and benefits provided under this Agreement or the sale of any shares of Common Stock issued hereunder shall be subject to the Waste Management,

Inc. Clawback Policy, adopted by the Committee of the Board on August 21, 2023, (as may be amended from time to time, the “Clawback

Policy”) and any other clawback or recovery policy adopted by the Committee or the Board from time to time, including, without

limitation, any such policy adopted in accordance with the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act

of 2010 or any rule or regulation of the SEC or New York Stock Exchange. Additionally, notwithstanding the terms of any of the organizational

documents of WM, any corporate policy, or any contract between Employee and WM, Employee hereby acknowledges and agrees that Employee

will not be entitled to (i) indemnification for any liability (including any amounts owed by Employee in a judgment or settlement in connection

with any action taken by the Committee or the Board to enforce the Clawback Policy) (such action, a “Clawback Proceeding”)

or loss (including judgments, fines, taxes, penalties or amounts paid in settlement by or on behalf of Employee incurred by Employee in

connection with or as a result of any Clawback Proceeding) or (ii) indemnification or advancement of any expenses (including attorneys’

fees) from WM incurred by Employee in connection any Clawback Proceeding; provided, however, if Employee is successful on the merits in

the defense of any claim asserted against Employee in a Clawback Proceeding, Employee shall be indemnified for the expenses (including

attorneys' fees) Employee reasonably incurred to defend such claim. Employee knowingly, voluntarily and intentionally waives, and agrees

not to asset any claims regarding, any and all rights to indemnification, advancement of expenses and other rights from WM to which Employee

is now or may become entitled under any indemnity agreement or other contract between Employee and WM, the organizational documents of

WM and the General Corporation Law of the State of Delaware, in each case to the extent such waiver and agreement is necessary to comply

with applicable law or give effect to the preceding provisions of this paragraph. |

| b. | Repayment of Award in the Event of Misconduct. |

| i. | Overriding any other inconsistent terms of this Agreement, if the Committee, in its sole discretion, determines

that Employee either engaged in or benefited from Misconduct (as defined below), then, to the fullest extent permitted by law, Employee

shall refund and pay to WM any Common Stock and/or amounts (including Dividend Equivalents), plus interest, received by Employee under

this Agreement. Misconduct means any act or failure to act by any employee of WM that (i) caused or was intended to cause

a violation of WM’s policies or the WM code of conduct, generally accepted accounting principles or any applicable laws in effect

at the time of the act or failure to act in question and that (ii) materially increased the value of the payment or Award received by

Employee under this Agreement. The Committee may, in its sole discretion, delegate the determination of Misconduct to an independent third

party (either a law firm or an accounting firm, hereinafter referred to as Independent Third Party) appointed by the Committee. |

| ii. | Following a determination of Misconduct by Employee, Employee may dispute such determination pursuant to

binding arbitration as set forth below under “General Terms” provided, however, that if Employee is determined to have benefited

from, but not engaged in, Misconduct, Employee will have no right to dispute such determination and such determination shall be conclusive

and binding. |

| iii. | WM must initiate recovery pursuant to this paragraph by the earliest of (i) one year after discovery of alleged

Misconduct, or (ii) the second anniversary of Employee’s Termination of Employment. |

| iv. | The provisions of this paragraph, without any implication as to any other provision of this Agreement, shall

survive the expiration or termination of this Agreement and Employee’s employment. |

| 5. | Acceleration upon Corporate Change. Overriding any other inconsistent terms of this Agreement: |

| a. | PSU Award. If there is a Corporate Change before the close of the Performance Period, Employee is

entitled to receive both i. and ii., as follows: |

| i. | For each half of the PSU Award, the result of an equation with a numerator of |

| (x) | the respective number of PSUs Employee would have otherwise received based upon achievement of the applicable

Performance Goal after reducing the Performance Period so that it ends on the last day of the quarter preceding the Corporate Change (the

“Early Measurement Date”) and, for the Cash Flow Generation half of the PSU Award, after adjusting the Threshold,

Target and Maximum Achievement Levels to reflect budgeted performance in the shorter Performance Period, multiplied by |

| (y) | a fraction equal to (1) the number of days occurring between the beginning of the Performance Period and

the Early Measurement Date (including the Early Measurement Date) divided by (2) 1095. |

Payout of the PSUs shall be an immediate cash payment (in all

events paid within 74 days following the Corporate Change) equal to the number of PSUs earned under this paragraph 5.a. multiplied by

the closing stock price of the Common Stock on the Early Measurement Date and will be accompanied by a cash payment of the associated

Dividend Equivalents through the Early Measurement Date; and

| ii. | As a substitute award for the lost opportunity to continue to earn PSUs for the entire length of the original

Performance Period: |

| 1. | If the successor entity is a publicly traded company as of the Early Measurement Date, an award of restricted

stock units in the successor entity equal to the number of shares of common stock of the successor entity that could have been purchased

on the Early Measurement Date with an amount of cash equal to the quotient obtained from the following equation: |

TAP X (1095

– EMD) x CP

1095

where

TAP is the number

of PSUs represented by the Target PSU Award;

EMD is the number

of days during the Performance Period which occur prior to and including the Early Measurement Date; and

CP is the closing

price of a share of Common Stock of the Company on the Early Measurement Date.

