Virtus Total Return Fund Inc. (NYSE: ZTR) today announced the

following monthly distributions:

Amount of Distribution

Ex-Date

Record Date

Payable Date

$0.05

September 13, 2024

September 13, 2024

September 26, 2024

$0.05

October 11, 2024

October 11, 2024

October 30, 2024

$0.05

November 12, 2024

November 12, 2024

November 27, 2024

Under the terms of its Managed Distribution Plan, the Fund will

seek to maintain a consistent distribution level that may be paid,

in part or in full, from net investment income and realized capital

gains, or a combination thereof. Shareholders should note, however,

that if the Fund's aggregate net investment income and net realized

capital gains are less than the amount of the distribution level,

the difference will be distributed from the Fund's assets and will

constitute a return of the shareholder's capital. You should not

draw any conclusions about the Fund’s investment performance from

the amount of this distribution or from the terms of the Fund’s

Managed Distribution Plan.

The Fund estimates that it has distributed more than its income

and capital gains; therefore, a portion of your distribution may be

a return of capital. A return of capital may occur, for example,

when some or all of the money that you invested in the Fund is paid

back to you. A return of capital distribution does not necessarily

reflect the Fund’s investment performance and should not be

confused with ‘yield’ or ‘income’.

The Fund previously provided this estimate of the sources of the

distributions:

Distribution Estimates

August 2024 (MTD)

Fiscal Year-to-Date (YTD)

(1)

(Sources)

Per Share Amount

Percentage of Current

Distribution

Per Share Amount

Percentage of Current

Distribution

Net Investment Income

$

0.000

0.0

%

$

0.022

4.9

%

Net Realized Short-Term Capital Gains

0.000

0.0

%

-

0.0

%

Net Realized Long-Term Capital Gains

0.000

0.0

%

-

0.0

%

Return of Capital (or other Capital

Source)

0.050

100.0

%

0.428

95.1

%

Total Distribution

$

0.050

100.0

%

$

0.450

100.0

%

(1)

Fiscal year started December 1,

2023.

Information regarding the Fund’s performance and distribution

rates is set forth below. Please note that all performance figures

are based on the Fund’s net asset value (NAV) and not the market

price of the Fund’s shares. Performance figures are not meant to

represent individual shareholder performance.

July 31, 2024

Average Annual Total Return on NAV for the

5-year period (2)

3.58

%

Annualized Current Distribution Rate

(3)

9.13

%

Fiscal YTD Cumulative Total Return on NAV

(4)

12.84

%

Fiscal YTD Cumulative Distribution Rate

(5)

6.09

%

(2)

Average Annual Total Return on

NAV is the annual compound return for the five-year period. It

reflects the change in the Fund’s NAV and reinvestment of all

distributions.

(3)

Annualized Current Distribution

Rate is the current distribution rate annualized as a percentage of

the Fund's NAV at month end.

(4)

Fiscal YTD Cumulative Total

Return on NAV is the percentage change in the Fund's NAV from the

first day of the fiscal year to this month end, including

distributions paid and assuming reinvestment of those

distributions.

(5)

Fiscal YTD Cumulative

Distribution Rate is the dollar value of distributions from the

first day of the fiscal year to this month end as a percentage of

the Fund's NAV at month end.

The amounts and sources of distributions reported in this notice

are estimates only and are not being provided for tax reporting

purposes. The actual amounts and sources of the distributions for

tax purposes will depend on the Fund’s investment experience during

the remainder of its fiscal year and may be subject to changes

based on tax regulations. The Fund or your broker will send you a

Form 1099-DIV for the calendar year that will tell you what

distributions to report for federal income tax purposes.

About the Fund

Virtus Total Return Fund Inc. is a diversified closed-end fund

whose investment objective is capital appreciation, with income as

a secondary objective. Virtus Investment Advisers, Inc. is the

investment adviser and Duff & Phelps Investment Management Co.

and Newfleet Asset Management are the subadvisers to the Fund.

For more information on the Fund, contact shareholder services

at (866) 270-7788, by email at closedendfunds@virtus.com, or

through the Closed-End Funds section of virtus.com.

Fund Risks

An investment in a fund is subject to risk, including the risk

of possible loss of principal. A fund’s shares may be worth less

upon their sale than what an investor paid for them. Shares of

closed-end funds may trade at a premium or discount to their NAV.

For more information about the Fund’s investment objective and

risks, please see the Fund’s annual report. A copy of the Fund’s

most recent annual report may be obtained free of charge by

contacting “Shareholder Services” as set forth at the bottom of

this press release.

About Duff & Phelps Investment Management Co.

Duff & Phelps Investment Management Co. pursues investment

strategies with exceptional depth of resources and expertise. With

more than 35 years of experience managing investment portfolios,

Duff & Phelps has earned a reputation as a leader in investing

in global listed infrastructure, global listed real estate, clean

energy, and diversified real assets in institutional separate

accounts and open- and closed-end funds. For more information,

visit dpimc.com.

About Newfleet Asset Management

Newfleet Asset Management provides comprehensive fixed income

portfolio management in multiple strategies. The Newfleet

Multi-Sector Strategies team that manages the Virtus Total Return

Fund Inc. employs active sector rotation and disciplined risk

management in portfolio construction, avoiding interest rate bets,

and remaining duration neutral to each strategy’s stated benchmark.

Newfleet Asset Management is a division of Virtus Fixed Income

Advisers, LLC, which is a registered investment adviser affiliated

with Virtus Investment Partners. For more information, visit

newfleet.com.

About Virtus Investment Partners, Inc.

Virtus Investment Partners (NYSE: VRTS) is a distinctive

partnership of boutique investment managers singularly committed to

the long-term success of individual and institutional investors. We

provide investment management products and services from our

affiliated managers, each with a distinct investment style and

autonomous investment process, as well as select subadvisers.

Investment solutions are available across multiple disciplines and

product types to meet a wide array of investor needs. Additional

information about our firm, investment partners, and strategies is

available at virtus.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240829901956/en/

For Further Information:

Shareholder Services (866) 270-7788 closedendfunds@virtus.com

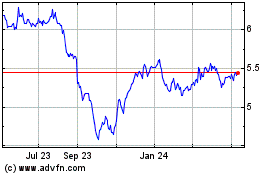

Virtus Total Return (NYSE:ZTR)

Historical Stock Chart

From Aug 2024 to Sep 2024

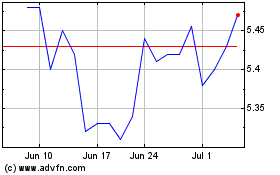

Virtus Total Return (NYSE:ZTR)

Historical Stock Chart

From Sep 2023 to Sep 2024