Algoma Central Corporation (“Algoma” or “the Company”) (TSX:

ALC), a leading provider of marine transportation services, today

announced its results for the year ended December 31, 2020. (All

amounts reported below are in thousands of Canadian dollars, except

for per share data and where the context dictates otherwise.)

Algoma is reporting very strong financial results for 2020, a

year in which a global pandemic introduced a number of economic and

operating challenges. As a marine transportation company and a

provider of critical marine infrastructure, the Company is a key

link in our customers' supply chains. Algoma, along with others in

the industry, was deemed an essential service and the Company

operated throughout the pandemic. In the face of these

unprecedented operating conditions, the Company delivered a 16%

increase in EBITDA, and a 92% increase in earnings per share (29%

increase on an adjusted basis - see Management's Discussion and

Analysis).

Fiscal 2020 business highlights include:

- A favourable mix of trades coupled with strong freight rates

drove higher results in the Domestic Dry-Bulk segment. The segment

experienced increased volumes in the higher margin grain and salt

sectors, while volumes in the iron ore and construction materials

sectors were lower than the prior year.

- The Product Tanker segment experienced strong utilization for

movements of products from the Great Lakes to the east coast,

despite a decline in retail fuel consumption that resulted from the

reductions in air travel and personal vehicle use in the spring and

summer.

- In the Ocean Self-Unloader segment, five dry-dockings were

undertaken successfully during the year, despite facing challenges

associated with the COVID-19 pandemic, and tight cost control

enabled the company to partially offset the impact of weakness in

volumes shipped.

- The Company completed a refinancing of its senior secured

credit facilities in December in advance of mid-2021 scheduled

maturities, securing long-dated debt on highly favourable

terms.

- The Company’s Board of Directors authorized payment of a

Special Dividend to shareholders of $2.65 per common share as a

result of the re-financing mentioned above. The dividend was paid

on January 12, 2021 to shareholders of record on December 28,

2020.

EBITDA, which includes our share of joint venture EBITDA, for

the year ended December 31, 2020 was $174,063 an increase of 16% or

$23,543, compared to the prior year. EBITDA is determined as

follows:

For the periods ended December 31

2020

2019

Net earnings

$

45,850

$

24,159

Depreciation and amortization

91,998

85,623

Interest and taxes

32,874

29,905

Foreign exchange (gain) loss

(534)

1,770

Impairment provision

9,746

15,970

Gain on disposal of assets

(5,871)

(6,907)

EBITDA

$

174,063

$

150,520

"When I reflect on the year here at Algoma, the resiliency of

the Algoma team always comes first to my mind,” said Gregg Ruhl,

President and CEO of Algoma Central Corporation. "Our teams, both

shipboard and shoreside, have had to pivot and adapt countless

times this year and I couldn’t be more proud of the hard work,

dedication and strength demonstrated by everyone in the Algoma

family,” continued Mr. Ruhl. "We reacted to the COVID-19 pandemic

early in March and we were able to respond quickly to address the

needs of our customers and, as a result, we experienced very strong

financial results. Although the year came with its challenges, we

successfully deployed our fleet to meet new market demand and we

did this all while maintaining our commitment to providing safe,

efficient and reliable transportation of essential goods both

domestically and around the world.”

Outlook

The steady improvement in volumes over the latter part of 2020

in the Domestic Dry-Bulk segment is expected to be sustained into

2021. Salt products are expected to continue to grow, offsetting a

return of grain volumes to more normal levels and shortfalls in

other commodities compared to historic levels. The Product Tanker

segment is very dependent on progress in re-opening the economy and

the country and particularly how this impacts air and vehicle

traffic. The current expectation for Product Tankers is for reduced

revenue days compared to 2020, when we benefited from logistics

decisions taken by our main customer that we do not expect to be

repeated in the coming year. The Ocean Self-Unloader business

should benefit from an increase in on-hire days now that the heavy

dry-docking calendar is behind us and Pool volumes are expected to

continue a slow recovery over the course of 2021.