Any restricted stock units in the successor

entity awarded under this paragraph 5.a.ii.1. will vest completely on December 31, 2026 (and be paid within 74 days thereof), provided

that Employee

remains continuously employed with the successor entity until then. Provided however, in the event of Employee’s involuntary

Termination of Employment without Cause during the Window Period (as defined in paragraph d.iv. below) or upon Employee’s

Retirement, death or Disability, Employee shall become immediately vested in full in the restricted stock units in the successor entity

awarded pursuant to this paragraph 5.a.ii.1 and paid (i) in the case of death or Disability, within 74 days of such time or (ii) in the

case of Retirement or involuntary Termination of Employment without Cause, within 74 days following December 31, 2026.

| 2. | If the successor entity is not a publicly traded company as of the Early Measurement Date, an amount of cash

equal to the quotient obtained from the equation in paragraph 5.a.ii.1. above. |

Any cash payment awarded under this paragraph

5.a.ii.2. will be paid to Employee as soon as administratively feasible (and no later than 74 days) following December 31, 2026, provided

that Employee remains continuously employed with the successor entity until such date. Provided however, in the event of Employee’s

involuntary Termination of Employment without Cause during the Window Period or upon Employee’s Retirement, death or Disability,

Employee shall become vested and be paid such cash payment by the successor entity (i) in the case of death or Disability, within 74 days

of such time or (ii) in the case of Retirement or involuntary Termination of Employment without Cause, within 74 days following December

31, 2026.

| b. | Window Period means the period beginning on the date occurring six (6) months immediately prior

to the date on which a Corporate Change first occurs and ending on the second anniversary of the date on which a Corporate Change occurs. |

| a. | The Company will pay Dividend Equivalents with respect to the PSUs when (i) the Performance Period has ended;

(ii) Employee has vested in the Award; and (iii) the PSU Awarded Shares have been certified by the Committee based on actual Achievement

during the Performance Period (or otherwise determined pursuant to paragraph 6.a.i. above). As soon as administratively feasible after

these events (and no later than 74 days following the end of the Performance Period), the Company will pay Employee a lump-sum cash amount

for PSU Award Dividend Equivalents based on the number of PSU Awarded Shares multiplied by the per share quarterly dividend payments made

to stockholders of the Company’s Common Stock during the Performance Period (without any interest or compounding). Any accumulated

and unpaid Dividend Equivalents attributable to PSUs that are cancelled or forfeited will not be paid and are immediately forfeited upon

cancellation of the PSUs. |

| a. | The Committee may establish procedures for Employee to elect for deferral, until a time or times later than

the vesting of PSU Awards, receipt of all or a portion of the shares of Common Stock deliverable under the Awards. Any such deferral must

be under the terms and conditions determined in the sole discretion of the Committee (or its designee) and the Waste Management, Inc.

409A Deferral Savings Plan (“WM 409A Plan”). The Committee further retains the authority and discretion to modify

and/or terminate existing deferral elections, procedures, and distribution options. Common Stock subject to a deferral election does not

confer any shareholder rights to Employee unless and until the date the deferral expires and certificates representing such shares are

delivered to Employee. |

| b. | No deferral of Dividend Equivalents is permitted. In the event shares of Common Stock received upon vesting

of PSU Awards are deferred pursuant to a valid deferral, then the Company will pay Dividend Equivalents to Employee in cash on such deferred

shares of Common Stock, as soon as administratively feasible following the payment of such dividends to stockholders of record. |

| c. | If the Committee permits deferral of the PSU Awards under this Agreement, then each provision of this Agreement

shall be interpreted to permit deferral only (i) in accordance with the terms of the WM 409A Plan and (ii) as allowed in compliance with

Section 409A. Any provision that would conflict with such requirements is not valid or enforceable. Employee acknowledges, without limitation,

and consents that the application of Section 409A to this Agreement may require additional delay of payments otherwise payable under this

