Currency Exchange International, Corp. (the “Group” or “CXI”) (TSX:

CXI; OTCBB: CURN), announces its financial results and Management’s

Discussion and Analysis (“MD&A”) for the three and six-month

periods ended April 30, 2023 (all figures are in U.S. dollars

except where otherwise indicated). The complete financial

statements and MD&A can be found on the Company's SEDAR profile

at www.sedar.com.

Randolph Pinna, CEO of the Group, stated, “The

second quarter of 2023 demonstrated strong year-over-year growth as

increased demand for international travel reaches near pre-COVID

levels. The return to more traditional seasonality in travel

patterns have translated into the second quarter showing continued

strong growth in banknotes leading into the third quarter being the

strongest as it relates to banknote revenue. We anticipate this

pattern will reoccur in 2023, supported by continued year-over-year

growth as international travel is expected to recover to

pre-pandemic levels during this year. Continued execution against

our strategic plan, in which significant investments are being made

in our people, infrastructure and technology platforms to support

more efficient future growth remains a top priority. The second

quarter continued the successful transition to our new

organizational structure that took effect on November 1, 2022, and

I am confident that we have the right team and systems to achieve

our vision of remaining a leading preferred provider of foreign

exchange solutions for financial institutions globally.”

Corporate Highlights for the three-months ended April 30,

2023:

- The Group

experienced significant growth, 41% in the Banknotes product line

with increased market share as the Group’s subsidiary, Exchange

Bank of Canada, continued to leverage the foreign bank

international cash services program with the Federal Reserve Bank

of New York, and consumer demand for foreign currencies improving

as international travel reaches near pre-COVID levels in both the

US and Canada;

- The Group continued

its focus and investment in the International Payments product

line, having processed 30,394 payments transactions, representing

$2.6 billion in volume in the three-month period ended April 30,

2023. This compares to 29,120 transactions on $2.8 billion of

volume in the three-month period ending April 30, 2022; and

- Increased

penetration of the financial institution sector in the U.S. with

the addition of 92 new clients, representing 142 transacting

locations.

Financial Highlights for the three-months ended April 30, 2023,

compared to the three-months ended April 30, 2023:

- Revenue increased

30% or $4.2 million to $18.3 million for the three-month period

ended April 30, 2023, as compared to $14.1 million in the

three-month period ending April 30, 2022. The Banknotes product

line accounted for $15.3 million of the revenue, an increase of 41%

and the Payments product line represented $3.0 million of the

revenue, a decrease of 7% over the prior year;

- Net operating

income increased 30% or $0.8 million to $3.7 million for the

three-month period ended April 30, 2023, from a net operating

income of $2.9 million in the same period in the prior year;

- Net income

increased 71% or $0.9 million to $2.2 million in the three-month

period ended April 30, 2023, from a net income of $1.3 million in

the same period in the prior year;

- Earnings per share

was $0.35 on a basic and $0.33 on a fully diluted basis for the

three-month period ended April 30, 2023, compared to earnings per

share of $0.20 and $0.19, respectively, in the same period in the

prior year; and

- The Group had

strong liquidity and capital positions of $64.4 million in net

working capital, and $73.1 million in total equity as at April 30,

2023.

Financial Highlights for the six-months ended April 30, 2023,

compared to the six-months ended April 30, 2022:

- Revenue increased

31% or $8.4 million to $34.9 million for the six-month period ended

April 30, 2023, as compared to $26.5 million in the six-month

period ending April 30, 2022. The Banknotes product line accounted

for $28.4 million of the revenue, an increase of 34% and the

Payments product line represented $6.5 million of the revenue, an

increase of 21% over the prior year;

- Net operating

income increased 8% or $0.5 million to $6.5 million for the

six-month period ended April 30, 2023, from a net operating income

of $6.0 million in the same period in the prior year;

- Net income

increased 36% or $1.0 million to $3.8 million in the six-month

period ended April 30, 2023, from a net income of $2.8 million in

the same period in the prior year;

- Cash flow from

operating activities, excluding the changes in balance sheet

accounts, increased 22% or $1.1 million to $5.8 million in the

six-month period ended April 30, 2023 from $4.7 million in the same

period in the prior year; and

- Earnings per share

was $0.60 on a basic and $0.57 on a fully diluted basis for the

six-month period ended April 30, 2023 compared to earnings per

share of $0.44 and $0.43, respectively, in the same period in the

prior year.

