Bitfarms Ltd. (NASDAQ/TSX: BITF), a global leader in vertically

integrated Bitcoin data center operations, today announced its

latest monthly production report. All financial references are in

U.S. dollars.

In October, Bitfarms announced a second hosting

agreement with Stronghold Digital Mining, Inc. (“Stronghold”)

that will deploy 10,000 miners, originally scheduled for Yguazu,

Paraguay, to Stronghold’s Scrubgrass site. This follows an initial

hosting agreement for 10,000 miners signed in September for a total

of 20,000 miners to be deployed at Stronghold’s two sites in

Pennsylvania. The two hosting agreements support approximately 4

EH/s with energization expected in several tranches over the coming

months.

CEO Ben Gagnon stated, “While we are pleased to

have reached our year-end efficiency goal of 21 w/TH three months

ahead of schedule, we recognize that we are behind schedule on

delivering our mid-year 12 EH/s target. Despite improvements in

recent miner shipments, continued miner warranty servicing has

impeded the achievement of our hash rate target. We have a strong

partnership with Bitmain and appreciate their diligence in rapidly

servicing the underperforming miners as deliveries are scheduled to

accelerate in the last two months of the year.”

Mining ReviewOctober mining

operations generated 236 BTC compared to 217 BTC in September

reflecting a 3% increase in average operating EH and an 8% increase

in Bitcoin difficulty during the month.

|

Key Performance Indicators |

October 2024 |

September 2024 |

October 2023 |

|

Total BTC earned |

236 |

217 |

398 |

|

Month End Operating EH/s |

11.5 |

11.3 |

6.3 |

|

BTC/Avg. EH/s |

22 |

21 |

67 |

|

Average Operating EH/s |

10.6 |

10.3 |

5.9 |

|

Operating Capacity (MW) |

310 |

310 |

240 |

|

Hydropower (MW) |

256 |

256 |

186 |

|

Watts/Terahash Efficiency (w/TH) |

21 |

21 |

35 |

|

BTC Sold |

194 |

173 |

341 |

October 2024 Select Operating

Highlights

- 11.5 EH/s operational at October

31, 2024, up 83% Y/Y.

- 10.6 EH/s average operational, up

80% Y/Y and up 3% M/M.

- 22.2 BTC/average EH/s, up 5% M/M

and 67% lower Y/Y.

- 236 BTC earned, up 9% M/M and 41%

lower Y/Y.

- 7.6 BTC earned daily on average,

equal to ~$540,000 per day based on a BTC price of $71,000 at

October 31, 2024.

Bitfarms’ BTC Monthly

Production

|

Month |

BTC Earned 2024 |

BTC Earned 2023 |

|

January |

357 |

486 |

|

February |

300 |

387 |

|

March |

286 |

424 |

|

April |

269 |

379 |

|

May |

156 |

459 |

|

June |

189 |

385 |

|

July |

253 |

378 |

|

August |

233 |

383 |

|

September |

217 |

411 |

|

October |

236 |

398 |

|

YTD Totals |

2,496 |

4,090 |

October 2024 Financial

Update

- Sold 194 of the 236 BTC earned as

part of the Company’s regular treasury management practice for

total proceeds of $13.0 million.

- Added 42 BTC, bringing Treasury to

1,188 BTC, up from 1,147 BTC last month and representing $84.3

million based on a BTC price of $71,000 at October 31,

2024.

- Synthetic HODL™ of 802 long-dated

BTC call options at October 31, 2024, up from 602 at the end of the

prior month.

Upcoming Conferences and

Events

- November 13-14: Cantor Crypto,

Digital Assets & AI Infrastructure Conference (Miami)

- November 19-20: ROTH Technology

Conference (NYC)

- November 20: Special Meeting of

Bitfarms Shareholders (Virtual)

- December 4: B. Riley Crypto &

Energy Infrastructure Conference (NYC)

- December 12: Northland Growth

Conference (Virtual)

- January 14-15, 2025: Needham Growth

Conference (NYC)

About Bitfarms Ltd.

Founded in 2017, Bitfarms is a global vertically

integrated Bitcoin data center company that contributes its

computational power to one or more mining pools from which it

receives payment in Bitcoin. Bitfarms develops, owns, and operates

vertically integrated mining facilities with in-house management

and company-owned electrical engineering, installation service, and

multiple onsite technical repair centers. The Company’s proprietary

data analytics system delivers best-in-class operational

performance and uptime.

Bitfarms currently has 12 operating Bitcoin data

centers and two under development, as well as hosting agreements

with two data centers, in four countries: Canada, the United

States, Paraguay, and Argentina. Powered predominantly by

environmentally friendly hydro-electric and long-term power

contracts, Bitfarms is committed to using sustainable and often

underutilized energy infrastructure.