Agreement or the WM 409A Plan. Employee and the Company agree to execute any instruments and take any action as reasonably may be necessary

to comply with Section 409A. |

General Terms

| 1. | Restrictions on Transfer. |

| a. | Absent prior written consent of the Committee, Awards may not be sold, assigned, transferred, pledged, or

otherwise encumbered, whether voluntarily or involuntarily, by operation of law or otherwise, other than pursuant to a domestic relations

order; provided, however, that the transfer of any shares of Common Stock issued under the Awards shall not be restricted by virtue of

this Agreement once such shares have been paid out. |

| b. | Consistent with paragraph 1.a. above and except as provided in paragraph 3. below, no right or benefit under

this Agreement shall be subject to transfer, anticipation, alienation, sale, assignment, pledge, encumbrance, or charge, whether voluntary,

involuntary, by operation of law or otherwise, and any attempt to transfer, anticipate, alienate, sell, assign, pledge, encumber or charge

the same shall be void. No right or benefit hereunder shall in any manner be liable for or subject to any debts, contracts, liabilities,

or torts of the person entitled to such benefits. If Employee or his Beneficiary shall attempt to transfer, anticipate, alienate, assign,

sell, pledge, encumber or charge any right or benefit hereunder (other than pursuant to a domestic relations order), or if any creditor

shall attempt to subject the same to a writ of garnishment, attachment, execution sequestration, or any other form of process or involuntary

lien or seizure, then such attempt shall have no effect and shall be void. |

| 2. | Fractional Shares. No fractional shares of Common Stock will be issued under the Plan or this Agreement. |

| 3. | Withholding Tax. Employee agrees that Employee is responsible for federal, state, and local tax consequences

associated with the Awards (and any associated Dividend Equivalents) under this Agreement. Upon the occurrence of a taxable event with

respect to any Award under this Agreement, Employee shall deliver to WM at such time, (i) such amount of money or shares of Common Stock

earned or owned by Employee or (ii) if employee is an executive officer at the time of such tax event and so elects (or, otherwise, with

WM’s approval), shares deliverable to Employee at such time pursuant to the applicable Award, in each case, as WM may require to

meet its obligation under applicable tax laws or regulations, and, if Employee fails to do so, WM is authorized to withhold from any shares

of Common Stock deliverable to Employee, cash, or other form of remuneration then or thereafter payable to Employee, any tax required

to be withheld. |

| 4. | Compliance with Securities Laws. WM is not required to deliver any shares of Common Stock under this

Agreement, if, in the opinion of counsel for the Company, such issuance would violate the Securities Act of 1933, any other applicable

federal or state securities laws or regulations, or the requirements of any stock exchange or market system upon which the Common Stock

may then be listed. Prior to the issuance of any shares, WM may require Employee (or Employee’s legal representative upon Employee’s

death or disability) to enter into such written representations, warranties and agreements as WM may reasonably request in order to comply

with applicable laws, including an agreement (in such form as the Committee may specify) under which Employee represents that the shares

of Common Stock acquired under an Award are being acquired for investment and not with a view to sale or distribution. |

| |

|

Further,WM may postpone issuing and/or delivering any Common Stock for so long as WM, in its complete and sole discretion, reasonably determines

is necessary to satisfy any of the following conditions: (a) the Company completing or amending any securities registration or qualification

of the Common Stock, (b) receipt of proof satisfactory to WM that a person seeking to exercise the Award after the Employee’s death

is entitled to do so; (c) establishment of Employee’s compliance with any necessary representations or terms and conditions of

the Plan or this Agreement, or (d) compliance with any federal, state, or local tax withholding obligations. |

| 5. | Employee to Have no Rights as a Stockholder. Employee shall have no rights as a stockholder with respect

to any shares of Common Stock subject to this Award prior to the date on which Employee is recorded as the holder of such shares of Common

Stock on the records of the Company, including no right to dividends declared on the Common Stock underlying the Award. Notwithstanding

the foregoing, Dividend Equivalents shall be paid to Employee in accordance with and subject to the terms of paragraph 6 under “Important

Award Details.” |

| 6. | Successors and Assigns. This Agreement shall bind and inure to the benefit of and be enforceable

by Employee, WM and their respective permitted successors or assigns (including personal representatives, heirs, and legatees), except

that Employee may not assign any rights or obligations under this Agreement except to the extent, and in the manner, expressly permitted

herein. The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or

substantially all of the business and/or assets of the Company to assume expressly and agree to perform this Agreement in the same manner

and to the same extent that WM would be required to perform it if no such succession had taken place, except as otherwise expressly provided

under “Important Award Details.” |

| 7. | Limitation of Rights. Nothing in this Agreement or the Plan may be construed to: |

| a. | give Employee any right to be awarded any further Awards other than in the sole discretion of the Committee; |

| b. | give Employee or any other person any interest in any fund or in any specified asset or assets of WM (other

than the Awards made by this Agreement, the related Dividend Equivalents awarded under this Agreement, and any Common Stock issuable under

the terms and conditions of such Awards); or |

| c. | confer upon Employee the right to continue in the employment or service of WM. |

| 8. | Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Texas,

without reference to principles of conflict of laws. |

| 9. | Severability/Entire Agreement. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity

or enforceability of any other provision of this Agreement. |

| a. | Employee understands and agrees that the Awards granted under this Agreement are granted under the authority of the Plan and these

