Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) today announced its 2024

budget, delivering disciplined capital investment and balancing

growth of the company’s base business with meaningful shareholder

returns. Continuing with the growth plan embarked on in 2023,

Cenovus expects to invest capital of between $4.5 billion and $5.0

billion in 2024. This investment includes $1.5 billion to $2.0

billion of optimization and growth capital, primarily for

progressing the West White Rose project as well as incrementally

growing production at the Foster Creek, Christina Lake and Sunrise

oil sands facilities. Additionally, Cenovus will implement further

initiatives in its downstream business to improve reliability and

increase margin capture as well as invest in opportunities in the

Conventional business. Approximately $3.0 billion will be directed

towards sustaining production and supporting continued safe and

reliable operations.

“We will continue to progress strategic initiatives in our

base business in 2024 that will enhance our integrated operations

and further drive our ability to grow total shareholder returns,

even in periods of price volatility,” said Jon McKenzie, Cenovus

President & Chief Executive Officer. “We will remain focused on

reducing costs and continued capital discipline, while realizing

the full value of our integrated strategy.”

2024 budget highlights:

- Total upstream production of between 770,000 and 810,000

barrels of oil equivalent per day (BOE/d) with production from oil

sands and thermal projects expected to be between 590,000 and

610,000 barrels per day (bbls/d), which reflects a turnaround at

Christina Lake in the third quarter of 2024.

- Total downstream crude throughput of 630,000 bbls/d to 670,000

bbls/d, an increase of approximately 17%1 compared to the prior

year.

- Oil sands operating expenses per barrel (bbl) of $12.00 to

$14.00 and U.S. refining operating expenses of $11.75/bbl to

$13.75/bbl, which includes expensed turnaround costs.

|

2024 Guidance (C$ before royalties) |

| |

(MBOE/d) |

Capital investments($Millions) |

Operating costs3($/BOE) |

| Upstream2 |

Production |

|

|

| Oil sands |

590 - 610 |

2,500 - 2,750 |

12.00 - 14.00 |

| Conventional |

120 - 130 |

350 - 425 |

12.00 - 13.00 |

| Atlantic |

10 - 15 |

|

55.00 - 65.00 |

| Asia Pacific |

50 - 55 |

|

11.00 - 13.00 |

| Offshore |

|

850 - 950 |

|

| Total

upstream |

770 - 810 |

|

|

| Downstream |

Throughput |

|

|

| Canadian Refining |

85 - 95 |

|

18.00 - 20.00 |

| U.S. Refining |

545 - 575 |

|

11.75 - 13.75 |

| Total

downstream |

630 - 670 |

750 - 850 |

|

| Total |

|

4,500 - 5,000 |

|

| |

| 1 Percentage increase

when compared to actual nine months ended September 30, 2023.2 See

Q3 2023 Management’s Discussion & Analysis for summary of

production by product type as at September 30, 2023.3 Upstream

operating expenses are divided by sales volumes. Downstream is

divided by barrels of crude oil throughput.

Note: Totals may not add due to rounding. Cenovus’s

full 2024 guidance can be found on cenovus.com. |

| |

2024 guidance

Oil SandsOil sands production guidance for 2024

is 590,000 bbls/d to 610,000 bbls/d, which reflects a turnaround in

the third quarter at Christina Lake, with an expected annualized

impact of approximately 13,000 bbls/d to 15,000 bbls/d. Oil sands

operating costs are expected to be in the range of $12.00/bbl to

$14.00/bbl in 2024, partially due to higher non-fuel costs

associated with the Christina Lake turnaround.

Cenovus plans to invest $2.5 billion to $2.75 billion of capital

in its oil sands assets, including approximately $650 million of

growth and optimization capital, largely related to further

advancing brownfield and multi-year growth opportunities that will

increase production across its oil sands portfolio.

Investment in the coming year will be focused on projects with

strong capital efficiencies, including the Foster Creek

optimization project, Narrows Lake tie-back to Christina Lake and

optimization and new well pads at Sunrise, positioning the company

to meaningfully increase production starting in 2025. In addition

to the Foster Creek optimization project, capital investment will

also be directed to a project to enhance sulphur recovery at Foster

Creek, leading to lower operating costs once completed.

ConventionalThe company plans to invest between

$350 million and $425 million in its conventional assets. Capital

will be primarily used to maintain production, advance methane

reduction projects and build gas handling infrastructure to support

future production growth. Total production is expected to be

between 120,000 BOE/d and 130,000 BOE/d.

OffshoreTotal Offshore production is expected

to be in the range of 60,000 BOE/d to 70,000 BOE/d. This includes

between 10,000 bbls/d and 15,000 bbls/d in the Atlantic region,

which reflects the impact of the SeaRose floating production,

storage and offloading (FPSO) vessel asset life extension program,

scheduled to begin in January. The SeaRose is expected to return to

the field and resume production late in the third quarter of

2024.