Selected Financial Data

|

Three-months ending |

Revenue |

Net operating income (loss) |

Net income (loss) |

Total assets |

Total equity |

Earnings (loss) per share (diluted) |

|

|

$ |

$ |

$ |

$ |

$ |

$ |

|

4/30/2023 |

18,345,342 |

3,743,075 |

2,243,714 |

134,697,253 |

73,104,851 |

0.33 |

|

1/31/2023 |

16,468,402 |

2,734,159 |

1,589,499 |

133,072,968 |

71,448,732 |

0.24 |

|

10/31/2022 |

19,800,463 |

5,401,678 |

4,383,876 |

125,528,832 |

69,305,509 |

0.66 |

|

7/31/2022 |

20,661,423 |

7,321,589 |

4,585,806 |

155,757,016 |

65,598,381 |

0.70 |

|

4/30/2022 |

14,071,953 |

2,888,757 |

1,308,445 |

150,804,096 |

60,821,752 |

0.19 |

|

1/31/2022 |

12,450,282 |

3,111,368 |

1,504,999 |

129,297,226 |

59,332,997 |

0.23 |

|

10/31/2021 |

10,125,893 |

775,748 |

1,633,766 |

102,982,531 |

58,015,799 |

0.25 |

|

7/31/2021 |

8,633,413 |

1,047,889 |

(120,246) |

92,962,398 |

56,319,701 |

(0.02) |

|

|

|

|

|

|

|

|

Conference Call

The Company plans to host a conference call on

Wednesday, June 14, 2023, at 8:30 AM (EST).

To participate in or listen to the call, please

dial the appropriate number:

- Toll Free - North

America: (+1) 888 886 7786

- Conference ID

Number: 8372 3808

About Currency Exchange International, Corp.

Currency Exchange International is in the

business of providing comprehensive foreign exchange technology and

processing services for banks, credit unions, businesses, and

consumers in the United States and select clients globally. Primary

products and services include the exchange of foreign currencies,

wire transfer payments, Global EFTs, and foreign cheque clearing.

Wholesale customers are served through its proprietary FX software

applications delivered on its web-based interface, www.cxifx.com

(“CXIFX”), its related APIs with core banking

platforms, and through personal relationship managers. Consumers

are served through Group-owned retail branches, agent retail

branches, and its e-commerce platform, order.ceifx.com

(“OnlineFX”).

The Group’s wholly-owned Canadian subsidiary,

Exchange Bank of Canada, based in Toronto, Canada, provides foreign

exchange and international payment services in Canada and select

international foreign jurisdictions. Customers are served through

the use of its proprietary software, www.ebcfx.com

(“EBCFX”), related APIs to core banking platforms,

and personal relationship managers.

Contact Information

For further information please contact: Bill

MitoulasInvestor Relations(416) 479-9547Email:

bill.mitoulas@cxifx.comWebsite: www.cxifx.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This press release includes forward-looking

information within the meaning of applicable securities laws. This

forward-looking information includes, or may be based upon,

estimates, forecasts, and statements as to management’s

expectations with respect to, among other things, demand and market

outlook for wholesale and retail foreign currency exchange products

and services, future growth, the timing and scale of future

business plans, results of operations, performance, and business

prospects and opportunities. Forward-looking statements are

identified by the use of terms and phrases such as “anticipate”,

“believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”,

“predict”, “preliminary”, “project”, “will”, “would”, and similar

terms and phrases, including references to assumptions.

Forward-looking information is based on the

opinions and estimates of management at the date such information

is provided, and on information available to management at such

time. Forward-looking information involves significant risks,

uncertainties and assumptions that could cause the Company’s actual

results, performance, or achievements to differ materially from the

results discussed or implied in such forward-looking information.

Actual results may differ materially from results indicated in

forward-looking information due to a number of factors including,

without limitation, the competitive nature of the foreign exchange

industry, the impact of COVID-19 or the evolving situation in

Ukraine on factors relevant to the Company’s business, currency

exchange risks, the need for the Company to manage its planned

growth, the effects of product development and the need for

continued technological change, protection of the Company’s

proprietary rights, the effect of government regulation and

compliance on the Company and the industry in which it operates,

network security risks, the ability of the Company to maintain

properly working systems, theft and risk of physical harm to

personnel, reliance on key management personnel, global economic

deterioration negatively impacting tourism, volatile securities

markets impacting security pricing in a manner unrelated to

operating performance and impeding access to capital or increasing

the cost of capital as well as the factors identified throughout

this press release and in the section entitled “Risks and

Uncertainties” of the Company’s Management’s Discussion and

Analysis for the three and six-months ended April 30, 2023. The

forward-looking information contained in this press release

represents management’s expectations as of the date hereof (or as

of the date such information is otherwise stated to be presented)

and is subject to change after such date. The Company disclaims any

intention or obligation to update or revise any forward-looking

information whether as a result of new information, future events

or otherwise, except as required under applicable securities

laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this press release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained in

this press release.

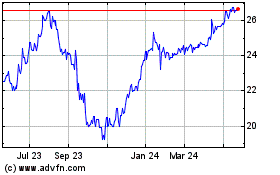

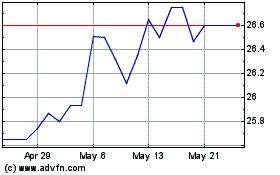

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Feb 2024 to Feb 2025