Awards and this Agreement are in all ways governed by the terms and conditions of the Plan and its administrative practices and interpretations,

which also include the Clawback Policy. Any inconsistency between the Agreement and the Plan shall be resolved in favor of the Plan. Employee

also agrees the terms and conditions of the Plan, this Agreement and related administrative practices and interpretations control, even

if there is a conflict with any other terms and conditions in any employment agreement or in any prior awards. Without limiting the generality

of the foregoing, as a condition to receipt of this Award, Employee agrees that the provisions relating to vesting and/or forfeiture of

this Award upon a Termination of Employment set forth in this Agreement supersede and replace any provisions relating to vesting of the

Award upon termination or other event set forth in any employment agreement, offer letter or similar document. |

| b. | Employee understands and agrees that he or she is to consult with and rely upon only Employee’s

own tax, legal, and financial advisors regarding the consequences and risks of this Agreement and the awards made under this Agreement. |

| c. | Except as provided in paragraph 13 below, this Agreement may not be amended except in writing (including

by electronic writing) signed by all the parties to this Agreement (or their respective successors and legal representatives). The captions

are not a part of the Agreement and for that reason shall have no force or effect. |

| 10. | No Waiver. In the event the Employee or WM fails to insist on strict compliance with any term or condition of this Agreement

or fails to assert any right under this Agreement, such failure is not a waiver of that term, condition or right. |

| 11. | Covenant Requirement Essential Part of Award. An overriding condition (even if any other provision

of the Plan and this Agreement are conflicting) for Employee to receive any benefit from or payment of any Award under this Agreement,

is that Employee must also have entered, and abided by the terms of, an agreement containing restrictive covenants concerning limitations

on Employee’s behavior following termination of employment that is satisfactory to WM. |

| 12. | Definitions. If not defined in this Agreement, capitalized terms have the meanings set forth in the

Plan. |

| 13. | Compliance with Section 409A. Both WM and Employee intend that this Agreement does not result in unfavorable

tax consequences to Employee under Section 409A. Accordingly, Employee consents to any amendment of this Agreement WM may reasonably make

consistent to achieve that intention and WM may, disregarding any other provision in this Agreement to the contrary, unilaterally execute

such amendment to this Agreement. WM shall promptly provide, or make available to, Employee a copy of any such amendment. WM agrees to

make any such amendments to preserve the intended benefits to the Employee to the maximum extent possible. This paragraph does not create

an obligation on the part of WM to modify this Agreement and does not guarantee that the amounts or benefits owed under the Agreement

will not be subject to interest and penalties under Section 409A. Each cash and/or stock payment and/or benefit provided under the Plan

and this Agreement and/or pursuant to the terms of WM’s benefit plans, programs and policies shall be considered a separate payment

for purposes of Section 409A. For purposes of Section 409A, to the extent that Employee is a “specified employee” within the

meaning of the Treasury Regulations issued pursuant to Section 409A as of Employee’s separation from service and to the limited

extent necessary to avoid the imputation of any tax, penalty or interest pursuant to Section 409A, notwithstanding anything to the contrary

in this Agreement, no amount which is subject to Section 409A of the Code and is payable on account of Employee’s separation from

service shall be paid to Employee before the date (the “Delayed Payment Date”) which is the first day of the seventh month

after the Employee’s separation from service or, if earlier, the date of the Employee’s death following such separation from

service. All such amounts that would, but for the immediately preceding sentence, become payable prior to the Delayed Payment Date will

be accumulated and paid without interest on the Delayed Payment Date. |

| 14. | Use of Personal Data. Employee agrees to the collection, use, processing, and transfer of certain personal data, including

name, salary, nationality, job title, position, social security number (or other tax identification number) and details of all past Awards

and current Awards outstanding under the Plan (“Data”), for the purpose of managing and administering the Plan.