Capital spending of between $850 million and $950 million will

be primarily directed towards the ongoing construction of the West

White Rose project in the Atlantic region, in addition to the

capital costs associated with the SeaRose asset life extension

program, which will support production at the White Rose field,

including production associated with West White Rose, until 2038.

First oil from the West White Rose project is expected in the first

half of 2026, with peak production of approximately 45,000 bbls/d

anticipated in 2028.

DownstreamCrude throughput is expected to be

between 630,000 bbls/d and 670,000 bbls/d, representing a crude

utilization rate of approximately 87%, and includes 85,000 bbls/d

to 95,000 bbls/d of crude throughput in the Canadian Refining

segment. The Lloydminster Upgrader will begin a turnaround in the

second quarter of 2024, which will impact annualized throughput by

approximately 10,000 bbls/d to 12,000 bbls/d. As a result of the

turnaround, operating costs per barrel in Canadian Refining are

expected to be $18.00/bbl to $20.00/bbl in 2024, with the increase

relative to 2023 attributable to higher expensed turnaround costs.

Crude throughput in U.S. Refining is expected to be 545,000 bbls/d

to 575,000 bbls/d, an increase of 24% year-over-year 4, which

reflects a full year of throughput at the Superior Refinery, in

addition to the increased working interest at the Toledo Refinery

acquired in early 2023. U.S. operating costs are expected to be

between $11.75/bbl and $13.75/bbl, a decrease of approximately 17%

when compared to 20234. Capital investment in the downstream

business is projected to be between $750 million to $850 million,

including approximately $155 million for growth and optimization

capital, and will be primarily focused on safety and reliability

initiatives across Cenovus’s downstream businesses as well as

optimization projects to enhance margin capture.

| 4

Percentage increase when compared to actual nine months ended

September 30, 2023. |

| |

CorporateGeneral and administrative (G&A)

expenses, not including stock-based compensation, are expected to

be in the range of $625 million to $725 million in 2024. In

addition, Cenovus expects to invest $200 million to $300 million on

IT systems upgrades, which will modernize and replace the company’s

existing enterprise resource planning systems, enhance cyber

security and standardize data across the company.

SustainabilityCenovus continues to progress

work towards its environmental, social and governance (ESG)

targets. The company continues to deploy previously announced

capital on initiatives to advance its goal of reducing absolute

scope 1 and 2 greenhouse gas (GHG) emissions by 35% by year-end

2035, from 2019 levels, on a net equity basis. In 2024, investments

in targeted emissions reduction initiatives and Cenovus’s

commitment to the Pathways Alliance foundational project are

forecast to reach almost $100 million. This includes progressing

carbon capture projects at the Lloydminster Upgrader and Christina

Lake, methane reduction initiatives across Conventional operations,

continuing work to increase energy efficiency at the company’s

Canadian offshore assets and advancing additional technology

assessments.

2024 planned maintenanceCenovus expects

maintenance and repair activities will contribute to higher

operating costs in 2024 as the company works to ensure the safety

and reliability of all its upstream and downstream assets. Atlantic

region operating expenses reflect the planned SeaRose FPSO vessel

asset life extension program, while work at Cenovus’s Lloydminster

Upgrader will result in higher operating costs for Canadian

Refining.

The following table provides details on planned turnaround

activities at Cenovus assets in 2024 and anticipated production or

throughput impacts. These planned turnarounds are reflected in

Cenovus’s Corporate Guidance assumptions.

|

2024 Planned maintenance |

|

Potential quarterly production/throughput impact

(MBOE/d or Mbbls/d) |

|

|

Q1 |

Q2 |

Q3 |

Q4 |

Annualized impact |

|

Upstream |

|

|

|

Oil Sands |

- |

2 - 3 |

50 - 60 |

- |

13 - 16 |

|

Atlantic |

8 - 10 |

8 - 10 |

8 - 10 |

- |

5 - 7 |

|

Conventional |

- |

3 - 5 |

4 - 6 |

- |

2 - 4 |

|

Downstream |

|

|

|

Canadian Refining |

- |

42 - 46 |

- |

- |

10 - 12 |

|

U.S. Refining |

20 - 24 |

12 - 16 |

30 - 34 |

56 - 60 |

30 - 35 |

For further details on Cenovus’s 2024 budget, see the company’s

2024 guidance available here.

Advisory

Basis of PresentationCenovus reports financial

results in Canadian dollars and presents production volumes on a

net to Cenovus before royalties basis, unless otherwise stated.

Cenovus prepares its financial statements in accordance with

International Financial Reporting Standards (IFRS).