We expect the cost environment to be more difficult in 2021 as

the Company makes significant investments in training and

developing its next generation of shipboard employees. In addition,

maintenance and lay-up spending is expected to rise, partially

reflecting the impact of the 2020 decisions to defer spending, as

well as dry-dockings that are required for certain domestic

vessels.

For the periods ended December 31

2020

2019

Revenue

$

545,660

$

567,908

Operating expenses

(366,693)

(408,240)

Selling, general and administrative

(29,727)

(31,283)

Depreciation and amortization

(75,154)

(70,015)

Operating earnings

74,086

58,370

Interest expense

(19,738)

(19,860)

Interest income

238

1,167

Gain on sale of property

5,621

—

Foreign currency gain (loss)

351

(886)

60,558

38,791

Income tax expense

(9,503)

(5,109)

Net loss from investments in joint

ventures

(5,205)

(9,523)

Net Earnings

$

45,850

$

24,159

Basic earnings per share

$

1.21

$

0.63

Diluted earnings per share

$

1.19

$

0.63

For the periods ended December 31

2020

2019

Domestic Dry-Bulk

Revenue

$

286,156

$

281,680

Operating earnings

46,752

33,435

Product Tankers

Revenue

114,273

141,912

Operating earnings

21,550

19,899

Ocean Self-Unloaders

Revenue

134,109

131,425

Operating earnings

18,791

18,673

Corporate and Other

Revenue

11,122

12,891

Operating loss

(13,007)

(13,637)

The MD&A for the year ended December 31, 2020 includes

further details. Full results for the year ended December 31, 2020

can be found on the Company’s website at www.algonet.com/investor-relations and on SEDAR at

www.sedar.com.

Normal Course Issuer Bid

On March 19, 2020, the Company renewed its normal course issuer

bid with the intention to purchase, through the facilities of the

TSX, up to 1,890,457 of its Common Shares ("Shares") representing

approximately 5% of the 37,809,143 Shares which were issued and

outstanding as at the close of business on March 4, 2020 (the

“NCIB”). The Company bought 23,600 shares under NCIBs in 2020.

The Company intends to renew its normal course issuer bid upon

receipt of the required approvals from regulatory authorities.

Cash Dividends

The Company’s Board of Directors has authorized payment of a

quarterly dividend to shareholders of $0.17 per common share, an

increase of $0.04 per common share. The dividend will be paid on

March 1, 2021 to shareholders of record on February 15, 2021.

Use of Non-GAAP Measures

There are measures included in this press release that do not

have a standardized meaning under generally accepted accounting

principles (GAAP). The Company includes these measures because it

believes certain investors use these measures as a means of

assessing financial performance. EBITDA is a non-GAAP measure that

does not have any standardized meaning prescribed by IFRS and may

not be comparable to similar measures presented by other companies.

Please refer to the Management’s Discussions and Analysis for the

year ended December 31, 2020 for further information regarding

non-GAAP measures.

About Algoma Central

Algoma owns and operates the largest fleet of dry and liquid

bulk carriers operating on the Great Lakes - St. Lawrence Waterway,

including self-unloading dry-bulk carriers, gearless dry-bulk

carriers, cement carriers, and product tankers. Algoma also owns

ocean self-unloading dry-bulk vessels operating in international

markets and a 50% interest in NovaAlgoma, which owns and operates a

diversified portfolio of dry-bulk fleets serving customers

internationally.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210226005292/en/

Gregg A. Ruhl President & CEO 905-687-7890 Peter D. Winkley

Chief Financial Officer 905-687-7897

Or visit www.algonet.com or

www.sedar.com

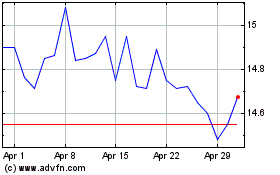

Algoma Central (TSX:ALC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Algoma Central (TSX:ALC)

Historical Stock Chart

From Feb 2024 to Feb 2025