Employee is not obliged to consent to such collection, use, processing, and transfer of personal data, but a refusal to provide such consent

may affect the ability to participate in the Plan. WM may transfer Data among themselves or to third parties as necessary for the purpose

of implementation, administration, and management of the Plan. These various recipients of Data may be located throughout the world. Employee

authorizes these various recipients of Data to receive, possess, use, retain and transfer the Data, in electronic or other form, for the

purposes of implementing, administering, and managing the Plan. Employee may, at any time, review Data with respect to Employee and require

any necessary amendments to such Data. Employee may withdraw his or her consent to use Data herein by notifying WM in writing (according

to the provisions of paragraph 15 below); however, Employee understands that by withdrawing his or her consent to use Data, Employee may

affect his or her ability to participate in the Plan. |

| 15. | Notices. Any notice given by one party under this Agreement to the other shall be in writing and may be delivered personally

or by mail, postage prepaid, addressed to the Secretary of the Company, at its then corporate |

| |

|

headquarters, and Employee at Employee’s address

as shown on WM’s records, or to such other address as Employee, by notice to the Company, may designate in writing from time

to time. |

| 16. | Electronic Delivery. WM may, in its sole discretion, deliver any documents related to the Awards under this Agreement,

the Plan, and/or the WM 409A Plan, by electronic means or request Employee’s consent to participate in the administration of this

Agreement, the Plan, and/or the WM 409A Plan by electronic means. Employee hereby consents to receive such documents by electronic delivery

and agrees to participate in the Plan through an on-line or electronic system established and maintained by WM or another third party

designated by WM. |

| 17. | Binding Arbitration. Except as otherwise specifically provided herein, the Committee’s findings,

calculations and determinations under this Agreement are made in the sole discretion of the Committee, and Employee expressly agrees that

such determinations shall be final and not subject to dispute. In the event, however, that Employee has a right to dispute a matter hereunder

(including, but not limited to, the right to dispute set forth in paragraph 4 under “Important Award Details”) or a matter

directly relating to this Award under the Clawback Policy, the Company and Employee agree that such dispute shall be settled exclusively

by final and binding arbitration, as governed by the Federal Arbitration Act (9 U.S.C. 1 et seq.). The arbitration proceeding,

including the rendering of an award, if any, shall be administered by JAMS pursuant to its Employment Arbitration Rules and Procedures,

which may be found on the JAMS Website www.jamsadr.com. All expenses associated with the arbitration shall be borne by WM; provided

however, that such arbitration expenses will not include attorney fees incurred by the respective parties. Judgment on any arbitration

award may be entered in any court having jurisdiction. |

| 18. | Counterparts. This Agreement may be executed in counterparts, which together shall constitute one and the same original. |

Execution

IN WITNESS WHEREOF, the Company has caused

this Agreement to be duly executed by one of its officers thereunto duly authorized and Employee has executed this Agreement, effective

as of [●].

| WASTE MANAGEMENT, INC. |

Employee |

| |

|

Exhibit 10.2

Long Term Incentive Compensation

Stock Option Award Agreement

under the

Waste Management, Inc. 2023

Stock Incentive Plan

This

Award Agreement (this “Agreement”) is entered

into effective as of [●] (the

“Grant Date”), by and between Waste Management,

Inc., a Delaware corporation (the “Company”) (together with its Subsidiaries

and Affiliates, “WM”), and [●]

(“Employee”).

At all times, the Awards under this Agreement are subject to the terms and conditions of the Waste Management, Inc. 2023 Stock Incentive

Plan (the “Plan”), this Agreement, and all applicable administrative interpretations

and practices. A copy of the Plan and the Plan Prospectus is available online at www.benefits.ml.com. Please also see the Company’s

Form 10-K included in its most recent Annual Report, available on the Investor Relations page of www.wm.com under Financial Reporting

– Annual Reports, for information about the Company. By executing this Agreement, you consent to receipt of the Plan, the Prospectus,

and the Annual Reports by electronic access as set forth in this paragraph.

You

must execute this Agreement in full, online in accordance with the instructions below, prior to

[●], in order for this Agreement to become effective. If you do not execute this Agreement by correctly following

the instructions below, your Awards may be cancelled.

Important Instructions for

Executing this Agreement

If you are a new equity award participant, you must

open a Limited Individual Investor Account (LIIA) before you can accept your awards. To open your LIIA, log in to www.benefits.ml.com

at the secure website maintained by the third-party stock administrator. Once logged in, follow the prompts to “Open a Brokerage

Account”. When you have successfully created your account, follow the online instructions, and complete all the steps required to

accept the award.

If you have previously received a stock-based incentive

award, log on to www.benefits.ml.com at the secure website maintained by the third-party stock administrator. Follow the online instructions

and complete all the steps required to accept the award.

Stock Options

| 1. | Stock Option Grant. The Company hereby grants to Employee a stock option award (the “Stock

Option Award”) for [●] shares (“Stock Options”) of Common Stock provided in the Notice.