Barrels of Oil EquivalentNatural gas volumes

have been converted to barrels of oil equivalent (BOE) on the basis

of six thousand cubic feet (Mcf) to one barrel (bbl). BOE may be

misleading, particularly if used in isolation. A conversion ratio

of one bbl to six Mcf is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent value equivalency at the wellhead. Given that the value

ratio based on the current price of crude oil compared with natural

gas is significantly different from the energy equivalency

conversion ratio of 6:1, utilizing a conversion on a 6:1 basis is

not an accurate reflection of value.

Forward-looking InformationThis news release

contains forward-looking statements and other information

(collectively referred to as “forward-looking information”) about

the company’s current expectations, estimates and projections, made

in light of the company’s experience and perception of historical

trends. Although the company believes that the expectations

represented by such forward-looking information are reasonable,

there can be no assurance that such expectations will prove to be

correct.

This forward-looking information is current only as of the date

indicated above. Readers are cautioned not to place undue reliance

on forward-looking information as actual results may differ

materially from those expressed or implied. Cenovus undertakes no

obligation to update or revise any forward-looking information

except as required by law.

Forward-looking information in this news release is identified

by words such as “anticipates”, “continue”, “deliver”, “expect”,

“focus”, “implement”, “opportunity”, “plan”, “position”,

“progressing”, and “will” or similar words or expressions and

includes suggestions of future outcomes, including, but not limited

to, statements about: capital allocation; operating costs and

expenses and general and administrative expenses; shareholder

returns; capital investment; optimization and growth; downstream

reliability and margin capture; strategic initiatives; net debt;

upstream production and downstream throughput; planned turnarounds;

downstream optimization; environmental performance; the West White

Rose project; the tie-back of Narrows Lake; optimizing gas handling

infrastructure in conventional and building infrastructure; methane

emissions; ESG targets; our GHG emissions reduction initiatives and

the extent and timing of investments therein, including the

Pathways Alliance foundational project and other carbon capture

projects. The 2024 guidance, as updated December 13, 2023 and

available on cenovus.com, assumes: Brent prices of US$79.00 per

barrel; WTI prices of US$75.00 per barrel; WCS of US$58.00 per

barrel; differential WTI-WCS of US$17.00 per barrel; AECO natural

gas prices of $2.80 per thousand cubic feet; Chicago 3-2-1 crack

spread of US$21.00 per barrel; and an exchange rate of $0.73

US$/C$.

In addition to the price assumptions disclosed herein, the

factors or assumptions on which the forward-looking information in

this news release is based include: projected capital investment

levels, the flexibility of capital spending plans and associated

sources of funding; our ability to finance capital expenditures and

expenses on a cost-effective basis; achievement of further

operating efficiencies, cost reductions and sustainability thereof;

our forecast production volumes are subject to potential ramp down

of production based on business and market conditions; foreign

exchange rate, including with respect to our US$ debt and refining

capital and operating expenses; future improvements in availability

of product transportation capacity; realization of expected impacts

of storage capacity within oil sands reservoirs; the ability of our

refining capacity and existing pipeline commitments to mitigate a

portion of heavy oil volumes against wider differentials; planned

turnaround and maintenance activity at both upstream and downstream

facilities; accounting estimates and judgments; our ability to

obtain necessary regulatory and partner approvals; the existence of

a favourable and stable regulatory framework concerning GHG

emissions that includes, among other things, support from various

levels of government, including financial support; and the

successful and timely implementation of capital projects or stages

thereof, including those associated with our ESG targets.

The information in this news release is also subject to risks

disclosed in our annual Management’s Discussion and Analysis

(MD&A) for the period ended December 31, 2022, supplemented by

updates in our most recent quarterly MD&A, available on SEDAR+

at sedarplus.ca, on EDGAR at sec.gov and at cenovus.com.

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and

natural gas production operations in Canada and the Asia Pacific

region, and upgrading, refining and marketing operations in Canada

and the United States. The company is focused on managing its

assets in a safe, innovative and cost-efficient manner, integrating

environmental, social and governance considerations into its

business plans. Cenovus common shares and warrants are listed on

the Toronto and New York stock exchanges, and the company’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, X, LinkedIn, YouTube and

Instagram.

Cenovus contacts:

| Investors |

Media |

| Investor Relations general

line403-766-7711 |

Media Relations general

line403-766-7751 |

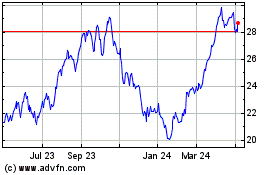

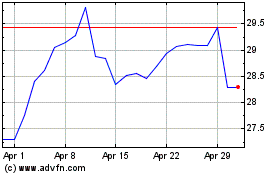

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Mar 2024 to Mar 2025