To learn more about Bitfarms’ events,

developments, and online communities:

www.bitfarms.comhttps://www.facebook.com/bitfarms/https://twitter.com/Bitfarms_iohttps://www.instagram.com/bitfarms/https://www.linkedin.com/company/bitfarms/

Glossary of Terms

- Y/Y or M/M=

year over year or month over month

- BTC or BTC/day

= Bitcoin or Bitcoin per day

- EH or EH/s =

Exahash or exahash per second

- MW or MWh =

Megawatts or megawatt hour

- w/TH = Watts/Terahash efficiency

(includes cost of powering supplementary equipment)

- Synthetic HODL™

= the use of instruments that create BTC equivalent exposure

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. The statements and information in this

release regarding the impact of the Stronghold hosting agreements,

projected growth, target hashrate, opportunities relating to the

Company’s geographical diversification and expansion, deployment of

miners as well as the timing therefor, closing of the Stronghold

acquisition on a timely basis and on the terms as announced, , the

ability to gain access to additional electrical power and grow

hashrate of the Stronghold business, performance of the plants and

equipment upgrades and the impact on operating capacity including

the target hashrate and multi-year expansion capacity, the

opportunities to leverage Bitfarms’ proven expertise to

successfully enhance energy efficiency and hashrate, and other

statements regarding future growth, plans and objectives of the

Company are forward-looking information.

Any statements that involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “prospects”,

“believes” or “intends” or variations of such words and phrases or

stating that certain actions, events or results “may” or “could”,

“would”, “might” or “will” be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

information.

This forward-looking information is based on

assumptions and estimates of management of Bitfarms at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance,

or achievements of Bitfarms to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors, risks and

uncertainties include, among others: receipt of the approval of the

shareholders of Stronghold and the Toronto Stock Exchange for the

Stronghold acquisition as well as other applicable regulatory

approvals; that the Stronghold acquisition may not close within the

timeframe anticipated or at all or may not close on the terms and

conditions currently anticipated by the parties for a number of

reasons including, without limitation, as a result of a failure to

satisfy the conditions to closing of the Stronghold acquisition;

the construction and operation of new facilities may not occur as

currently planned, or at all; expansion of existing facilities may

not materialize as currently anticipated, or at all; new miners may

not perform up to expectations; revenue may not increase as

currently anticipated, or at all; the ongoing ability to

successfully mine digital currency is not assured; failure of the

equipment upgrades to be installed and operated as planned; the

availability of additional power may not occur as currently

planned, or at all; expansion may not materialize as currently

anticipated, or at all; the power purchase agreements and economics

thereof may not be as advantageous as expected; potential

environmental cost and regulatory penalties due to the operation of

the Stronghold plants which entail environmental risk and certain

additional risk factors particular to the business of Stronghold

including, land reclamation requirements may be burdensome and

expensive, changes in tax credits related to coal refuse power

generation could have a material adverse effect on the business,

financial condition, results of operations and future development

efforts, competition in power markets may have a material adverse

effect on the results of operations, cash flows and the market

value of the assets, the business is subject to substantial energy

regulation and may be adversely affected by legislative or

regulatory changes, as well as liability under, or any future

inability to comply with, existing or future energy regulations or

requirements, the operations are subject to a number of risks

arising out of the threat of climate change, and environmental

laws, energy transitions policies and initiatives and regulations

relating to emissions and coal residue management, which could

result in increased operating and capital costs and reduce the

extent of business activities, operation of power generation

facilities involves significant risks and hazards customary to the

power industry that could have a material adverse effect on our

revenues and results of operations, and there may not have adequate

insurance to cover these risks and hazards, employees, contractors,

customers and the general public may be exposed to a risk of injury

due to the nature of the operations, limited experience with carbon

capture programs and initiatives and dependence on third-parties,

including consultants, contractors and suppliers to develop and

advance carbon capture programs and initiatives, and failure to

properly manage these relationships, or the failure of these

consultants, contractors and suppliers to perform as expected,

could have a material adverse effect on the business, prospects or

operations; the digital currency market; the ability to

successfully mine digital currency; it may not be possible to

profitably liquidate the current digital currency inventory, or at

all; a decline in digital currency prices may have a significant

negative impact on operations; an increase in network difficulty

may have a significant negative impact on operations; the

volatility of digital currency prices; the anticipated growth and

sustainability of hydroelectricity for the purposes of

cryptocurrency mining in the applicable jurisdictions; the

inability to maintain reliable and economical sources of power to

operate cryptocurrency mining assets; the risks of an increase in

electricity costs, cost of natural gas, changes in currency

exchange rates, energy curtailment or regulatory changes in the

energy regimes in the jurisdictions in which Bitfarms and

Stronghold operate and the potential adverse impact on

profitability; future capital needs and the ability to complete

current and future financings, including Bitfarms’ ability to

utilize an at-the-market offering program ( “ATM Program”) and the

prices at which securities may be sold in such ATM Program, as well

as capital market conditions in general; share dilution resulting

from an ATM Program and from other equity issuances; volatile

securities markets impacting security pricing unrelated to

operating performance; the risk that a material weakness in

internal control over financial reporting could result in a

misstatement of financial position that may lead to a material

misstatement of the annual or interim consolidated financial

statements if not prevented or detected on a timely basis;