This Stock Option Award grants Employee the right to purchase shares of Common Stock at the Grant Price. The “Grant Price”

is the Fair Market Value of a share of Common Stock on the Grant Date. |

| 2. | Term. Notwithstanding any other provisions of this Agreement, the maximum term of the Stock Option

Award is the 10th anniversary of the Grant Date. |

| 3. | Right to Exercise. Provided Employee remains employed by WM continuously through the applicable exercise

dates, the Stock Option Award will become vested and exercisable as follows: |

| Exercise Date |

Cumulative Percentage of Stock

Option Award Exercisable |

| Prior to the first anniversary of the Grant Date |

0% |

| On or after the first anniversary of the Grant Date |

34% |

| On or after the second anniversary of the Grant Date |

67% |

| On or after the third anniversary of the Grant Date |

100% |

| 4. | Manner of Exercise. To exercise all or a portion of the Stock Option Award, Employee must contact

(either by phone or online) the third-party stock plan administrator designated by the Company and follow the procedures established by

the Company for exercising a Stock Option Award. |

| 5. | Payment of Grant Price. The Grant Price is payable in full to the Company either (a) in cash or its

equivalent; (b) by tendering previously acquired shares of Common Stock held for at least six months and with an aggregate fair market

value at the time of exercise equal to the aggregate Grant Price; (c) to the extent Employee is an executive officer at the time of exercise,

by withholding shares of Common Stock that otherwise would be acquired pursuant to the Stock Option Award; or (d) any combination of the

foregoing. The Grant Price may also be paid by cashless exercise through delivery of irrevocable instructions to a broker to promptly

deliver to the Company the amount of proceeds from a sale of shares having fair market value equal to the Grant Price, provided that such

instructions are delivered by no later than the close of the New York Stock Exchange on the last Trading Day prior to the

10th anniversary of the Grant Date. Payment by cashless exercise shall not be considered to have occurred until the broker has issued

confirmation of the transaction. For these purposes, Trading Day means a day on which the New York Stock Exchange is open

for trading for its regular trading sessions. |

Important Award Details

Your Awards under this Agreement are subject to

important terms and conditions set forth below. Please read them carefully and seek advice from your own legal and tax advisors before

executing this Agreement.

| 1. | Death or Disability. Upon Employee’s death or disability (as determined by the Committee and

within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended, and the Treasury Regulations issued thereunder (“Section

409A”) and specifically Section 409A(a)(2)(C) (“Disability”)), Employee (or in the case of Employee’s

death, Employee’s beneficiary) shall, subject to paragraph 2.e below, be entitled to: |

| a. | exercise all Stock Options outstanding under the Stock Option Award (whether previously exercisable) for

one year following such event. Provided however, if Employee was eligible for Retirement (as defined below) at the time

of his death or Disability, the Stock Option Award will remain exercisable for three years following the date of such event. |

| 2. | Treatment of Stock Option Award upon Involuntary Termination; Resignation; Retirement. |

| a. | Involuntary Termination of Employment Without Cause or Resignation by Employee. Upon an involuntary

Termination of Employment without Cause by WM or a Termination of Employment due to a voluntary resignation by Employee that is accepted

by WM that is not a Retirement, for a period of 90 days following such Termination of Employment, Employee shall be entitled to exercise

all the Stock Options then outstanding and exercisable under the Stock Option Award. Any Stock Options that are not outstanding and exercisable

at the time of the applicable termination shall be forfeited without the payment of any consideration by WM, and any Stock Options that

were eligible to be exercised pursuant to this paragraph 3.a but were not exercised during the 90-day exercise period shall also be forfeited

without the payment of any consideration by WM. |

| b. | Retirement. Upon Employee’s Retirement, the Stock Option Award shall continue to become exercisable

under the applicable exercise schedule for three years following Employee’s Retirement and once exercisable shall remain exercisable

for the three-year period following Employee’s Retirement |

| c. | The following terms shall have the meanings set forth below for purposes of this Agreement: |

| i. | Retirement means Termination of Employment due to the voluntary resignation of employment by

Employee, after Employee (1) has reached age 55 or greater; (2) has a sum of age plus years of Service (as defined in paragraph ii. below)

with WM equal to 65 or greater; and (3) has completed at least 5 consecutive full years of Service with WM during the 5-year period immediately

preceding the resignation; provided, that Employee is not receiving severance benefits pursuant to the severance pay plans of WM

in connection with such Termination of Employment. |

| ii. | Service is measured from Employee’s original date of hire by WM, except as provided below.

In the case of a break of employment by Employee from WM of one year or more in length, Employee’s service before the break of employment

is not considered Service. Service with an entity acquired by WM is considered Service so long as Employee remained continuously employed

with such predecessor company(ies) and WM. In the case of a break of employment between a predecessor company and WM of any length, Employee’s

Service shall be measured from the original date of hire by WM and shall not include any service with any predecessor company. |

| iii. | Termination of Employment means the termination of Employee’s employment or other service

relationship with WM as determined by the Committee. Temporary absences from employment because of illness, vacation or leave of absence

and transfers among the Company and its Subsidiaries and Affiliates will not be considered a Termination of Employment. Any question as

to whether and when there has been a Termination of Employment, and the cause of such termination, shall be determined by and in the sole

discretion of the Committee and such determination shall be final. |

| iv. | Cause means any of the following: (1) willful or deliberate and continual refusal to materially

perform Employee’s duties reasonably requested by WM after receipt of written notice to Employee of such failure to perform, specifying

such failure (other than as a result of Employee’s sickness, illness, injury, death or disability) and Employee fails to cure such

nonperformance within ten (10) days of receipt of said written notice; (2) breach of any statutory or common law duty of loyalty to WM;

(3) Employee has been convicted of, or pleaded nolo contendre to, any felony; (4) Employee willfully or intentionally caused material

injury to WM, its property, or its assets; (5) Employee disclosed to unauthorized person(s) proprietary or confidential information of

WM that causes a material injury to WM; or (6) any material violation or a repeated and willful violation of WM’s policies or procedures,

including but not limited to, WM’s Code of Business Conduct and Ethics (or any successor policy) then in effect. |

| d. | In order to receive any of the vesting or exercisability benefits upon termination described in paragraphs

1 and 2 (except resignation), Employee (or, if applicable, Employee’s estate) must (x) execute and not revoke a general release

of claims in favor of WM and its affiliates in a form that is acceptable to WM and which has become effective and irrevocable prior to

the payment date set forth above (or such earlier deadline set by WM) and (y) continue to abide by all ongoing obligations to WM under

any restrictive covenant agreement. |

| 3. | Termination of Employment for Other Reasons. |

| a. | Stock Option Award in the Event of Involuntary Termination with Cause. Upon Termination of Employment

by WM with Cause, Employee shall forfeit all Stock Options under the Stock Option Award, whether exercisable, without the payment of any

consideration by WM. |

| i. | Notwithstanding any provisions in the Plan or this Agreement to the contrary, any portion of the payments

and benefits provided under this Agreement or the sale of any shares of Common Stock issued hereunder shall be subject to the Waste Management,

Inc. Clawback Policy, adopted by the Committee of the Board on August 21, 2023, (as may be amended from time to time, the “Clawback

Policy”) and any other clawback or recovery policy adopted by the Committee or the Board from time to time, including, without

limitation, any such policy adopted in accordance with the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act

of 2010 or any rule or regulation of the SEC or New York Stock Exchange. Additionally, notwithstanding the terms of any of the organizational

documents of WM, any corporate policy, or any contract between Employee and WM, Employee hereby acknowledges and agrees that Employee

will not be entitled to (i) indemnification for any liability (including any amounts owed by Employee in a judgment or settlement in connection

with any action taken by the Committee or the Board to enforce the Clawback Policy) (such action, a “Clawback Proceeding”)

or loss (including judgments, fines, taxes, penalties or amounts paid in settlement by or on behalf of Employee incurred by Employee in

connection with or as a result of any Clawback Proceeding) or (ii) indemnification or advancement of any expenses (including attorneys’

fees) from WM incurred by Employee in connection any Clawback Proceeding; provided, however, if Employee is successful on the merits in

the defense of any claim asserted against Employee in a Clawback Proceeding, Employee shall be indemnified for the expenses (including

attorneys' fees) Employee reasonably incurred to defend such claim. Employee knowingly, voluntarily and intentionally waives, and agrees

not to asset any claims regarding, any and all rights to indemnification, advancement of expenses and other rights from WM to which Employee

is now or may become entitled under any indemnity agreement or other contract between Employee and WM, the organizational documents of

WM and the General Corporation Law of the State of Delaware, in each case to the extent such waiver and agreement is necessary to comply

with applicable law or give effect to the preceding provisions of this paragraph. |

| b. | Repayment of Award in the Event of Misconduct. |

| i. | Overriding any other inconsistent terms of this Agreement, if the Committee, in its sole discretion, determines

that Employee either engaged in or benefited from Misconduct (as defined below), then, to the fullest extent permitted by law, Employee

shall refund and pay to WM any Common Stock and/or amounts (including Dividend Equivalents), plus interest, received by Employee under

this Agreement. Misconduct means any act or failure to act by any employee of WM that (i) caused or was intended to cause

a violation of WM’s policies or the WM code of conduct, generally accepted accounting principles or any applicable laws in effect

at the time of the act or failure to act in question and that (ii) materially increased the value of the payment or Award received by