historical prices of digital currencies and the ability to mine

digital currencies that will be consistent with historical prices;

and the adoption or expansion of any regulation or law that will

prevent Bitfarms from operating its business, or make it more

costly to do so. For further information concerning these and other

risks and uncertainties, refer to Bitfarms’ filings

on www.sedarplus.ca (which are also available on the

website of the U.S. Securities and Exchange Commission (the “SEC")

at www.sec.gov), including the MD&A for the year-ended

December 31, 2023, filed on March 7, 2024 and the MD&A for the

three and six months ended June 30, 2024 filed on August 8, 2024,

and its registration statement on Form F-4 (File No. 333-282657)

filed by Bitfarms with the SEC (the “registration statement”),

which includes a proxy statement of Stronghold that also

constitutes a prospectus of Bitfarms (the “proxy

statement/prospectus”). Although Bitfarms has attempted to identify

important factors that could cause actual results to differ

materially from those expressed in forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended, including factors that are

currently unknown to or deemed immaterial by Bitfarms. There can be

no assurance that such statements will prove to be accurate as

actual results, and future events could differ materially from

those anticipated in such statements. Accordingly, readers should

not place undue reliance on any forward-looking information.

Bitfarms does not undertake any obligation to revise or update any

forward-looking information other than as required by law. Trading

in the securities of the Company should be considered highly

speculative. No stock exchange, securities commission or other

regulatory authority has approved or disapproved the information

contained herein. Neither the Toronto Stock Exchange, Nasdaq, or

any other securities exchange or regulatory authority accepts

responsibility for the adequacy or accuracy of this release.

Additional Information about the Merger

and Where to Find It

This communication relates to a proposed merger

between Stronghold and Bitfarms. In connection with the proposed

merger, Bitfarms intends to file with the SEC a registration

statement on Form F-4, which will include a proxy statement of

Stronghold that also constitutes a prospectus of Bitfarms. After

the registration statement is declared effective, Stronghold will

mail the proxy statement/prospectus to its shareholders. This

communication is not a substitute for the registration statement,

the proxy statement/prospectus or any other relevant documents

Bitfarms and Stronghold has filed or will file with the

SEC. Investors are urged to read the proxy

statement/prospectus (including all amendments and supplements

thereto) and other relevant documents filed with the SEC carefully

and in their entirety if and when they become available because

they will contain important information about the proposed merger

and related matters.

Investors may obtain free copies of the

registration statement, the proxy statement/prospectus and other

relevant documents filed by Bitfarms and Stronghold with the SEC,

when they become available, through the website maintained by the

SEC at www sec.gov. Copies of the documents may also be obtained

for free from Bitfarms by contacting Bitfarms' Investor Relations

Department at investors@bitfarms.com and from Stronghold by

contacting Stronghold's Investor Relations Department at

SDIG@gateway-grp.com.

No Offer or Solicitation

This communication is not intended to and does

not constitute an offer to sell or the solicitation of an offer to

buy, sell or solicit any securities or any proxy, vote or approval,

nor shall there be any sale of securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offer of securities shall be deemed to be made

except by means of a prospectus meeting the requirements of Section

10 of the Securities Act of 1933, as amended.

Participants in Solicitation Relating to

the Merger

Bitfarms, Stronghold, their respective directors

and certain of their respective executive officers may be deemed to

be participants in the solicitation of proxies from Stronghold's

shareholders in respect of the proposed merger. Information

regarding Bitfarms’ directors and executive officers can be found

in Bitfarms’ annual information form for the year ended December

31, 2023, filed on March 7, 2024, as well as its other filings with

the SEC. Information regarding Stronghold’s directors and executive

officers can be found in Stronghold’s proxy statement for its 2024

annual meeting of stockholders, filed with the SEC on April 29,

2024, and supplemented on June 7, 2024, and in its Form 10-K for

the year ended December 31, 2023, filed with the SEC on March 8,

2024. This communication may be deemed to be solicitation material

in respect of the proposed merger. Additional information regarding

the interests of such potential participants, including their

respective interests by security holdings or otherwise, will be set

forth in the proxy statement/prospectus and other relevant

documents filed with the SEC in connection with the proposed merger

if and when they become available. These documents are available

free of charge on the SEC’s website and from Bitfarms and

Stronghold using the sources indicated above.

Investor Relations

Contacts:

BitfarmsTracy KrummeSVP, Head

of IR & Corp. Comms.+1 786-671-5638tkrumme@bitfarms.com

Media Contacts:

Québec: TactLouis-Martin

Leclerc+1 418-693-2425lmleclerc@tactconseil.ca

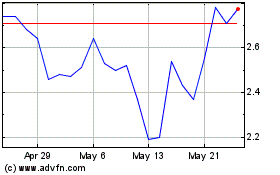

Bitfarms (TSX:BITF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bitfarms (TSX:BITF)

Historical Stock Chart

From Feb 2024 to Feb 2025