Employee under this Agreement. The Committee may, in its sole discretion, delegate the determination of Misconduct to an independent third

party (either a law firm or an accounting firm, hereinafter referred to as Independent Third Party) appointed by the Committee. |

| ii. | Following a determination of Misconduct by Employee, Employee may dispute such determination pursuant to

binding arbitration as set forth below under “General Terms” provided, however, that if Employee is determined to have benefited

from, but not engaged in, Misconduct, Employee will have no right to dispute such determination and such determination shall be conclusive

and binding. |

| iii. | WM must initiate recovery pursuant to this paragraph by the earliest of (i) one year after discovery of alleged

Misconduct, or (ii) the second anniversary of Employee’s Termination of Employment. |

| iv. | The provisions of this paragraph, without any implication as to any other provision of this Agreement, shall

survive the expiration or termination of this Agreement and Employee’s employment. |

| 5. | Acceleration upon Corporate Change. Overriding any other inconsistent terms of this Agreement: |

| a. | Stock Option Award. In the event of Employee’s involuntary Termination of Employment without

Cause or Termination of Employment due to a resignation by Employee for Good Reason that, in either case, occurs on or before the second

anniversary of a Corporate Change, the Stock Option Award shall become exercisable immediately (whether previously exercisable) and shall

remain exercisable for the three-year period following such Termination of Employment. For this purpose, “Good Reason”

has the same meaning as within the Waste Management Holding, Inc. Executive Severance Plan (“Executive Severance Plan”).

In the event Employee is not a participant in the Executive Severance Plan, then Good Reason means the initial existence of one or more

of the following conditions, arising without the consent of the Employee: (1) a material diminution in Employee’s base compensation;

(2) a material diminution in Employee’s authority, duties, or responsibilities; (3) the relocation of the geographic location of

the Employee’s principal place of employment by more than 50 miles from the location Employee’s immediately prior principal

place of employment; provided, that, Employee cannot terminate Employee’s employment for “Good Reason”

unless Employee has provided written notice to the Company of the existence of the condition providing grounds for termination for Good

Reason within ninety (90) days of the initial existence of the condition, the written notice must provide for a date of termination not

less than thirty (3) nor more than sixty (60) days after the date such notice is given, and the condition specified in the notice must

remain uncorrected through the date of termination set forth in the notice. |

| b. | The following terms shall have the meanings set forth below for purposes of this Agreement: |

| c. | Window Period means the period beginning on the date occurring six (6) months immediately prior

to the date on which a Corporate Change first occurs and ending on the second anniversary of the date on which a Corporate Change occurs. |

General Terms

| 1. | Restrictions on Transfer. |

| a. | Absent prior written consent of the Committee, Awards may not be sold, assigned, transferred, pledged, or

otherwise encumbered, whether voluntarily or involuntarily, by operation of law or otherwise, other than pursuant to a domestic relations

order; provided, however, that the transfer of any shares of Common Stock issued under the Awards shall not be restricted by virtue of

this Agreement once such shares have been paid out. |

| b. | Consistent with paragraph 1.a. above and except as provided in paragraph 3. below, no right or benefit under

this Agreement shall be subject to transfer, anticipation, alienation, sale, assignment, pledge, encumbrance, or charge, whether voluntary,

involuntary, by operation of law or otherwise, and any attempt to transfer, anticipate, alienate, sell, assign, pledge, encumber or charge

the same shall be void. No right or benefit hereunder shall in any manner be liable for or subject to any debts, contracts, liabilities,

or torts of the person entitled to such benefits. If Employee or his Beneficiary shall attempt to transfer, anticipate, alienate, assign,

sell, pledge, encumber or charge any right or benefit hereunder (other than pursuant to a domestic relations order), or if any creditor

shall attempt to subject the same to a writ of garnishment, attachment, execution sequestration, or any other form of process or involuntary

lien or seizure, then such attempt shall have no effect and shall be void. |

| 2. | Fractional Shares. No fractional shares of Common Stock will be issued under the Plan or this Agreement. |

| 3. | Withholding Tax. Employee agrees that Employee is responsible for federal, state, and local tax consequences

associated with the Awards under this Agreement. Upon the occurrence of a taxable event with respect to any Award under this Agreement,

Employee shall deliver to WM at such time, (i) such amount of money or shares of Common Stock earned or owned by Employee or (ii) if employee

is an executive officer at the time of such tax event and so elects (or, otherwise, with WM’s approval), shares deliverable to Employee

at such time pursuant to the applicable Award, in each case, as WM may require to meet its obligation under applicable tax laws or regulations,

and, if Employee fails to do so, WM is authorized to withhold from any shares of Common Stock deliverable to Employee, cash, or other

form of remuneration then or thereafter payable to Employee, any tax required to be withheld. |

| 4. | Compliance with Securities Laws. WM is not required to deliver any shares of Common Stock under this

Agreement, if, in the opinion of counsel for the Company, such issuance would violate the Securities Act of 1933, any other applicable